Loan management software

in Philippines

Under the hood

Credit scoring and KYC

Automate KYC/AML and ID checks. Have your in-house decision-making

process, utilize AI capabilities, or integrate with the 3rd party providers.

process, utilize AI capabilities, or integrate with the 3rd party providers.

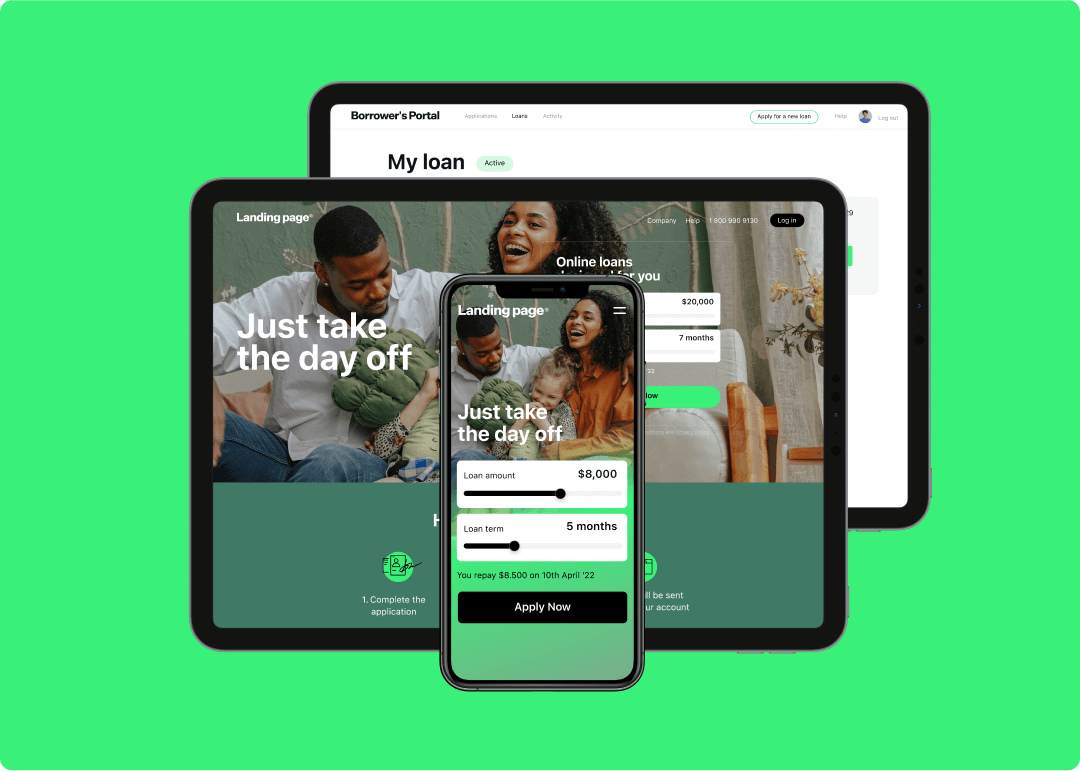

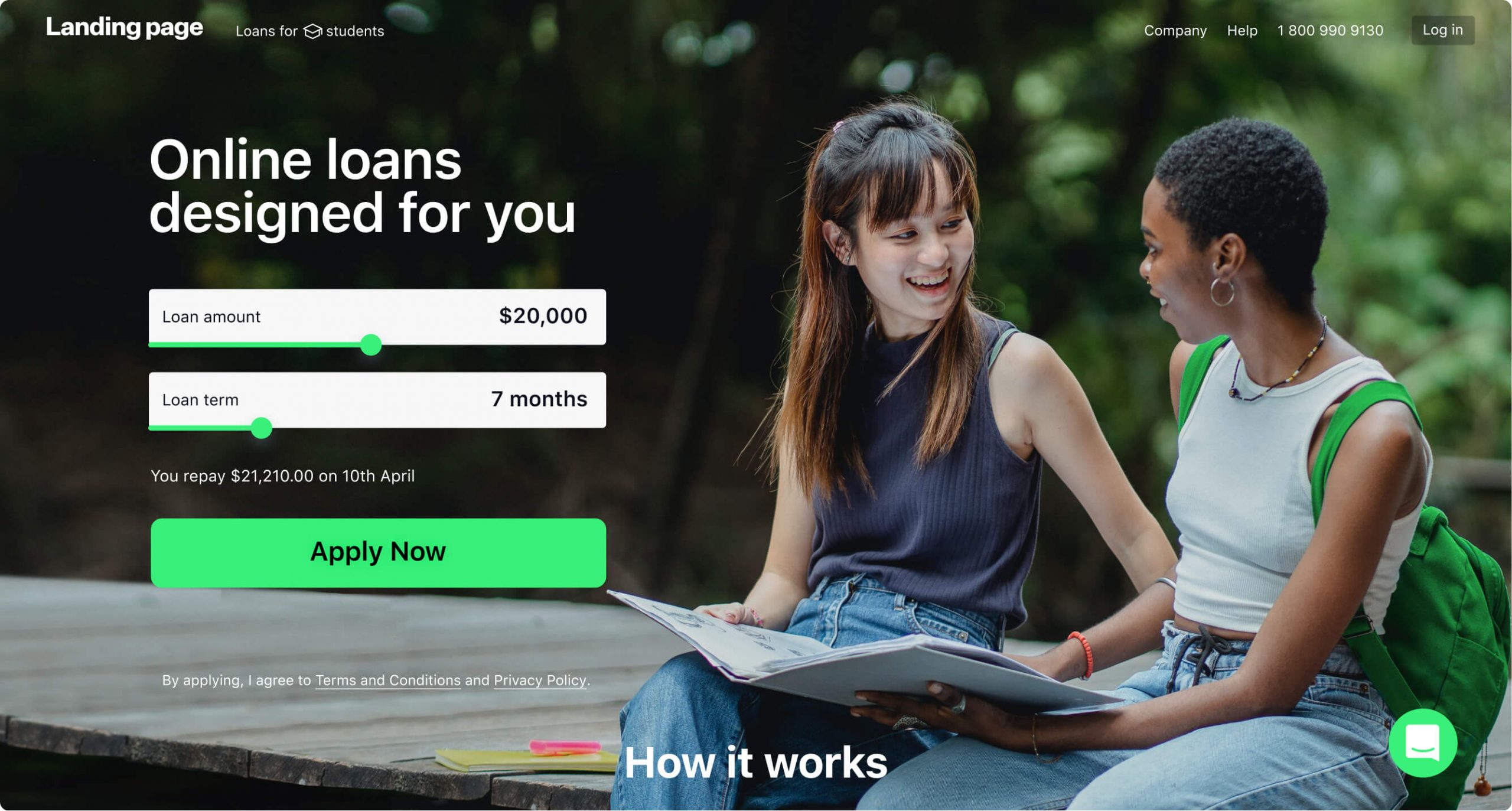

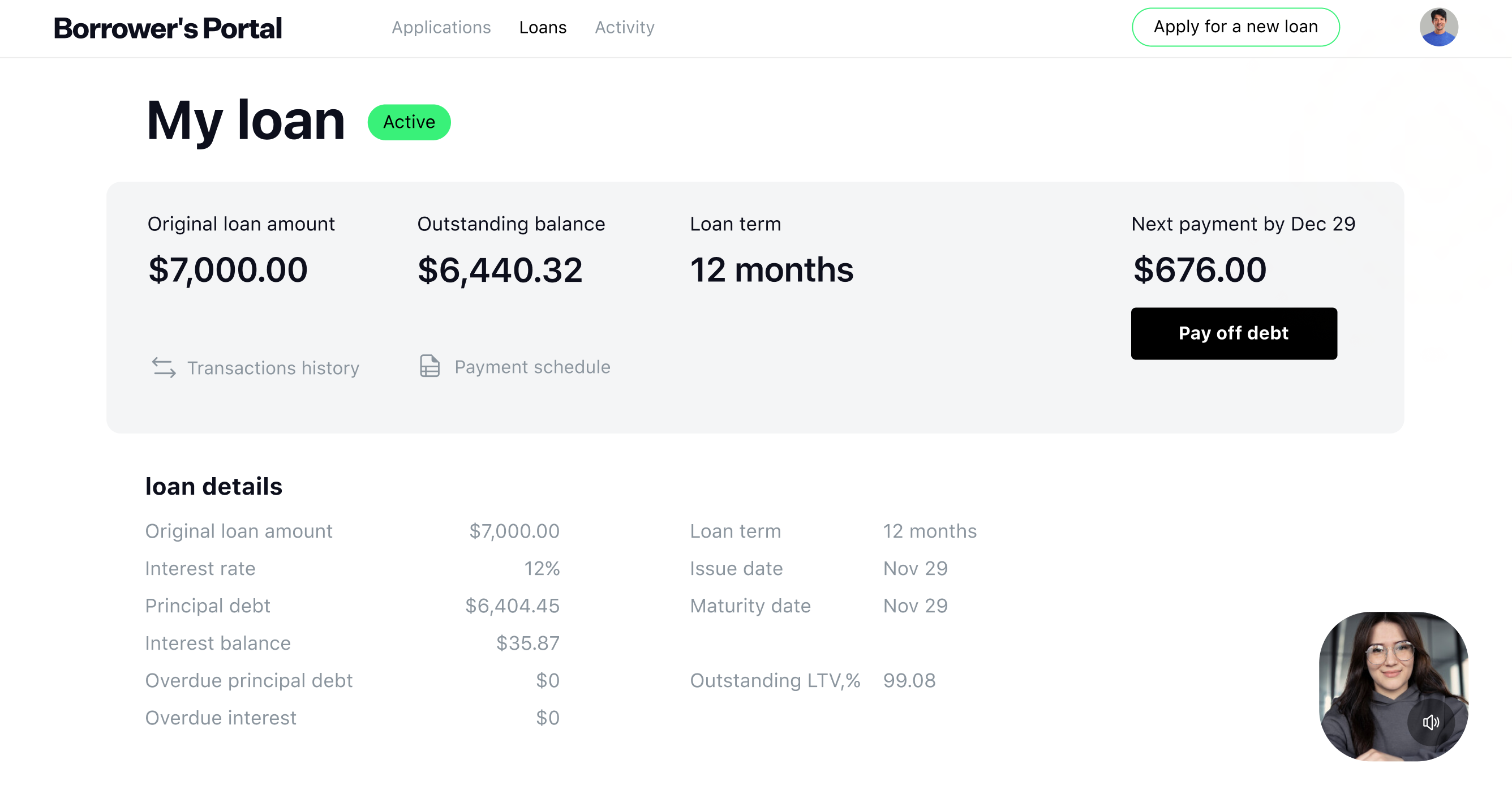

Origination module

Automate customer onboarding and account opening across multiple

channels. Run a feature-rich customer portal and personal area.

channels. Run a feature-rich customer portal and personal area.

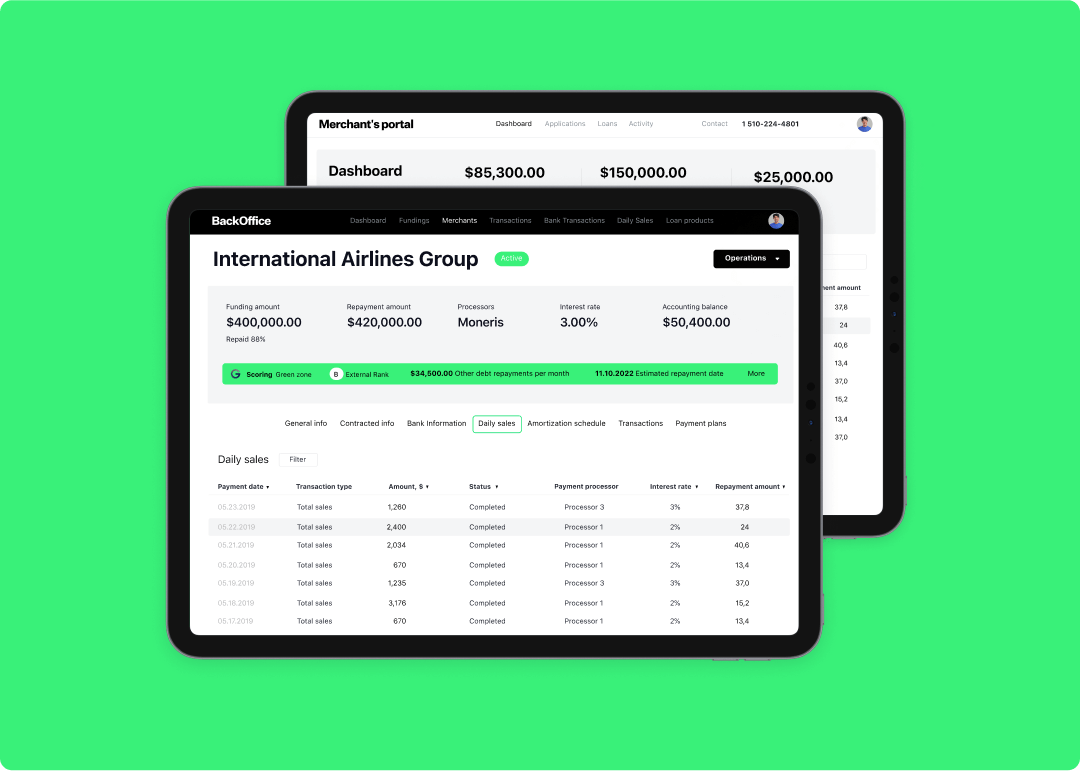

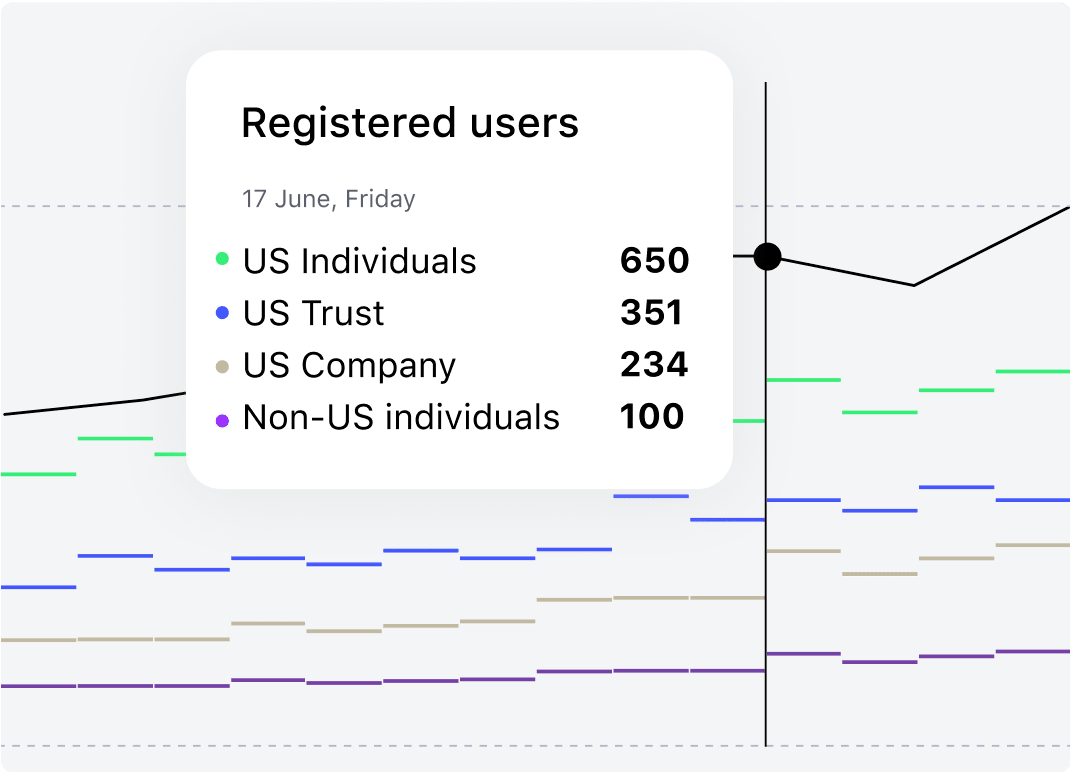

Statistics and reporting

Take advantage of the data visualization tools. Customize performance

and service dashboards. Configure new reports or modify existing ones.

and service dashboards. Configure new reports or modify existing ones.

Product engine

Launch numerous unique product types and comply with the legislation

changes. Configuration of the product, including repayment period, rates, penalties.

changes. Configuration of the product, including repayment period, rates, penalties.

and much more

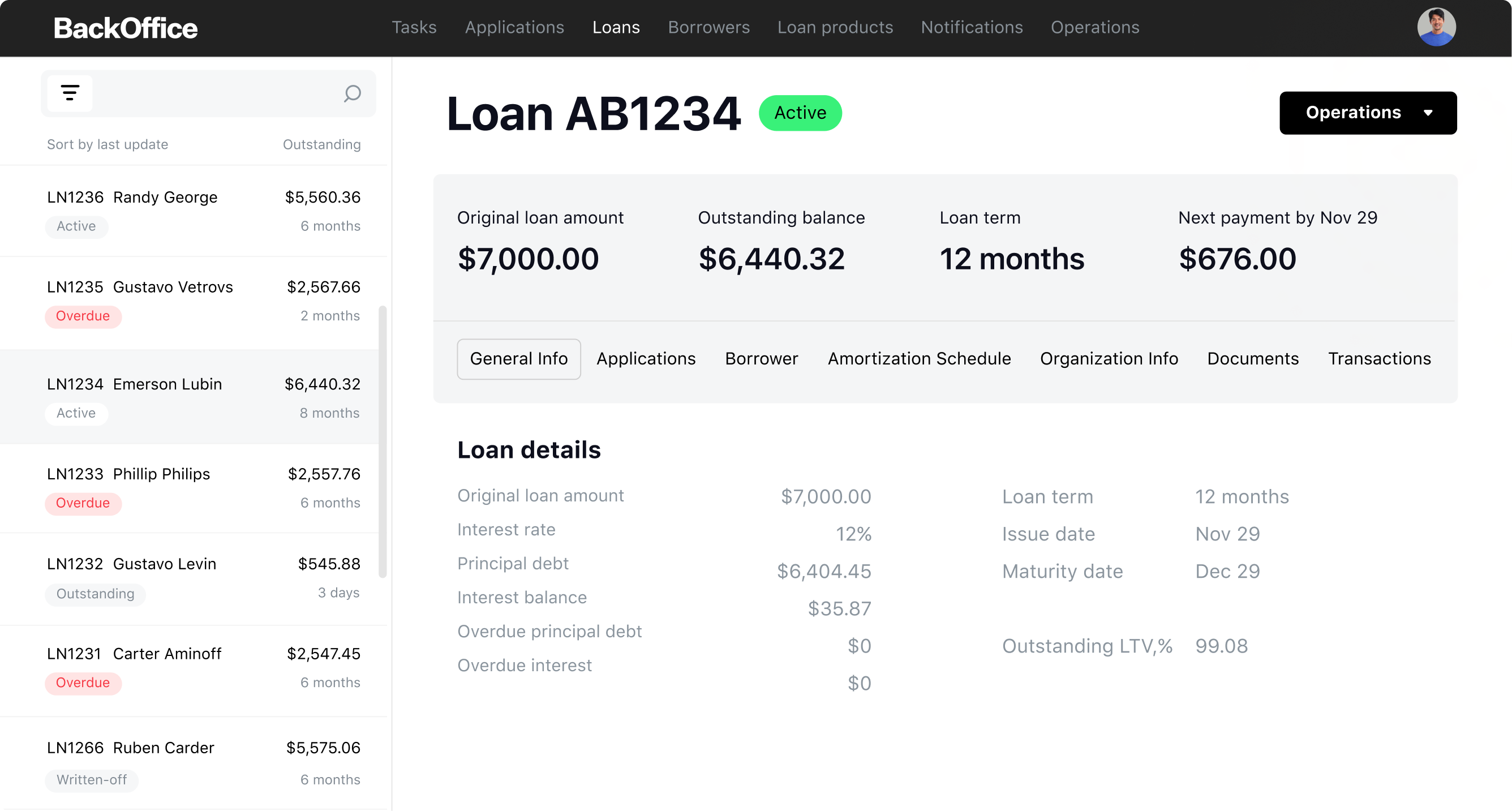

Debt collection

Set and deploy a collection strategy. Automatically manage overdue loans (check status, notify, etc). Generate notifications and letters.

Document management

Security settings

Easy integrations

Success stories

HES Core solution covers the full loan management process from onboarding to reporting. HES Fintech has a huge

expertise in digital transformation. We’ve been empowering lending business in Philippines with robust loan software since 2012.

expertise in digital transformation. We’ve been empowering lending business in Philippines with robust loan software since 2012.

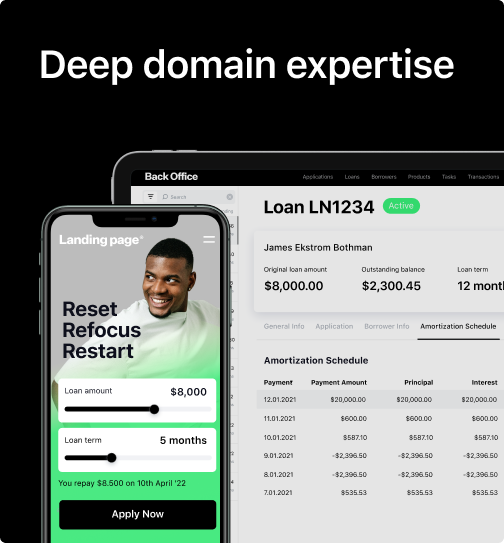

For business lending in Philippines

we suggest

Scalable end-to-end lending solution

3-4 months time-to-market

A few seconds for a loan decision

No additional charges per customer