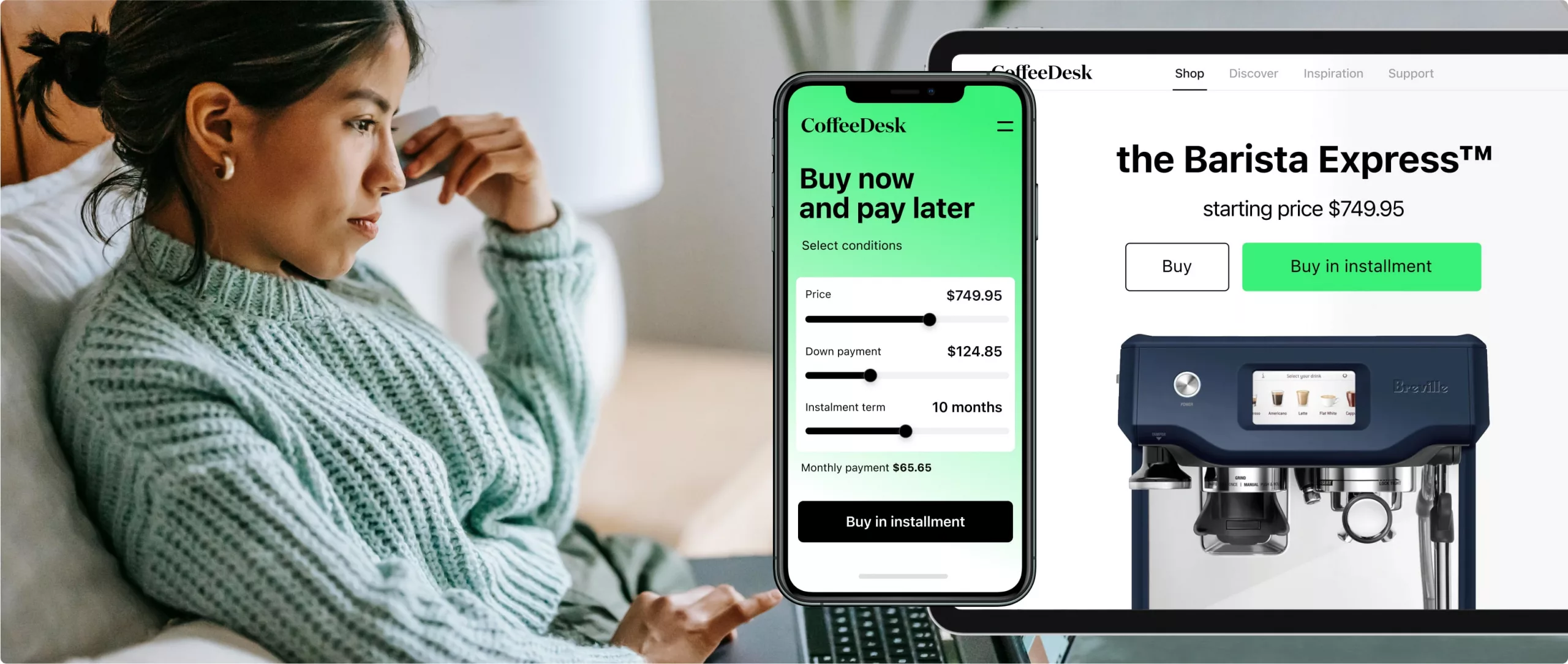

Buy Now Pay Later software

Increase conversions, average order values, and customer loyalty with HES LoanBox

BNPL software includes

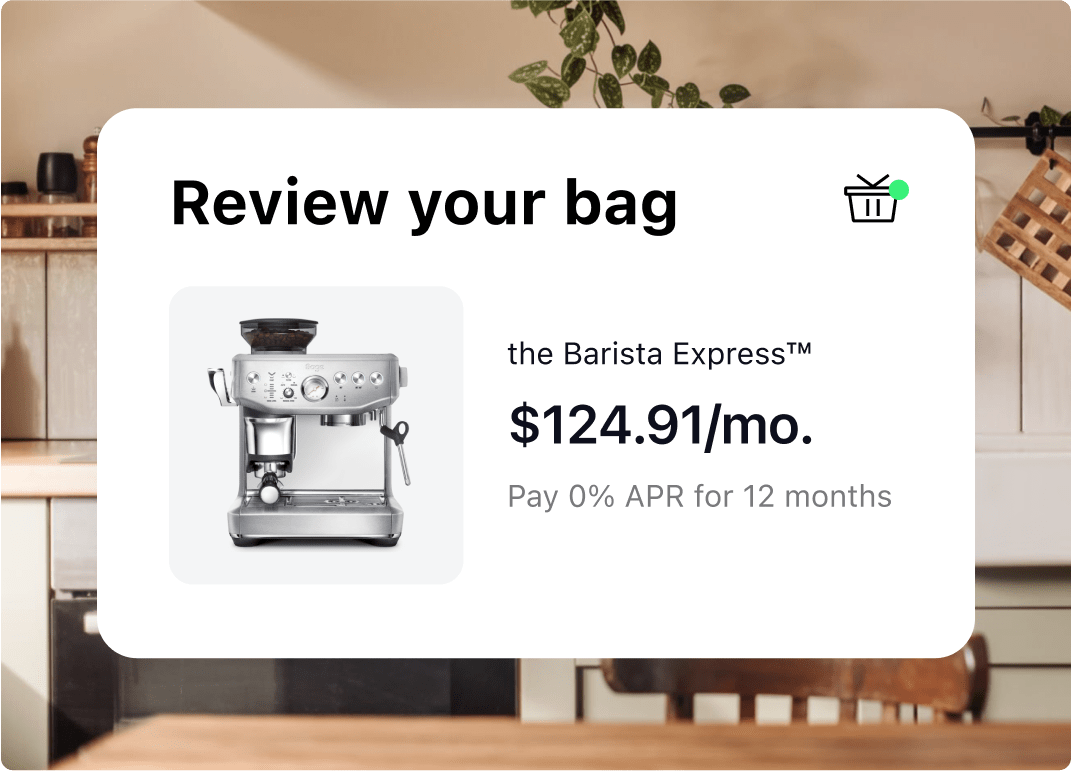

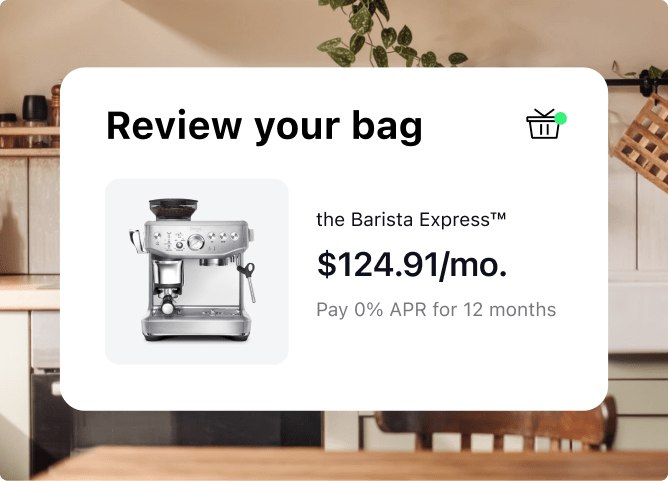

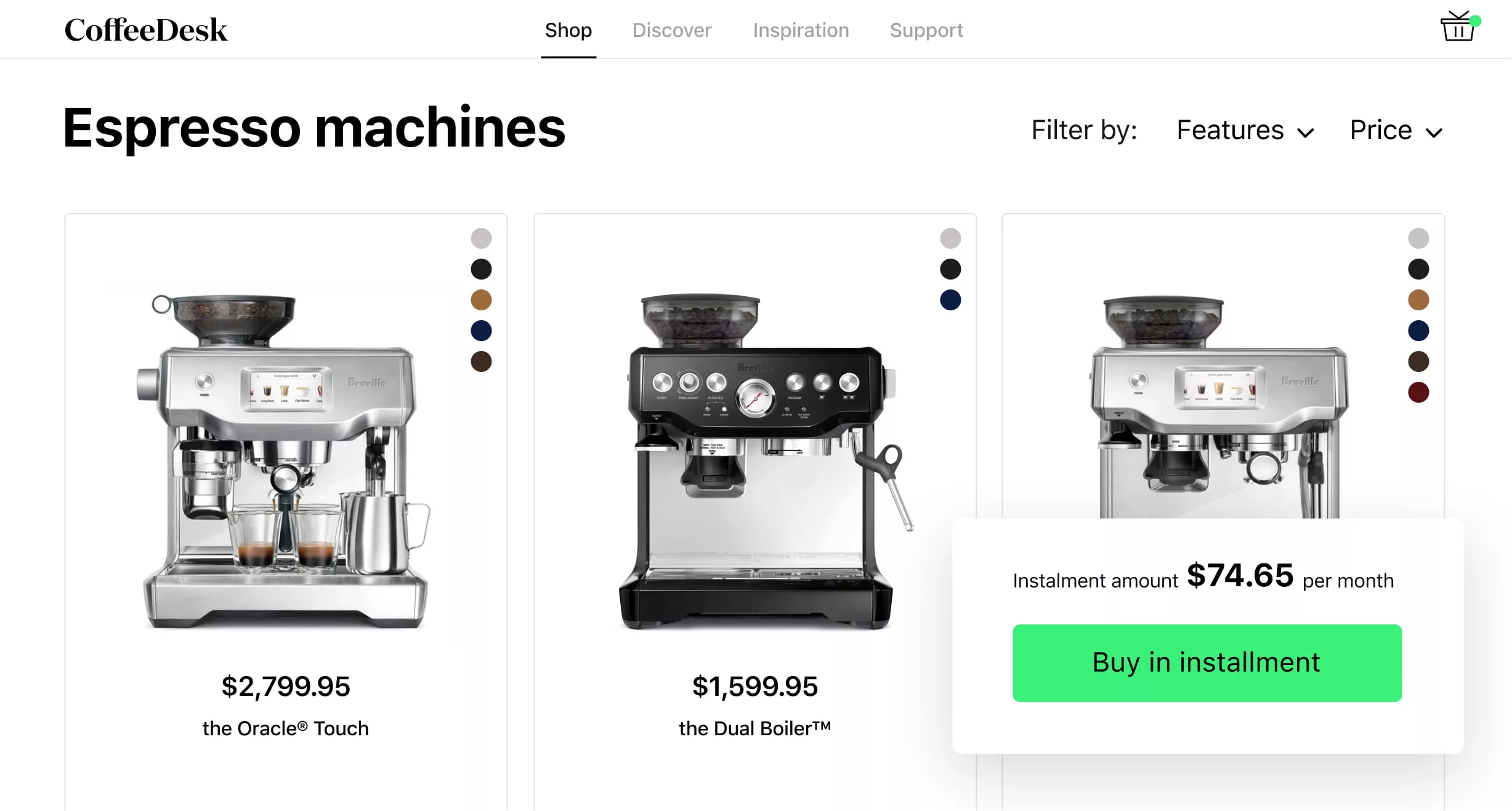

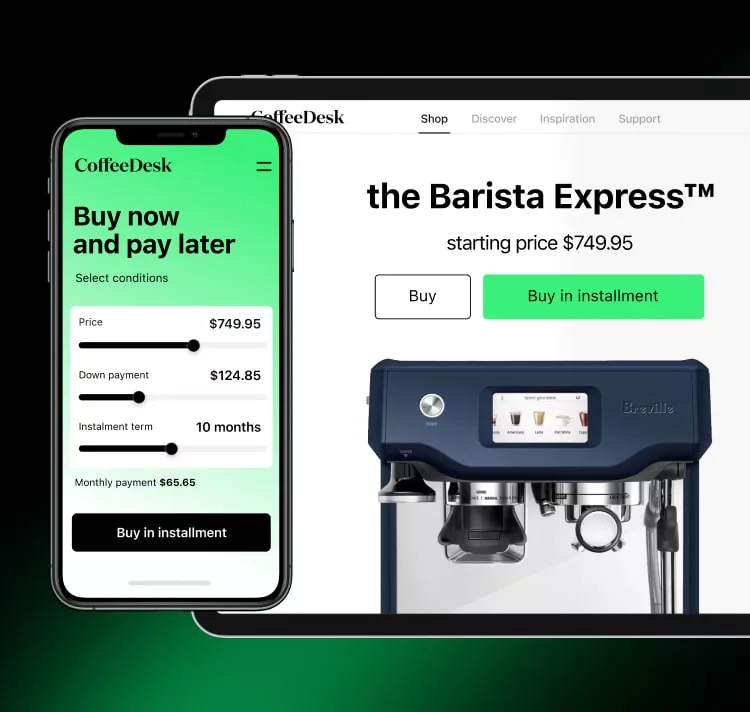

Embeddable plugins

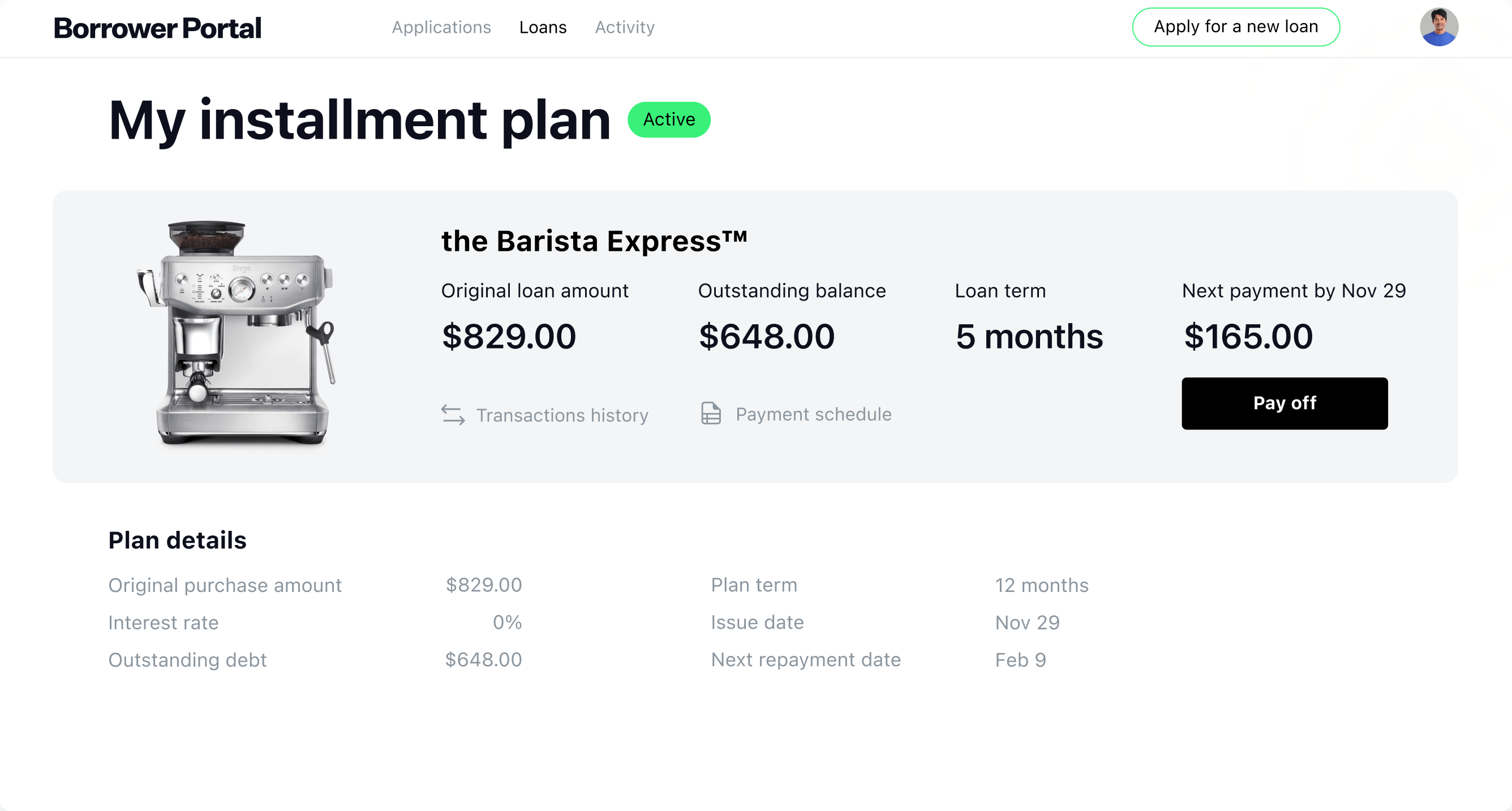

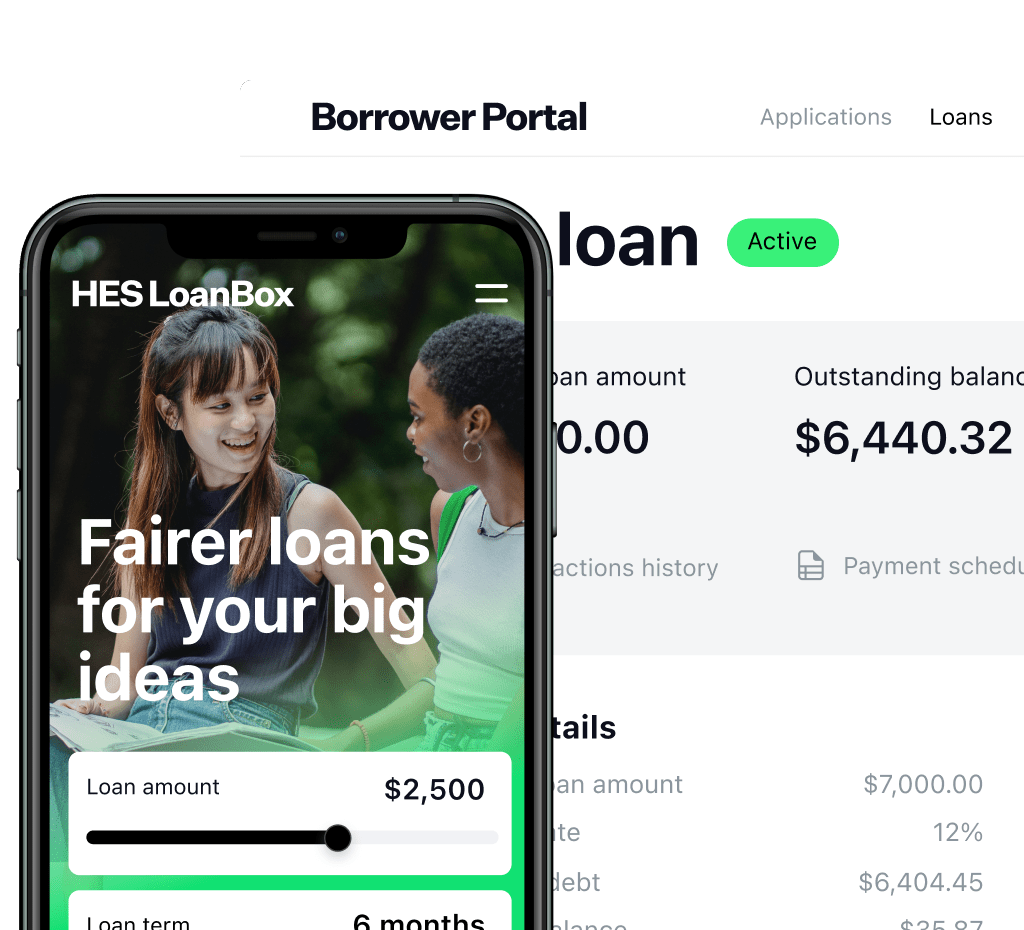

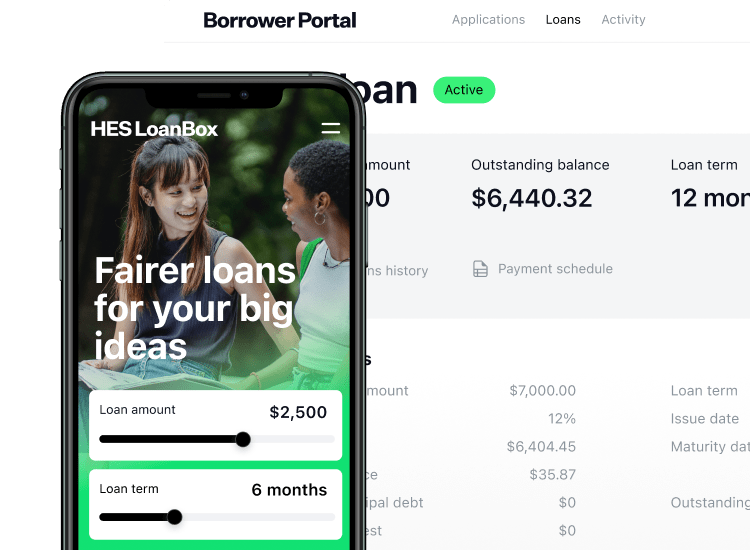

Borrower Portal

Back Office

Time-to-market from 3 months

Integrations with 3rd-party software

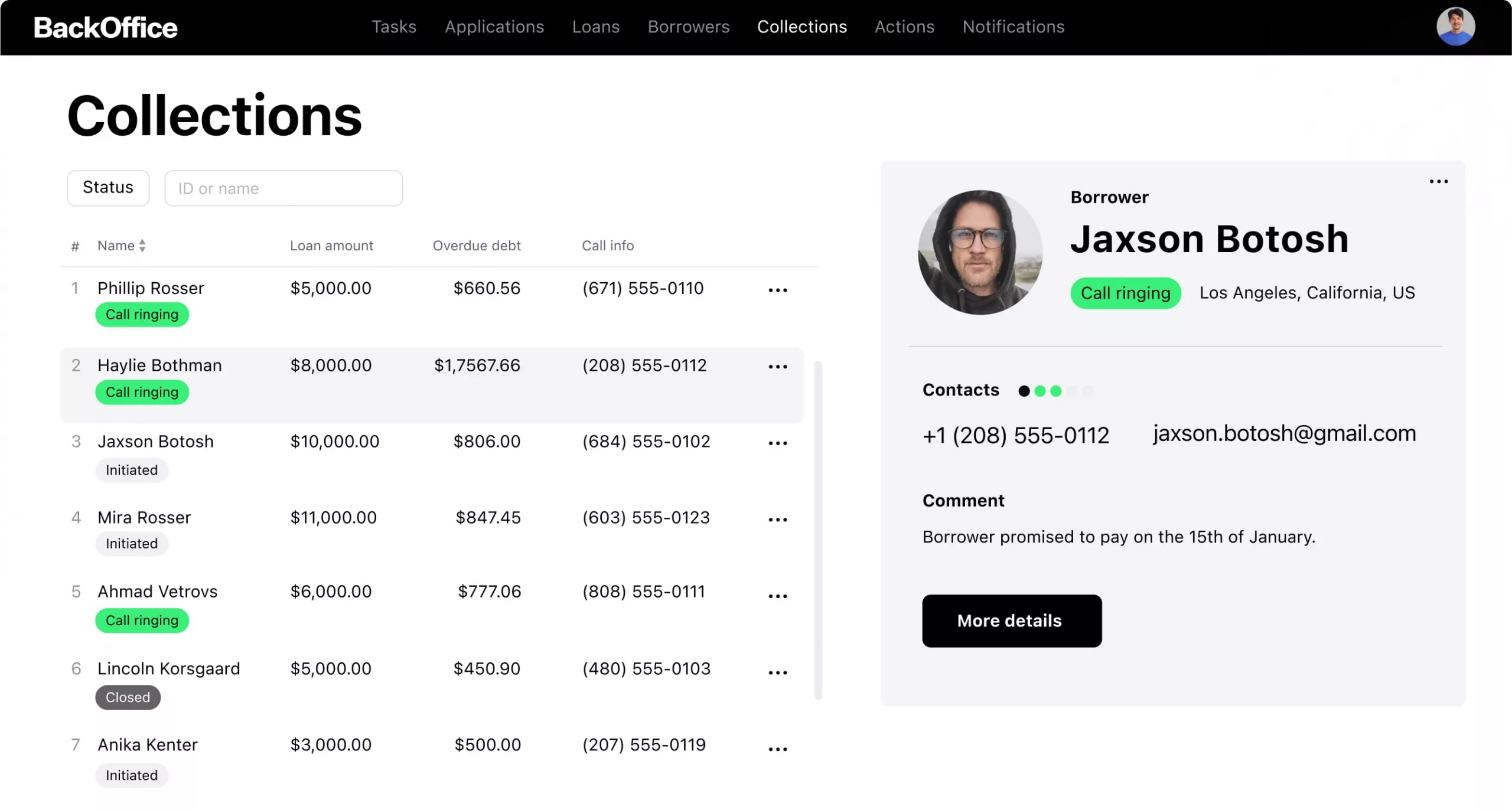

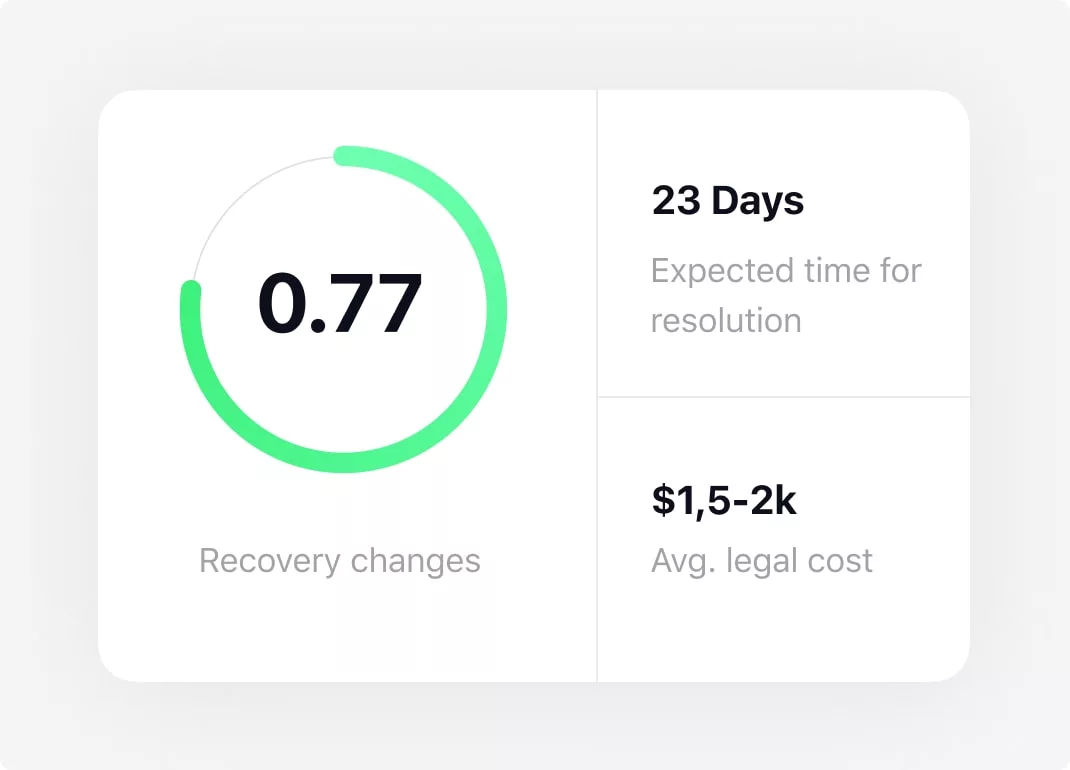

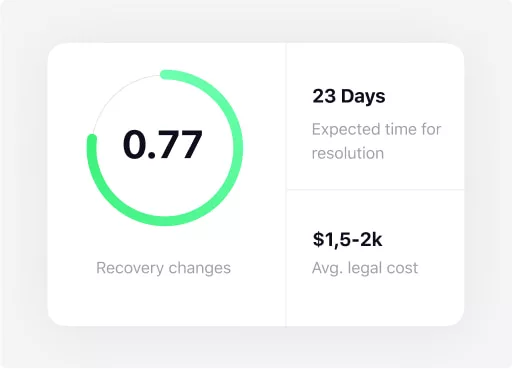

AI-powered collection module

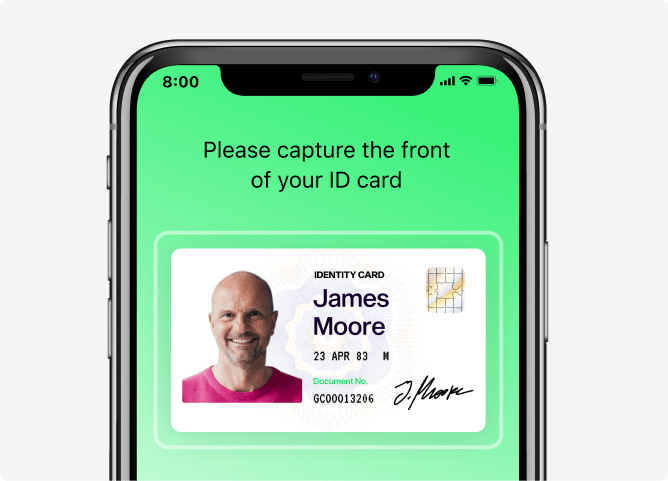

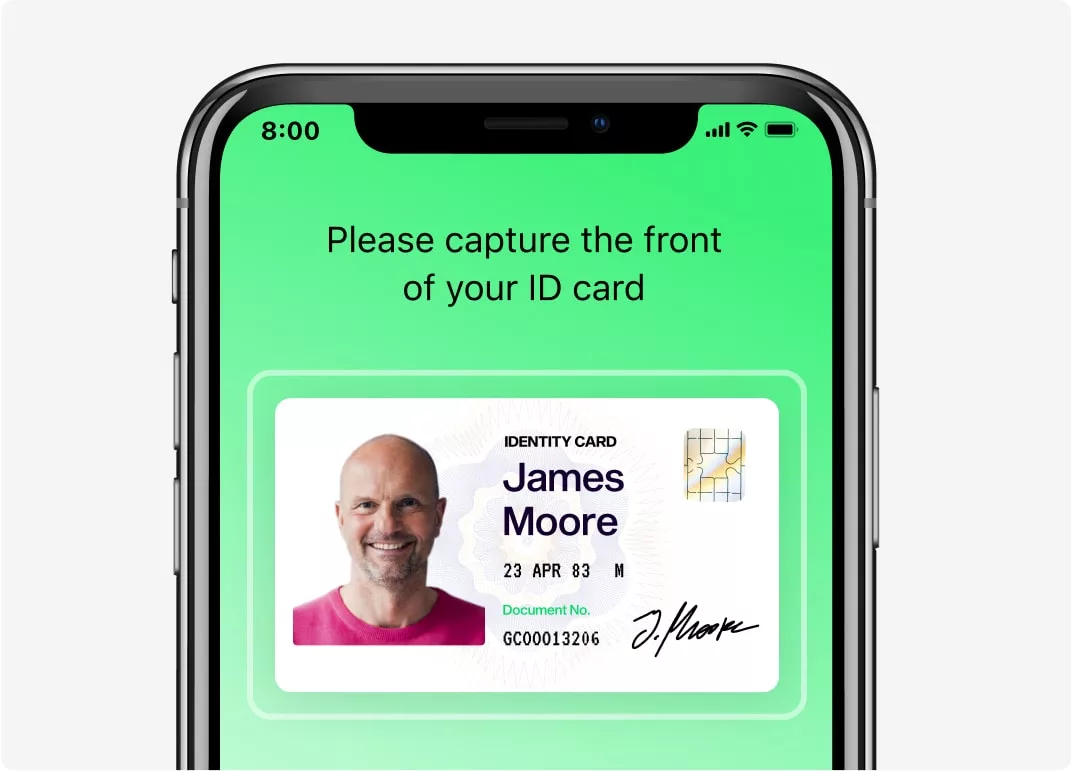

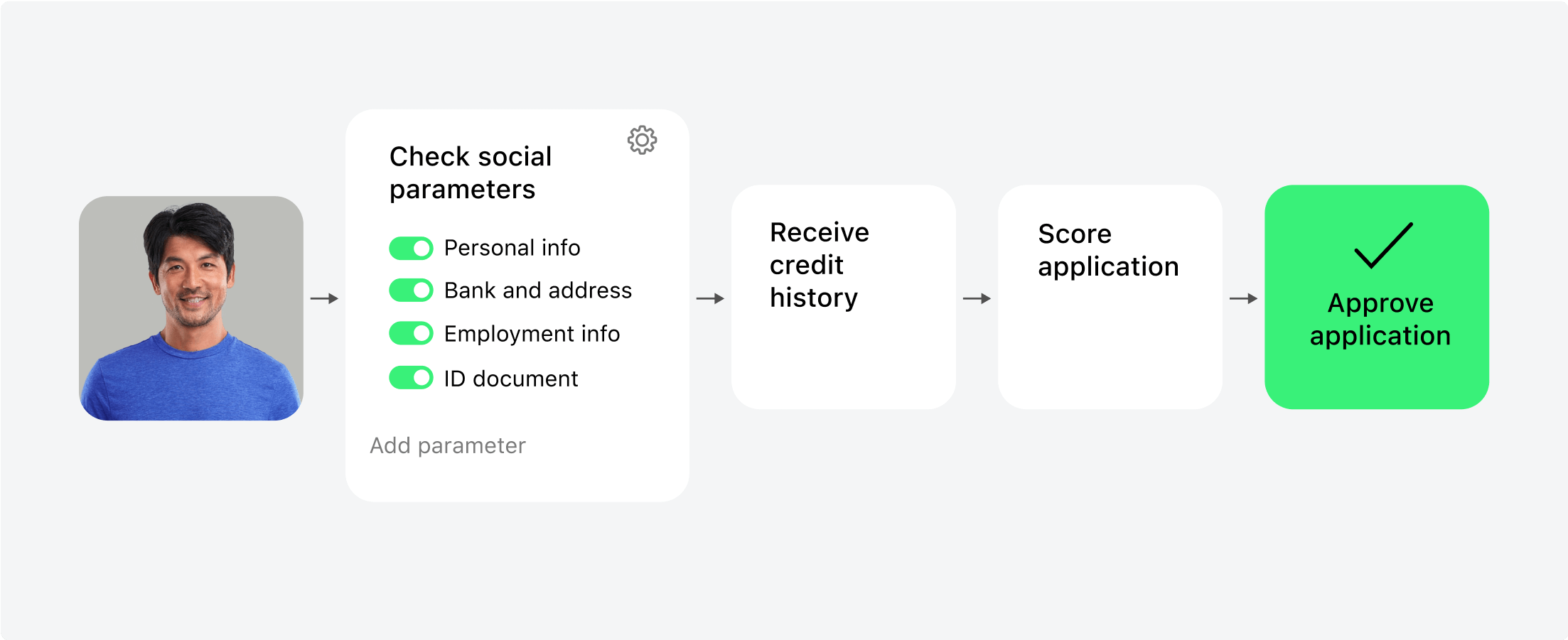

Automated loan application flow

AI-powered decision-making

Why integrate

HES LoanBox?

Increased

transaction

volume

transaction

volume

Enhanced customer

analytics

analytics

Higher average

transaction value

transaction value

Easing of inventory

stockpiles

stockpiles

Improved

CX and loyalty

CX and loyalty

Reduced

transactional

burden

transactional

burden

Boosted sales

conversion

conversion

Competitive

advantage

advantage

Access to new

audience segments

audience segments

Advantages

for your shoppers

Offer your customers a seamless and empowering shopping experience with our BNPL solution.

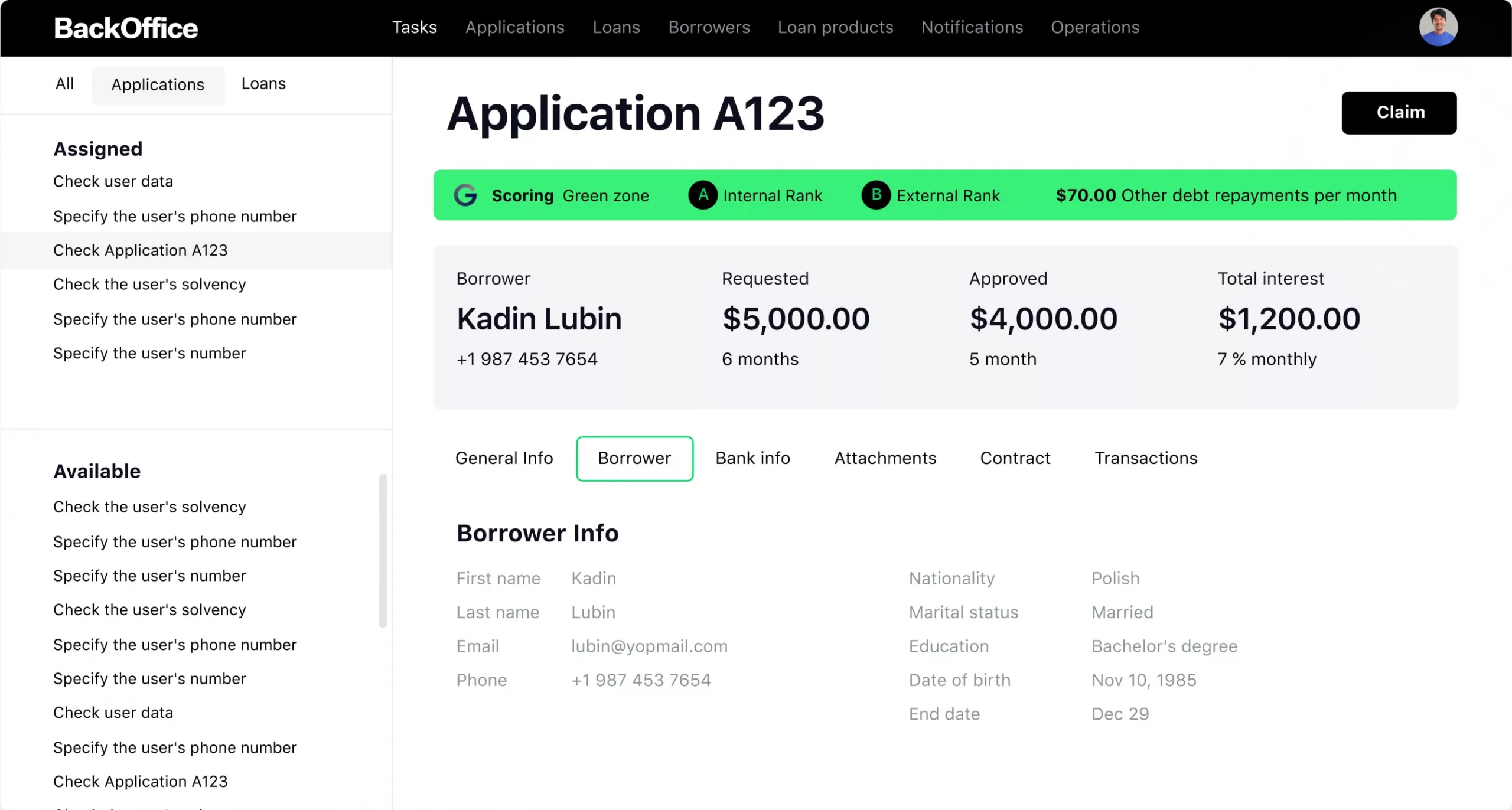

Boost your business with our BNPL platform

Offer a seamless, secure, and fast transition from application to approval without compromising your financial interests. GiniMachine’s analysis pinpoints the banking partners offering the best conditions for each product, in every store, for every shopper.

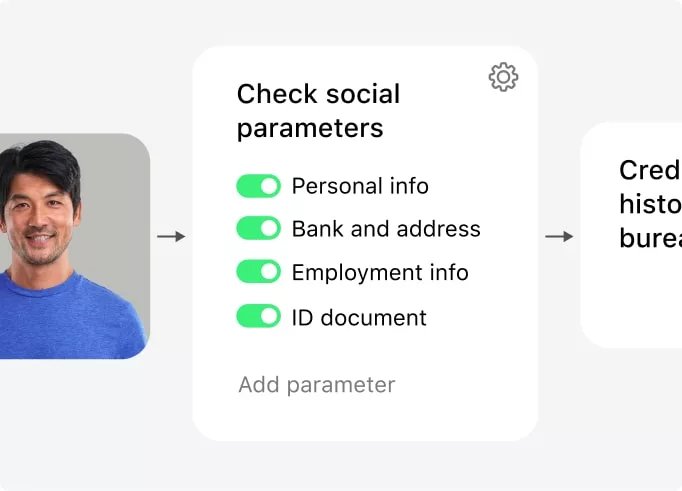

Once a shopper submits their application, GiniMachine analyzes borrower data in real-time and assesses their creditworthiness with impressive accuracy.

Anonymous application scoring

Customized installment offers

Data-driven business decision

Improved customer satisfaction

Enhanced security measures

Insights into customer behavior

Book a HES LoanBox demo to scale

your sales

your sales

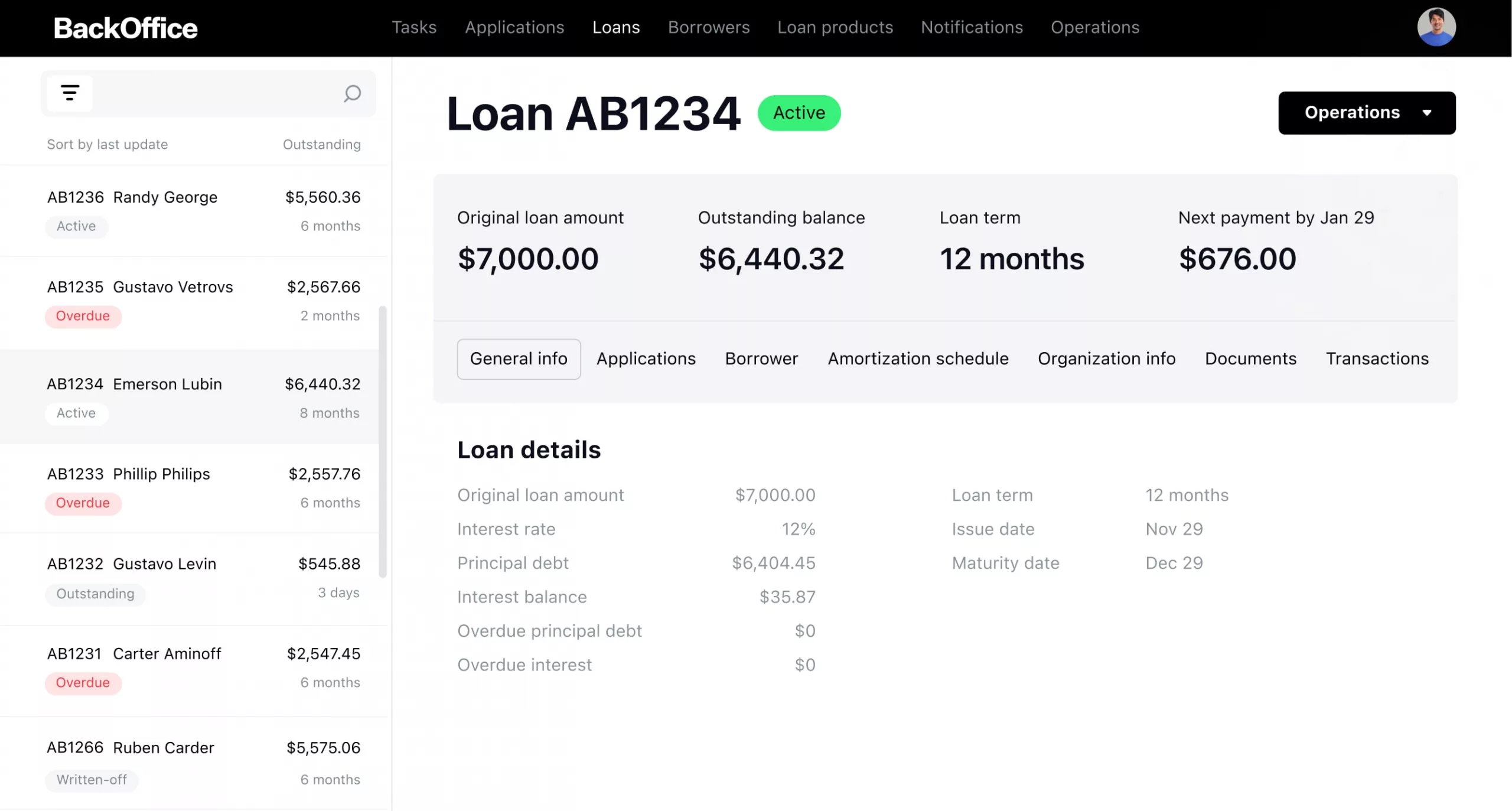

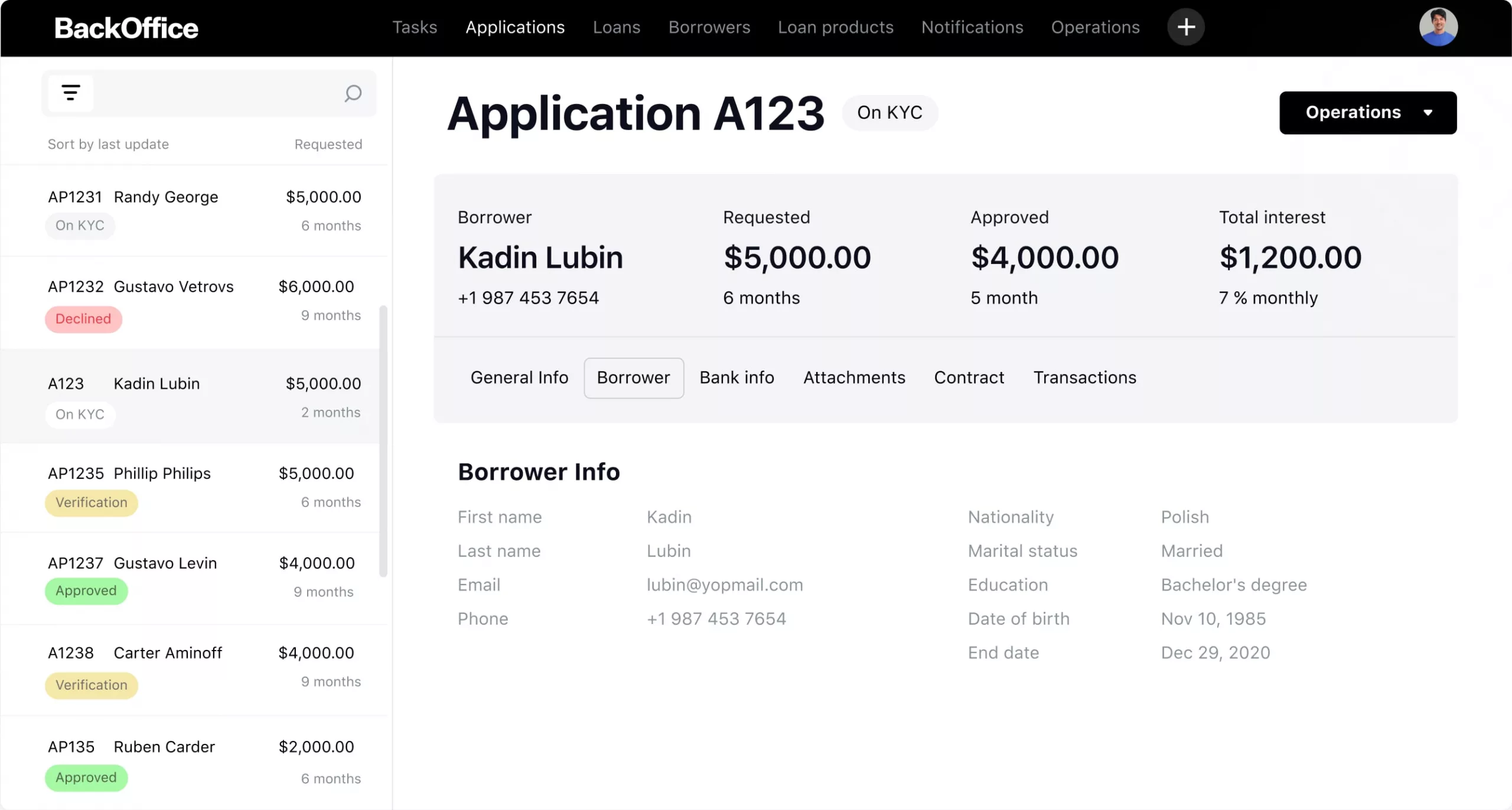

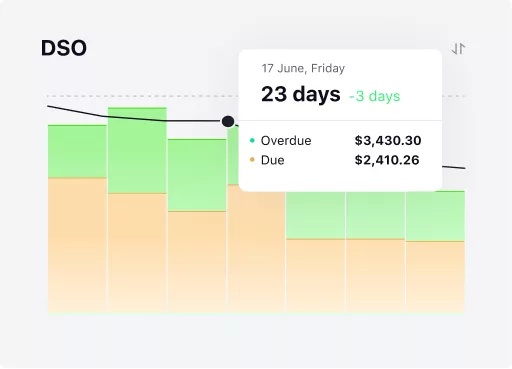

Feature-rich back

office

for loan managers

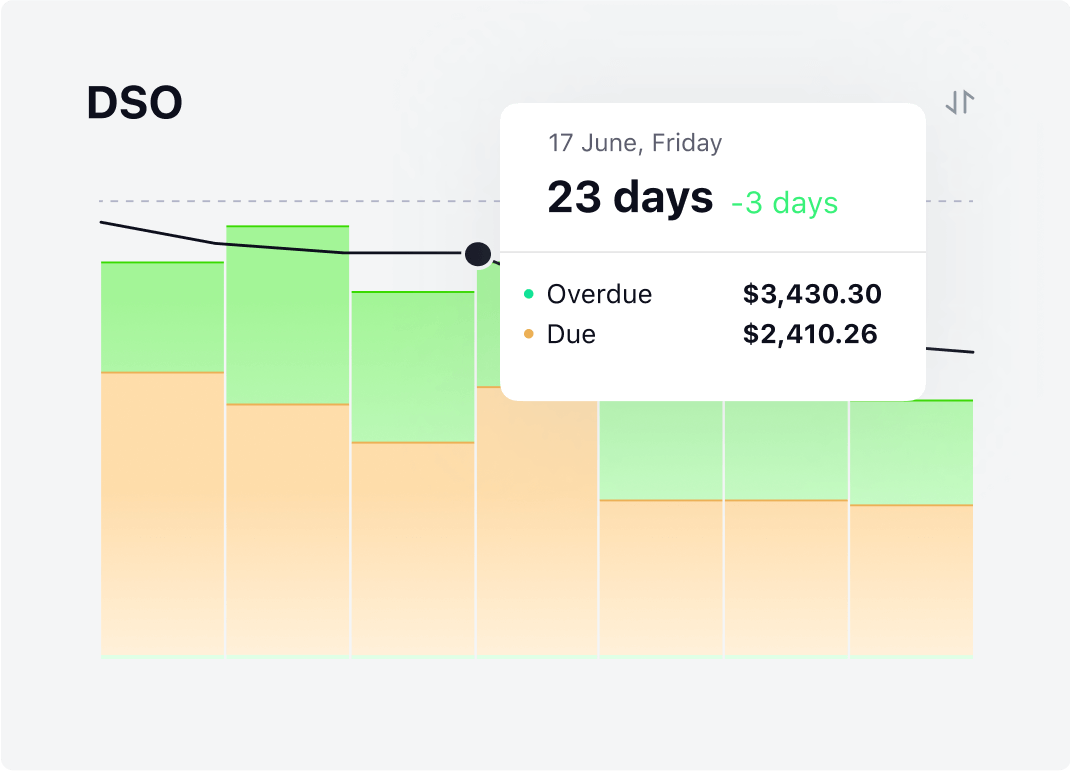

Automated decision-making

Buy Now Pay Later software sweeps away manual processes, ad-hoc queries, and paper trails. Get a single

smooth automated workflow that meets borrowers’ needs while improving operational efficiency.

smooth automated workflow that meets borrowers’ needs while improving operational efficiency.

and much more

Loan application management

Loan management

Document templates

Automation of disbursements and payments

Transactions and reporting

Unlock all the benefits of BNPL model

Activate BNPL

for your business

Workflow customization

No limits on assets or customers

3 months time-to-market

No additional charges per user

FAQ

What’s BNPL?

How does BNPL work?

What are the benefits of BNPL model for merchants?

What are the benefits of BNPL model for shoppers?