Loan management software

in Saudi Arabia

Grow your business with fully digital, 100% automated, AI-powered, and secure operations that comply

with SAMA regulations and Islamic finance rules.

with SAMA regulations and Islamic finance rules.

Trusted by Middle Eastern businesses

Digital lending ecosystem

for today’s banks and lenders

HES LoanBox is a fully Shariah-compliant,

AI-powered loan management system that covers every aspect of loan origination, management, and servicing. As a cloud-native and locally hosted tool, HES LoanBox enables banks and alternative lenders to conduct their lending business more effectively – faster, more securely, and with greater automation. This reduces NPLs and drives increased revenue.

AI-powered loan management system that covers every aspect of loan origination, management, and servicing. As a cloud-native and locally hosted tool, HES LoanBox enables banks and alternative lenders to conduct their lending business more effectively – faster, more securely, and with greater automation. This reduces NPLs and drives increased revenue.

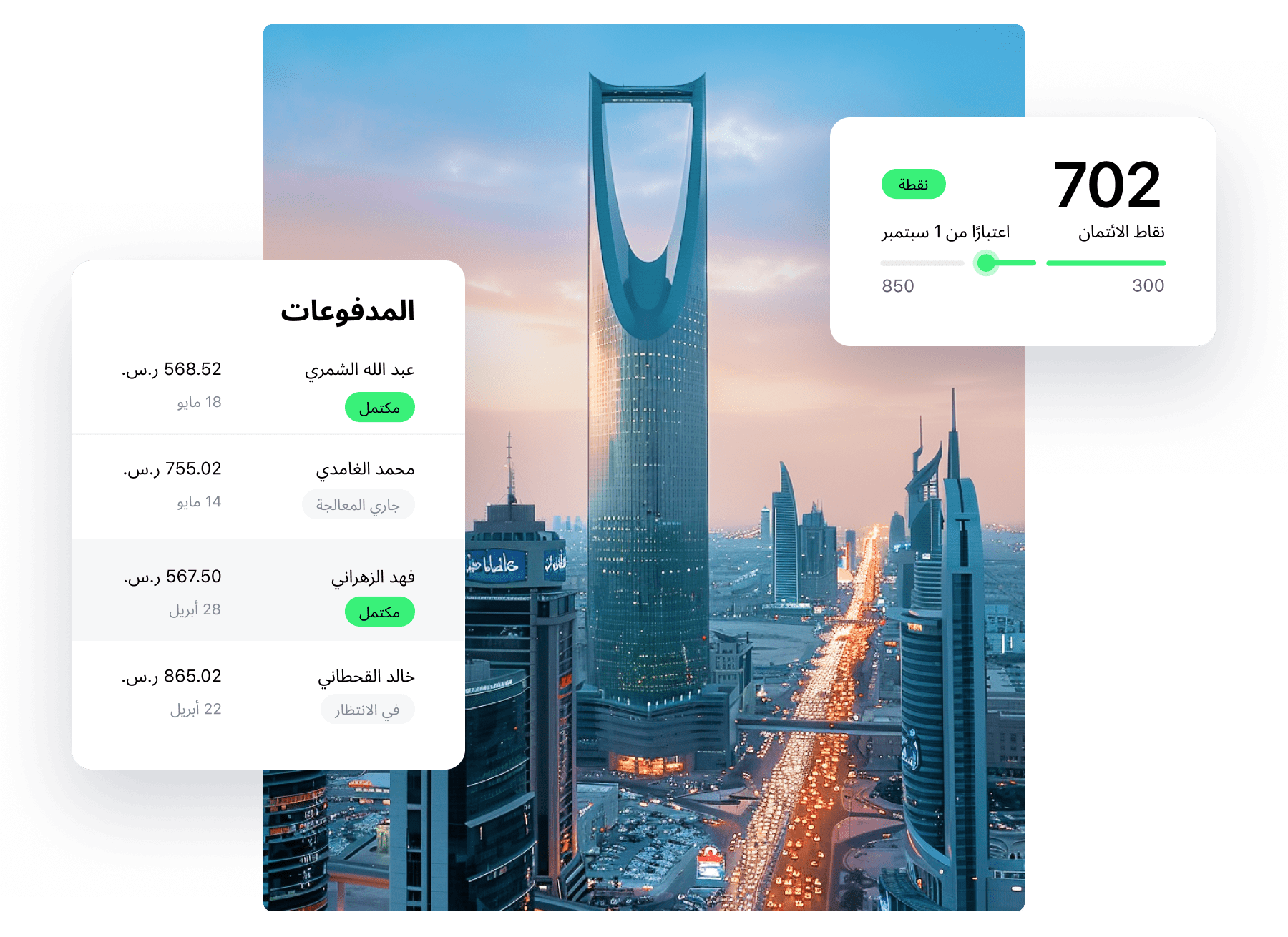

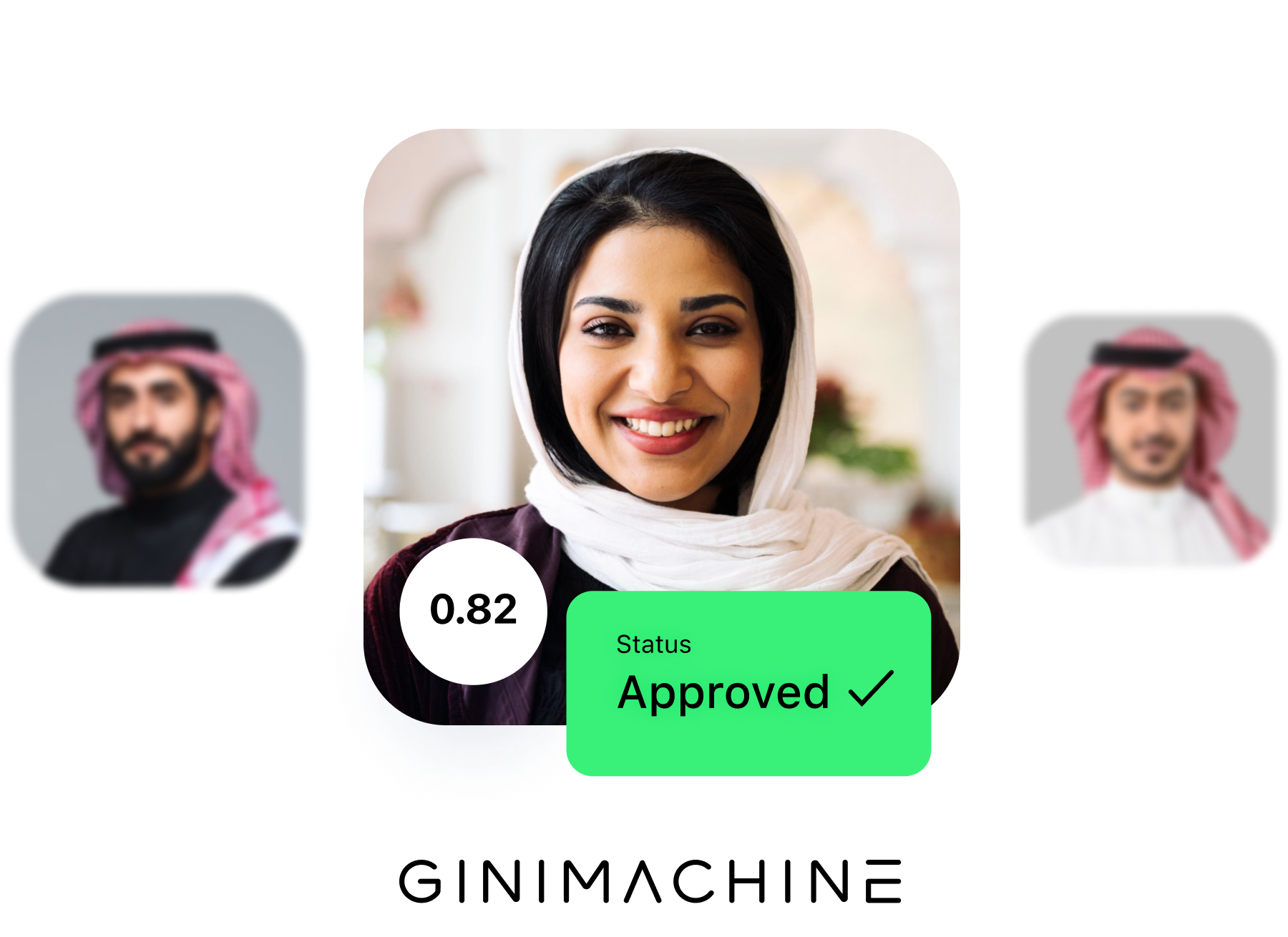

GiniMachine is a no-code AI tool

that employs machine learning algorithms to analyze borrowers’ data, including alternative

data, and provide lenders with insights into their behavior. Seamlessly integrated within

HES LoanBox, it eliminates guesswork from decision-making, enabling informed,

data-driven choices.

that employs machine learning algorithms to analyze borrowers’ data, including alternative

data, and provide lenders with insights into their behavior. Seamlessly integrated within

HES LoanBox, it eliminates guesswork from decision-making, enabling informed,

data-driven choices.

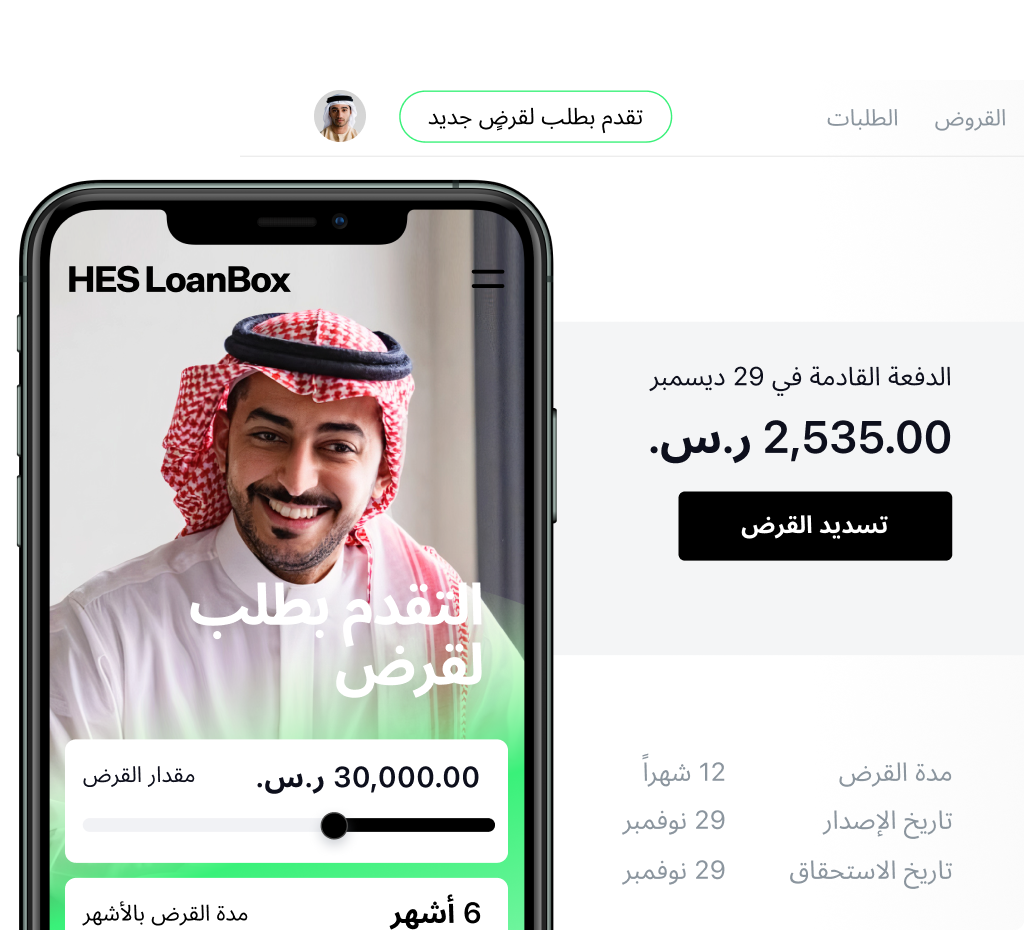

HES LoanBox overview

Transform your

lending operations

Our software revolutionizes lending by enabling end-to-end digital loan management – from origination through servicing – on any device, at any time.

Comply with SAMA regulations

HES LoanBox is a maturity-level-3 software designed to meet Saudi ethical standards and regulatory requirements at all levels, including local data storage with ORACLE.

Saudi-ready lending software

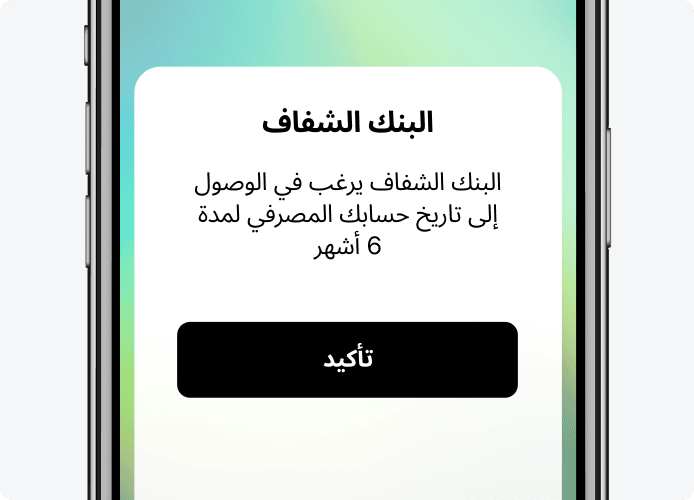

Our loan management system features direct connections to regional banking systems and local service platforms, which enhance operational efficiency and ensure compliance.

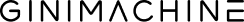

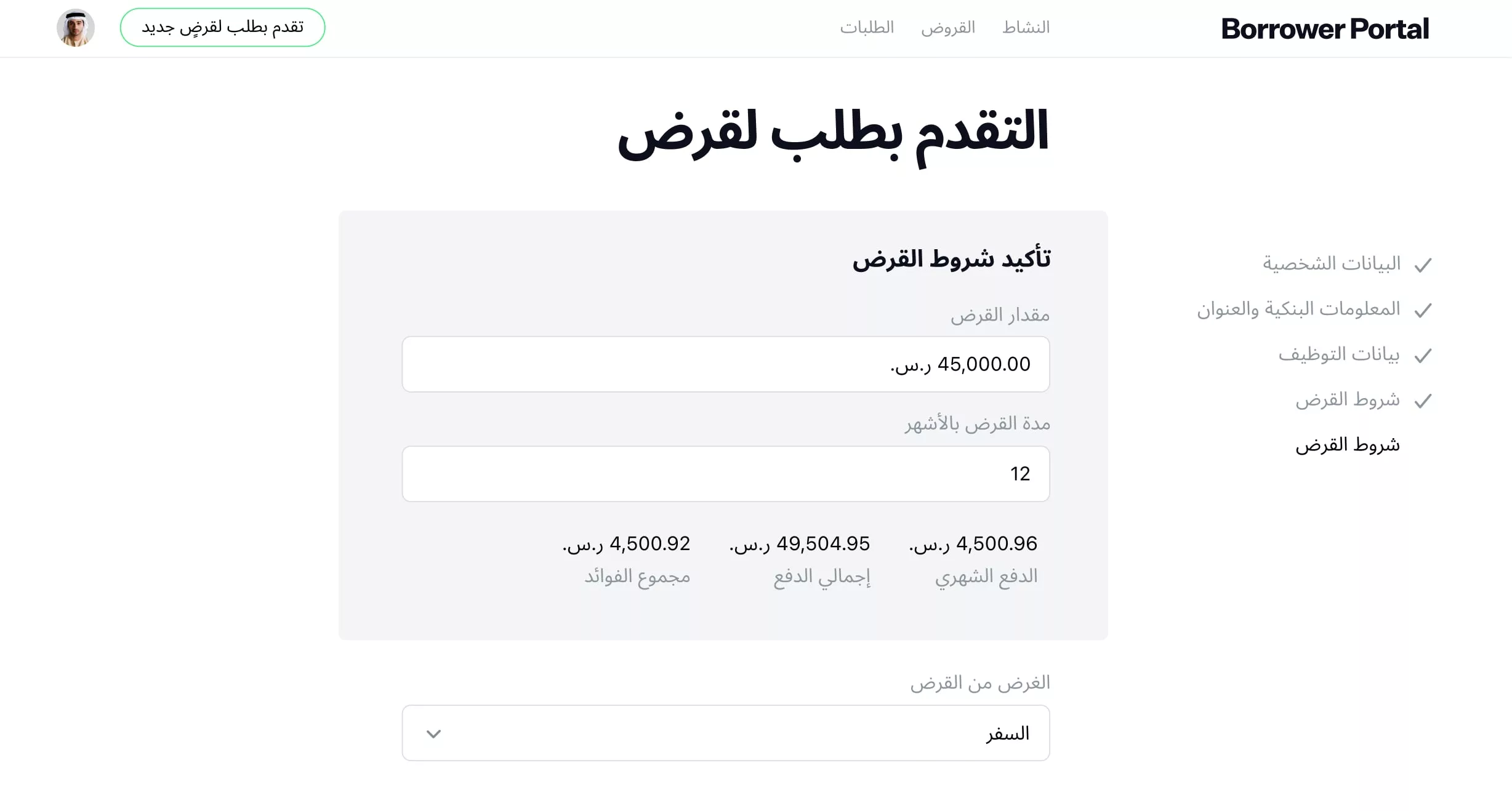

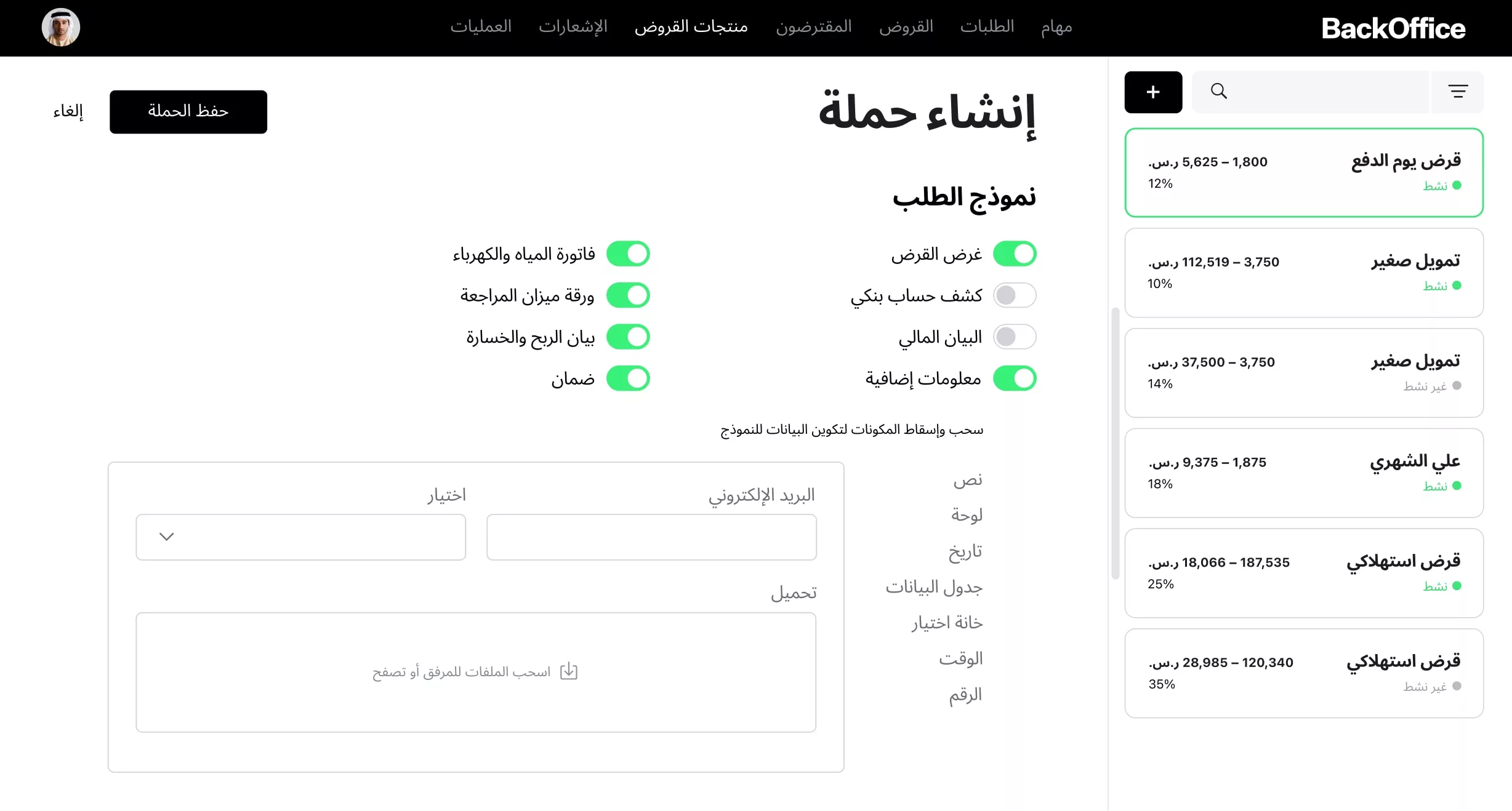

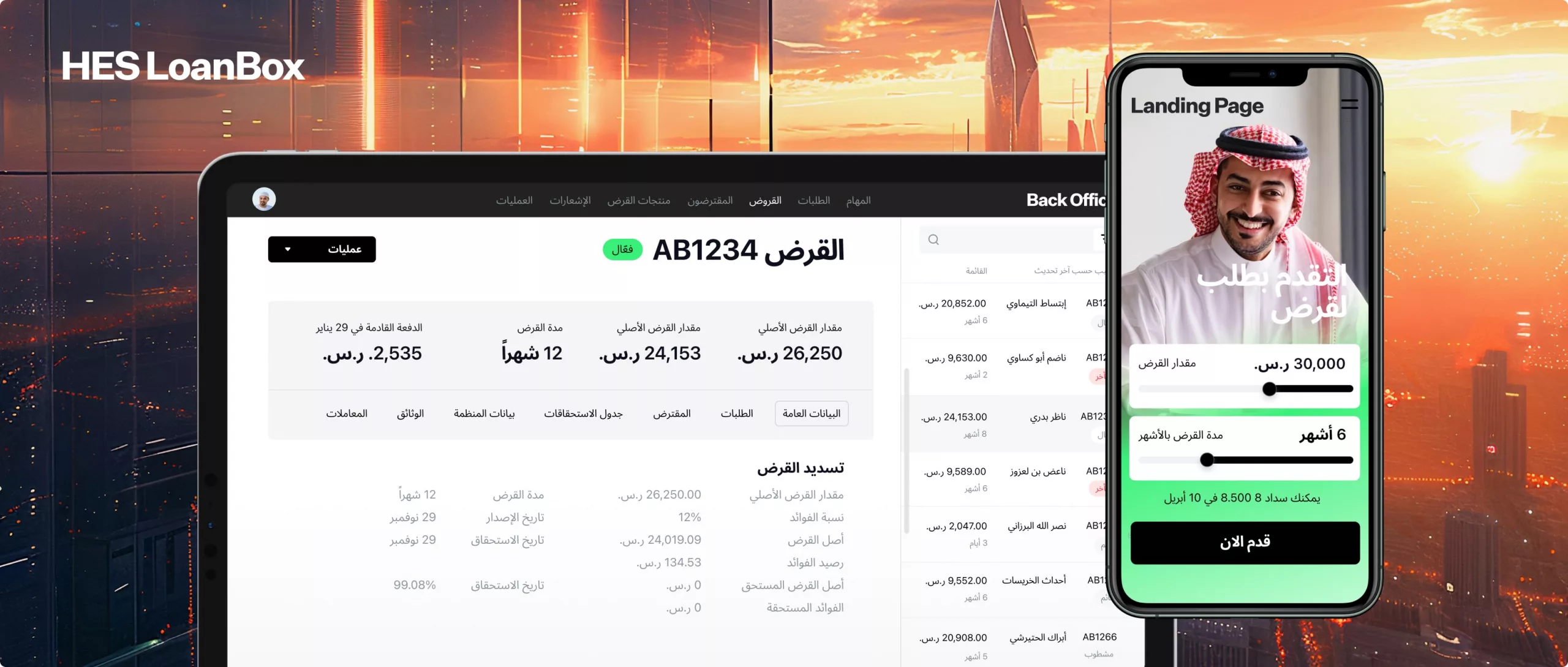

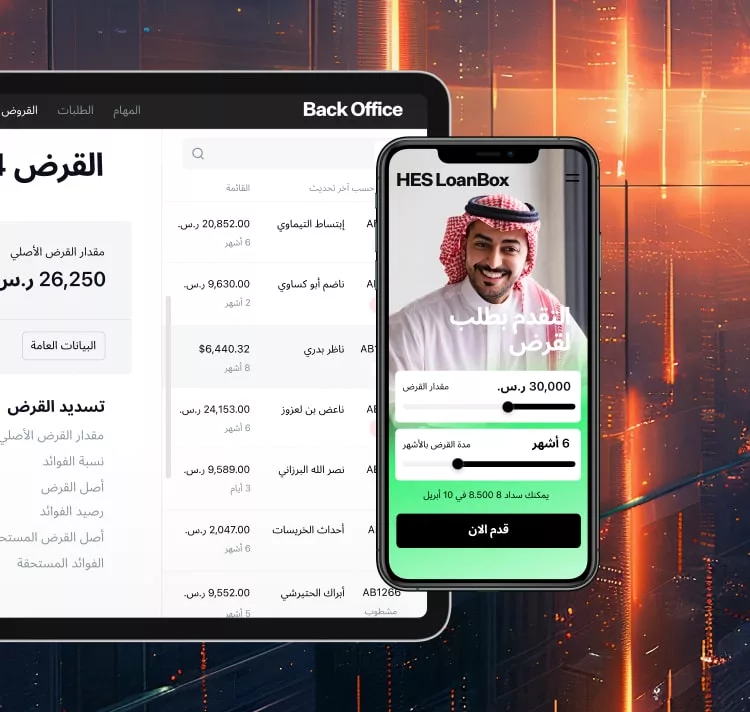

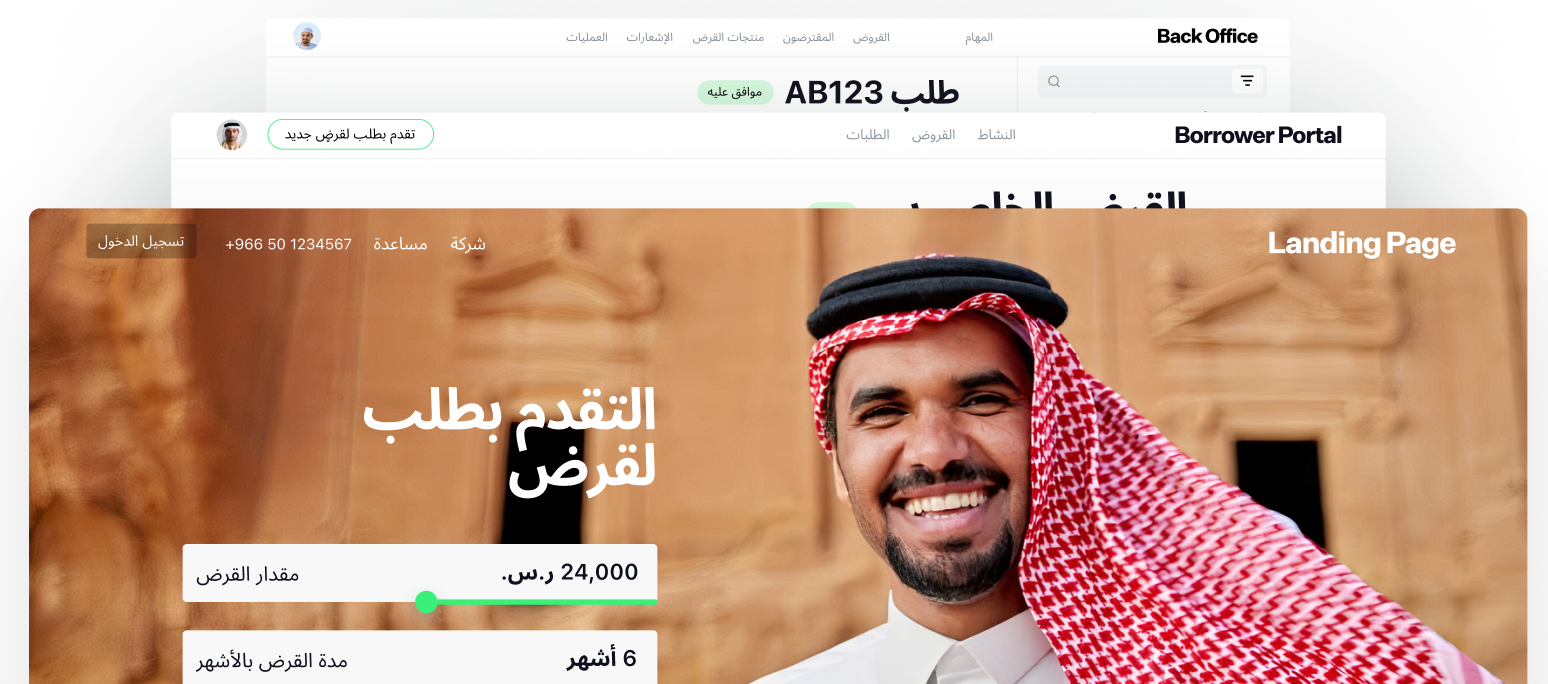

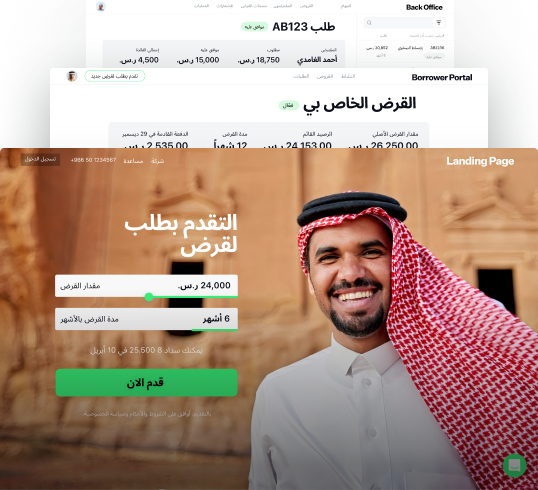

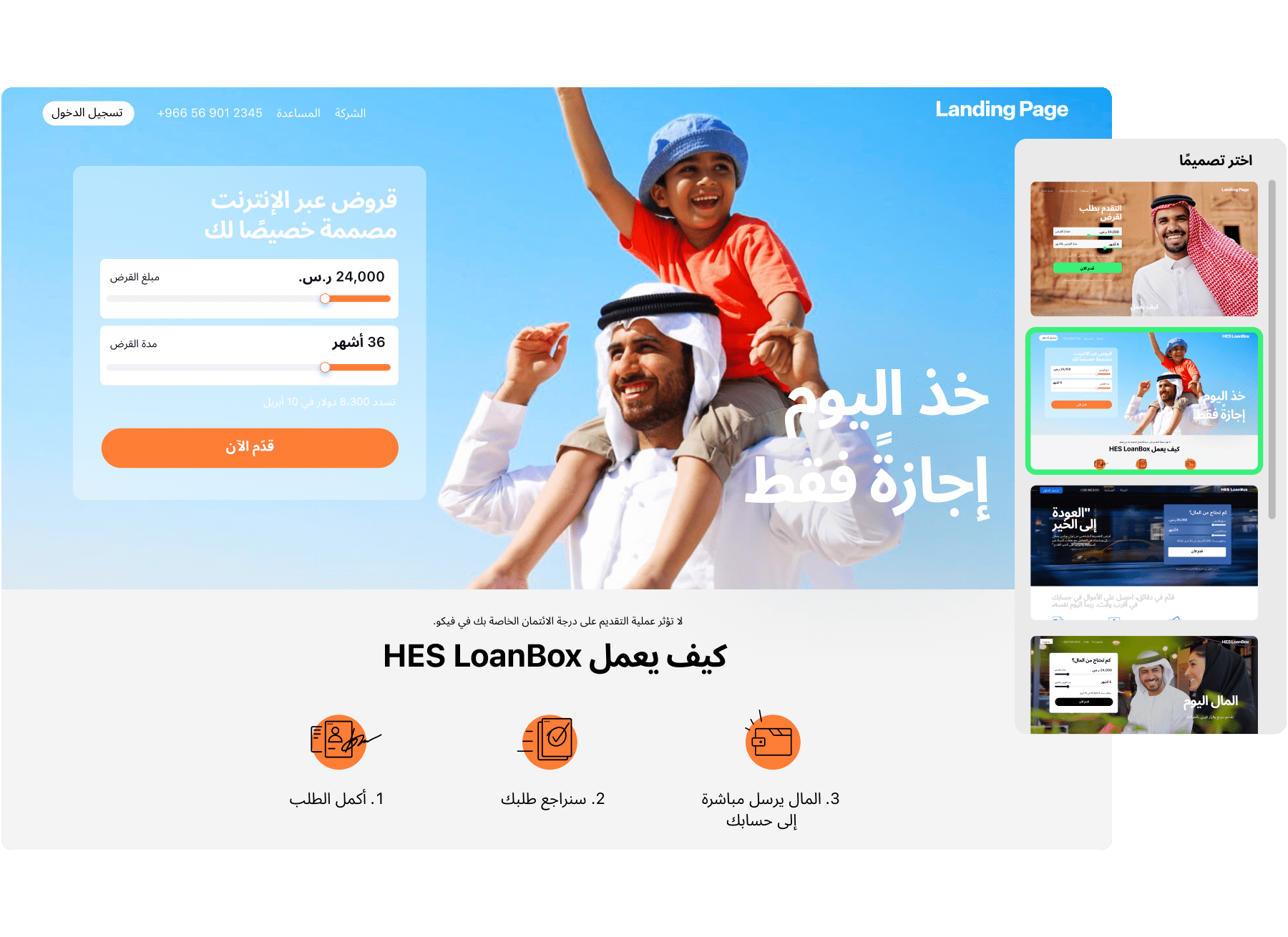

White-label landing page

Choose your own design for a user-friendly loan website enhances user engagement and boosts application numbers.

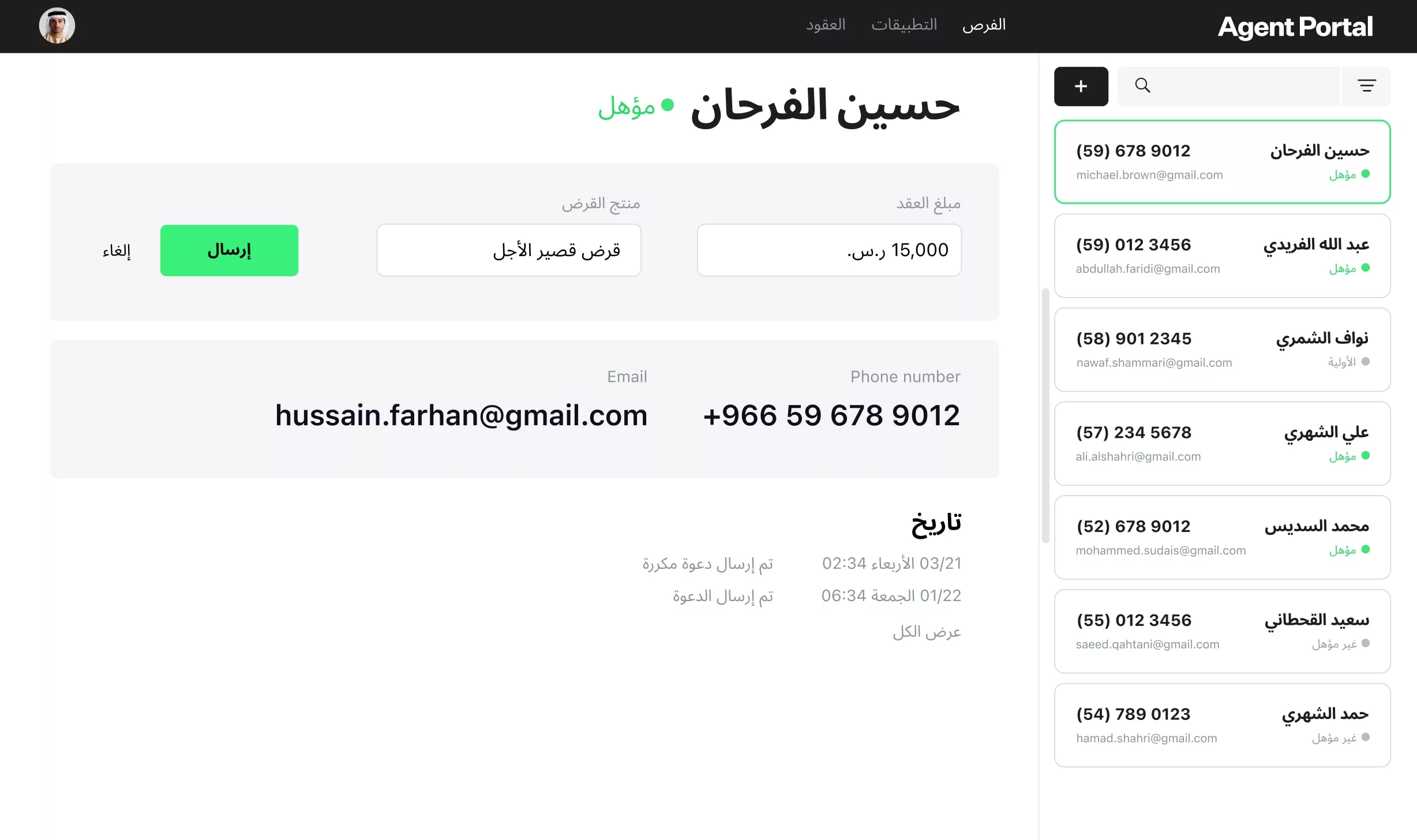

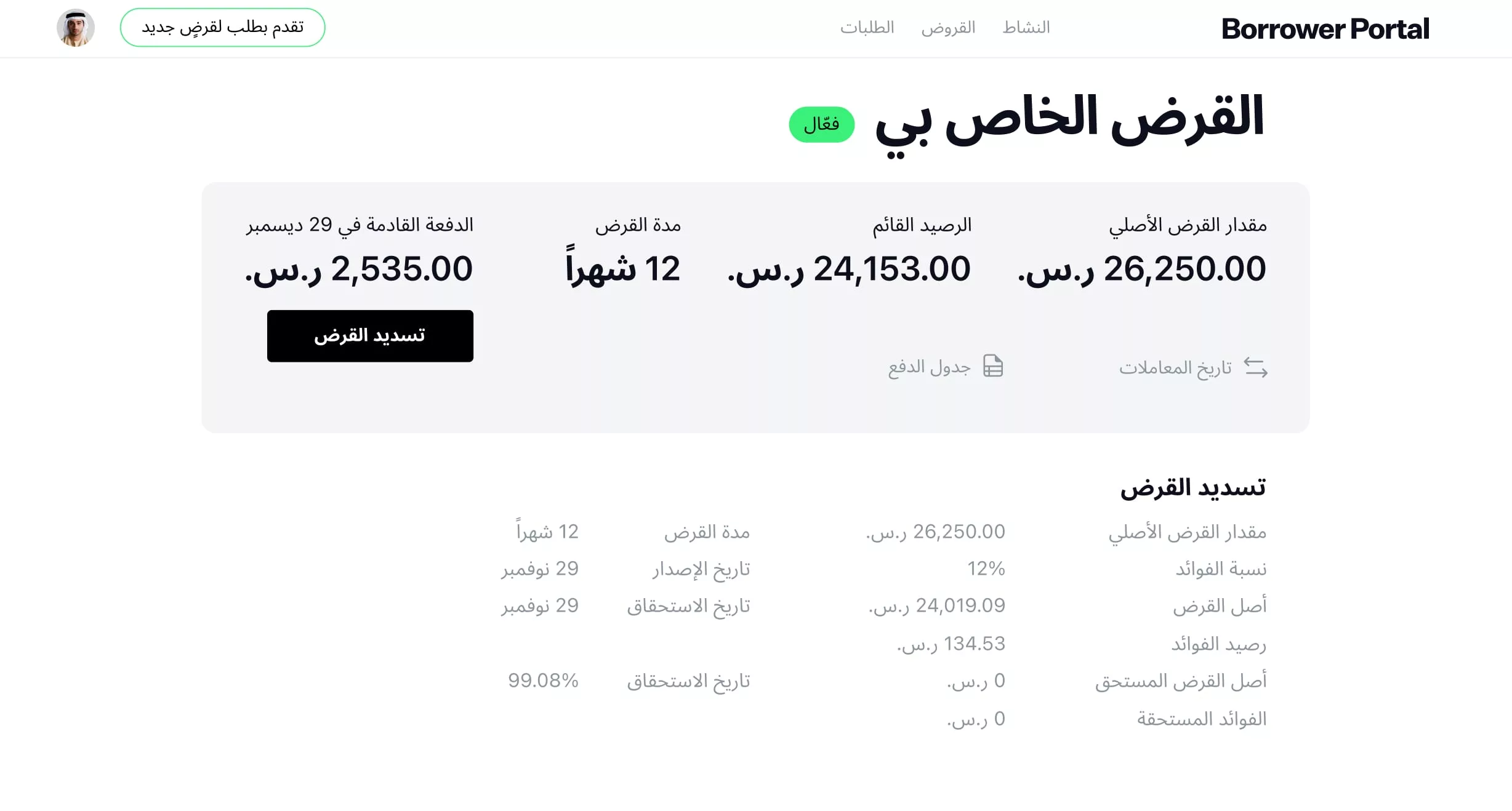

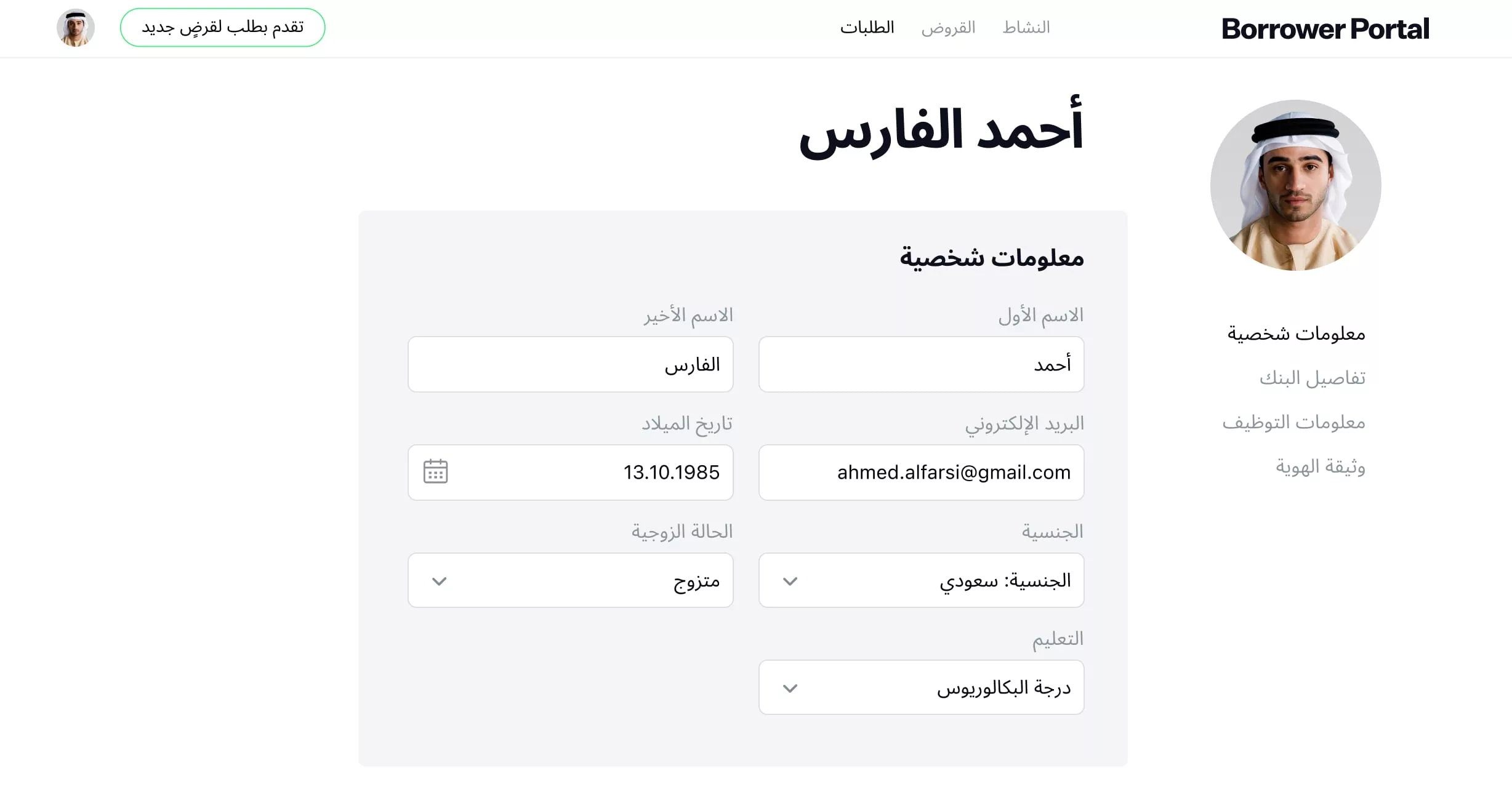

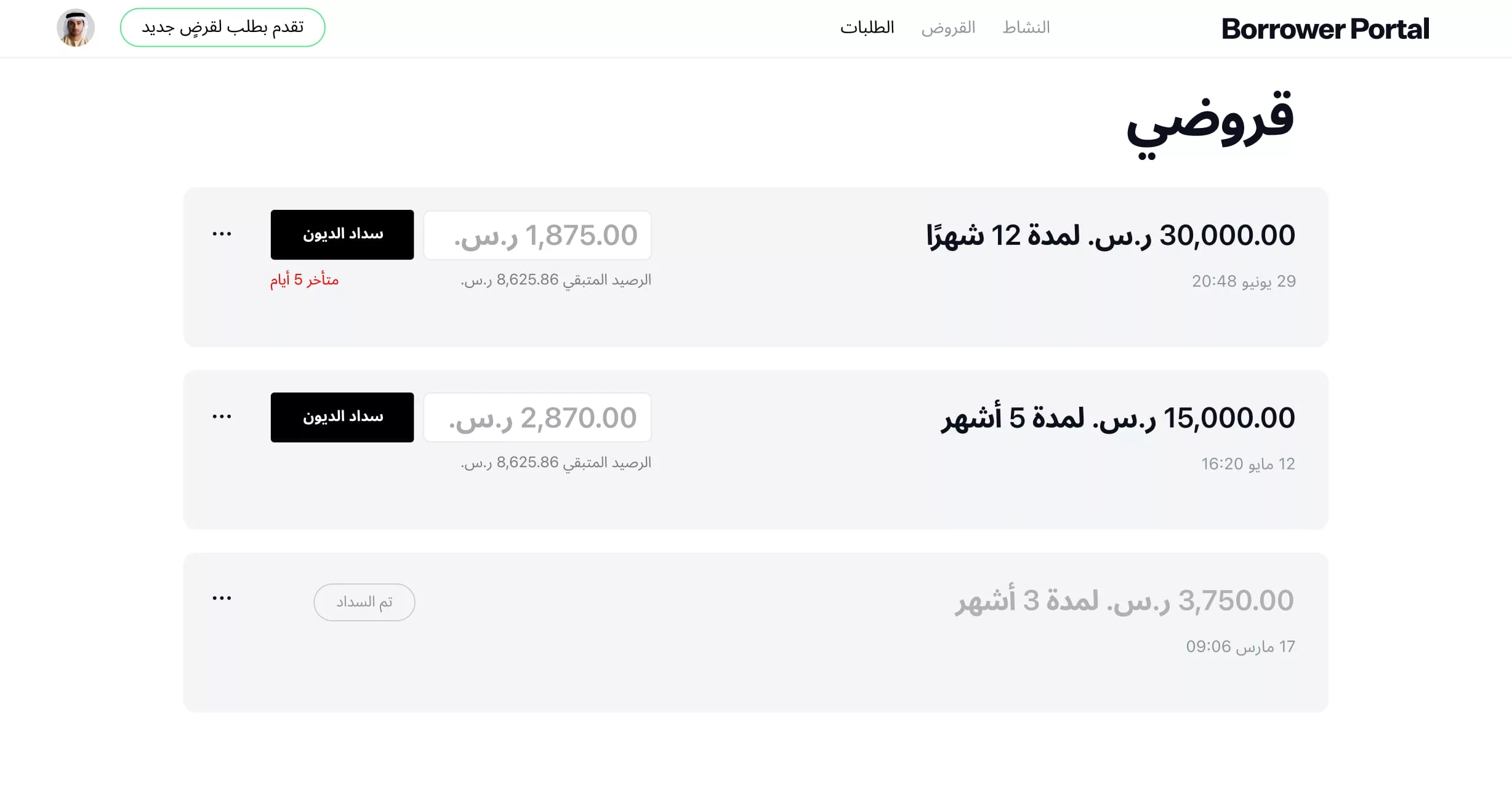

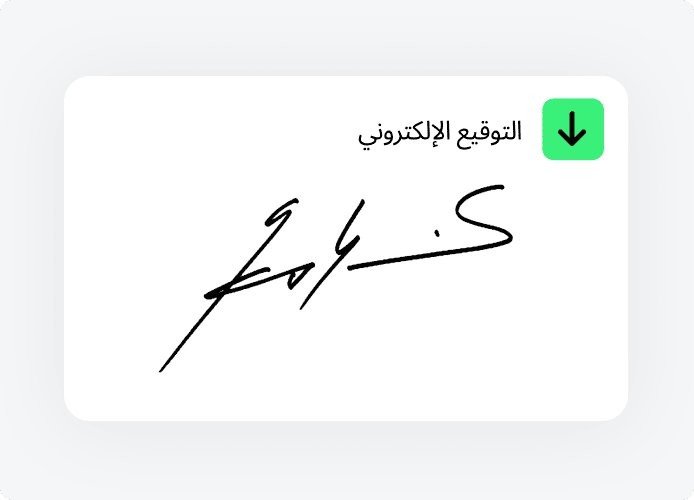

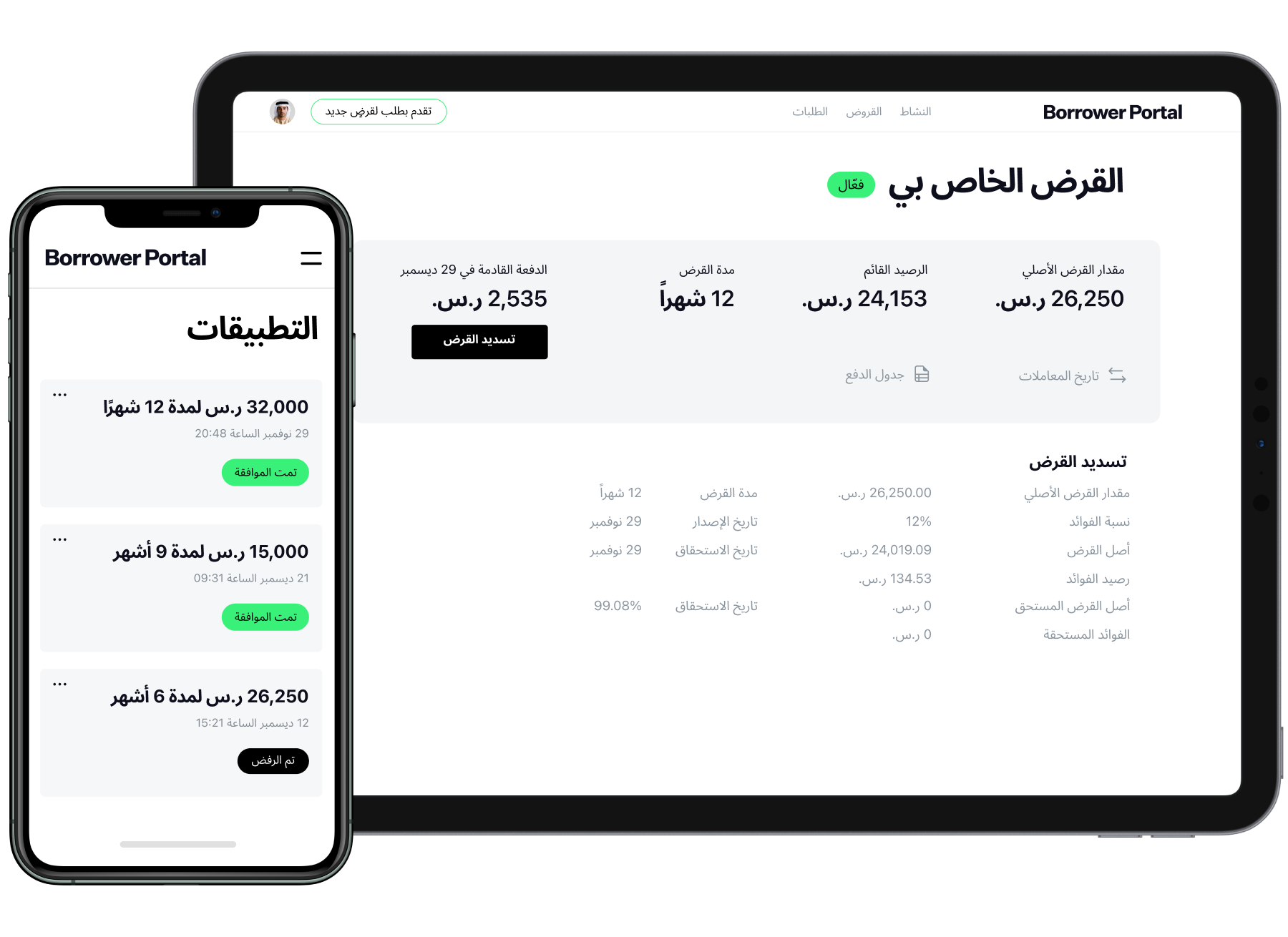

Simplify your customers’ loan journey

Provide a personal space where borrowers can control every aspect of their loan journey – from application to digital KYC verification.

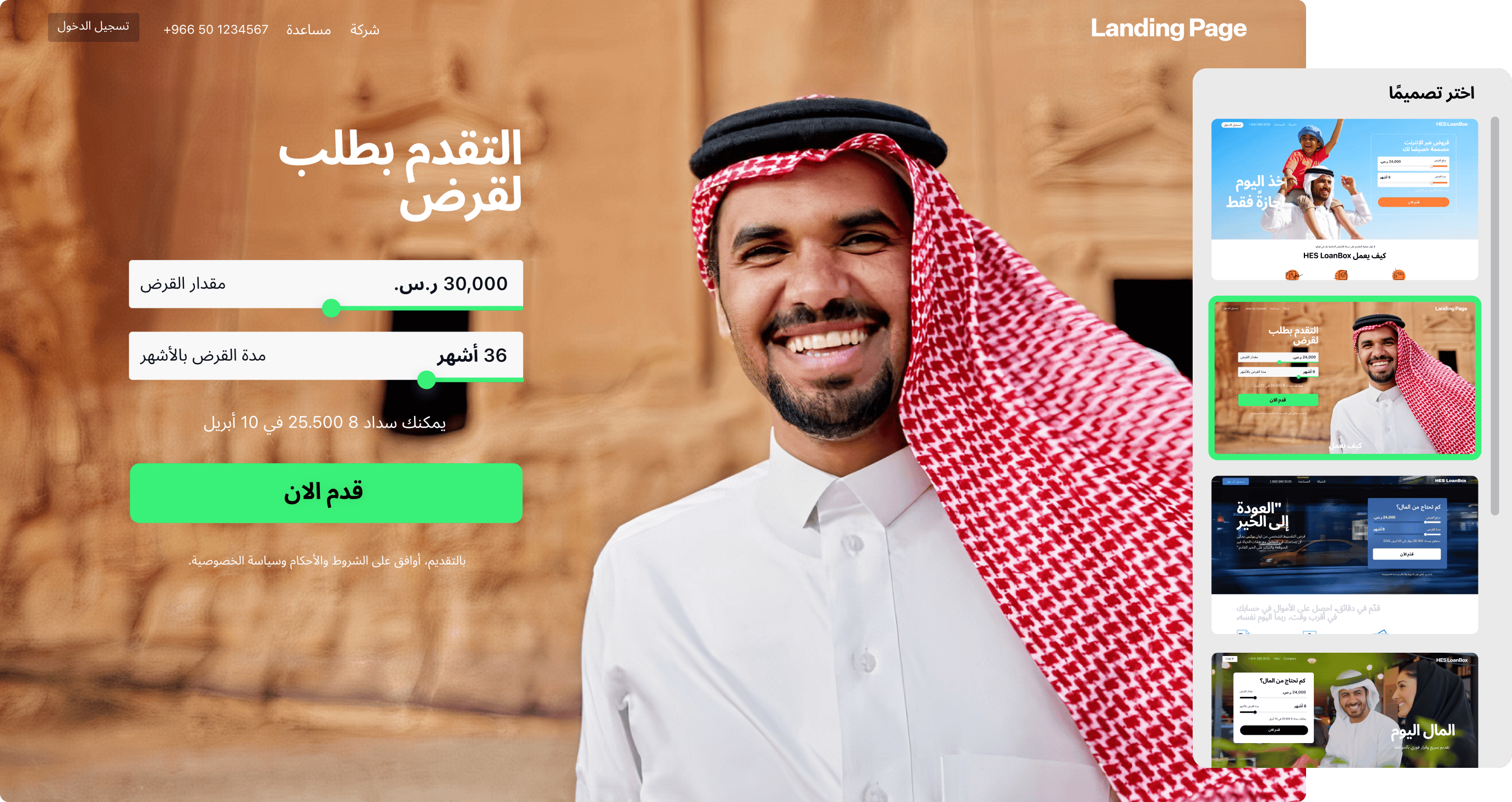

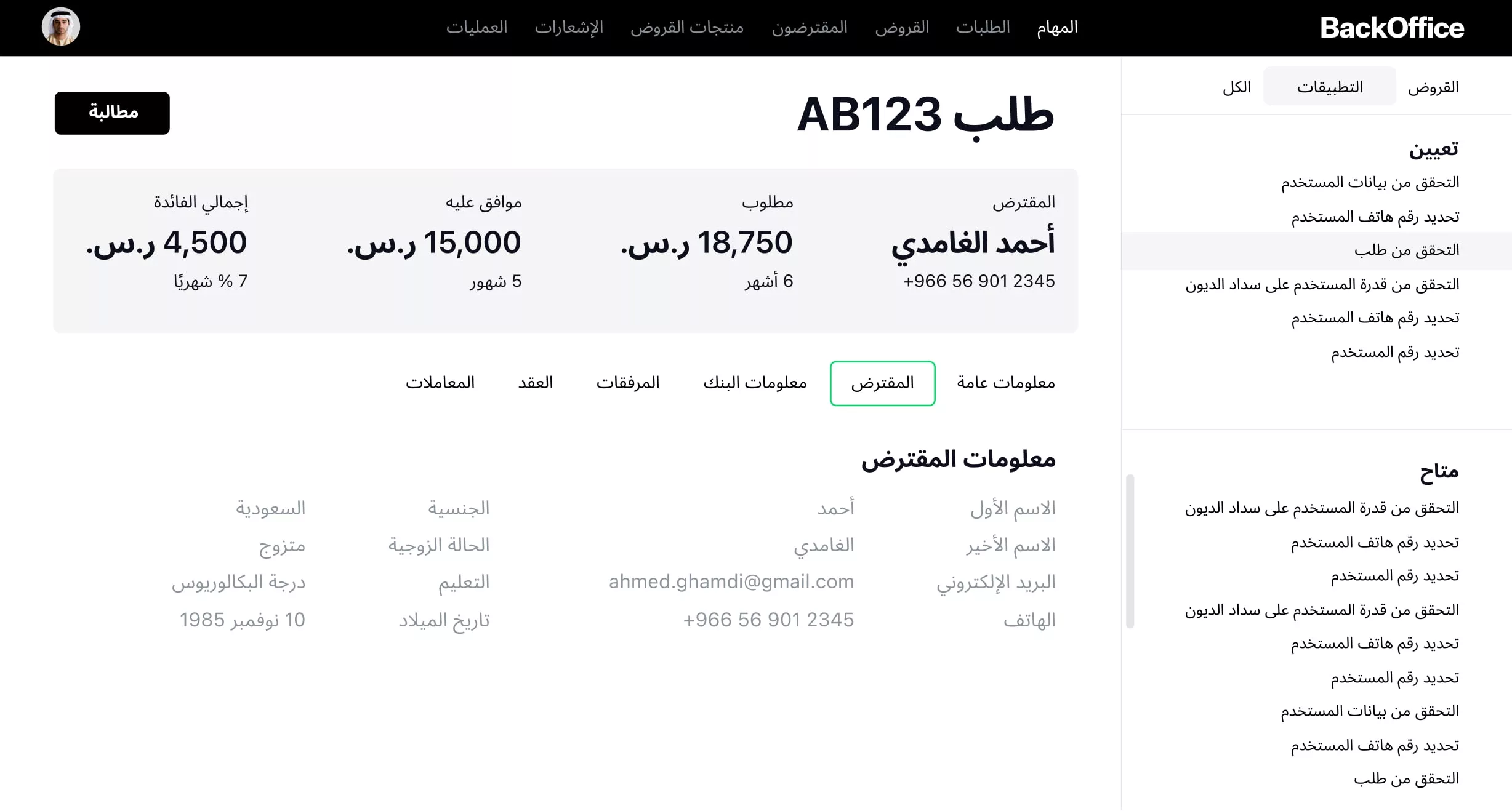

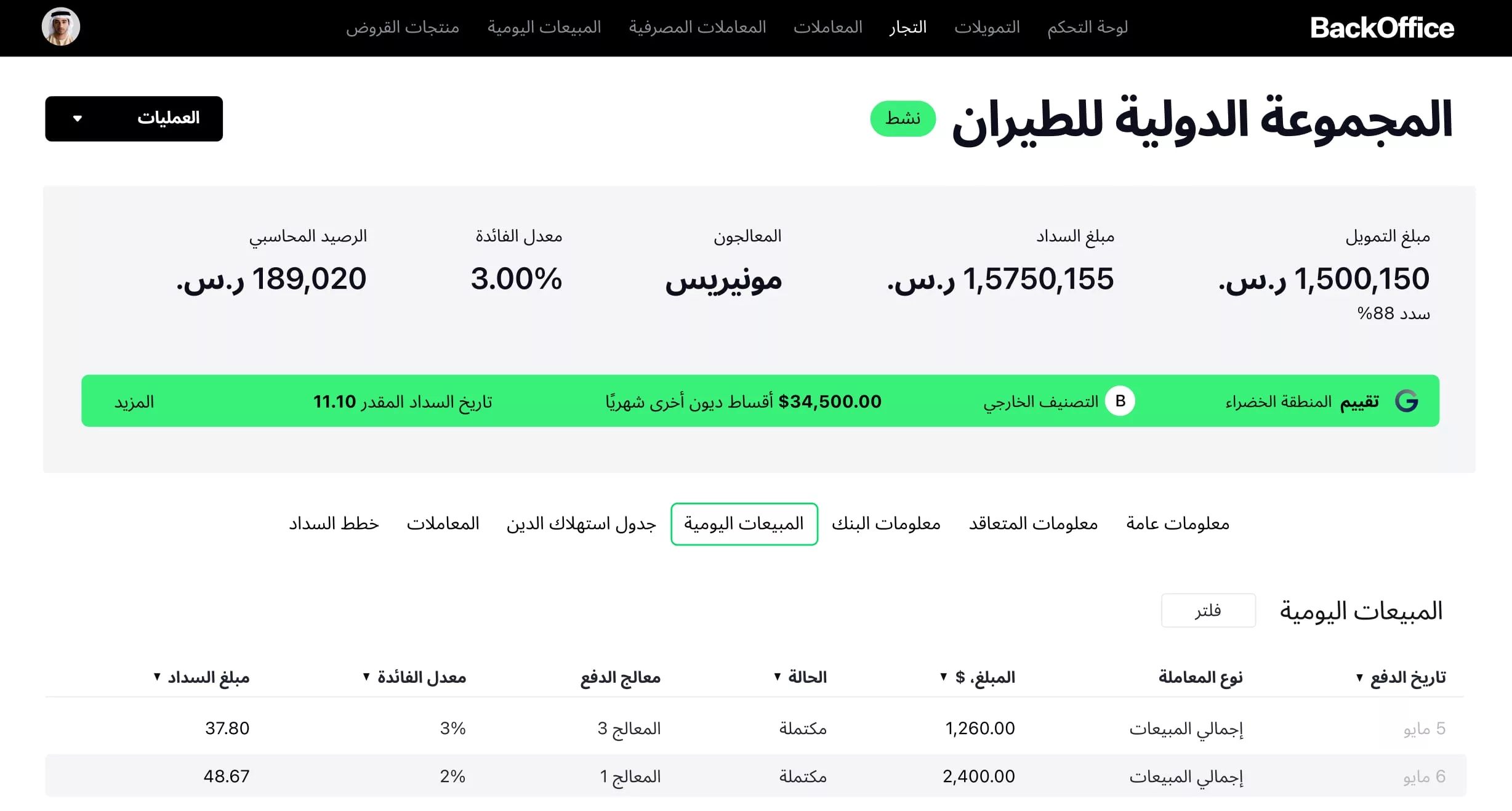

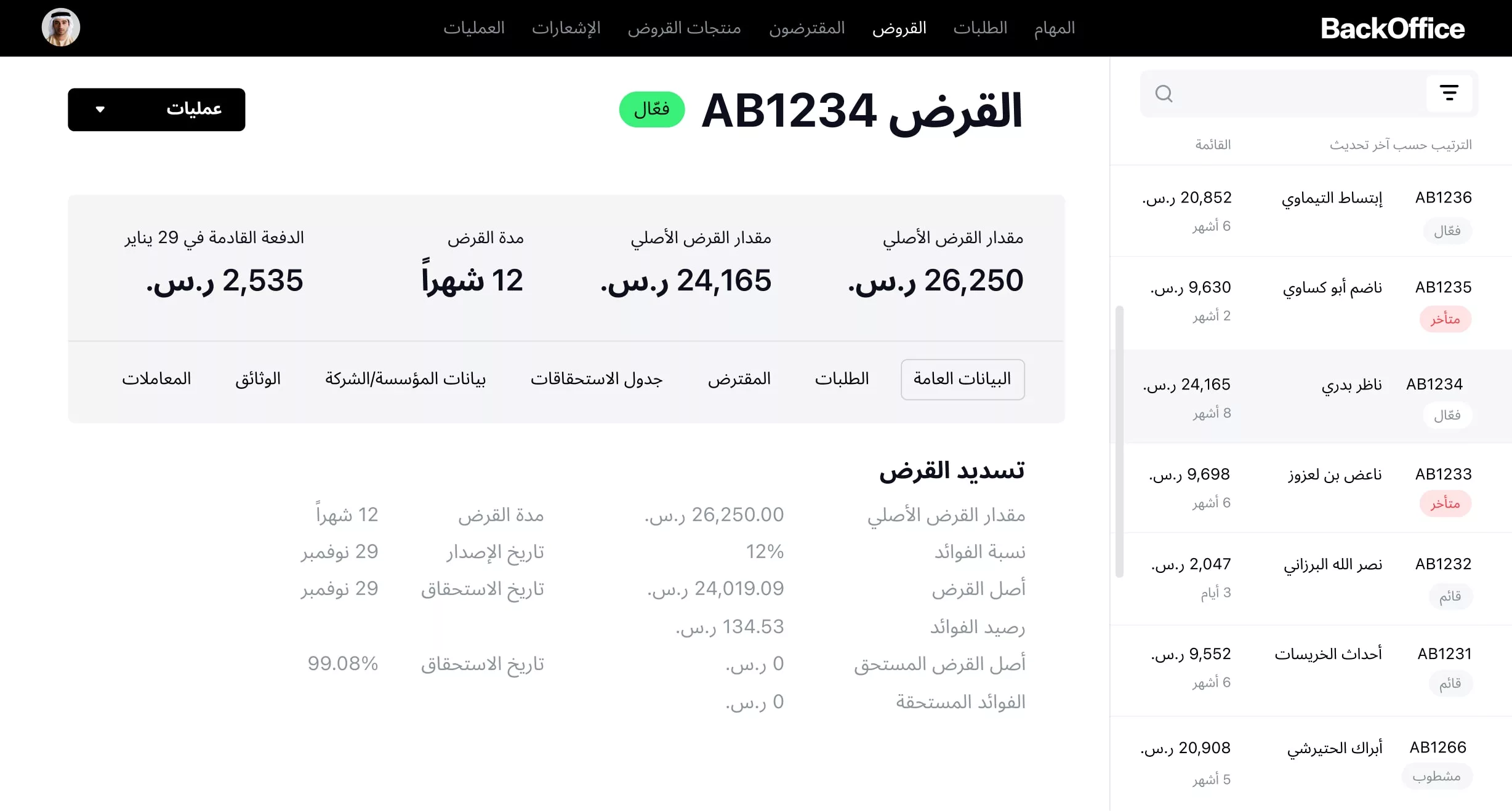

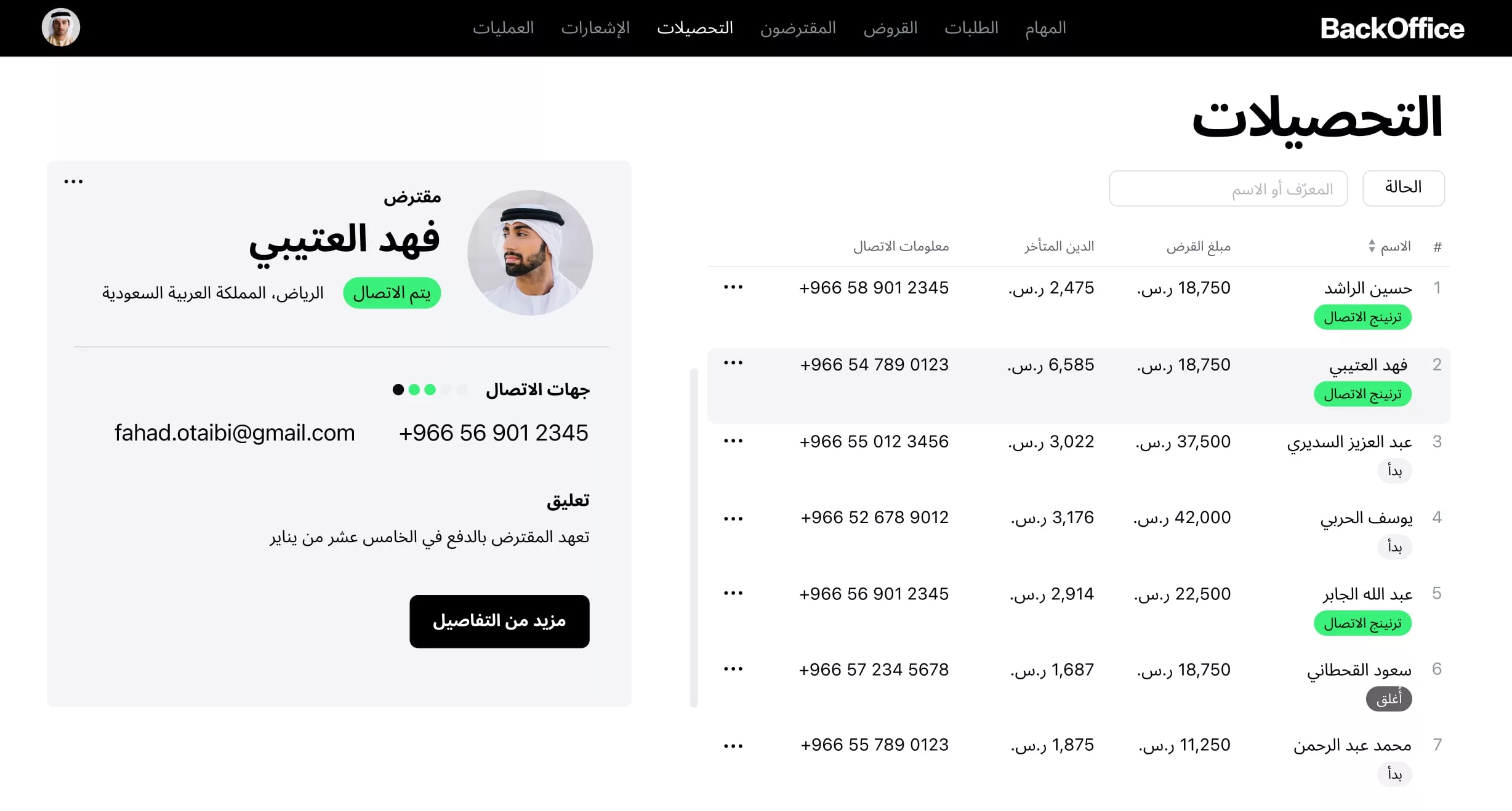

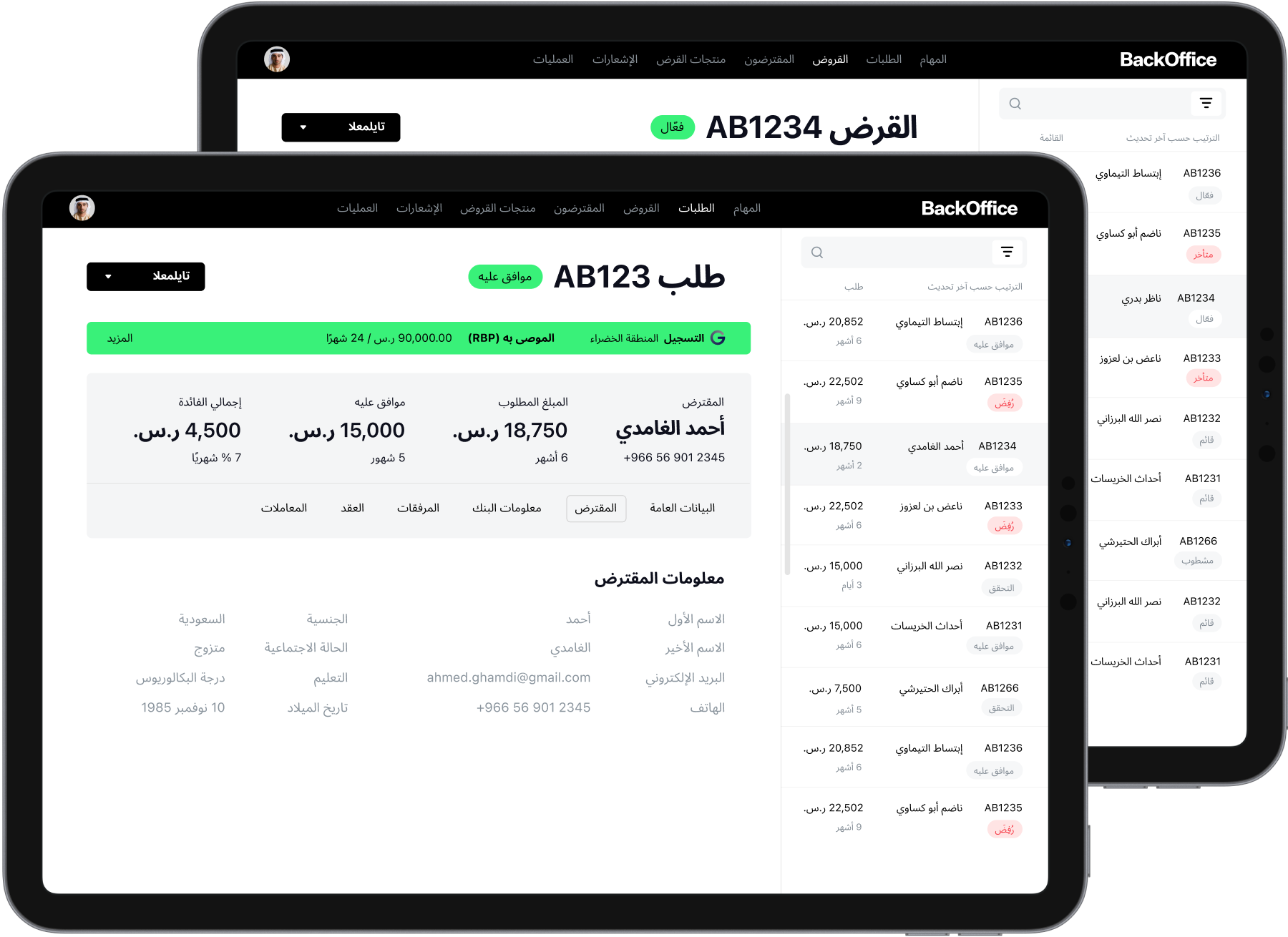

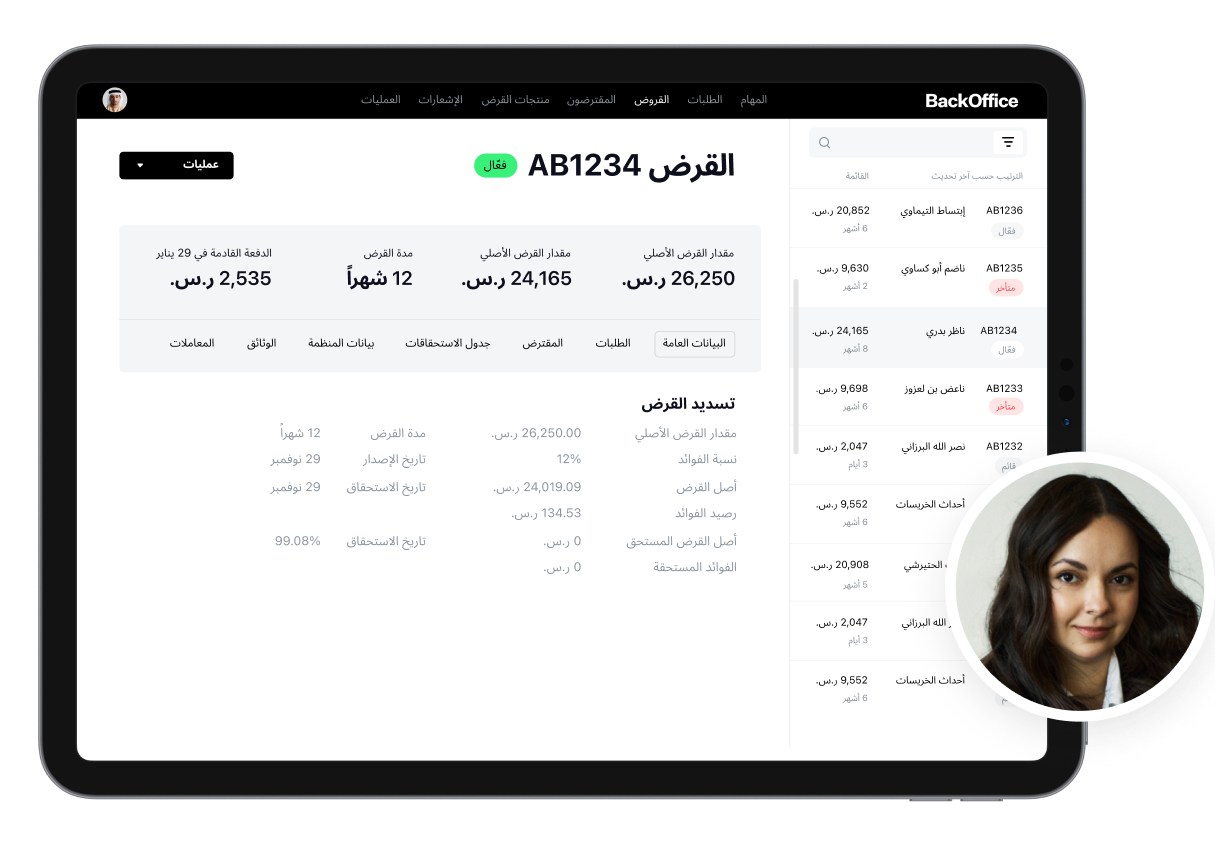

Manage all lending operations in one place

Optimize your operations with our API-rich Back Office, offering loan products, real-time data, amortization schedules, automated calculations, and everything else you need to grow your business.

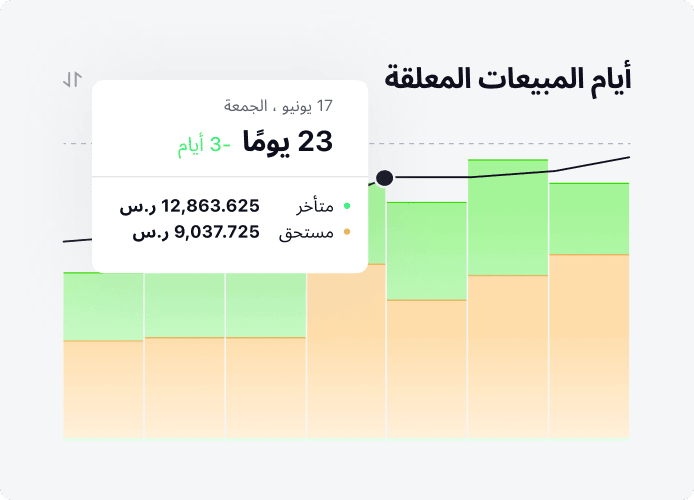

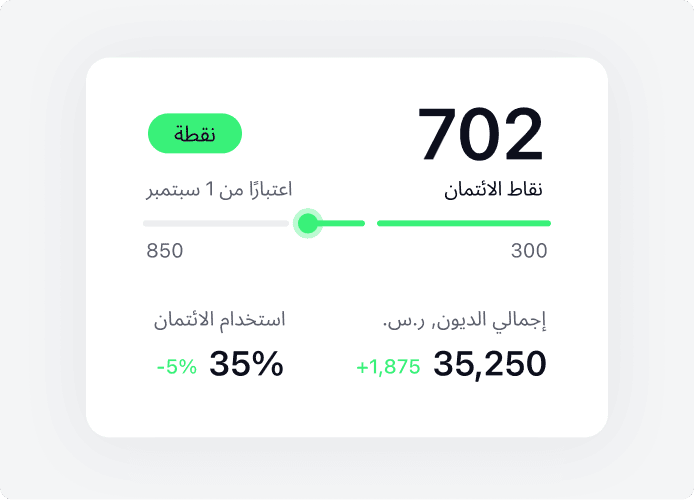

Boost revenue with AI-powered credit scoring

GiniMachine AI harnesses machine learning to analyze complex data patterns, enhancing accuracy in credit decisions, reducing NPLs, and enabling more reliable credit assessments.

Built on the latest tech stack

Scalability, performance, and security are ensured by the modern tech stack, incorporating open-source technologies, that we use to develop HES LoanBox.

Let us show

you how it works

Experience the advantages of HES LoanBox. Request a personalized tour to explore all its

features and see how it can streamline your business operations.

features and see how it can streamline your business operations.

Seamless

integrations

We are experts

in the KSA market

Our product team has deep expertise in the Saudi lending market and regulatory compliance, with a proven success record across the EMEA region.

We believe that direct interaction helps us better understand your objectives and tailor our

solutions to fit your exact requirements. That’s why HES FinTech is always eager to meet clients

on-site in Saudi Arabia and discuss each need and project.

solutions to fit your exact requirements. That’s why HES FinTech is always eager to meet clients

on-site in Saudi Arabia and discuss each need and project.

Murabaha and

Sharia compliant

lending software

Our software facilitates all transactions and lending processes in accordance with ethical and regulatory requirements.

HES LoanBox provides a secure and reliable framework for lending activities and offers peace of mind

to lenders and confidence in their financial operations.

to lenders and confidence in their financial operations.

Why choose HES LoanBox

Kickstart online lending

Fully compliant loan management system

Seamless integrations

Customer support

Future-proof architecture

Why HES FinTech

software?

Post-lauch support

We are always ready to assist you, ensuring smooth operations and continuous adaptation to help

your business derive maximum value from our software.

your business derive maximum value from our software.

European-founded company

HES FinTech is trusted by 130+ businesses worldwide. Our expertise lets us deliver best-in-class solutions tailored to meet the unique needs of our clients.

Saudi clients and partners

Our network is a testament to our commitment to regional engagement and tailored support.

Our journey

in Saudi Arabia

Lending

software

solution

in Saudi Arabia

Scalable end-to-end lending solution

First deployment in 3 months

Instant loan decision-making

Software compliant with Sharia law

FAQ

How can HES LoanBox benefit lenders in Saudi Arabia?

Is HES LoanBox compliant with Sharia law?

Does HES LoanBox facilitate integrations with local Saudi Arabian services?

What kind of support does HES FinTech offer?