Factoring platform

for immediate financing

Customizable factoring solution

that benefits all parties

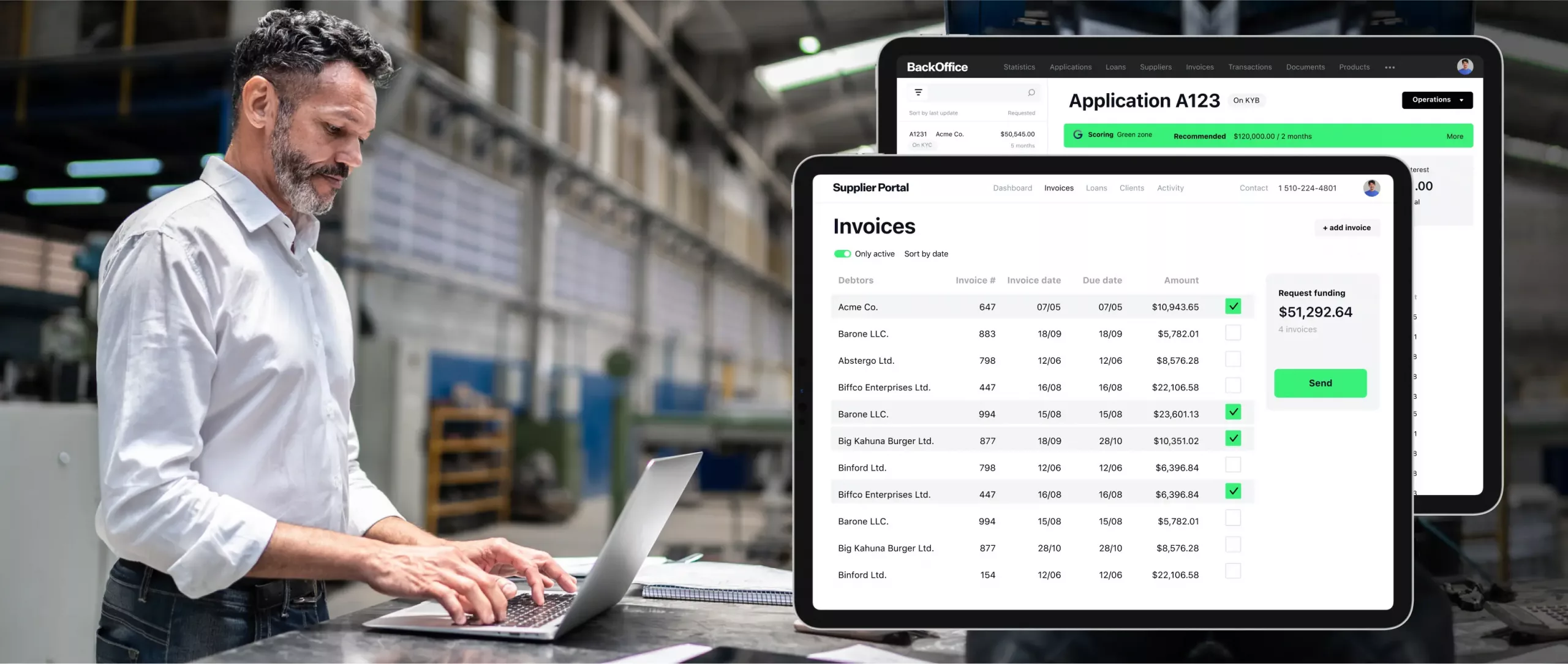

Supplier

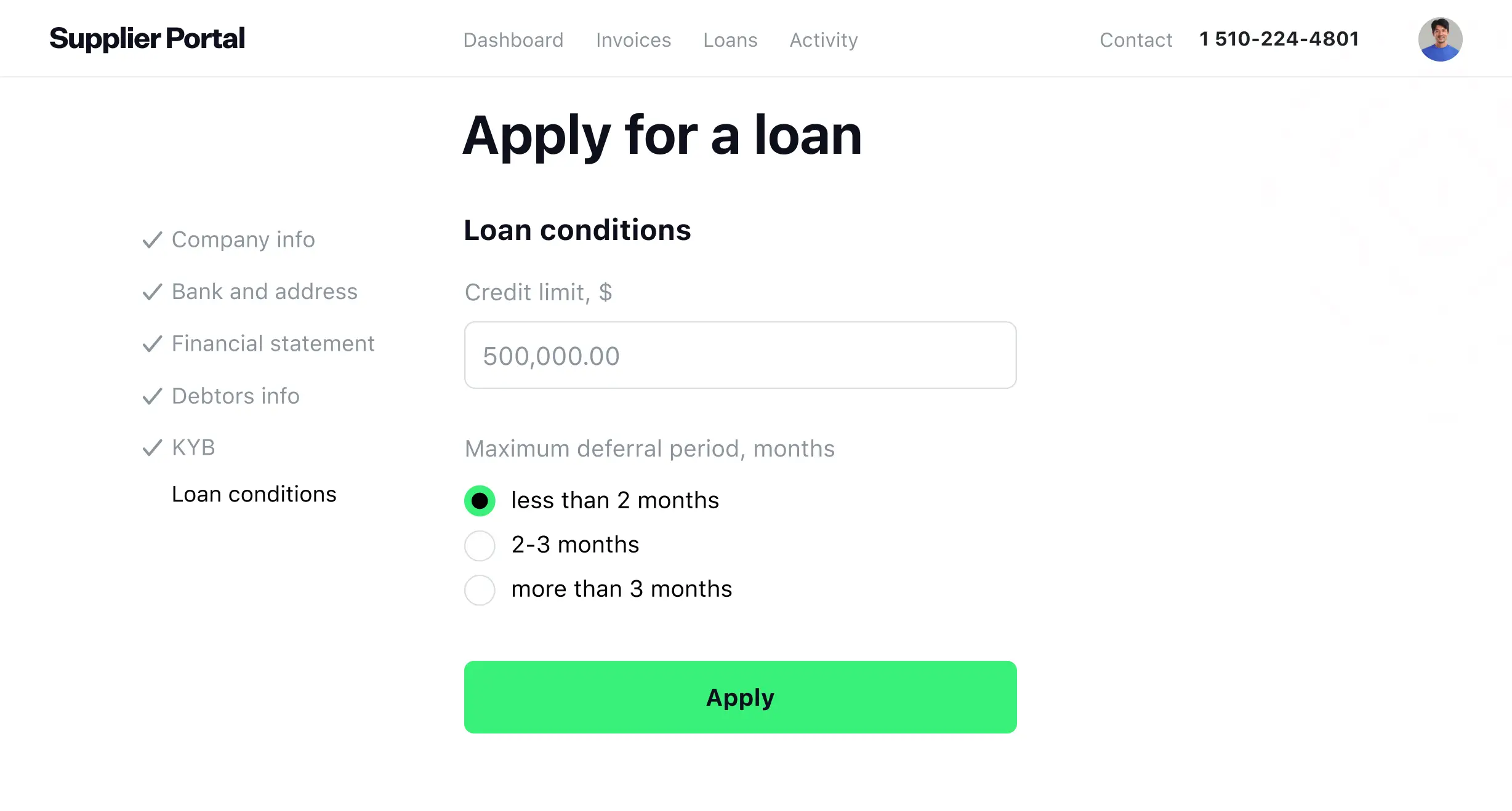

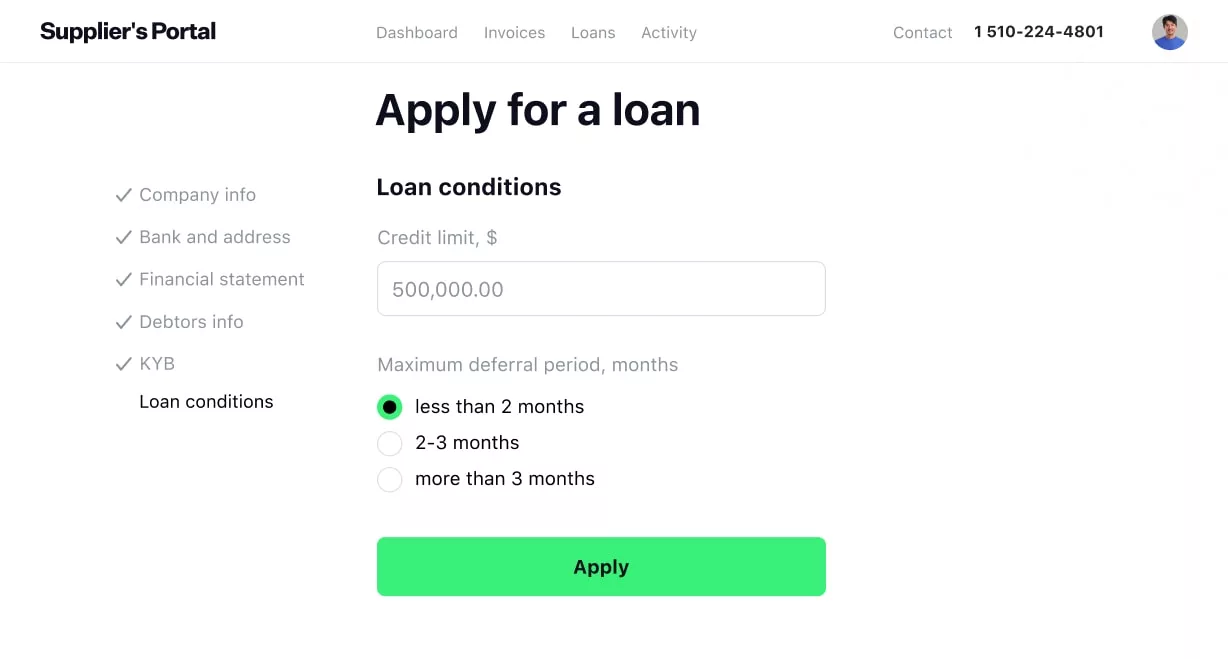

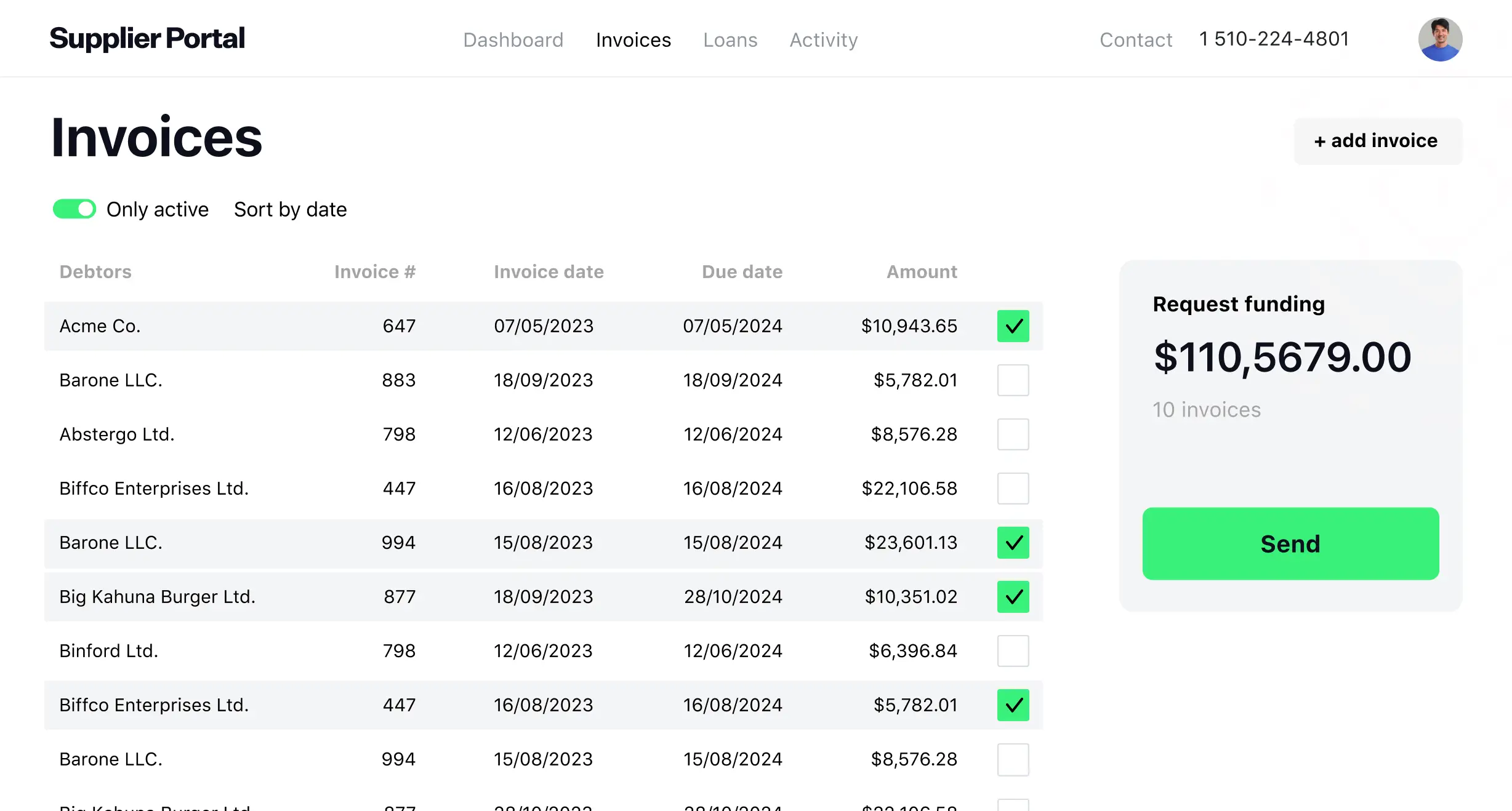

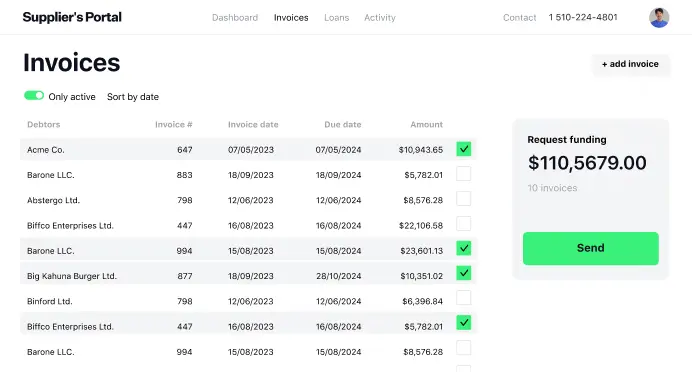

A factoring origination system provides omnichannel online registration. Suppliers can

submit invoices online, generate reports on commissions and funding received, and securely

store electronic documents in their personal accounts.

submit invoices online, generate reports on commissions and funding received, and securely

store electronic documents in their personal accounts.

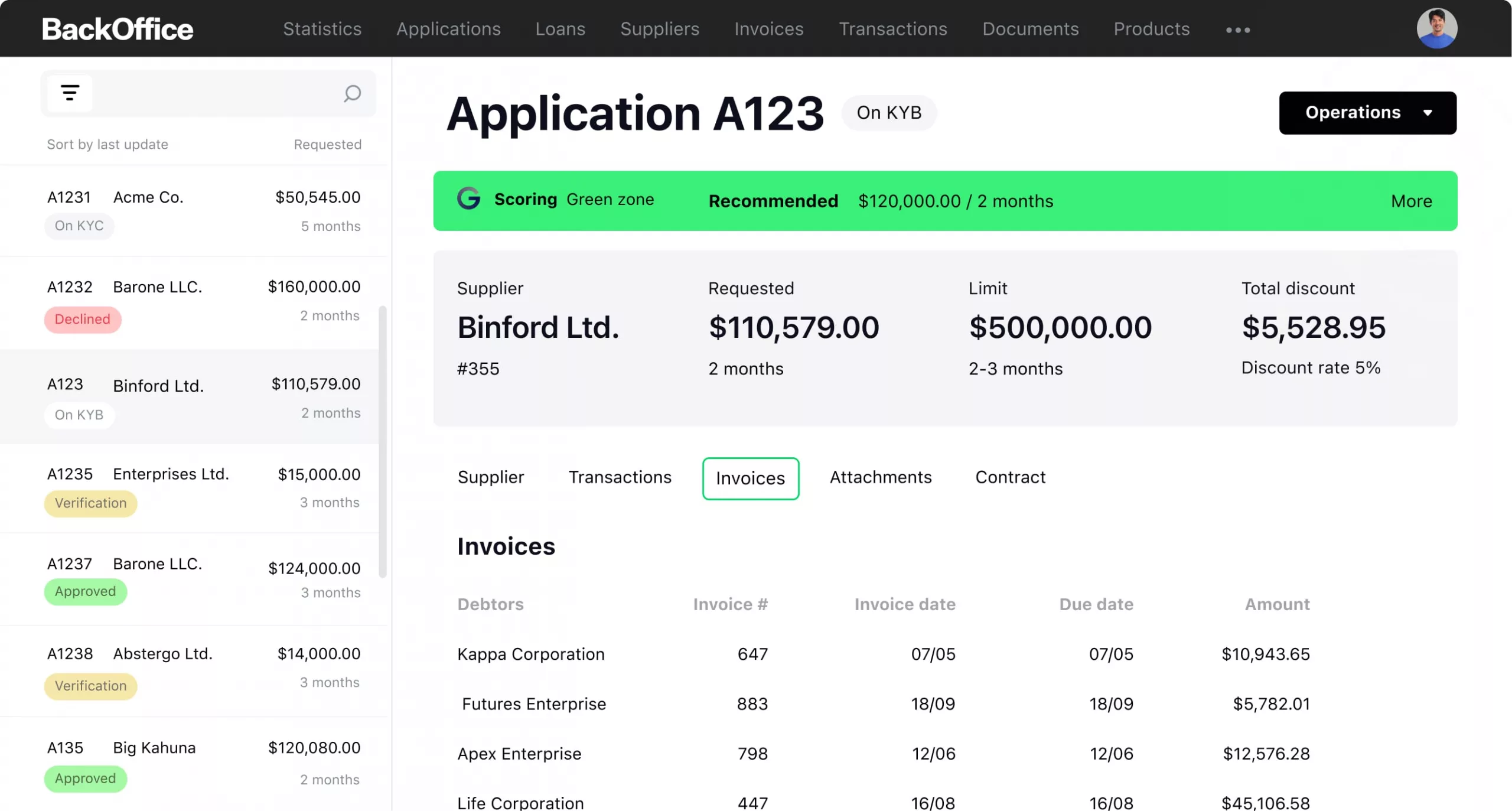

Factor

A factor can automatically build scoring models based on historical data, enabling

data-driven decisions. The system provides end-to-end coverage of the factoring process:

from supplier onboarding, loan origination, and decision-making to disbursement,

calculation, and loan closure.

data-driven decisions. The system provides end-to-end coverage of the factoring process:

from supplier onboarding, loan origination, and decision-making to disbursement,

calculation, and loan closure.

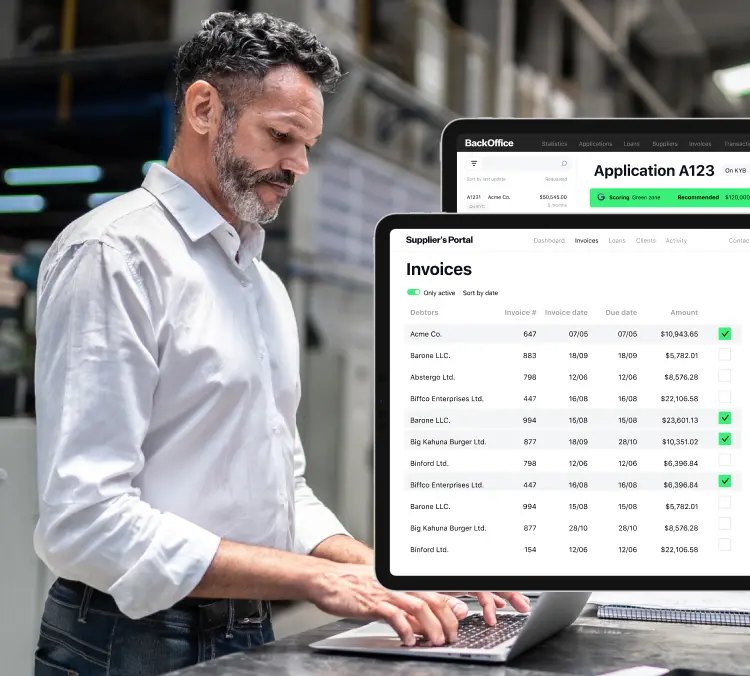

Debtor

Under open factoring, a debtor may confirm the validity of a transaction through invoice

verification. The debtor can be granted limited access to the list of invoices submitted to

the factor by the supplier.

verification. The debtor can be granted limited access to the list of invoices submitted to

the factor by the supplier.

Sign documents electronically

Securely store and share financial information with a simple, paperless interface. Factoring

finance software can include built-in electronic signature capabilities. Enable fully digital

e-signature and approval workflows for both your team and borrowers.

finance software can include built-in electronic signature capabilities. Enable fully digital

e-signature and approval workflows for both your team and borrowers.

Customizable workflows

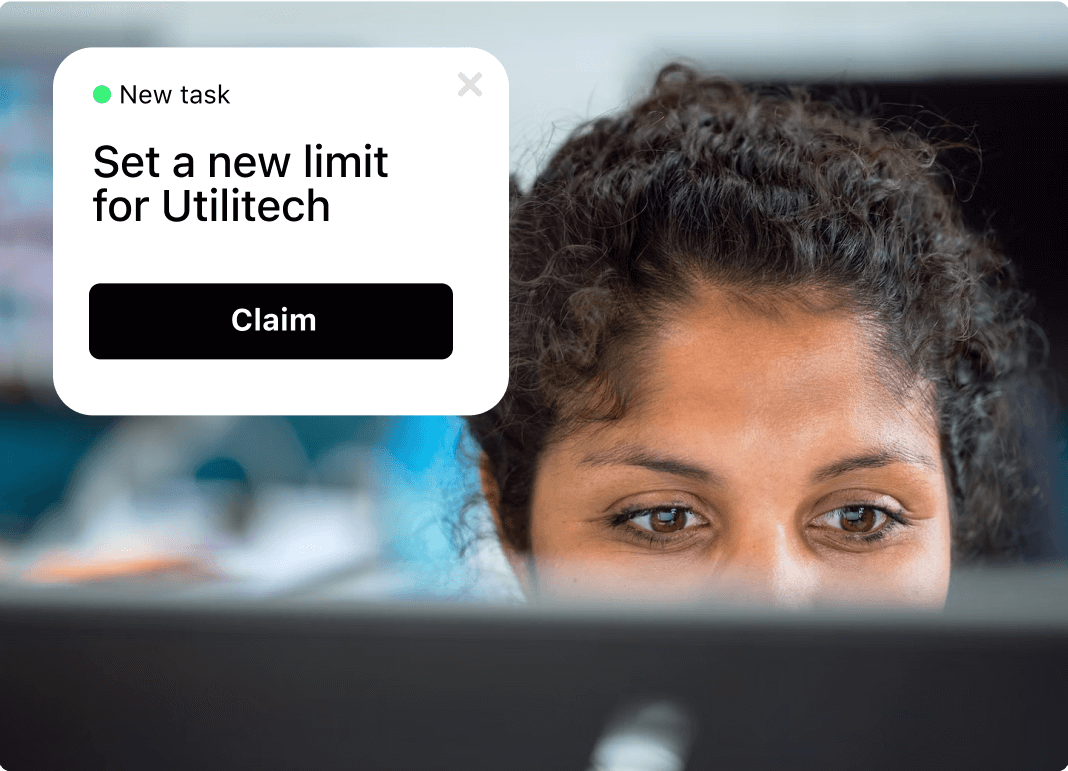

Task management

Intuitive interface of a dashboard with lists of tasks assigned to

users according to their roles simplifies the workflow management

and efficiency tracking.

users according to their roles simplifies the workflow management

and efficiency tracking.

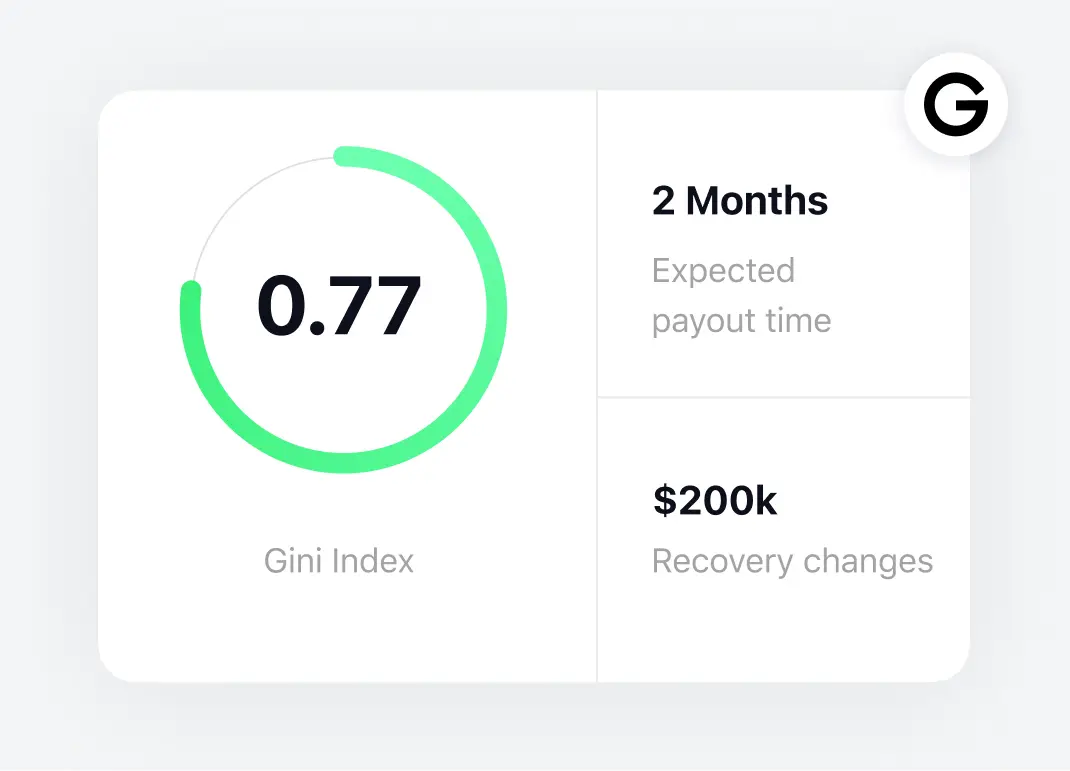

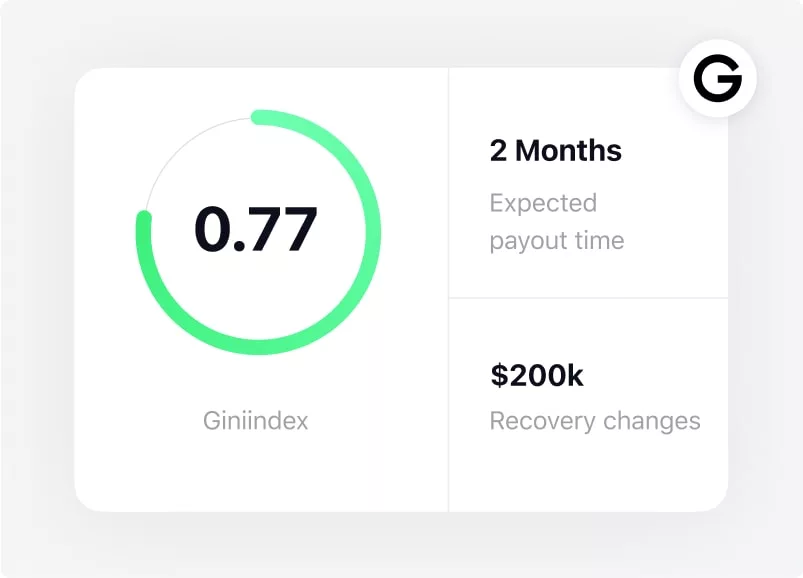

AI/ML scoring software for factoring

Use GiniMachine AI module to assess discipline and credit limits.

Estimate payout terms and recovery changes at ease with the smart

factoring solution.

Estimate payout terms and recovery changes at ease with the smart

factoring solution.

and much more

Application management

Factoring deal management

Document templates

Automation of disbursements and payments

Transactions and reporting

Flexible integrations

for advanced factoring

Technology architecture overview

Powerful tools

HES FinTech uses updated tech stack, including Java 17, Spring

Core, PostgreSQL. The factoring software architecture is based on

FOSS technologies. No additional licensing fees – you pay for the

platform’s source code only.

Core, PostgreSQL. The factoring software architecture is based on

FOSS technologies. No additional licensing fees – you pay for the

platform’s source code only.

Cloud provider

Success stories

All-in-one factoring

software solutions

Total invoice factoring fintech solution

3-4 months time-to-market

A few seconds for a loan decision

No additional charges per customer

FAQ

How can I integrate HES’ factoring software with my existing

system?

system?

How does your software handle invoice verification and payment

processing?

processing?

How secure is HES FinTech’s factoring software?

What level of customer support can I expect?