Borrower portal software

Solution includes

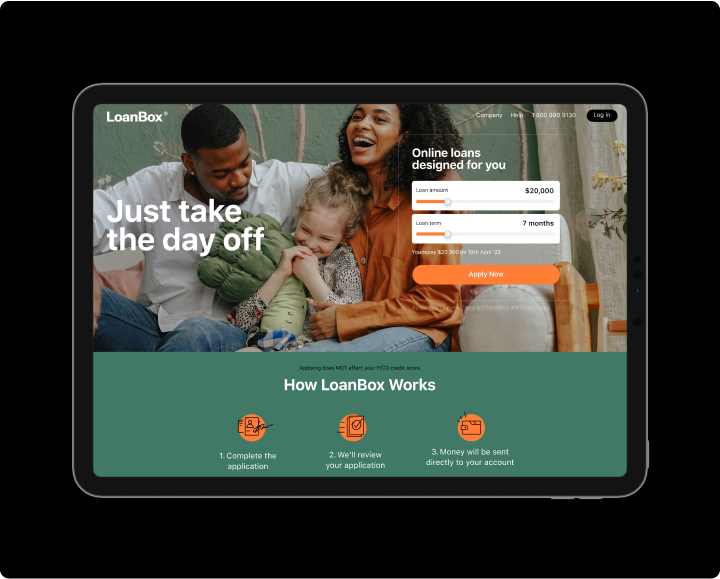

Borrower portal

Empower your customers with an option to apply for loans anytime and manage them online

with the online client portal software.

with the online client portal software.

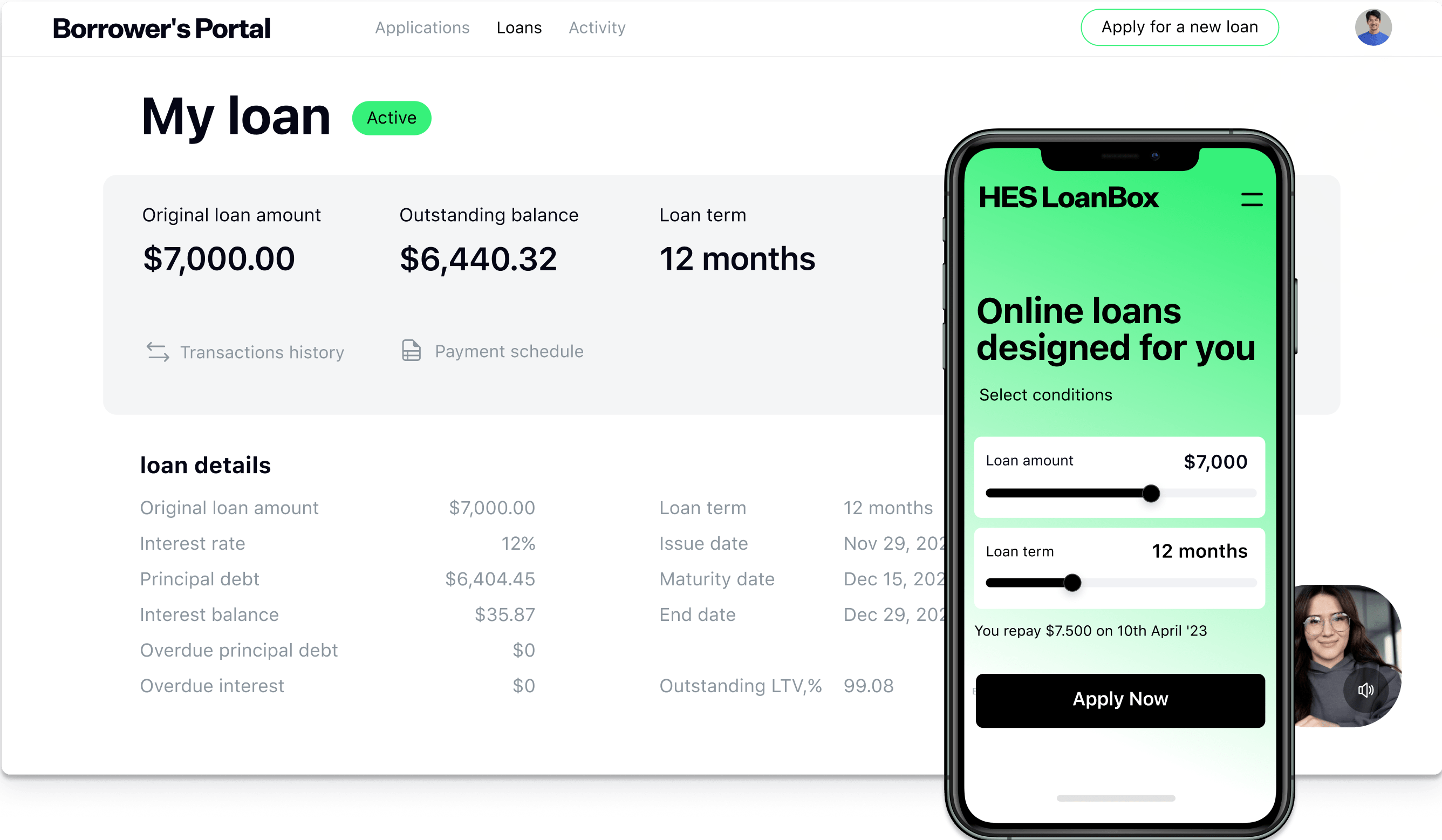

Fully functional channel

Personal space

for your customers

In the client portal software users can apply for loans, monitor the

status of their applications, track active and repaid loans. The portal settings are flexible

and can be adjusted according to the lender’s business model.

status of their applications, track active and repaid loans. The portal settings are flexible

and can be adjusted according to the lender’s business model.

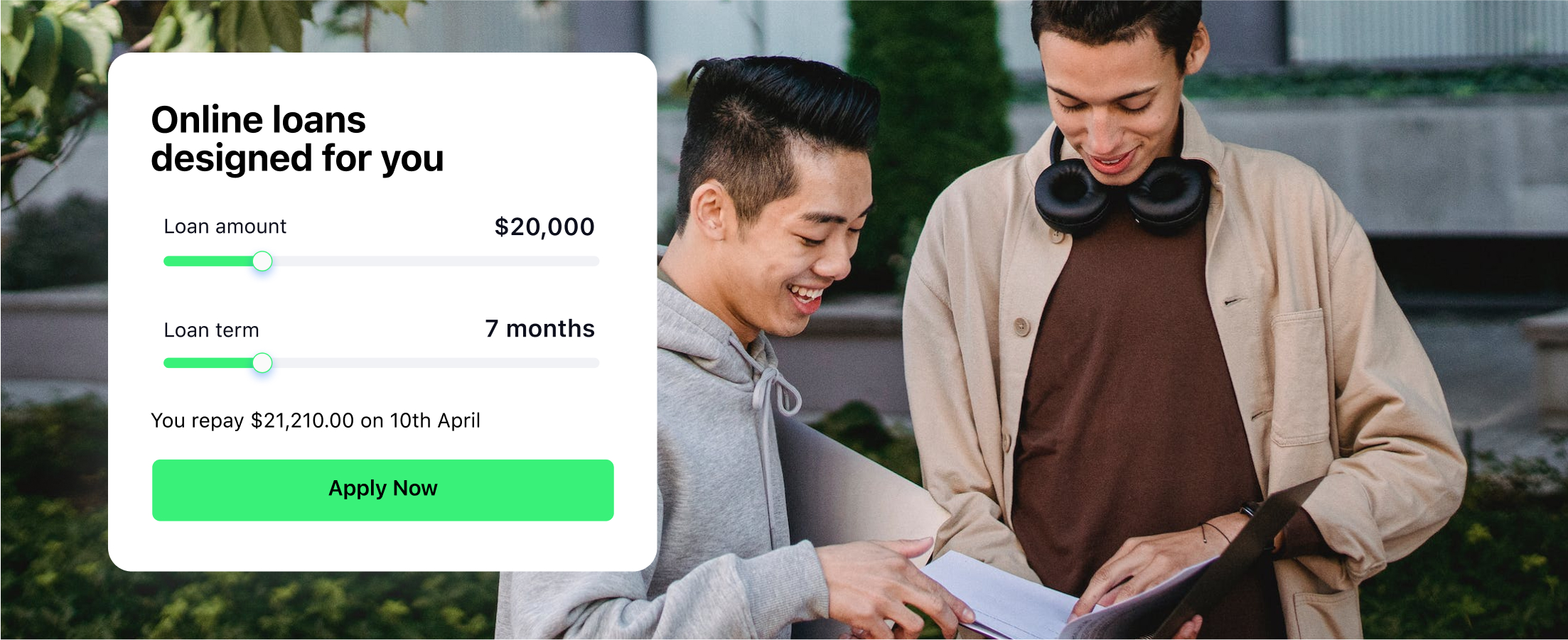

Loan calculator

The calculations automatically consider the interest rates, loan

amounts, and loan terms for several loan products.

amounts, and loan terms for several loan products.

Loan calculator

The calculations automatically consider the interest rates, loan

amounts, and loan terms for several loan products.

amounts, and loan terms for several loan products.

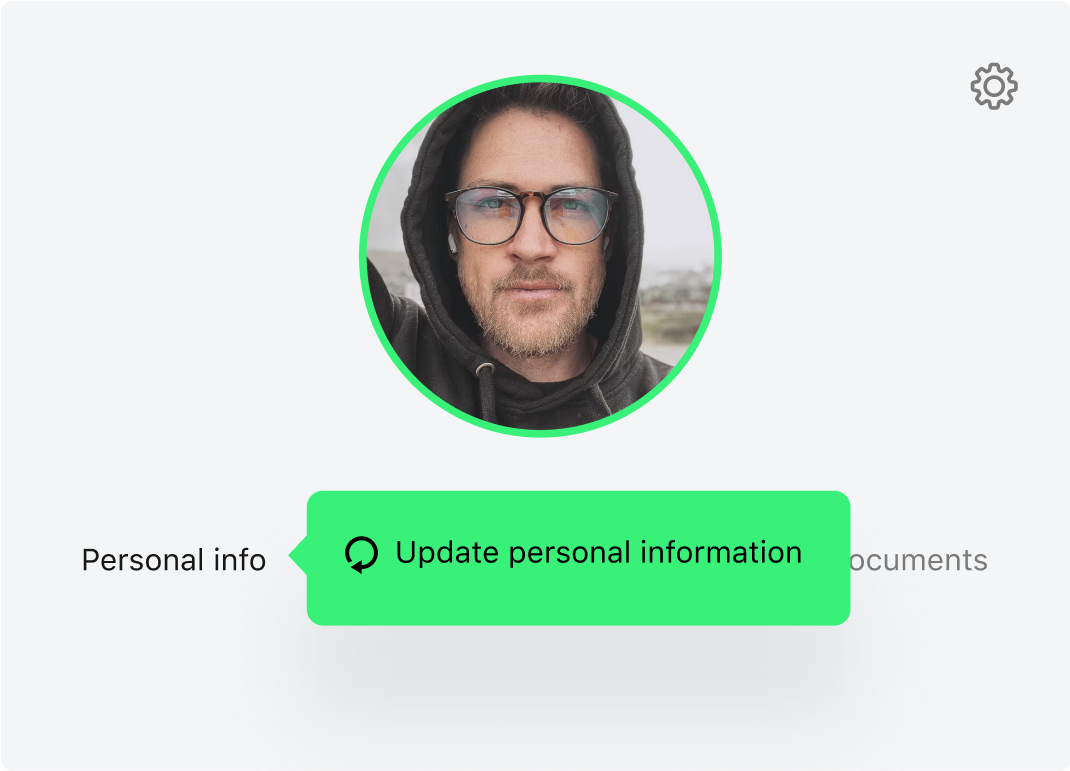

Borrower profile

Borrowers can view and update their personal information when needed

for a faster loan application process.

for a faster loan application process.

Activity dashboard

The client portal software functionality includes a convenient dashboard

that lists all possible actions for a user in one place.

that lists all possible actions for a user in one place.

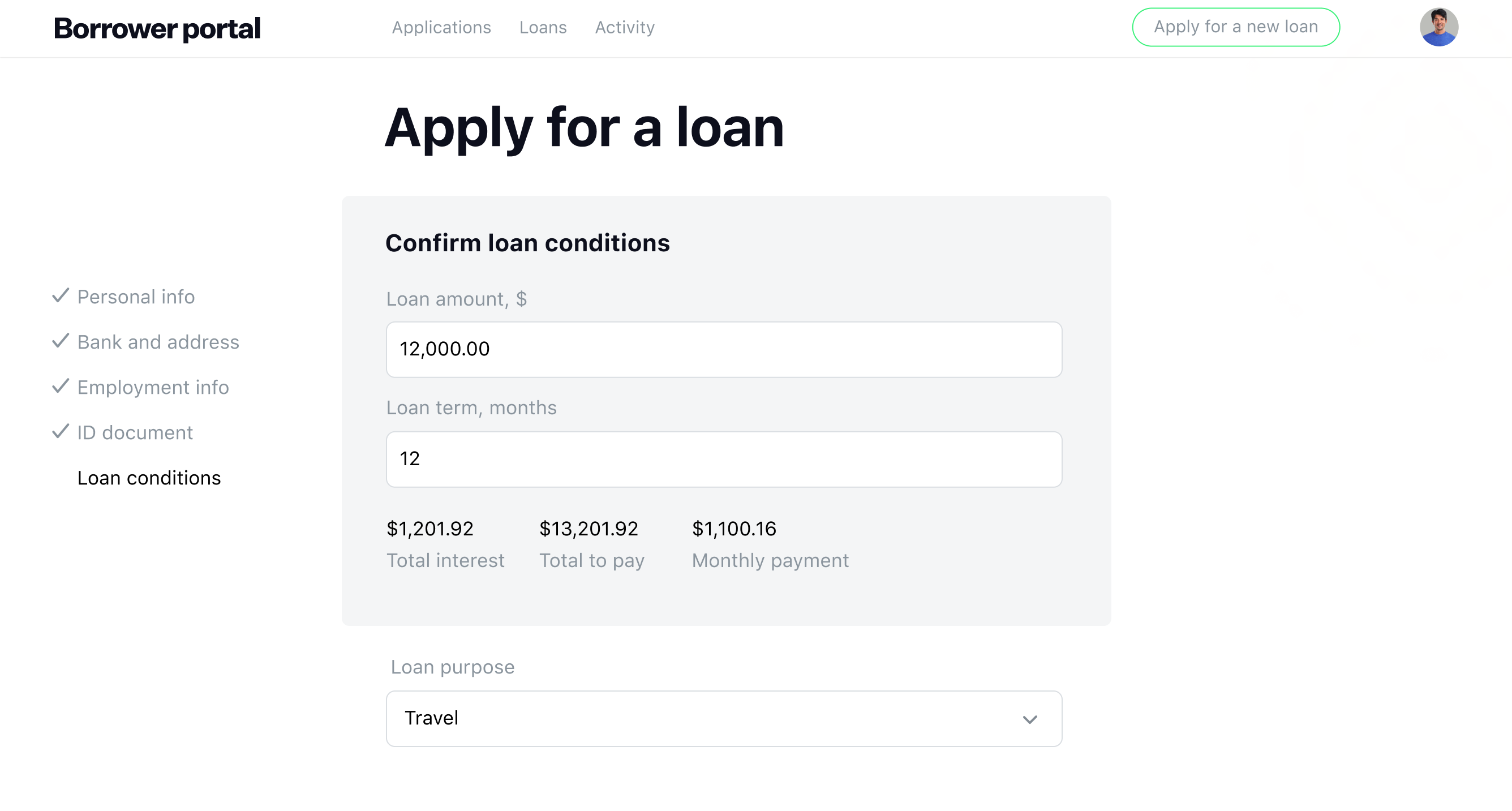

Intuitive application flow

The system covers the entire loan application process online: from filling out the forms

all the way to digital KYC service and online document signing.

all the way to digital KYC service and online document signing.

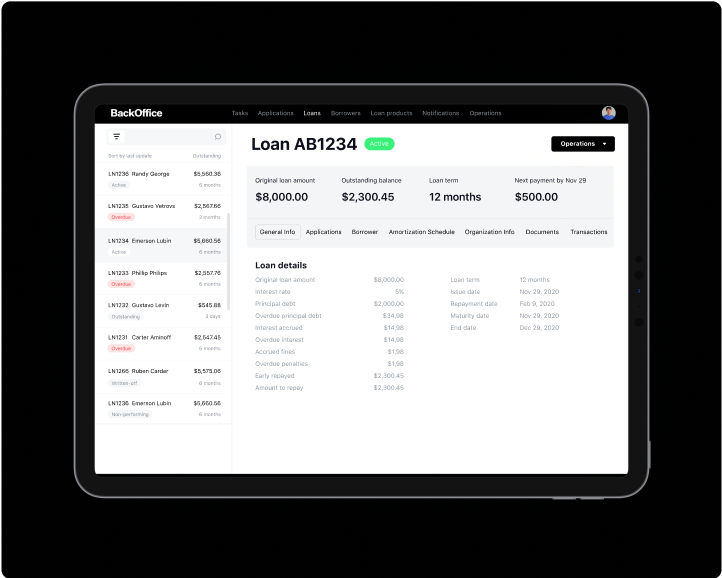

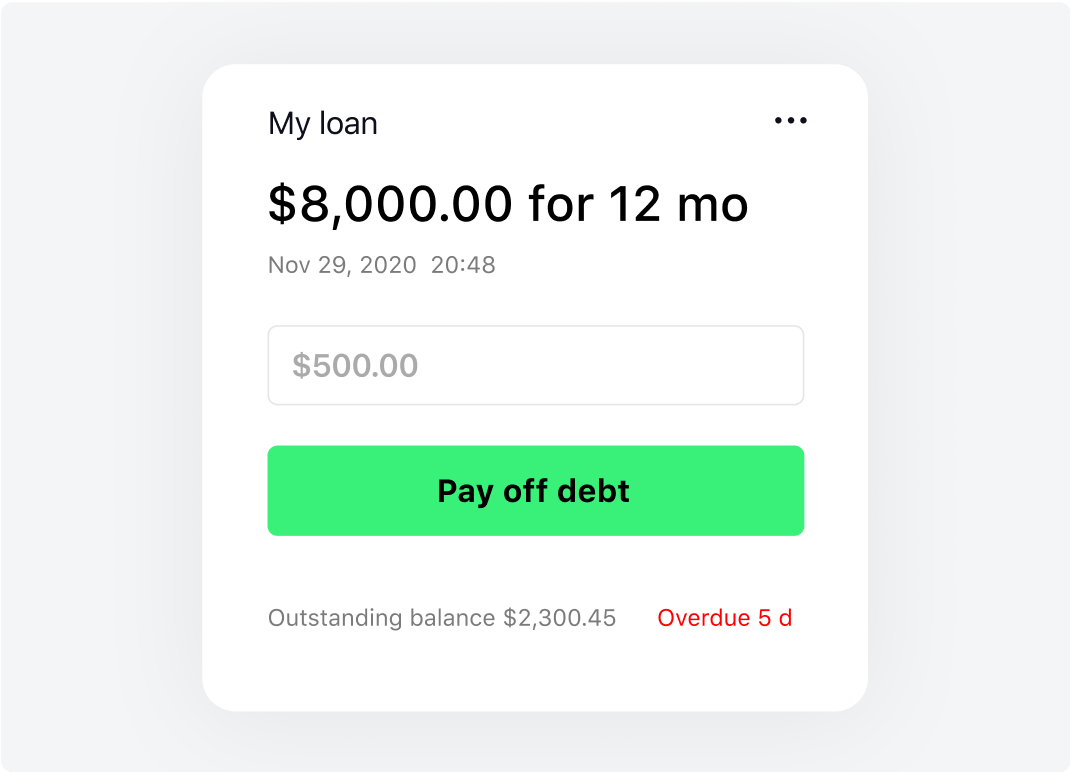

Loan applications and loans

Borrowers can view their loan applications and cancel them, check

loan status, repayments, and amortization schedule.

loan status, repayments, and amortization schedule.

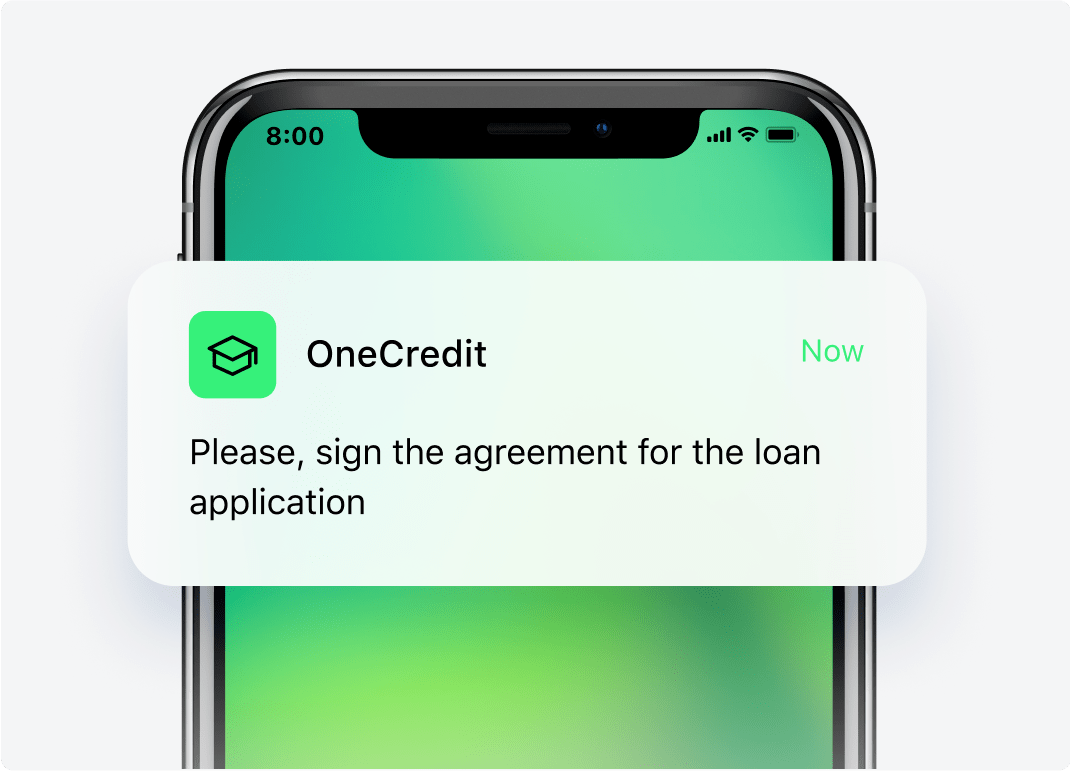

SMS and email notifications

The Borrower portal functionality includes a convenient dashboard

that lists all possible actions for a user in one place.

that lists all possible actions for a user in one place.

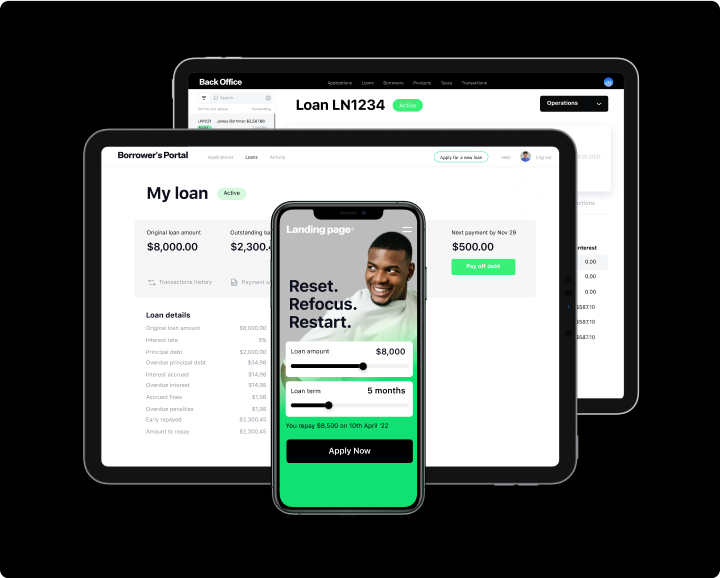

Customer-centered lending

A single portal for all lending operations

Loan application in a few clicks

Tech-advanced KYC

Applications and loans on fingertips

Lifetime customer support

Higher user involvement