Commercial lending

software solution

Get commercial loan origination software ready in 3 months

Solution includes

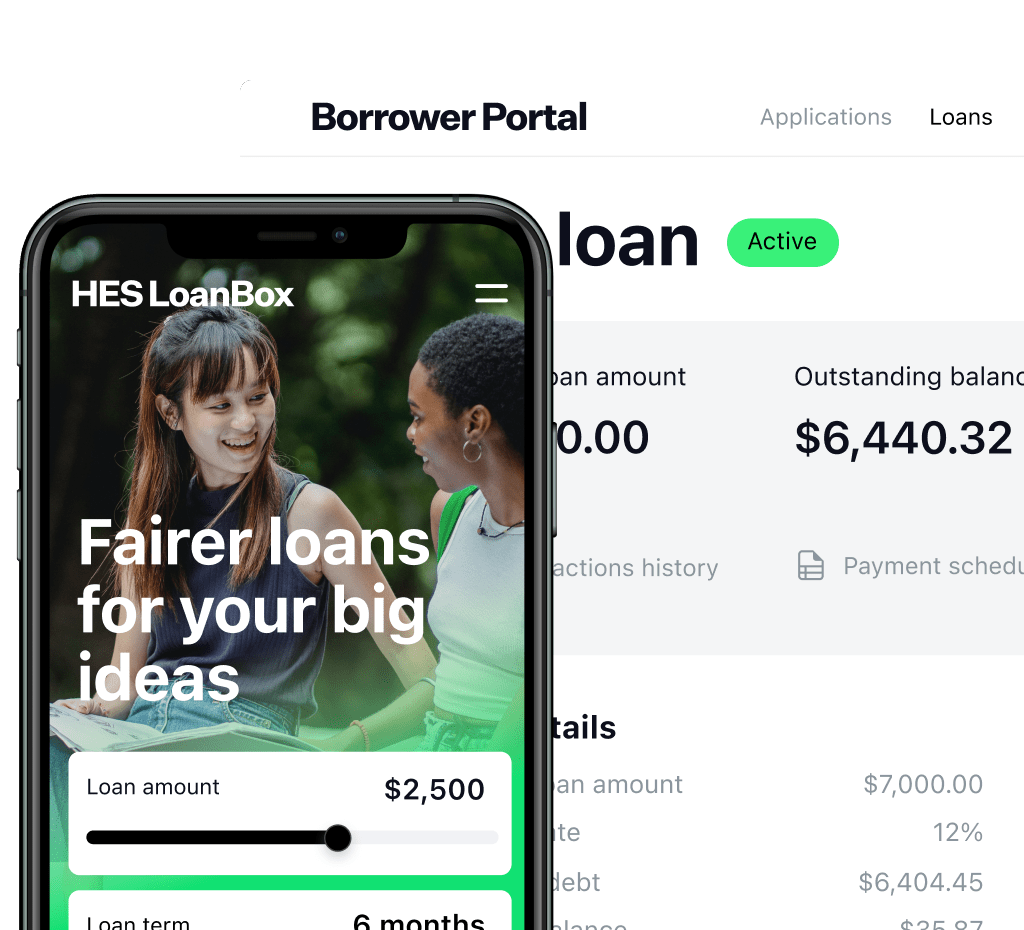

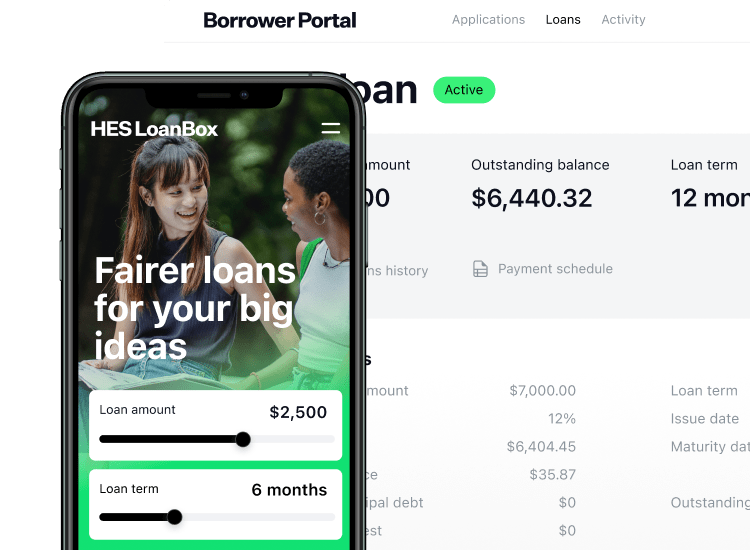

Landing Page

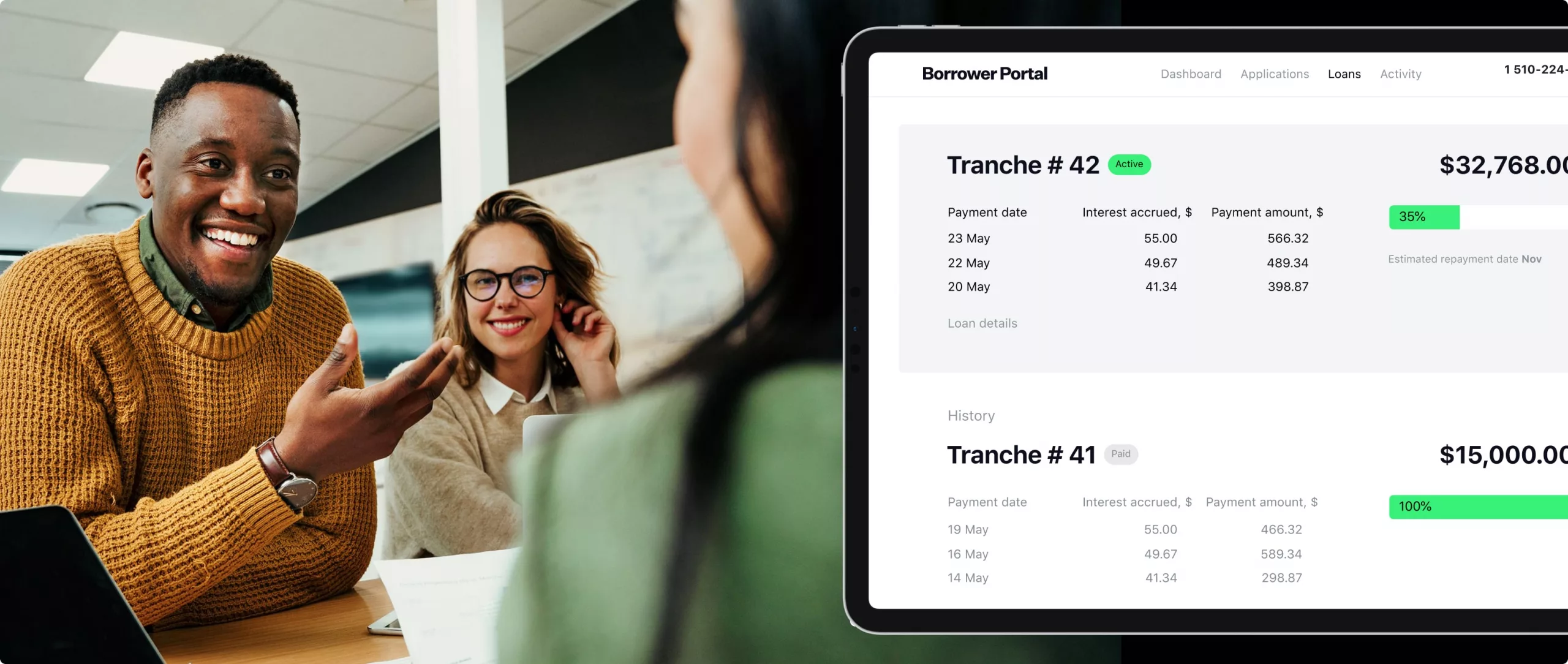

Borrower Portal

Agent Portal

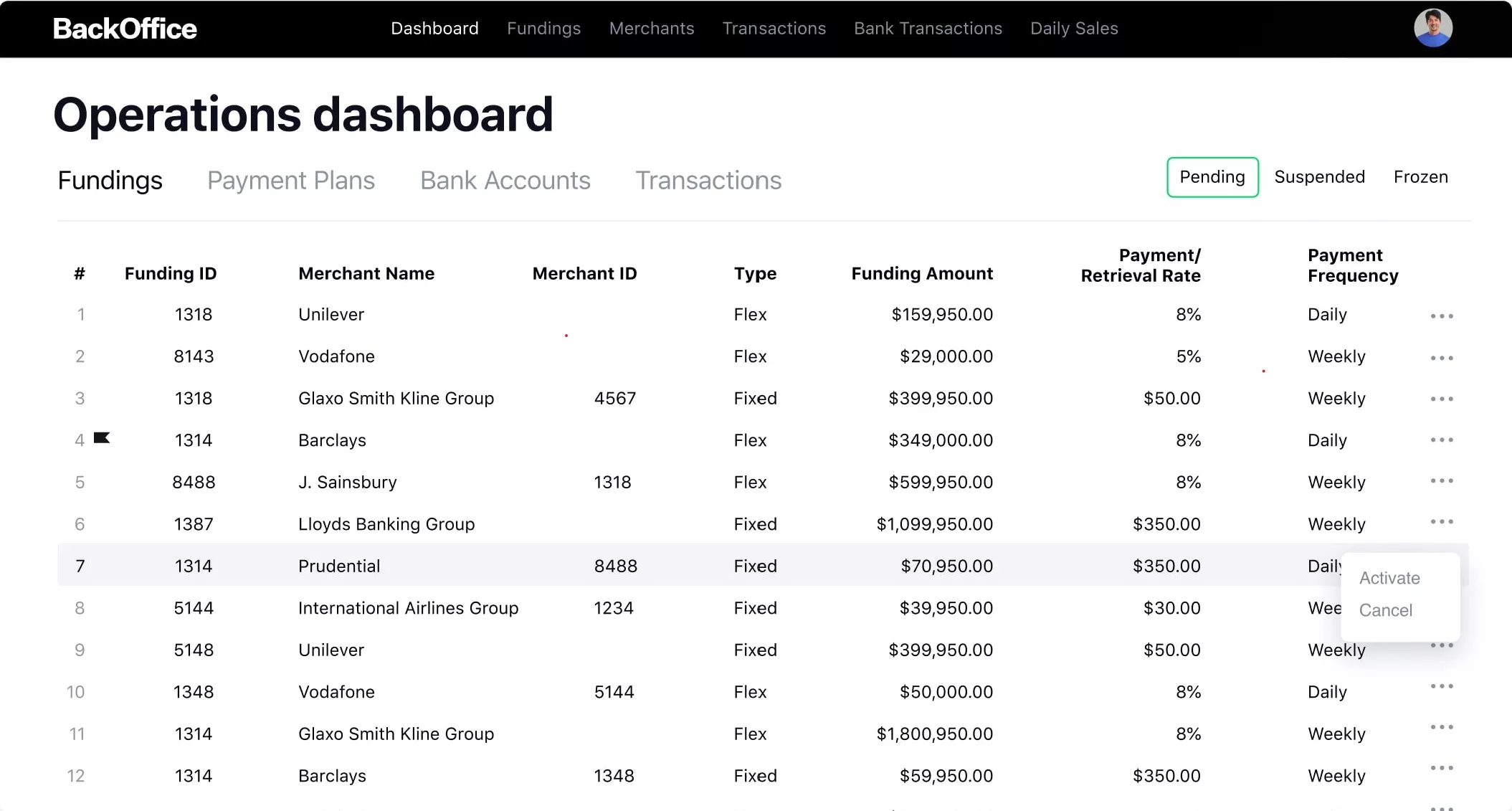

Back Office

White-label commercial loan software

Fraud prevention via user identification

Automated workflows

Smart AI-based scoring system

Elevate collaboration

Flexible integration options

E-signature for commercial lending solutions

Implementing hi-tech commercial loan servicing software grows business

effectiveness, reduces the paperwork and the need in physical visits to your office. It

comes with a built-in e-signature tool and monitors the security of the process.

effectiveness, reduces the paperwork and the need in physical visits to your office. It

comes with a built-in e-signature tool and monitors the security of the process.

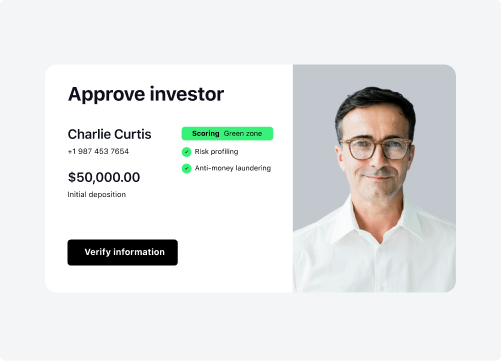

KYB & AML for commercial lending software

Protect your business from fraud by double-checking the organizations

and verifying their documents. With commercial loan origination system, you can make sure

they are not related to AML or PEP and are

not on the sanction list.

and verifying their documents. With commercial loan origination system, you can make sure

they are not related to AML or PEP and are

not on the sanction list.

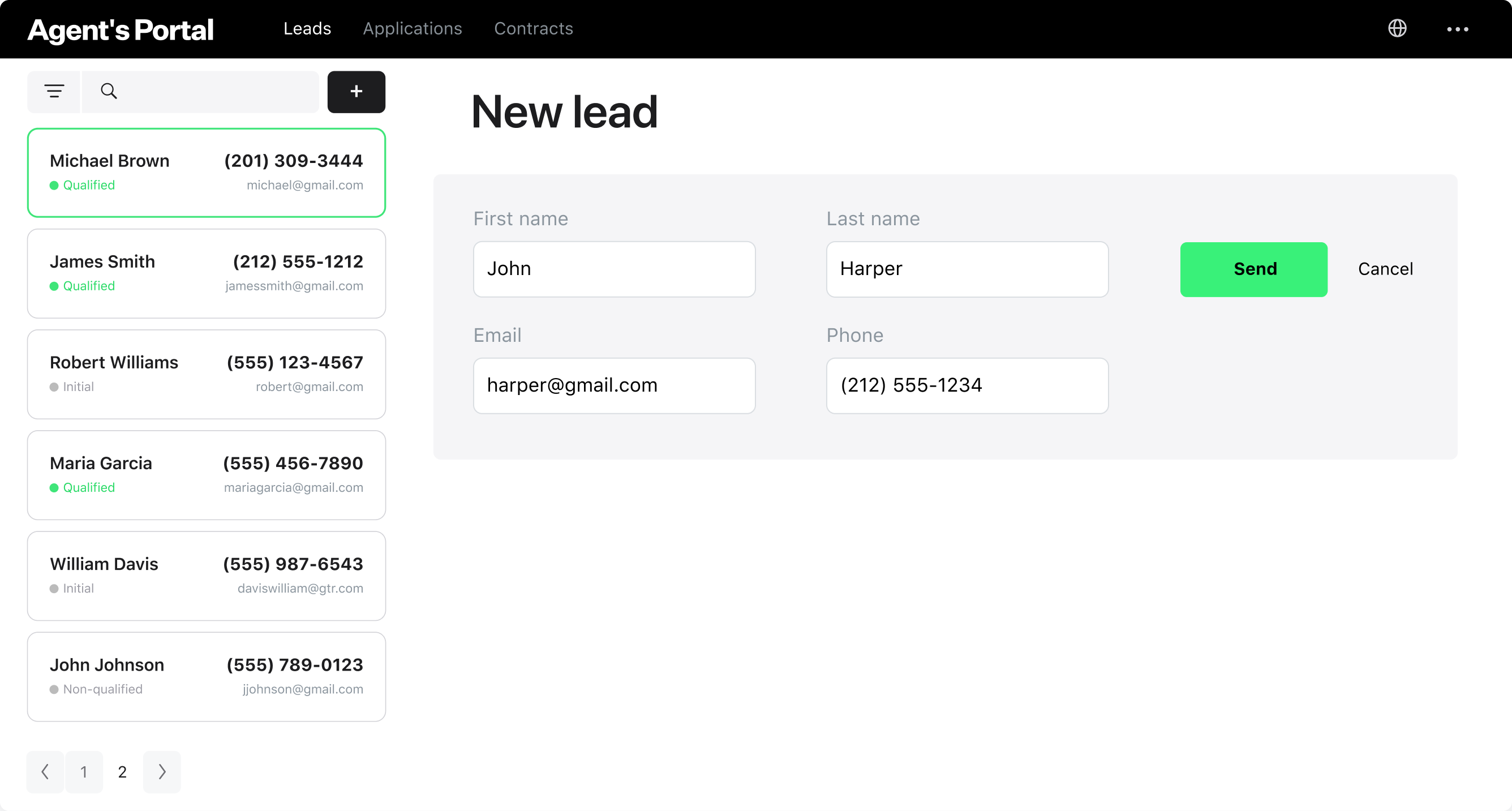

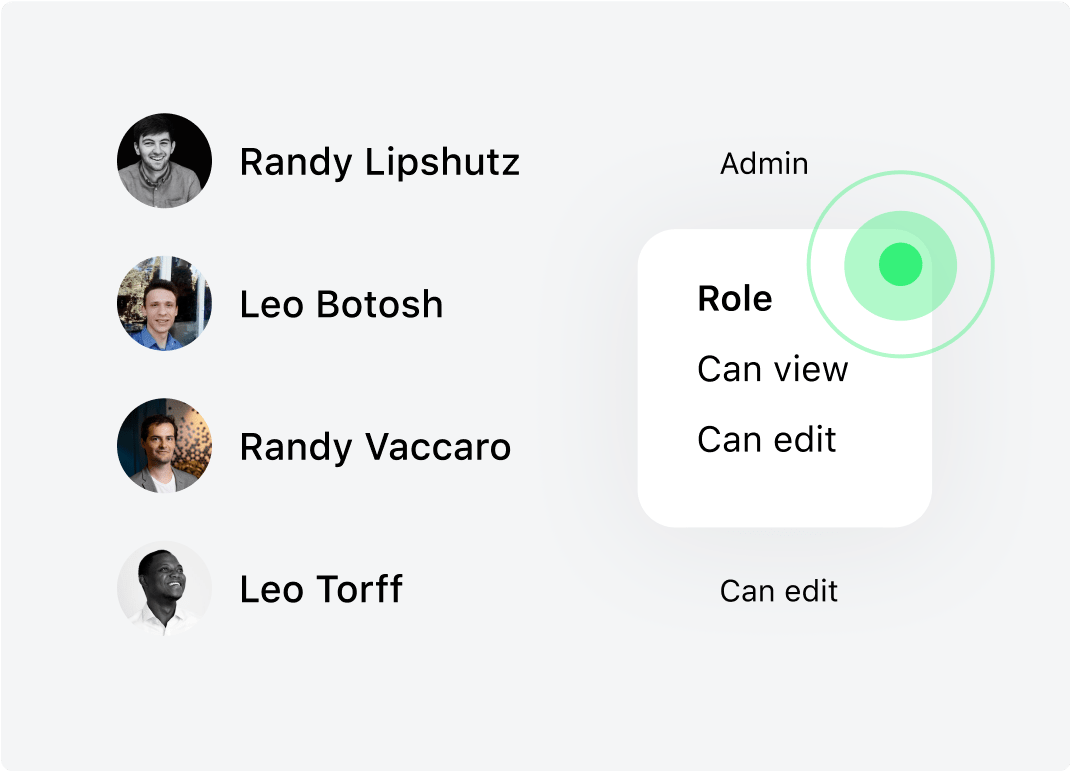

Agent dashboard

Here, agents can efficiently invite colleagues using their email addresses, ensuring a streamlined

onboarding process. Also, they have immediate access to the contact details of potential leads,

positioning them to extend precise and tailored offers.

onboarding process. Also, they have immediate access to the contact details of potential leads,

positioning them to extend precise and tailored offers.

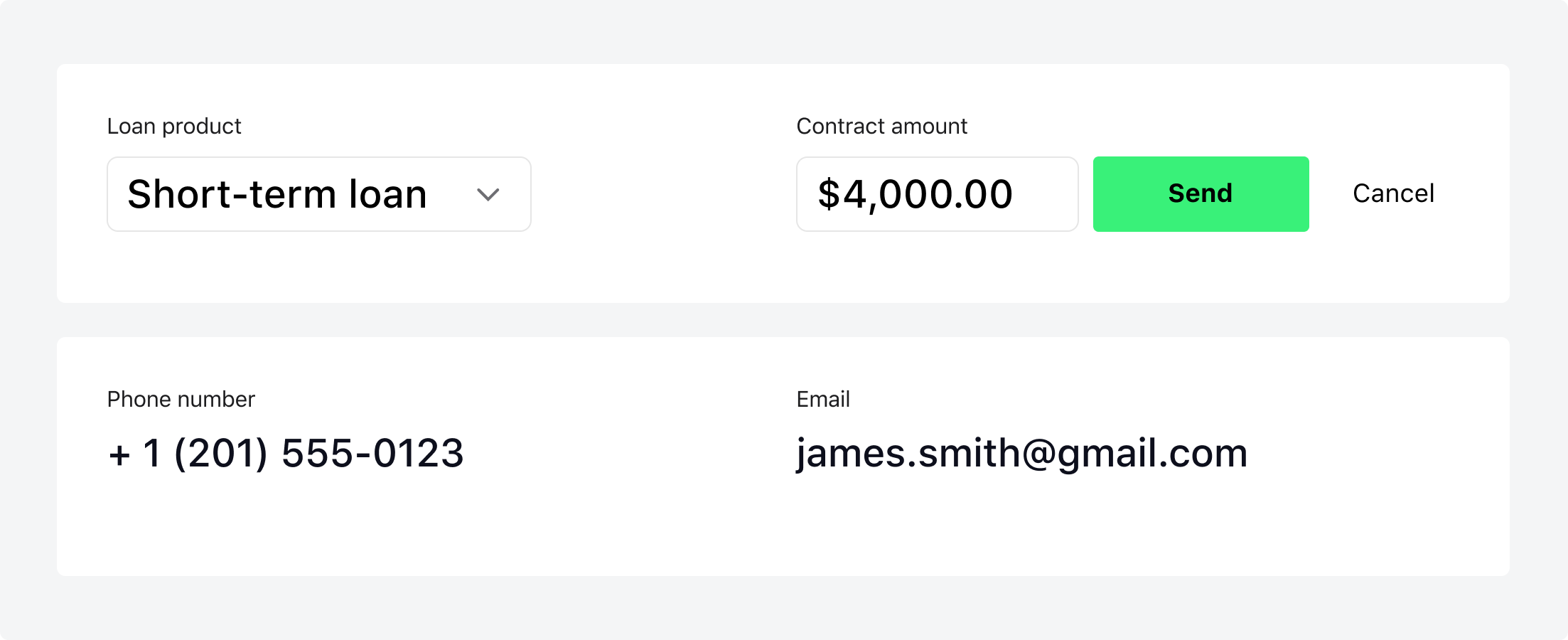

Personalized offer dispatch

Sending offers to leads has never been easier. Agents just select the loan product and specify the

amount, and the offer is dispatched. Leads then receive this offer in their inbox, which directs them

straight to the Borrower Portal, packed with all the loan details they need.

amount, and the offer is dispatched. Leads then receive this offer in their inbox, which directs them

straight to the Borrower Portal, packed with all the loan details they need.

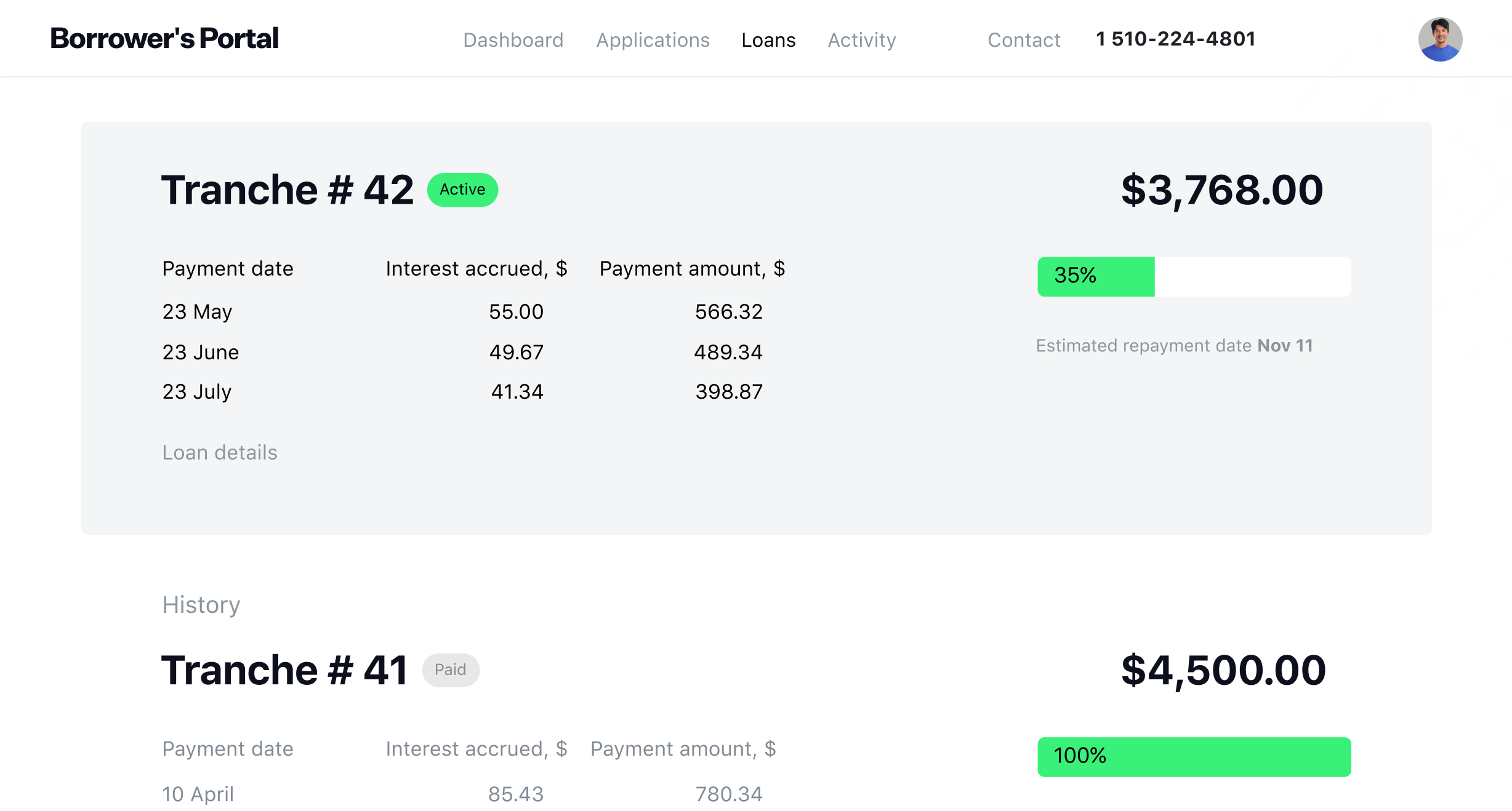

Payment automation

HES SME lending software can be integrated with any bank or payment provider,

allowing you to automate all the payment processes. Disburse, place debit orders, and accept payments

without any additional steps.

allowing you to automate all the payment processes. Disburse, place debit orders, and accept payments

without any additional steps.

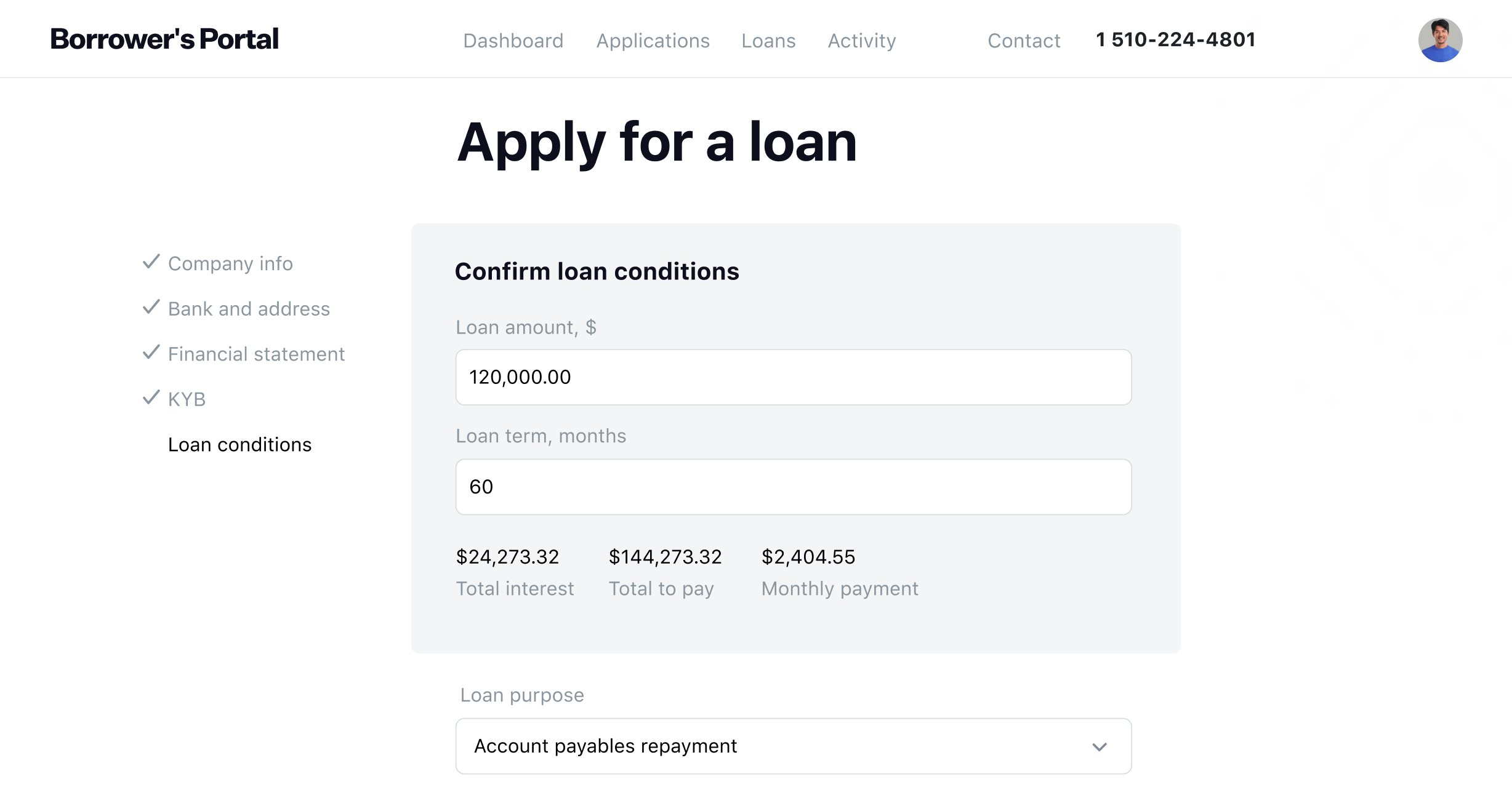

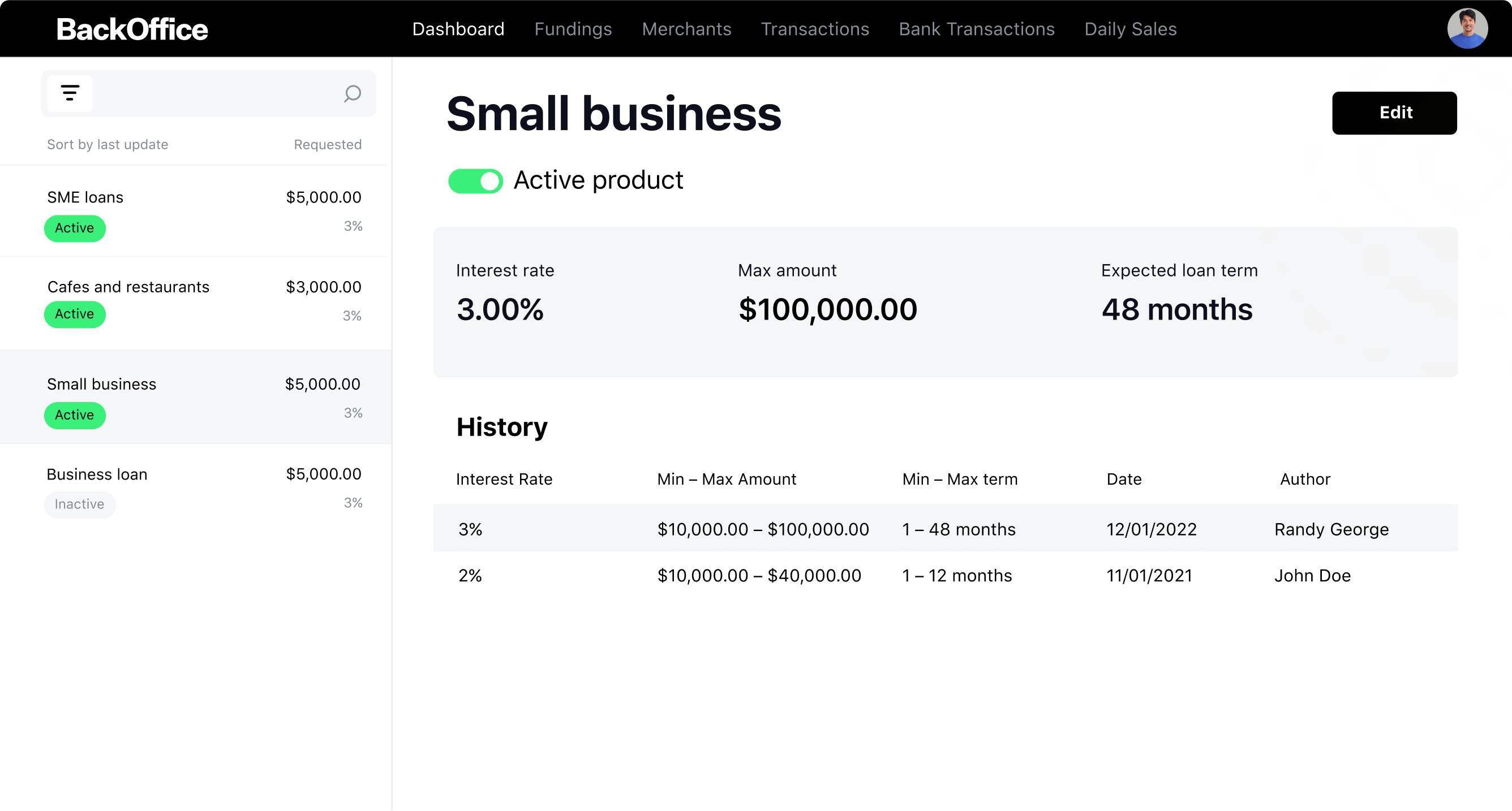

The configurable workflows

Commercial loan servicing software

HES small business lending software gives you complete freedom over loan

calculations. Depending on your business needs, they can include any type of fee, have various rates and

terms, etc.

calculations. Depending on your business needs, they can include any type of fee, have various rates and

terms, etc.

Smart commercial loan solutions

Task management

The commercial lending platform can come with a built-in task management

module that helps you allocate tasks among employees and monitor their performance.

module that helps you allocate tasks among employees and monitor their performance.

and much more

Omnichannel application flow

Loan calculator

Smart credit scoring

Document management and templates

SMS & email notifications

Easy integrations

Start building your business loan software now. Hop on a live

demo

and learn more about HES small business loan software.

demo

and learn more about HES small business loan software.

Out-of-the-box

commercial lending platform

End-to-end commercial lending solutions

Advance your enterprise or small business with lending software tailored to

your needs. Automate mundane tasks of loan officers

to save time and reduce operational costs.

your needs. Automate mundane tasks of loan officers

to save time and reduce operational costs.

Complete lending software in 3

months

HES loan software for small businesses and large financial institutions is

ready for a kickstart in just 3 months. Benefit from

fine-tuning of HES LoanBox solution for your business demands.

ready for a kickstart in just 3 months. Benefit from

fine-tuning of HES LoanBox solution for your business demands.

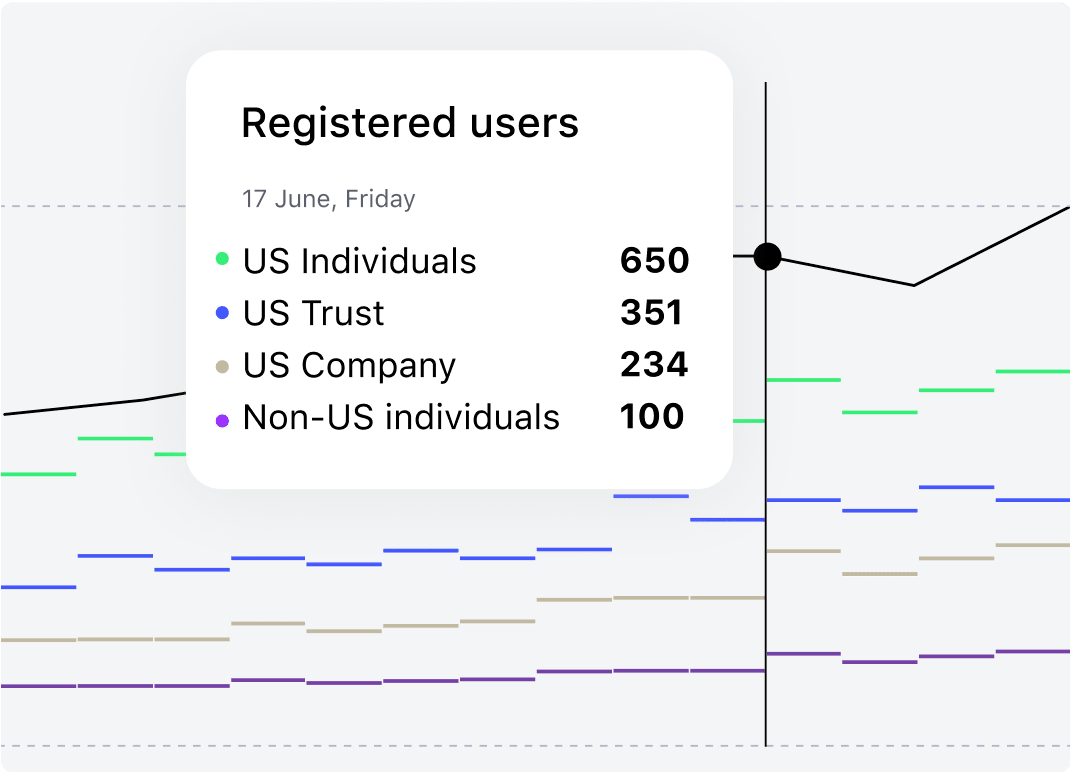

AI-powered commercial loan software

Adhere high service standards with the AI/ML-based commercial lending.

Implement powerful application scoring models to improve

your credit portfolio. Make data-driven decisions instantly with the small

business lending software.

Implement powerful application scoring models to improve

your credit portfolio. Make data-driven decisions instantly with the small

business lending software.

No additional charges per customer

HES provides

fully managed commercial lending software solutions with no limits

on the number of users. Flexible pricing depends on the features you choose.

fully managed commercial lending software solutions with no limits

on the number of users. Flexible pricing depends on the features you choose.

FAQ

What types of businesses can benefit from using commercial lending software?

How secure is HES FinTech’s commercial lending software?

How long does it take to set up HES FinTech’s business loan software?

What kind of customer support does HES provide?