Loan management software

in Australia

Maximize your loan portfolio, reduce NPL rates, automate processes, and make loan management transparent

with HES LoanBox.

with HES LoanBox.

Trusted by global businesses

Digital lending software

for banks and alternative lenders

HES LoanBox is an AI-powered loan management system

that covers every aspect of loan origination, management, and servicing. Designed to meet Australian regulatory standards, HES LoanBox enables banks and alternative lenders to streamline their lending operations with increased speed, security, and automation. Our solution reduces NPL rate, drives increased revenue, and helps financial institutions serve their customers more effectively and efficiently.

that covers every aspect of loan origination, management, and servicing. Designed to meet Australian regulatory standards, HES LoanBox enables banks and alternative lenders to streamline their lending operations with increased speed, security, and automation. Our solution reduces NPL rate, drives increased revenue, and helps financial institutions serve their customers more effectively and efficiently.

GiniMachine is a no-code AI tool

that extracts insights into borrowers’ behavior using machine learning algorithms. Integrated within HES LoanBox, it eliminates guesswork from decision-making, enabling lenders to make informed, data-driven choices with confidence.

that extracts insights into borrowers’ behavior using machine learning algorithms. Integrated within HES LoanBox, it eliminates guesswork from decision-making, enabling lenders to make informed, data-driven choices with confidence.

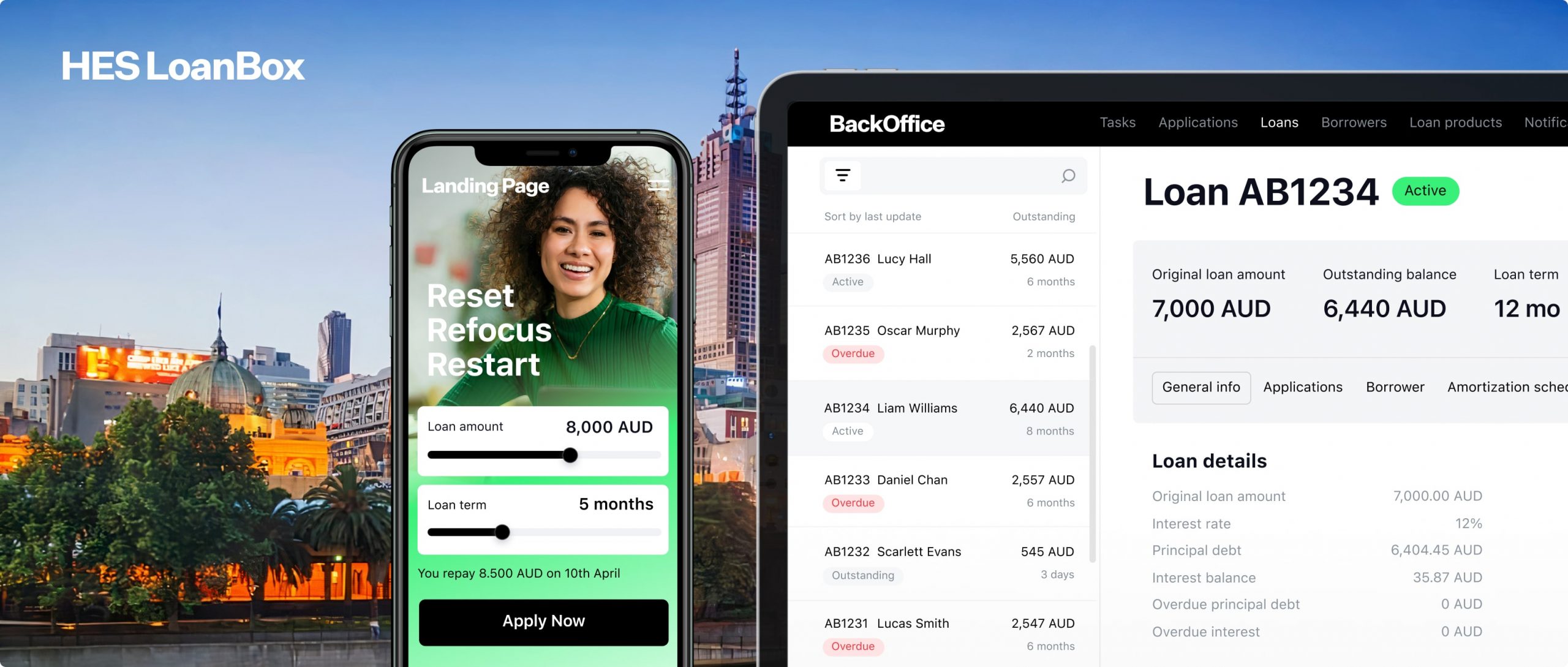

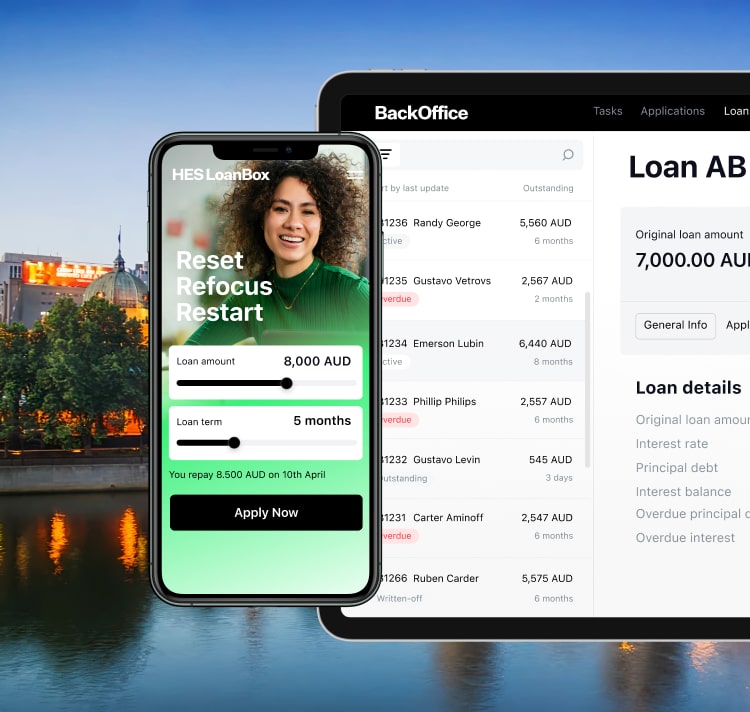

HES LoanBox overview

Lending

management software

Our software is the go-to option for banks and alternative lenders aspiring to efficient, data-driven, digital loan management – from origination through servicing.

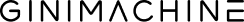

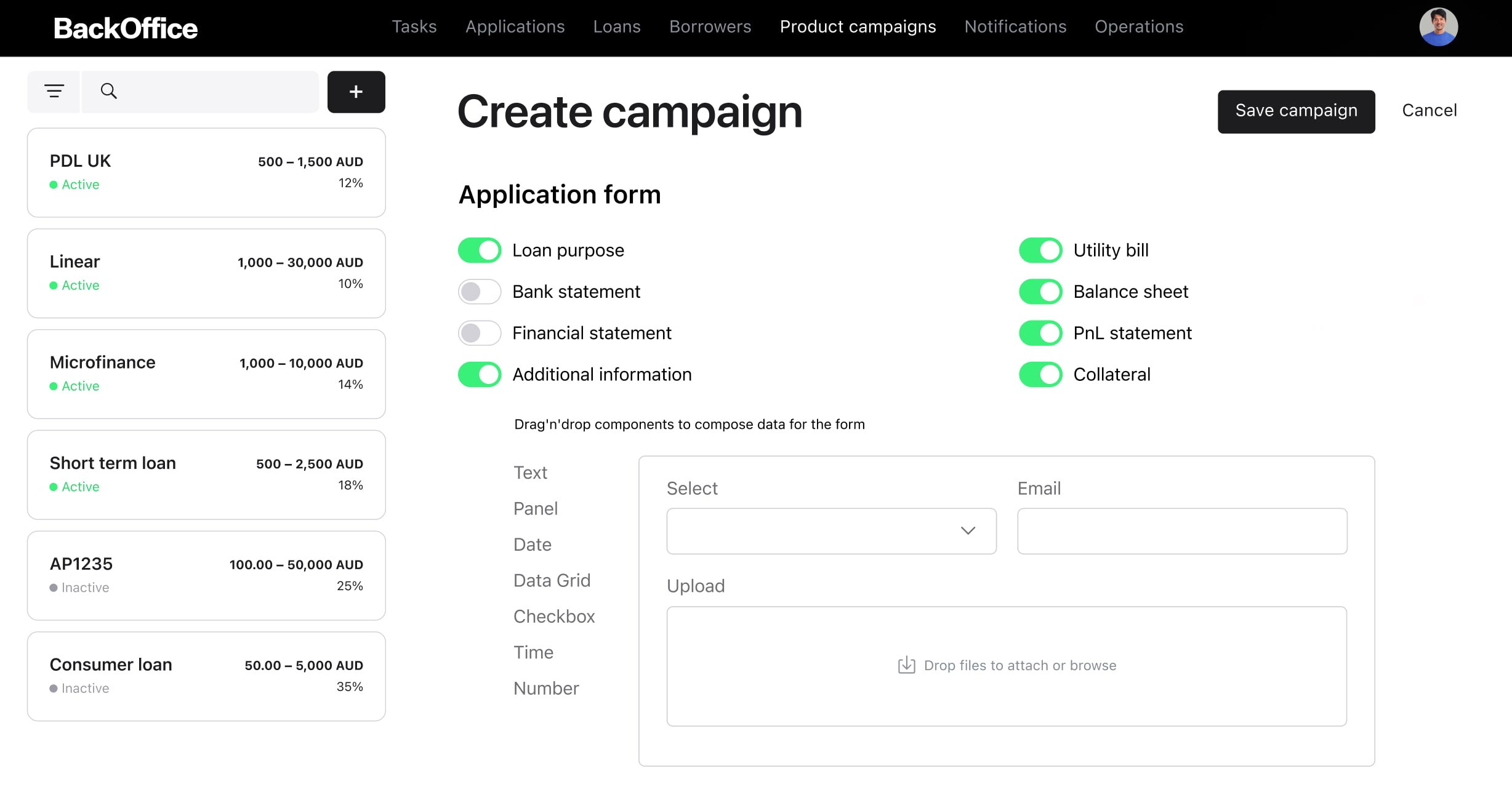

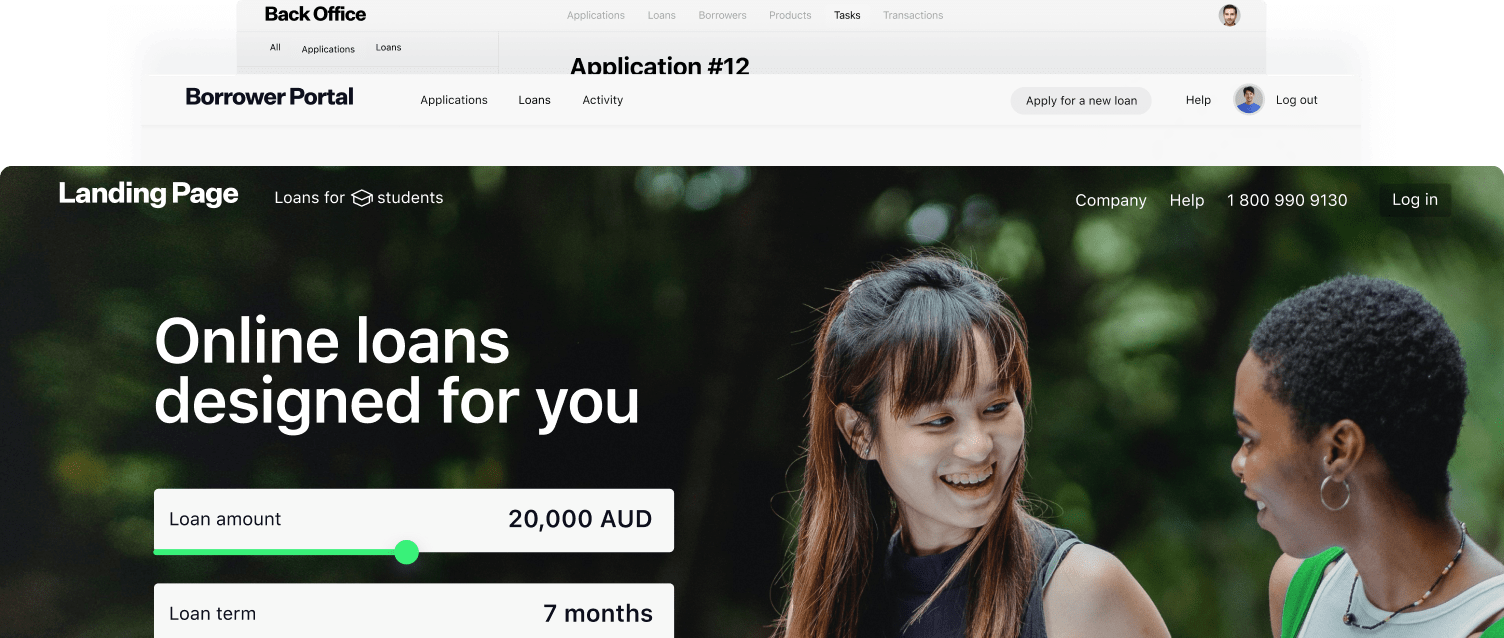

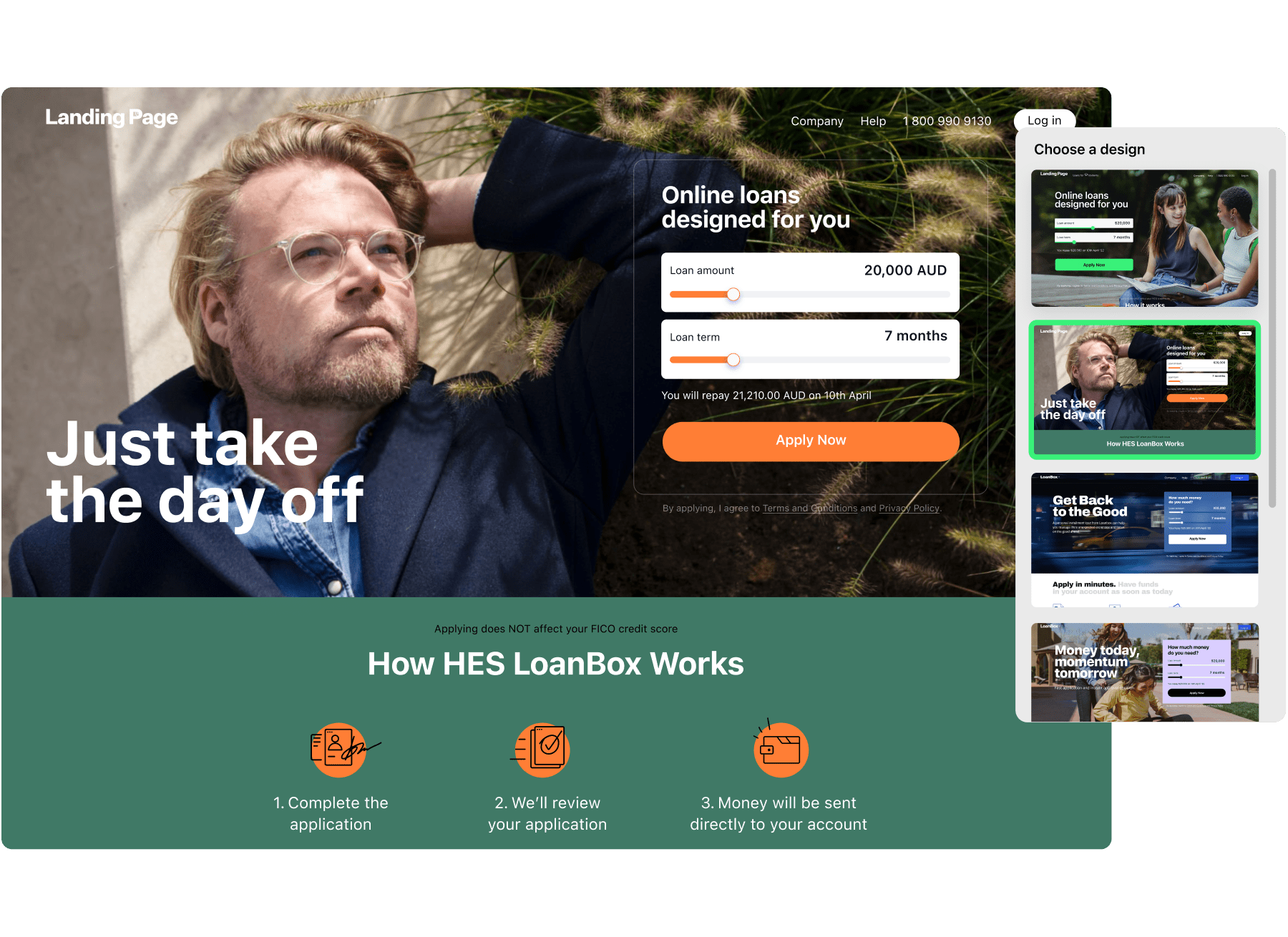

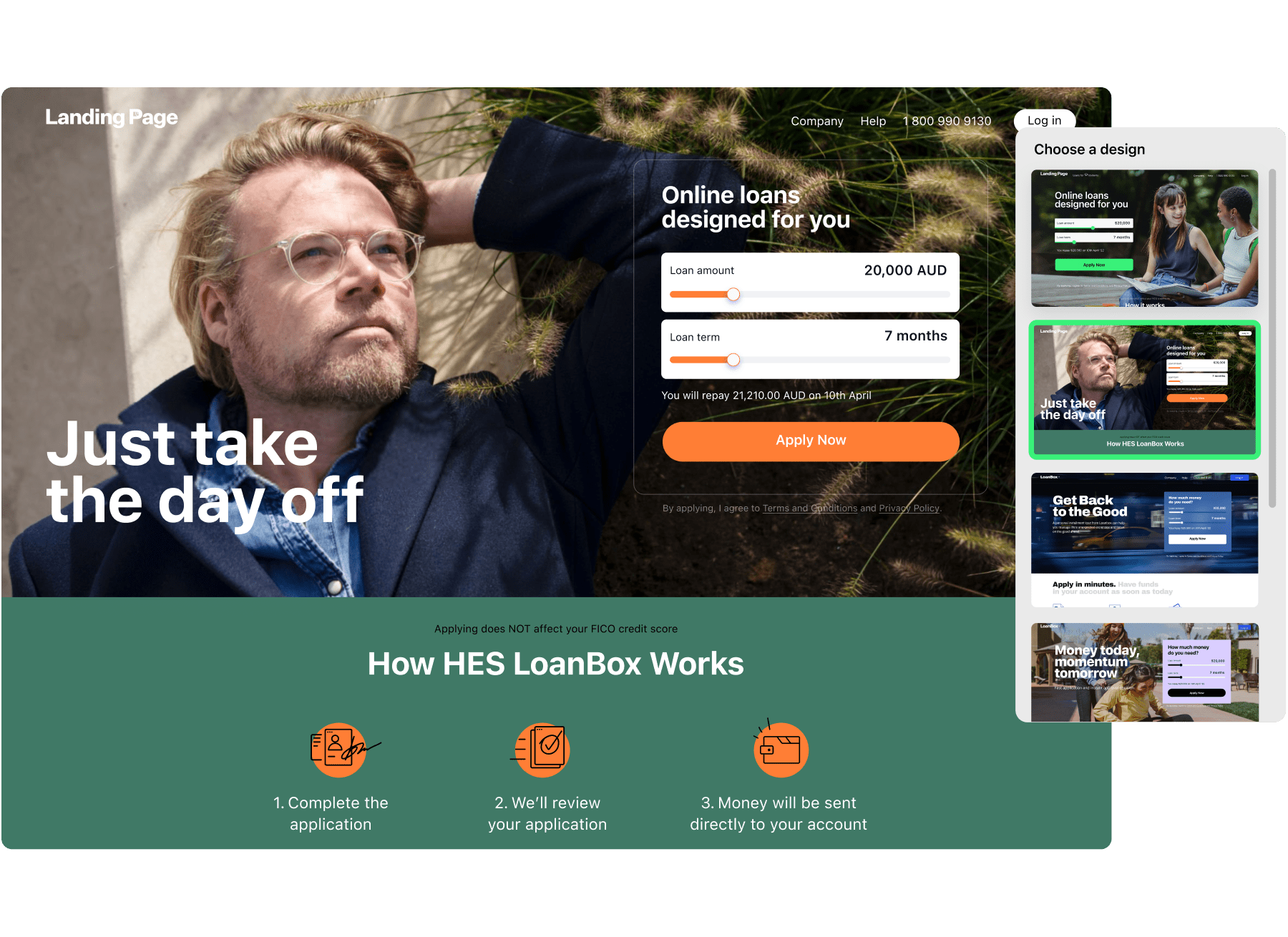

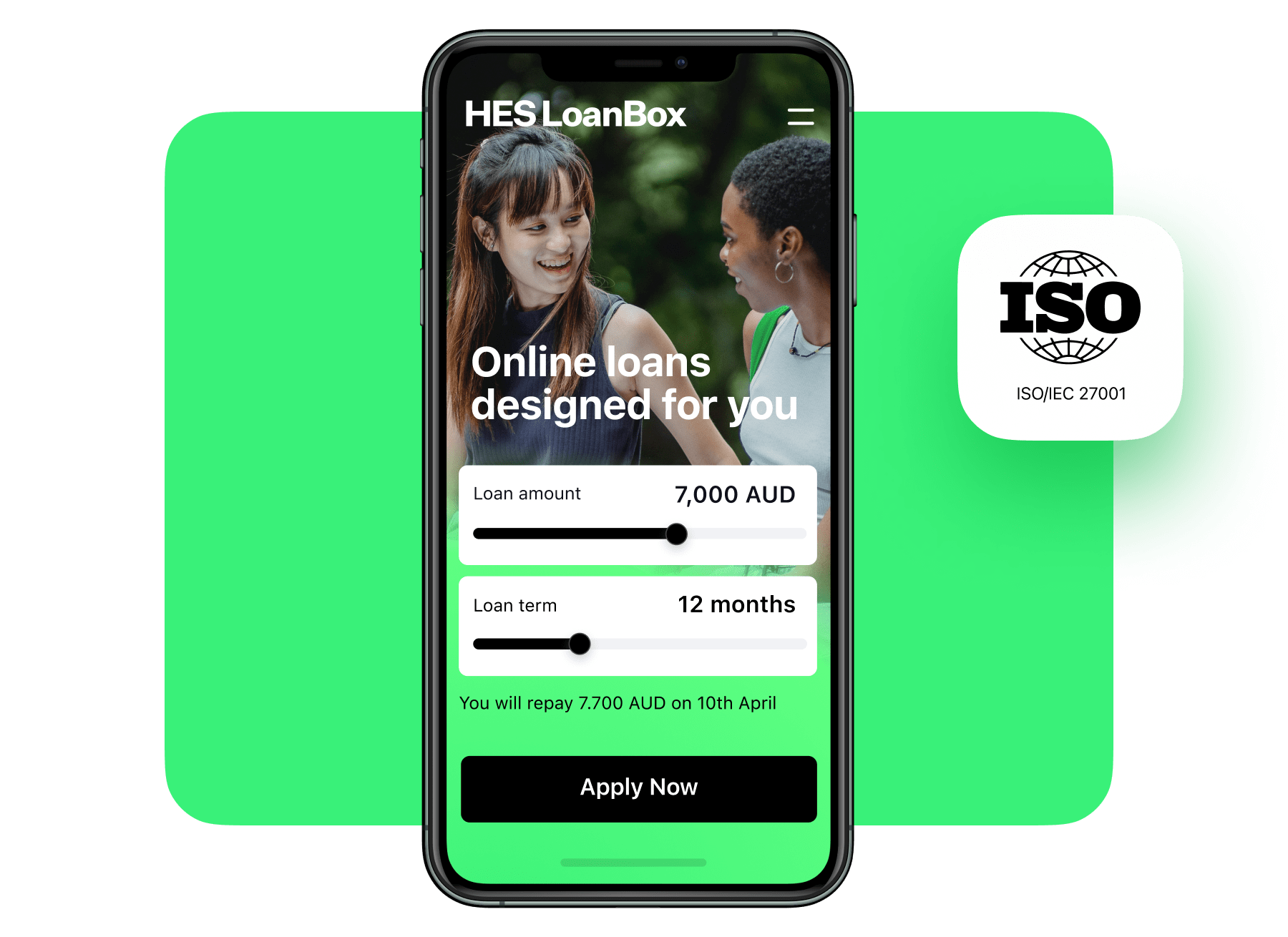

Customizable landing page

Create an intuitive loan website to increase engagement and drive more applications using

customizable white-label solutions.

customizable white-label solutions.

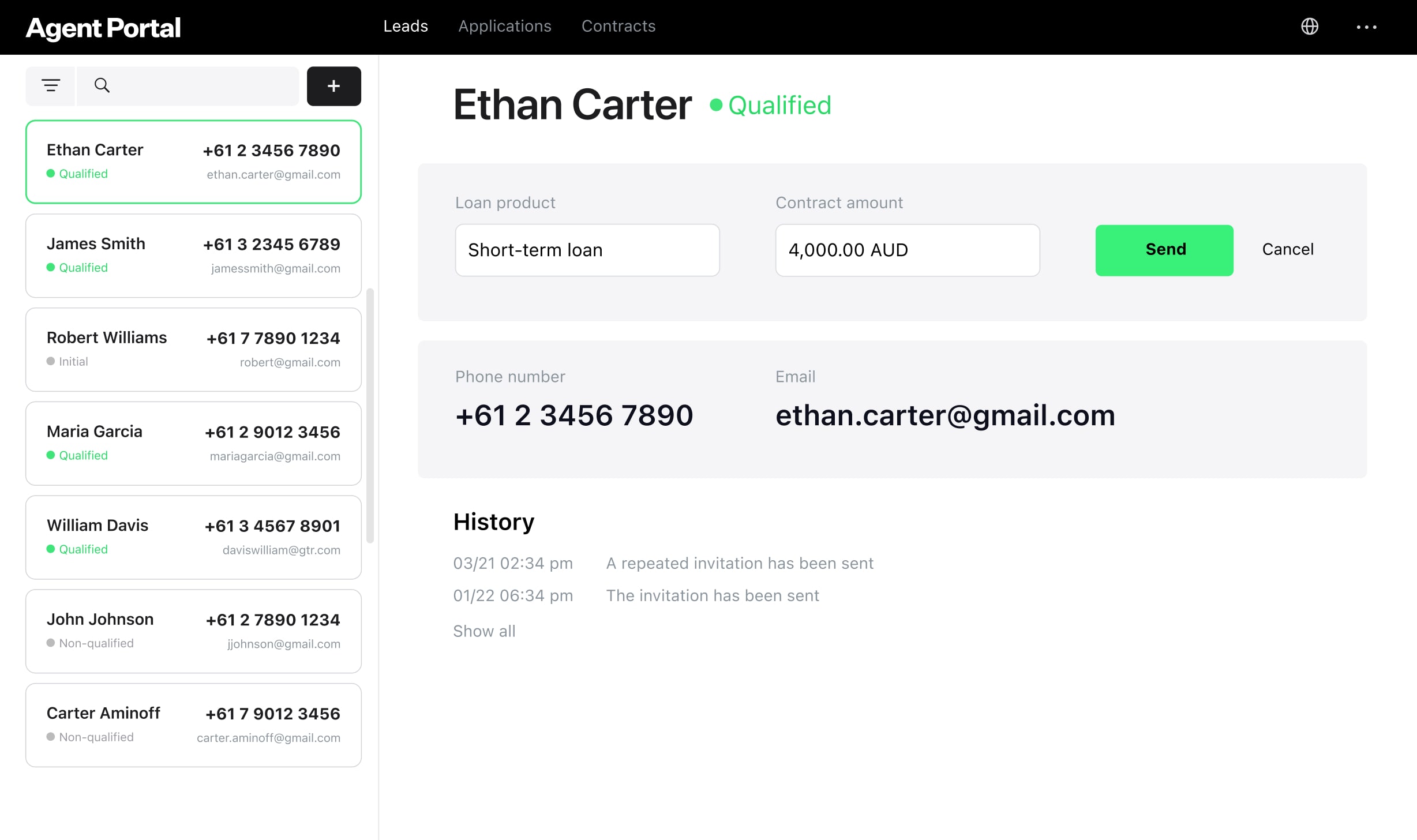

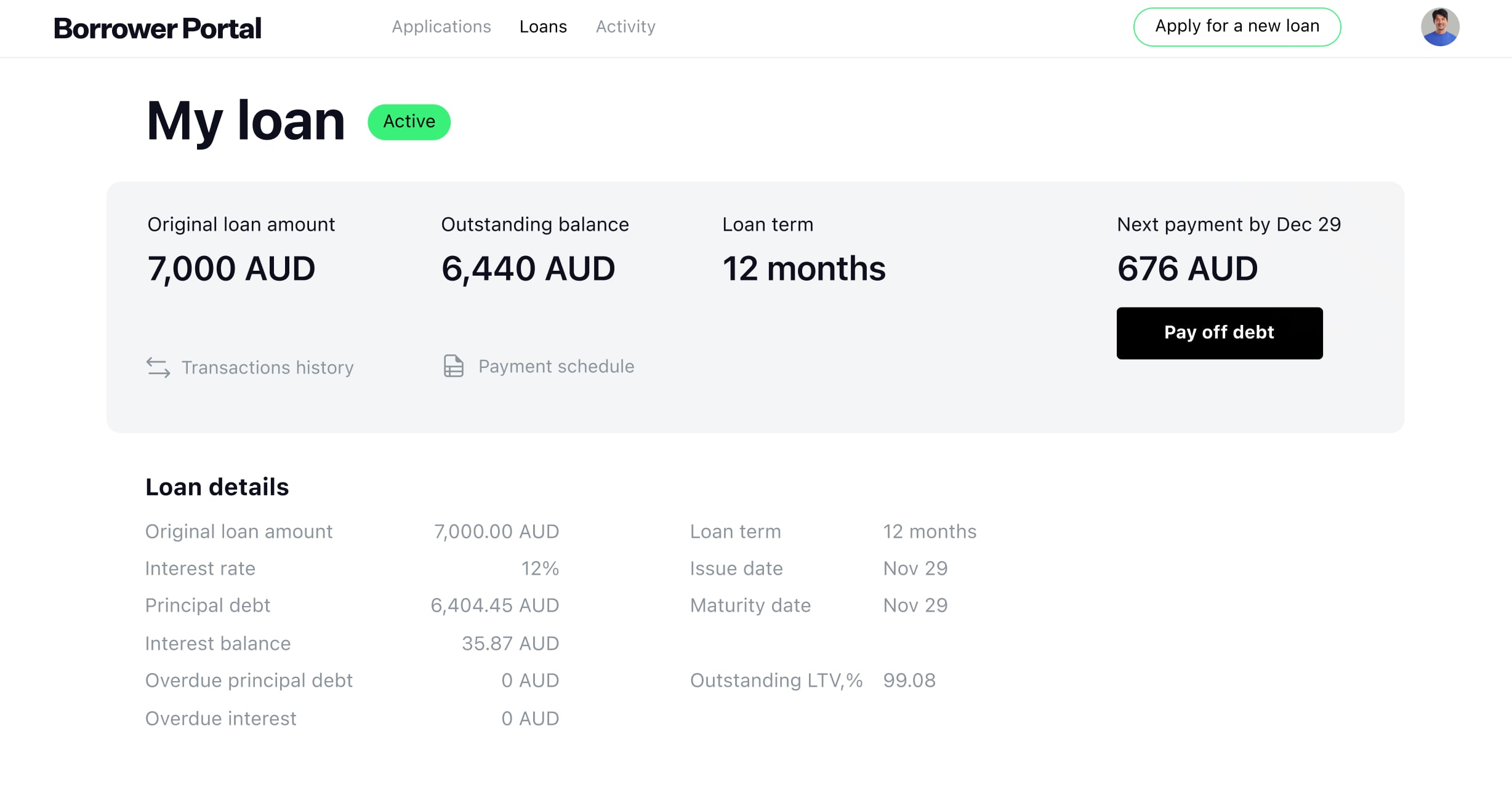

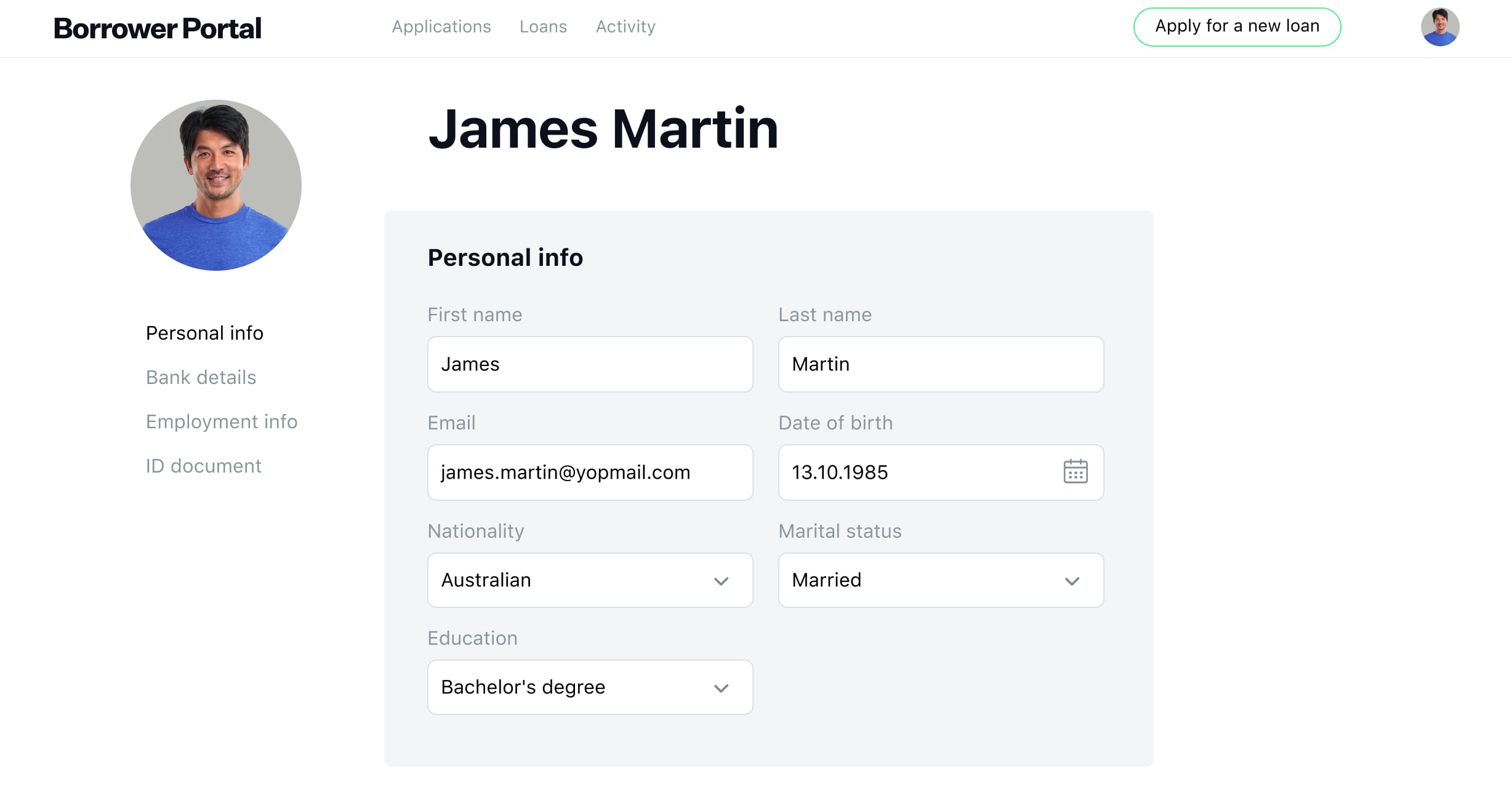

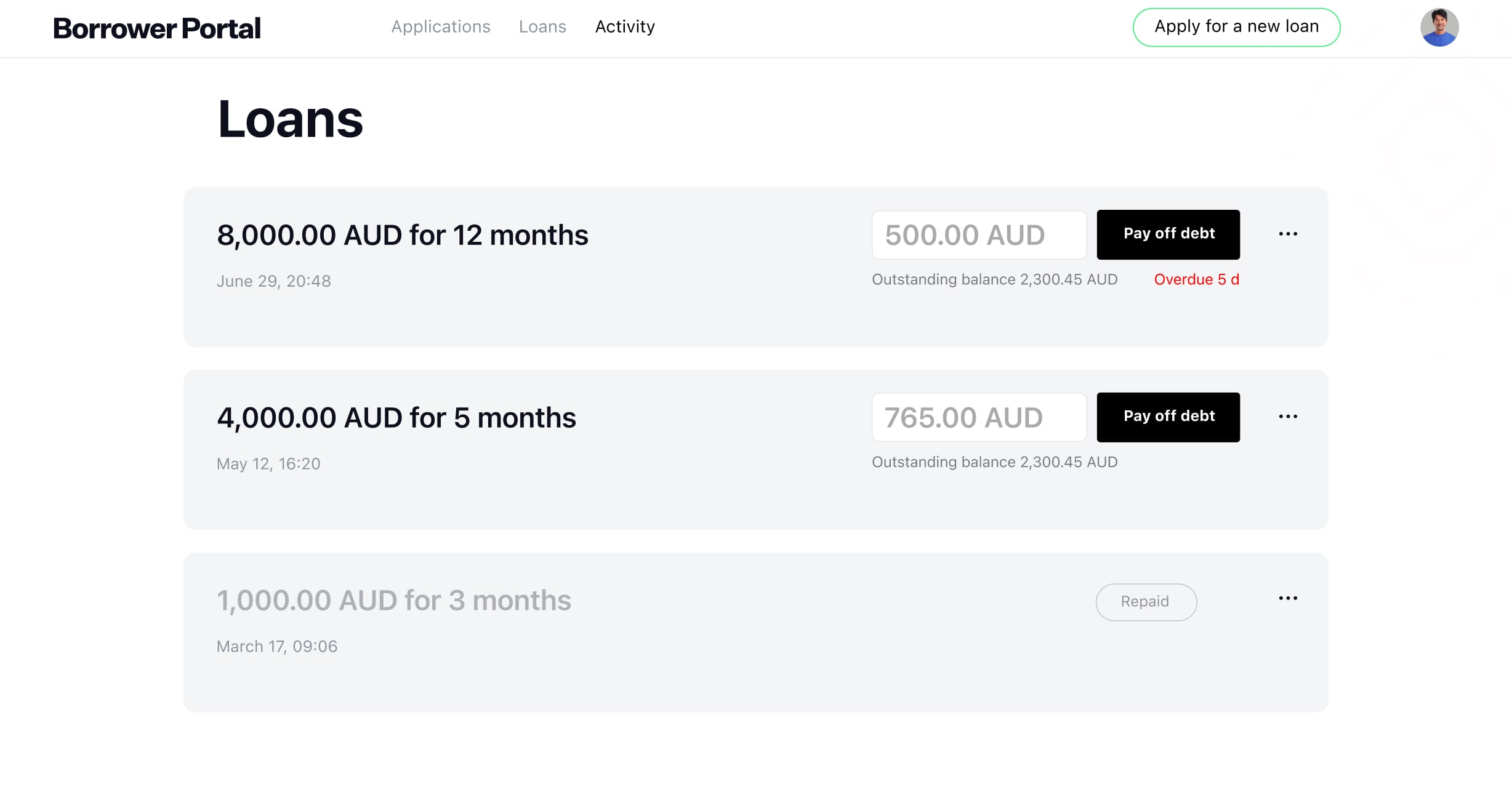

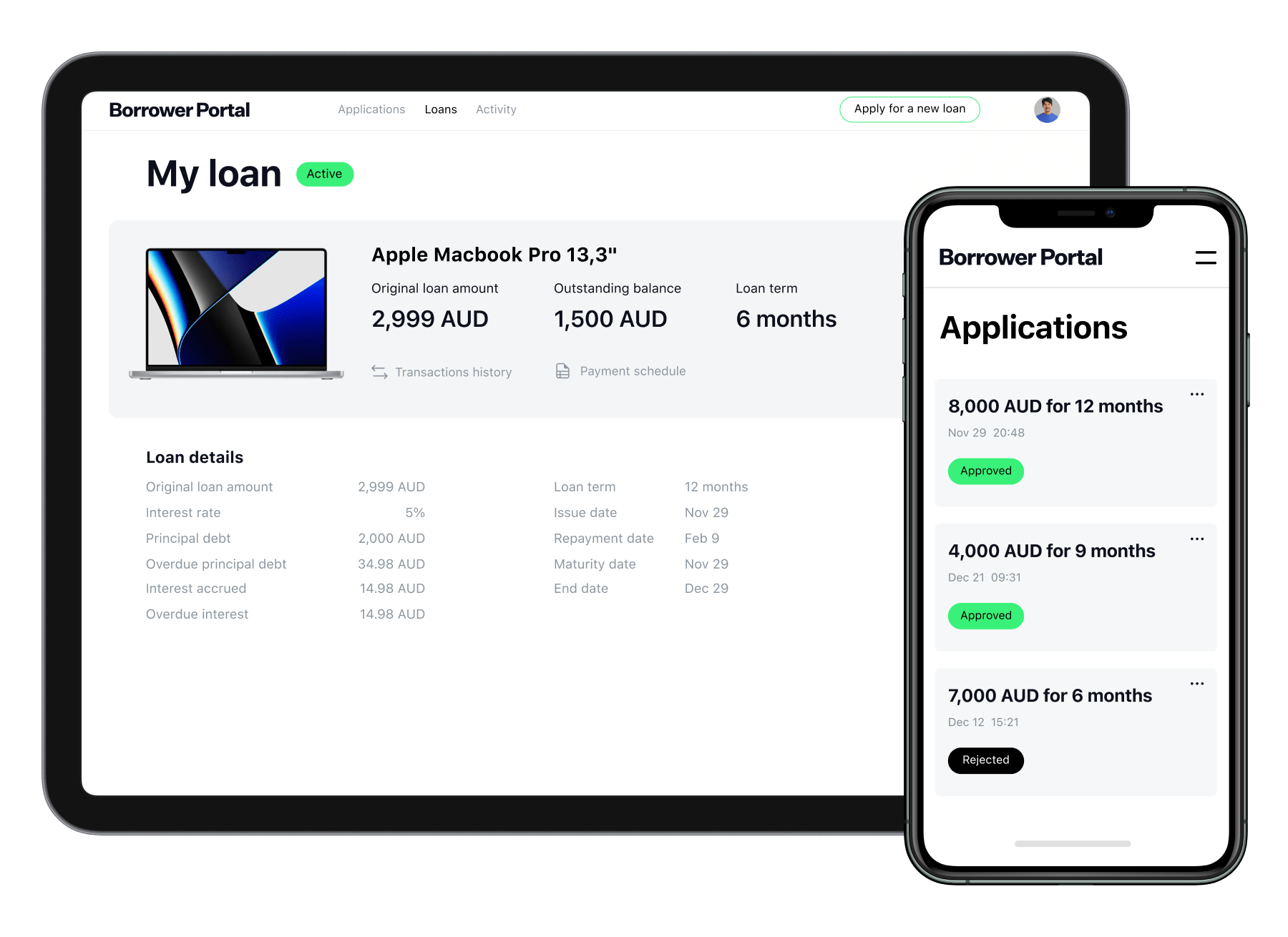

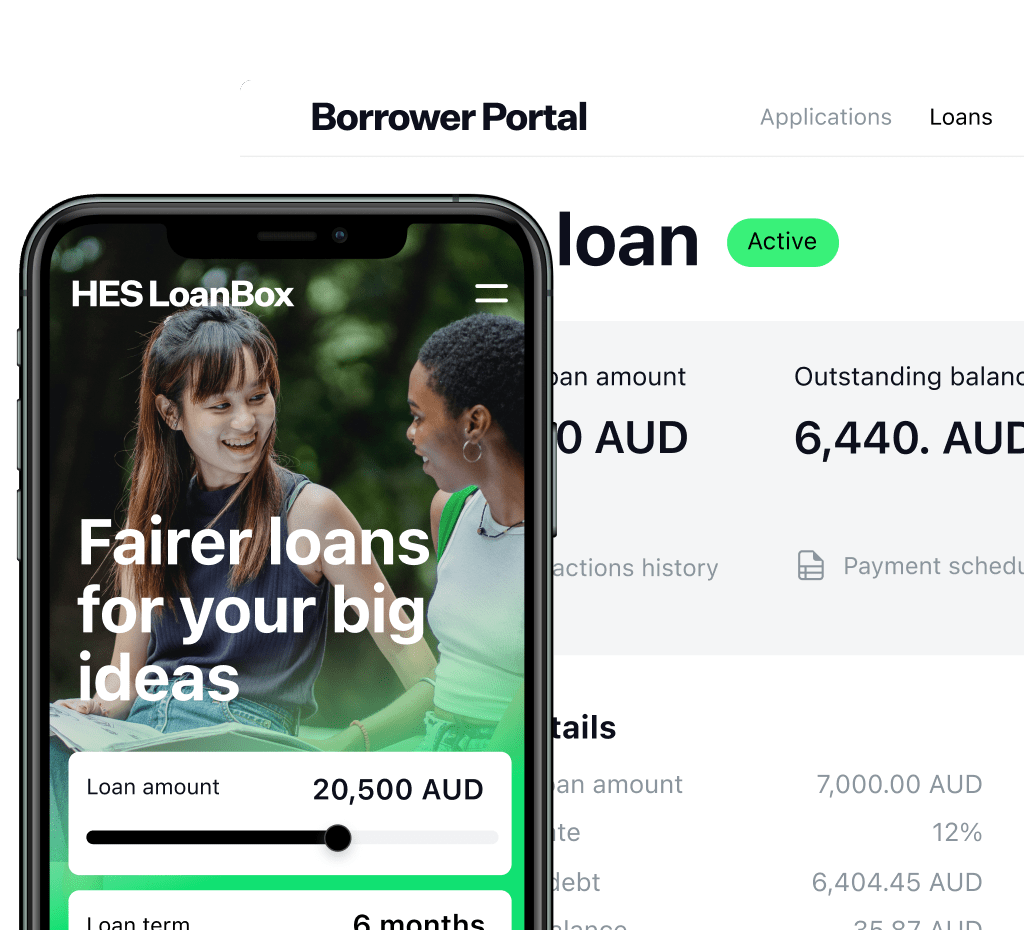

Make your customers’ loan process easier

Provide a personal space where borrowers can manage every aspect of their loan journey –from

application to repayment.

application to repayment.

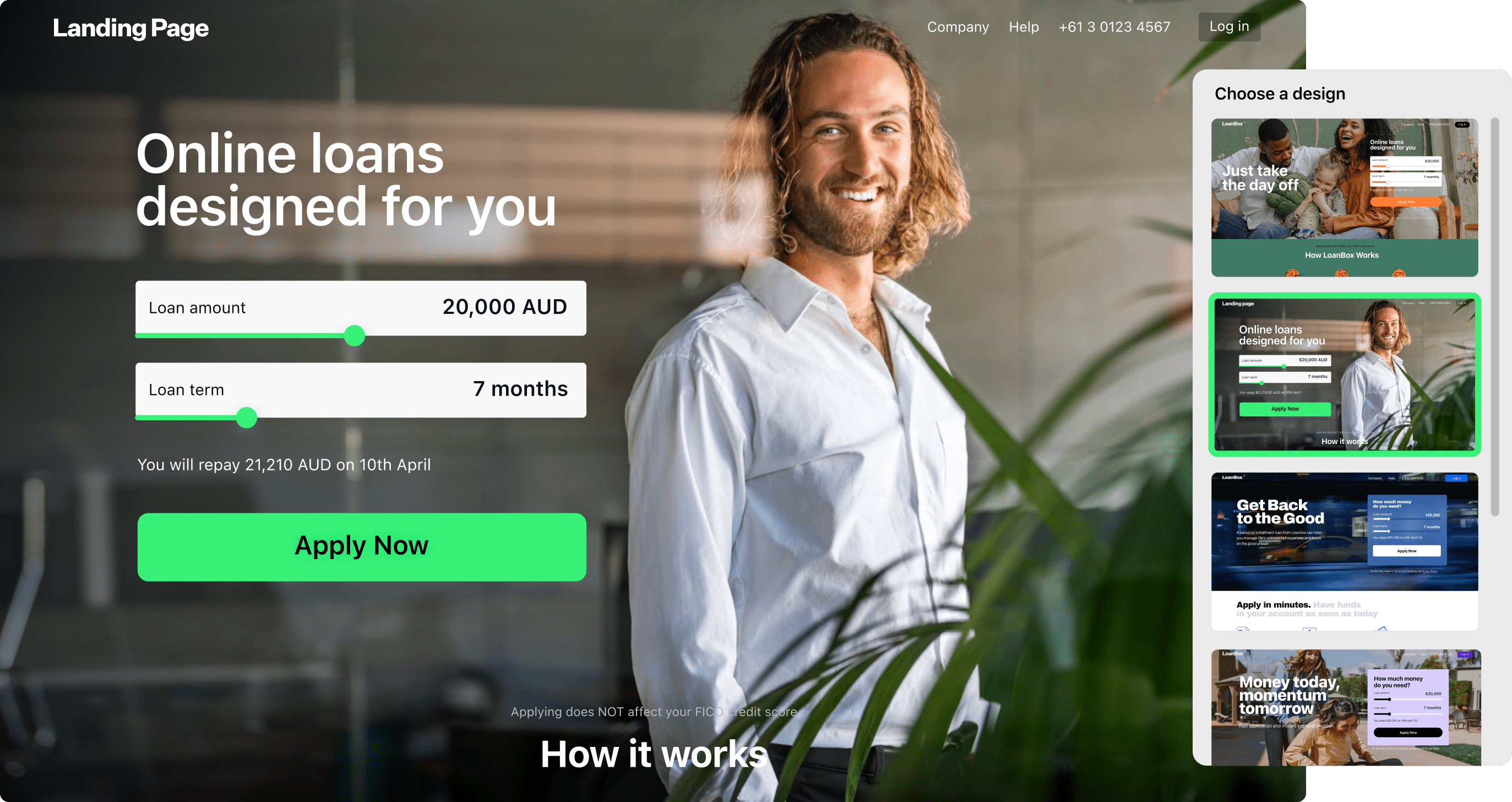

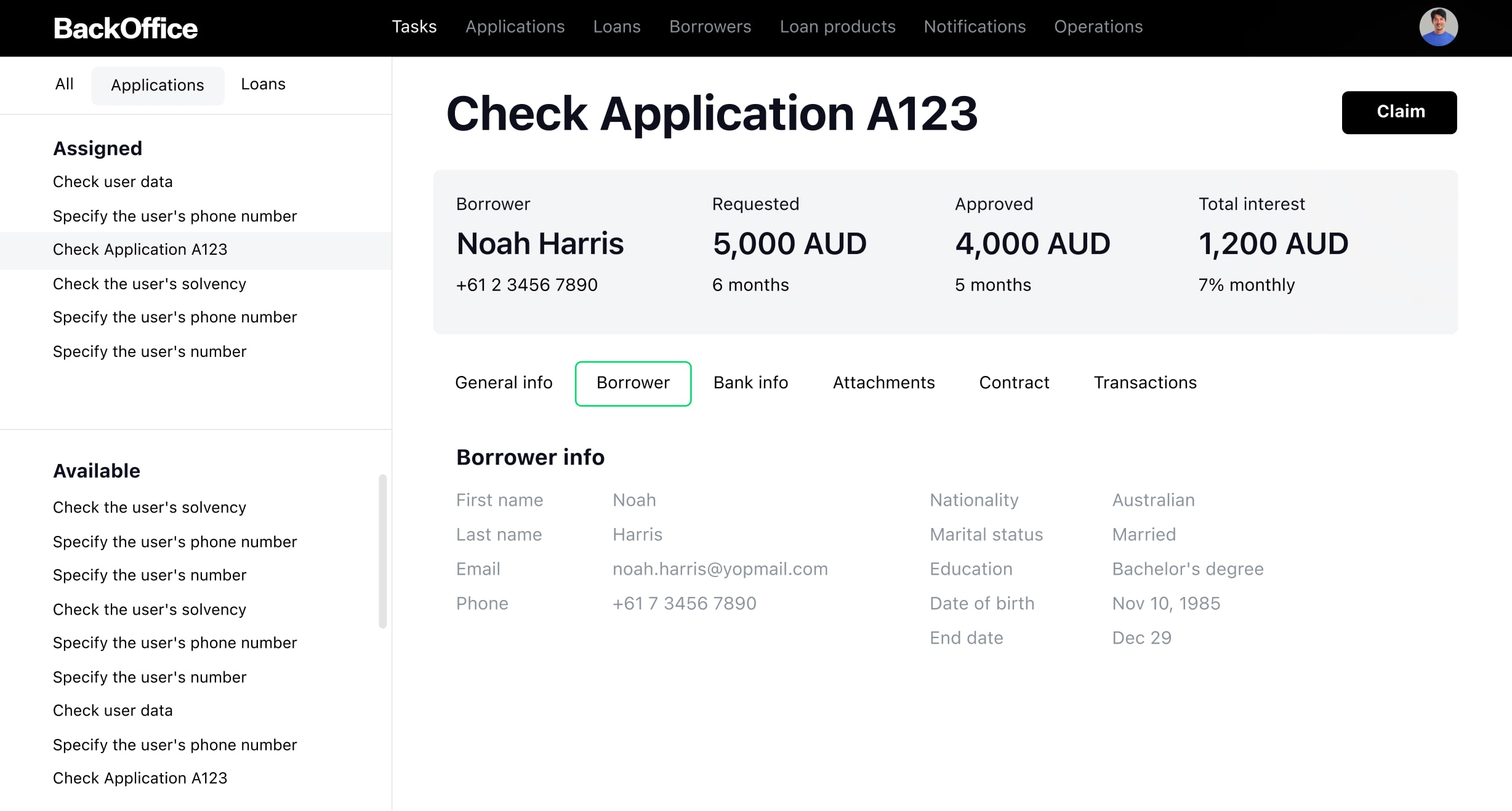

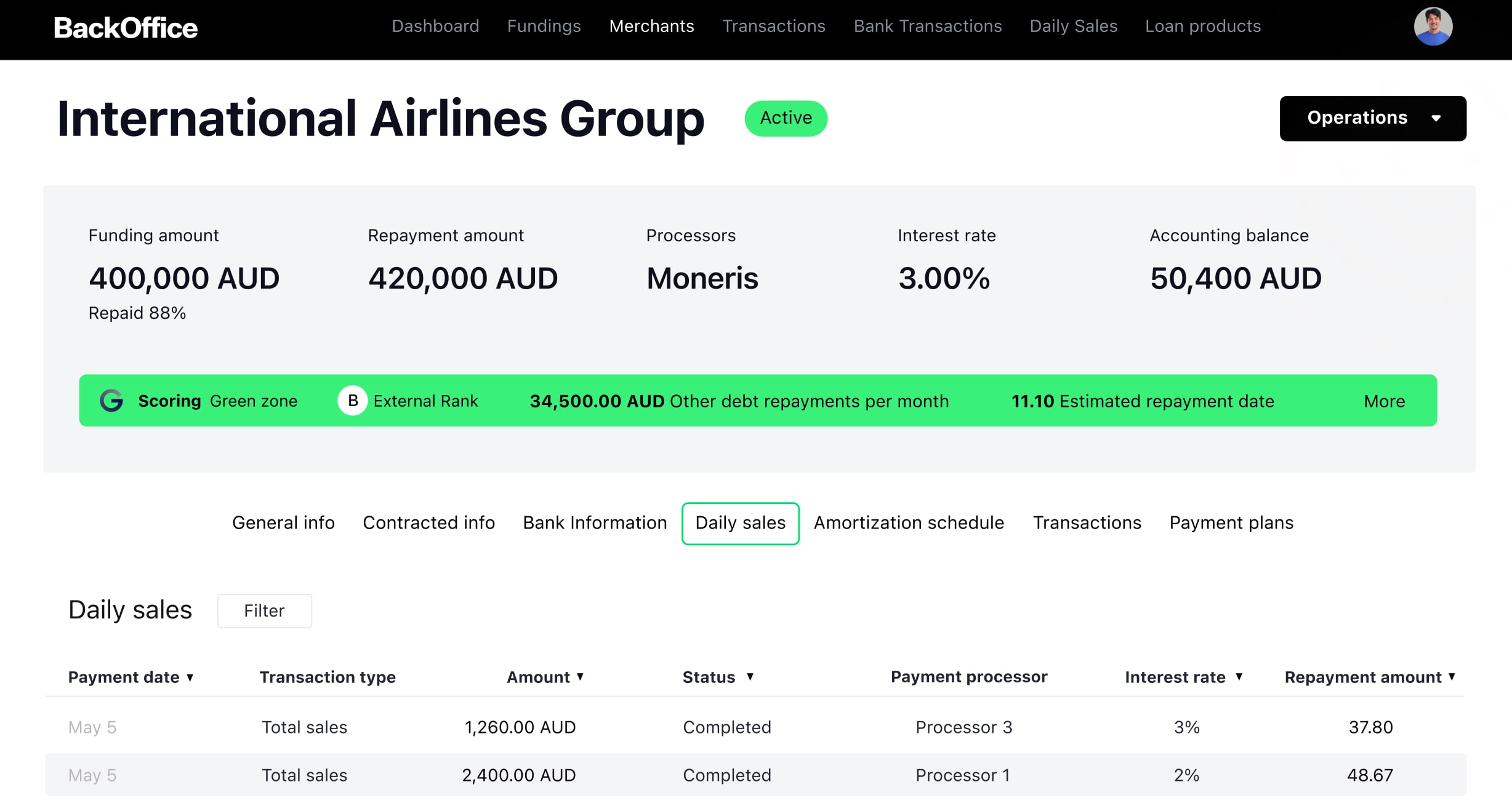

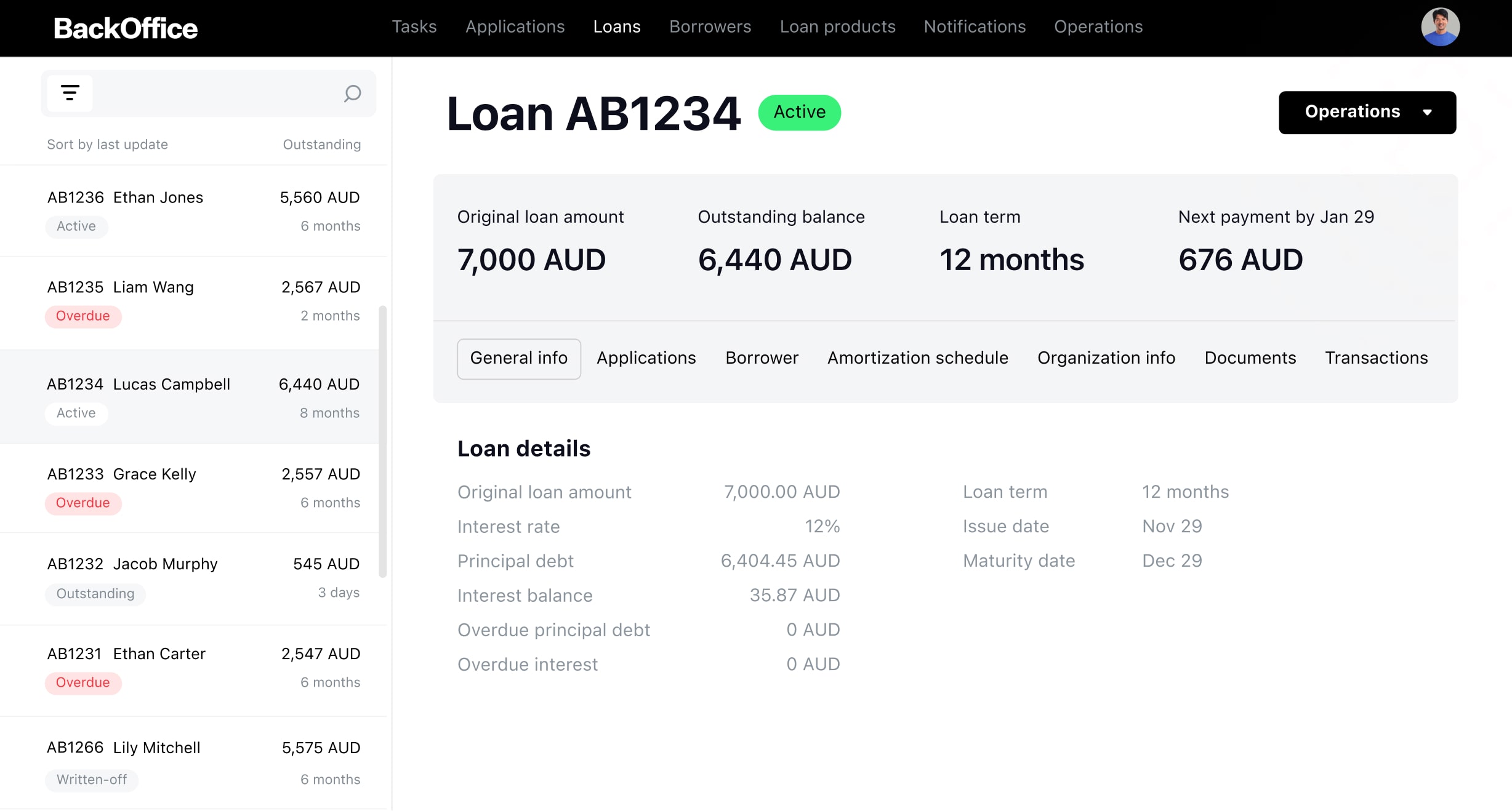

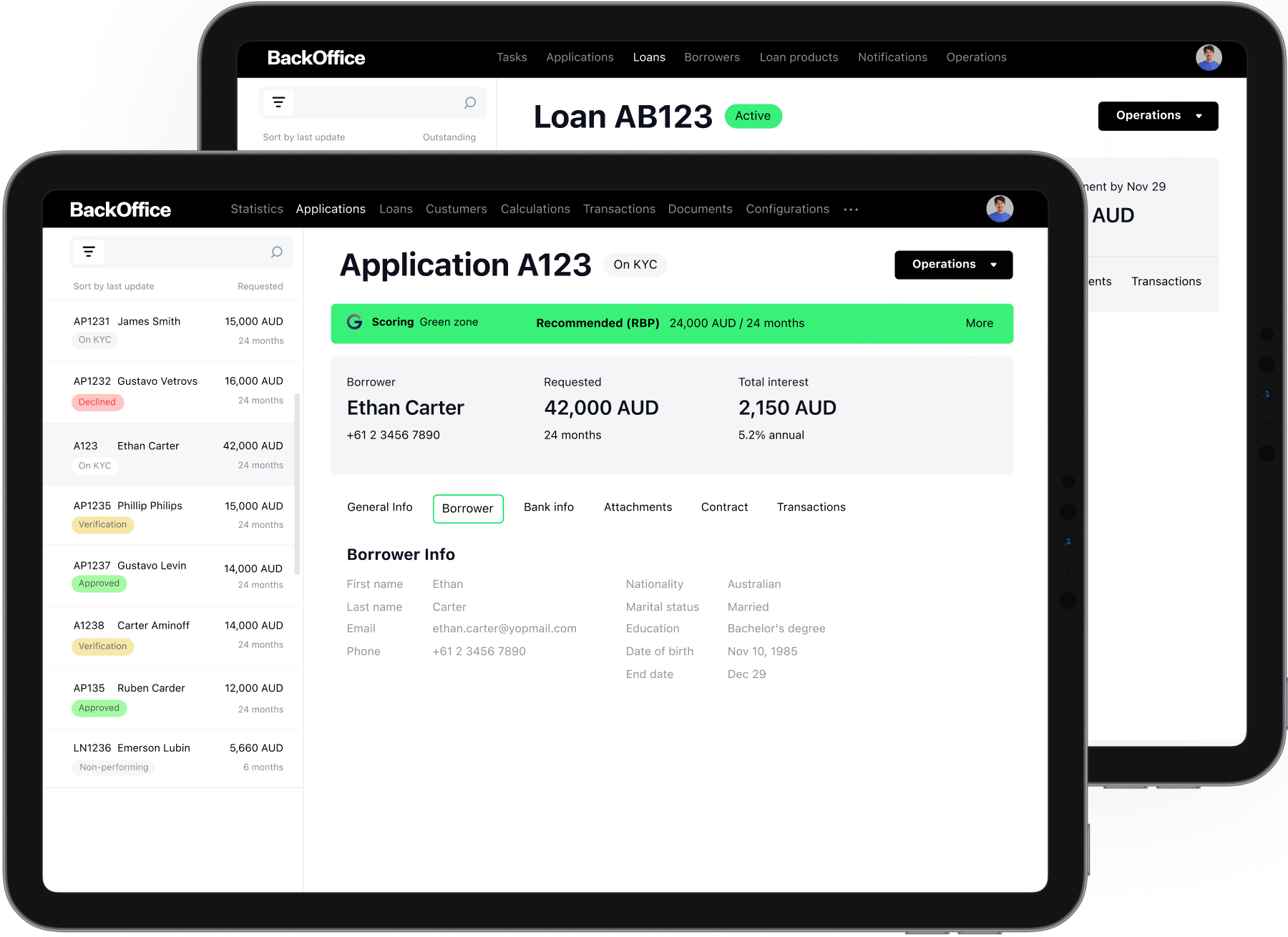

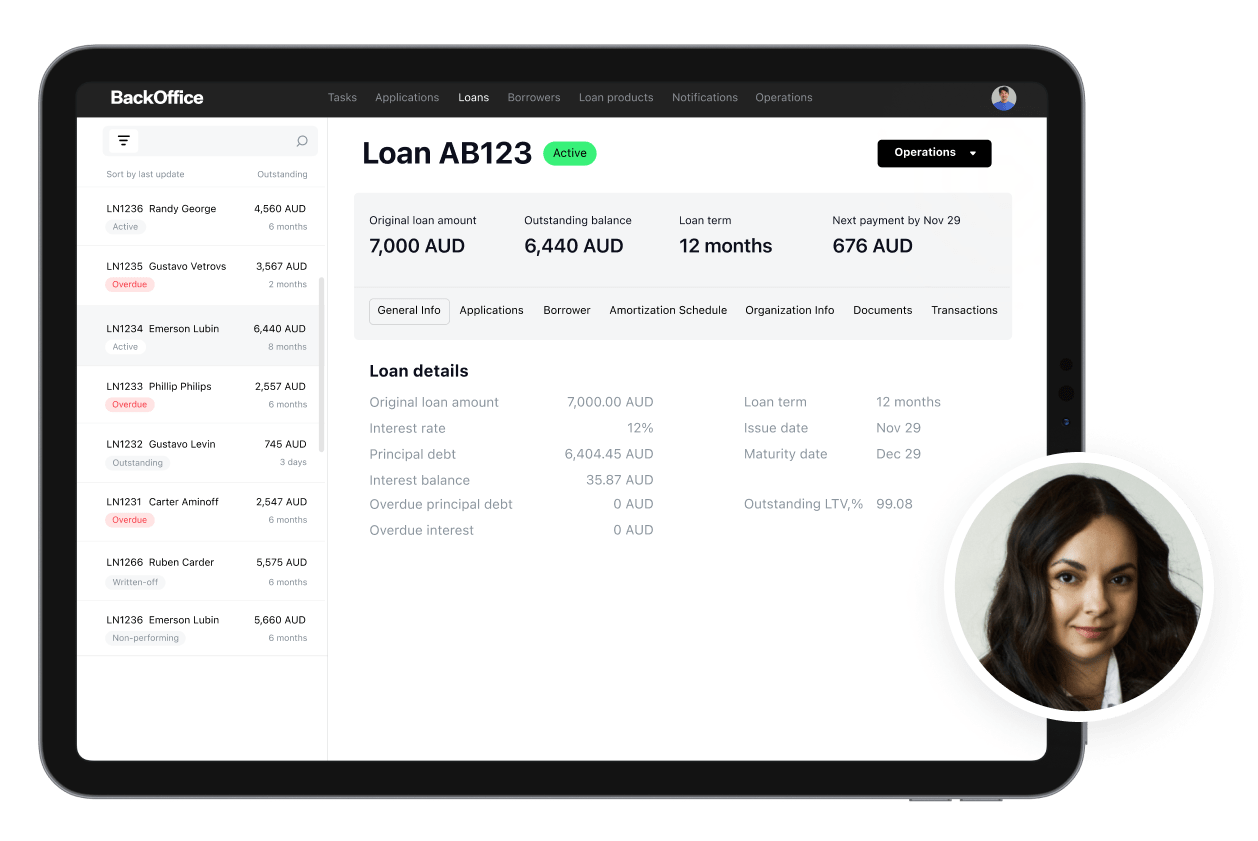

Centralize all lending operations

Streamline your operations with our API-rich Back Office, providing comprehensive loan products,

real-time data, amortization schedules, automated calculations, and everything else needed to

grow your business.

real-time data, amortization schedules, automated calculations, and everything else needed to

grow your business.

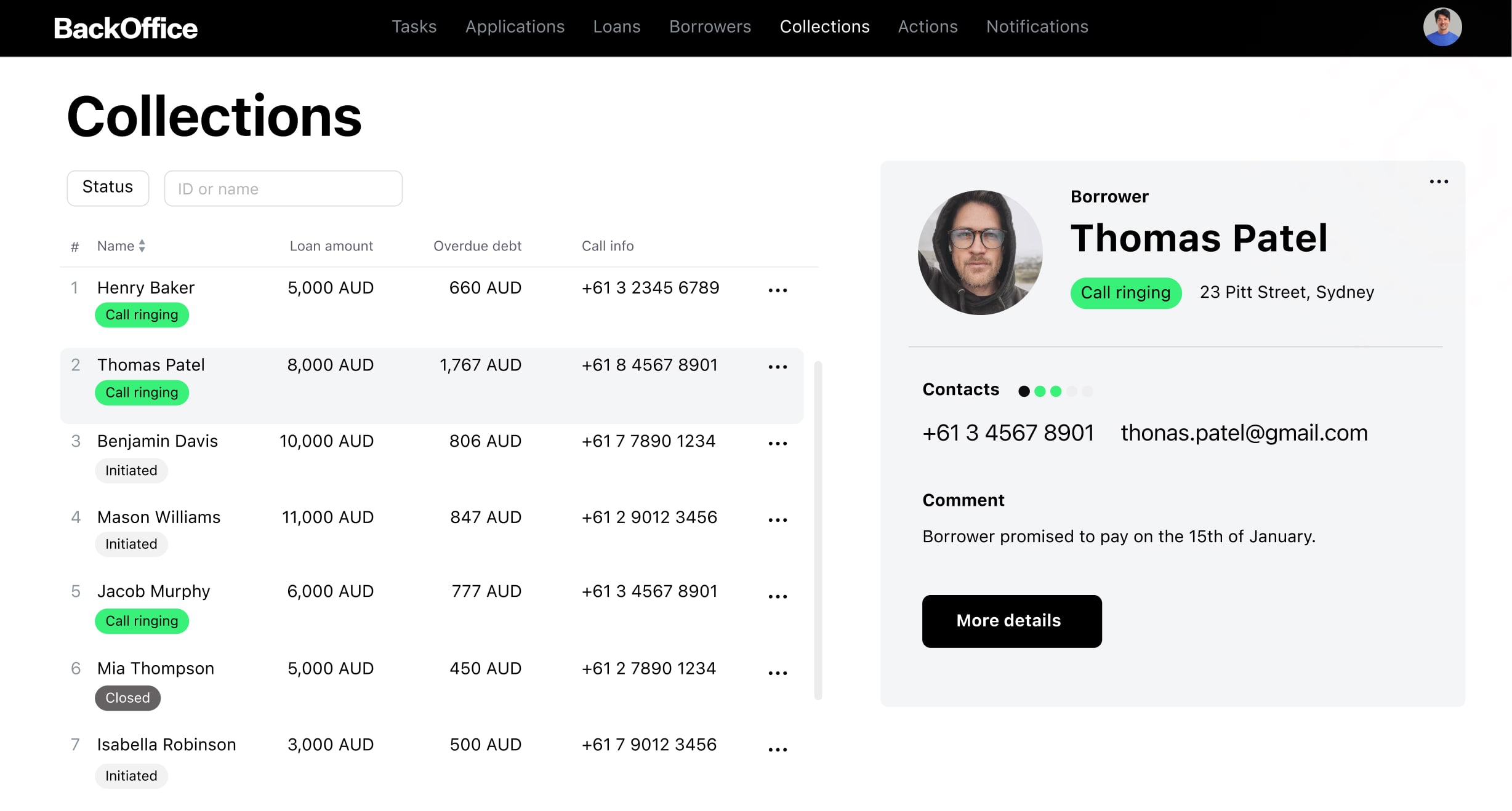

Reduce risk with AI-powered credit scoring

Leverage GiniMachine to analyze complex data patterns, improving accuracy in credit decisions,

minimizing NPLs, and facilitating more dependable credit assessments.

minimizing NPLs, and facilitating more dependable credit assessments.

Developed with the newest tech stack

Ensure scalability, performance, and security with HES LoanBox, a cloud loan management system

developed using a modern tech stack that incorporates open-source technologies.

developed using a modern tech stack that incorporates open-source technologies.

Security and compliance focused

HES FinTech holds ISO 27001 certification. It validates that our company adheres to

international best practices for information security, ensuring that client data remains secure

and confidential.

international best practices for information security, ensuring that client data remains secure

and confidential.

Let us show

you how it works

Request a personalized tour to explore all HES LoanBox features and see how it can streamline your business operations and cover your unique needs.

Seamless

integrations

Australian lending

market expertise

Our team of BAs has a decade of diverse financial experience, specializing in the Australian lending market and compliance nuances.

Why choose HES LoanBox

Kickstart online lending

Seamless integrations

Customer support

Future-proof architecture

Why HES FinTech

software?

Post-lauch support

We handle all software support, maintenance, and development in-house to guarantee the highest

quality of service.

quality of service.

European-founded company

HES FinTech has earned the trust of 102 companies across 32 countries. We deliver solutions

that meet their needs and foster business growth.

that meet their needs and foster business growth.

Australian clients and partners

The relationship we have built with regional industry players is the best testament of our commitment to excellence and reliability.

Our journey

in Australia

Lending software

solution in Australia

Scalable end-to-end lending solution

Deployment in 3 months

AI-powered credit scoring

100% process automation

FAQ

What types of loans can be managed using HES LoanBox?

How does HES LoanBox enhance loan processing efficiency?

Can HES LoanBox be integrated with our existing systems?

How secure is the data stored in HES LoanBox?