Australian lender success story

A consumer lending platform on the Australian financial services market

Learn how HES LoanBox helped to launch the Australian lending business from scratch within 2 months.

Founded in

2023

Markets

Australia

Team Size

10-100

Type

Consumer lending

Web site

Under NDA

Challenge

Rapid business launch

As a startup without an initial loan management system in place, they not only needed guidance

on financial business strategies but also a rapid entry into the market. Their vision was clear

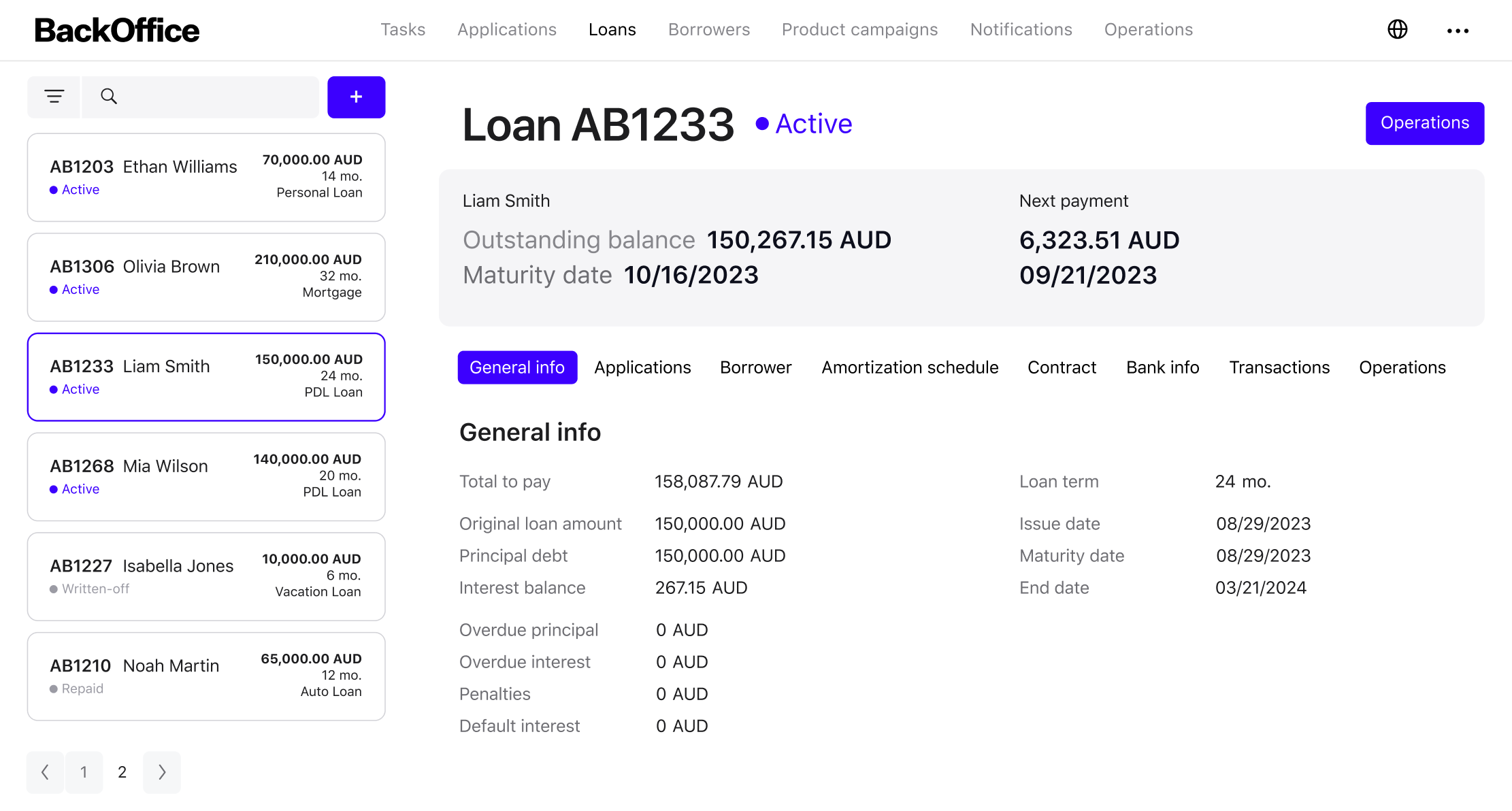

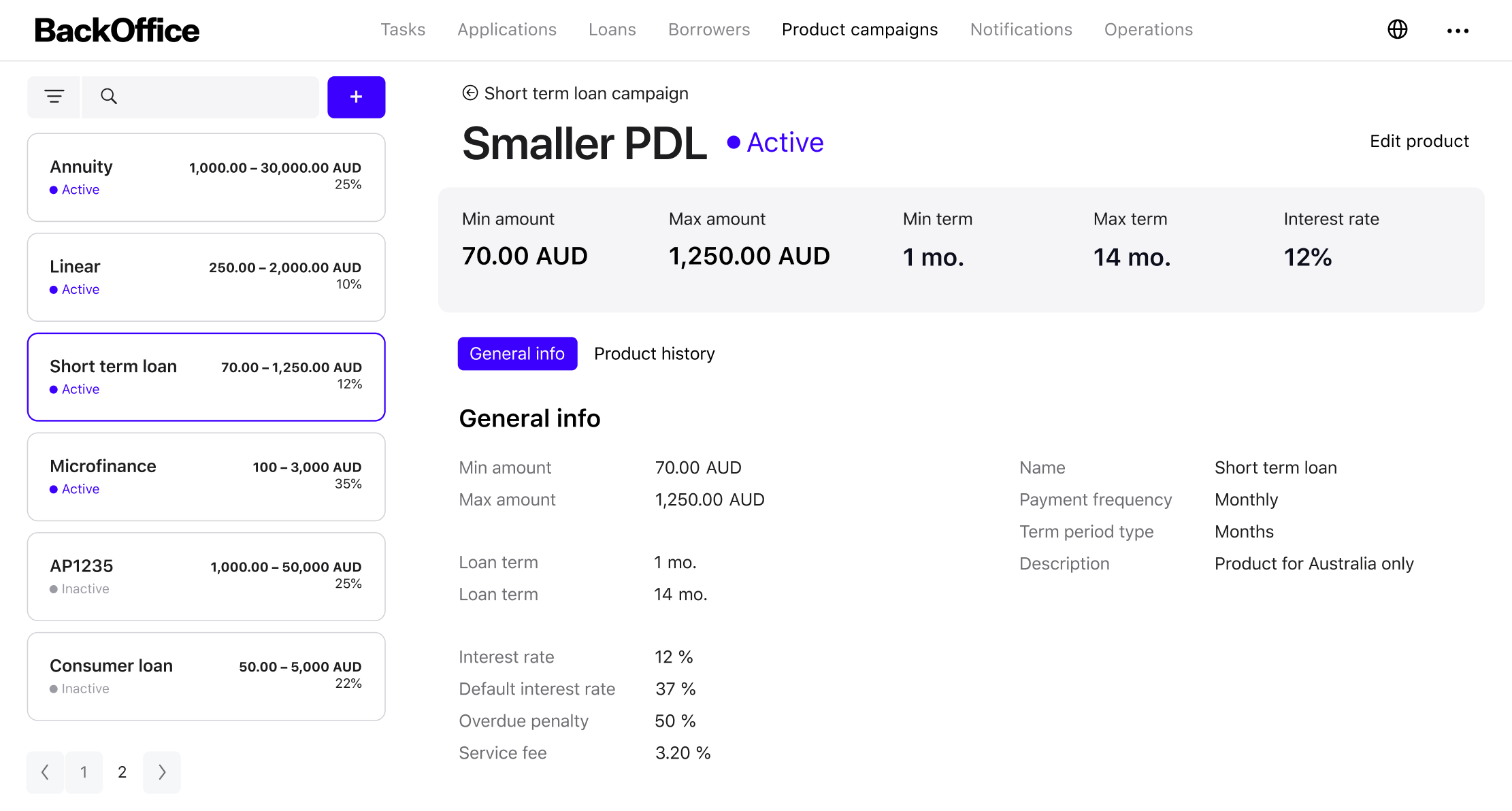

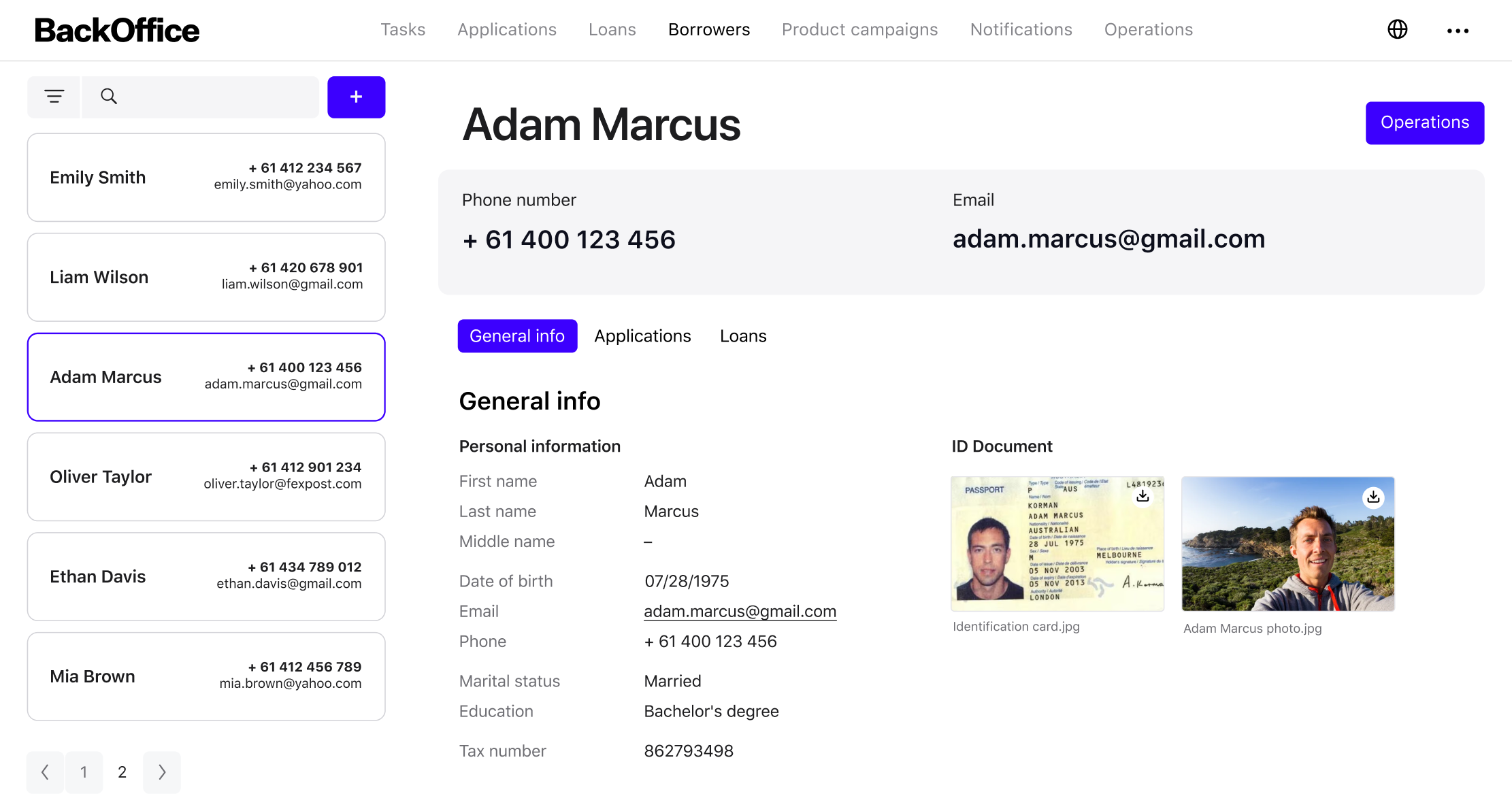

– a holistic loan processing system that included features like digital loan origination,

automated underwriting, a streamlined document workflow, efficient loan registration, and

flexible management capabilities. These were non-negotiables, forming the core of their

requirements.

on financial business strategies but also a rapid entry into the market. Their vision was clear

– a holistic loan processing system that included features like digital loan origination,

automated underwriting, a streamlined document workflow, efficient loan registration, and

flexible management capabilities. These were non-negotiables, forming the core of their

requirements.

Approach

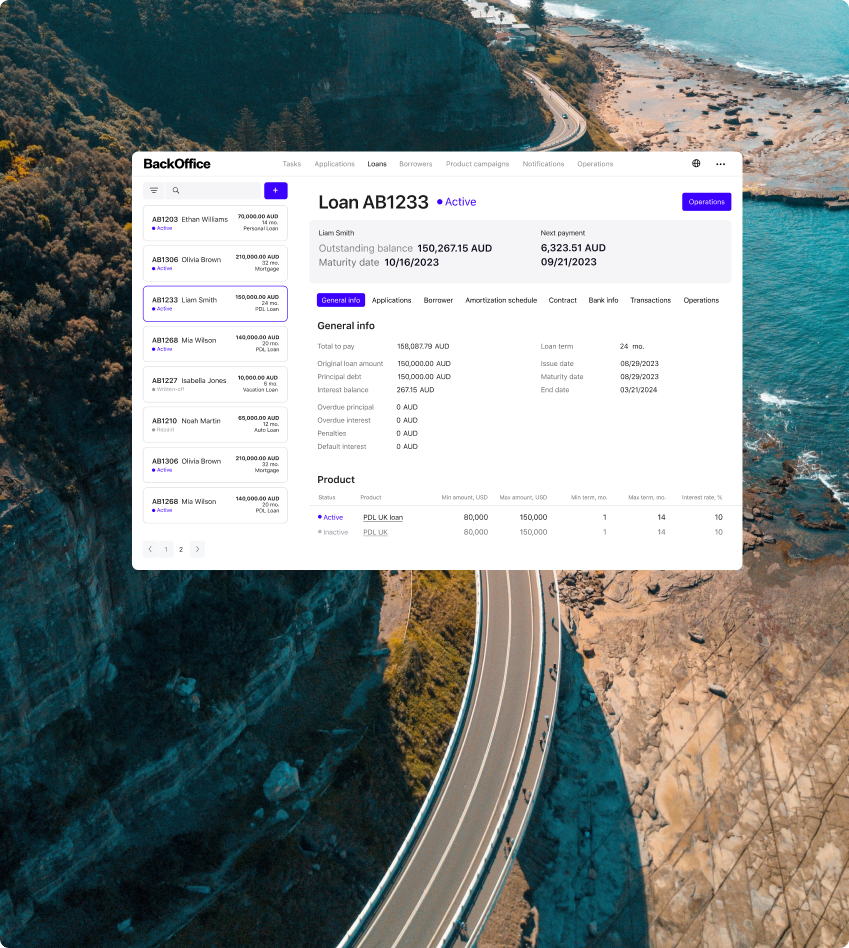

Providing a ready-made lending solution

After an in-depth analysis of the customer requirements, the Business Analysis team at HES

FinTech determined that the HES LoanBox ready-made lending platform aligns perfectly with the

client’s needs. The off-the-shelf solution was rapidly adapted to the nuances of the Australian

finance market. Swift integration of HES LoanBox with the Illion Open Banking facilitated the

retrieval of bank account data for potential borrowers. Our technical experts successfully

linked the SquarePay API to ensure secure online transactions.

FinTech determined that the HES LoanBox ready-made lending platform aligns perfectly with the

client’s needs. The off-the-shelf solution was rapidly adapted to the nuances of the Australian

finance market. Swift integration of HES LoanBox with the Illion Open Banking facilitated the

retrieval of bank account data for potential borrowers. Our technical experts successfully

linked the SquarePay API to ensure secure online transactions.

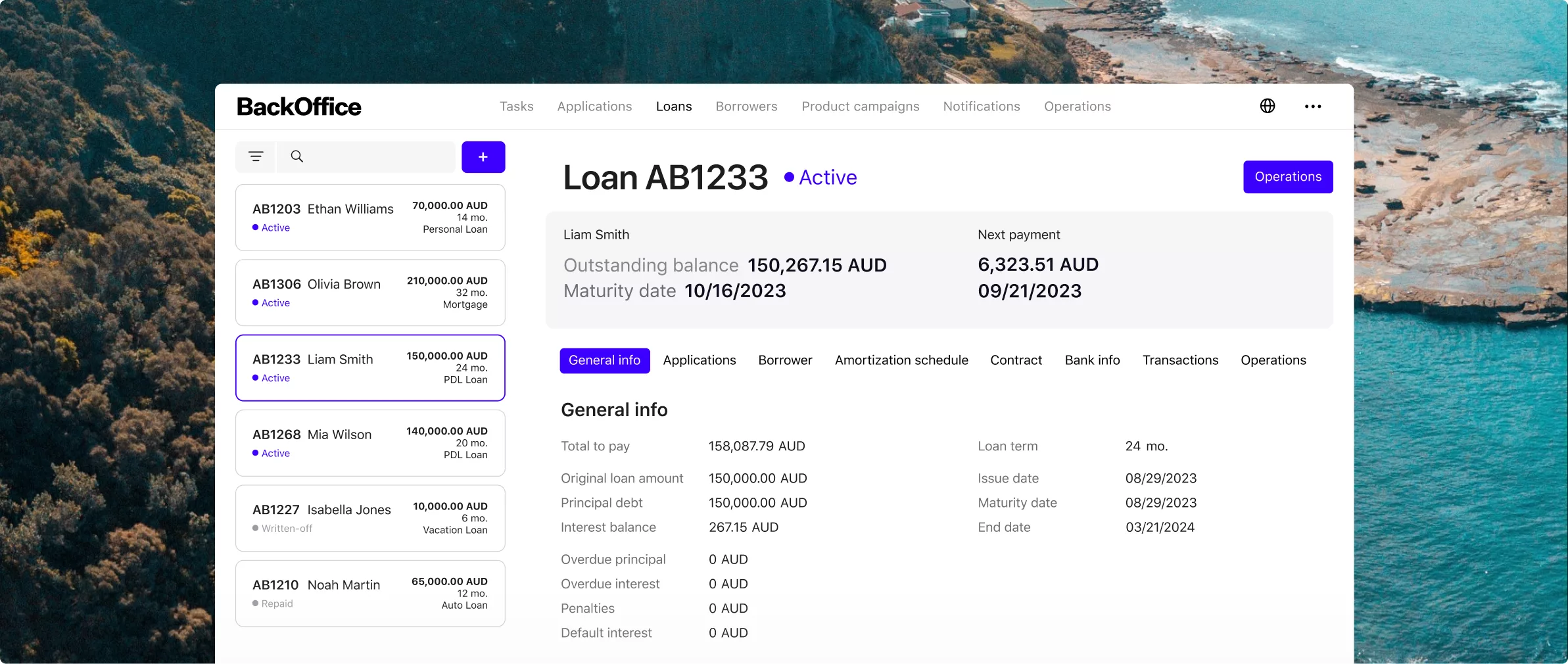

This client now leverages customizable credit products, task management, and end-to-end

automated loan servicing. At the customer’s behest, we slightly adjusted both the landing

website and the borrower portal to adhere to the client’s brand identity.

automated loan servicing. At the customer’s behest, we slightly adjusted both the landing

website and the borrower portal to adhere to the client’s brand identity.

8 min

to submit a loan application

2 months

time to market

100%

digital loan processing

Result

2 months from idea to working business

HES FinTech opened the door to the world of digital lending for the Australian lender. The

software configuration took us only 2 months to complete. After this, the client officially

launched their platform online and started to issue the first loans. In the first month of

business operation, the company originated dozens of loans, catering financial services to

numerous clients. Our ready-made lending platform HES LoanBox has become the main tool for

digital lending operations. It ensures seamless online onboarding: it takes only 8 minutes to

submit a loan application, and the borrower receives application approval within 1 business

day.

software configuration took us only 2 months to complete. After this, the client officially

launched their platform online and started to issue the first loans. In the first month of

business operation, the company originated dozens of loans, catering financial services to

numerous clients. Our ready-made lending platform HES LoanBox has become the main tool for

digital lending operations. It ensures seamless online onboarding: it takes only 8 minutes to

submit a loan application, and the borrower receives application approval within 1 business

day.