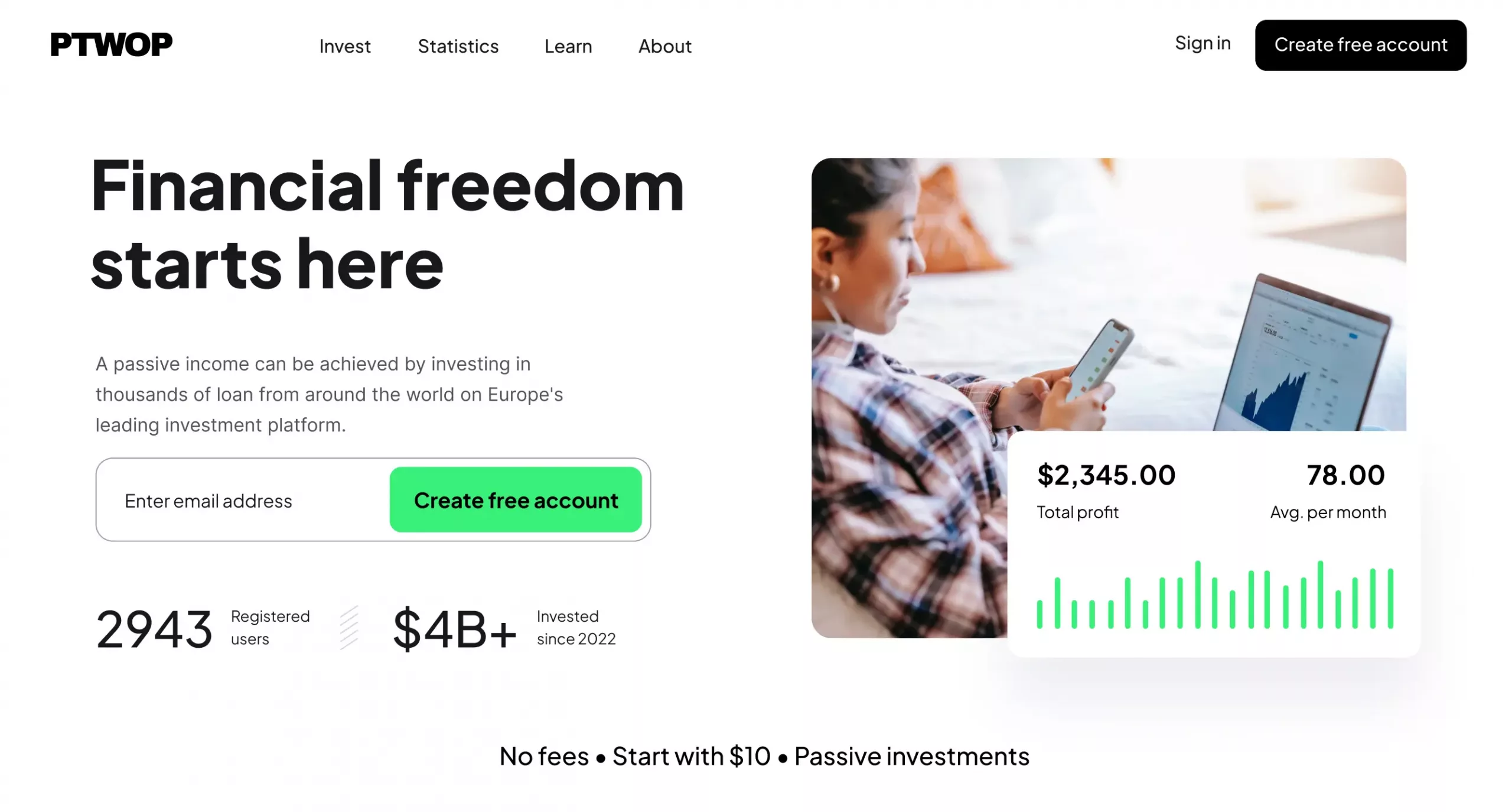

Automated peer-to-peer

lending software

Get customized peer-to-peer loan

software ready to go in 90 days

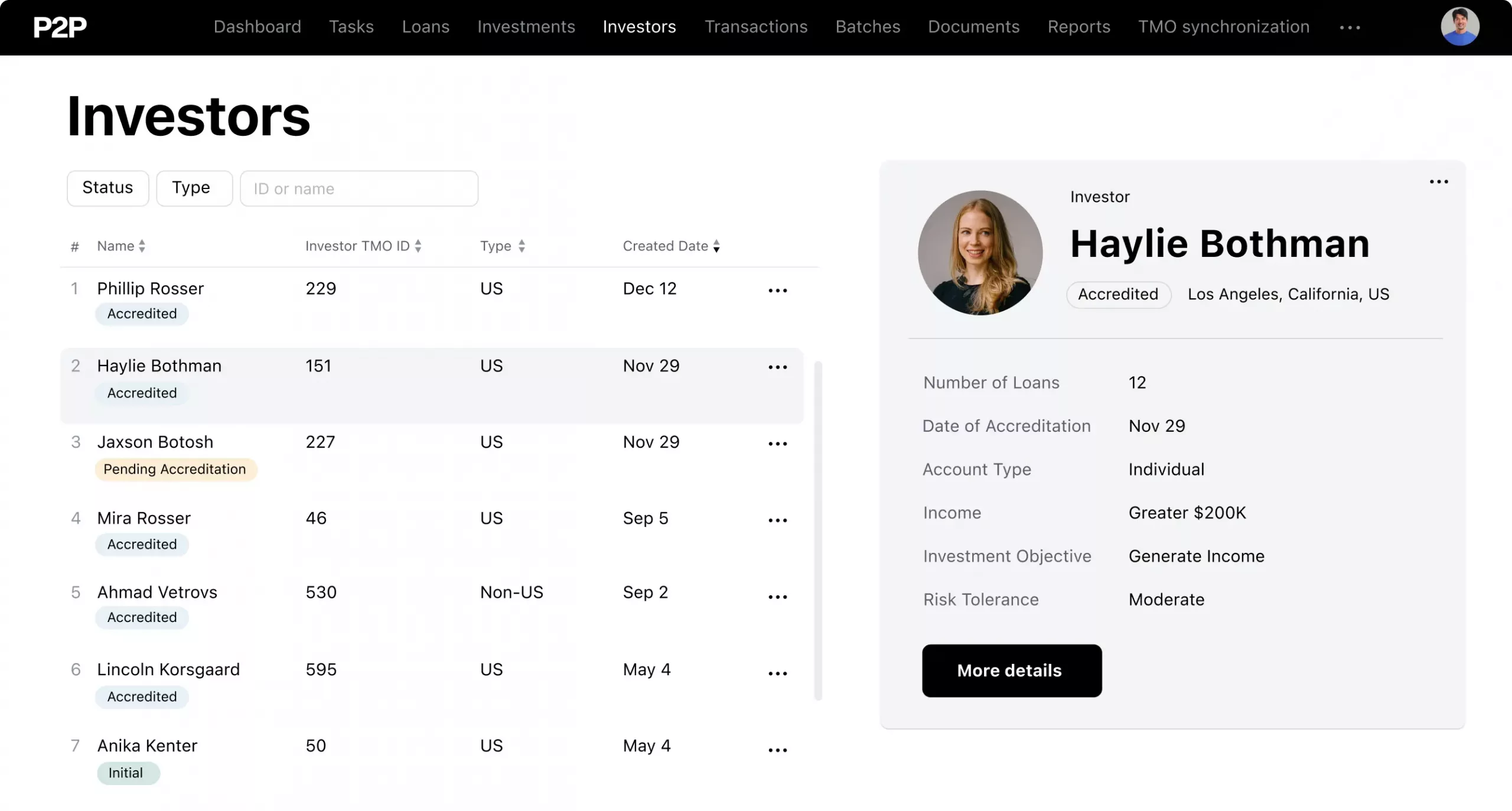

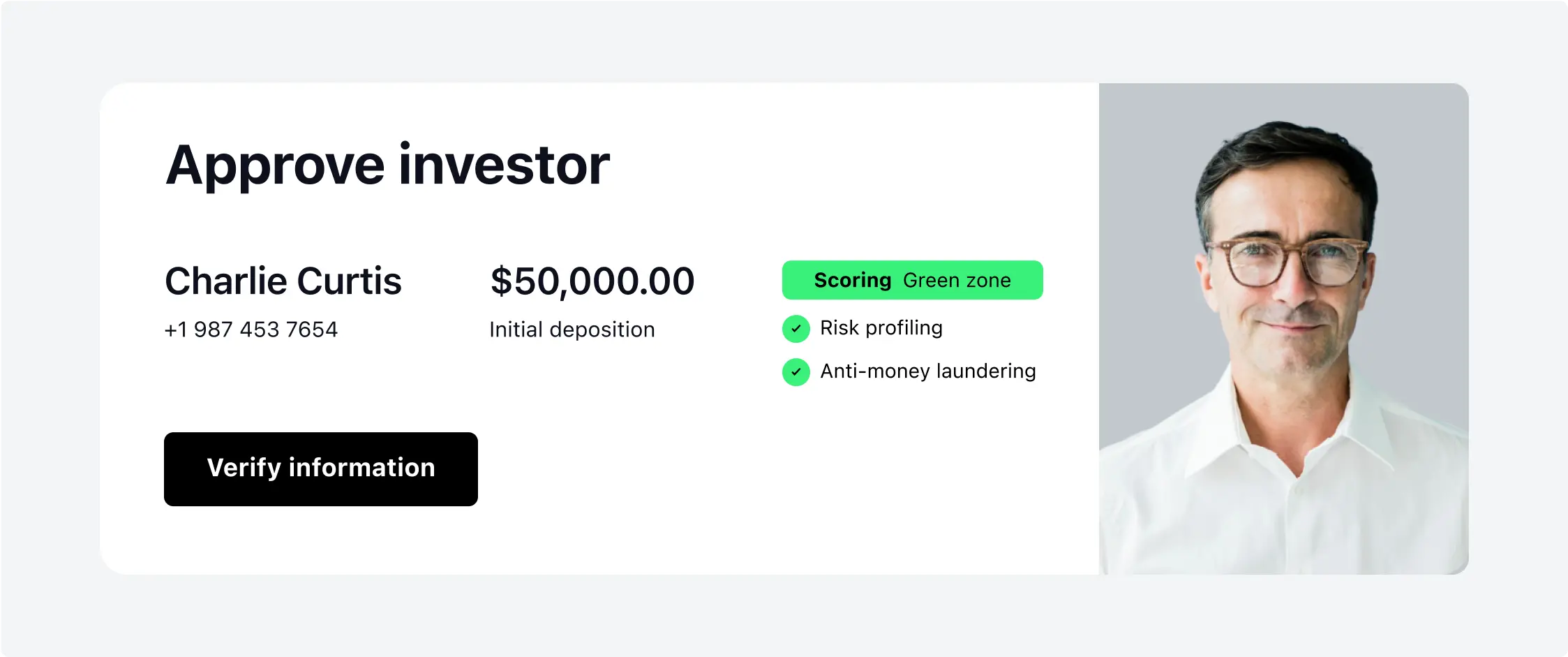

Counterparty identification

All users of the P2P online lending platform pass KYC or KYB verification. This allows you to protect partners and clients and minimize risks.

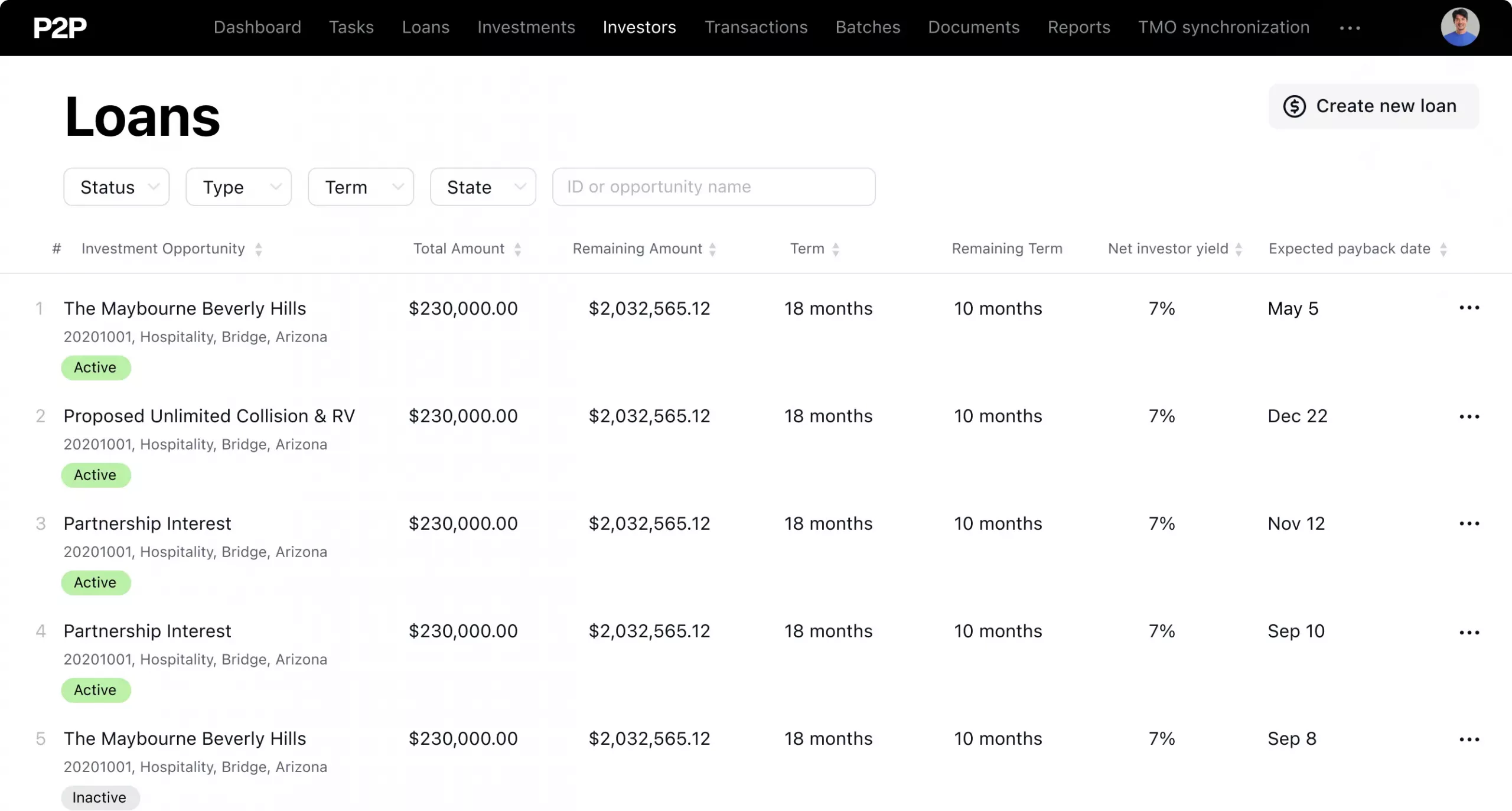

Statistics

and reporting

and reporting

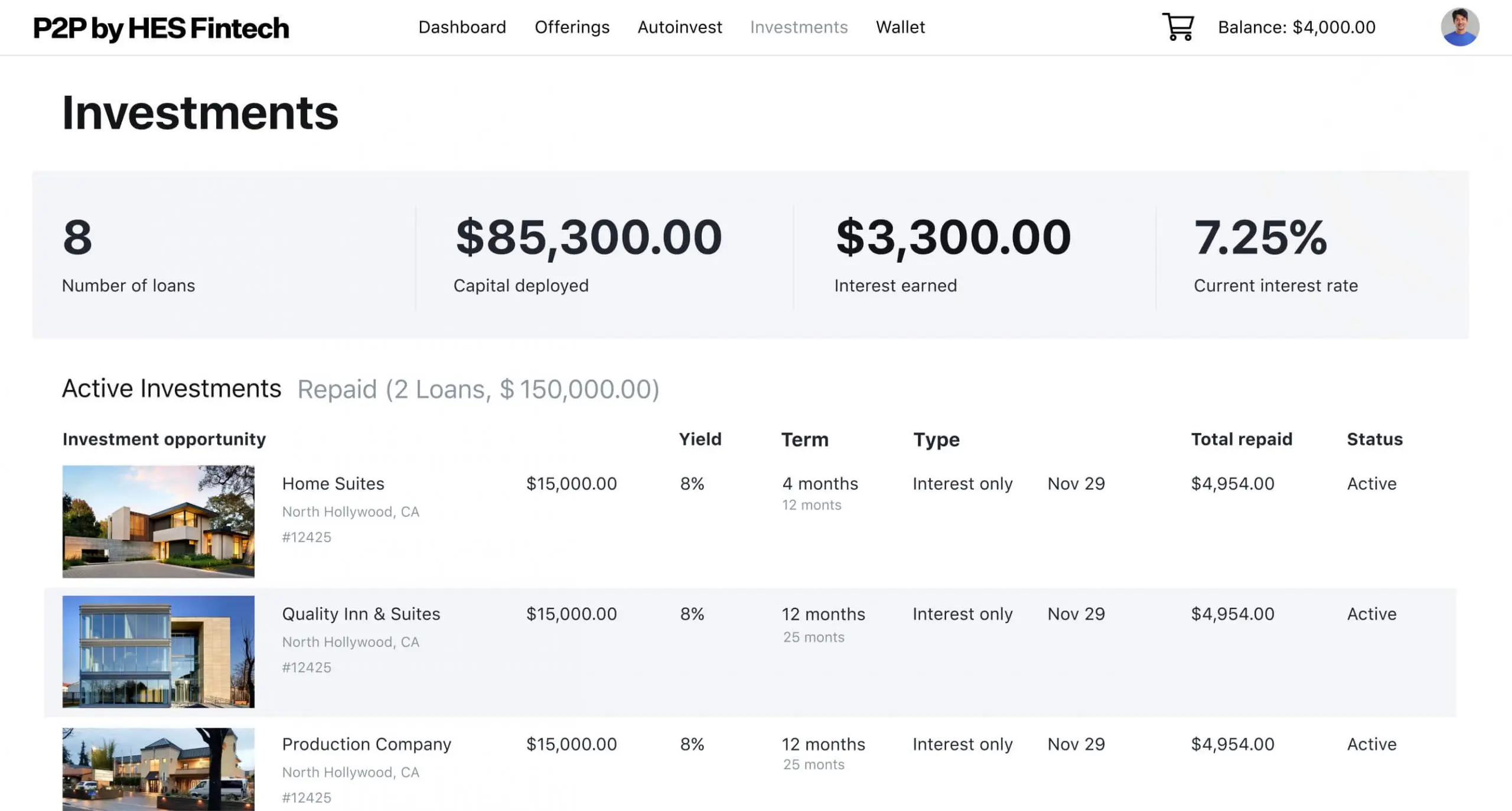

Keep an eye on your business performance by tracking the history of all deals, income, and expenses in peer-to-peer lending software.

Payment processing automatization

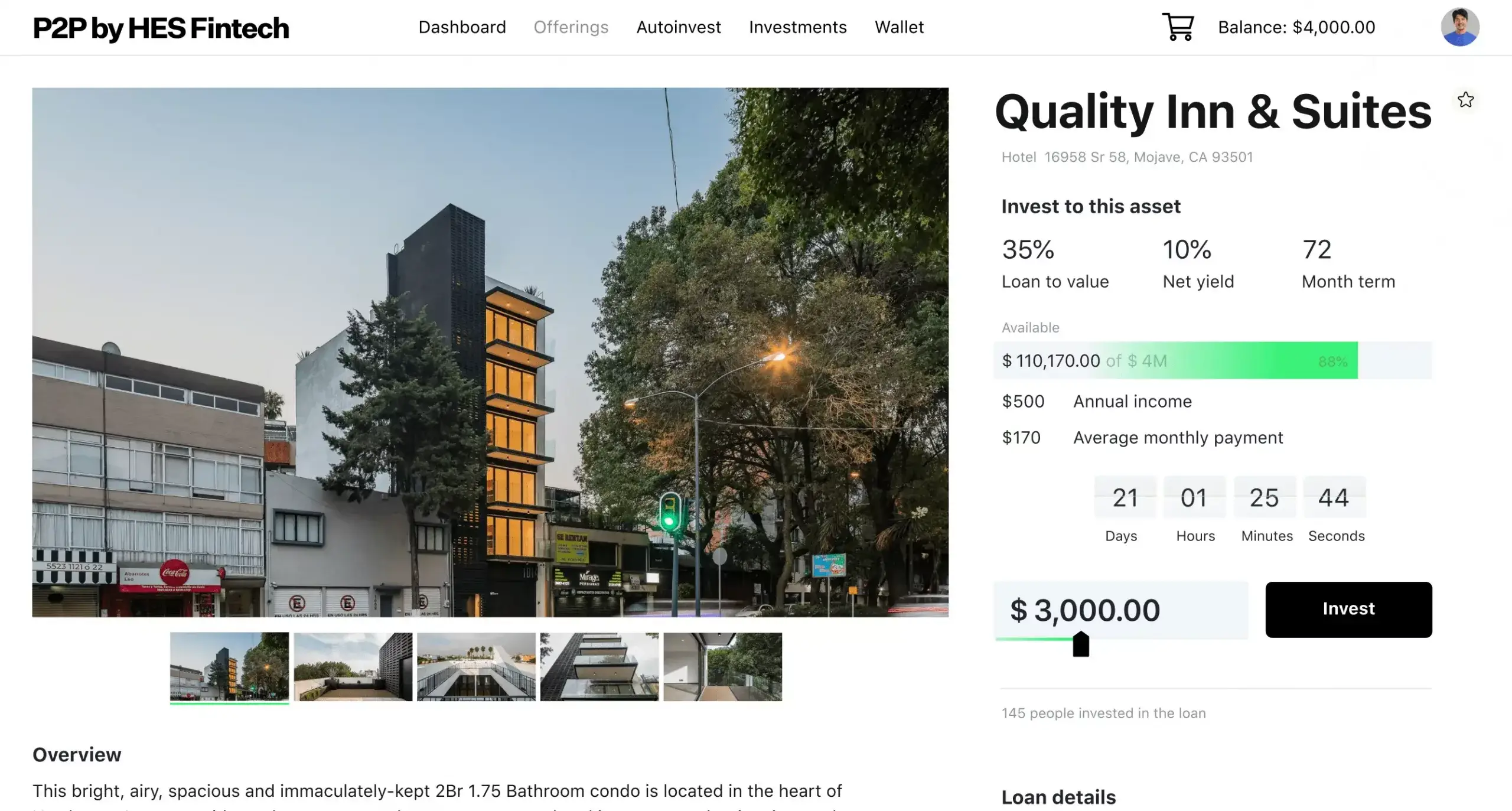

Smart system of electronic wallets provides users with seamless and transparent online payments.

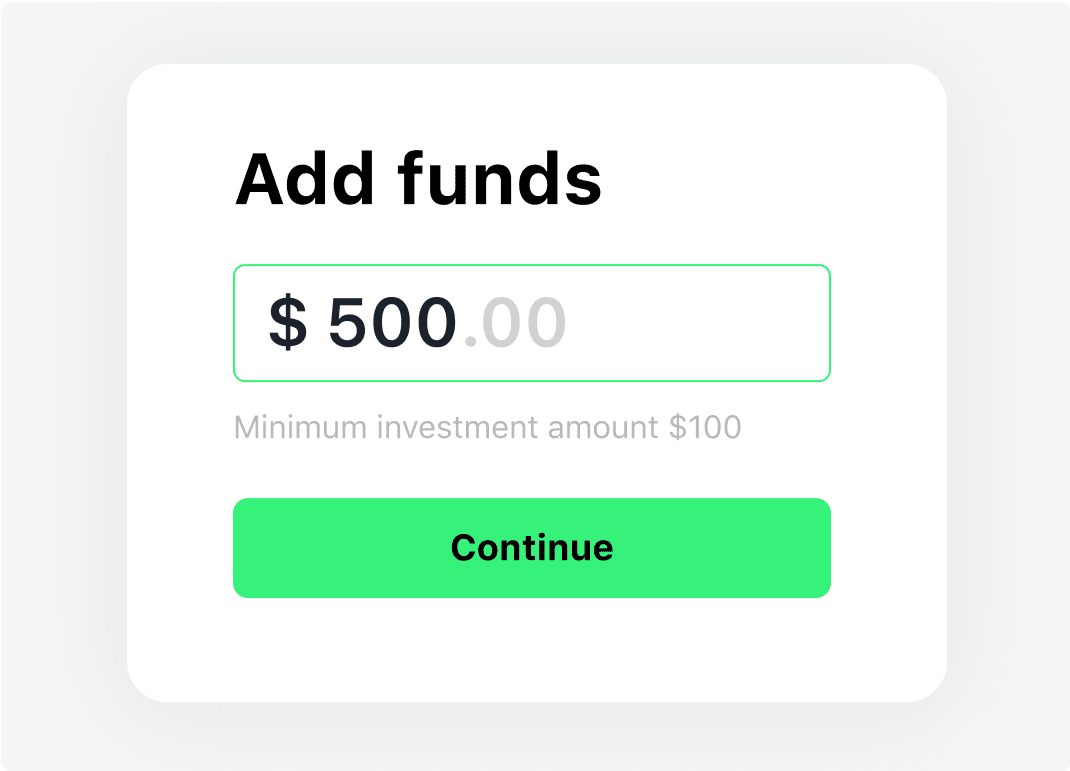

E-wallet

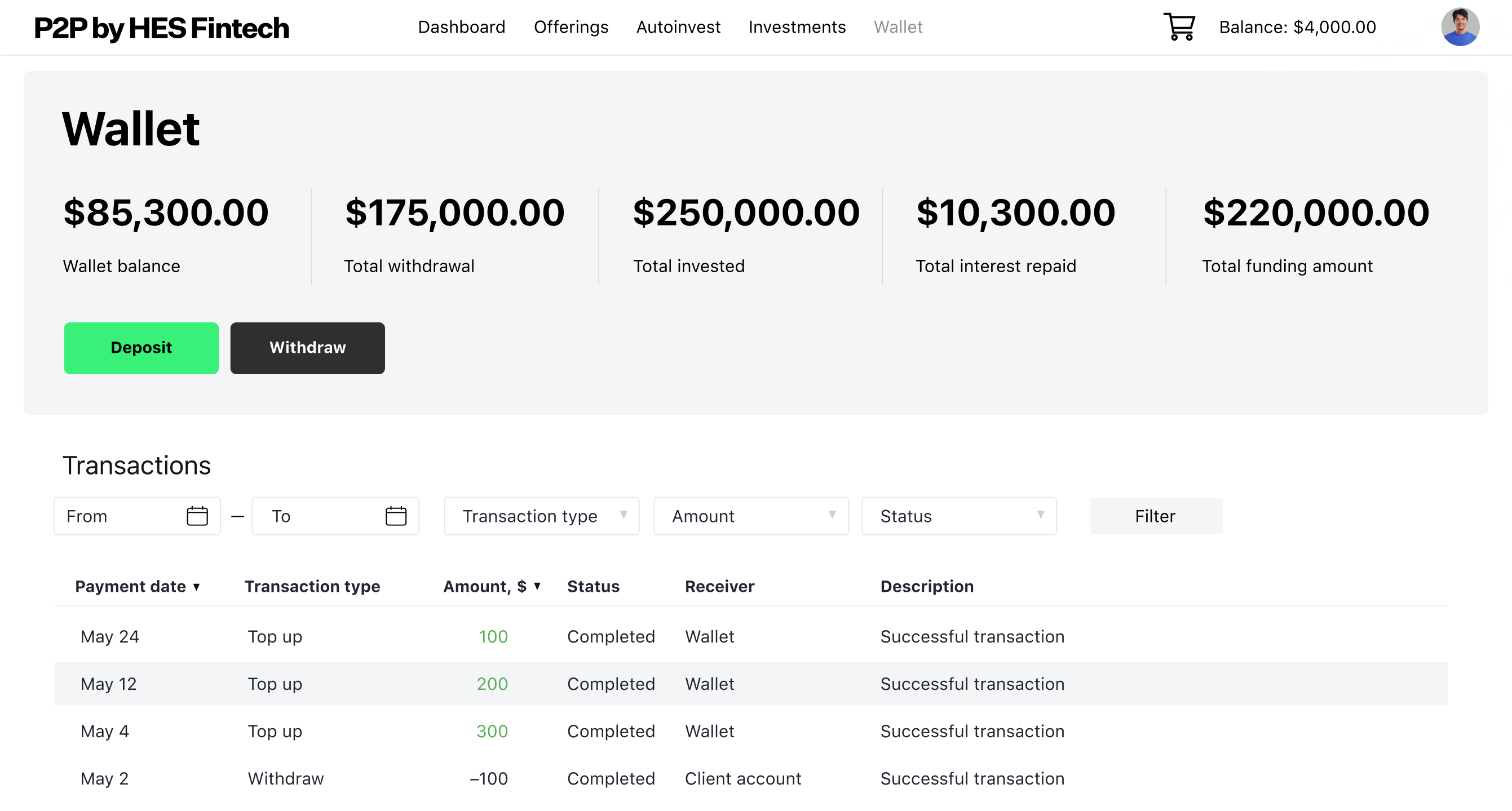

Make transactions safer by implementing e-wallets for both counterparties. HES P2P lending software keeps track of all wallet balances, freezes bid amounts in lender wallets, and transfers money to borrower wallets once the project is fully funded. The interest revenue of each investor accumulates in their wallet and can be reinvested.

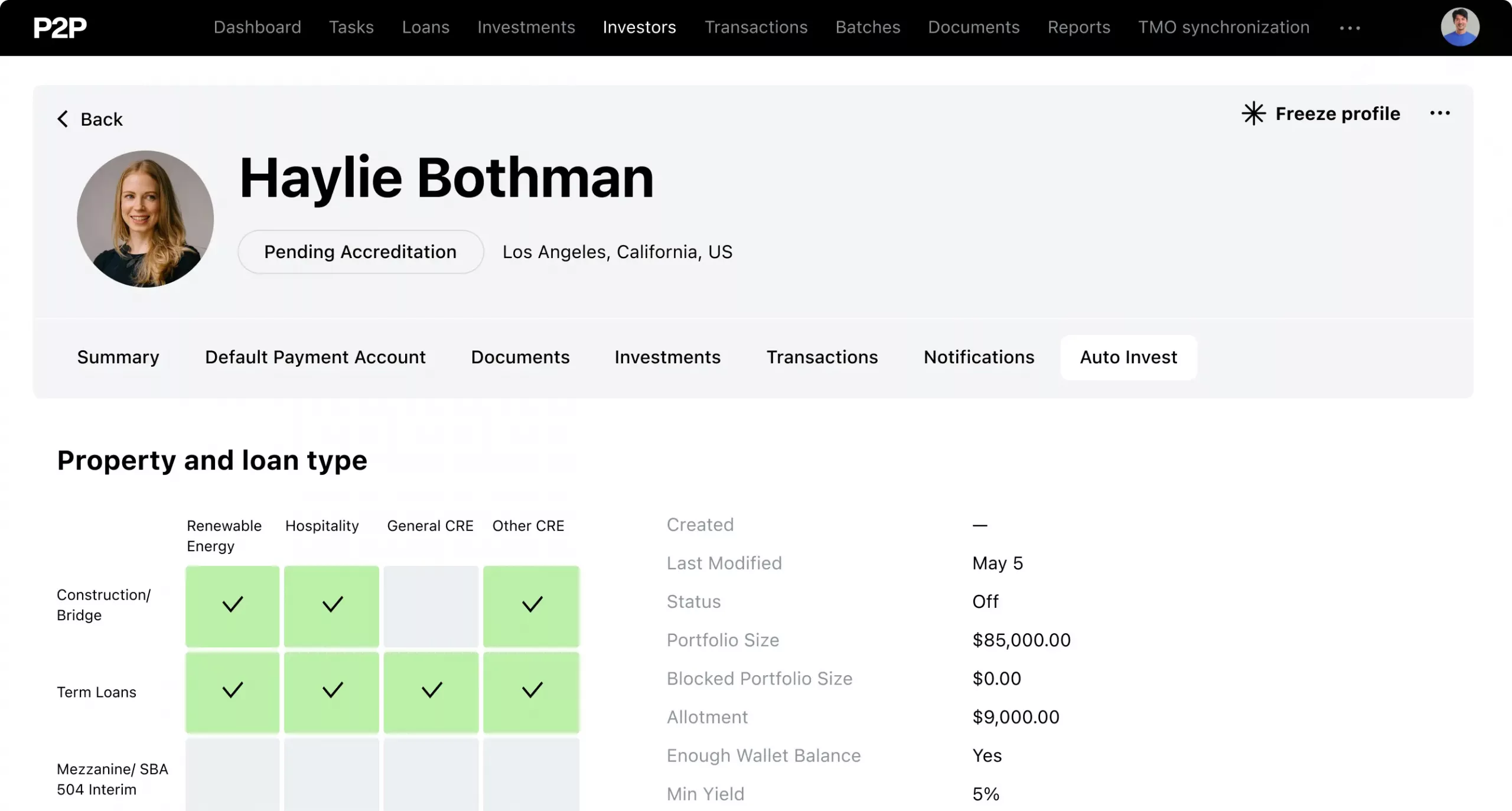

Configurable workflow

Benefit from backend functionality

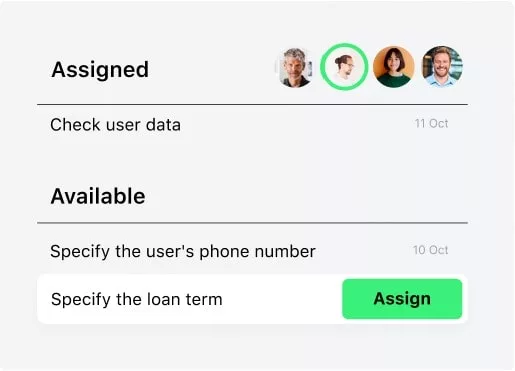

Task management

Peer-to-peer marketplace lending software allows you to keep an eye on what’s going on, assign tasks to your employees and track their progress.

Newsletters and discounts

Send informative newsletters to borrowers and lenders. P2P lending software can be integrated with email distribution services. To make special offers to the clients, you can add built-in tools for discounts to the software.

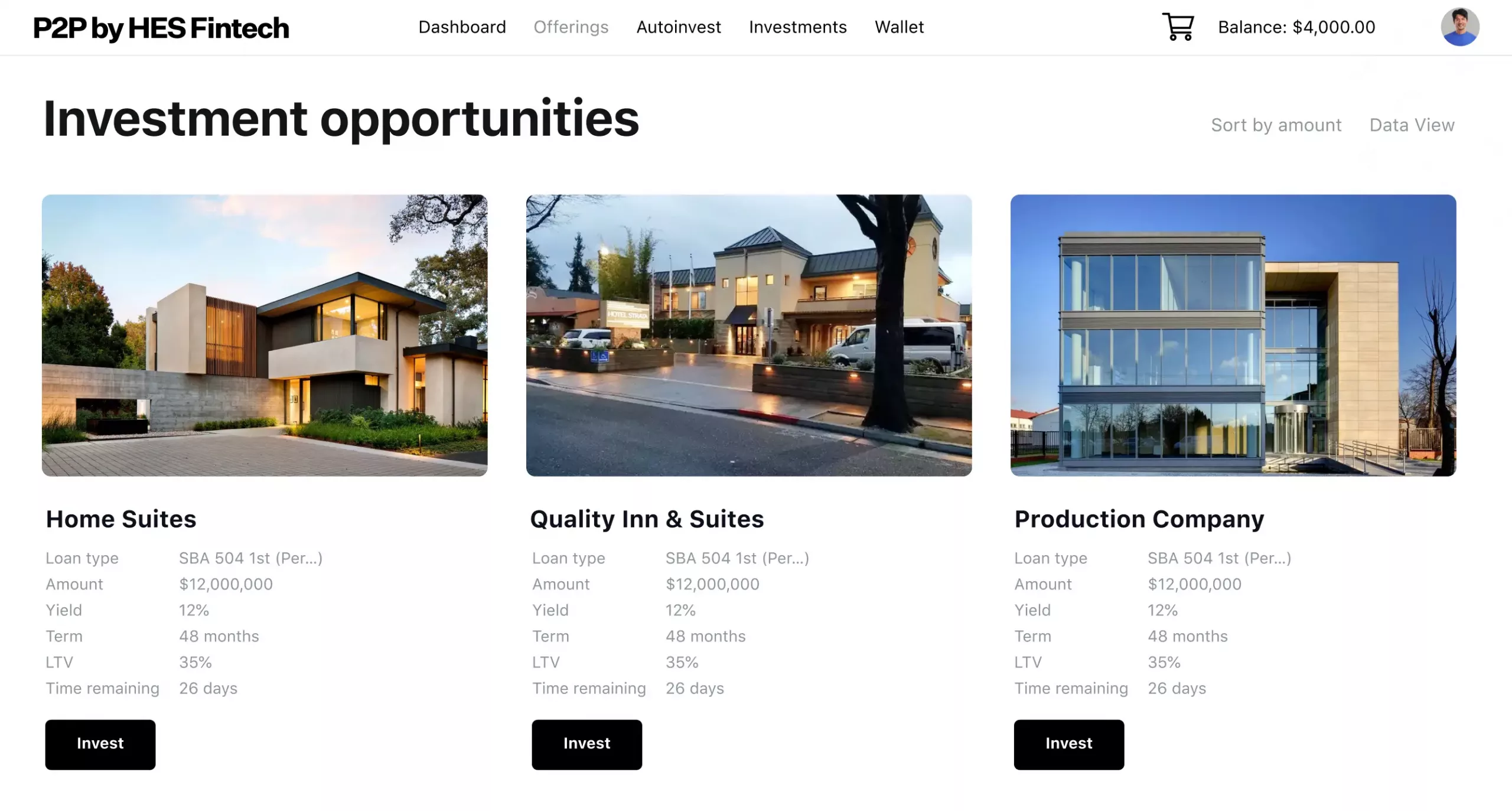

Attracting investors

Attract and retain investors by creating advertising campaigns. Track CPC, CPA, and other result measurements in your back office.

API for your website.Map up your day-to-day processes with HES BPM-powered consumer installment loan software. Whether you are a bank, credit union, alternative lender, or financial company, we can help you automate repetitive tasks, manage lending processes, and increase efficiency

and much more

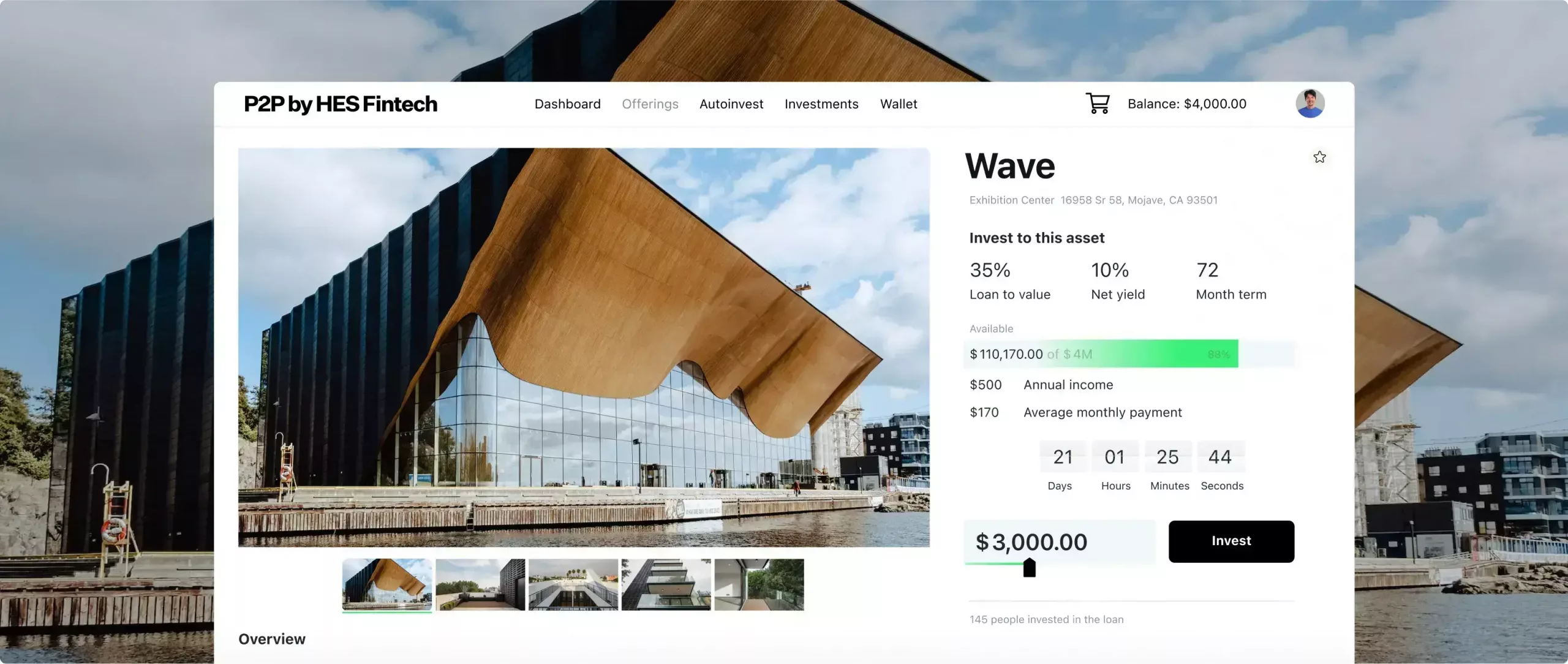

Omnichannel application flow

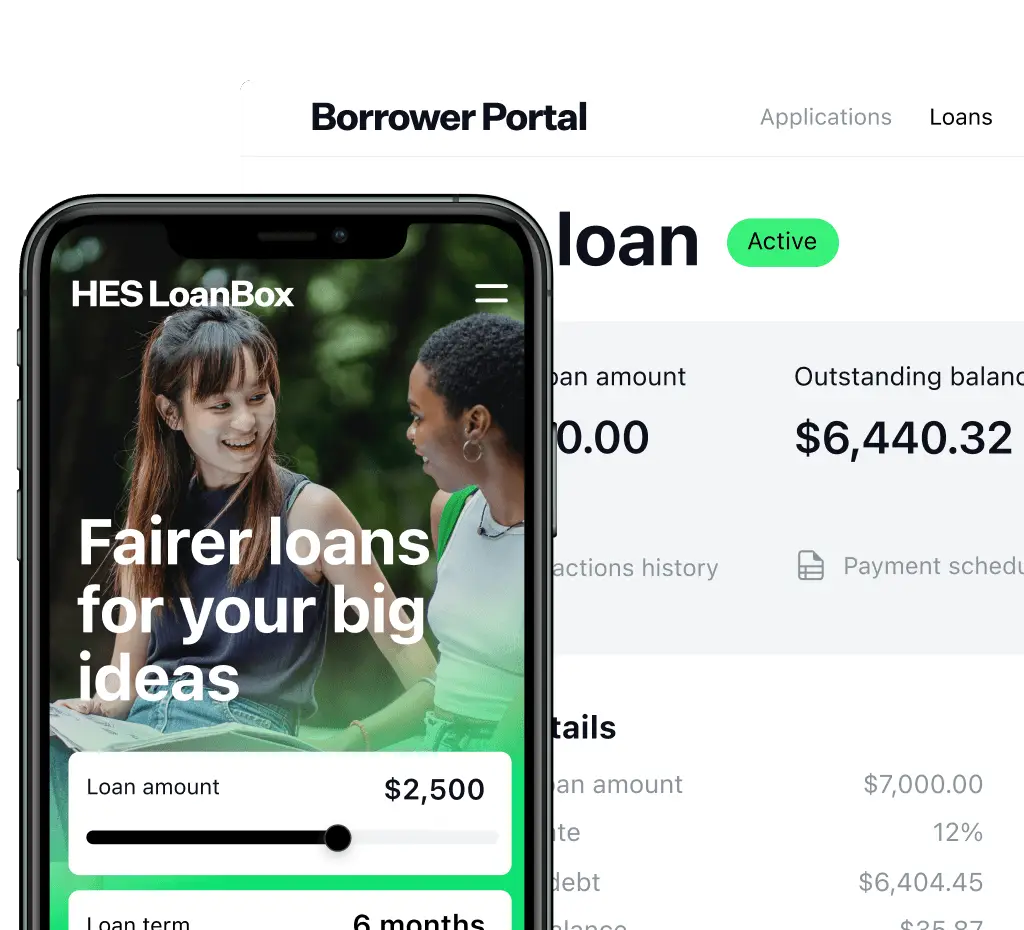

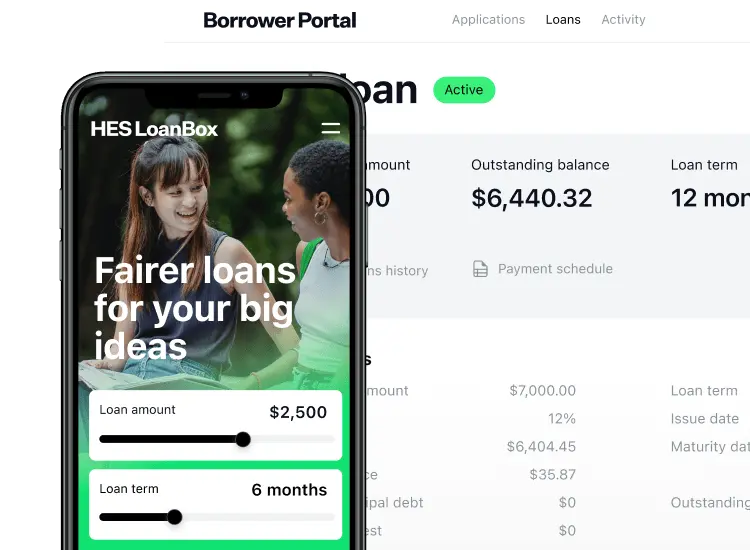

Customer accounts for borrowers and investors

Smart credit scoring

Document management and templates

Analytics and reporting

Easy integrations with 3rd parties

Peer-to-peer loan servicing software comes in all shapes and sizes. Dive into the success stories of our customers to see how they have already transformed their business and come back for yours.

HES FinTech has been working in the fintech industry since 2012 and has successfully released 160+ projects for clients from 30+ countries worldwide.

For peer-to-peer lending

we suggest

Scalable P2P lending solution

2-3 months time-to-market

Lifelong user support

No additional charges per customer

FAQ

What are the benefits of using P2P lending software?

What types of loans can be offered through peer-to-peer marketplace software?

How does peer-to-peer finance software handle delinquent loans?

How to start with P2P lending platform software by HES FinTech?