Loan management software

in United Kingdom

Maximise efficiency and security in your operations with our fully automated, AI-powered digital solution.

Trusted by lenders worldwide

Digital lending ecosystemfor banks and alternative lenders

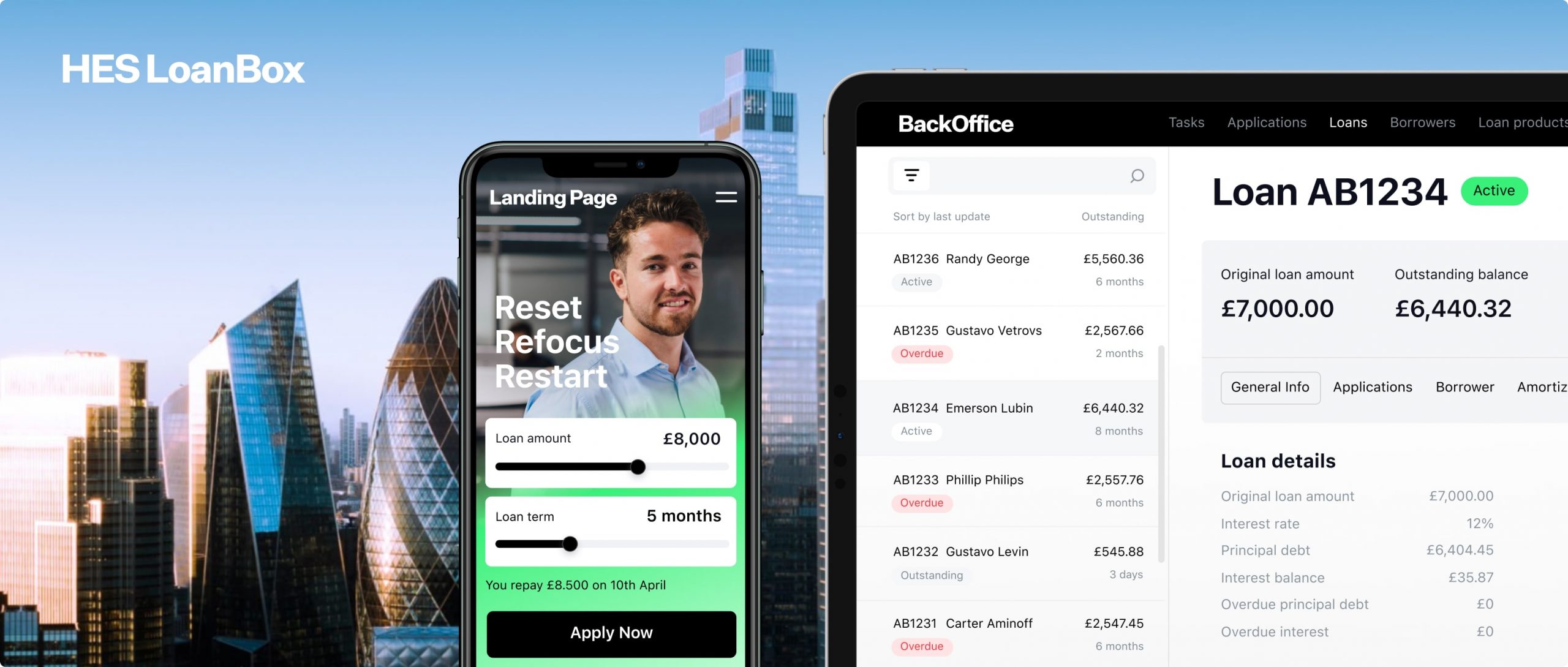

HES LoanBox is an advanced AI-powered, cloud-based loan management software covering all aspects of loan management: from origination to debt collection. Designed for banks, alternative lenders, and financial institutions in the UK, it helps conduct lending more effectively – faster, more securely, and with greater automation, reducing NPLs and increasing revenue.

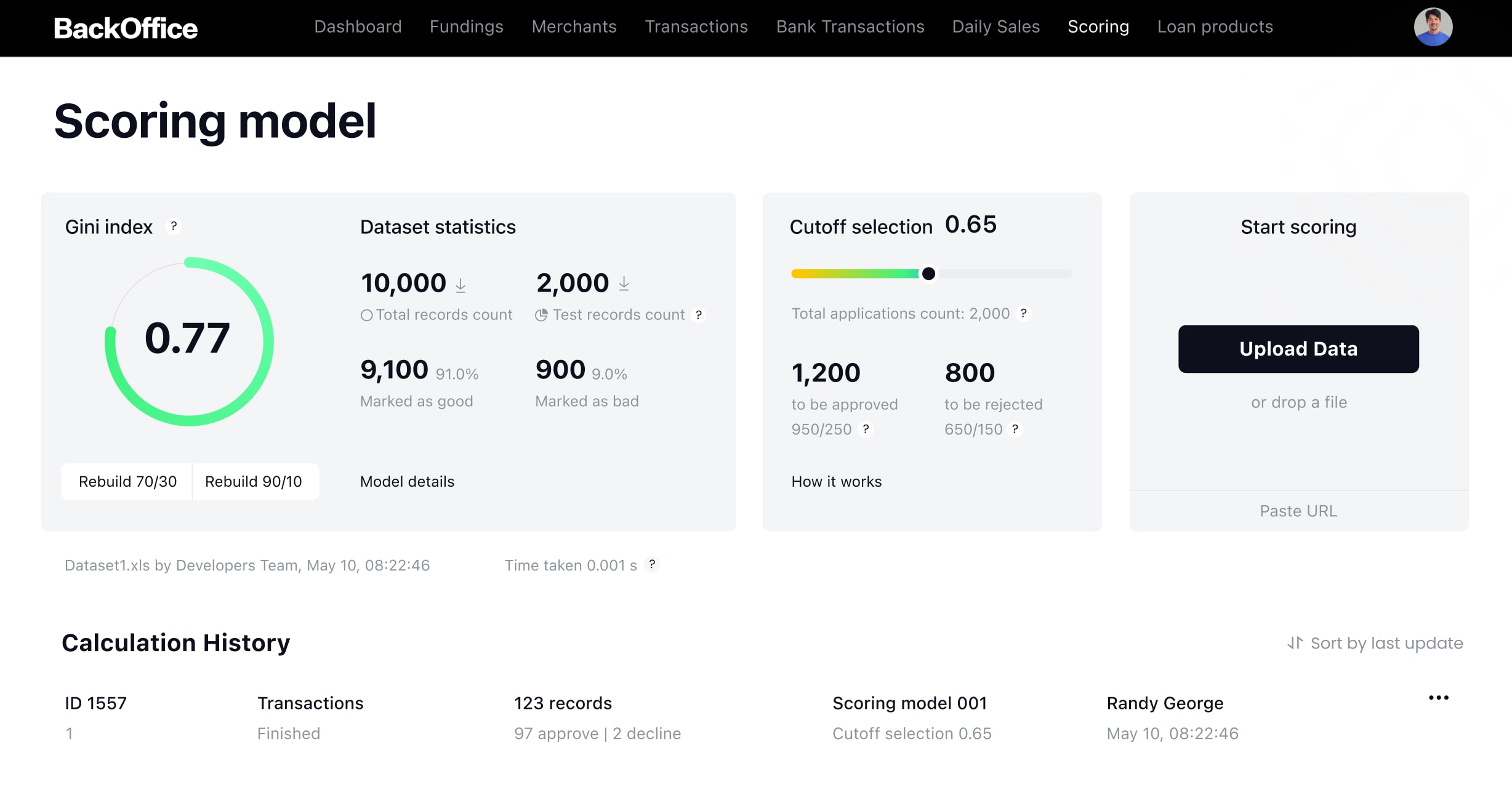

GiniMachine is a no-code AI tool that utilises machine learning algorithms to analyse borrowers’ data and provide you with insights into their behaviour. Integrated within HES LoanBox, it helps lenders make informed, data-driven decisions.

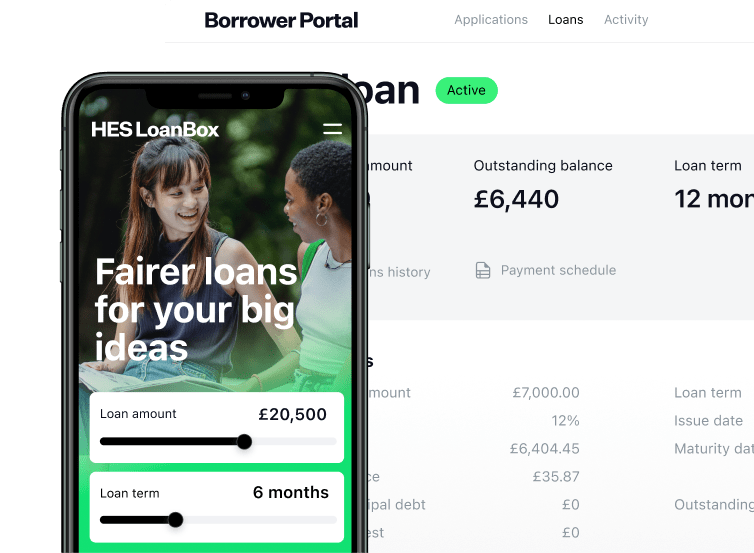

HES LoanBox overview

Complete loan

management system

The only loan management software you’ll ever need, offering a suite of features and integrations for all your lending operations.

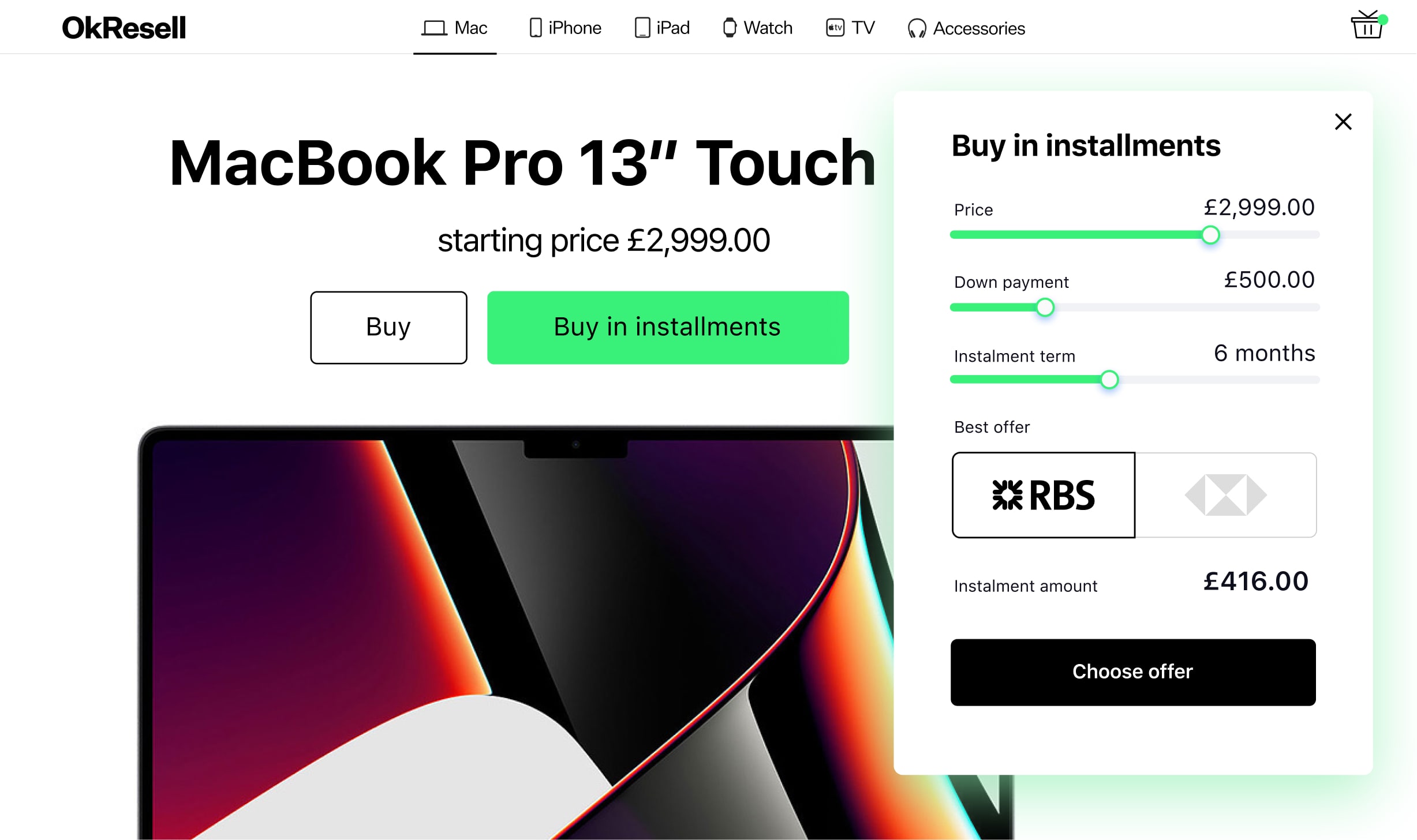

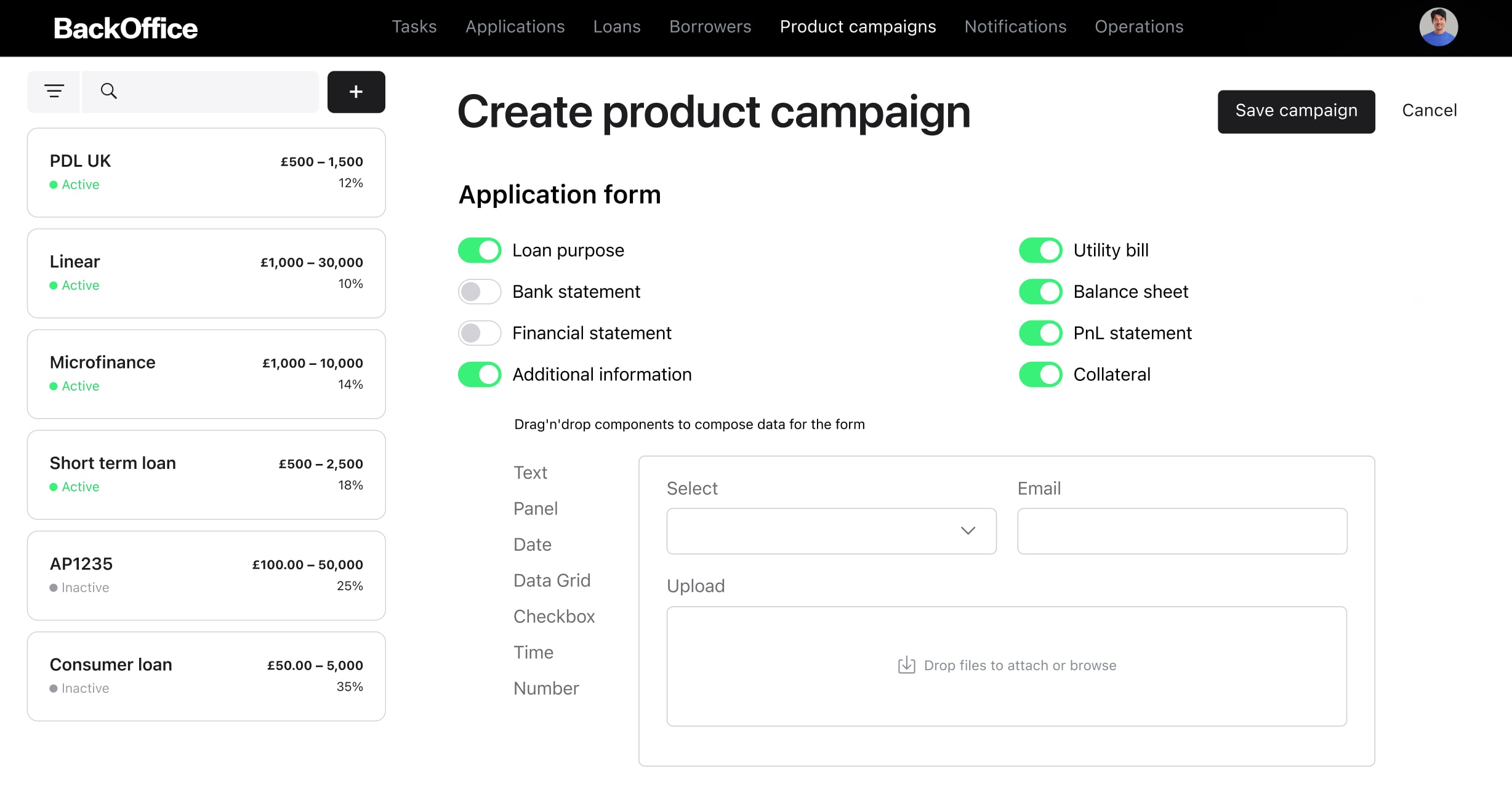

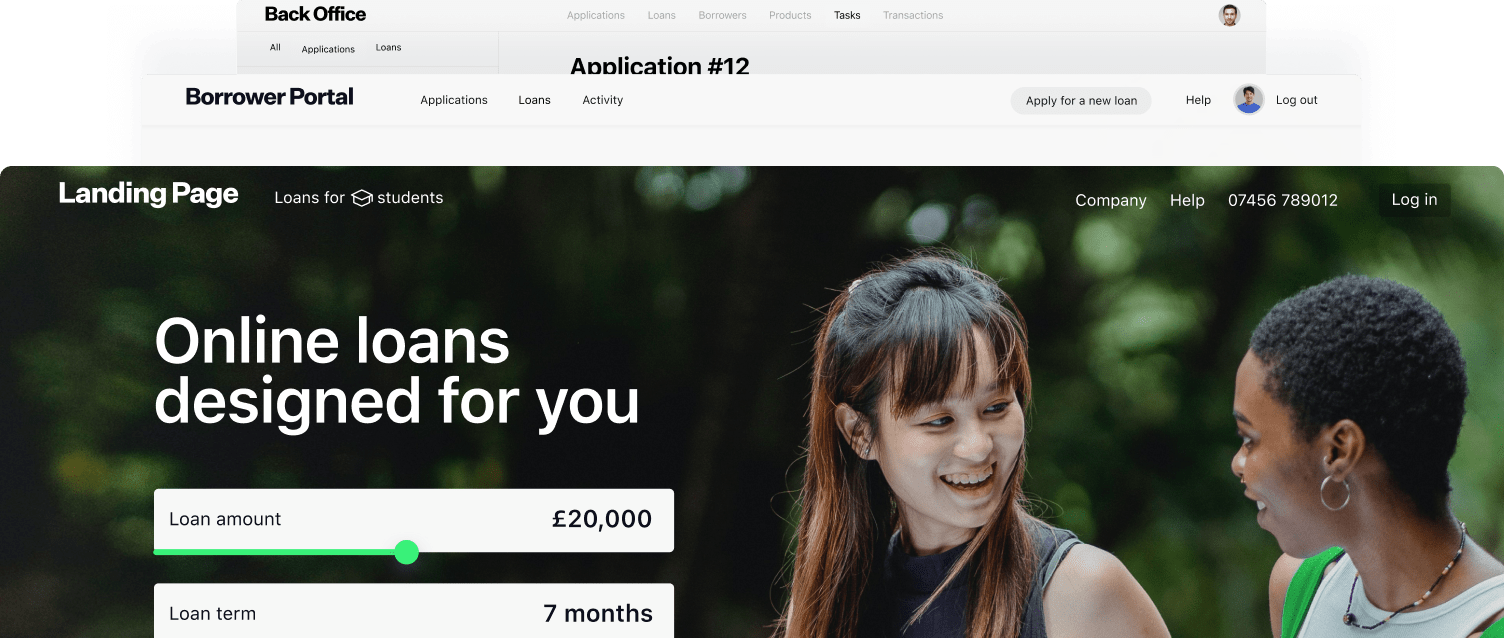

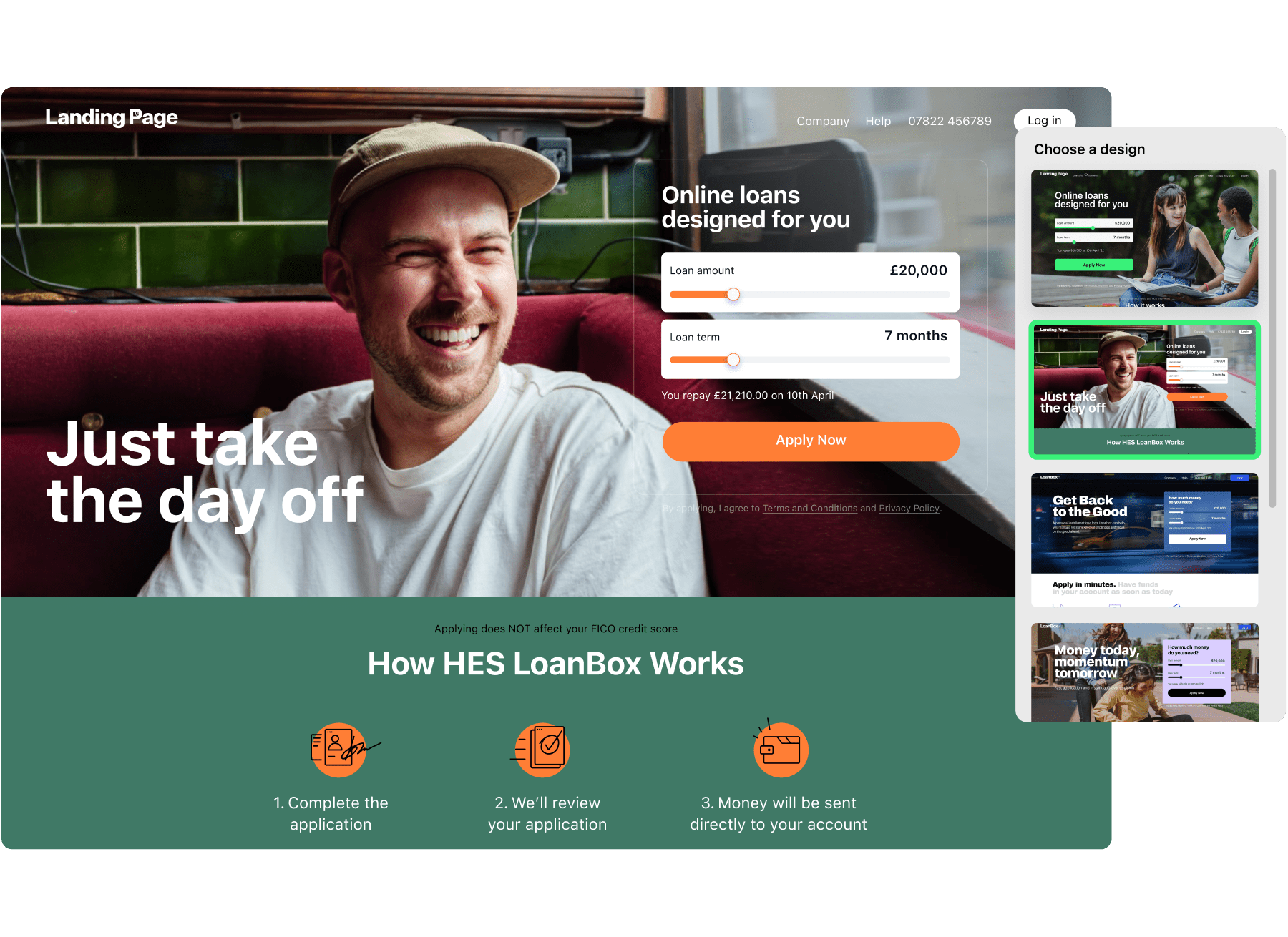

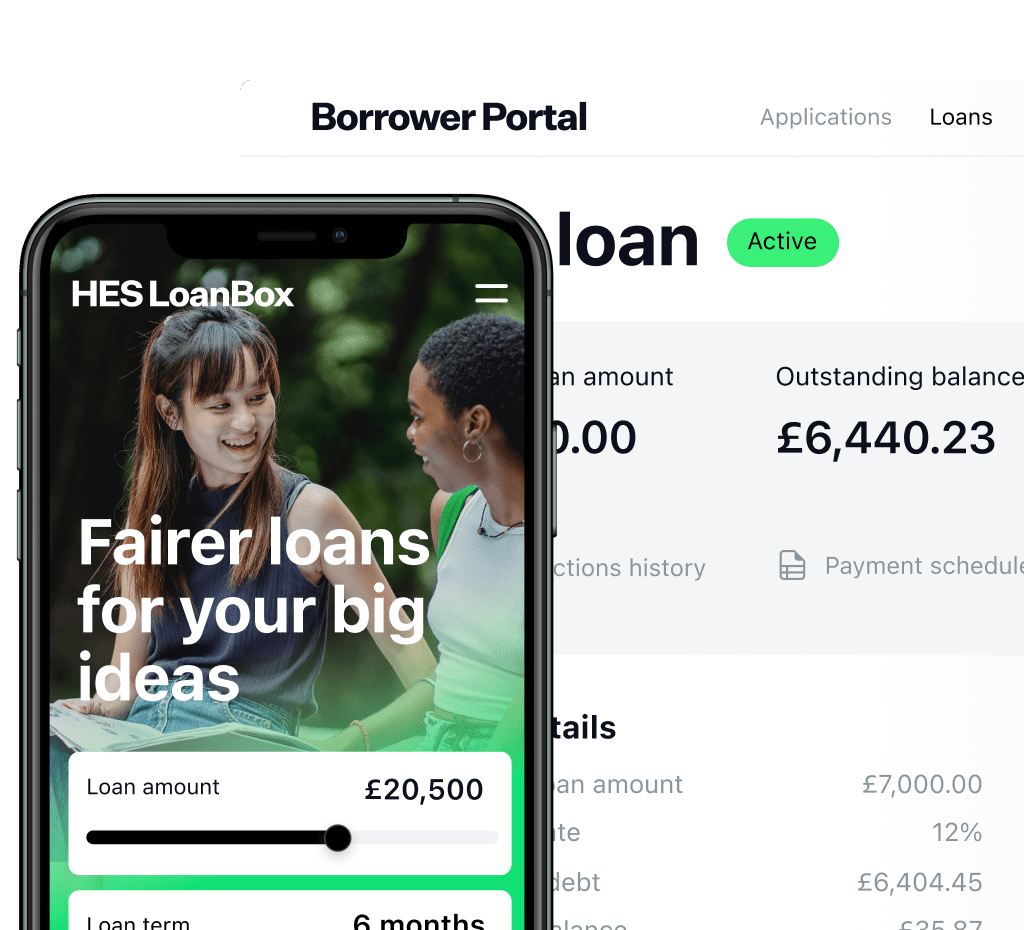

White-label landing page

Customise your loan website design to create a user-friendly experience that enhances engagement and increases application numbers.

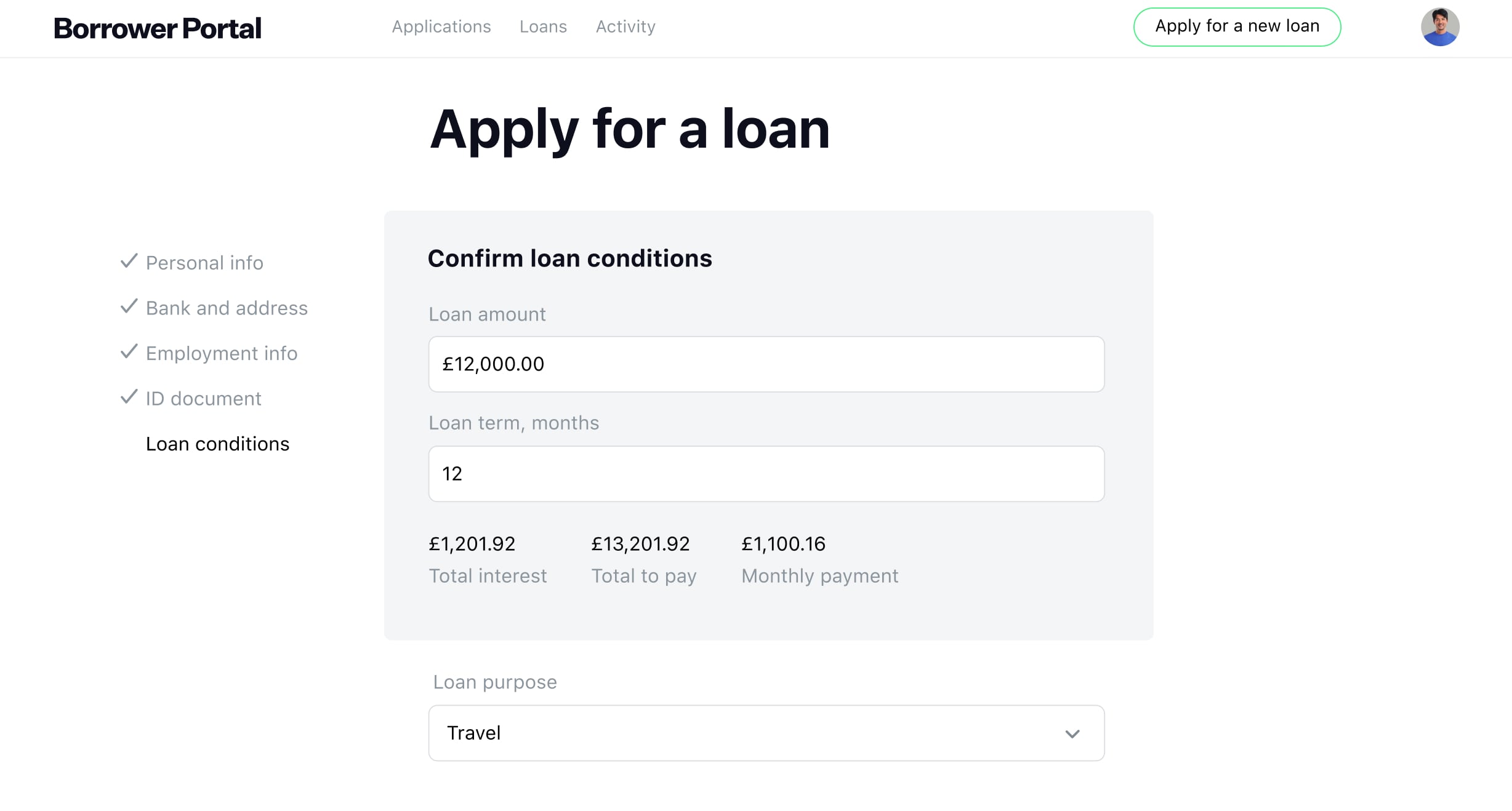

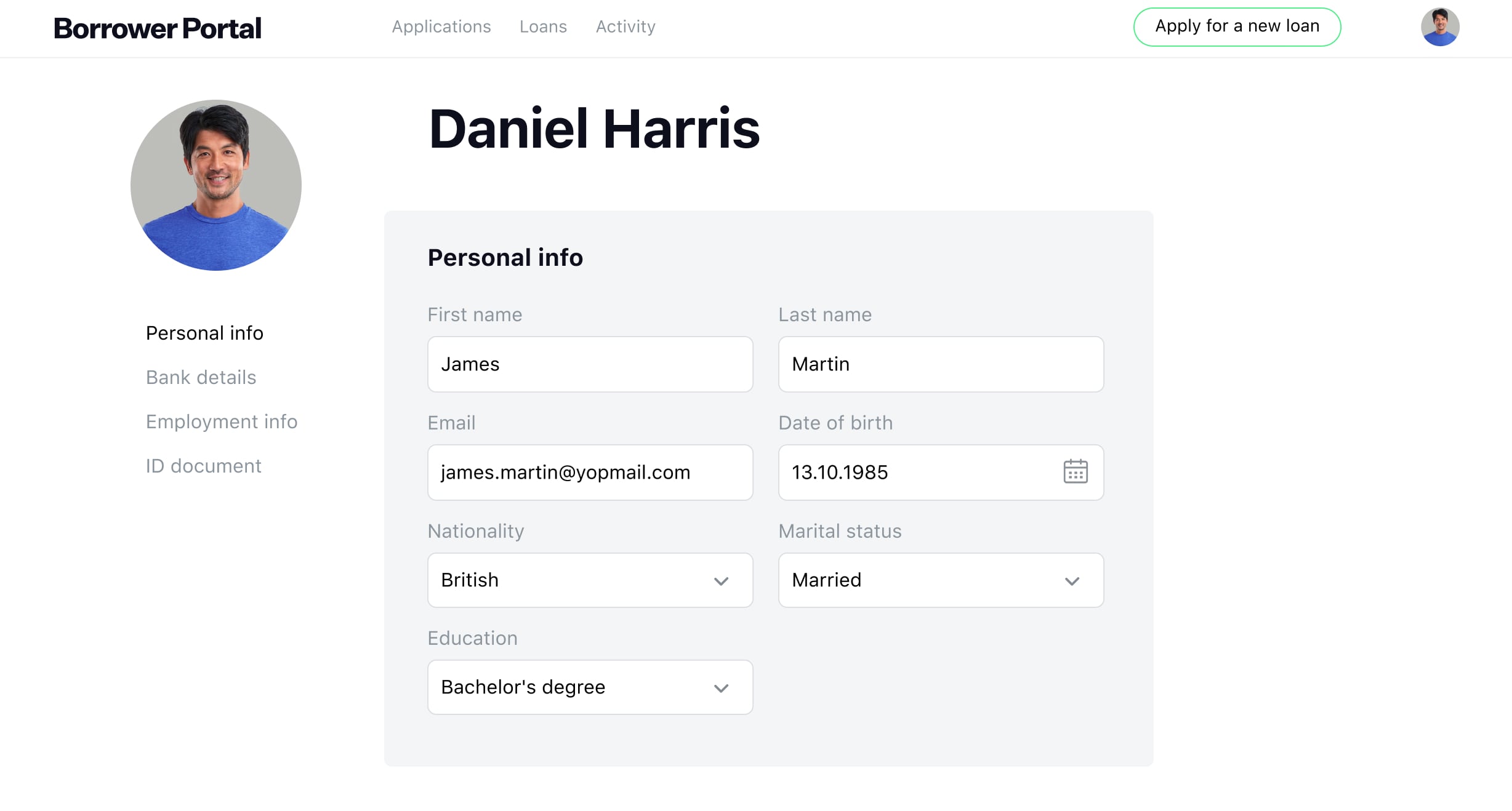

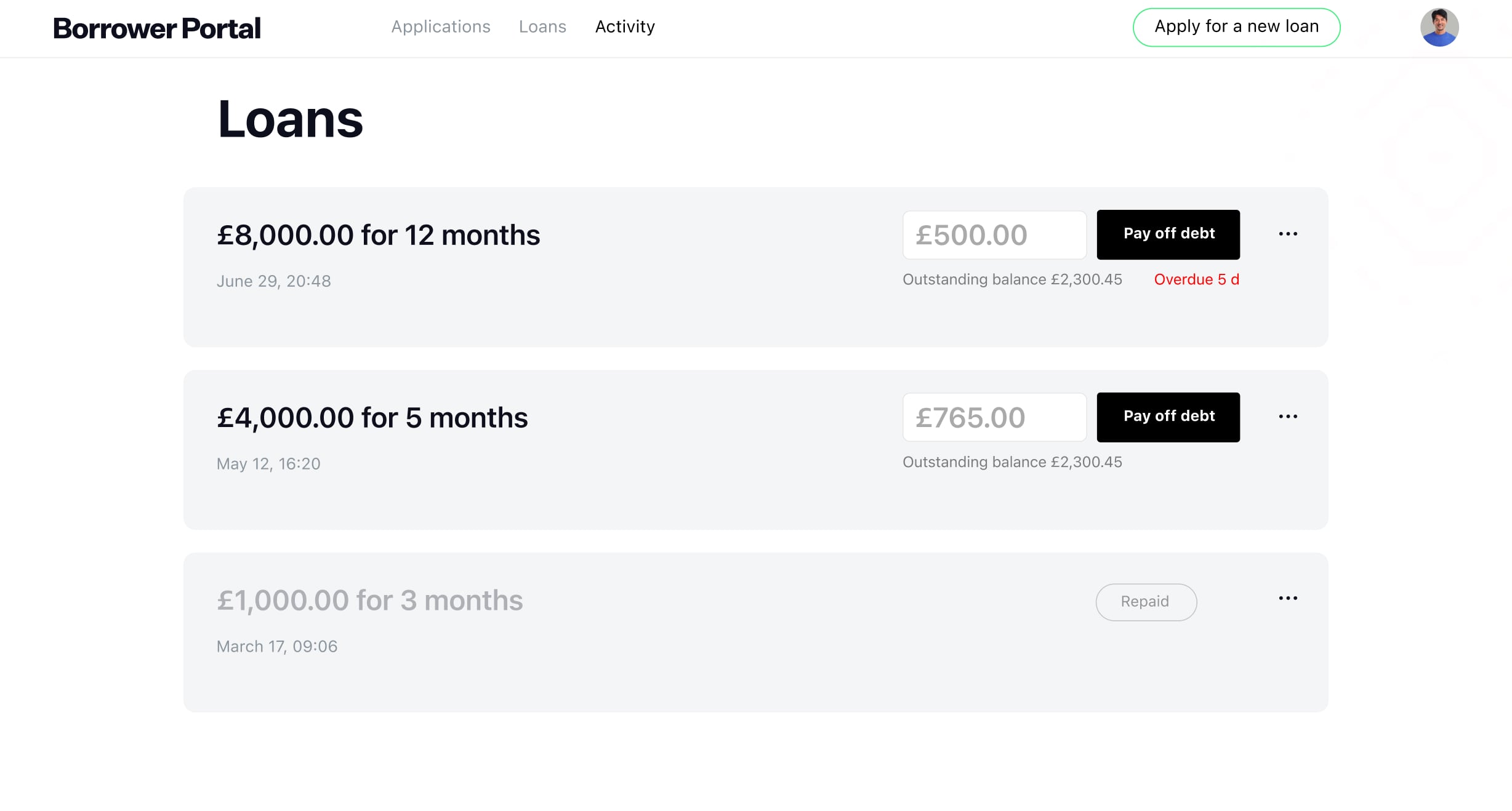

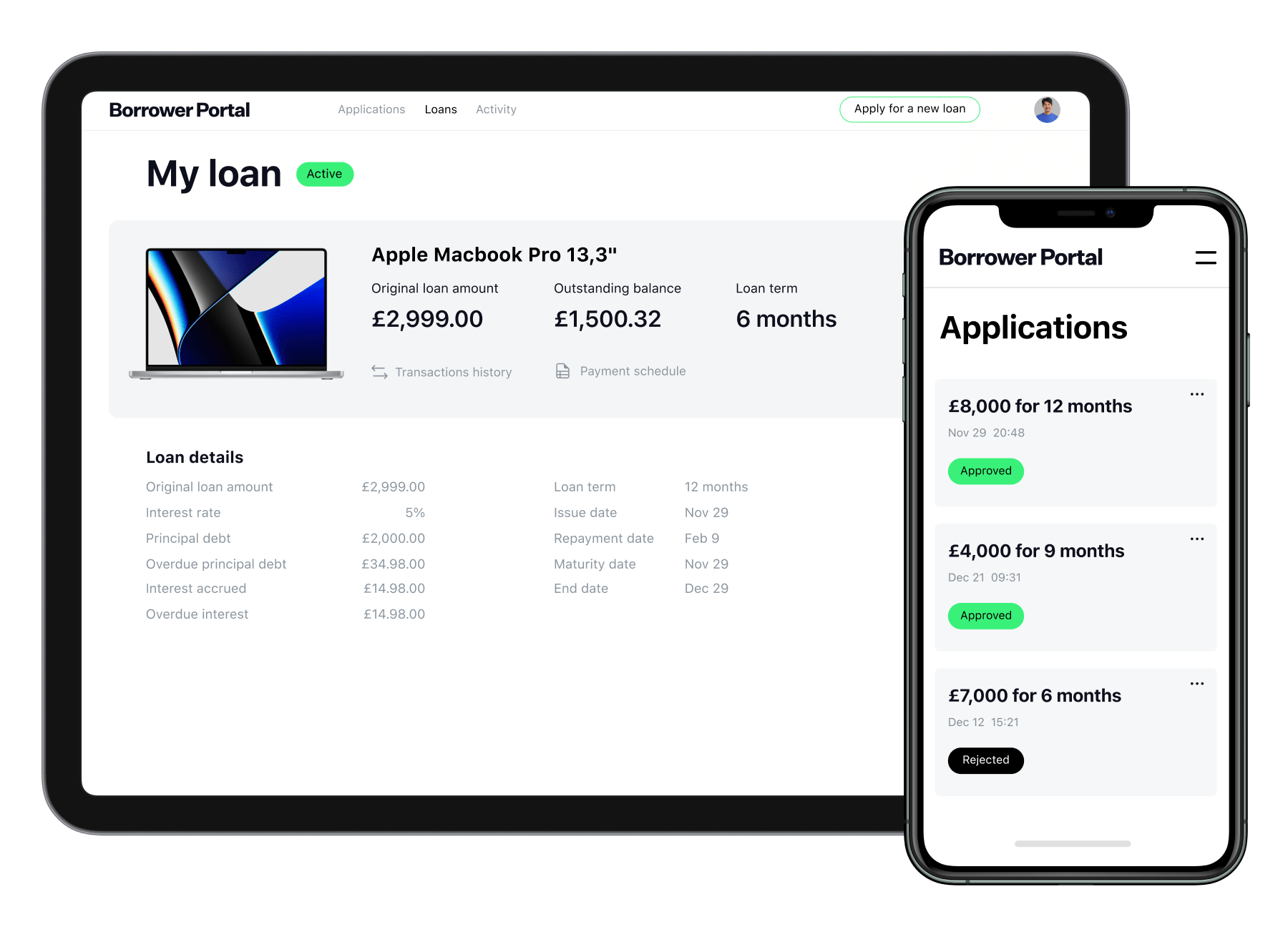

Streamline your customers’ loan experience

Offer borrowers a personalised space where they can manage every aspect of their loan journey – from application to digital KYC verification.

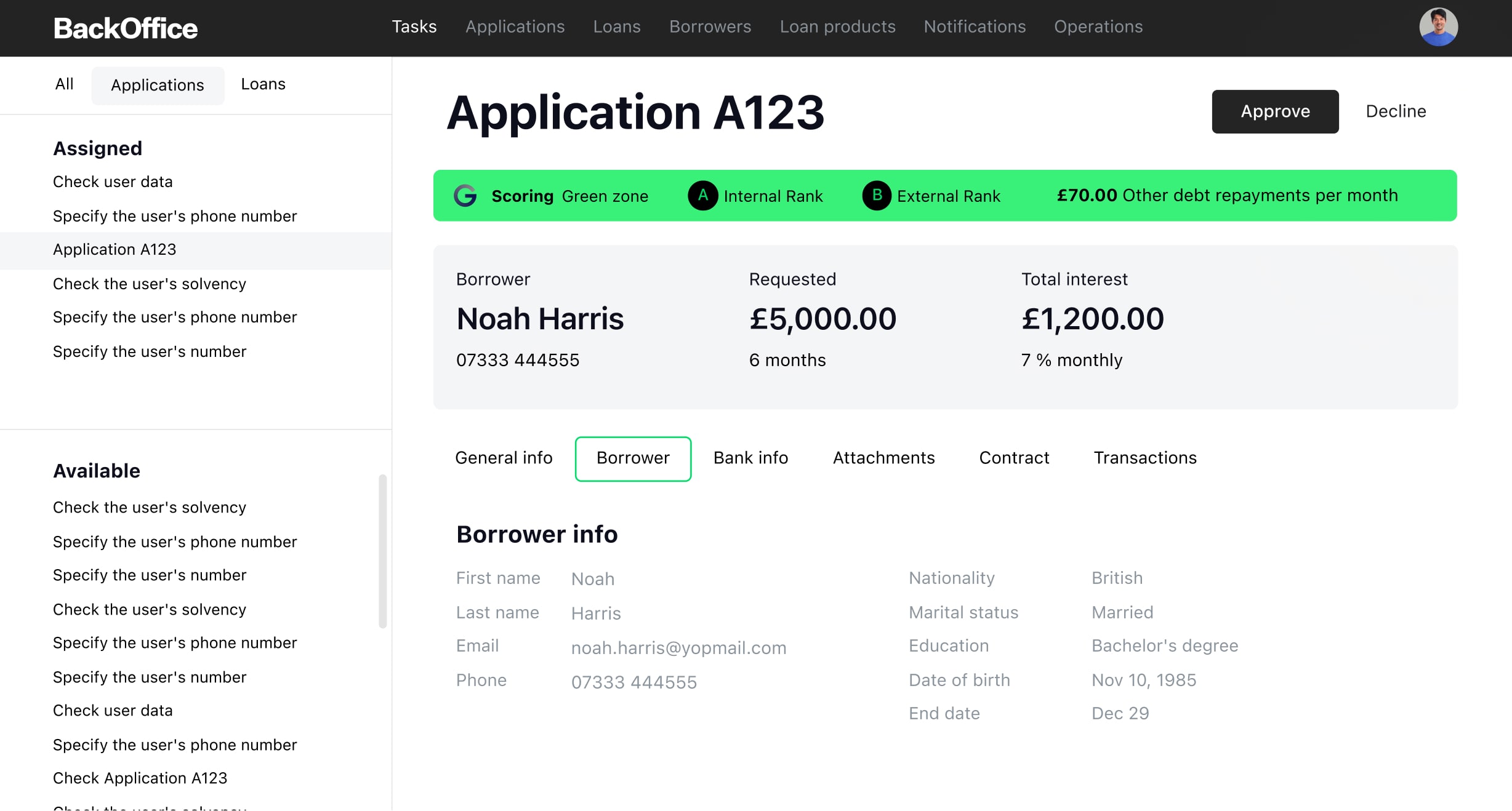

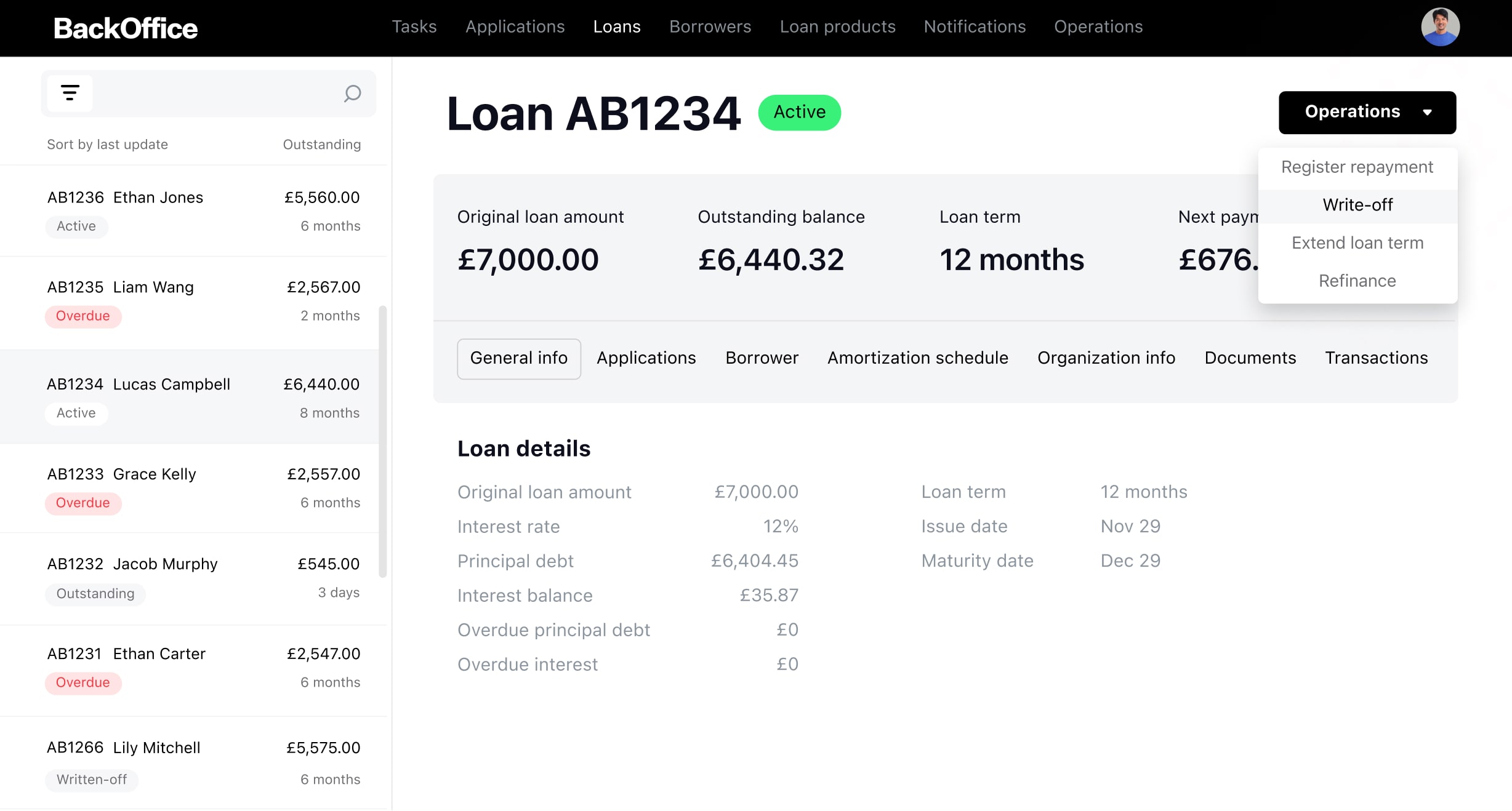

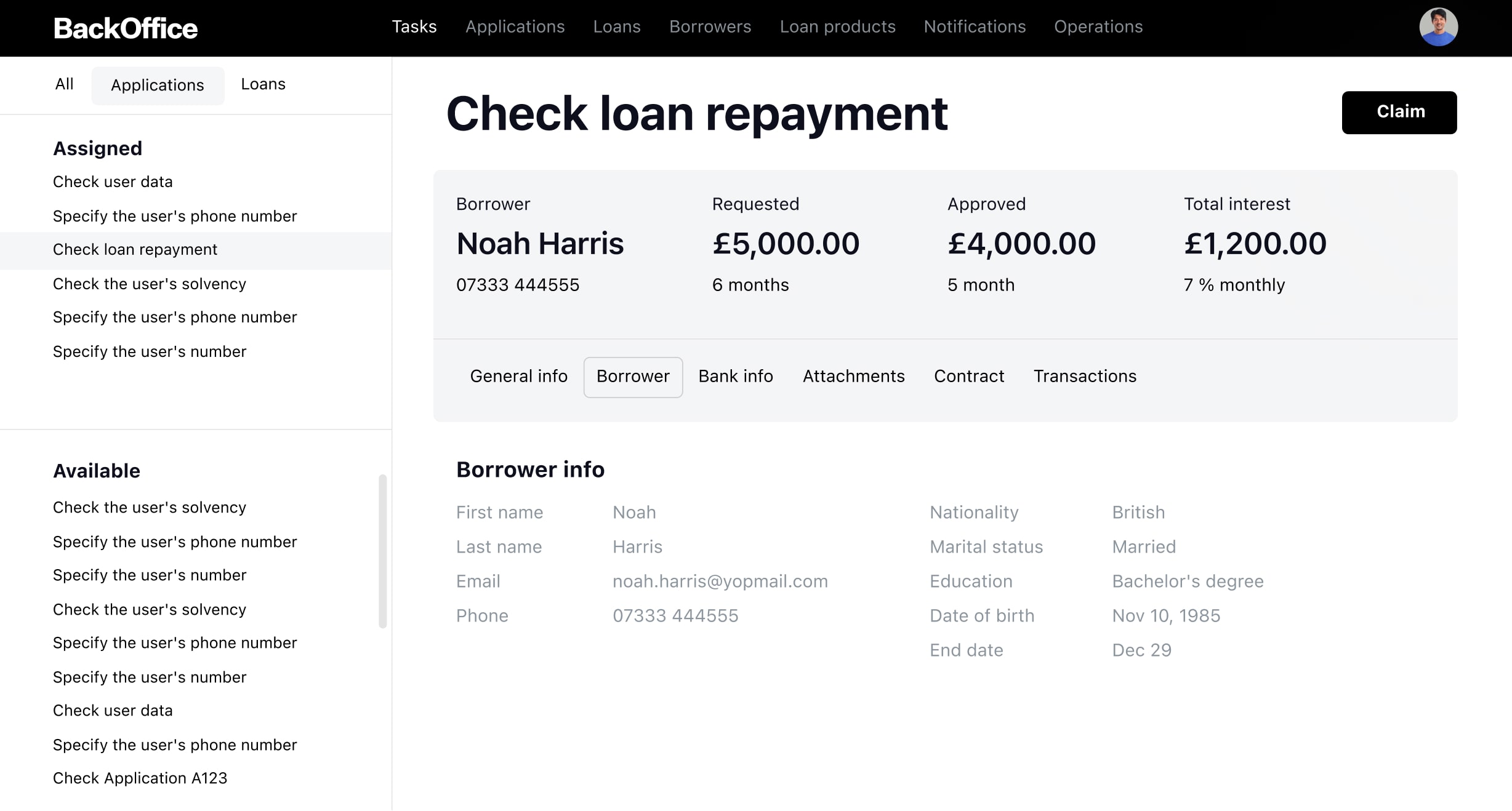

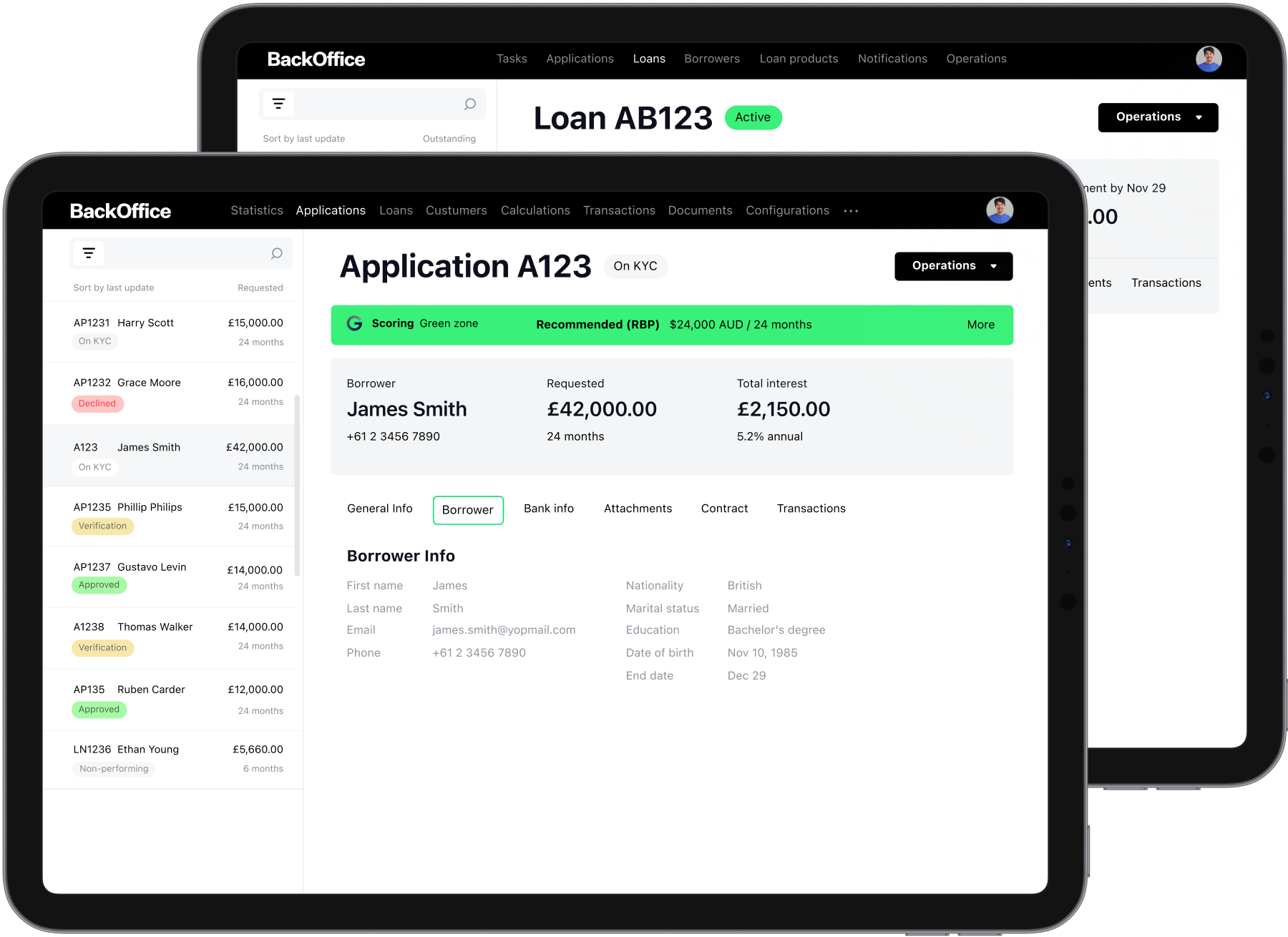

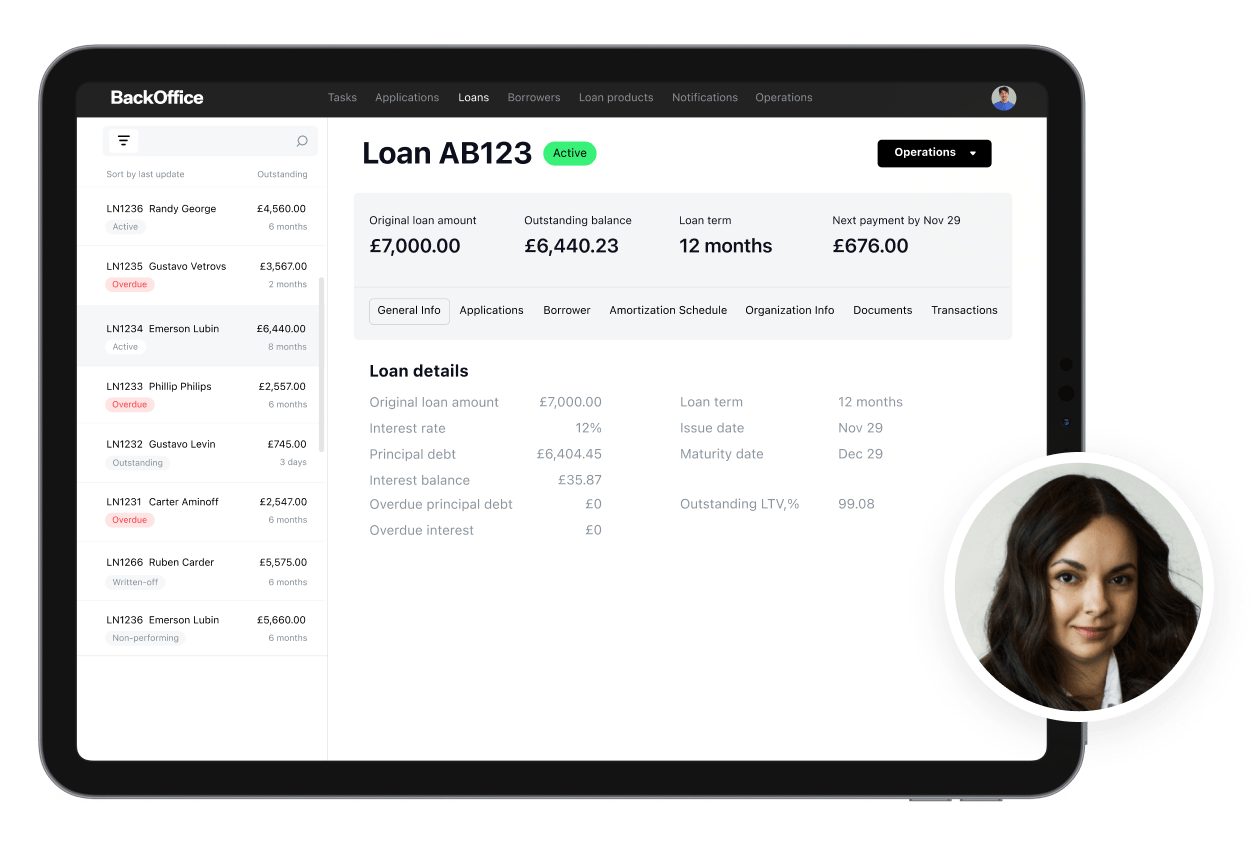

Centralise all your lending operations

Enhance your efficiency with our API-rich Back Office, featuring comprehensive loan products, real-time data, amortisation schedules, automated calculations, and all the tools necessary to expand your business.

Unleash AI for credit scoring

GiniMachine analyses complex data patterns to improve the accuracy of credit decisions, decrease NPLs, and provide more reliable credit assessments.

Advanced tech stack

HES LoanBox is a loan management solution developed using a modern tech stack that incorporates open-source technologies, ensuring scalability, performance, and security.

Let us show

you how it works

Experience the advantages of HES LoanBox. Request a personalised tour to explore all its features and see how it can streamline your business operations.

Seamless

integrations

Your partner

in UK lending

Our expertise in UK lending practices ensures seamless, compliant, and efficient operations, perfectly suited to the local market’s unique demands.

Why choose HES LoanBox

Transform your lending

Fully compliant loan management system

Seamless integrations

Customer support

Future-proof architecture

Why HES FinTech

software?

Post-lauch support

Our team provides ongoing assistance, system updates, and continuous optimisation to keep your lending processes efficient and compliant.

Global trust

HES FinTech’s loan management solutions are trusted by over 130 businesses worldwide, thanks to our commitment to innovation, security, and compliance.

Local clients and partners

We prioritize building strong connections with local industry players. This approach allows us to provide effective and compliant solutions that drive business success.

Success stories

Lending software

solution in

United Kingdom

Instant loan decision-making

Scalable end-to-end lending solution

3-month time-to-market

Complete process automation

FAQ

How can HES LoanBox benefit my business?

Can HES LoanBox integrate with our existing systems?

How long does it take to implement HES LoanBox?

What security measures are in place to protect data?