ALM Securities success story

Automation of securities management

asset and liability transactions. However, with the expansion of their business, they

encountered a growing issue of escalating manual workload and a rising occurrence of human

errors. To address this challenge, the client sought the expertise of HES FinTech to implement a

cloud-based solution that would comprehensively automate intricate calculations and reduce the

need for manual data input.

Custom system for securities servicing

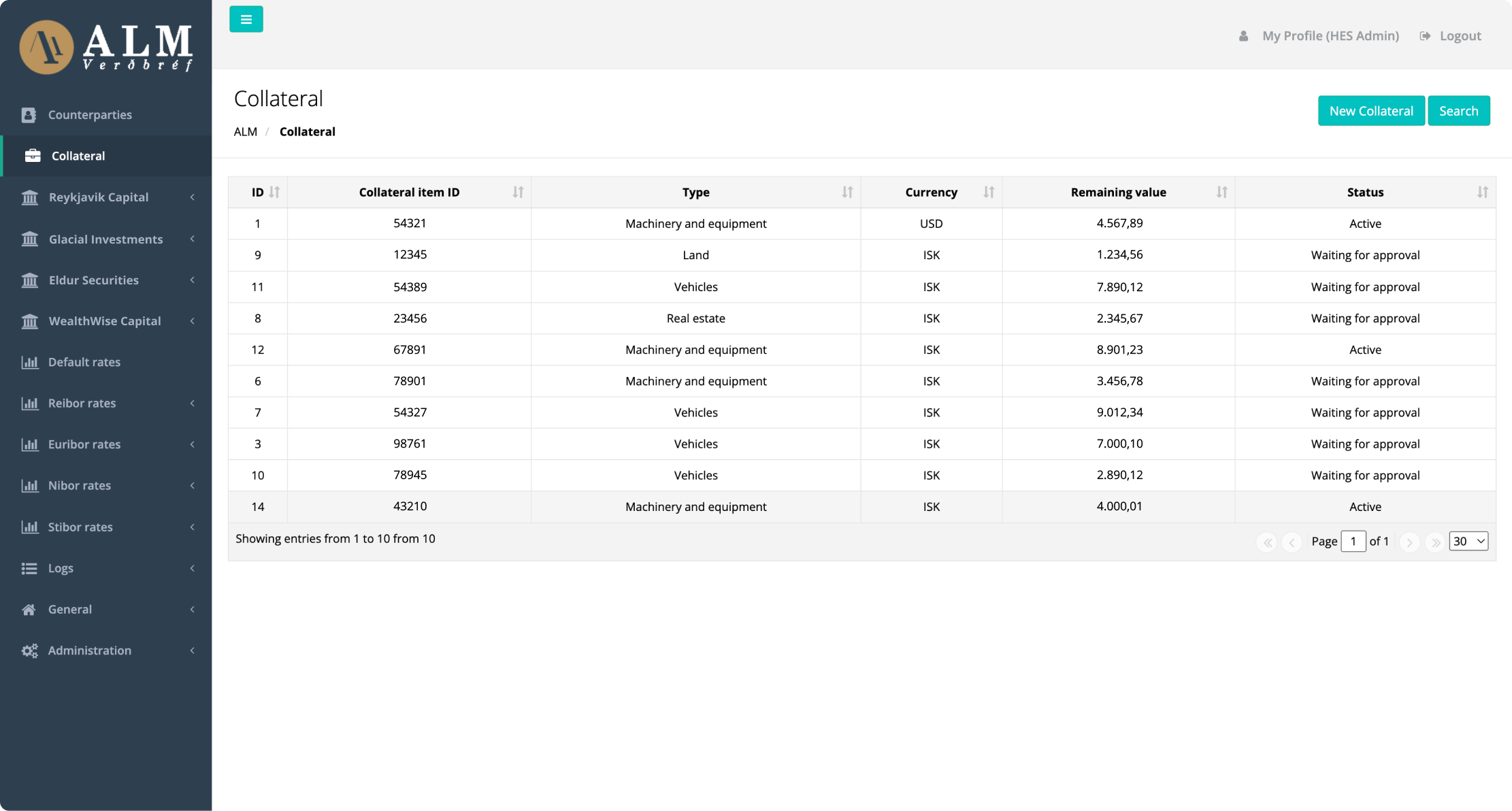

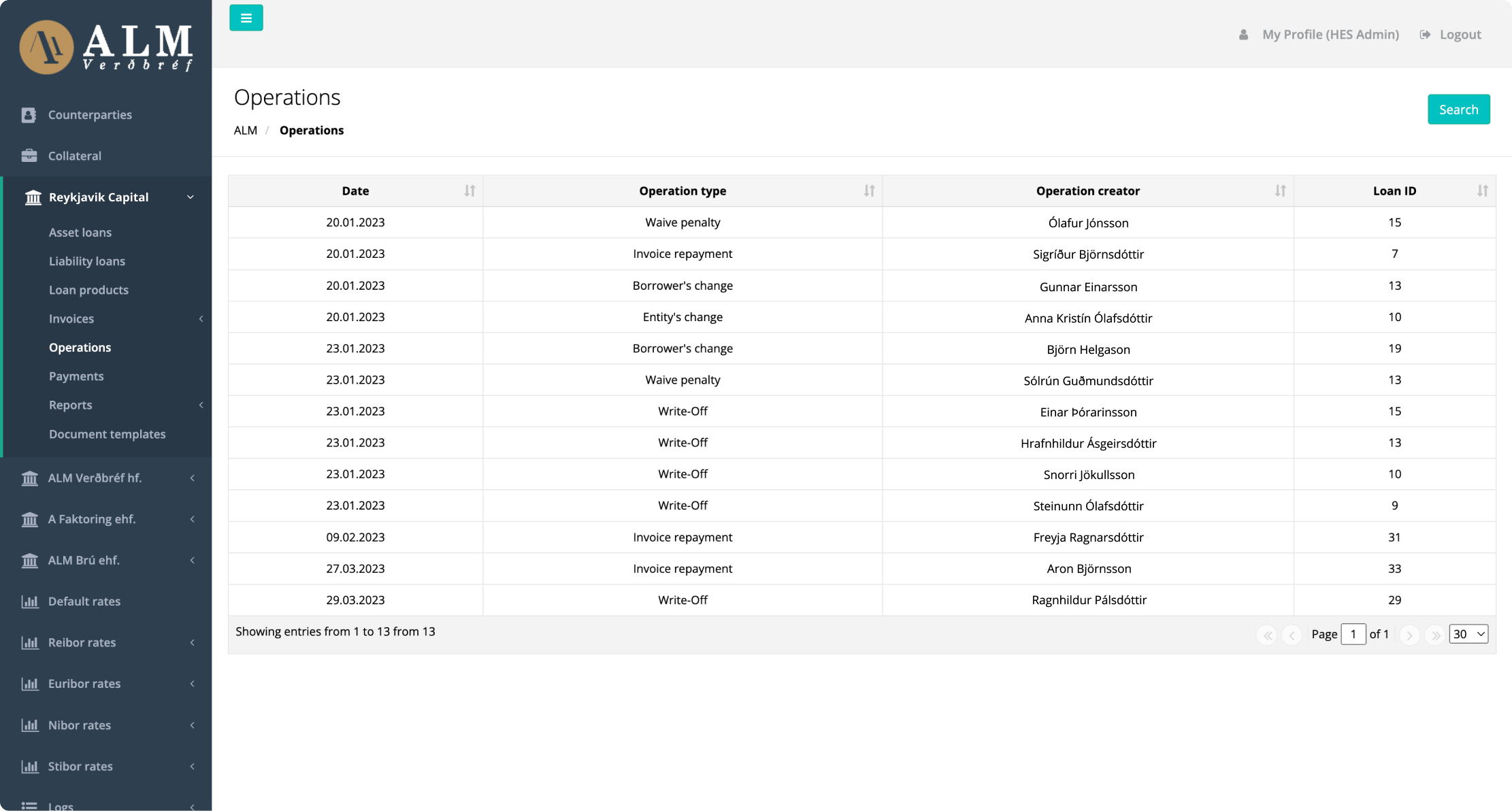

The project presented four main challenges: automating comprehensive interest calculations, enabling automatic payment issuance, generating real-time charts and reports, and ensuring continuous synchronization of interest rate adjustments based on the Central Bank of Iceland’s indicators. Additionally, the system’s adaptability allows it to handle multiple currencies and scale seamlessly with the client’s business growth.

To address these challenges, HES developers integrated the client’s accounting system with services like CreditInfo and sourced EURIBOR, Stibor, and Nibor rates. Our team also successfully connected HES LoanBox to the Central Bank of Iceland and various commercial banks. For optimal performance and data security, the system is hosted on Amazon AWS cloud services.

8 min

6 months

100%

6 months from idea to working business

securities transactions. The intuitive user interface streamlines manual data input, resulting

in time savings for employees. Furthermore, the automated calculations have notably decreased

the occurrence of errors, reducing the impact of the human factor. The system has continued to

operate successfully, effectively optimizing the client’s operational expenses.

has since expanded, and the HES team now offers technical support and system enhancements.

storing all our data in Excel to a fast, reliable, and user-friendly platform that caters to our

specific needs.