Point of sale lending software

Get the POS lending software ready

in 3 months

BNPL software includes

Landing Page

Borrower Portal

Agent Portal

Back Office

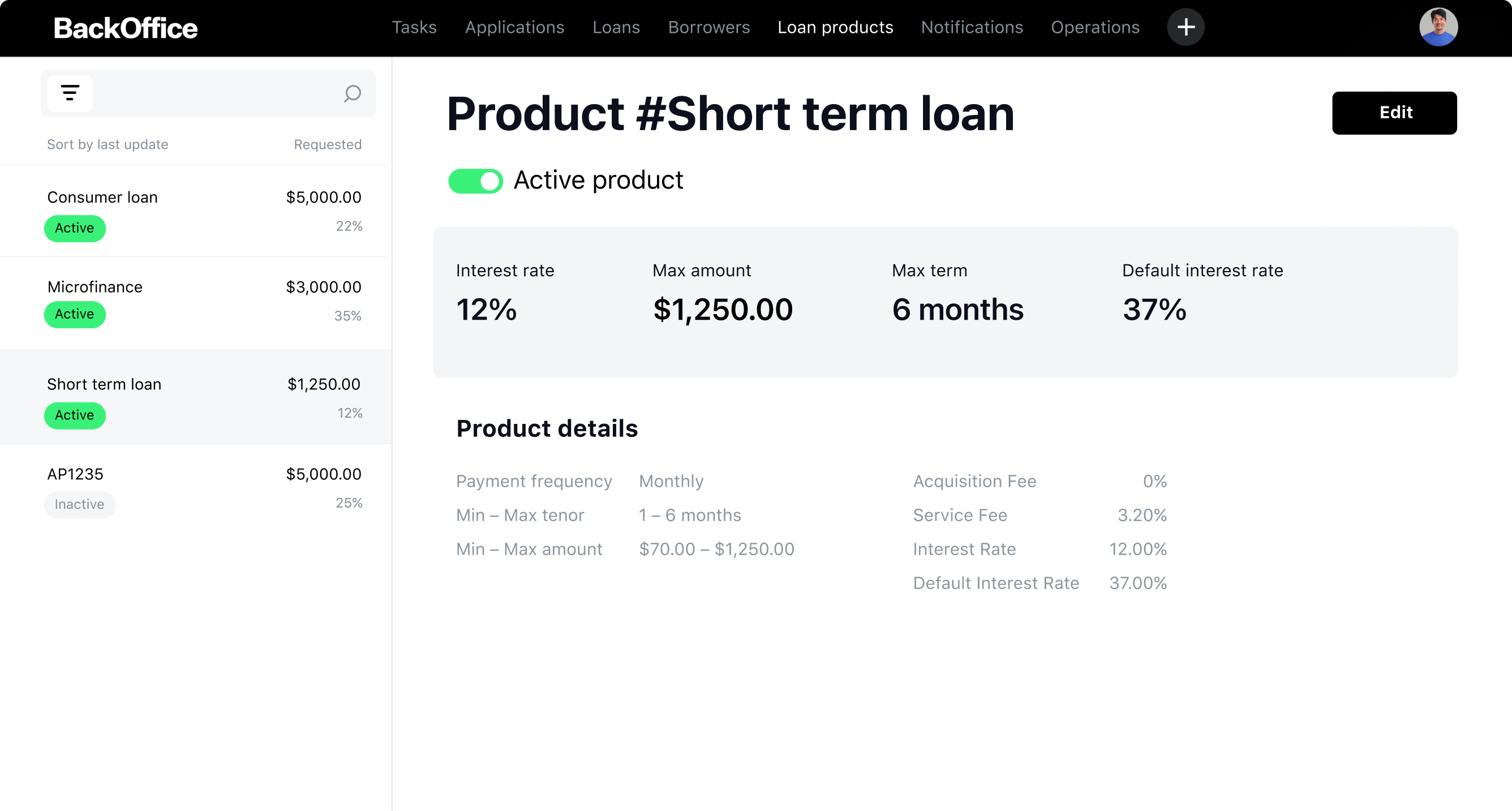

All-set POS lending system

User-friendly white-label UI/UX

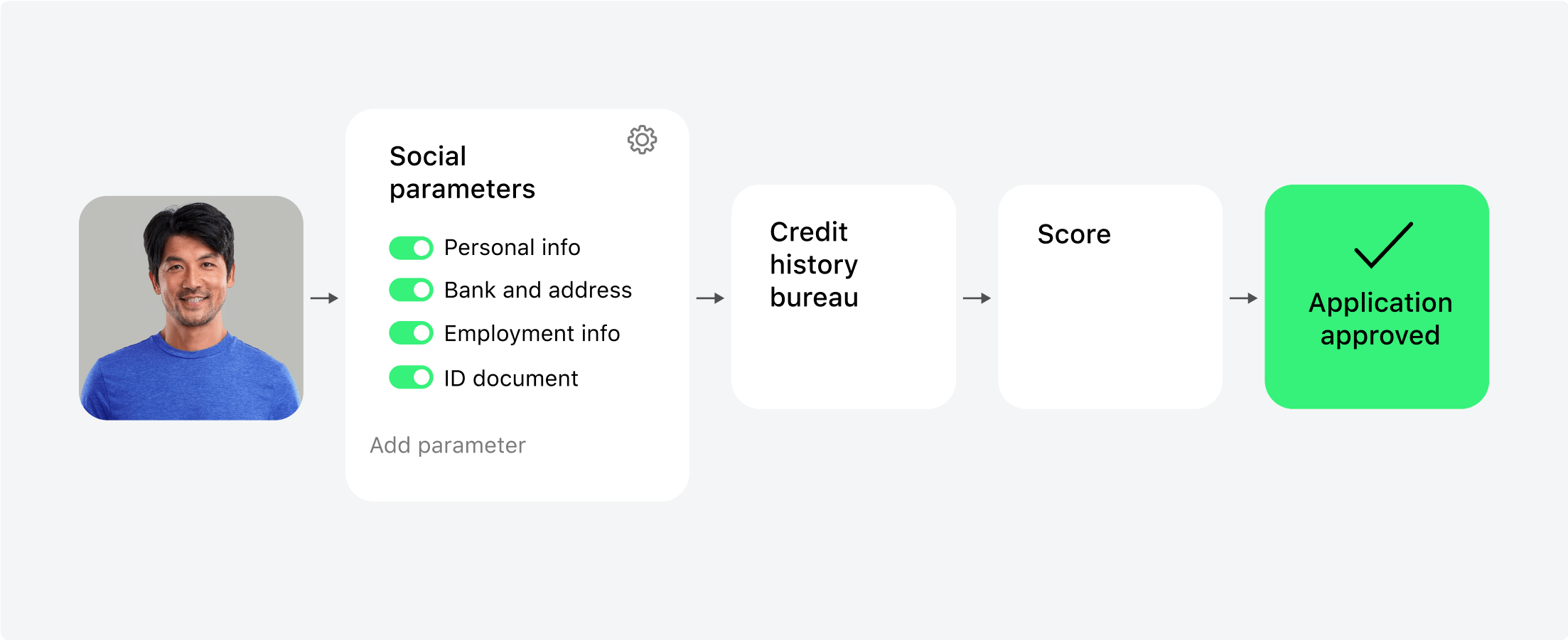

Automated loan application flow

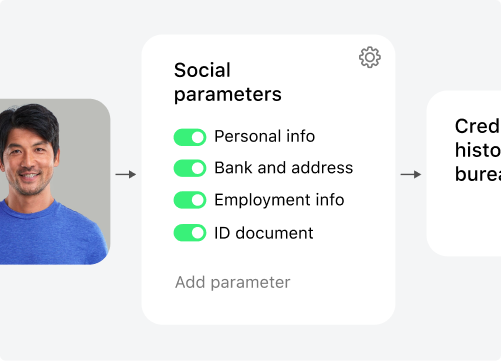

Smart scoring system

Integrations with 3rd-party software

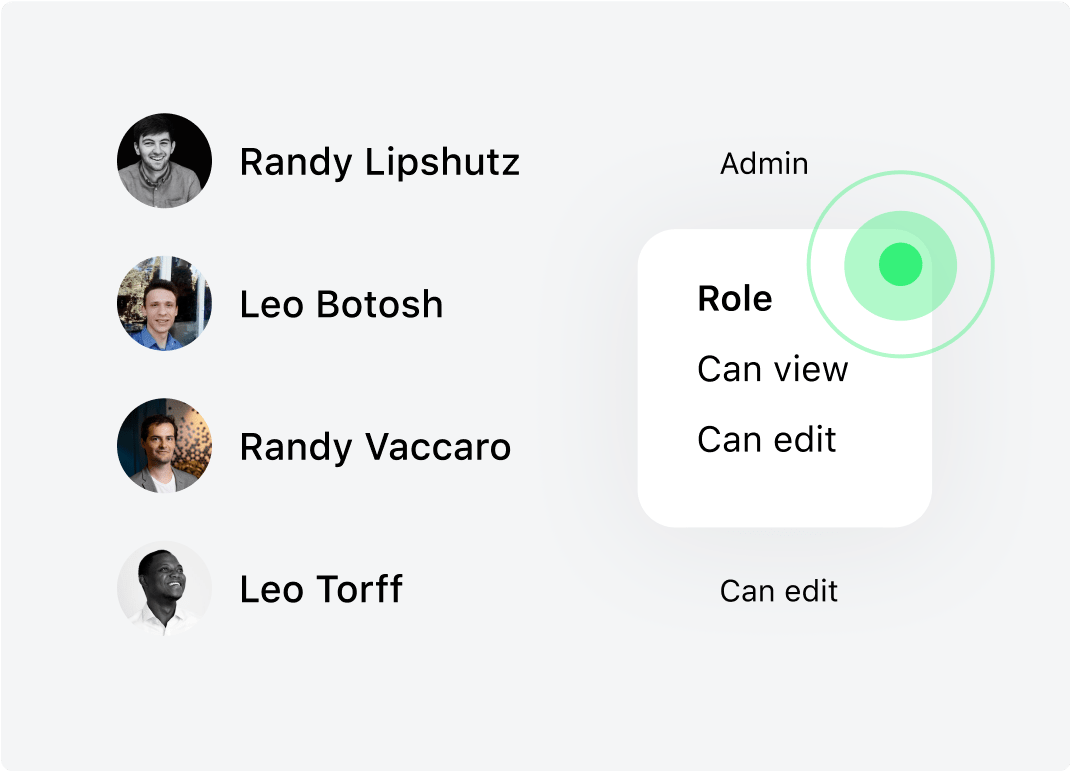

Elevate collaboration

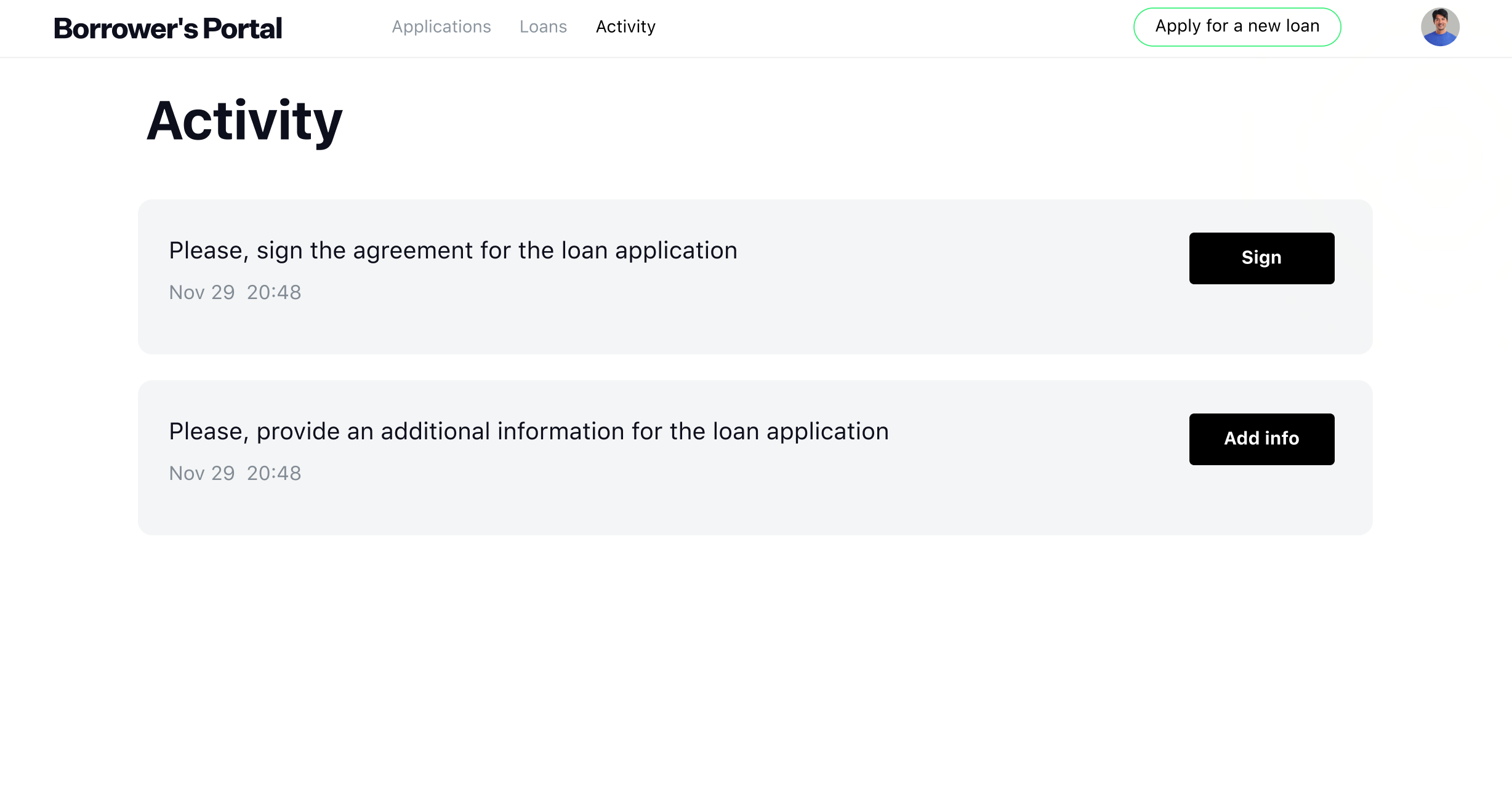

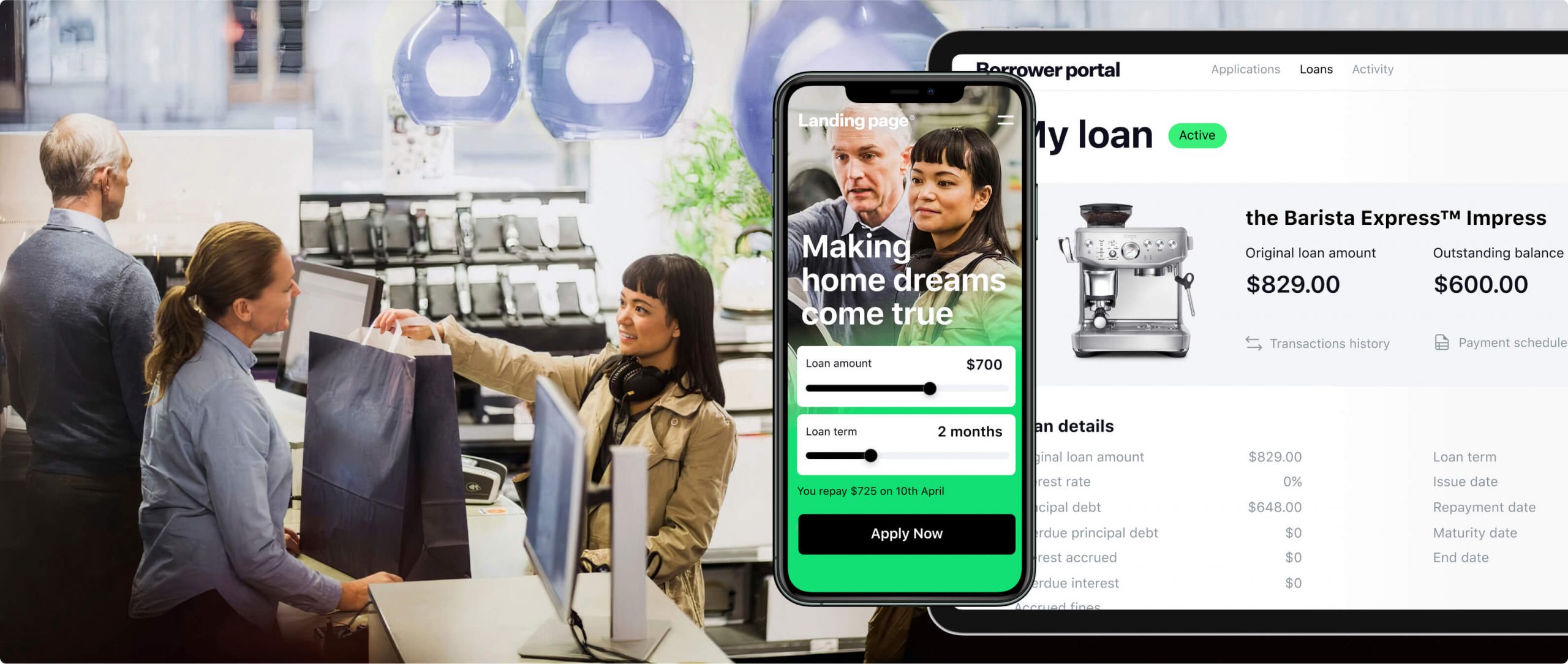

Omnichannel loan application

Let customers apply for an installment loan using any device or switching

devices during the process. For example, they can start filling out the form on PC but upload

document photos from their smartphones. HES point-of-sale lending platform saves users’ progress without losing

already filled-in information.

devices during the process. For example, they can start filling out the form on PC but upload

document photos from their smartphones. HES point-of-sale lending platform saves users’ progress without losing

already filled-in information.

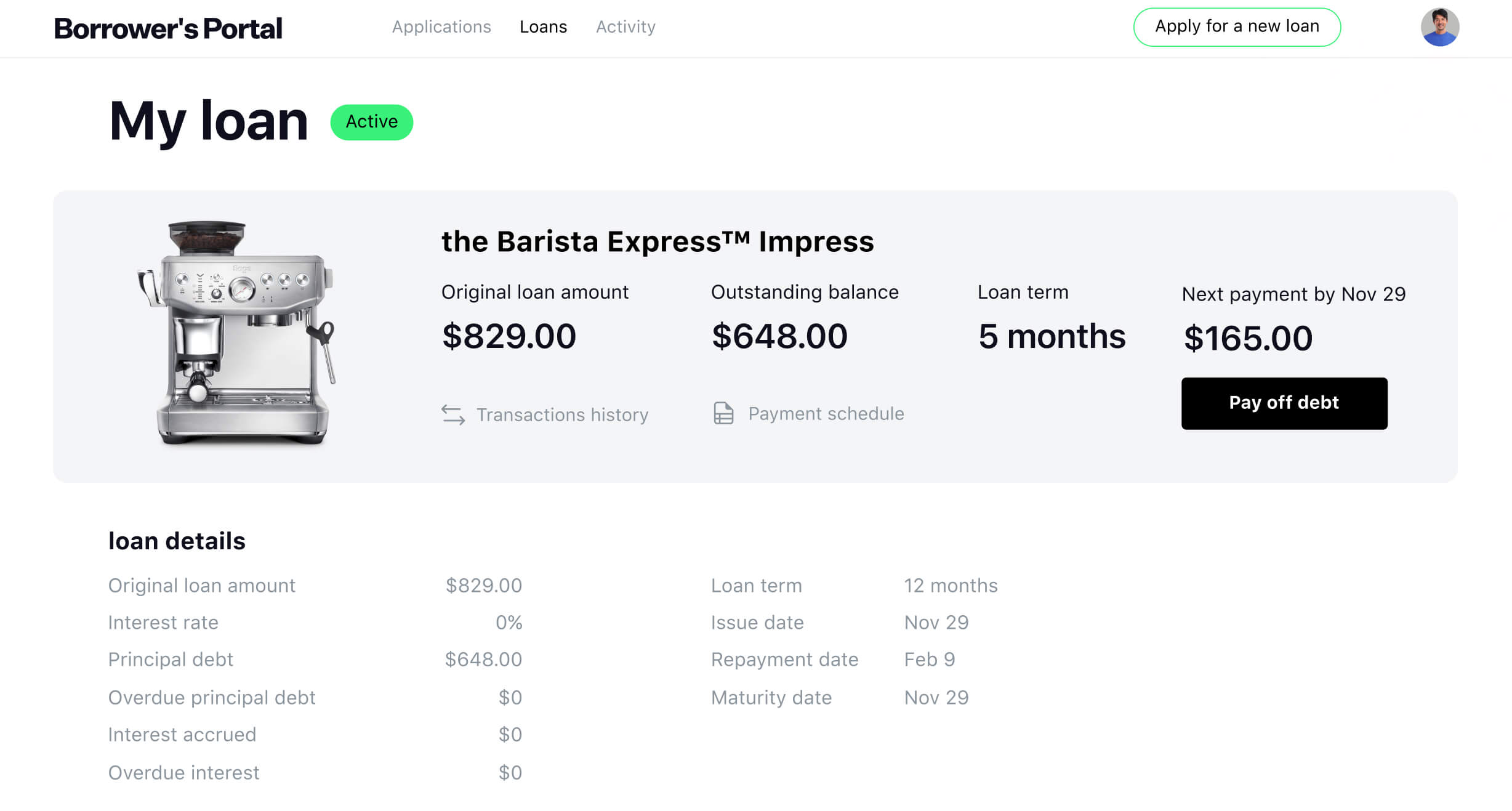

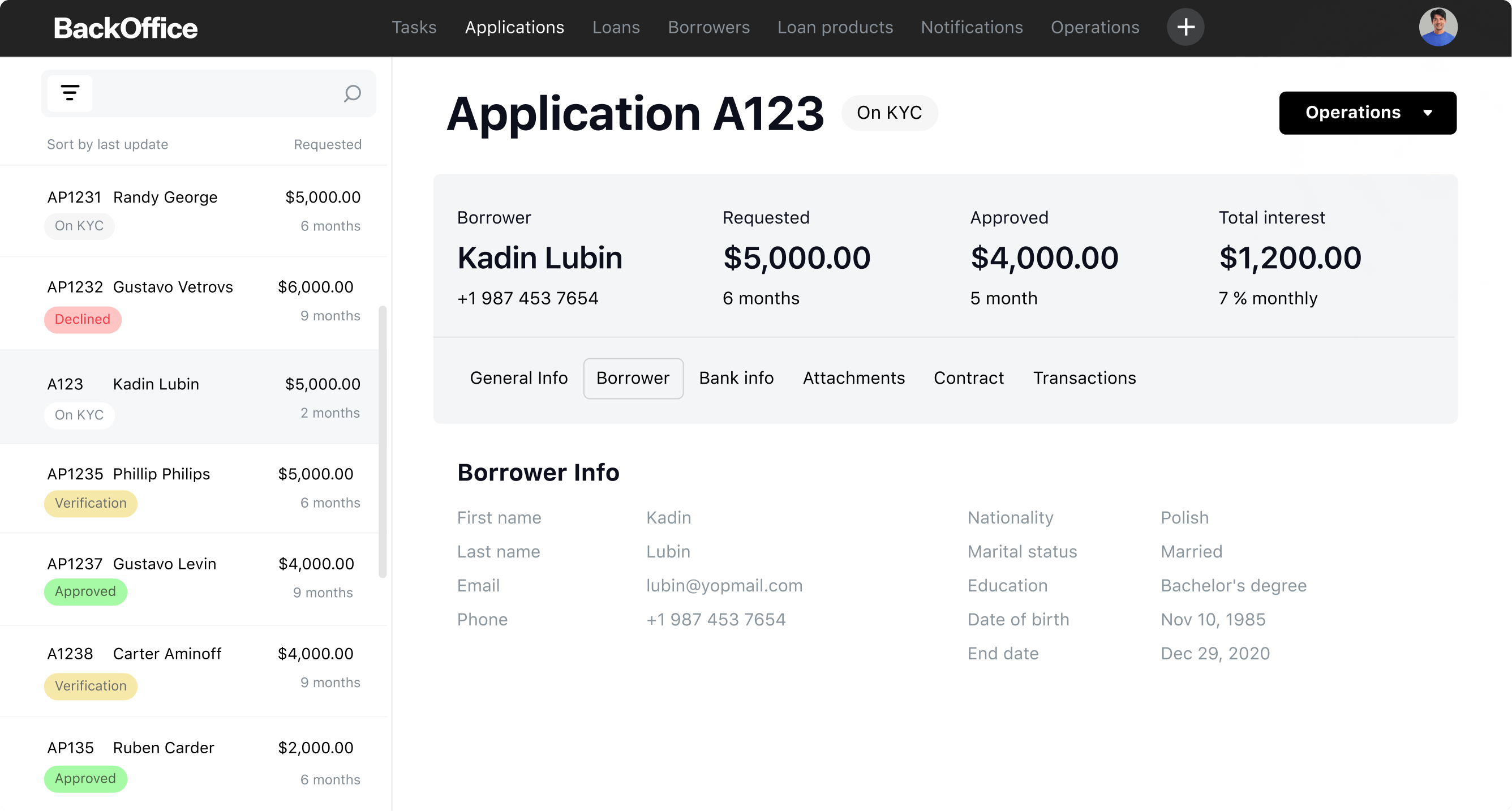

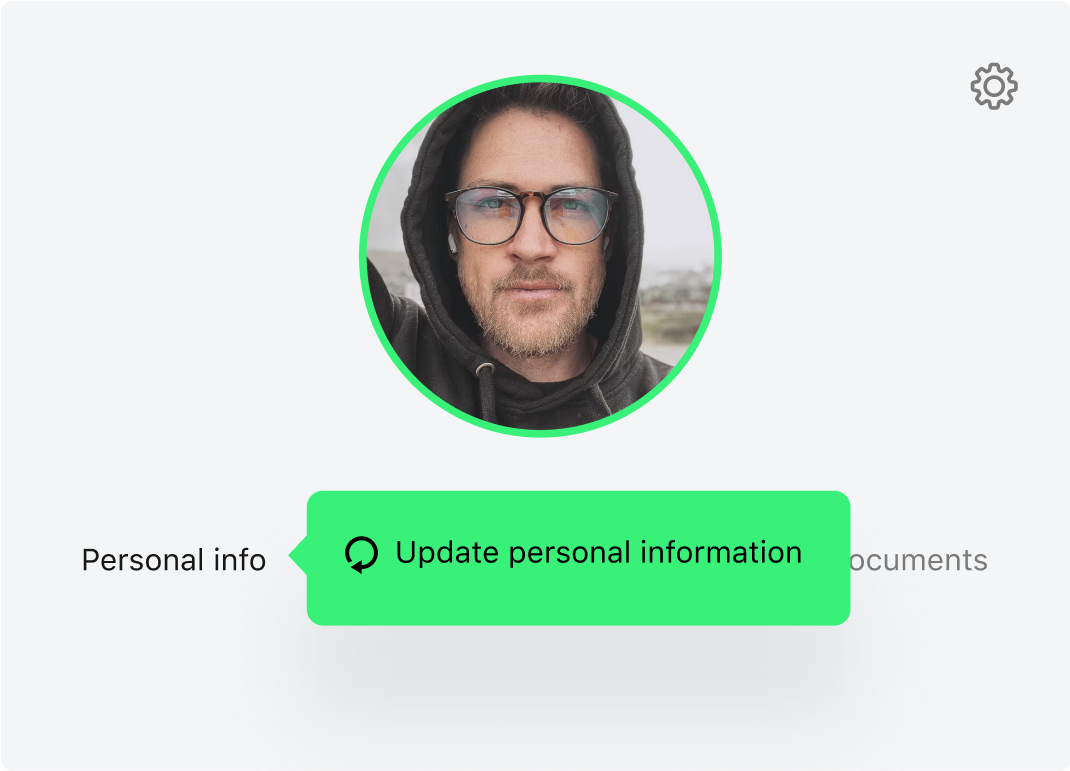

Borrower profile

HES buy now pay later software allows your customers to save their

information into a client account and use it for repeat loan requests to speed up the

process.

information into a client account and use it for repeat loan requests to speed up the

process.

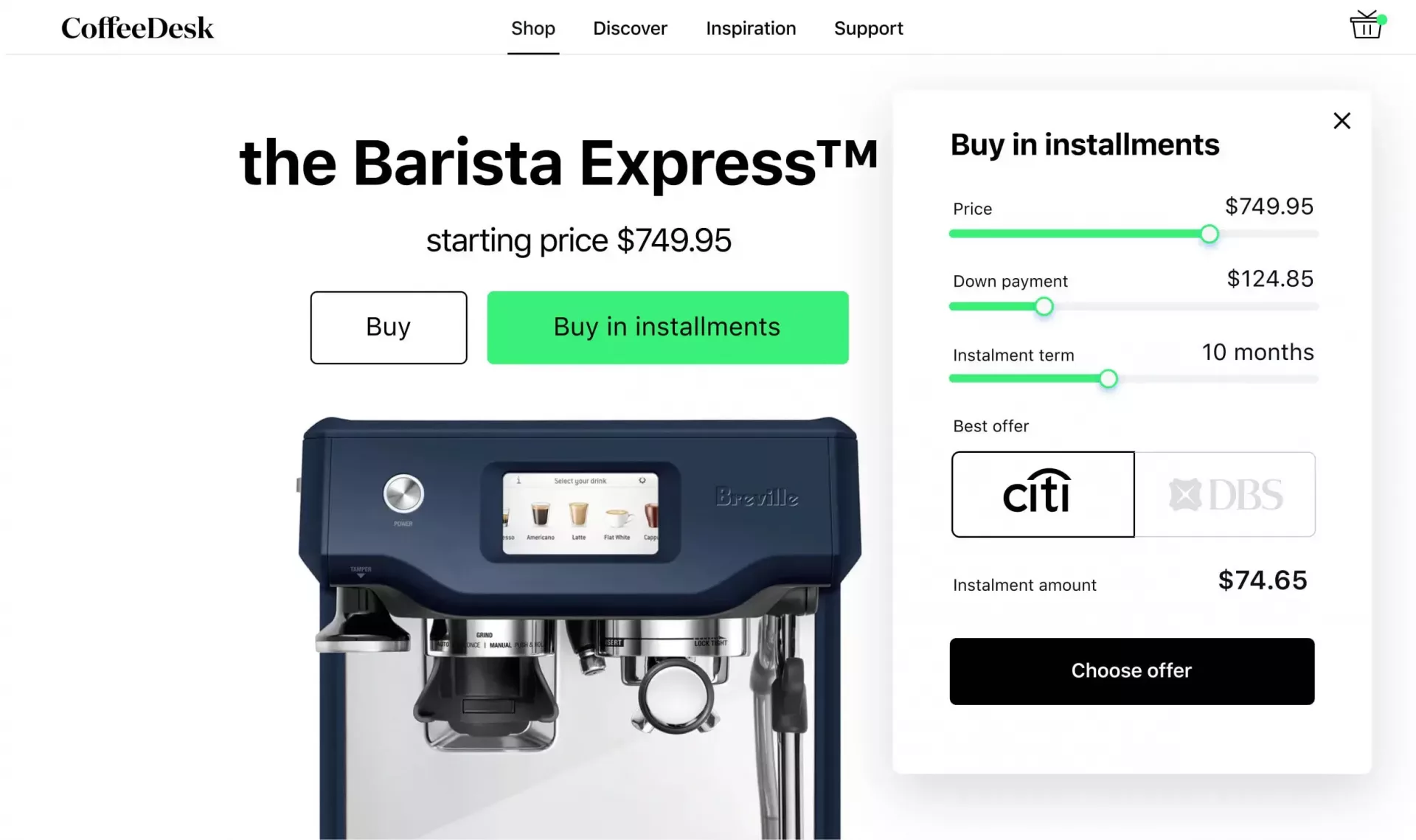

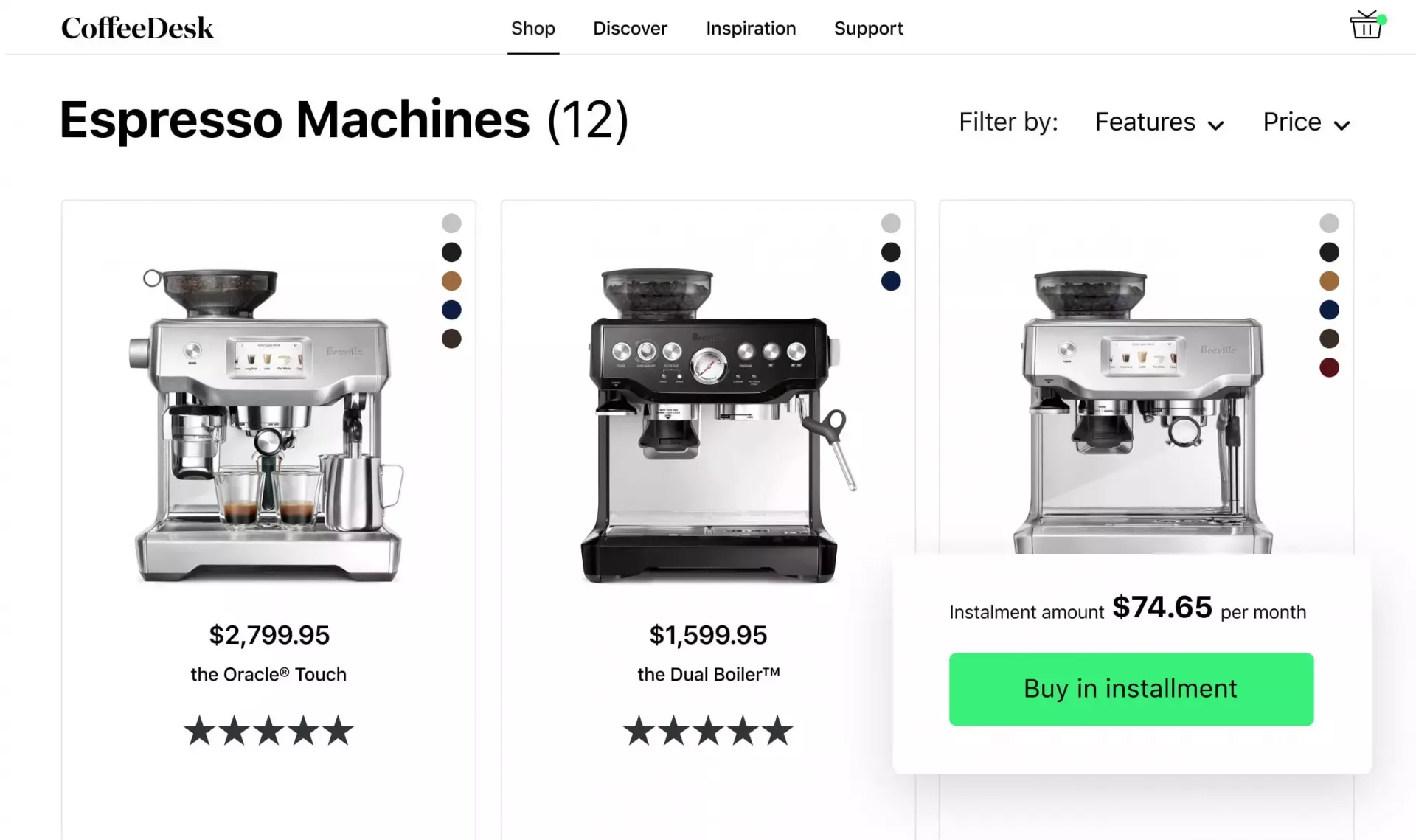

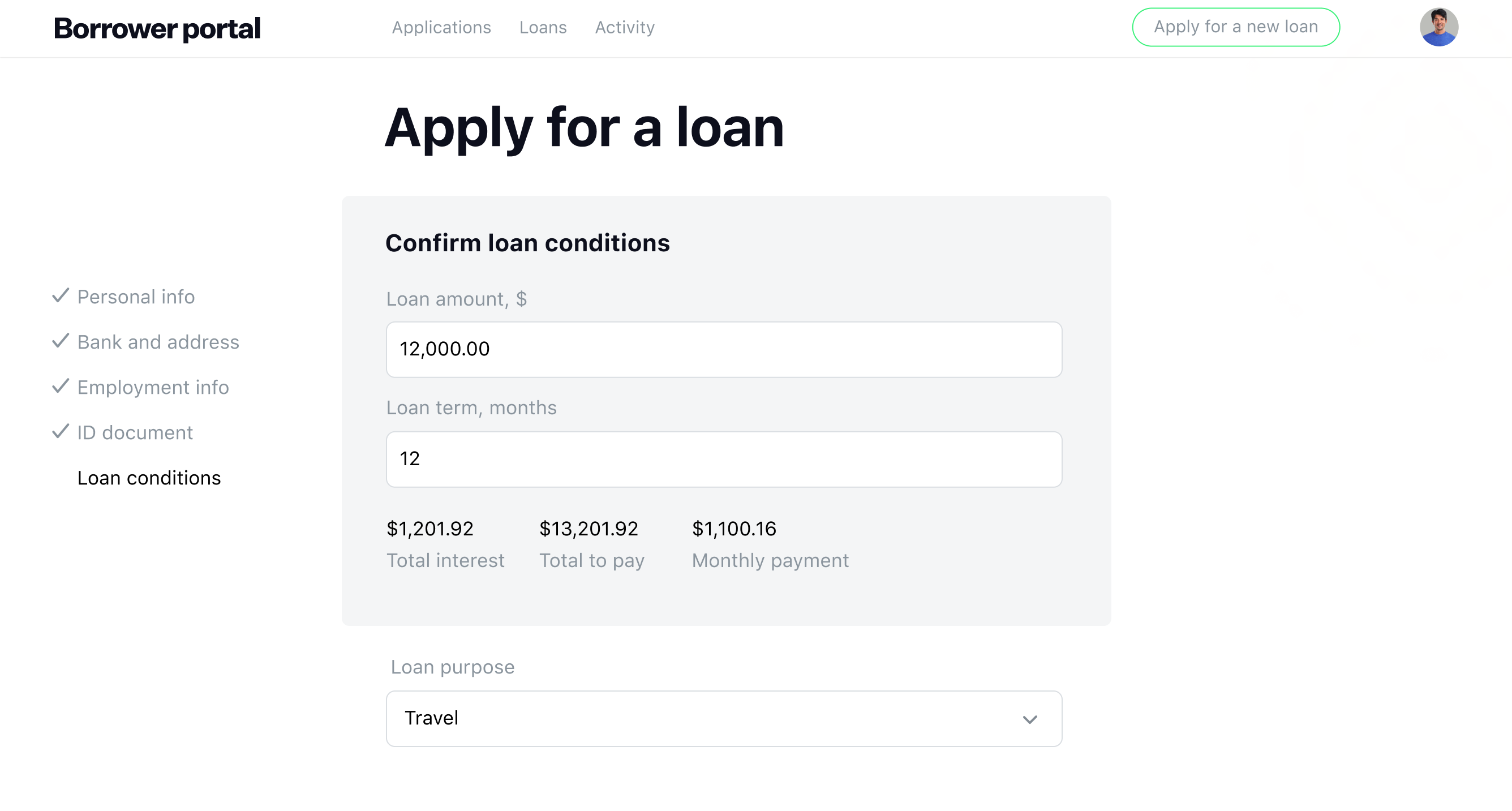

Loan calculator

Provide customers with a convenient loan calculator they can use to see

how their possible payments change depending on the loan terms.

how their possible payments change depending on the loan terms.

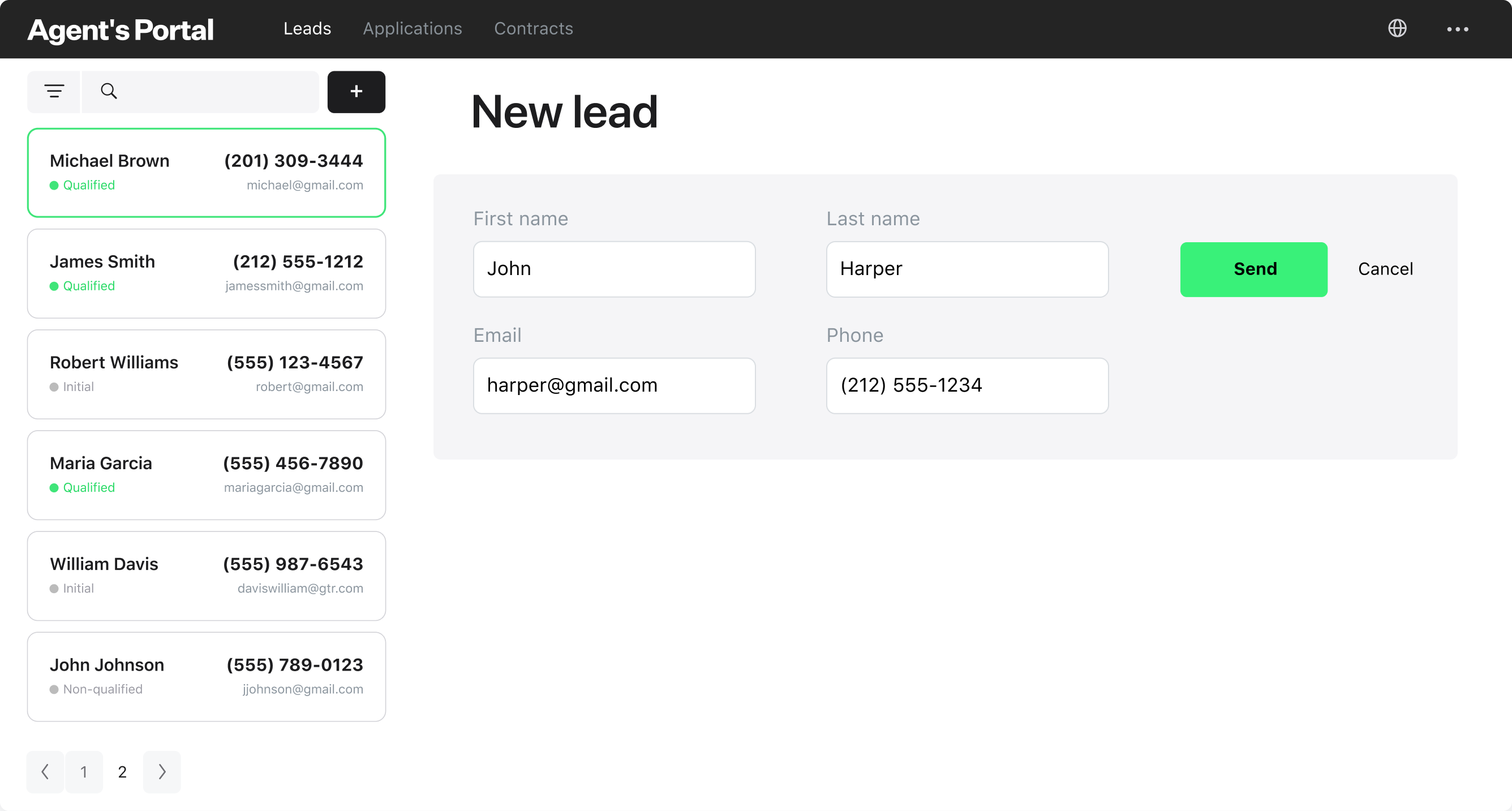

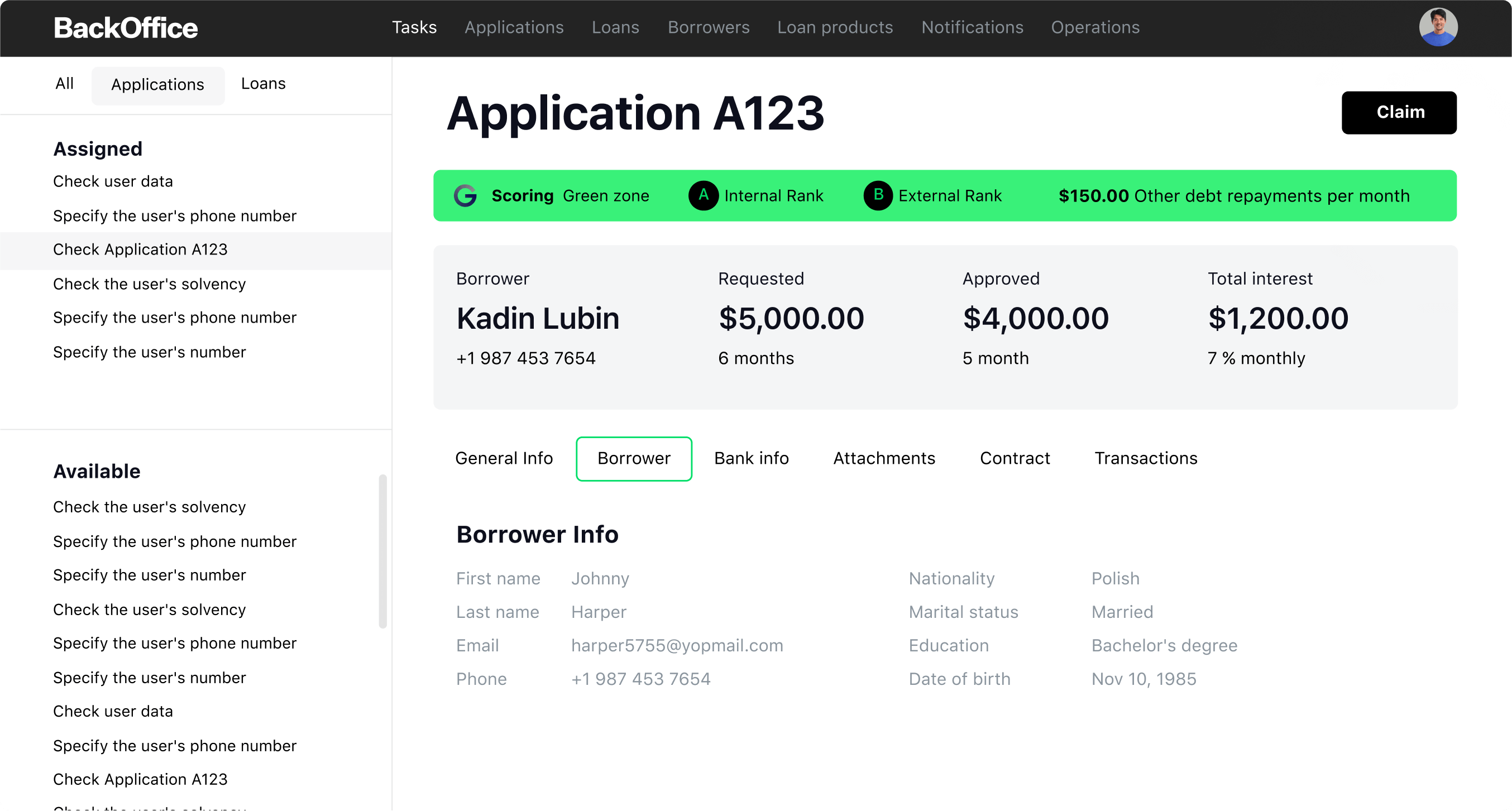

Agent dashboard

Here, agents can efficiently invite colleagues using their email addresses, ensuring a streamlined

onboarding process. Also, they have immediate access to the contact details of potential leads,

positioning them to extend precise and tailored offers.

onboarding process. Also, they have immediate access to the contact details of potential leads,

positioning them to extend precise and tailored offers.

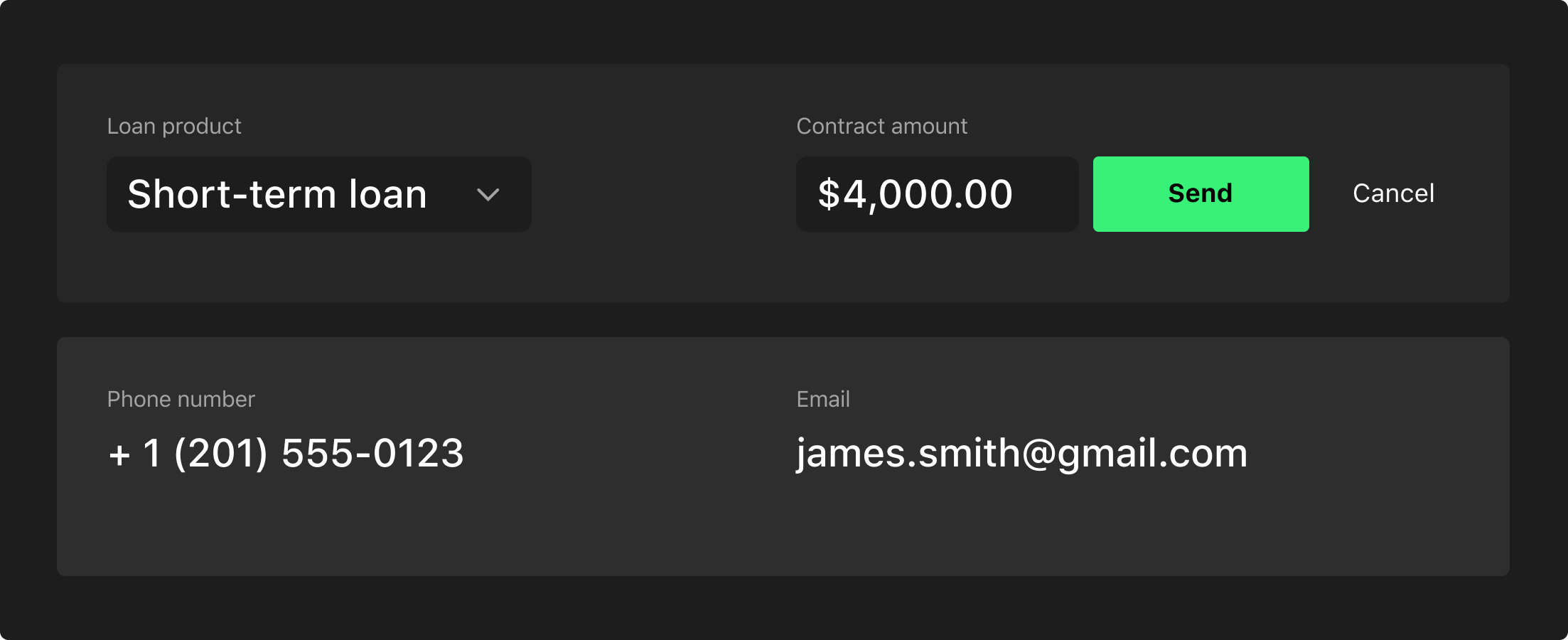

Personalized offer dispatch

Sending offers to leads has never been easier. Agents just select the loan product and specify the

amount, and the offer is dispatched. Leads then receive this offer in their inbox, which directs them

straight to the Borrower Portal, packed with all the loan details they need.

amount, and the offer is dispatched. Leads then receive this offer in their inbox, which directs them

straight to the Borrower Portal, packed with all the loan details they need.

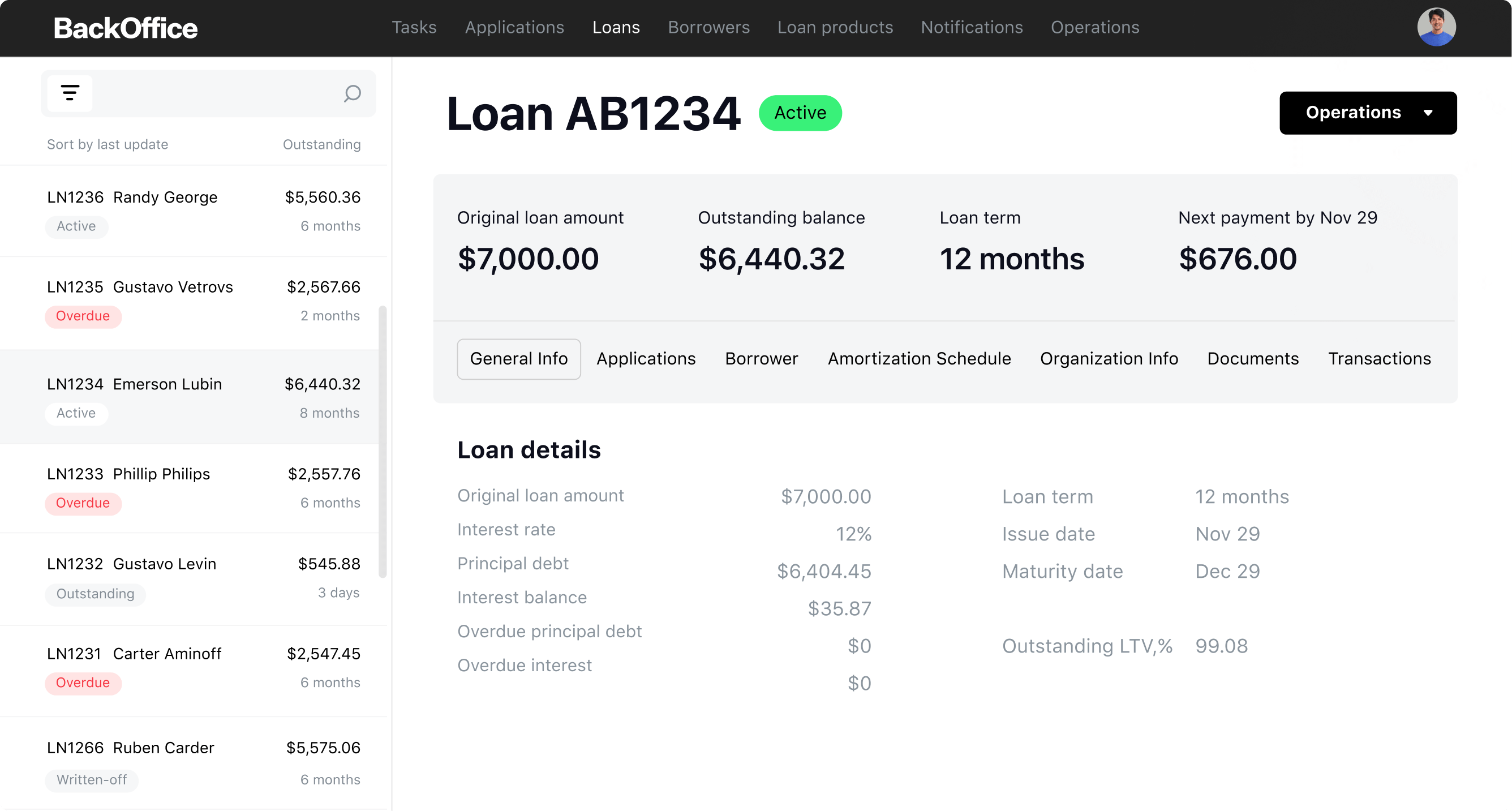

Full-featured back office

AI-driven POS lending software

The BNPL software sweeps away manual processes, ad-hoc queries, and paper

trails. Get a single smooth automated workflow that meets customers’ needs while improving

operational efficiency.

trails. Get a single smooth automated workflow that meets customers’ needs while improving

operational efficiency.

and much more

Loan application management

POS lending management

Document templates

Automation of disbursements and payments

Transactions and reporting

Easy POS lending software integrations

HES provides adjustable point of sale financing solutions.

Learn our customers success stories and come back for yours.

Learn our customers success stories and come back for yours.

FAQ

Why do I need point-of-sale lending software?

How can a POS system benefit my business?

Can point-of-sale finance software integrate with other systems?