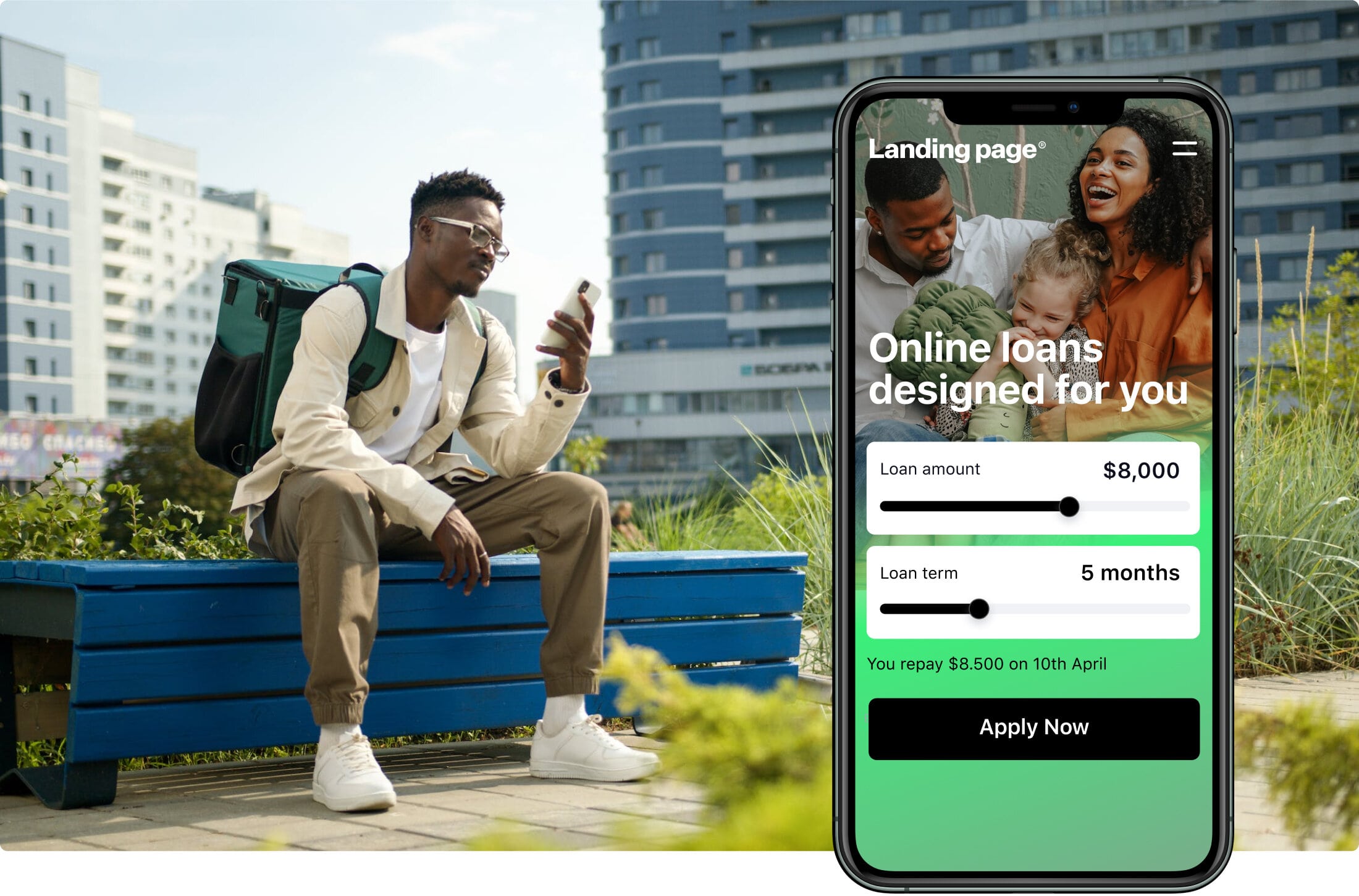

User-friendly and engaging

Increase your financial market presence by offering your clients an online digital onboarding

platform. Fully customizable white-label loan website boosts the number of applications, simplifies the

approval process and grants superb user experience.

platform. Fully customizable white-label loan website boosts the number of applications, simplifies the

approval process and grants superb user experience.

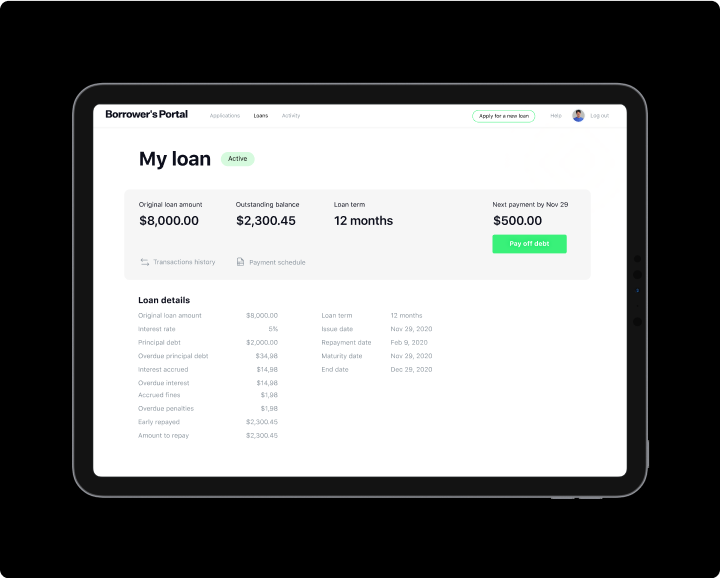

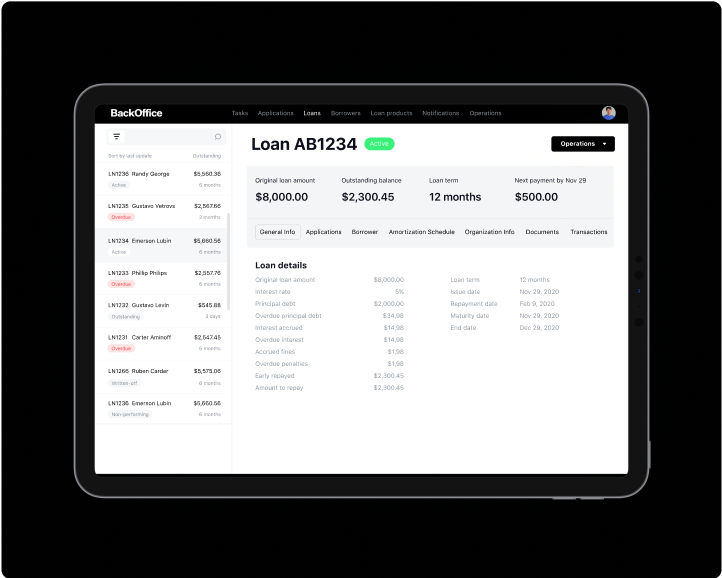

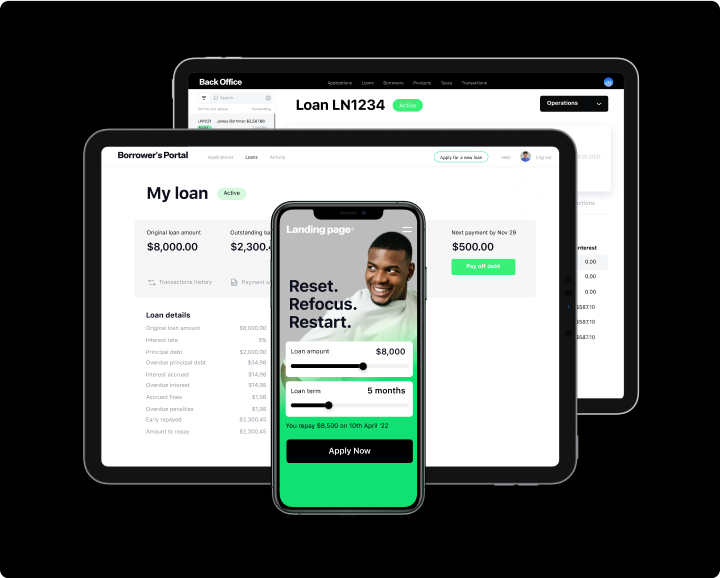

HES LoanBox solution

Omnichannel

digital onboarding solution

Lower the abandonment rates by enabling your clients with a possibility to access the finance

landing

page from

multiple channels. Starting to fill the application on a smartphone, they can proceed

later with a

different device.

landing

page from

multiple channels. Starting to fill the application on a smartphone, they can proceed

later with a

different device.

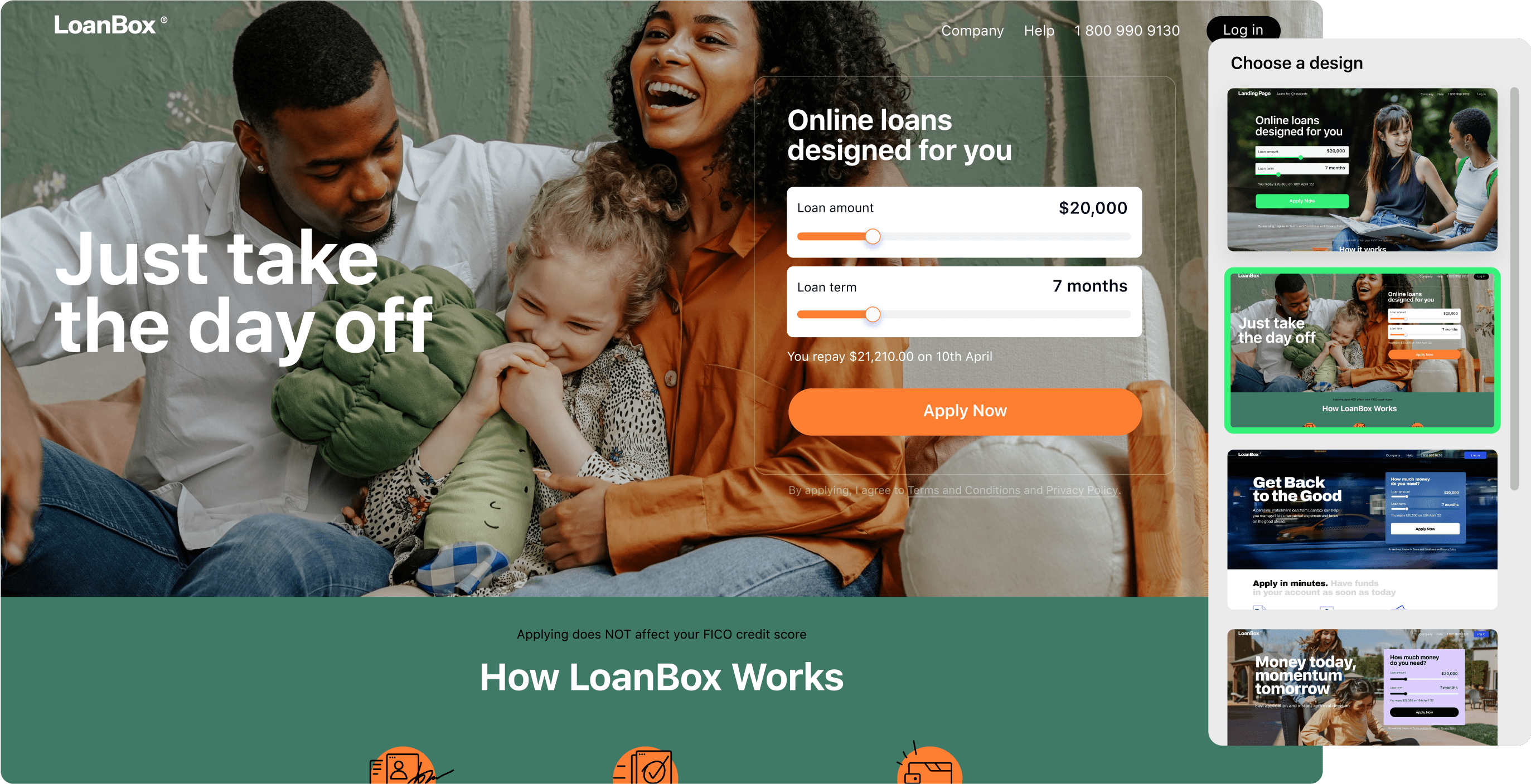

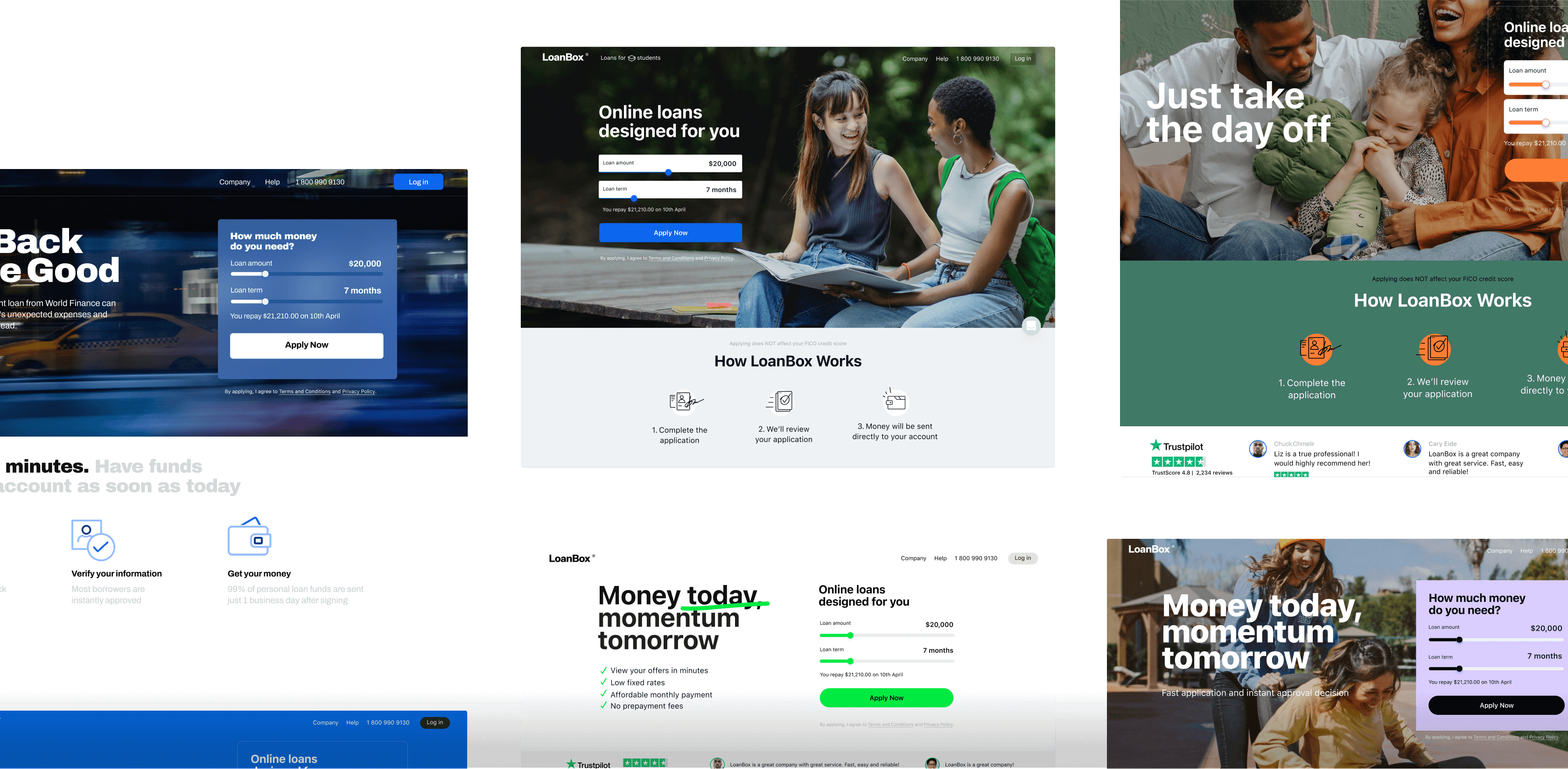

White-label design

Customize the onboarding platform to reflect your business identity. HES LoanBox

offers digital client onboarding software for financial services. Integrate UI/UX design with your unique

brand appearance to enhance user engagement.

offers digital client onboarding software for financial services. Integrate UI/UX design with your unique

brand appearance to enhance user engagement.

HES FinTech is trusted by 130+ businesses worldwide. Leveraging our expertise in customer onboarding automation, we’ve developed a digital onboarding solution that enhances loan processing efficiency and customer satisfaction.