PayDay loan software

Get PayDay lending software ready to generate revenue in 3 months

PayDay solution includes

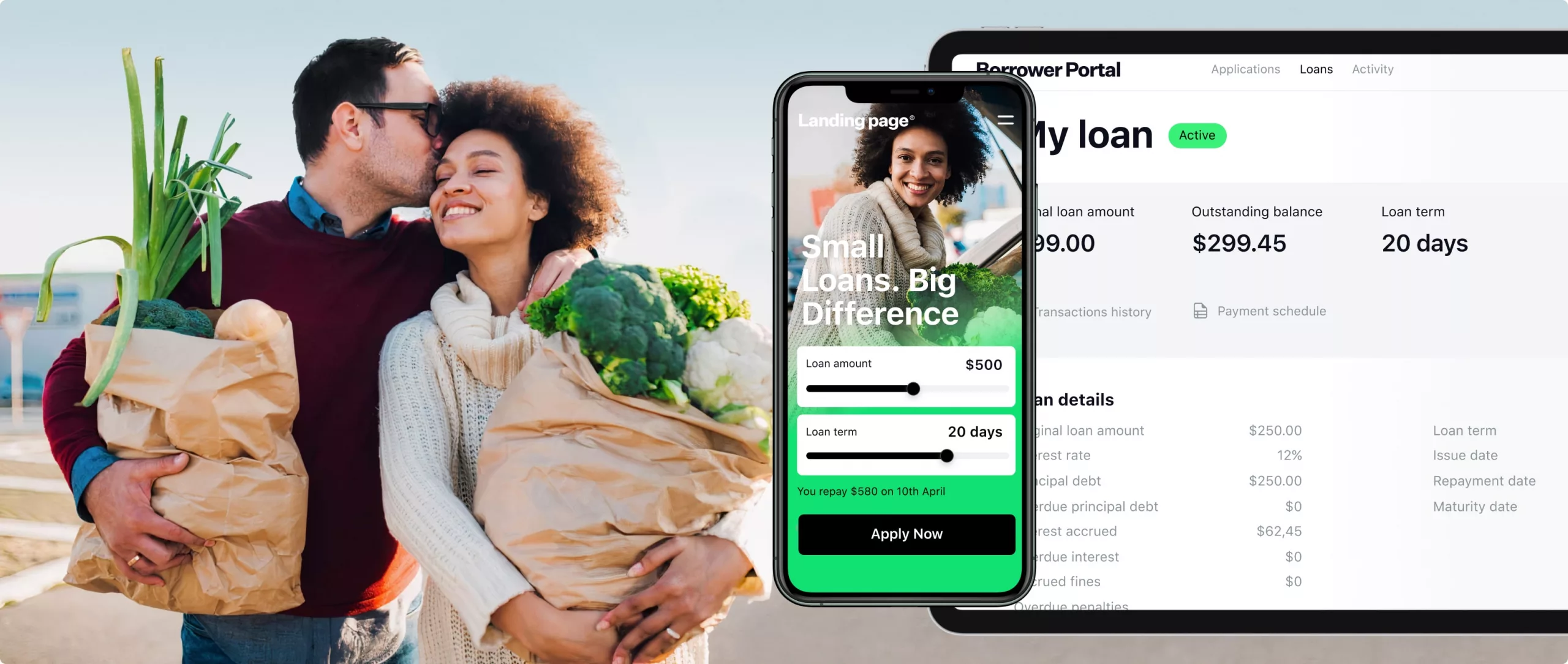

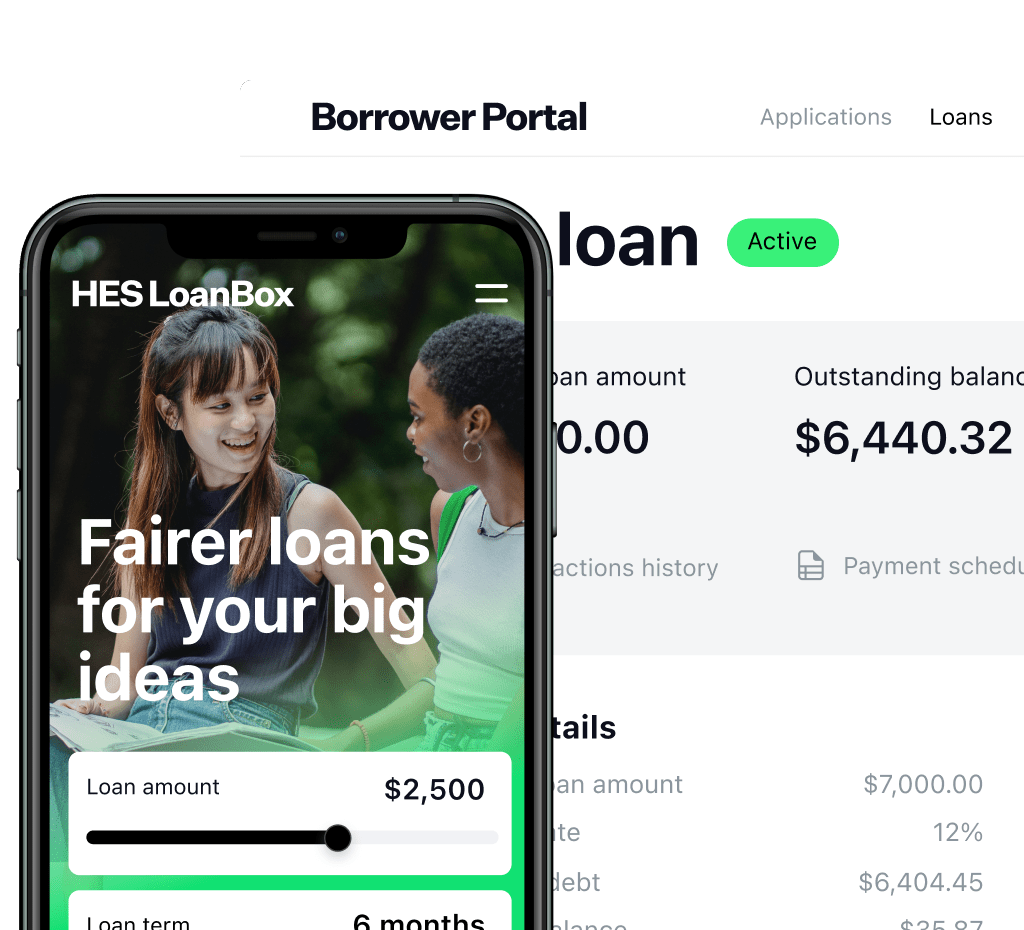

Landing Page

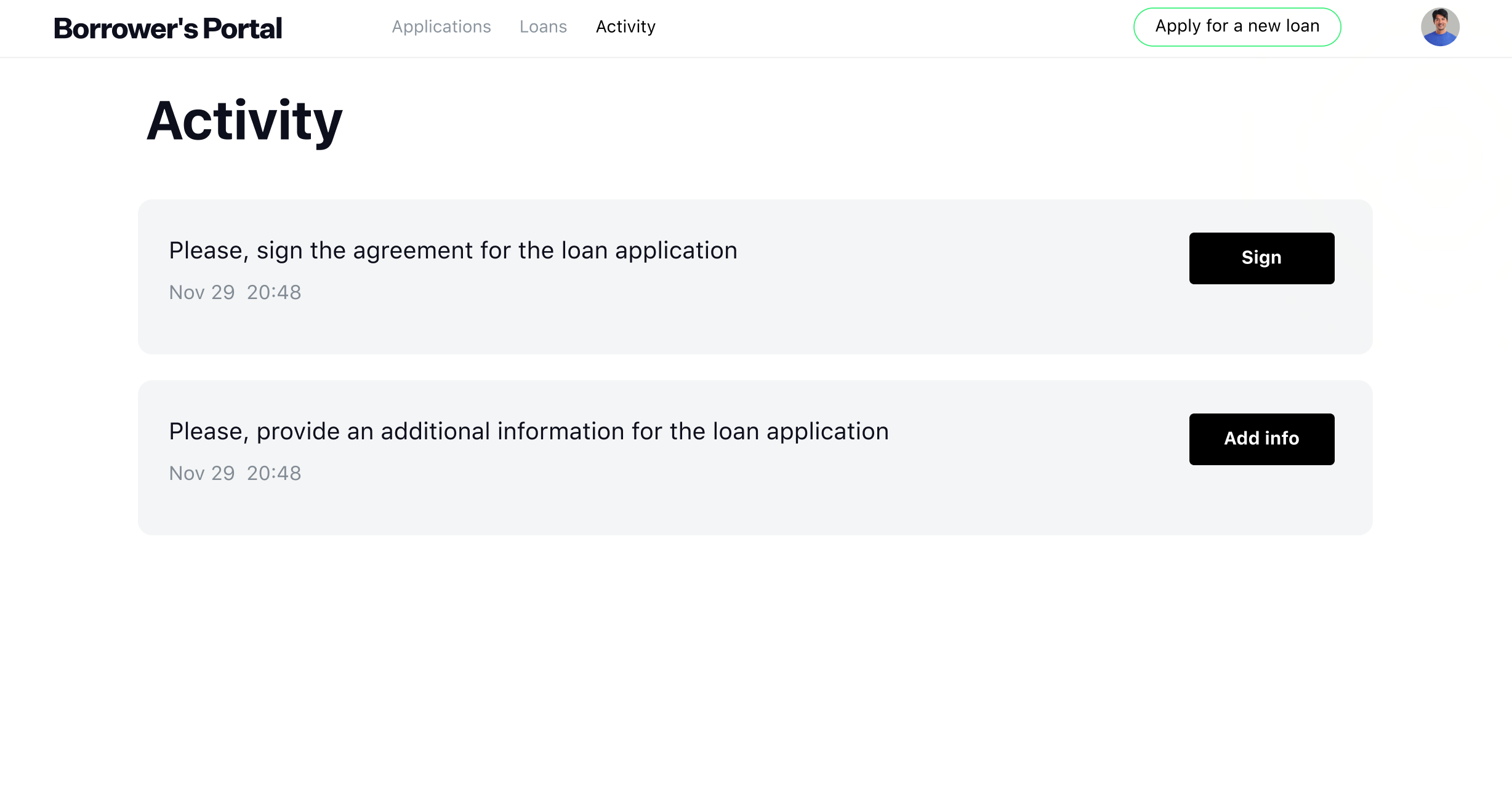

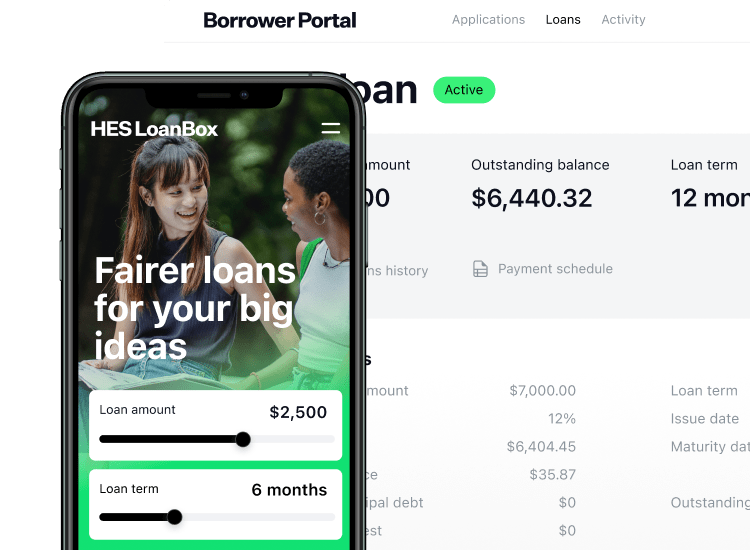

Borrower Portal

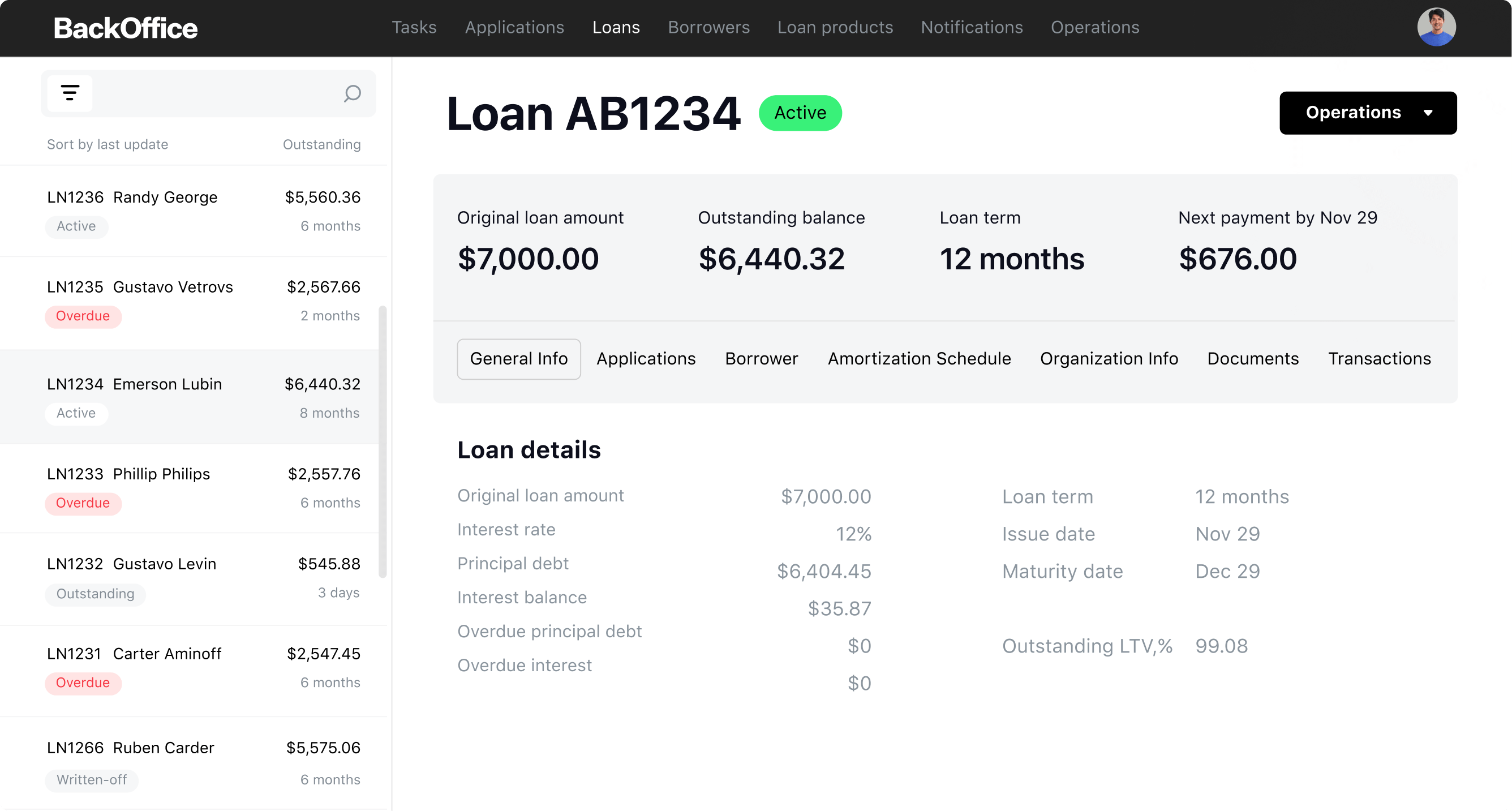

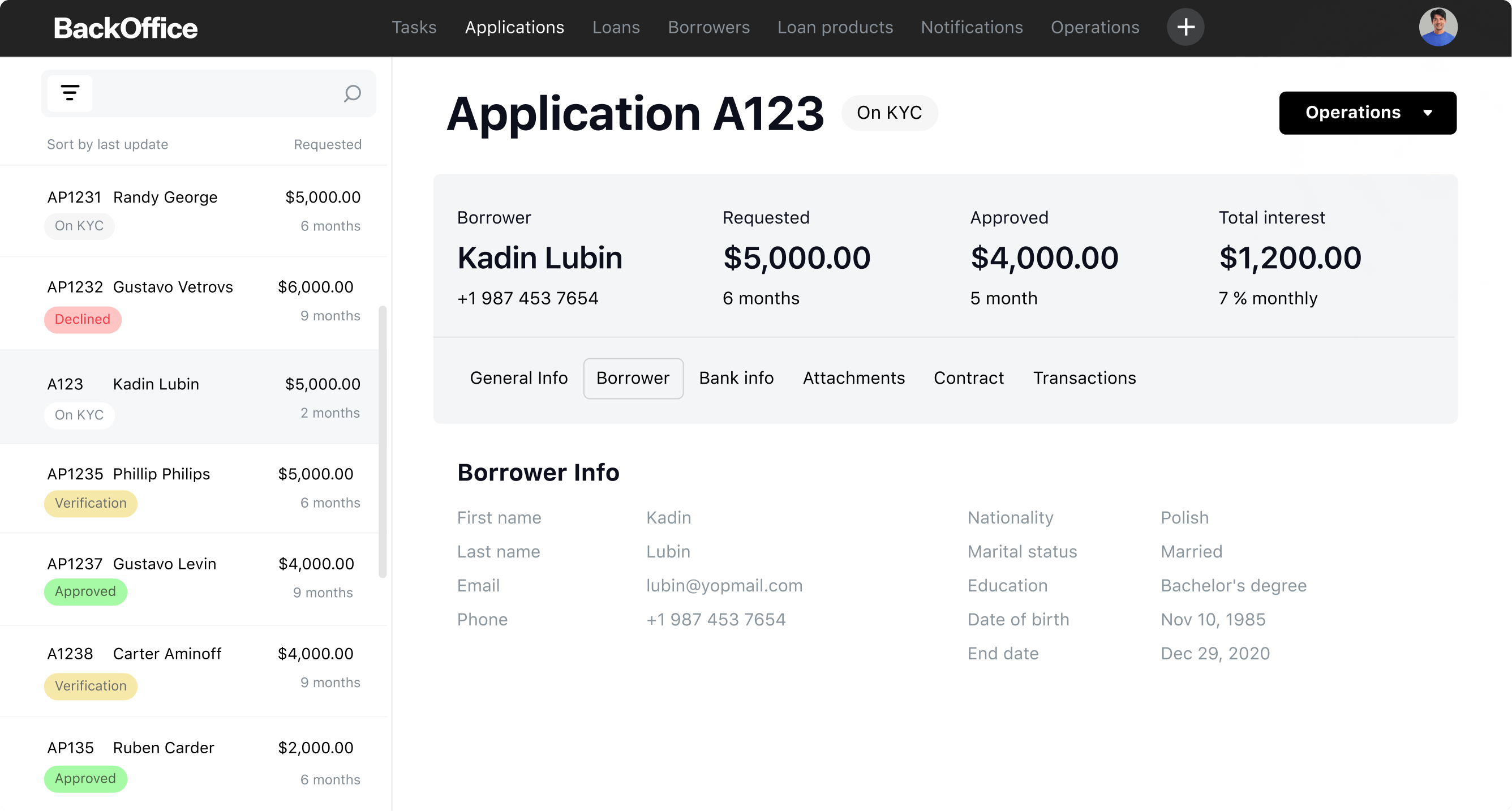

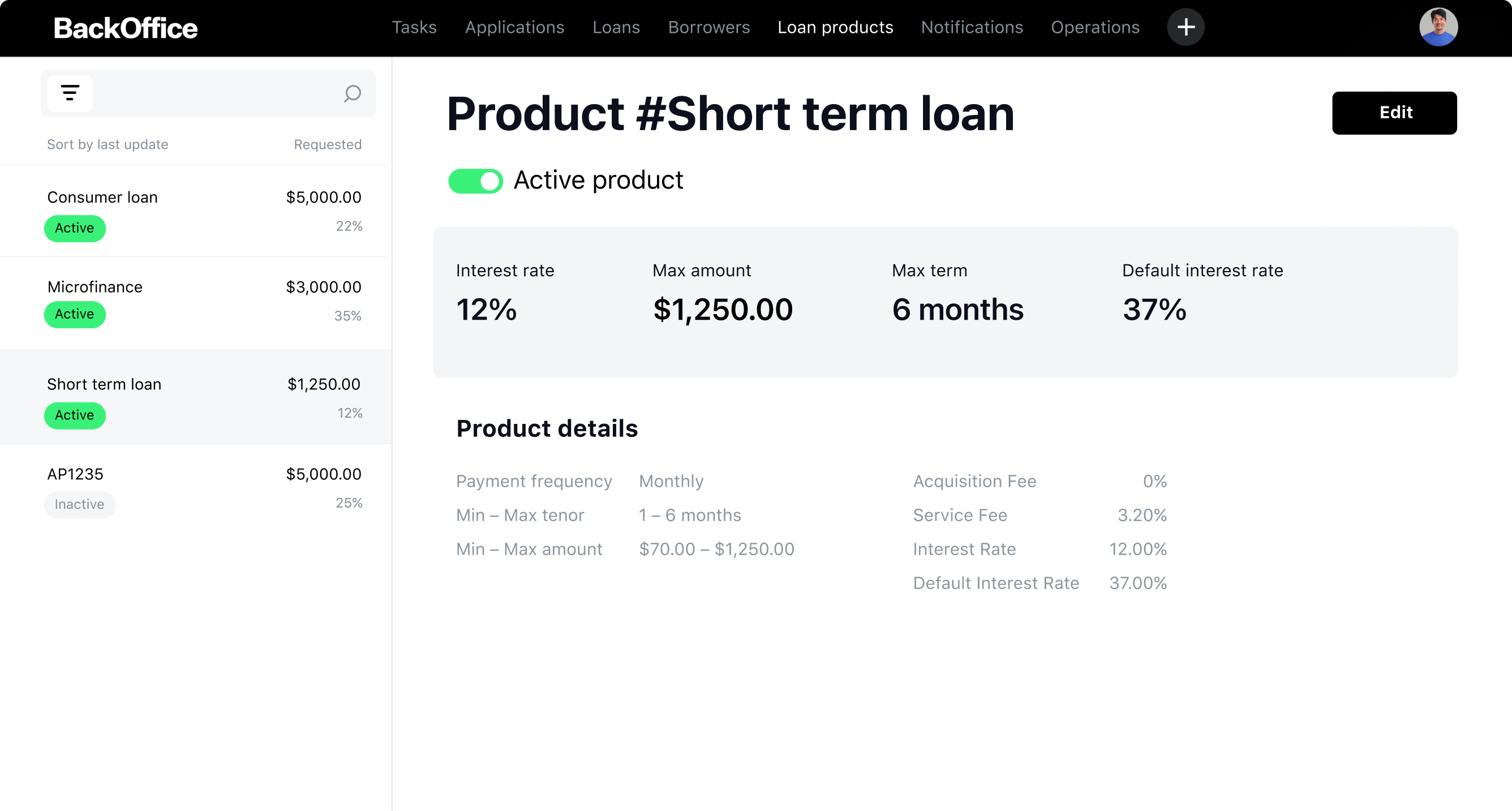

Back Office

Ready-made off-brand solution

Intuitive application flow

Easily scalable software

Fully automated PayDay lending process

Integrations with 3rd-party services

Omnichannel approach

Let your clients apply for a PayDay using any device. HES

online PayDay lending software allows users to start the application process on the desktop and

switch to a mobile device to upload document photos. The auto-save feature allows borrowers to

continue filling out the request form when convenient.

online PayDay lending software allows users to start the application process on the desktop and

switch to a mobile device to upload document photos. The auto-save feature allows borrowers to

continue filling out the request form when convenient.

Borrower profile

Your clients can save and update personal information in Pay Day loan software. It can be used

for an auto-fill when they apply for a new loan, speeding up the process and increasing

conversions. Stored data is protected by KeyCloak technologies.

for an auto-fill when they apply for a new loan, speeding up the process and increasing

conversions. Stored data is protected by KeyCloak technologies.

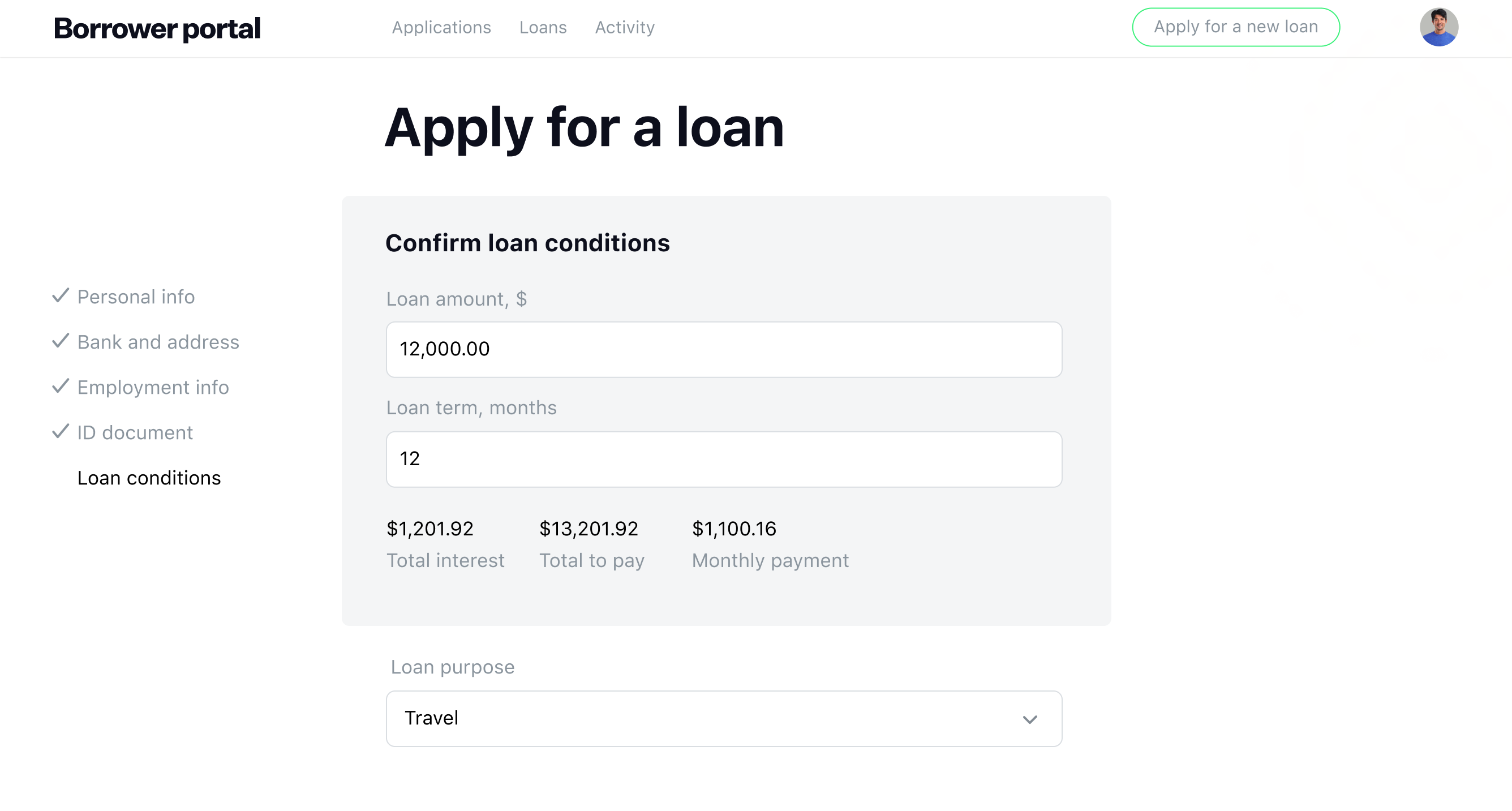

Loan calculator

HES PayDay loans software includes a loan calculator to analyze how

repayments change depending on loan amounts, terms, and payment frequency. Based on this

information, the platform suggests the most suitable loan product.

repayments change depending on loan amounts, terms, and payment frequency. Based on this

information, the platform suggests the most suitable loan product.

Upscale PayDay loan solution

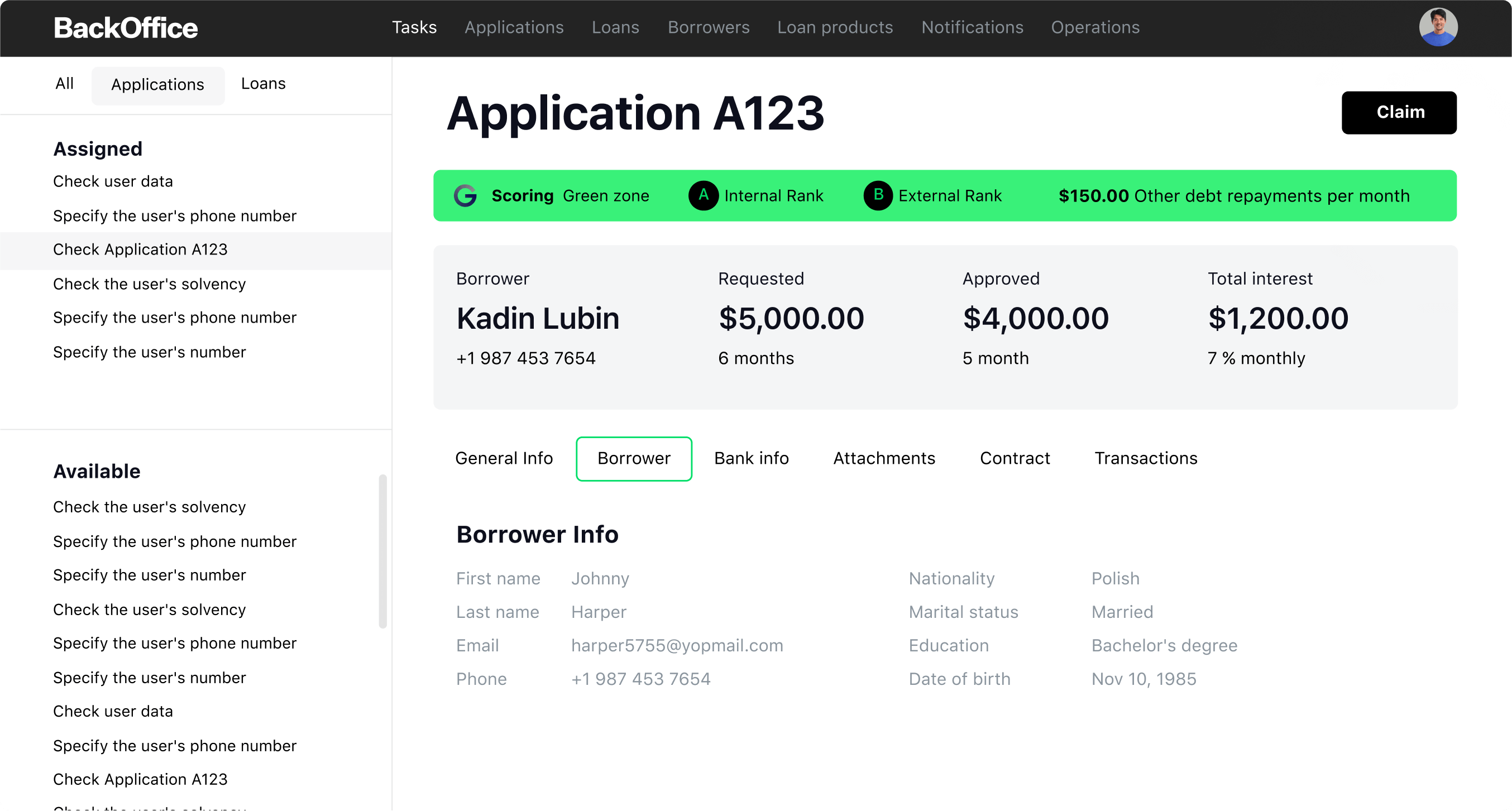

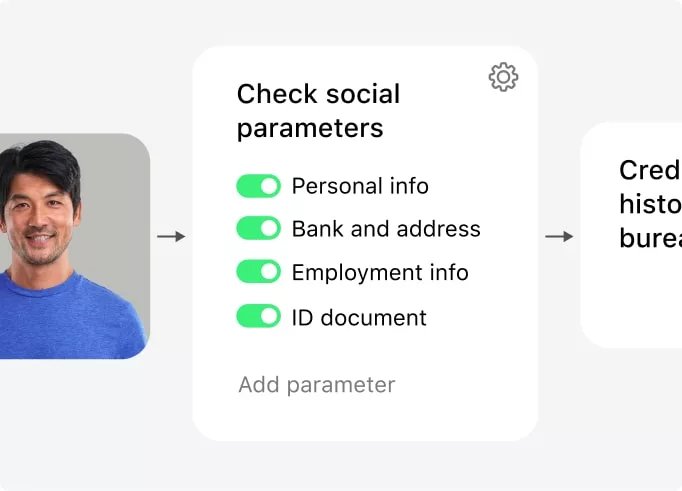

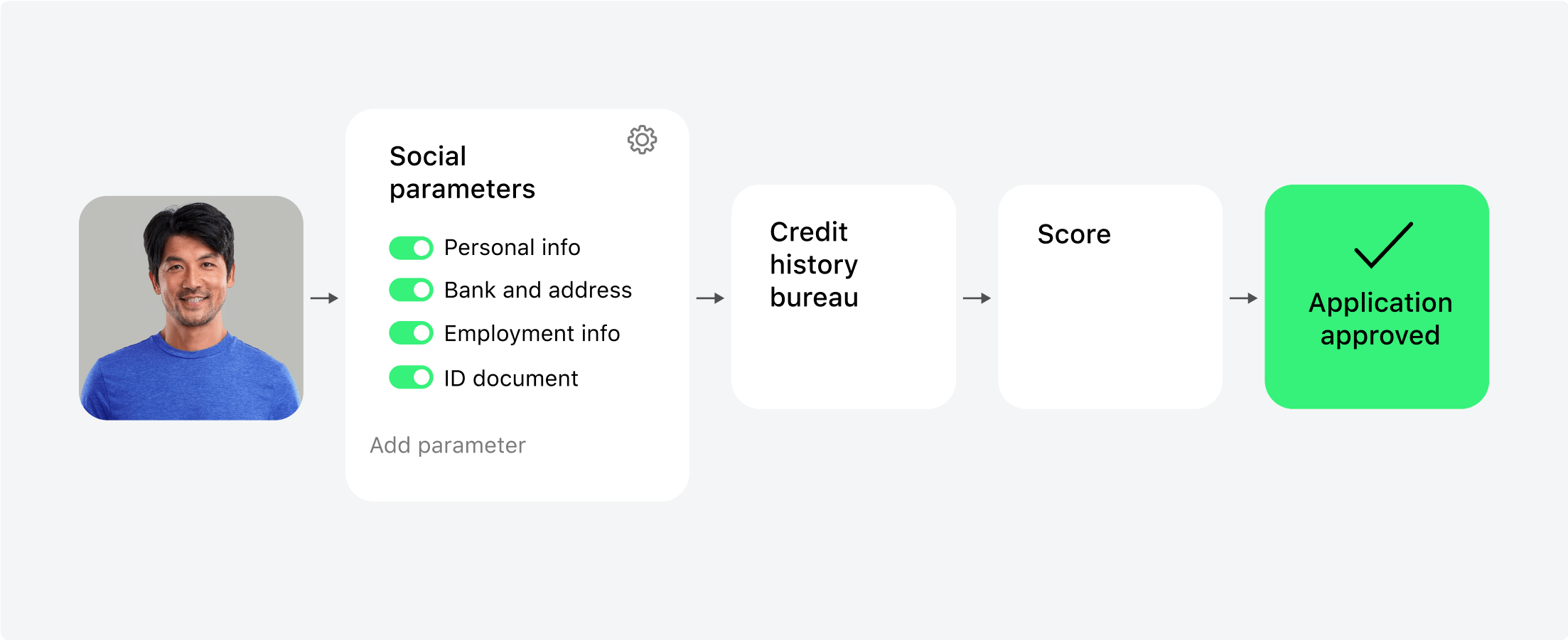

Automated decision-making

HES software for PayDay loan businesses allows setting up the necessary

automation level. Define the degree of employee involvement in loan approval flow.

automation level. Define the degree of employee involvement in loan approval flow.

and much more

Loan application management

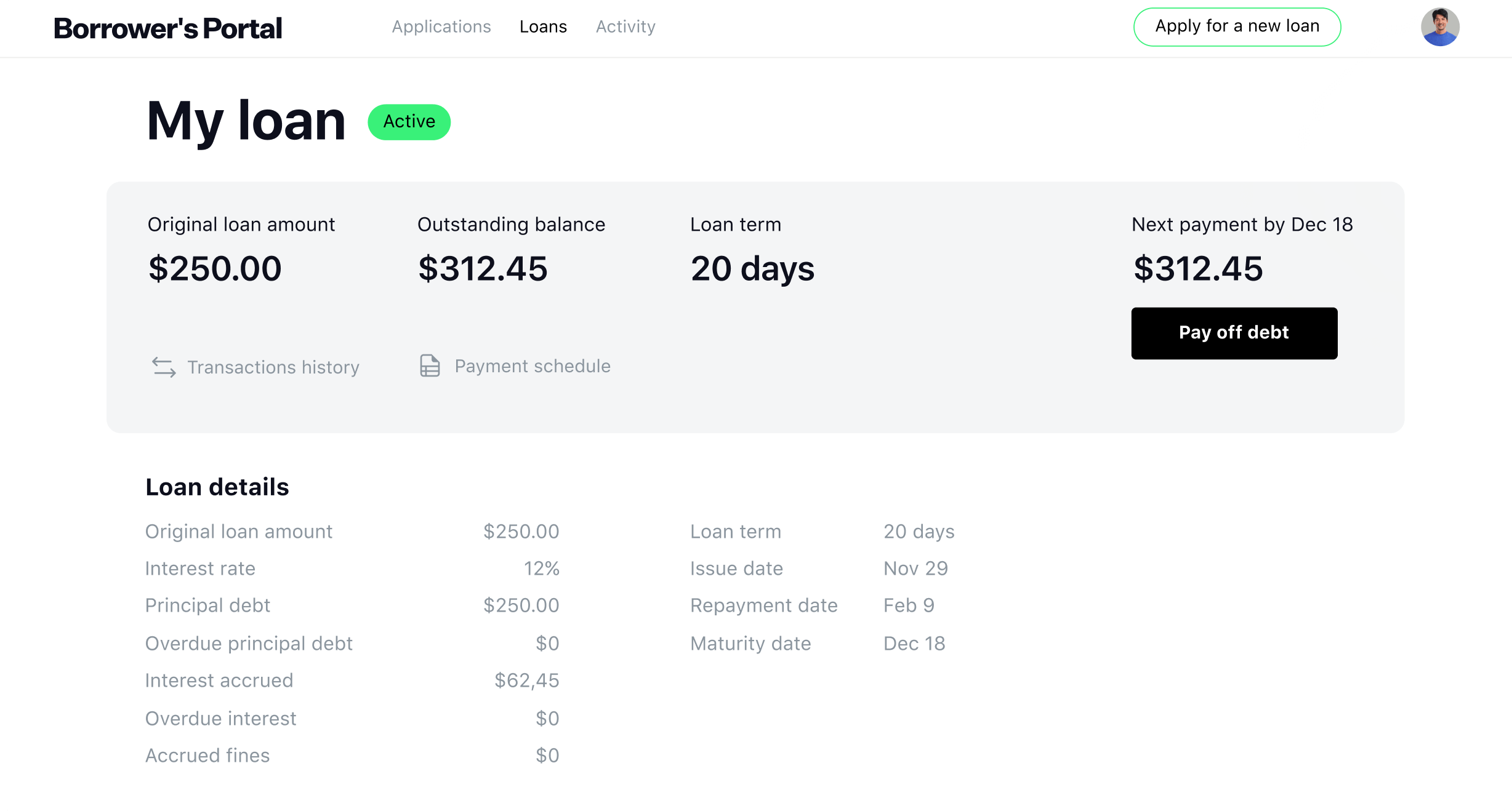

Loan management

Document templates

Automation of disbursements and payments

Transactions and reporting

Empower with high-tech integrations

Book a live demo tour to explore financial services powered by HES

Smart software

for PayDay lending

Scalable end-to-end lending solution

3 months time-to-market

A few seconds for a loan decision

No additional charges per customer

FAQ

Is HES PayDay loan software easy to learn?

Does HES FinTech provide customer support?

Can the PayDay loan solution be integrated with other services?

How much does online payday loan software cost?