Our software is designed to deliver a range of benefits to your business. Streamline your loan management process and improve your bottom line:

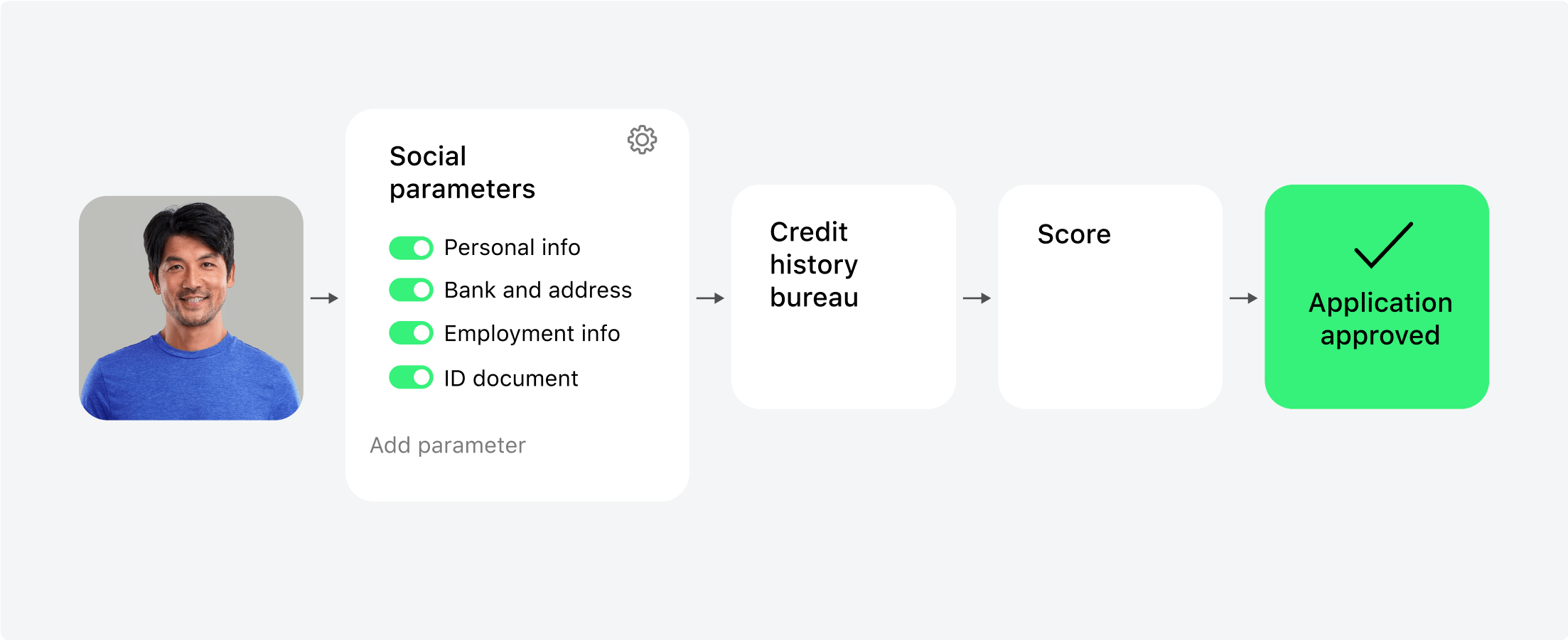

- Reduce loan application processing time by 30%

- Accelerate data entry by 42%

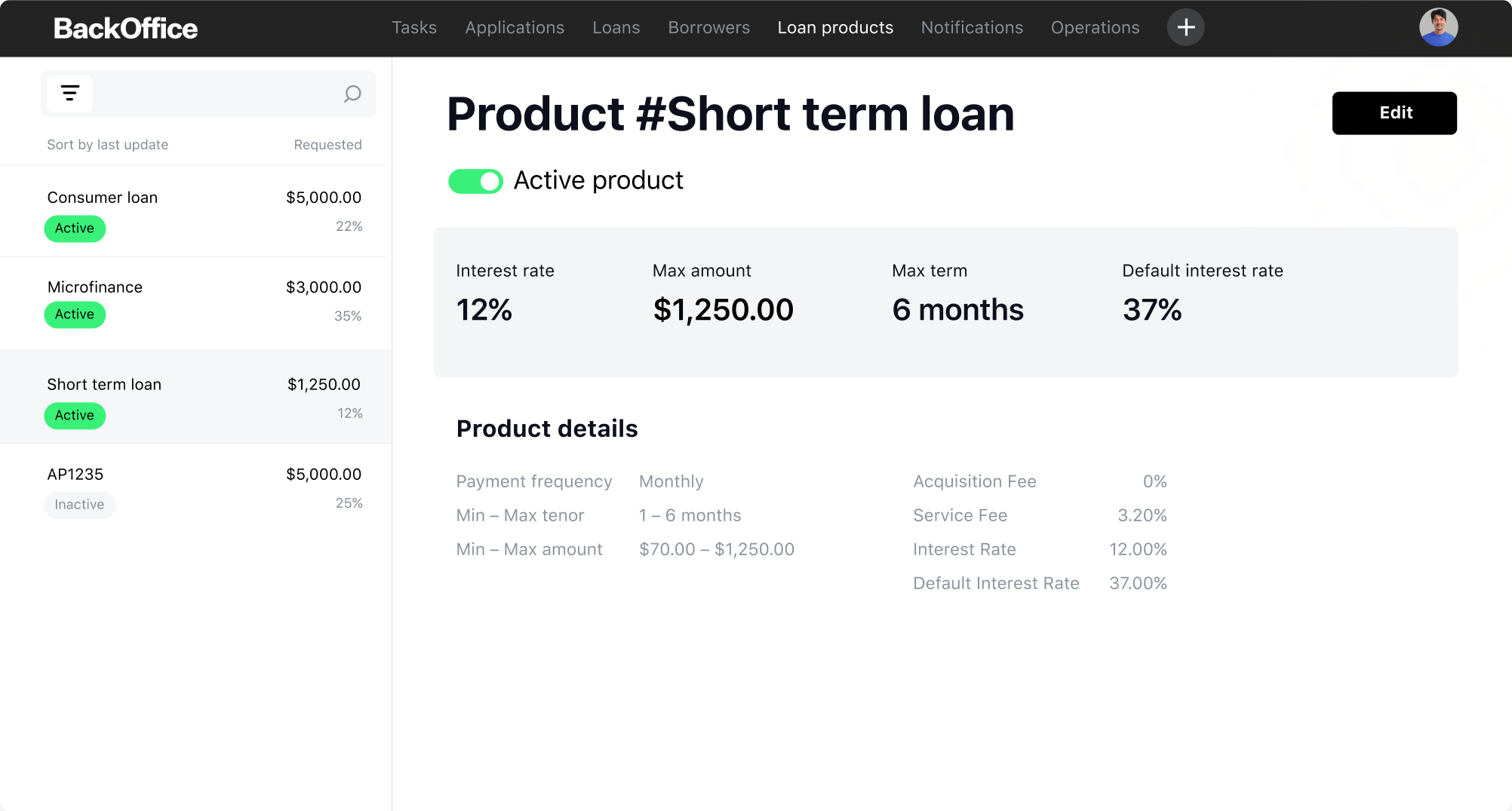

- Lower your business operating costs by 38%

- Optimize the loan application cutoff rate

- Dramatically reduce NPLs by eliminating biases and human mistakes

- Enhance communication among loan officers

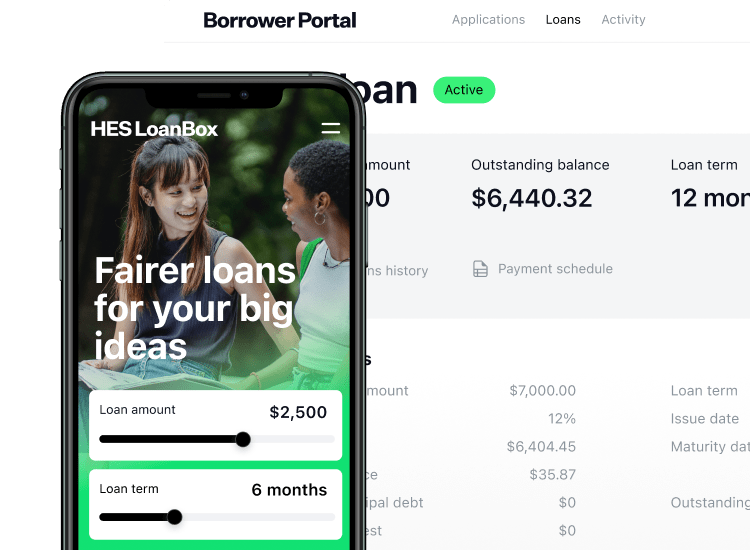

If you’re ready to take your loan management process to the next level, try HES FinTech’s cloud-based loan management system today.