Equip your lending business with the scalable

digital loan origination system

Rapid launch 3 months

Lifelong customer support

Automated decision-making

Pre-built integrations

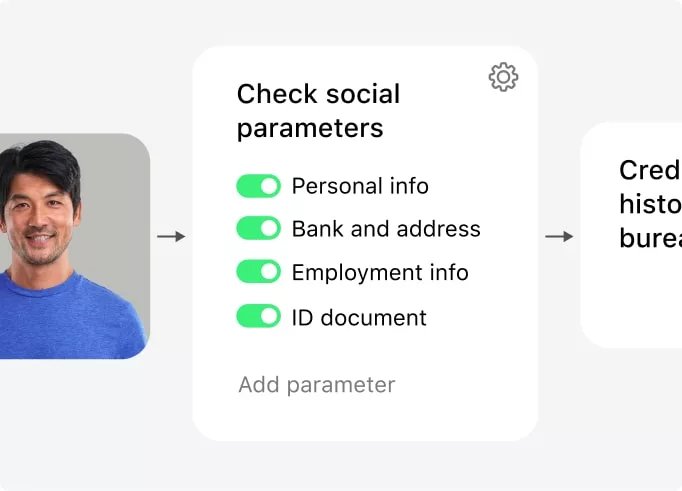

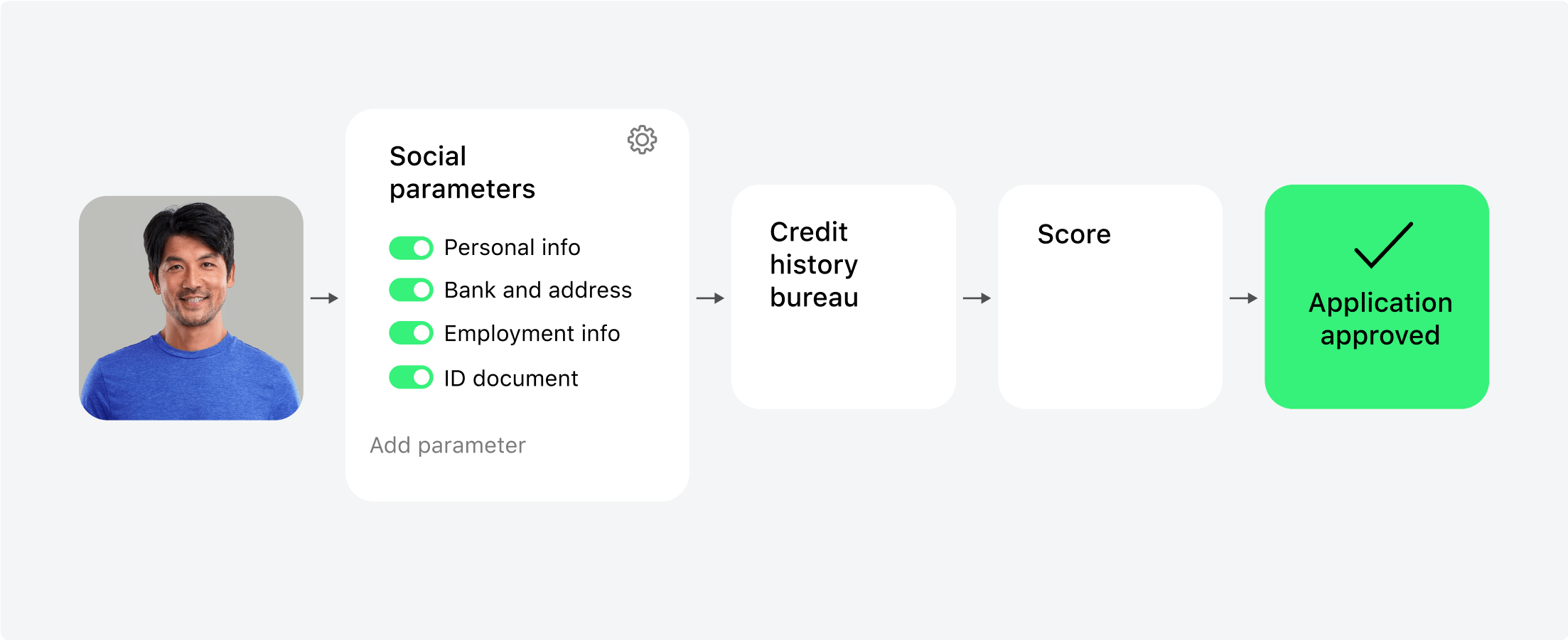

Precise decisions with loan origination system

Eliminate human mistakes. With HES FinTech, you can rely on automated

credit origination powered by KYC integrations, AI-based credit scoring, and granular

data

access to minimize errors and data breaches.

credit origination powered by KYC integrations, AI-based credit scoring, and granular

data

access to minimize errors and data breaches.

Automated loan origination

software for clients

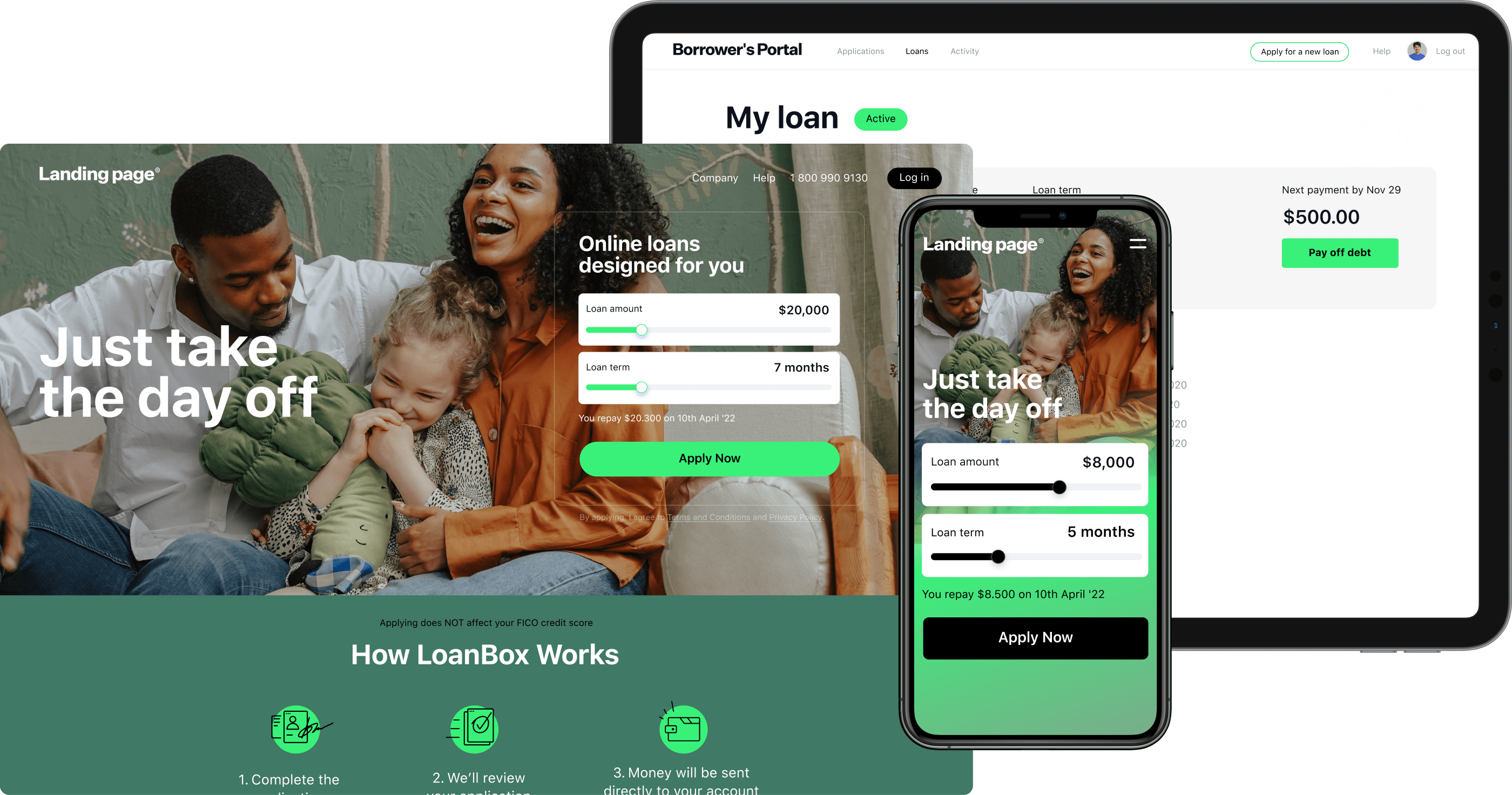

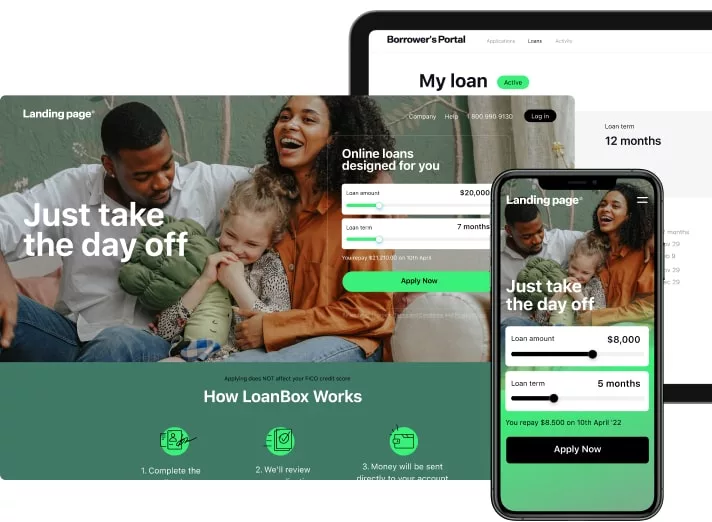

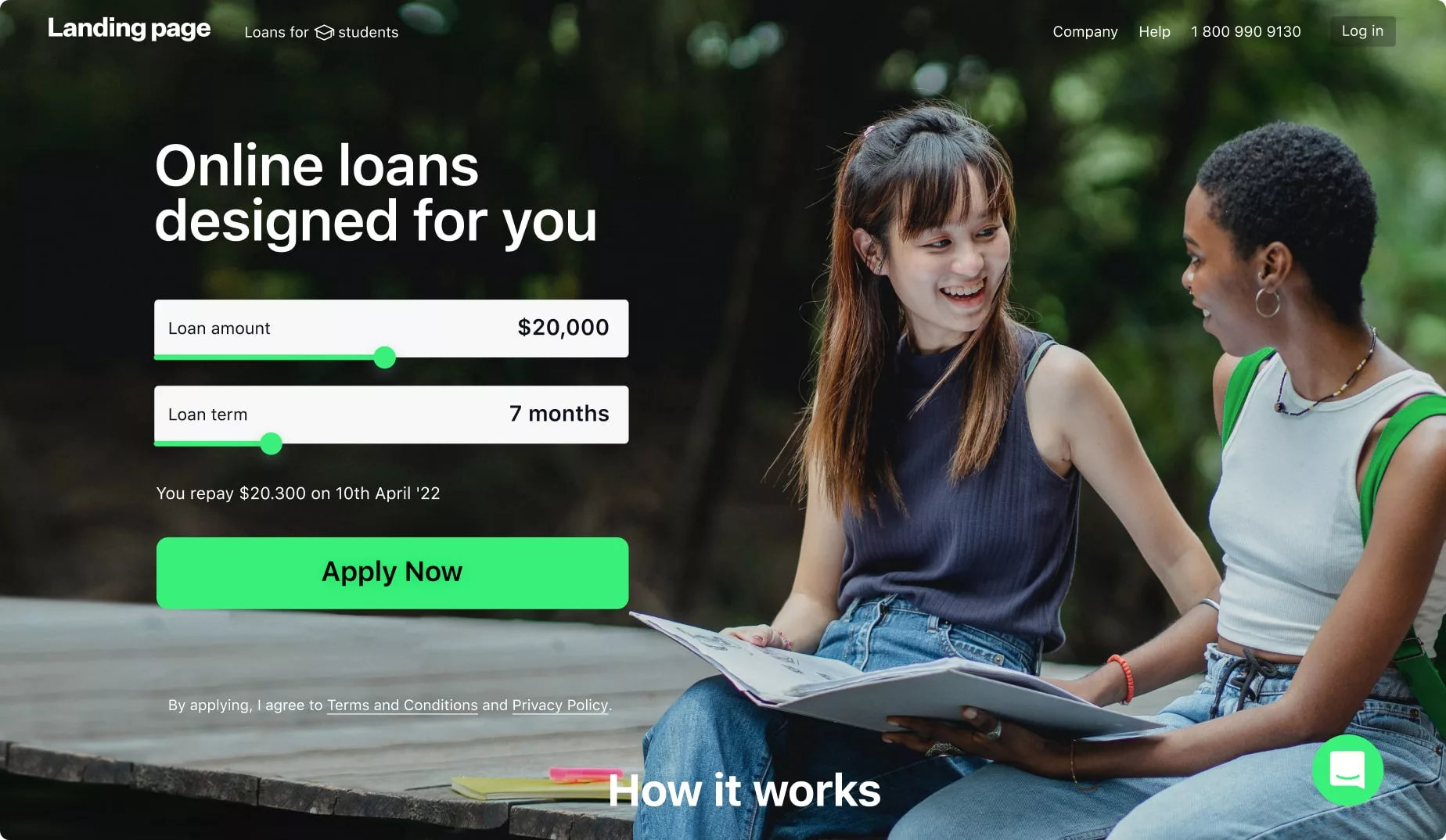

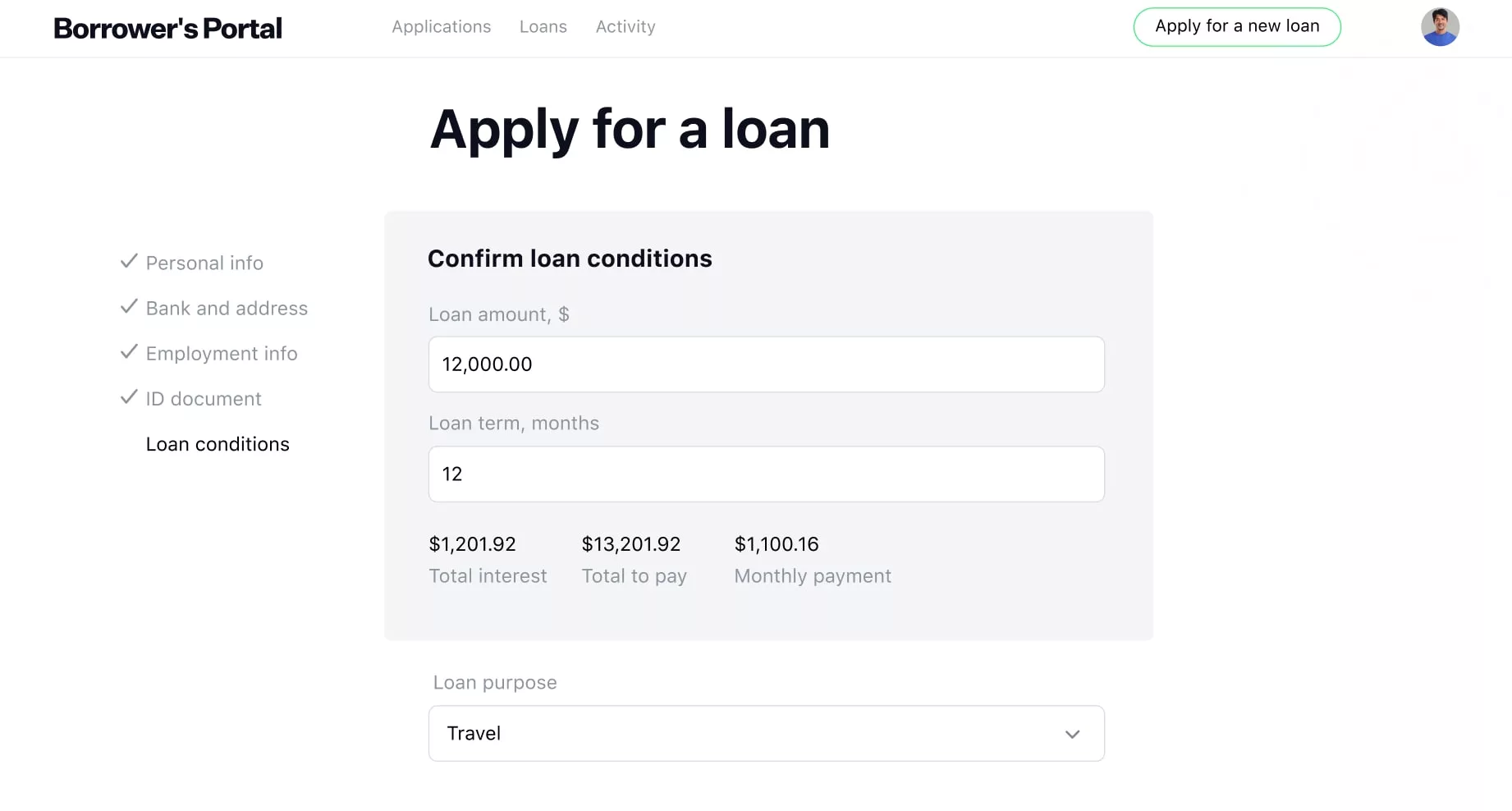

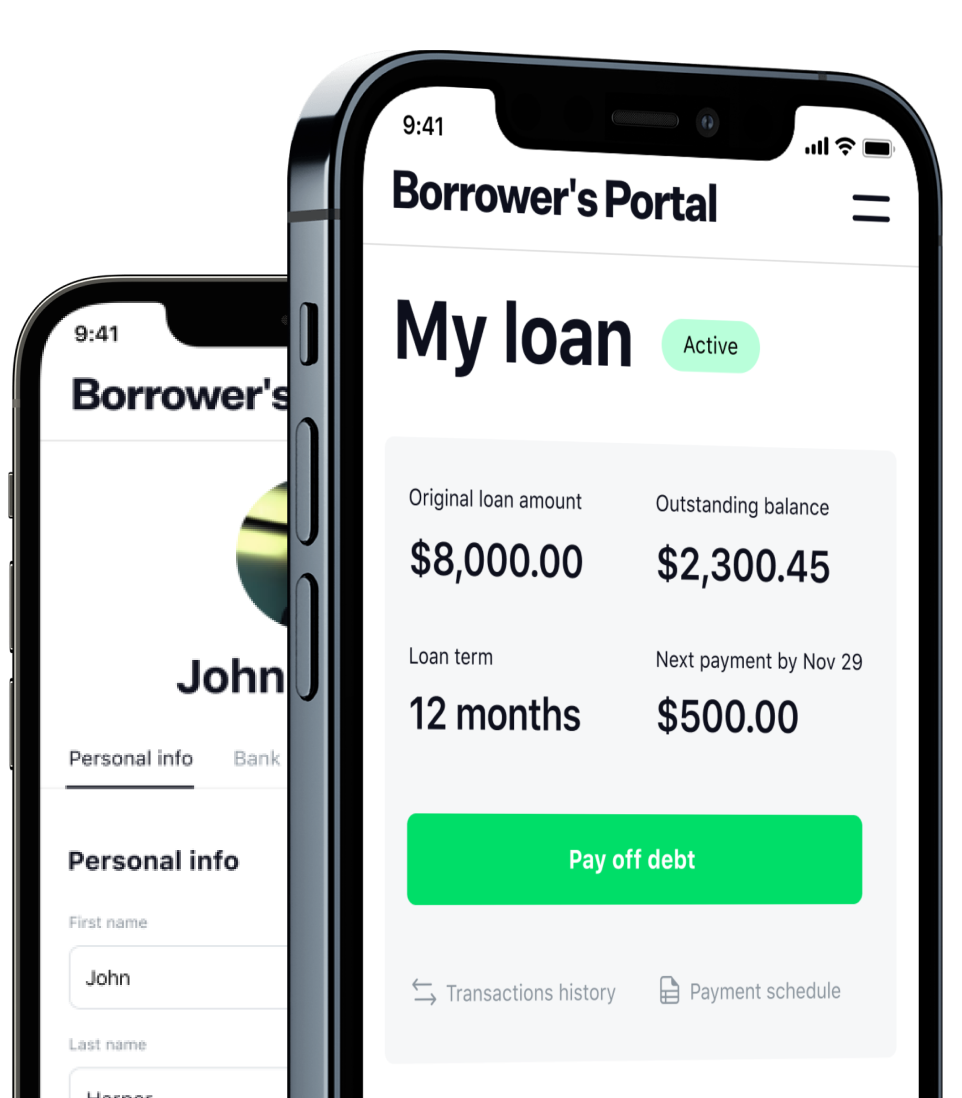

HES loan processing software has a landing page with a built-in loan calculator. Users can

play with different loan amounts, terms, and payment schedules to select the right option.

play with different loan amounts, terms, and payment schedules to select the right option.

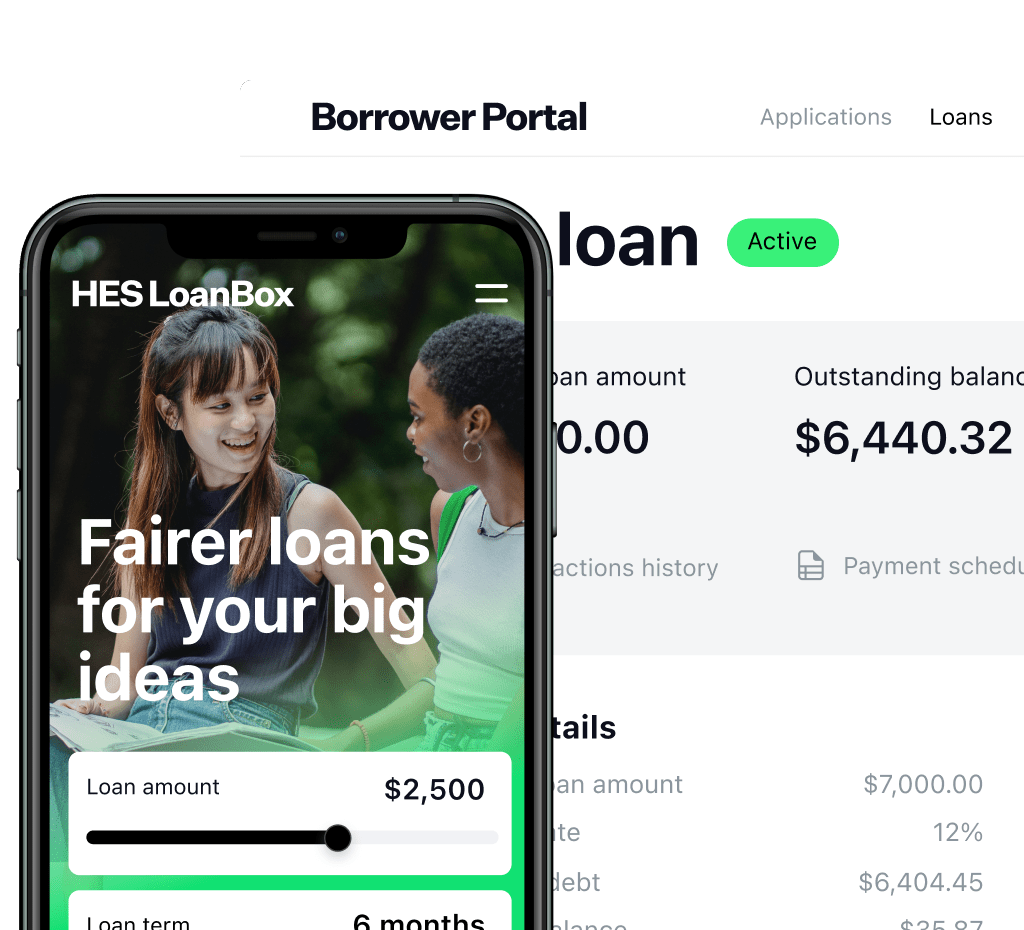

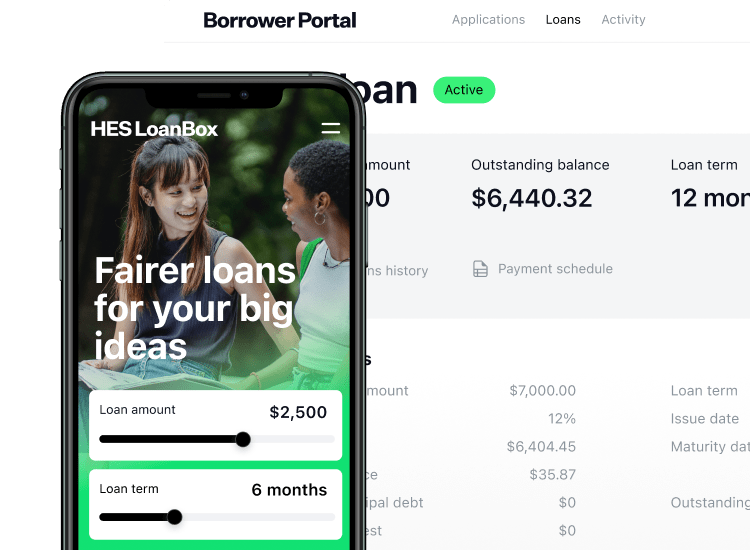

Borrower profile

Borrowers having access to updated personal information speeds up loan application process.

Loan origination solution helps to track outstanding balance and the state of the request.

Loan origination solution helps to track outstanding balance and the state of the request.

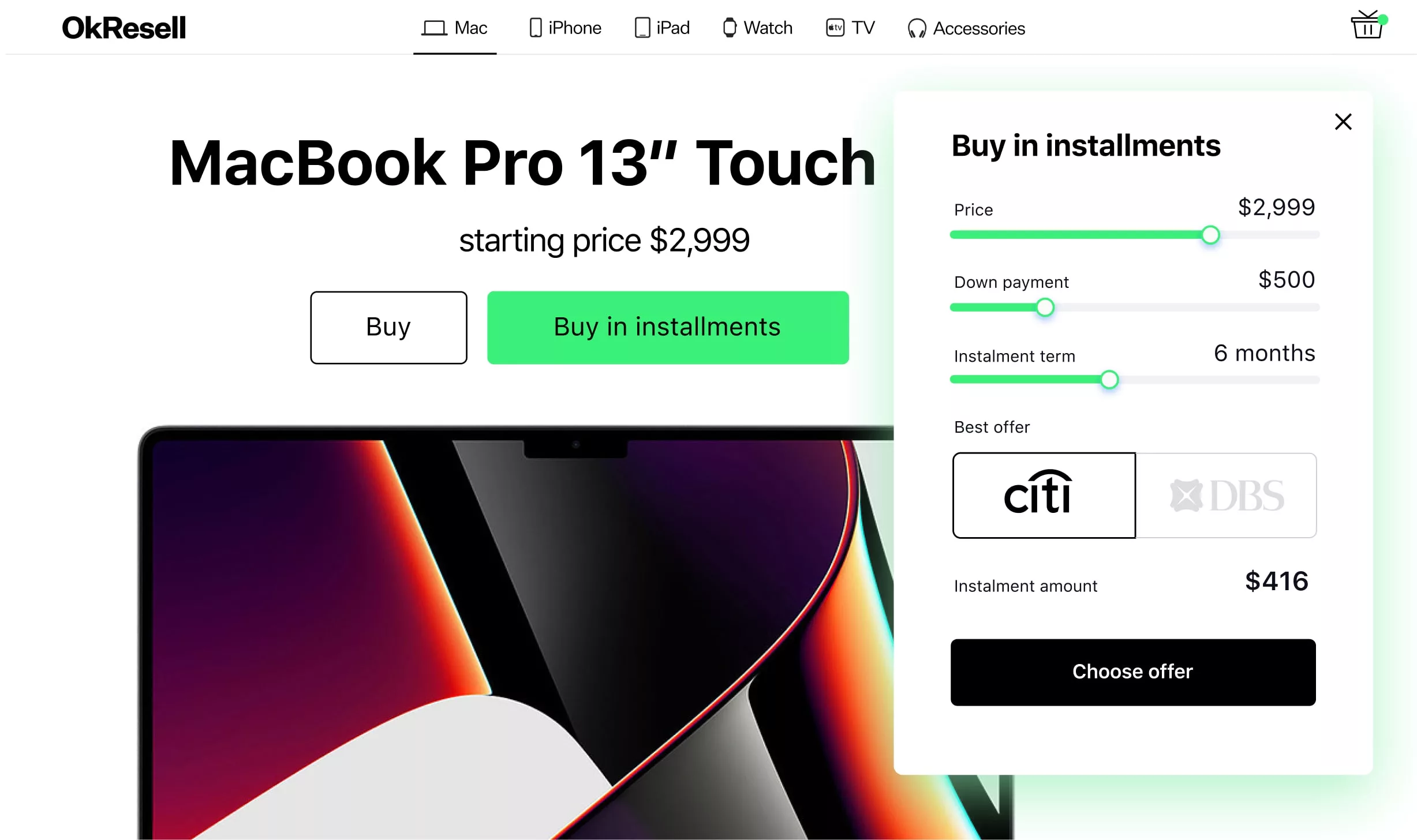

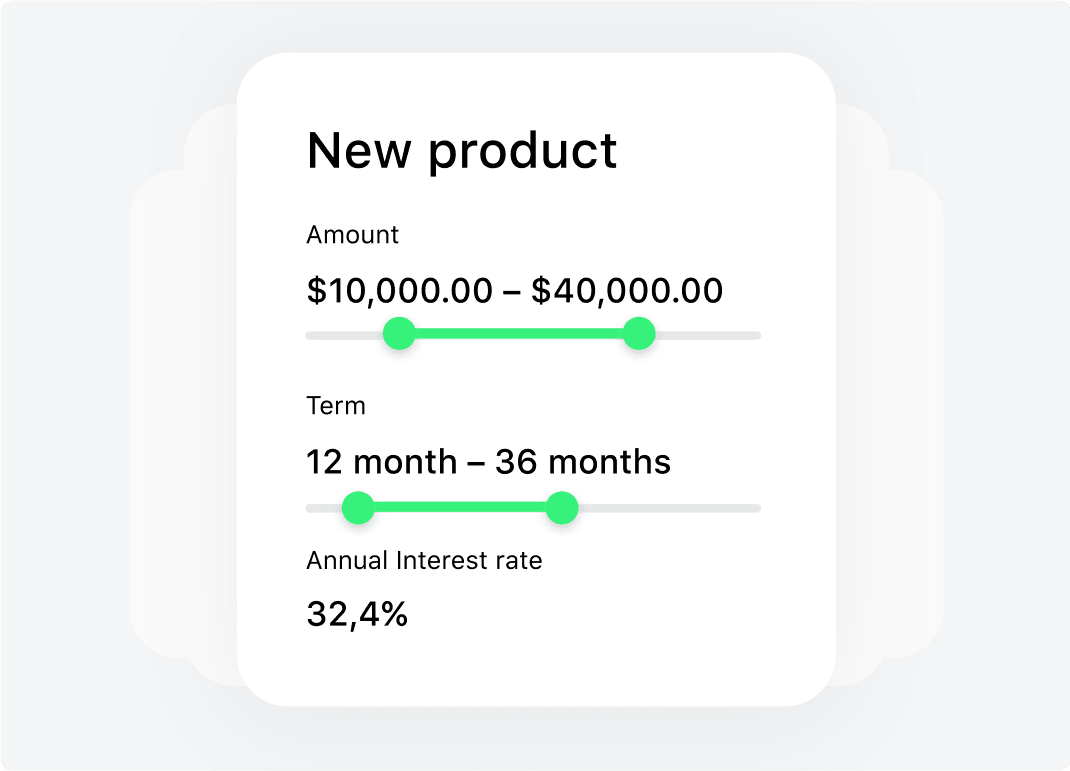

Configure flexible lending products

The loan origination technology allows several calculation types and

features a powerful product engine to build loan products and product groups. This way

borrowers get flexible and versatile offers, while you benefit from easy process

orchestration.

features a powerful product engine to build loan products and product groups. This way

borrowers get flexible and versatile offers, while you benefit from easy process

orchestration.

Easy loan process system integrations

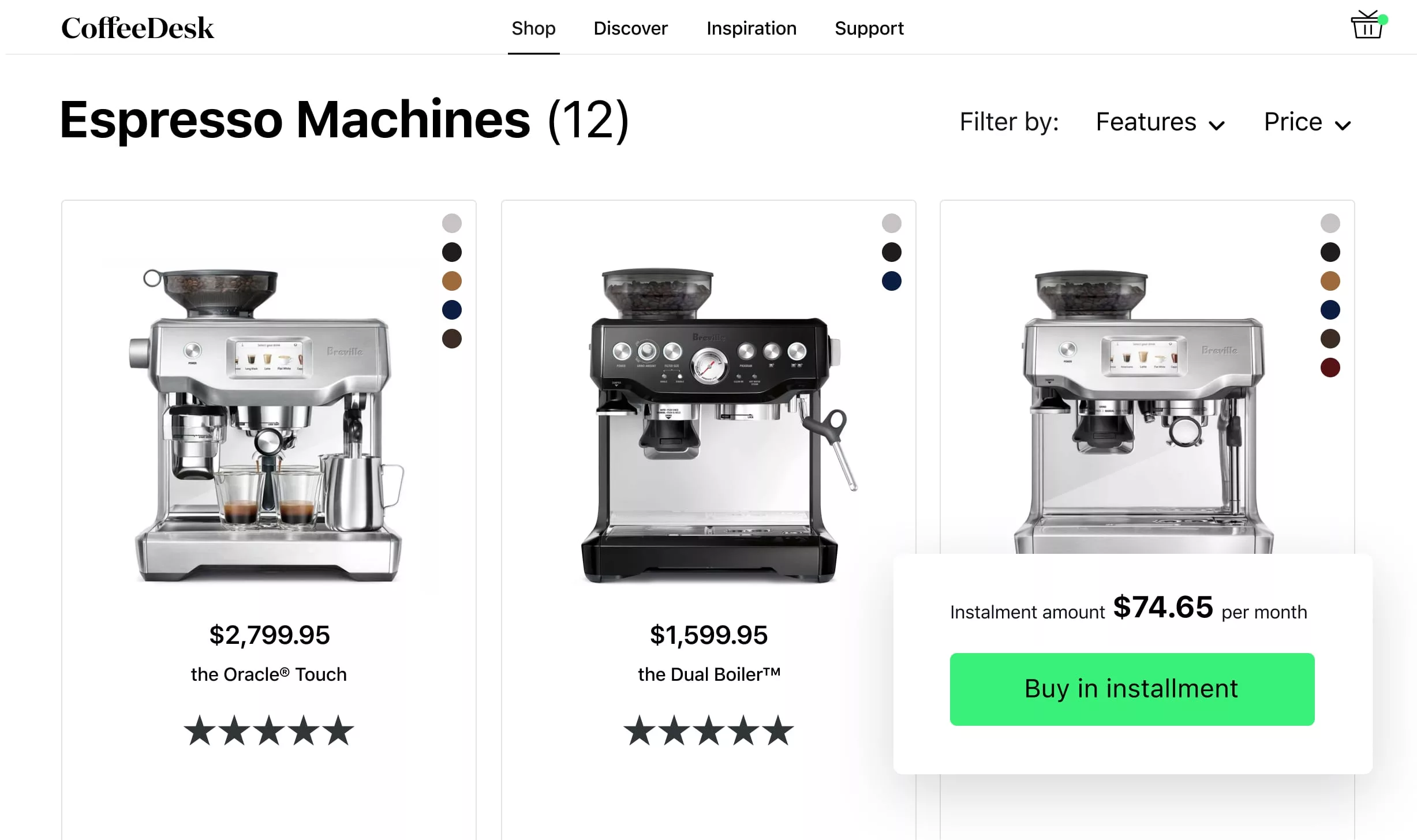

Automated loan processing software for any lending type

HES FinTech digital lending system is designed to fit

alternative

lenders, credit unions, brokers, and even banks.

alternative

lenders, credit unions, brokers, and even banks.

Asset-based financing

Installment

Revolving credit line

Merchant cash advance

Secured

Unsecured loans

PDL

HES FinTech is a leader in loan processing automation. We

develop intelligent loan origination platforms that adhere to enterprise-level security standards. GDPR compliance. ISO 27001 certified.

develop intelligent loan origination platforms that adhere to enterprise-level security standards. GDPR compliance. ISO 27001 certified.

Success stories

Credit origination solution

for your business

Turnkey loan origination platform

Ready-made LOS loan processing software is ready

for deploy and will be tailored to your needs just in 3 months

for deploy and will be tailored to your needs just in 3 months

Automated system

Provide end-to-end loan origination automation,

from the borrower’s application to the credit approval. Reduce manual tasks and improve performance

from the borrower’s application to the credit approval. Reduce manual tasks and improve performance

No additional charges per customer

HES provides fully managed loan operating software with no limits

on the number of users. Flexible pricing depends on the features you choose

on the number of users. Flexible pricing depends on the features you choose

AI loan operating system

Accelerate credit decisions with AI-driven loan

origination software. Evaluate applications instantly and reduce the risk of NPLs

origination software. Evaluate applications instantly and reduce the risk of NPLs