Explore HES LoanBox features

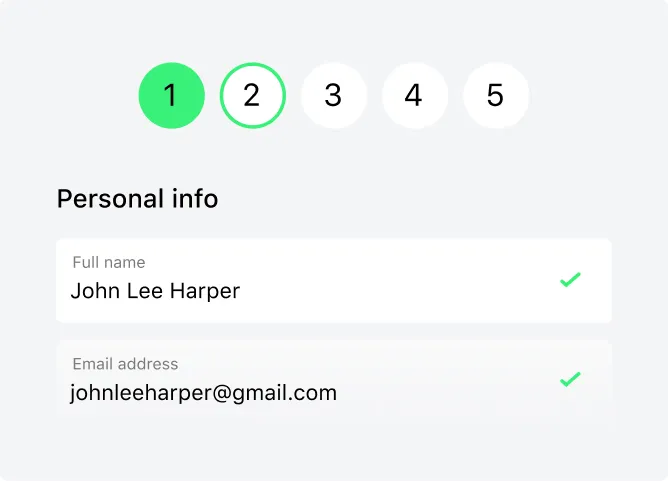

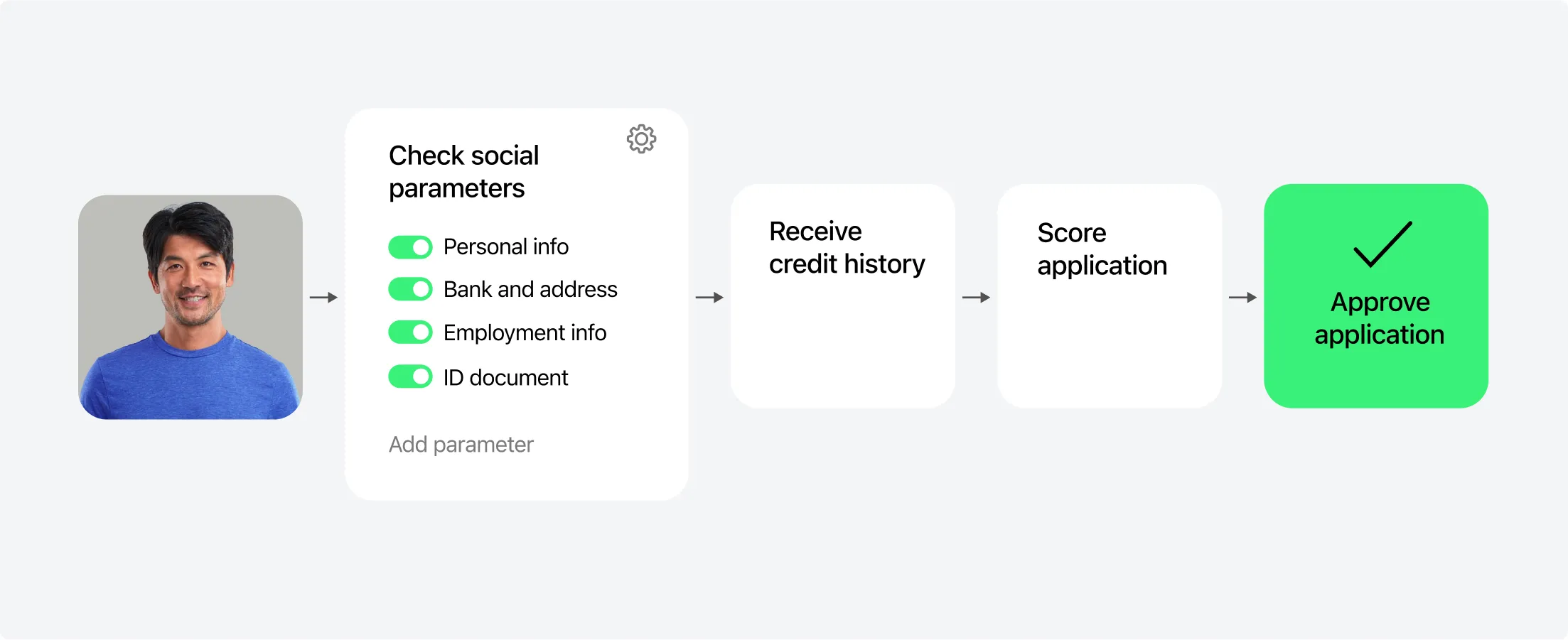

Loan origination

Streamline your loan initiation, ensuring a seamless and

personalized journey from start to

finish

personalized journey from start to

finish

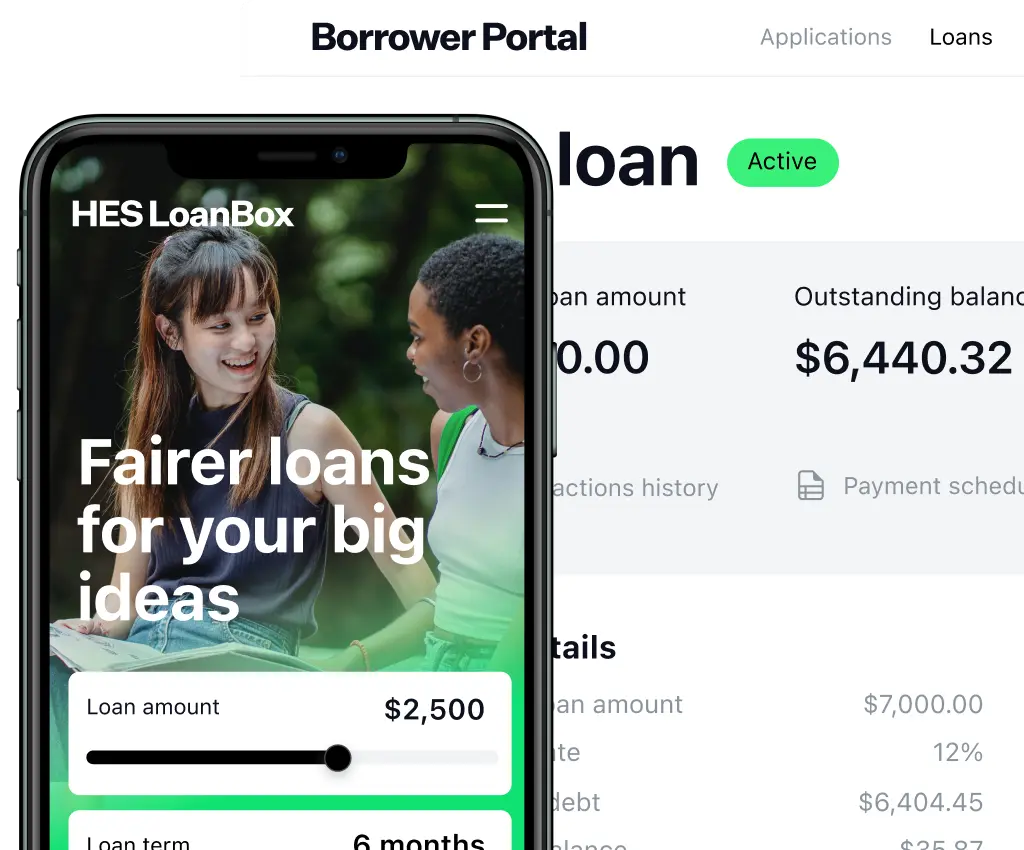

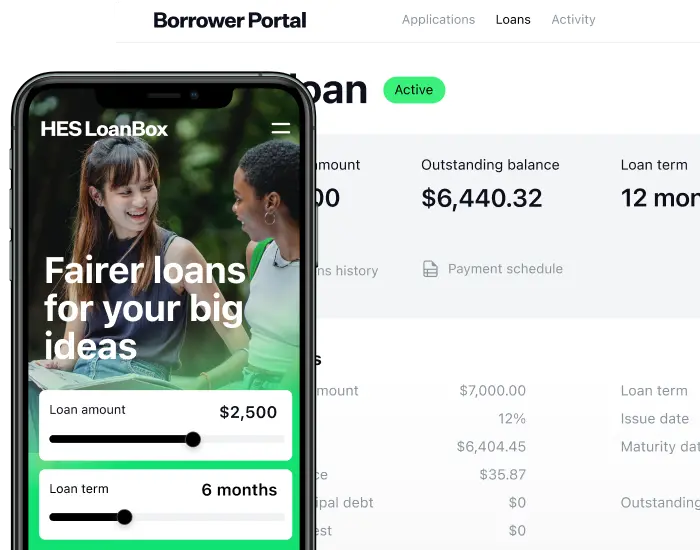

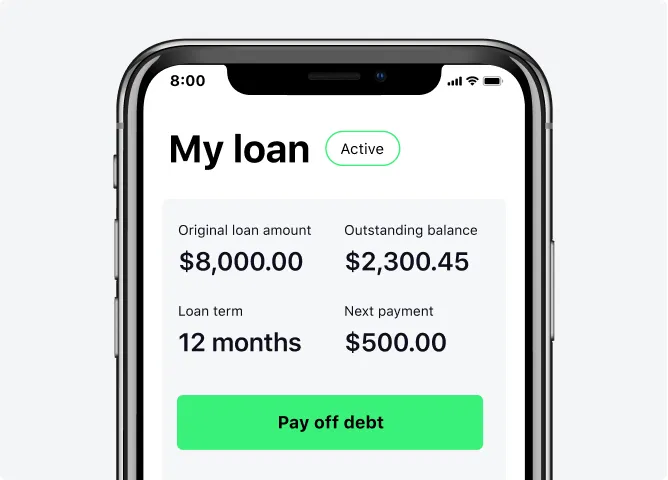

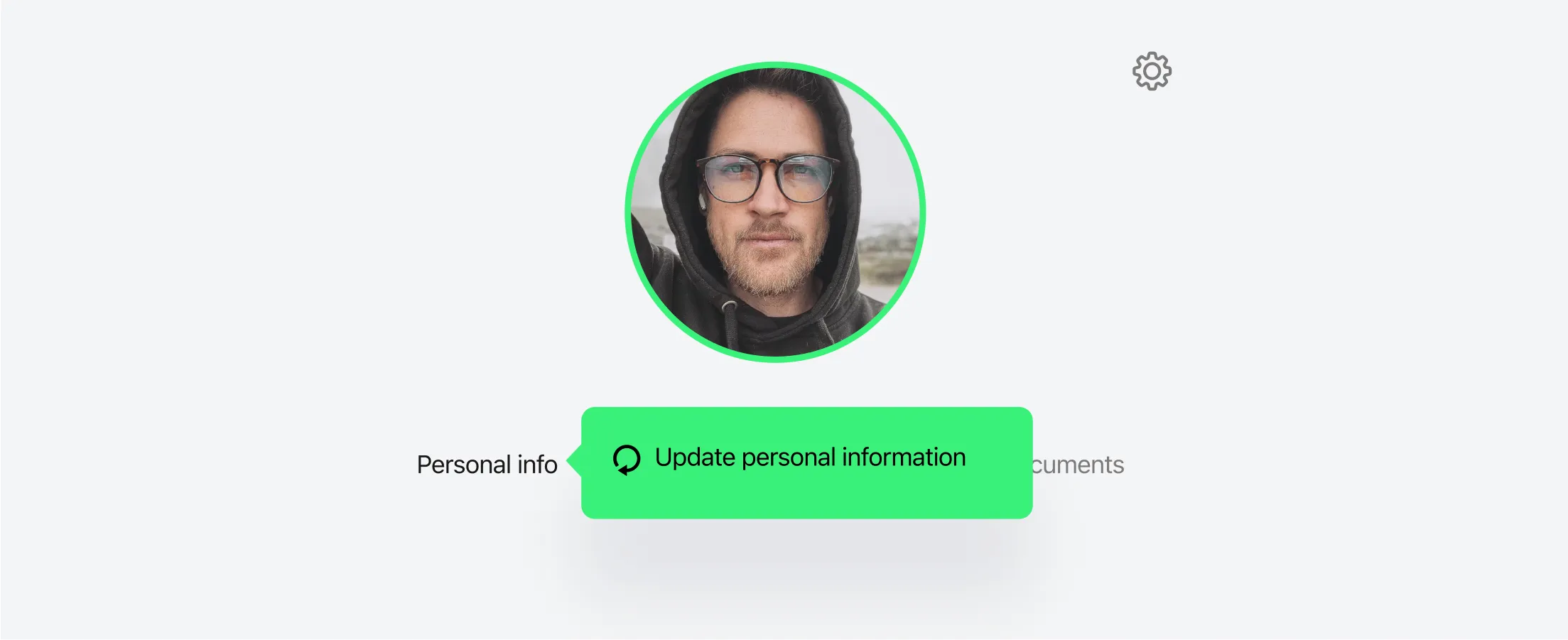

Borrower profile

Customers can apply for loans, monitor application statuses, and manage their loan details,

all in one place.

all in one place.

Loan management

Master your loan portfolio with a range of intuitive tools for

proactive decision-making

proactive decision-making

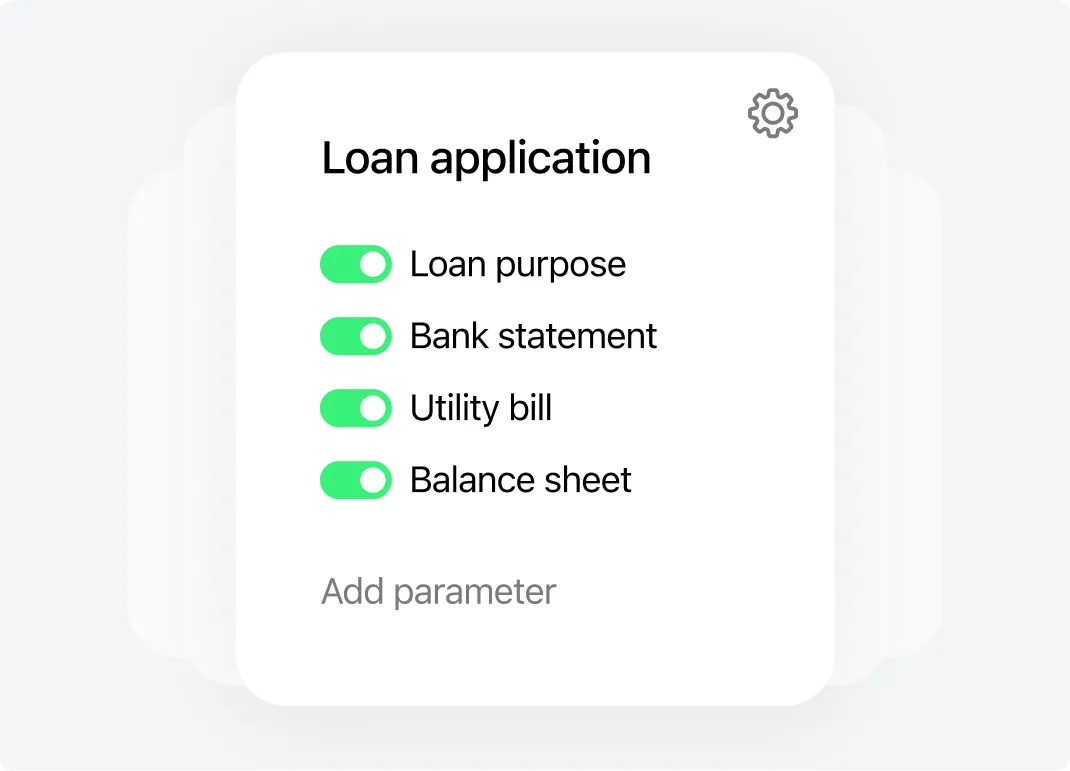

Custom workflow rules

Set custom rules and apply them to the entire system with a single click. Modify multiple

workflows using Open API and Camunda for full control over the lending process.

workflows using Open API and Camunda for full control over the lending process.

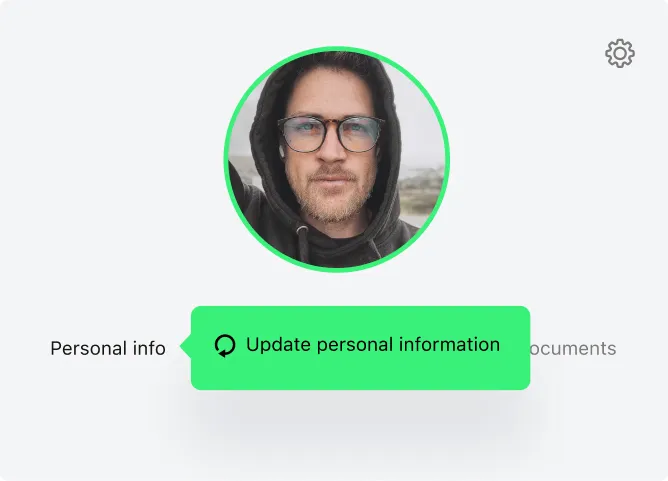

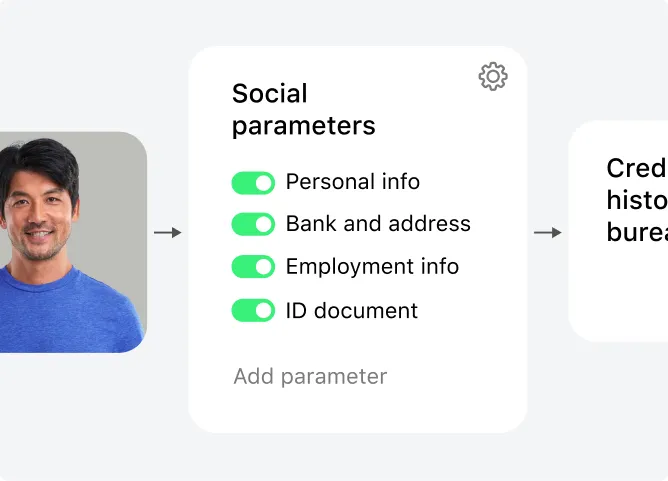

Know Your Customer

Identify your borrowers through their personal information and a photo of their ID. The KYC

module enhances efforts against money laundering and fraud, safeguarding your reputation.

module enhances efforts against money laundering and fraud, safeguarding your reputation.

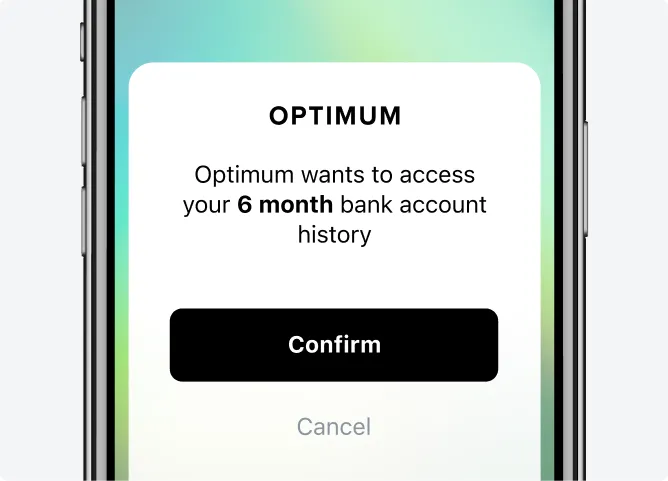

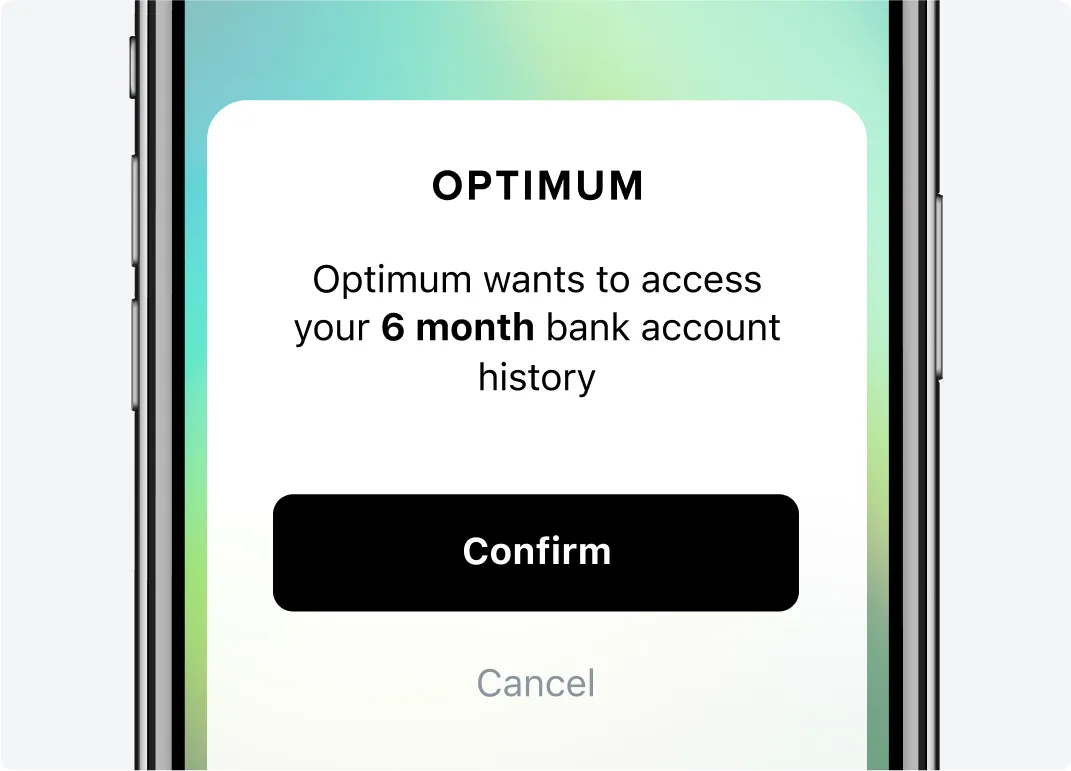

Open banking

Open Banking APIs allow you to access a borrower’s comprehensive financial data with their

consent. This includes transaction history, income streams, expenses, and other financial

behaviors.

consent. This includes transaction history, income streams, expenses, and other financial

behaviors.

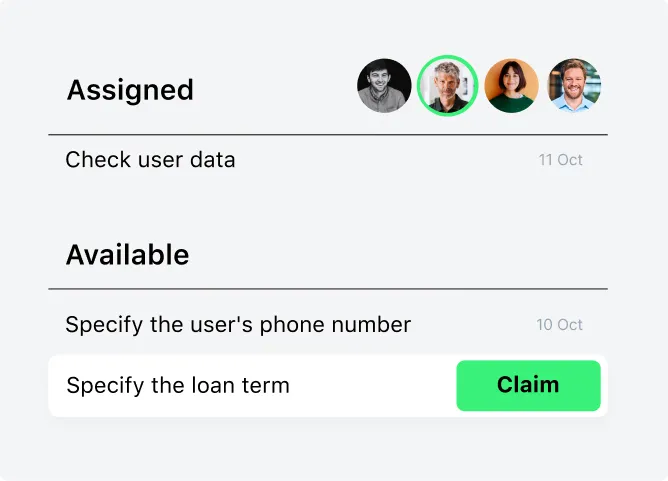

Task management

Streamline task organization and allocation effectively. Monitor KPIs and automate workflows

for loan officers and underwriters, ensuring your team remains focused and maintains high

productivity levels.

for loan officers and underwriters, ensuring your team remains focused and maintains high

productivity levels.

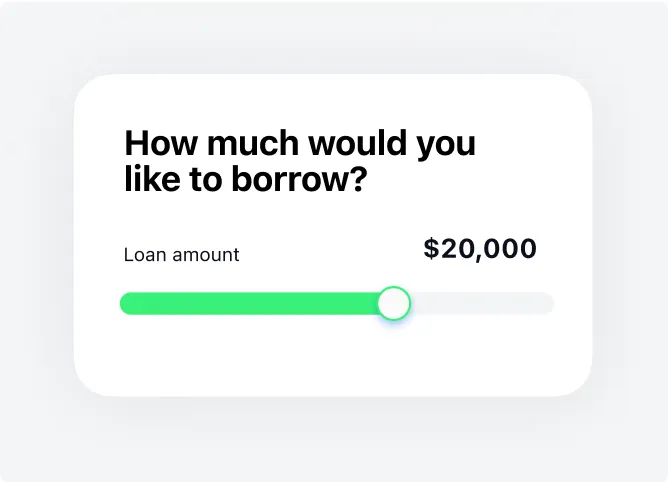

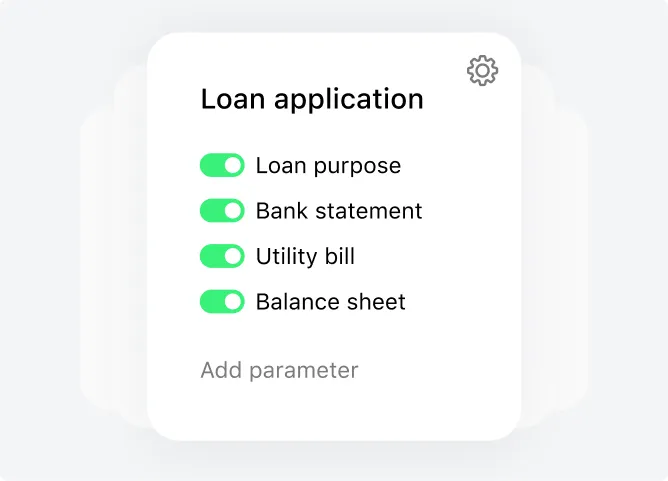

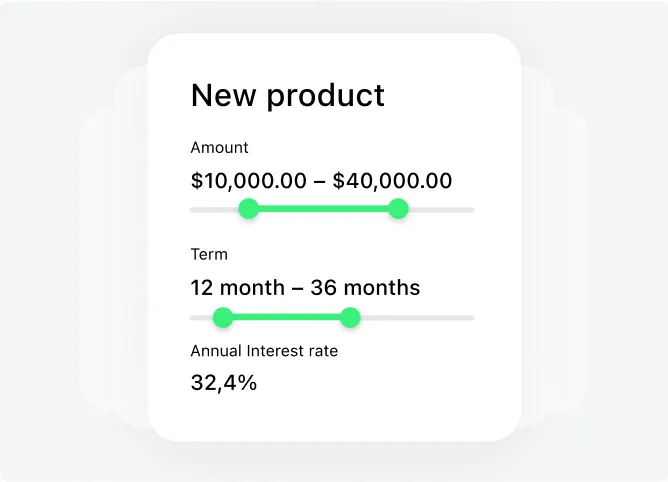

Configurable loans

Create and manage product campaigns with ease. Define loan conditions, rates, and product

configurations. Build workflows for specific offers, including required data, collateral,

and decision-making processes.

configurations. Build workflows for specific offers, including required data, collateral,

and decision-making processes.

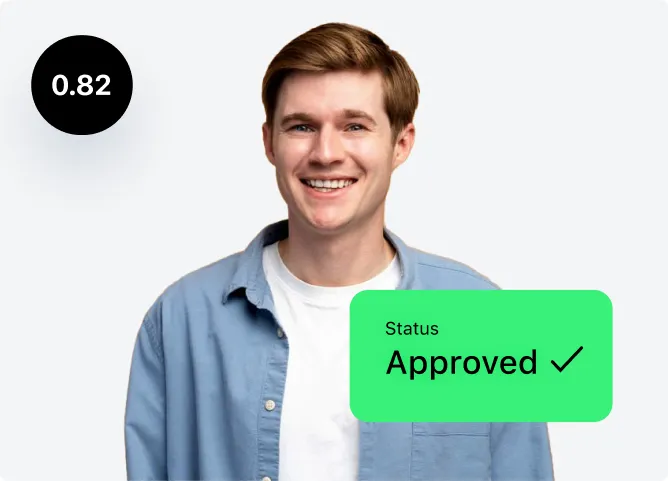

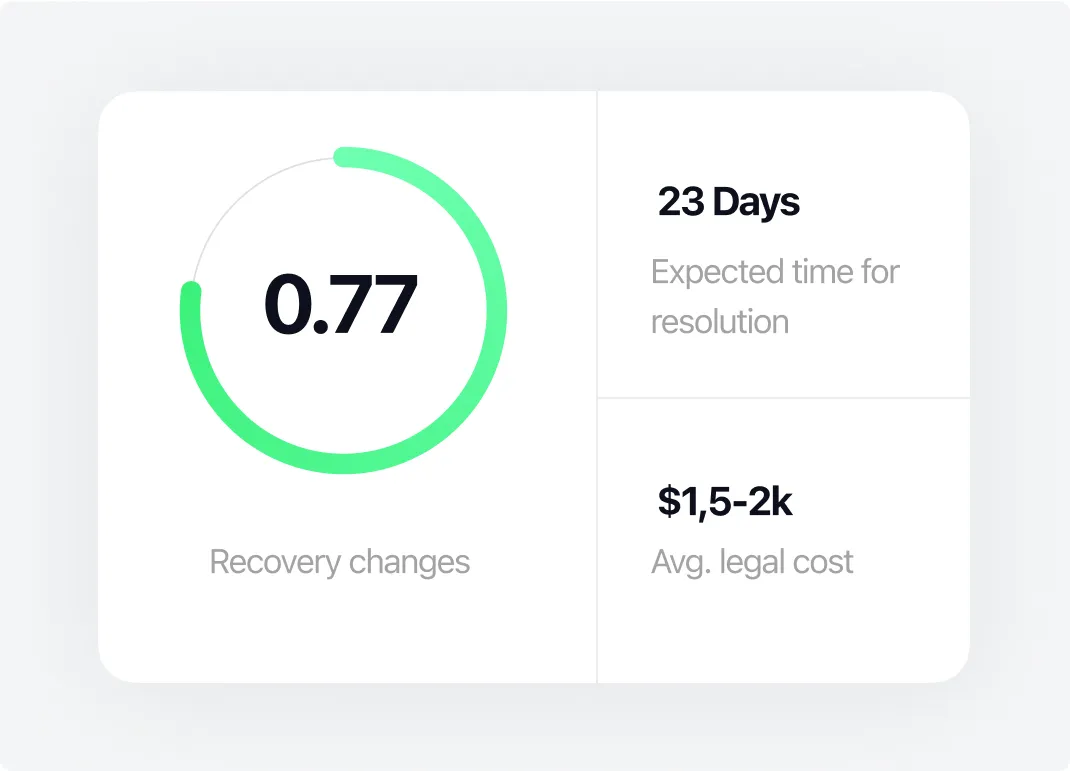

Credit decisioning

Cut manual scoring costs. AI-driven tool automates preapproval for applications, estimating

NPL risk based on historical loan data. The AI uses alternative data for more accurate

credit decisions.

NPL risk based on historical loan data. The AI uses alternative data for more accurate

credit decisions.

Digital signature

PandaDoc serves as our primary e-signature provider. We provide predefined signing workflows to

simplify the management of documents and reduce manual data entry.

simplify the management of documents and reduce manual data entry.

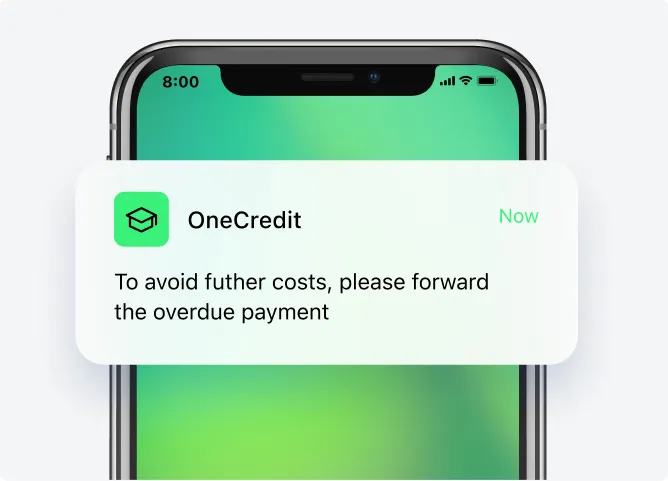

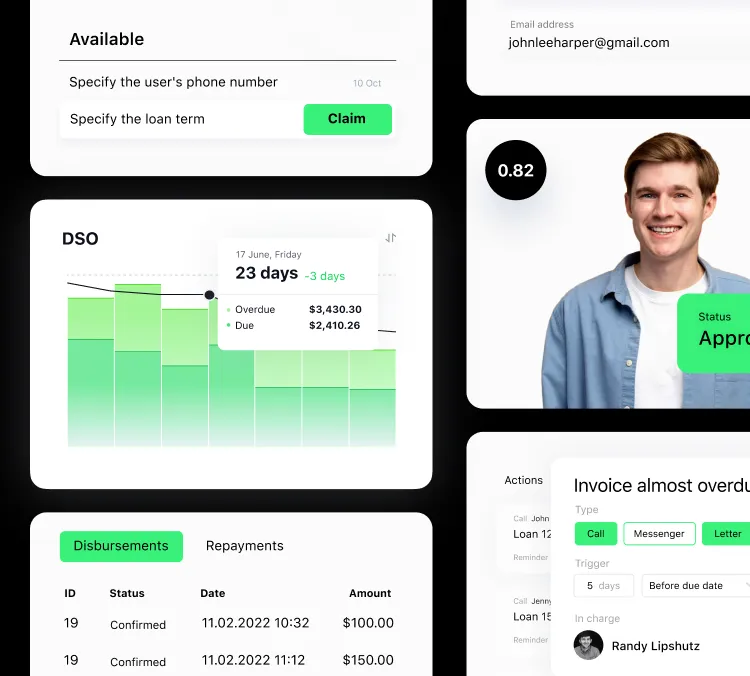

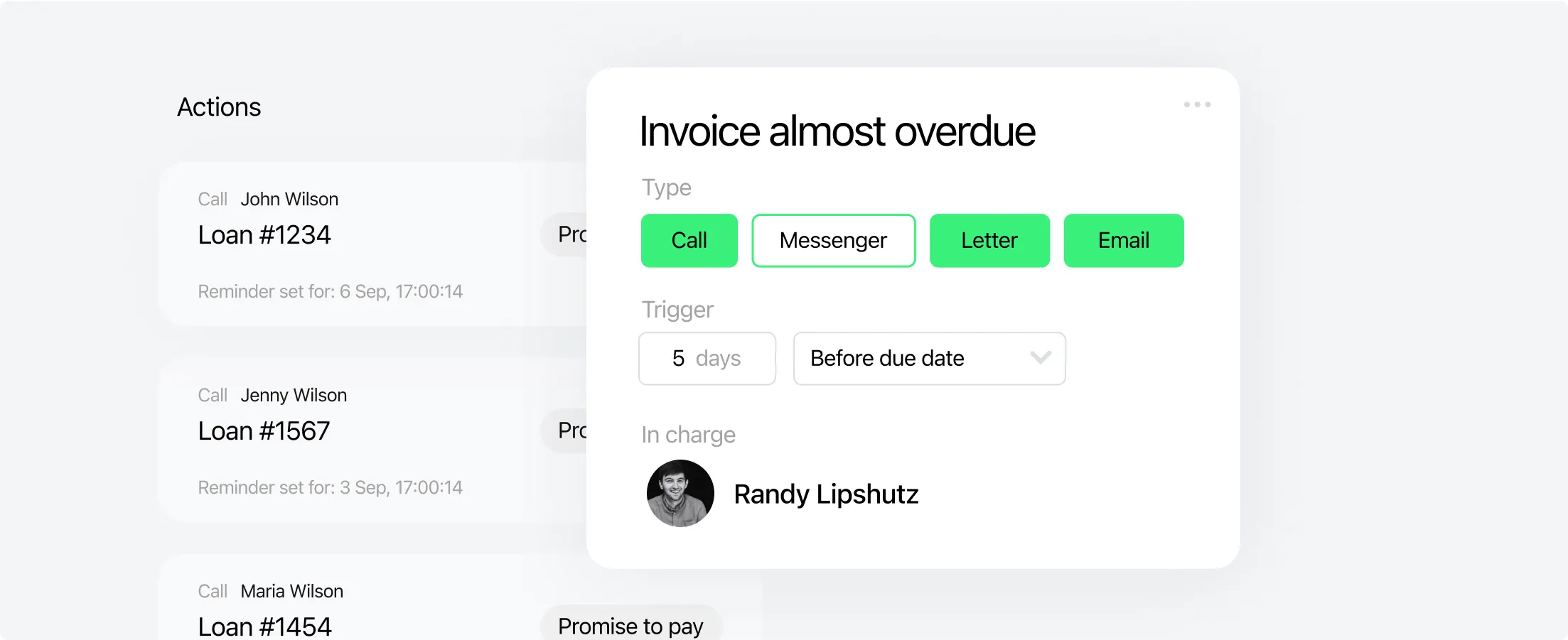

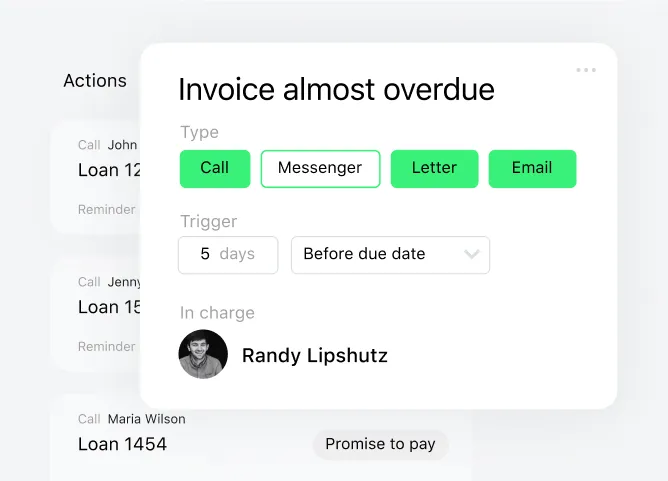

Reminders and notifications

Use message templates to remind clients of outstanding payments. Send automatic

notifications by Email, Push, and SMS. Communicate with debtors via the most efficient

channel, to maximize debt recovery.

notifications by Email, Push, and SMS. Communicate with debtors via the most efficient

channel, to maximize debt recovery.

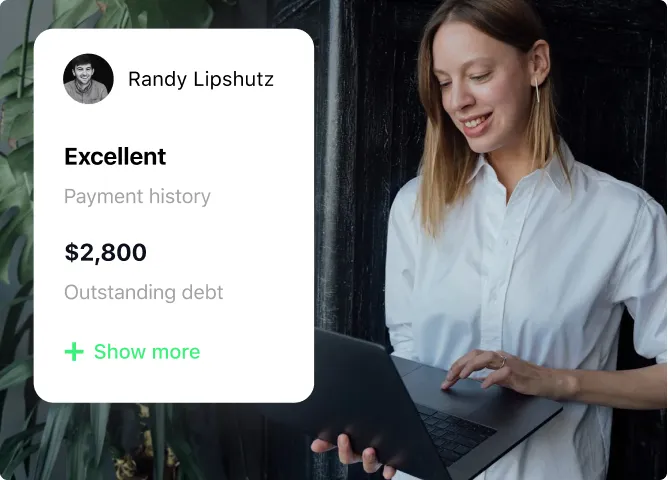

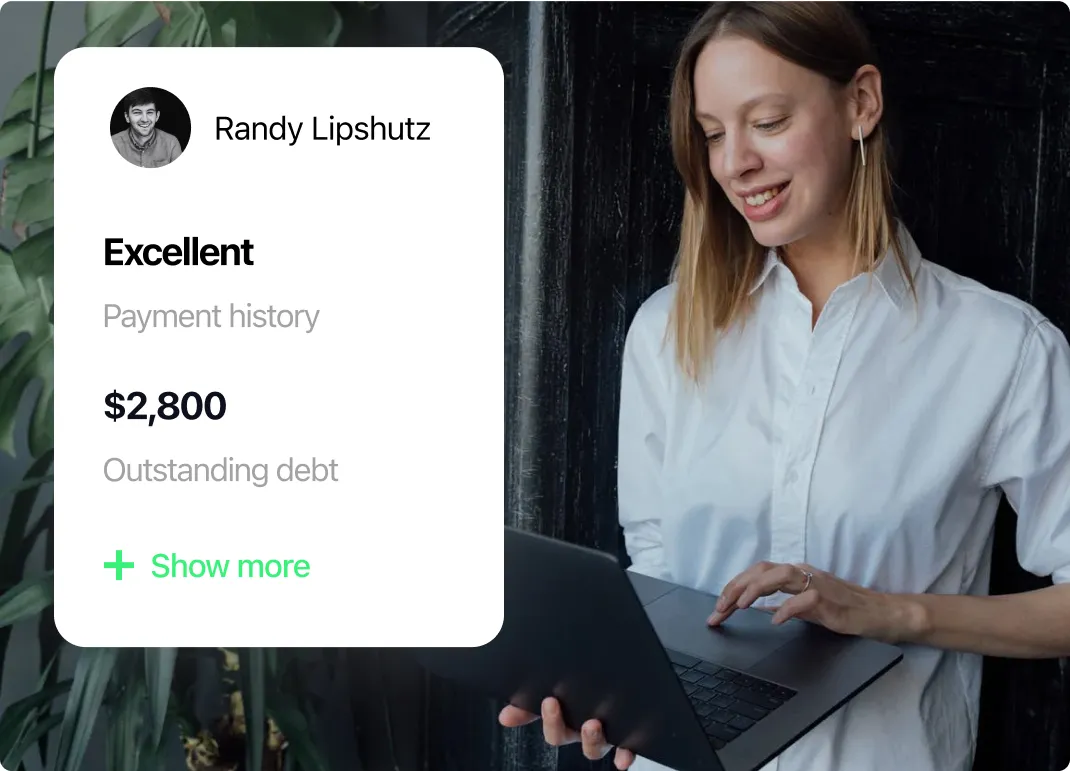

Credit bureau integrations

Credit bureaus provide lenders with a comprehensive view of an applicant’s credit history.

This includes details about previous loans, credit card usage, payment history, outstanding

debts, and more.

This includes details about previous loans, credit card usage, payment history, outstanding

debts, and more.

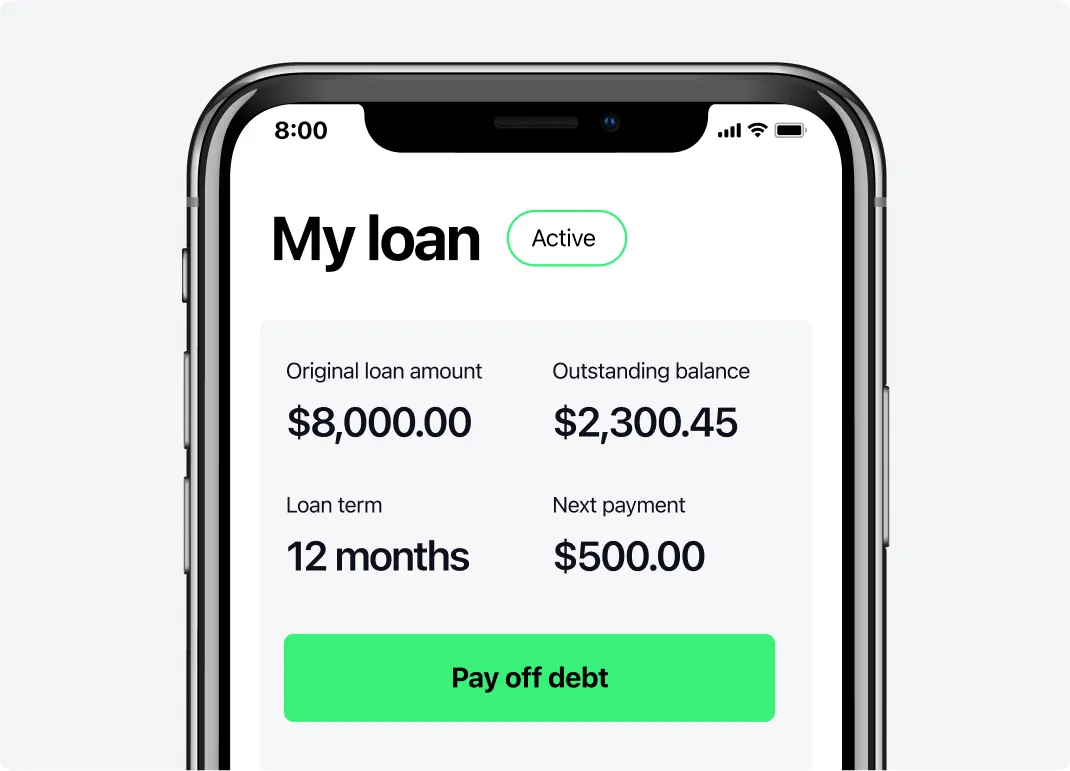

Loan servicing

Ensure timely transactions and unparalleled borrower

satisfaction with automated tools

satisfaction with automated tools

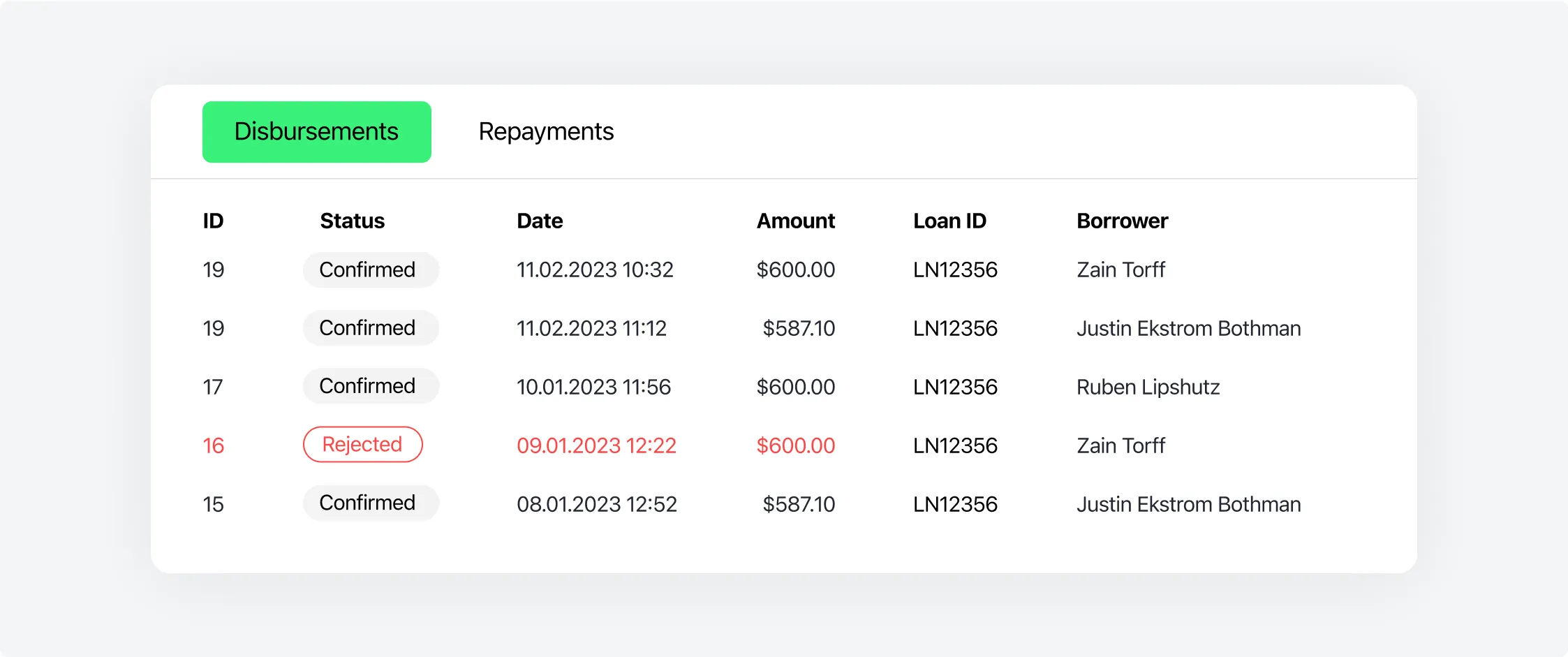

Automated online transactions

Manage all your transactions in one place. Use filters to sort transactions, navigate their

details, and register offline payments. Automate online loan disbursements and repayments.

details, and register offline payments. Automate online loan disbursements and repayments.

Automated online transactions

Manage all your transactions in one place. Use filters to sort transactions, navigate their

details, and register offline payments. Automate online loan disbursements and repayments.

details, and register offline payments. Automate online loan disbursements and repayments.

Debt collection

Revolutionize your collection approach, blending efficiency

with a client-centric focus

with a client-centric focus

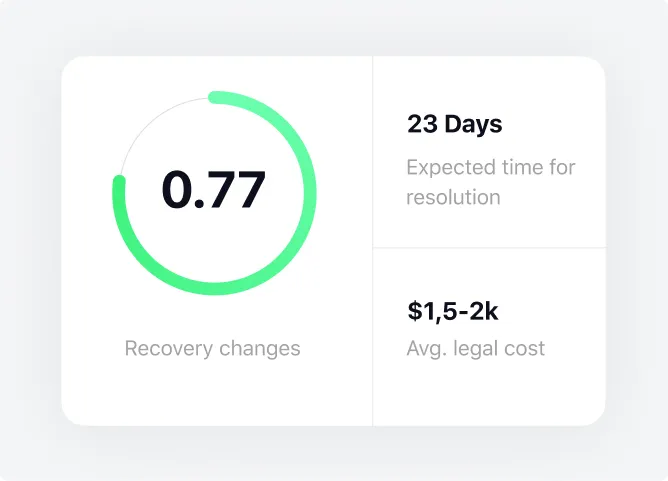

Debt collection module

Effectively handle delinquent debt using our collection module. Leverage personalized AI debt

collection strategy for each particular case. Tailor your collection processes to align with the

specific requirements of your business.

collection strategy for each particular case. Tailor your collection processes to align with the

specific requirements of your business.

Debt collection module

Effectively handle delinquent debt using our collection module. Leverage personalized AI

debt collection strategy for each particular case. Tailor your collection processes to align

with the specific requirements of your business.

debt collection strategy for each particular case. Tailor your collection processes to align

with the specific requirements of your business.

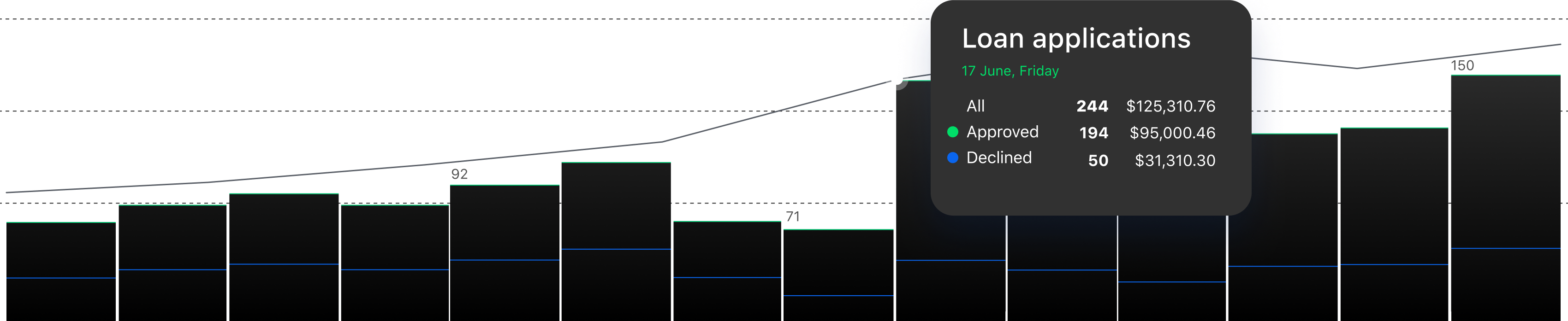

Reporting

and analytics

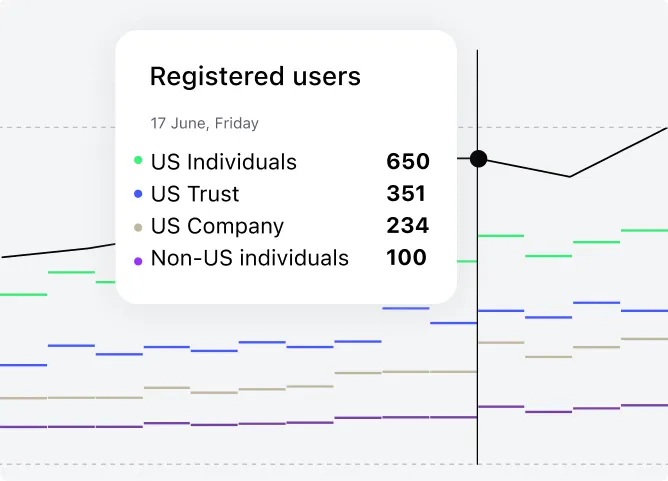

Powerful BI tools

Gain data-driven insights to improve your lending strategy. Power up your reporting with

advanced data analysis and automated dashboards to enhance business decision-making.

advanced data analysis and automated dashboards to enhance business decision-making.

Reporting

and analytics

Powerful BI tools

Gain data-driven insights to improve your lending strategy. Power up your reporting with

advanced data analysis and automated dashboards to enhance business decision-making.

advanced data analysis and automated dashboards to enhance business decision-making.

Boost lending

with integrations

HES FinTech makes it easy to connect technology integrations to your software solution.

Integrate online payments, Open Banking, automated document processing, BI instruments, and

other powerful tools into your proprietary lending system.

Integrate online payments, Open Banking, automated document processing, BI instruments, and

other powerful tools into your proprietary lending system.

End-to-end microfinancing software

Intelligent consumer lending solution is fully adjustable for your business

demands. Automate mundane tasks with consumer loan origination software

to save time and reduce operational costs.

3-month time-to-market

90% of our clients launch their online lending platforms within 3 months and achieve a quick ROI. HES LoanBox is designed for rapid deployment and can be customized to meet your specific needs.

Reliable customer support

Experience peace of mind with our dependable customer support. We provide expert guidance and quick solutions to any problems, helping you maintain optimal performance and satisfaction.

No additional charges per customer

HES provides

fully managed consumer credit software solutions with no limits

on the number of users. Flexible pricing depends on the features you choose.

fully managed consumer credit software solutions with no limits

on the number of users. Flexible pricing depends on the features you choose.