Ultimate merchant

cash advance software

Get merchant cash advance software ready to go in 3 months:

Solution includes

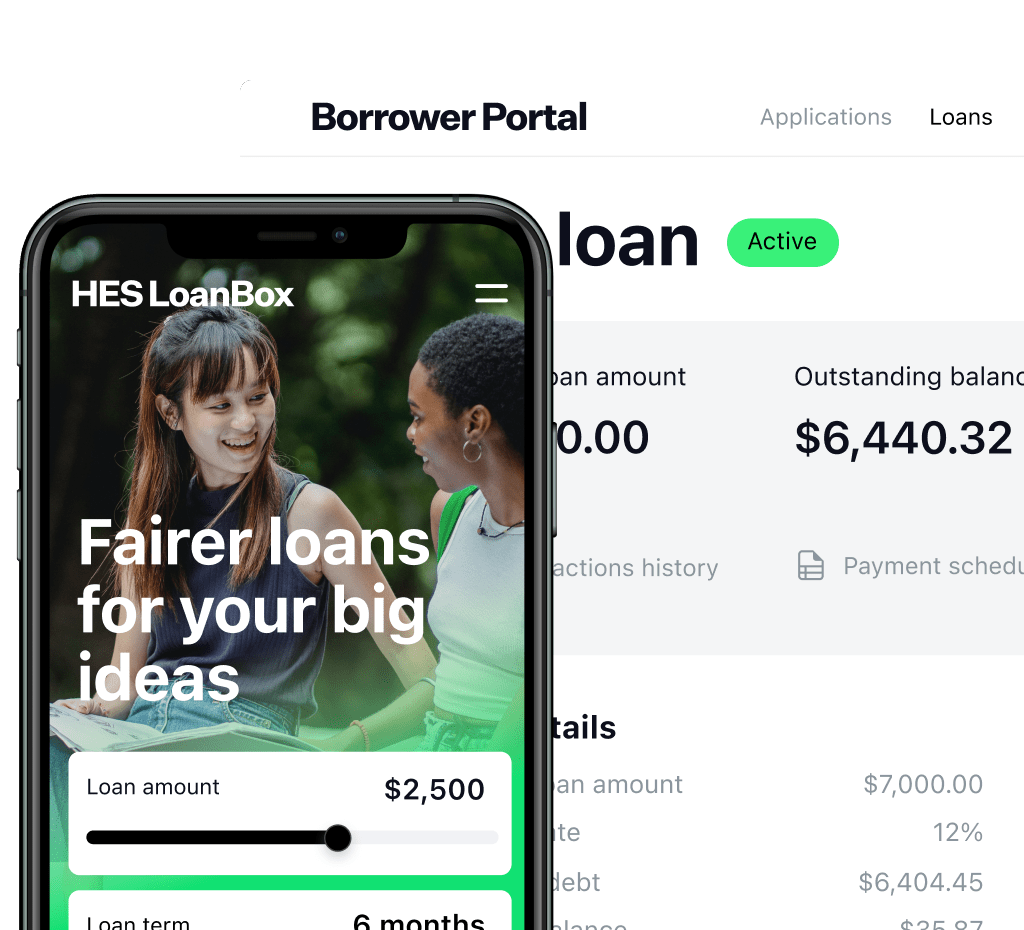

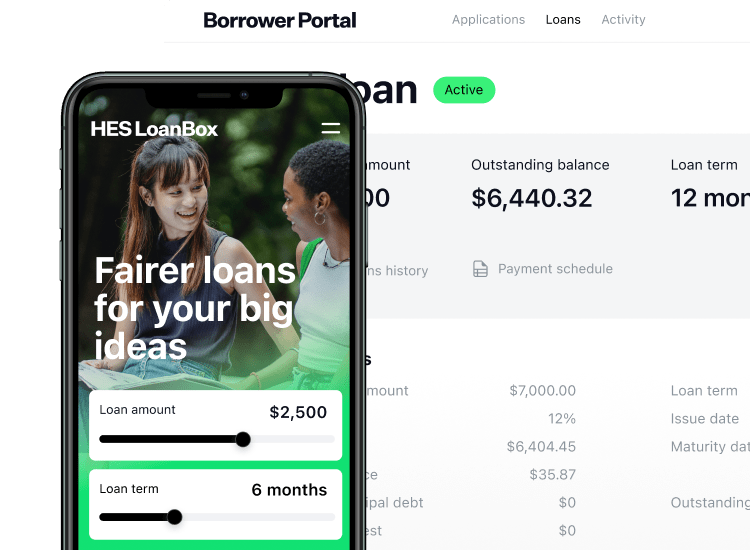

Landing Page

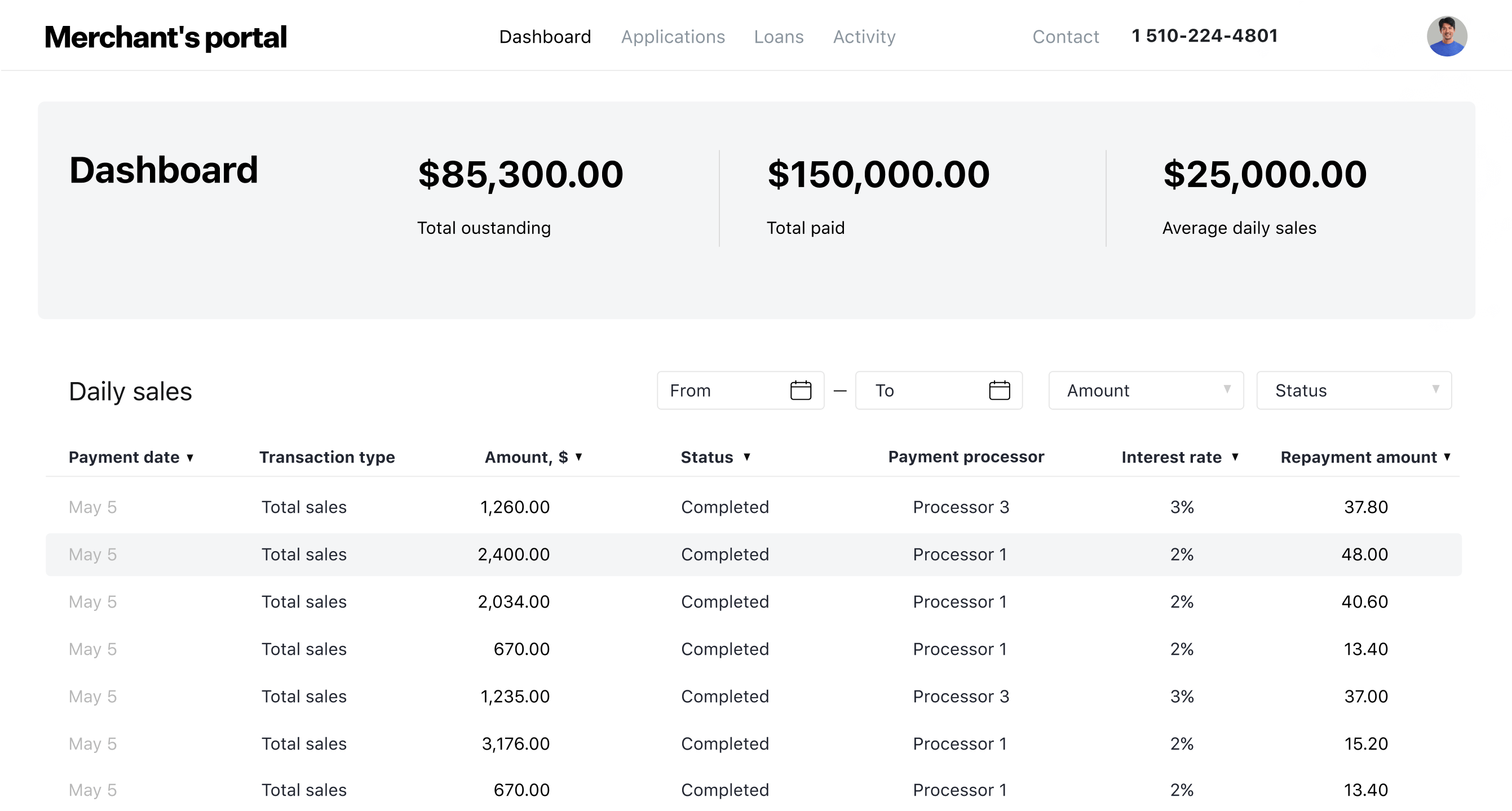

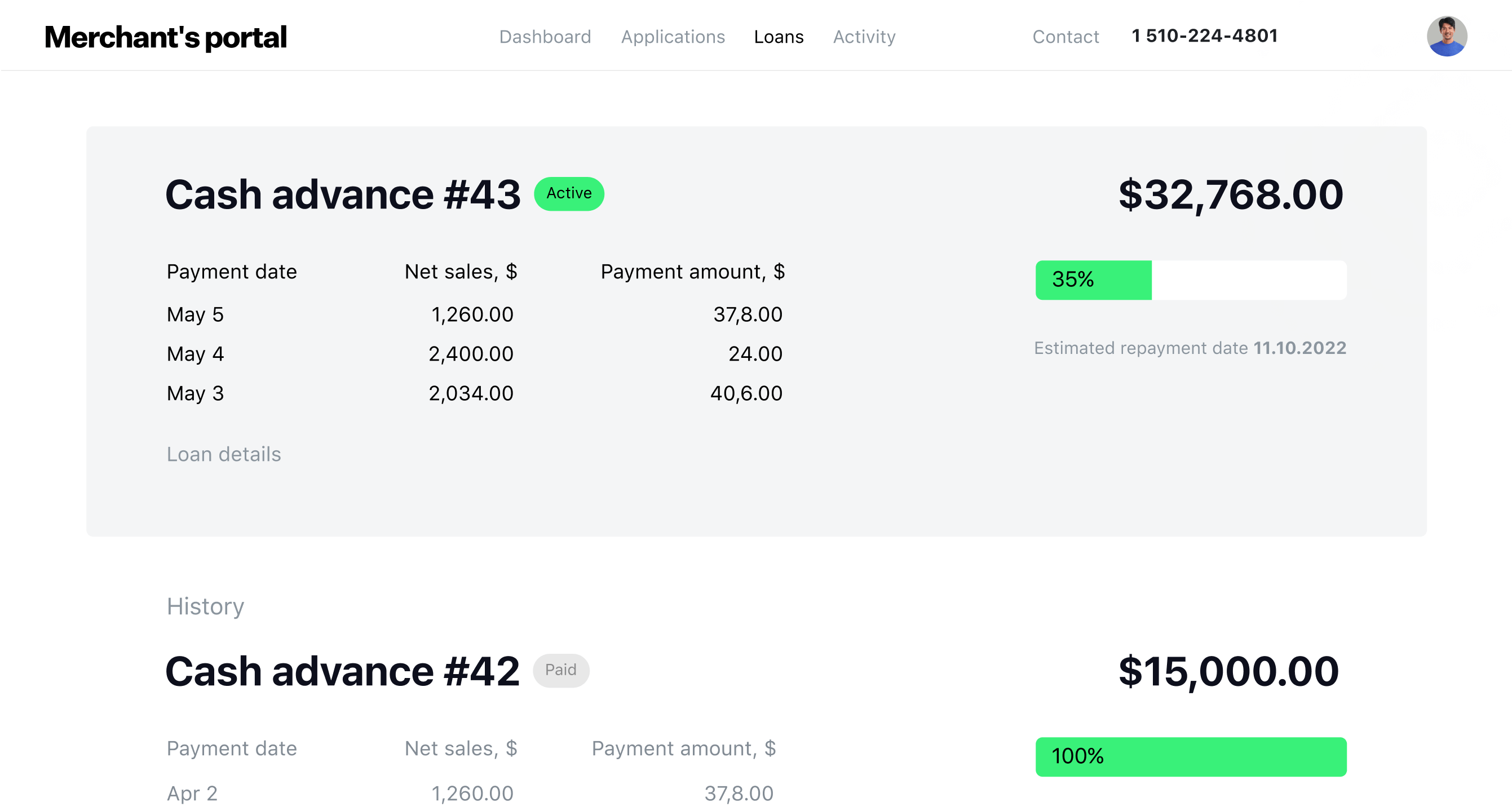

Merchant Portal

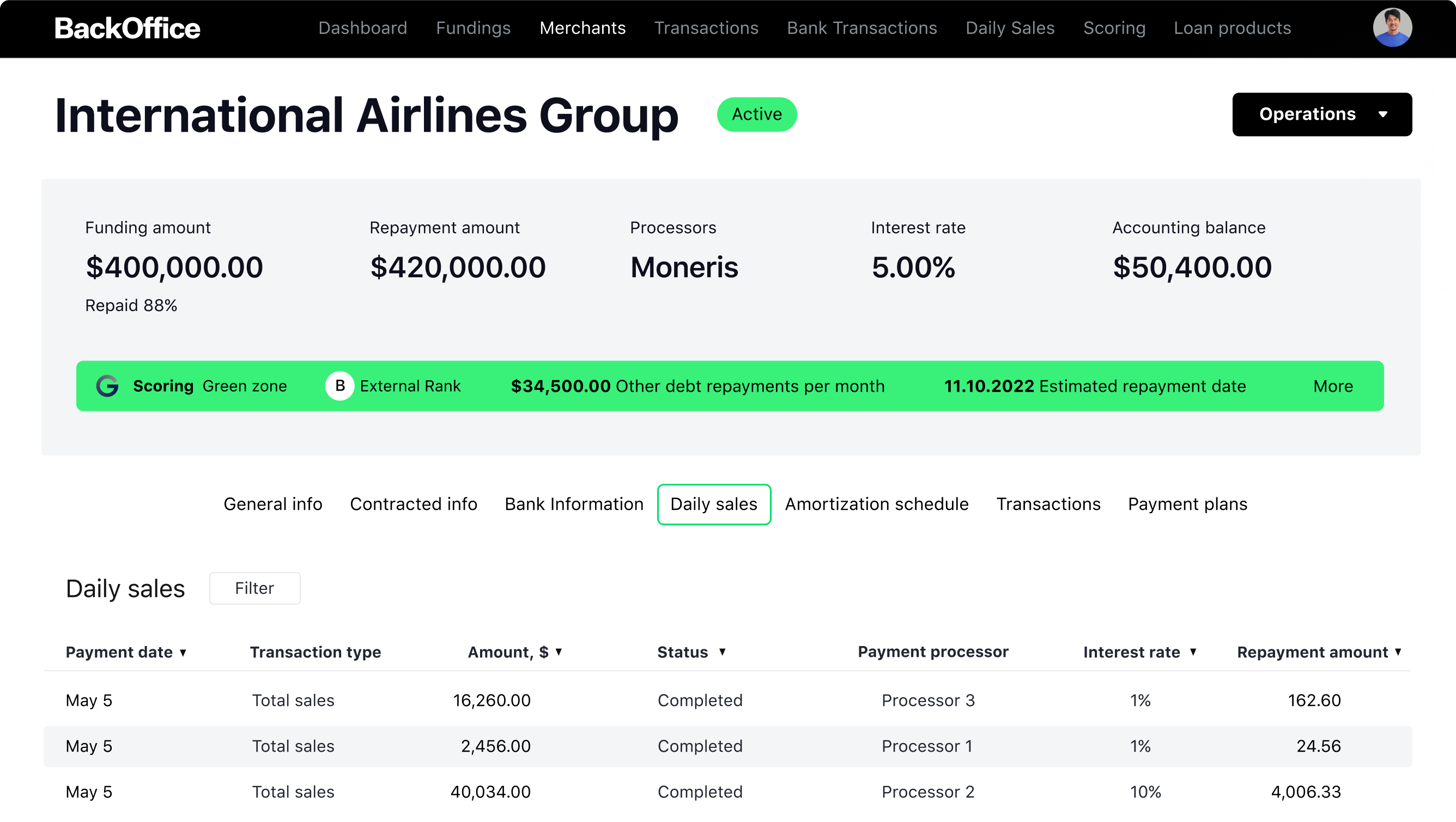

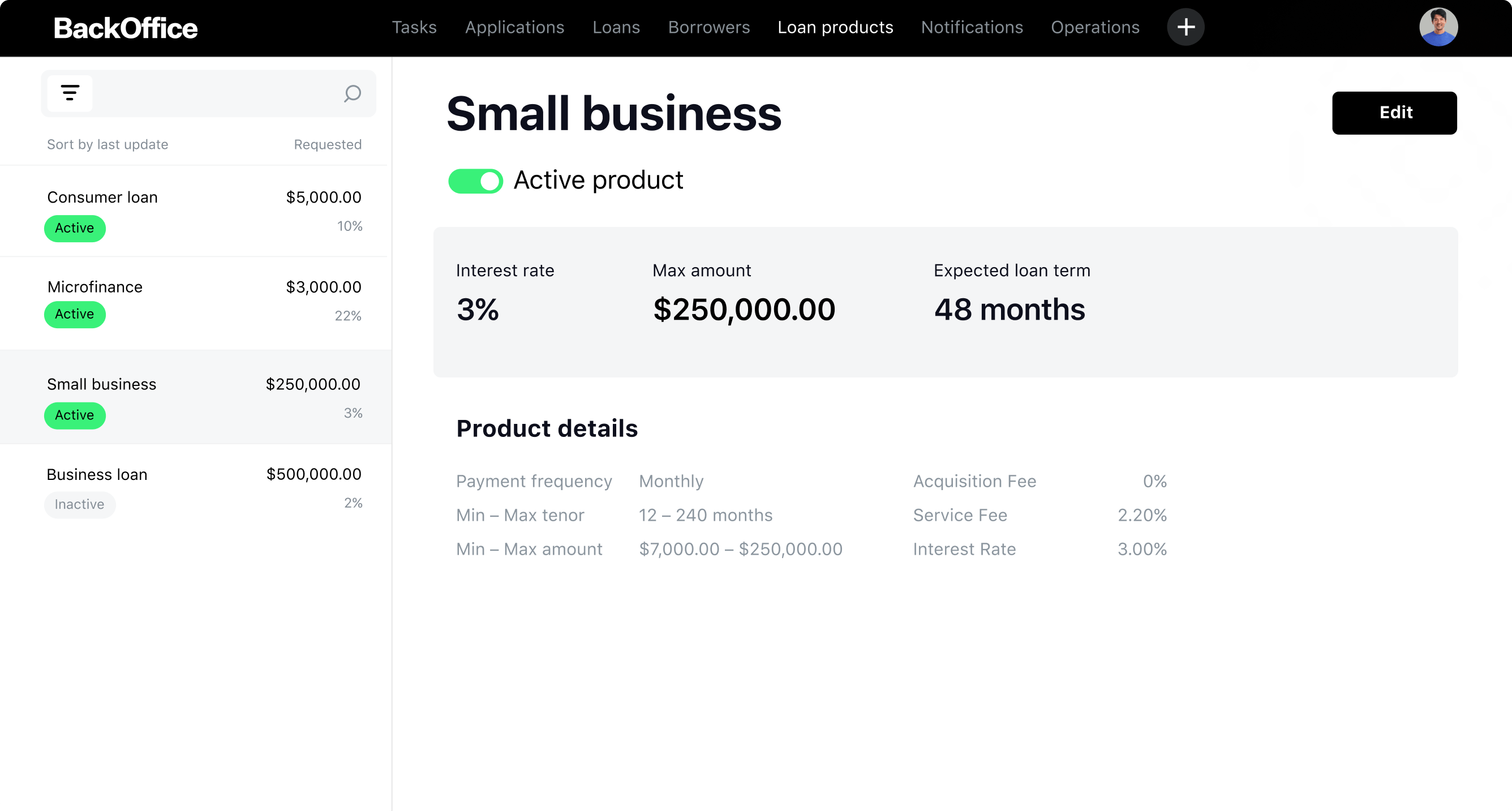

Back Office

Automated disbursements and calculations

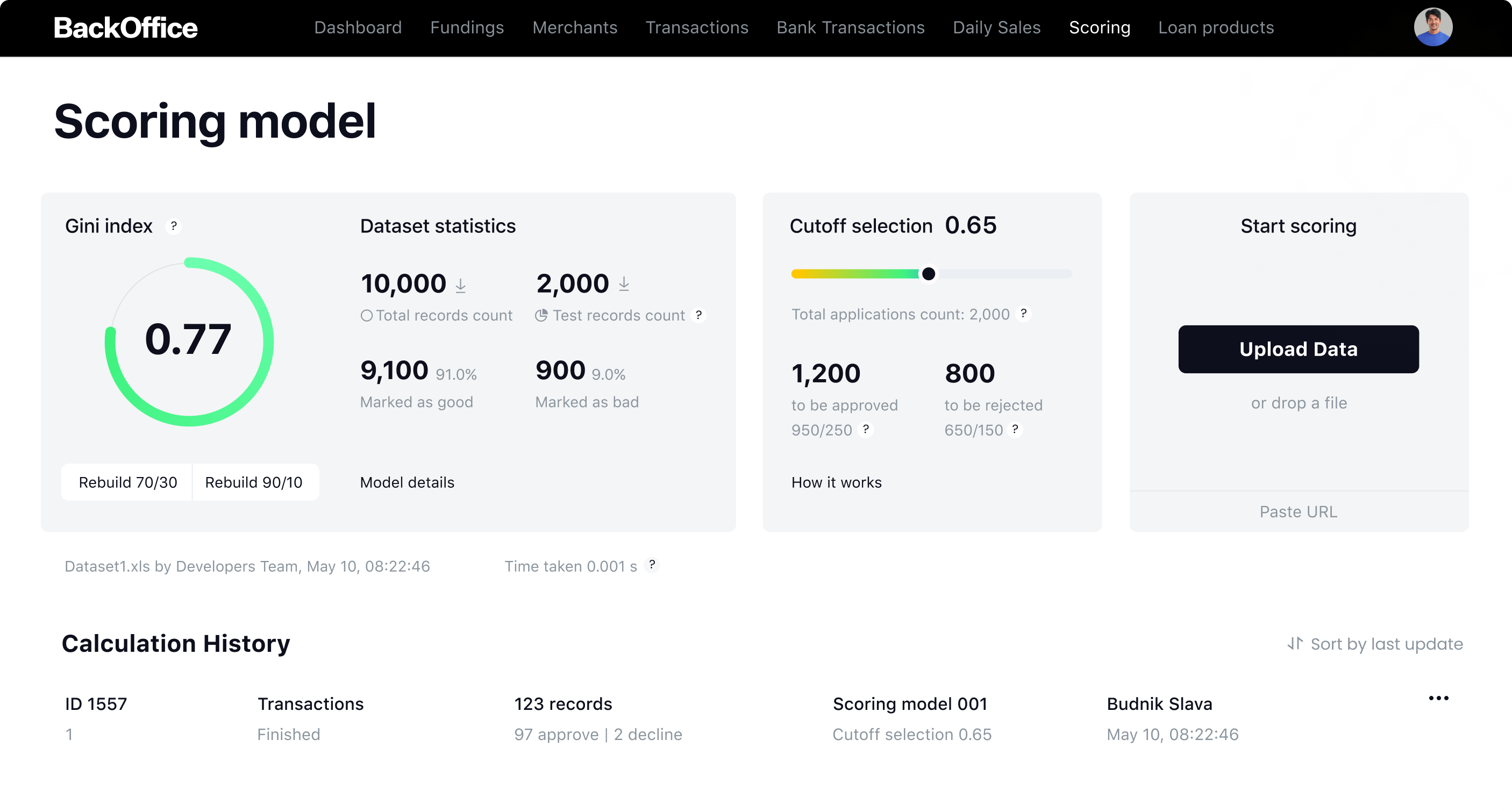

Client AI-based credit scoring

Intelligent debt collection

Fully customizable solution

Lifetime customer support

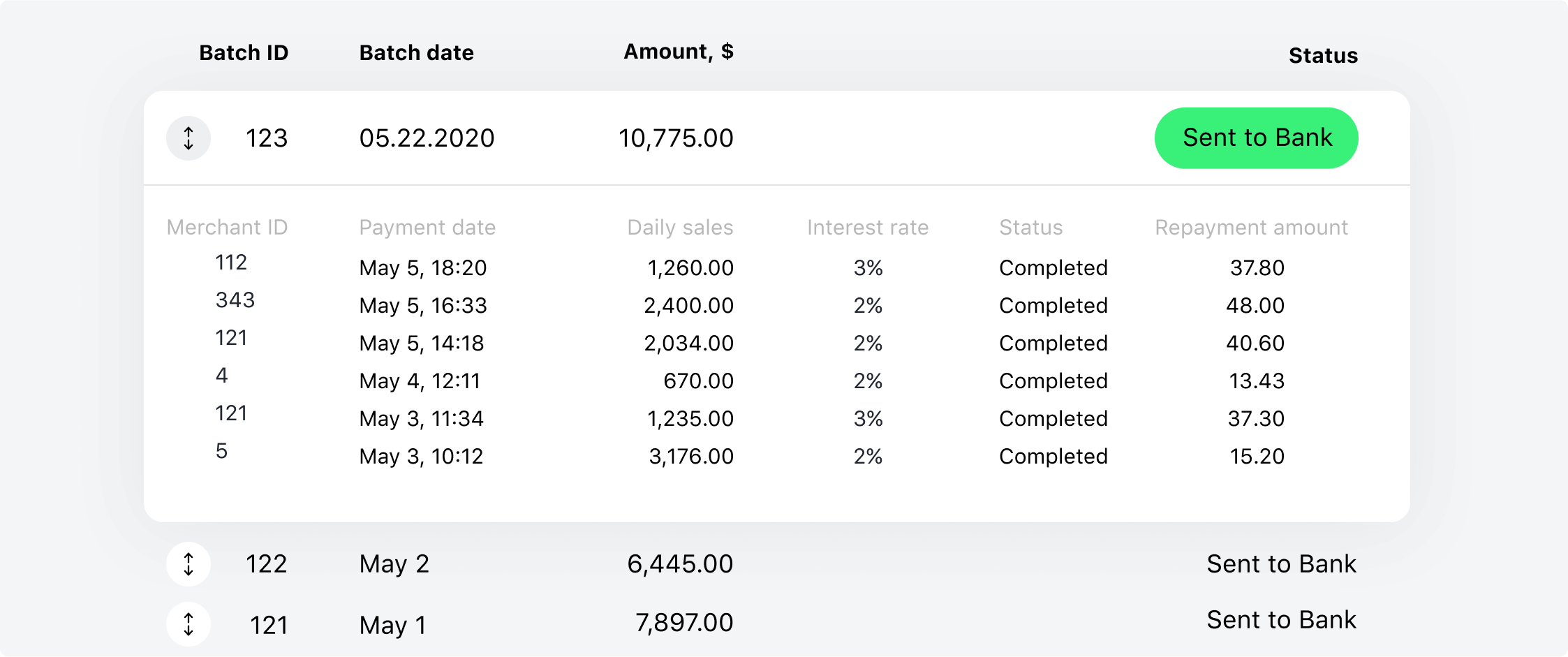

Daily sales

The system calculates the amount from every transaction automatically.

The configurable workflows

Enjoy powerful backend features

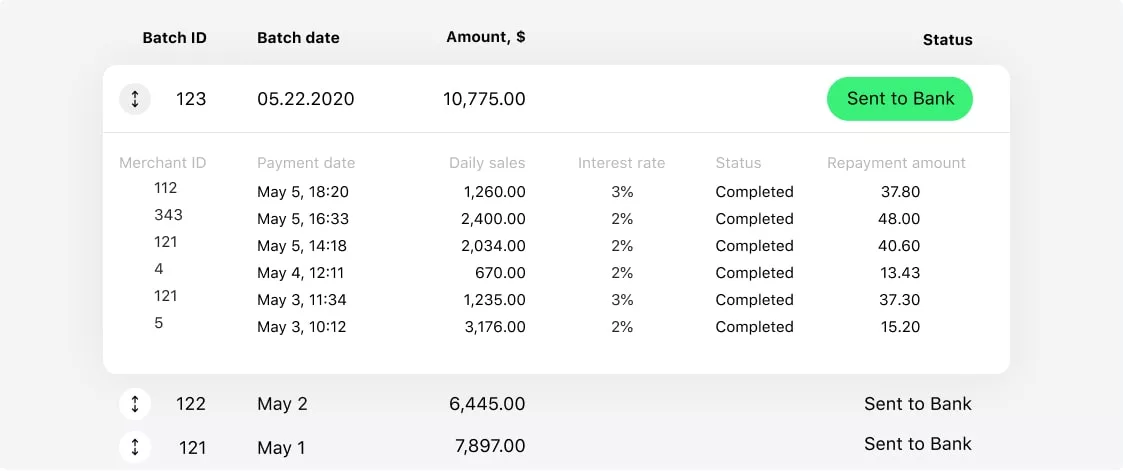

Batch transactions

Save time and money by implementing batch transactions functionality into

your cash lending software.

your cash lending software.

API for your website.

Offer your clients a smooth onboarding process by connecting your website with

the merchant cash advance platform via API and redirecting them to the needed page directly.

Offer your clients a smooth onboarding process by connecting your website with

the merchant cash advance platform via API and redirecting them to the needed page directly.

and much more

Application management

Loan processing

Document templates

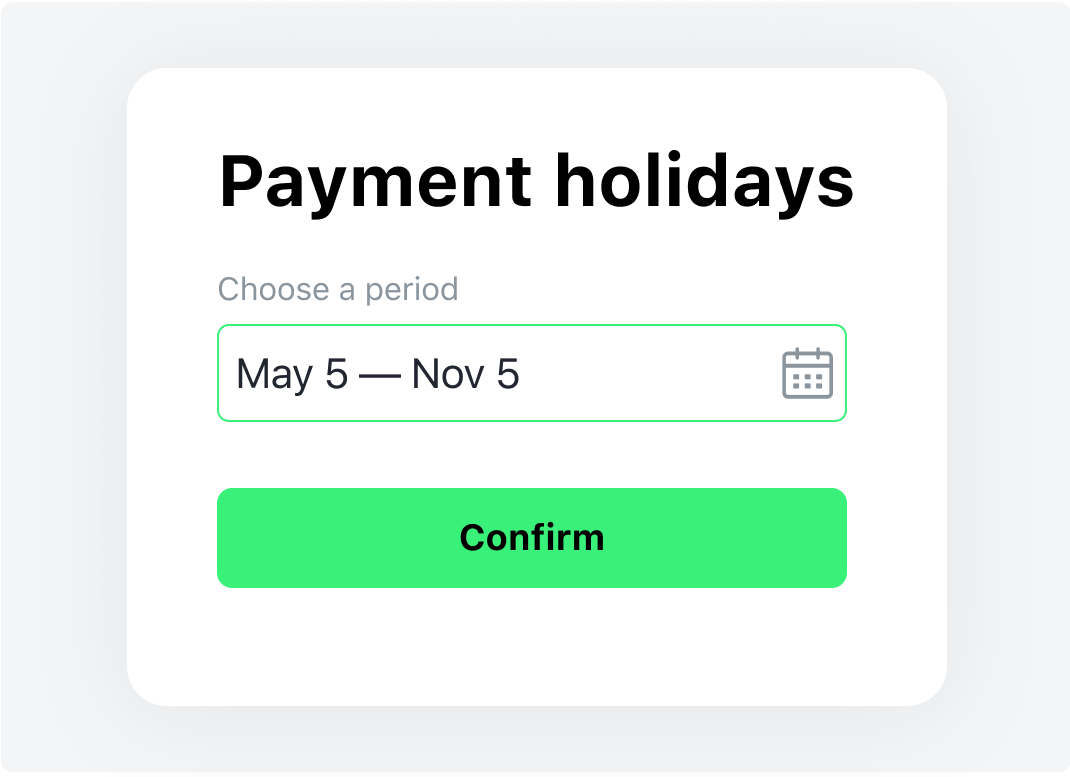

Automation of disbursements and payments

Transactions and reporting

Expand your capabilities with integrations

End-to-end solution

for cash advance lending

Scalable cash advance software

3-4 months time-to-market

A few seconds for a loan decision

No additional charges per customer

FAQ

Is technical support available for cash advance software?

How long does it take to implement cash advance loan software?

Can MCA software provide insights and reports on a business’s performance?

What are the benefits of using merchant cash advance platform?