Mortgage lending software

Launch mortgage servicing software

in 3

months

Solution includes

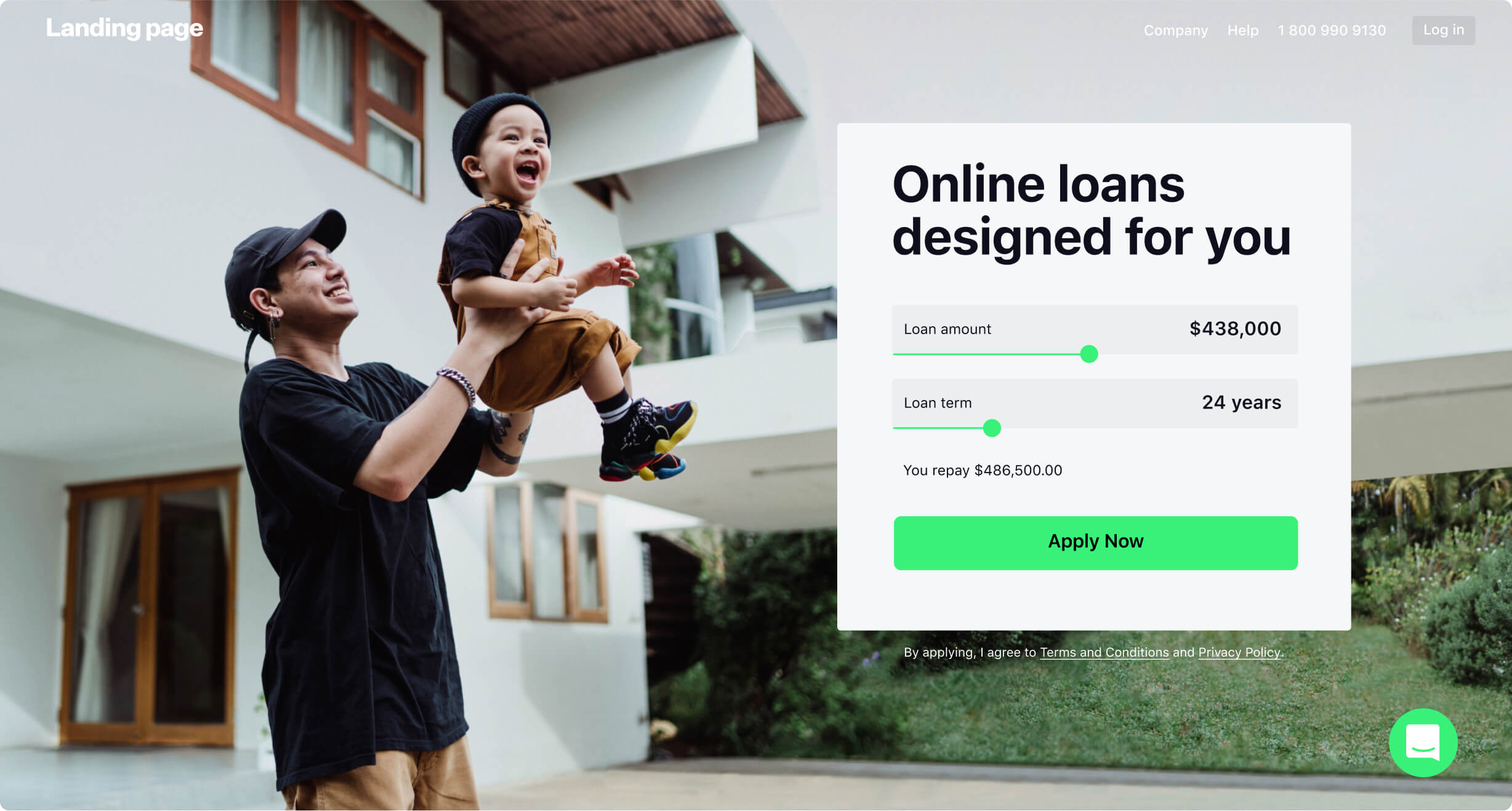

Landing Page

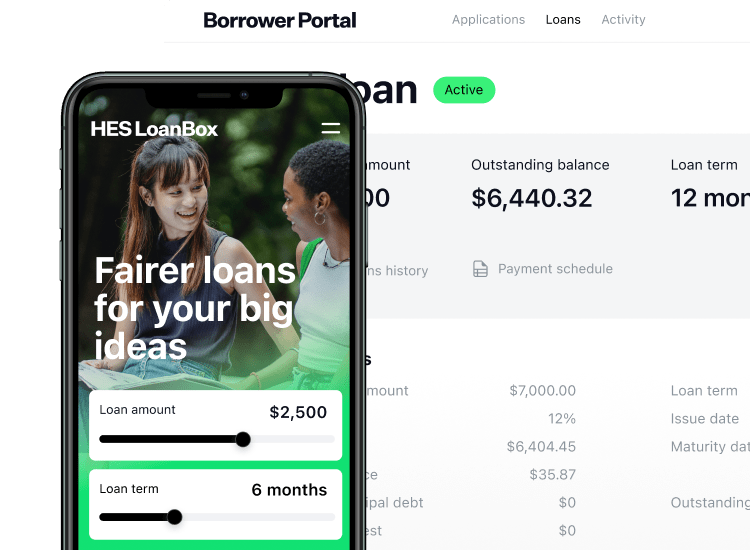

Borrower Portal

Agent Portal

Back Office

Smart scoring system

Ready mortgage loan software

Fully automated decision-making

White-label design

User-friendly application process

Elevate collaboration

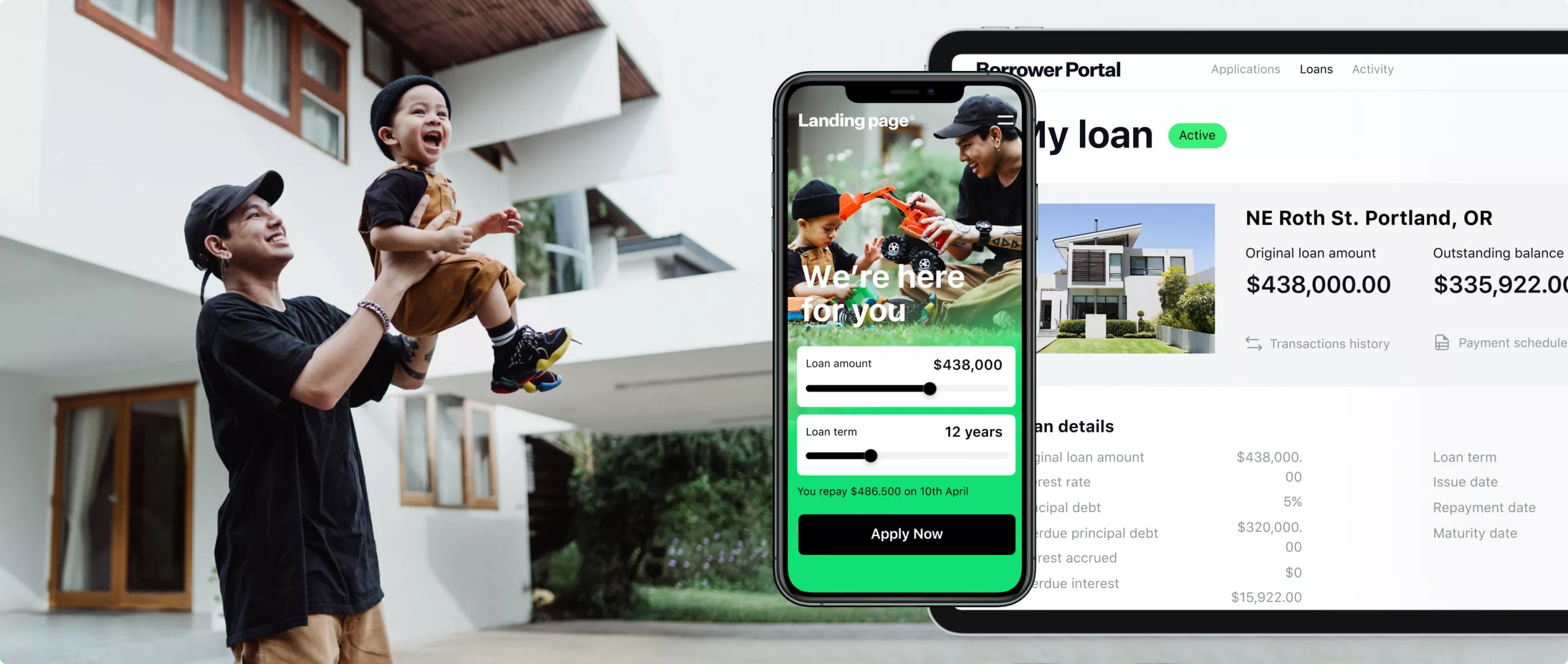

Seamless application flow

Allow your customers the flexibility to apply for a loan through any

channel, using any device — from PC to smartphone — and even switch devices mid-process. The

mortgage LOS software by HES FinTech enables seamless and paperless onboarding.

channel, using any device — from PC to smartphone — and even switch devices mid-process. The

mortgage LOS software by HES FinTech enables seamless and paperless onboarding.

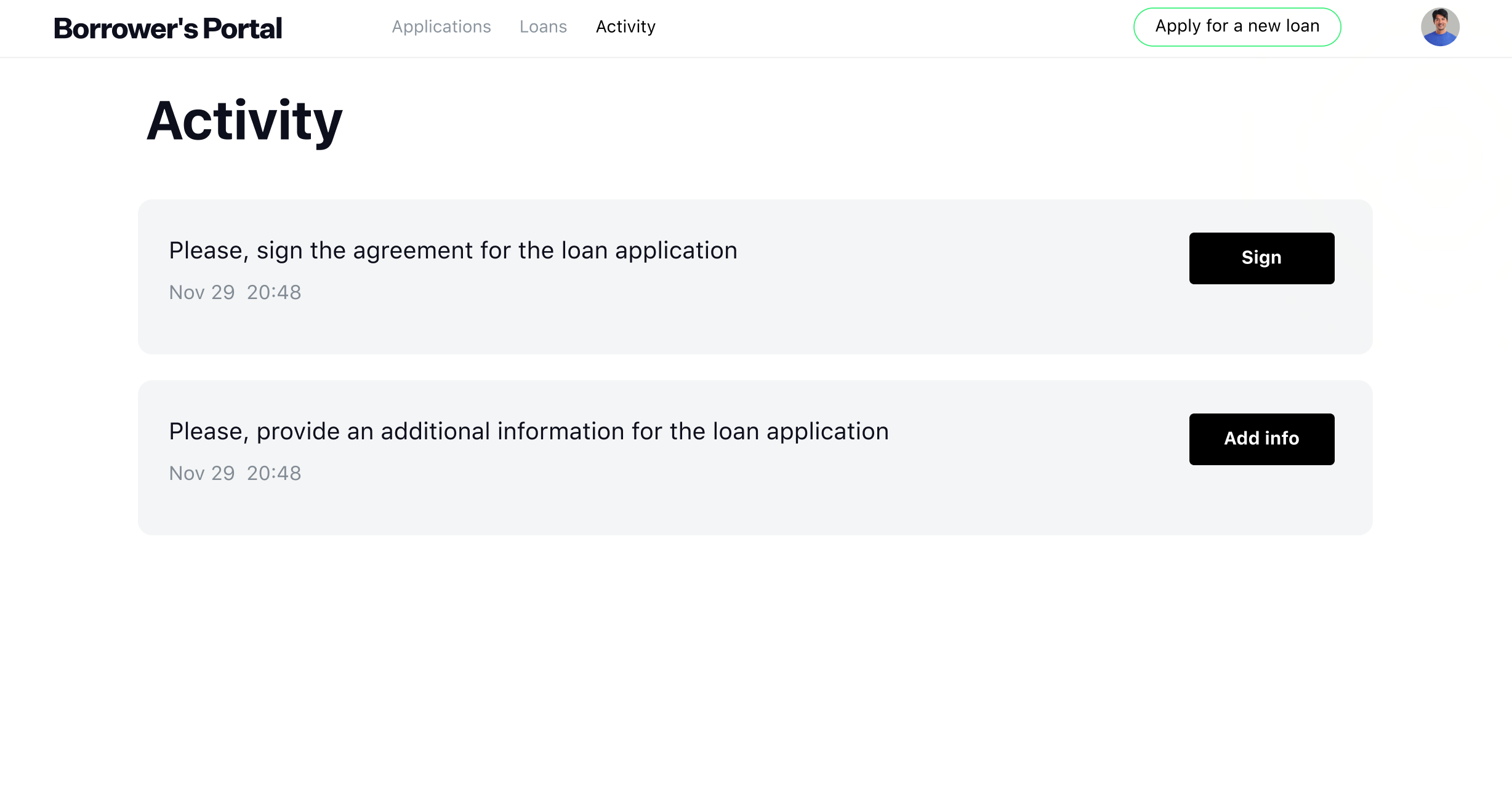

Functional broker’s space

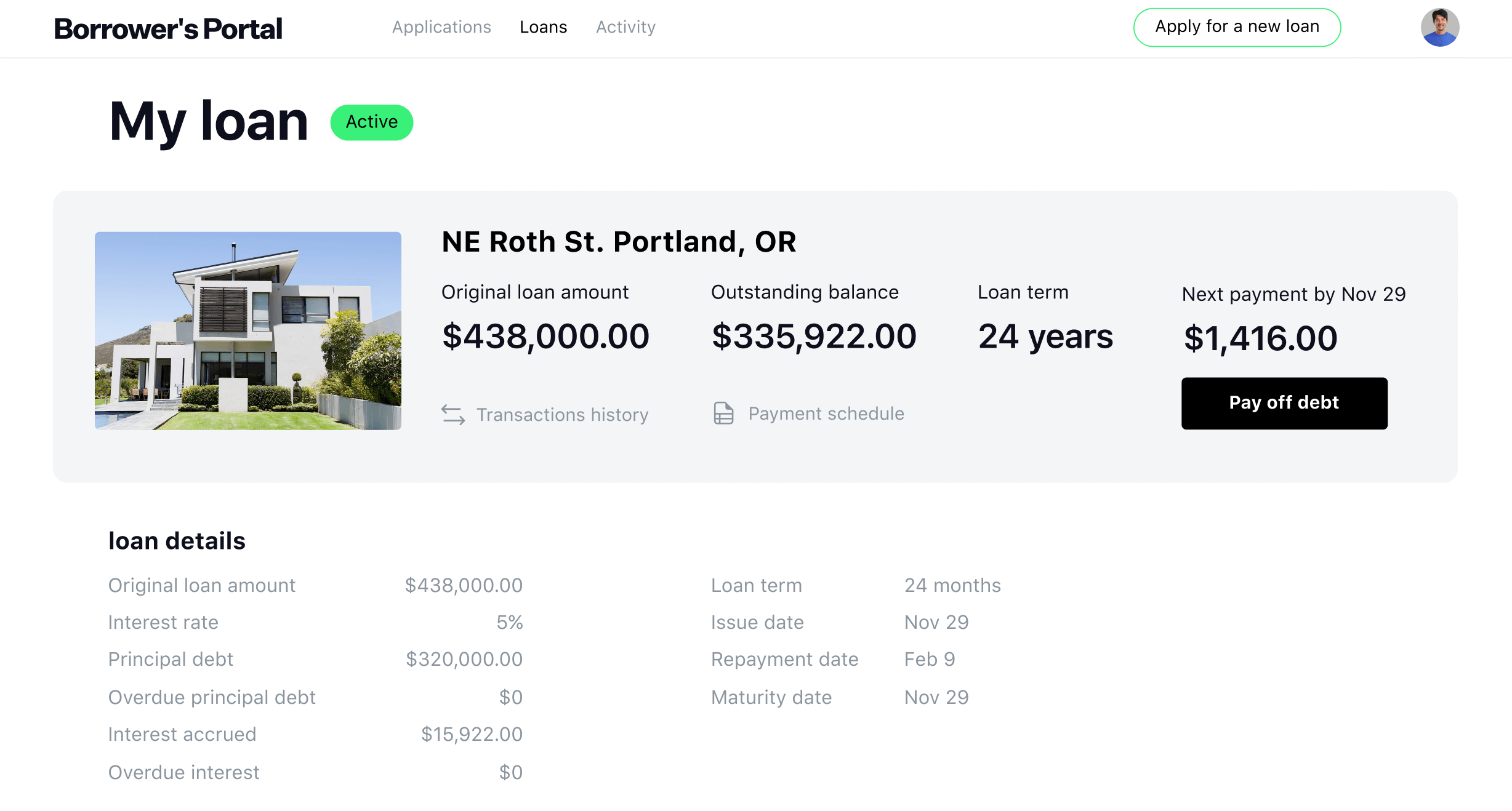

A fully functional user profile allows your customers to save their

information, update it if needed, and reuse it for new lending requests.

information, update it if needed, and reuse it for new lending requests.

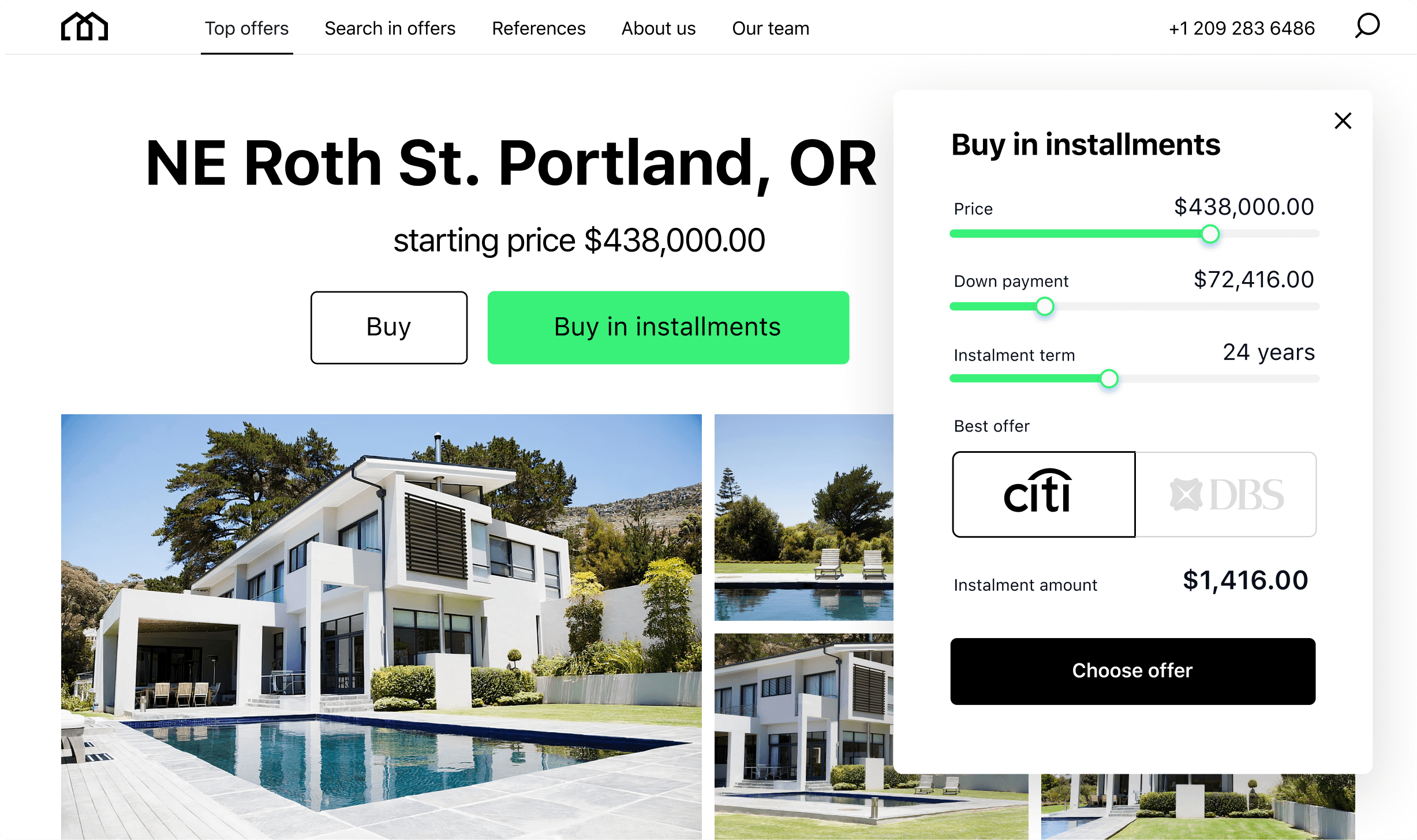

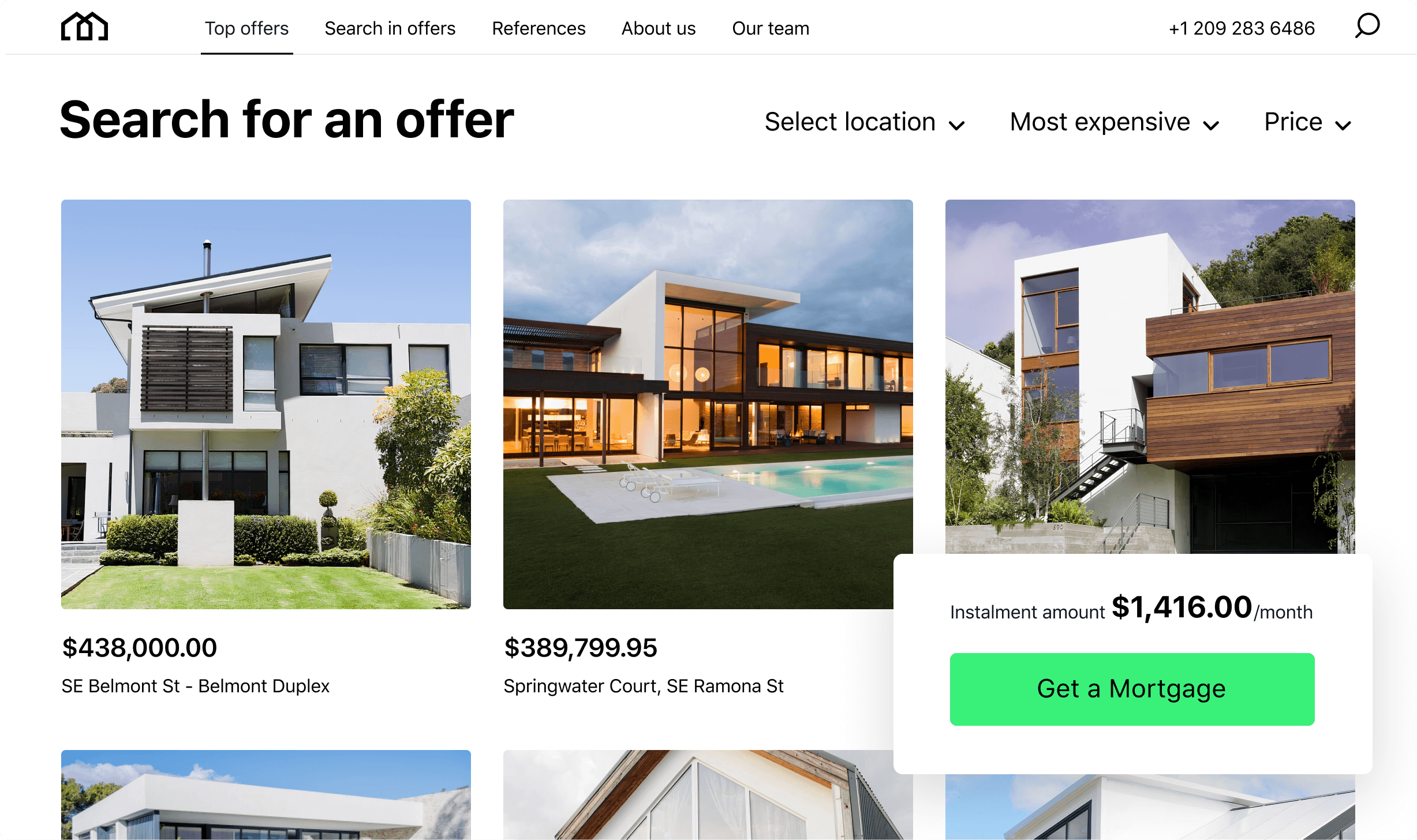

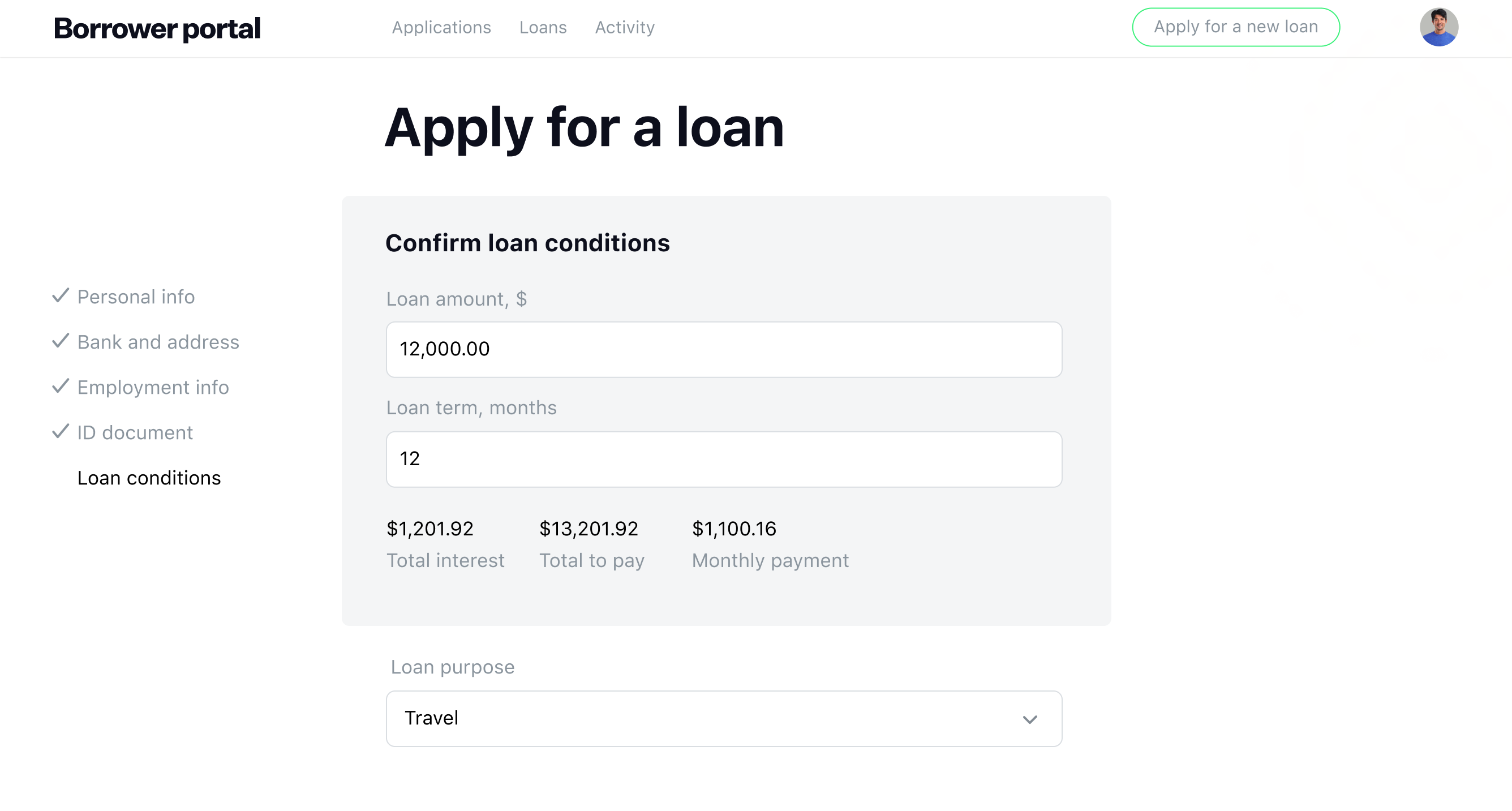

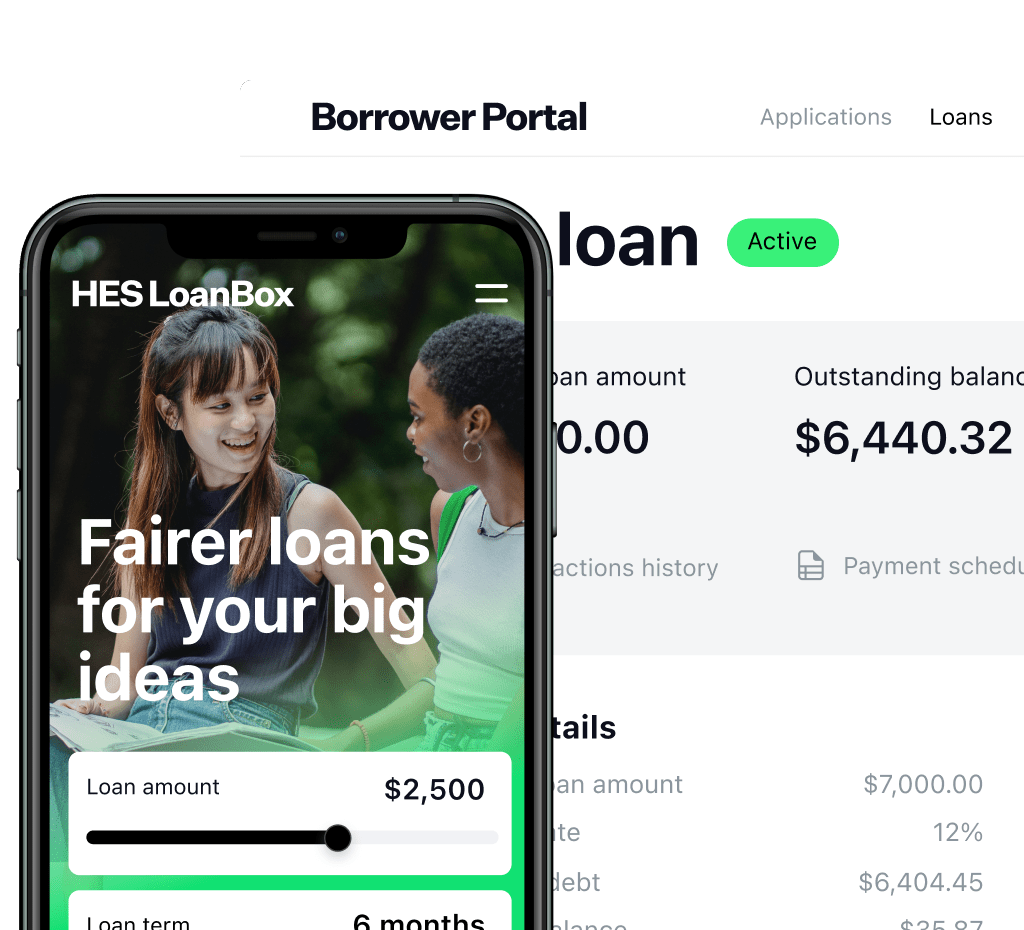

Customer-facing loan calculator

HES mortgage broking software have built-in handy loan calculators.

Potential clients can see how their regular payments depend on different loan terms.

Potential clients can see how their regular payments depend on different loan terms.

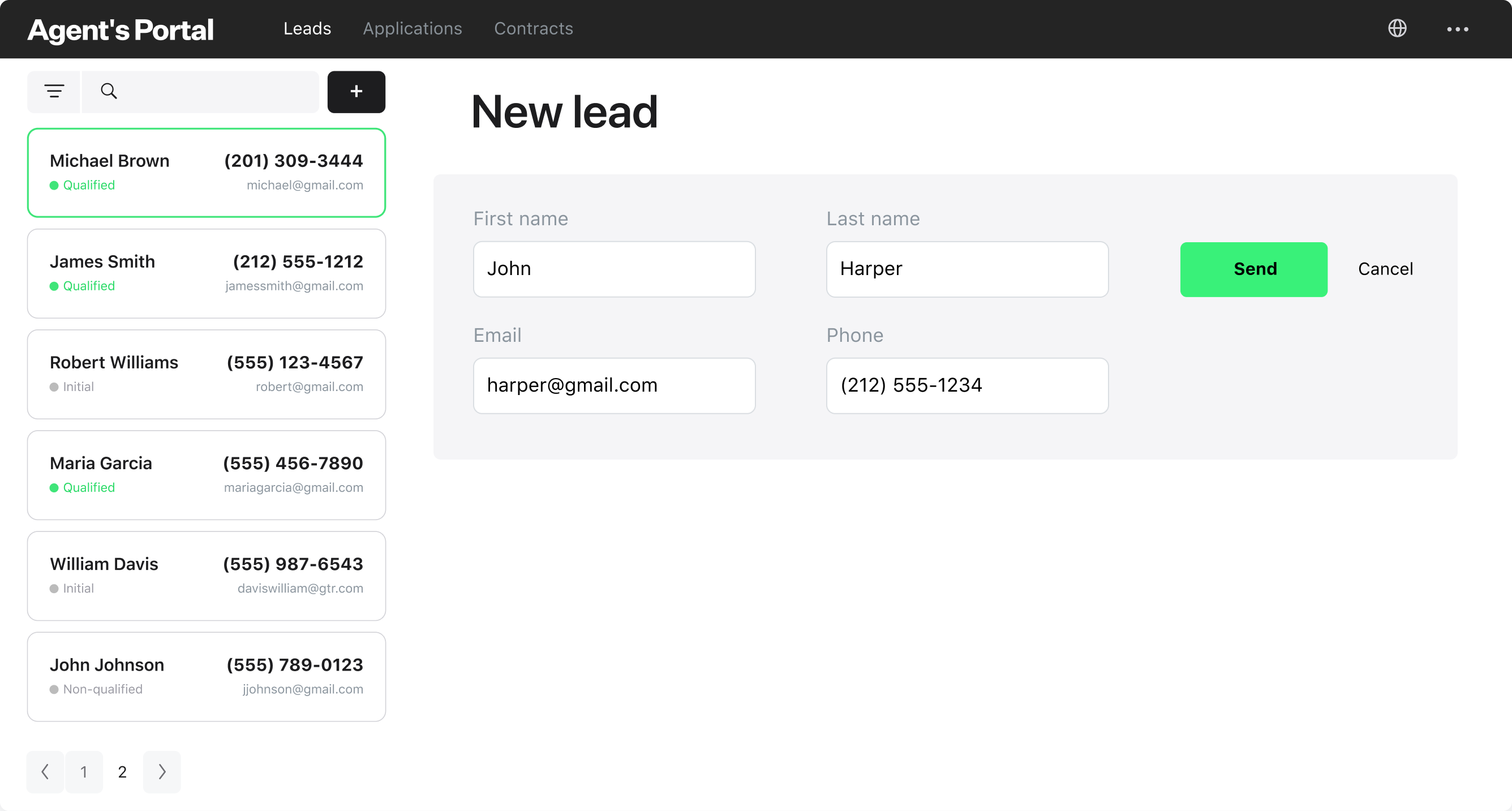

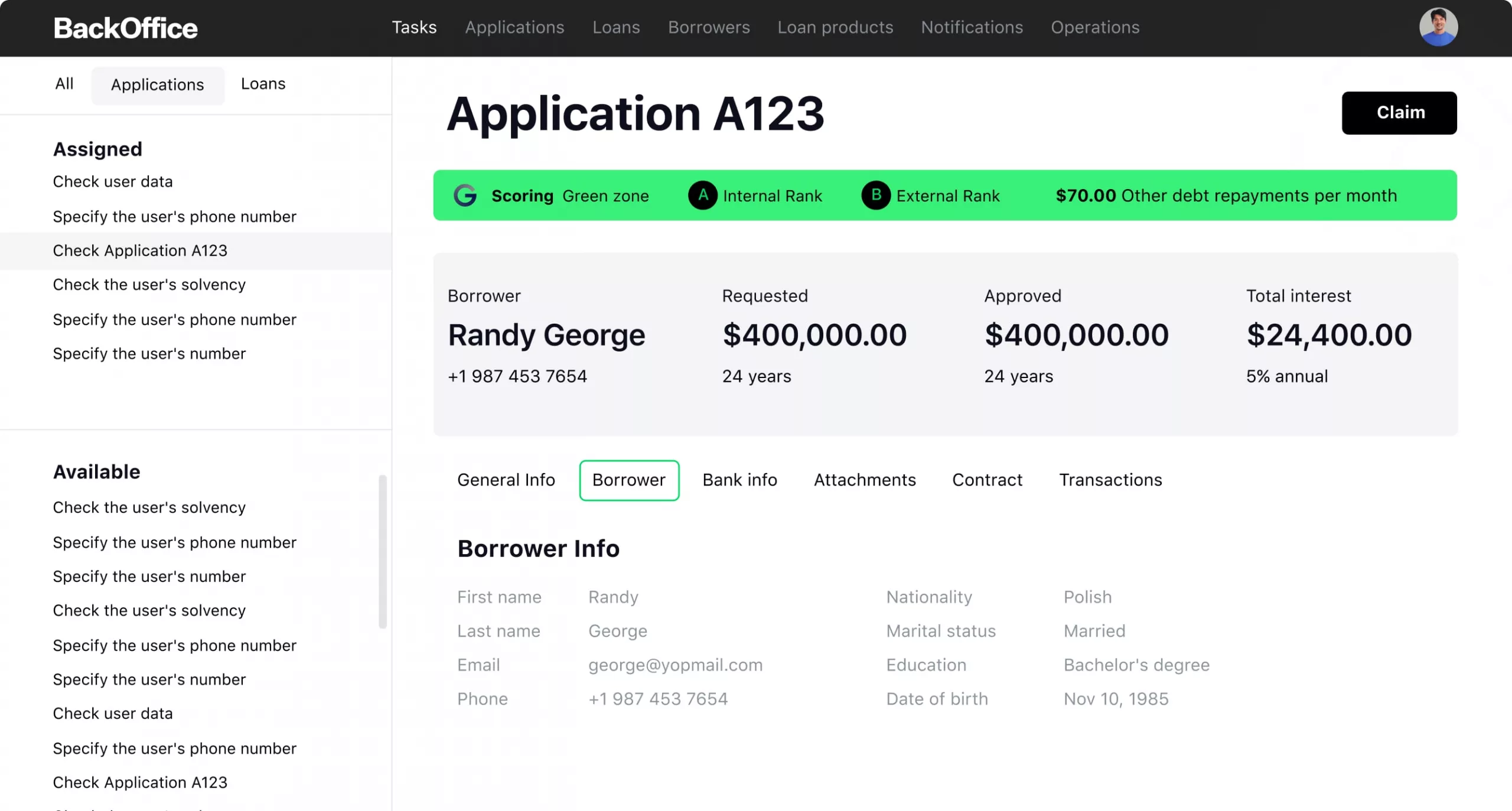

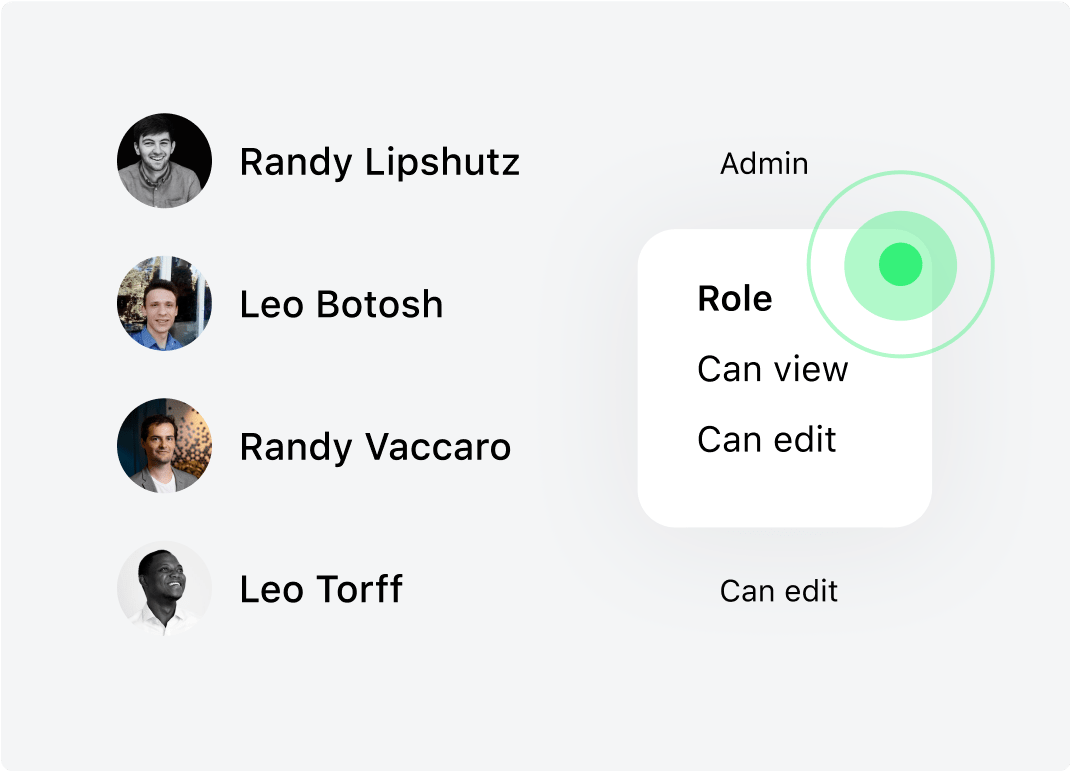

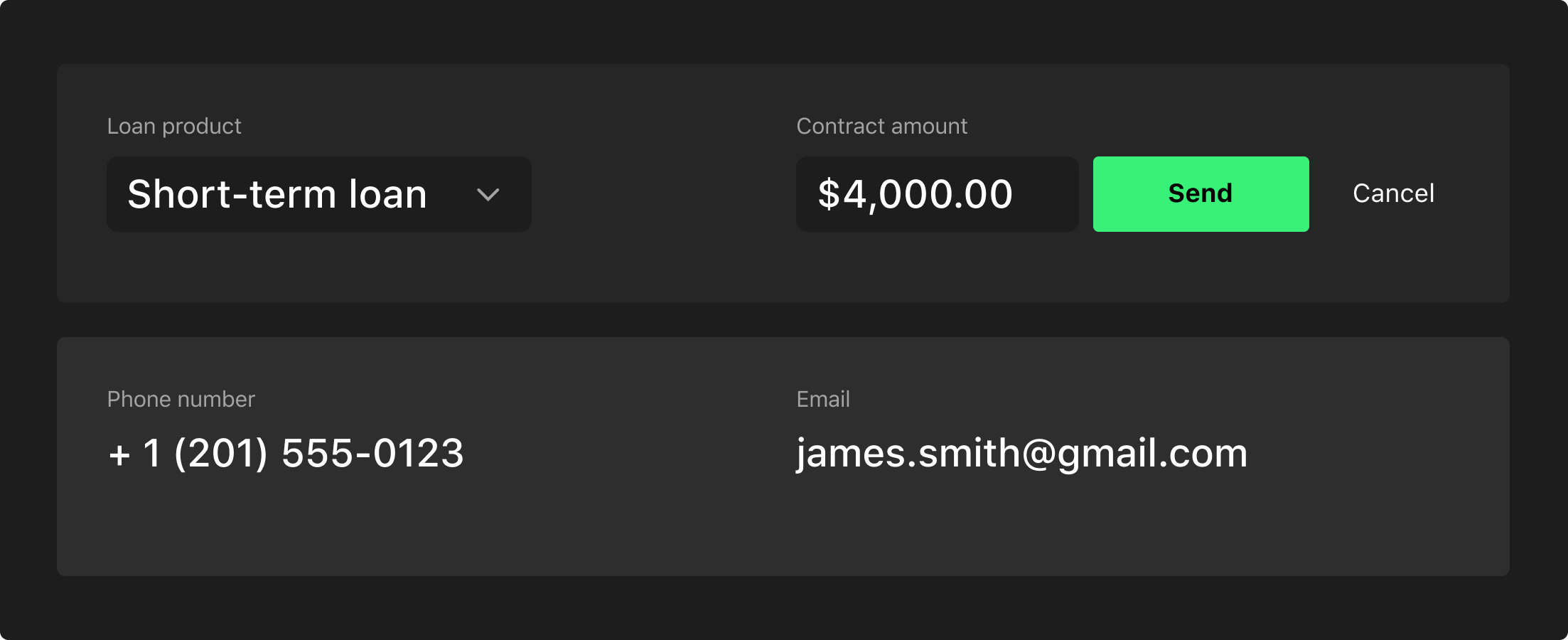

Agent dashboard

Agents can streamline the onboarding process by inviting

colleagues thought their email addresses. Also, they gain immediate access to the contact details of

potential leads, enabling them to make precise and tailored offers.

colleagues thought their email addresses. Also, they gain immediate access to the contact details of

potential leads, enabling them to make precise and tailored offers.

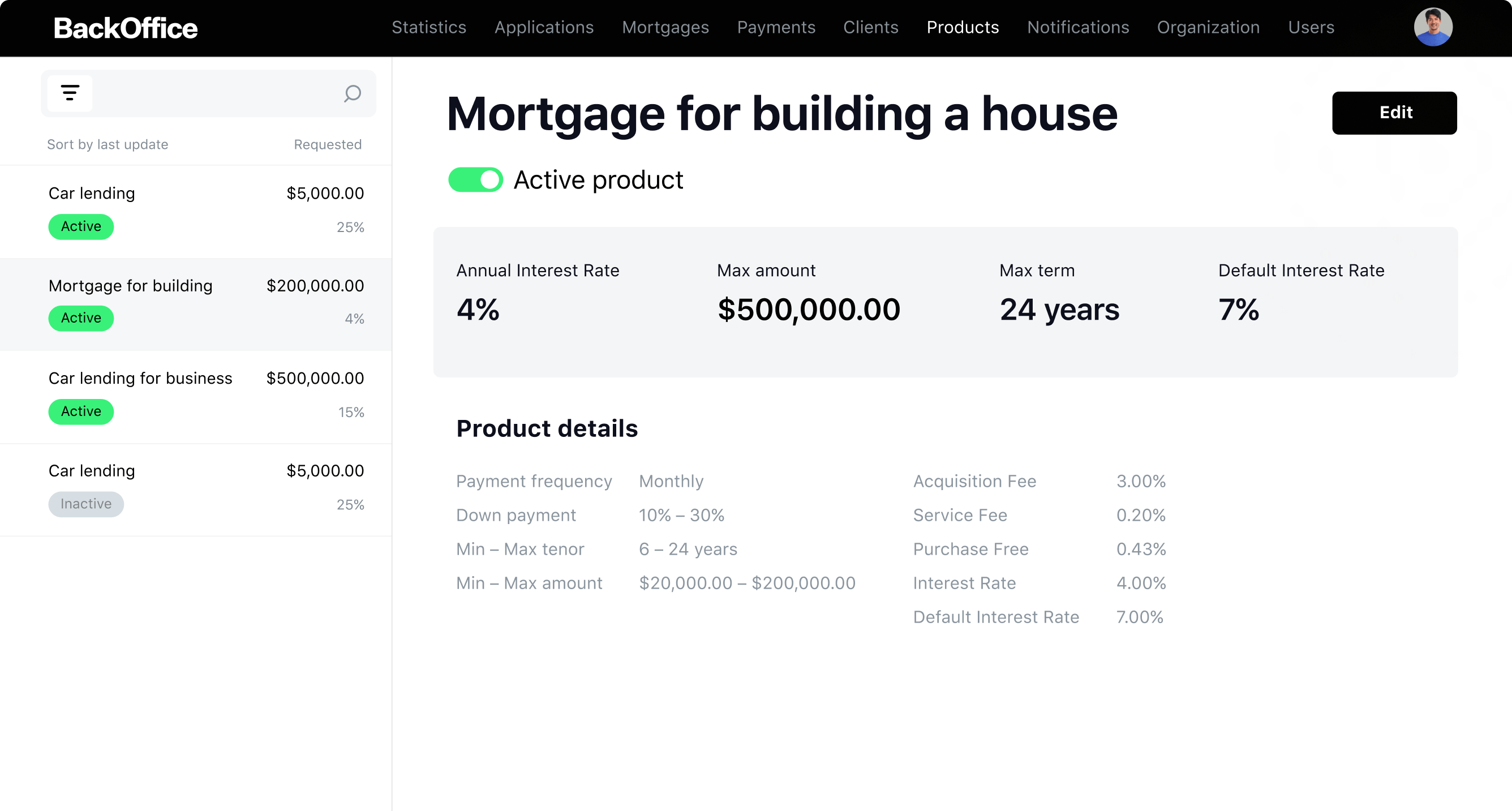

Personalized offer dispatch

Sending offers to leads has never been easier. Agents just

select the loan product and specify the

amount, and the offer is dispatched. Leads then receive this offer in their inbox, which directs them

straight to the Borrower Portal, packed with all the loan details they need.

select the loan product and specify the

amount, and the offer is dispatched. Leads then receive this offer in their inbox, which directs them

straight to the Borrower Portal, packed with all the loan details they need.

Complete mortgage software solution

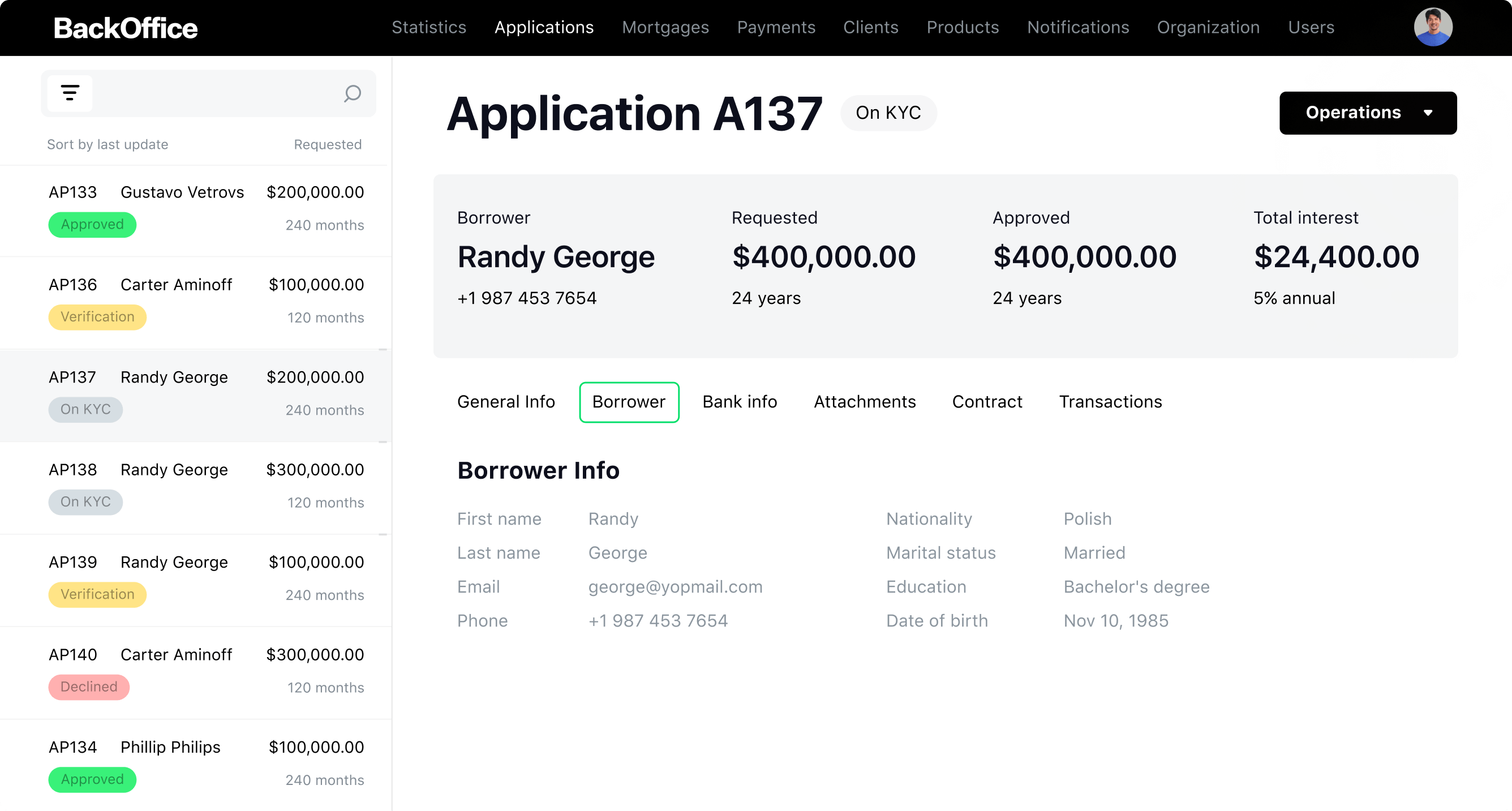

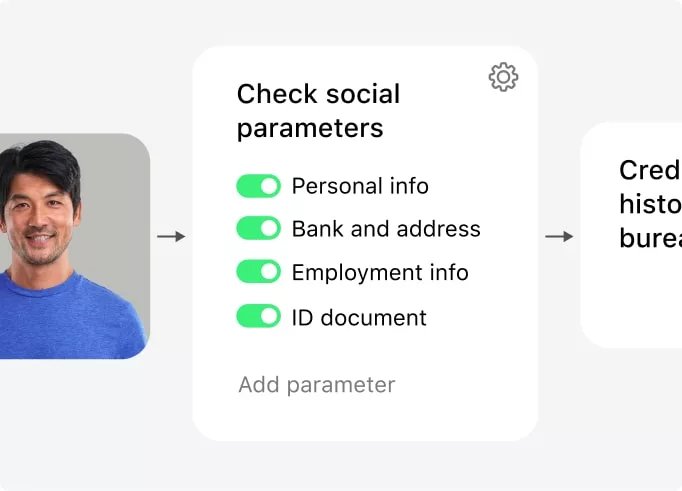

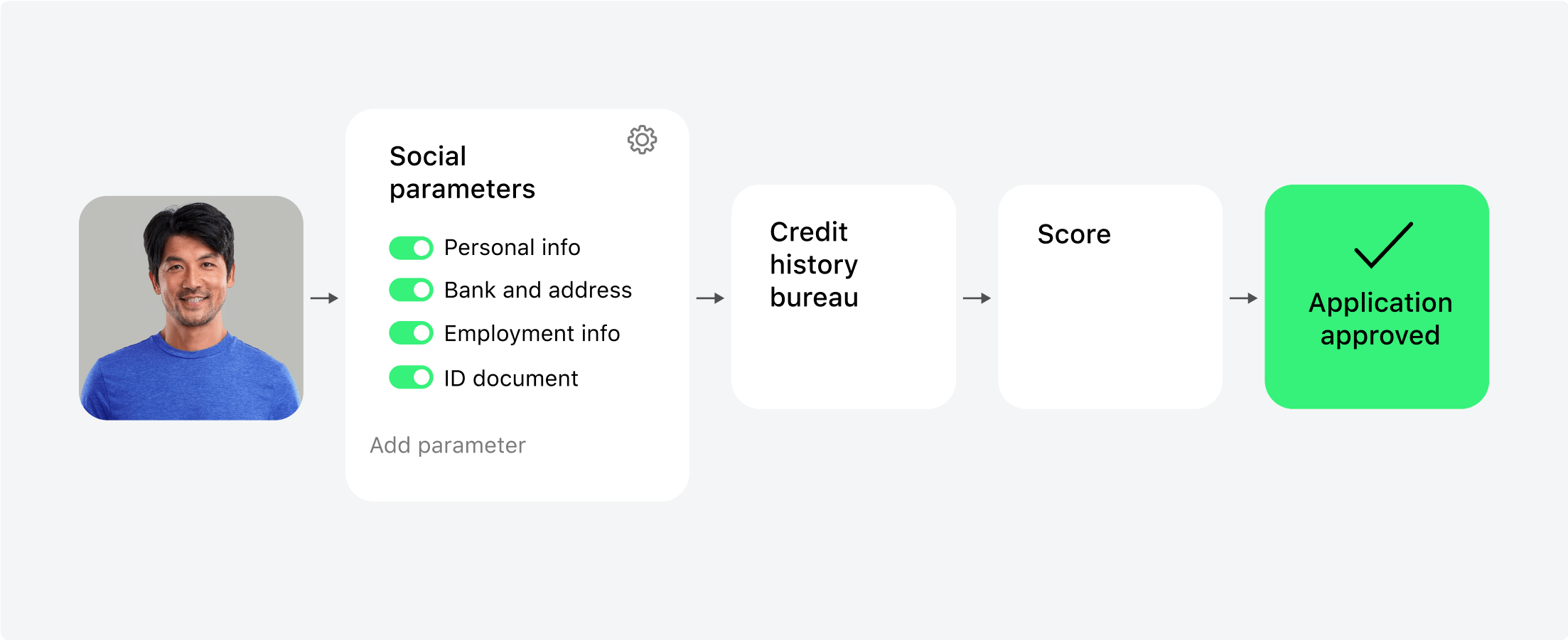

Automated decision-making

Minimize credit scoring risks and increase control. Assess the financial

standing of borrowers and make more accurate decisions with the underwriting module. HES digital

mortgage software can automatically approve or decline loan applications based on selected

parameters.

standing of borrowers and make more accurate decisions with the underwriting module. HES digital

mortgage software can automatically approve or decline loan applications based on selected

parameters.

and much more

Rapid loan application

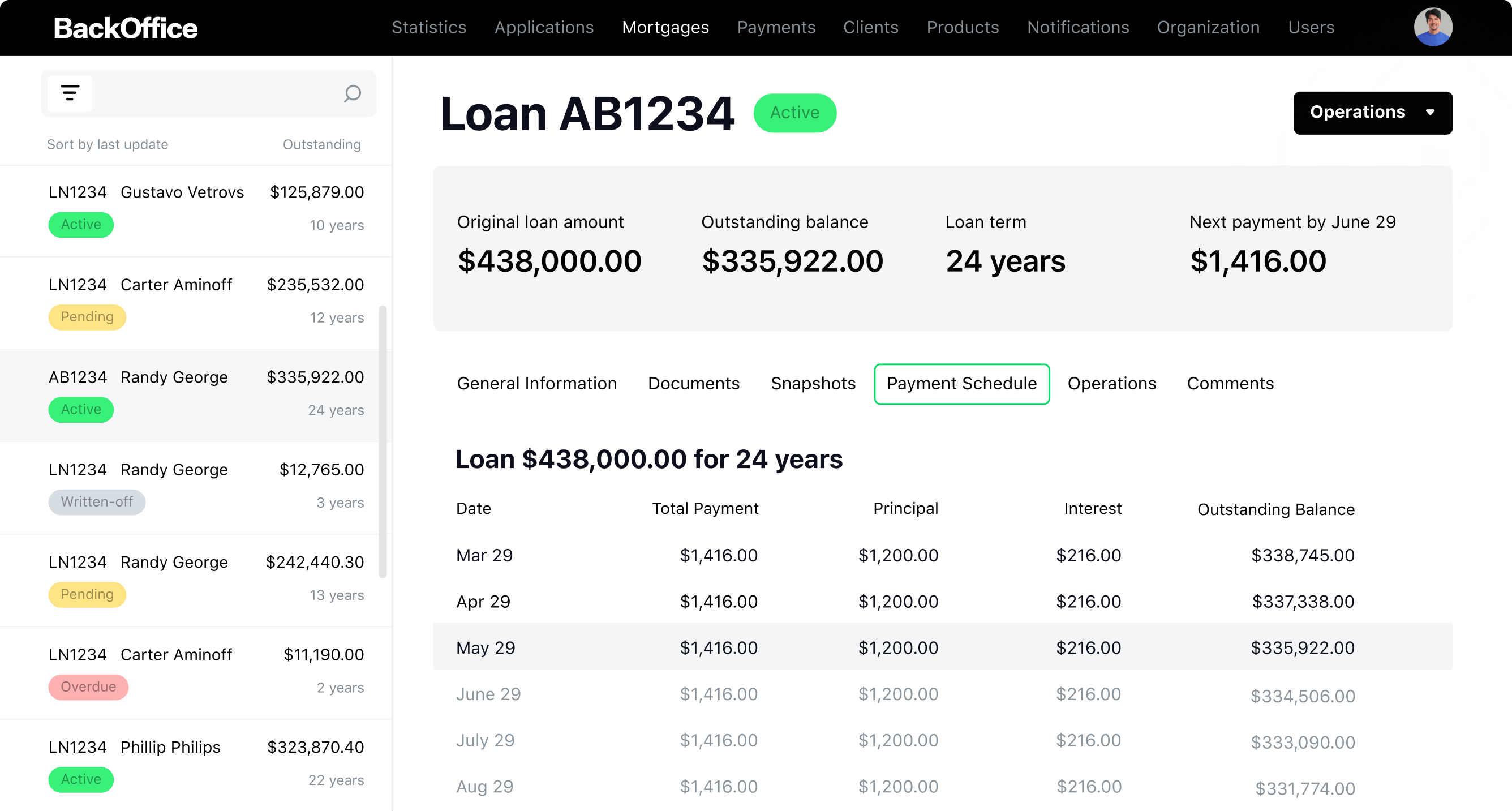

Lending management

Document templates

Automation of disbursements and payments

Transactions and reporting

Powerful integrations

Boost your business with our mortgage

platform

platform

Your robust mortgage

lending software

End-to-end mortgage processing solution

3 months time-to-market

AI decision-making process

Secure mortgage management software

FAQ

How can HES FinTech help me with my mortgage lending business?

Can I customize HES FinTech to fit my specific business needs?

How does HES FinTech integrate with my existing mortgage lending

systems?

systems?

How do I get started with HES, and what kind of support do you

offer?

offer?