Out-of-the-box

student loan software

Get your education loan software ready in 3 months

HES LoanBox solution includes

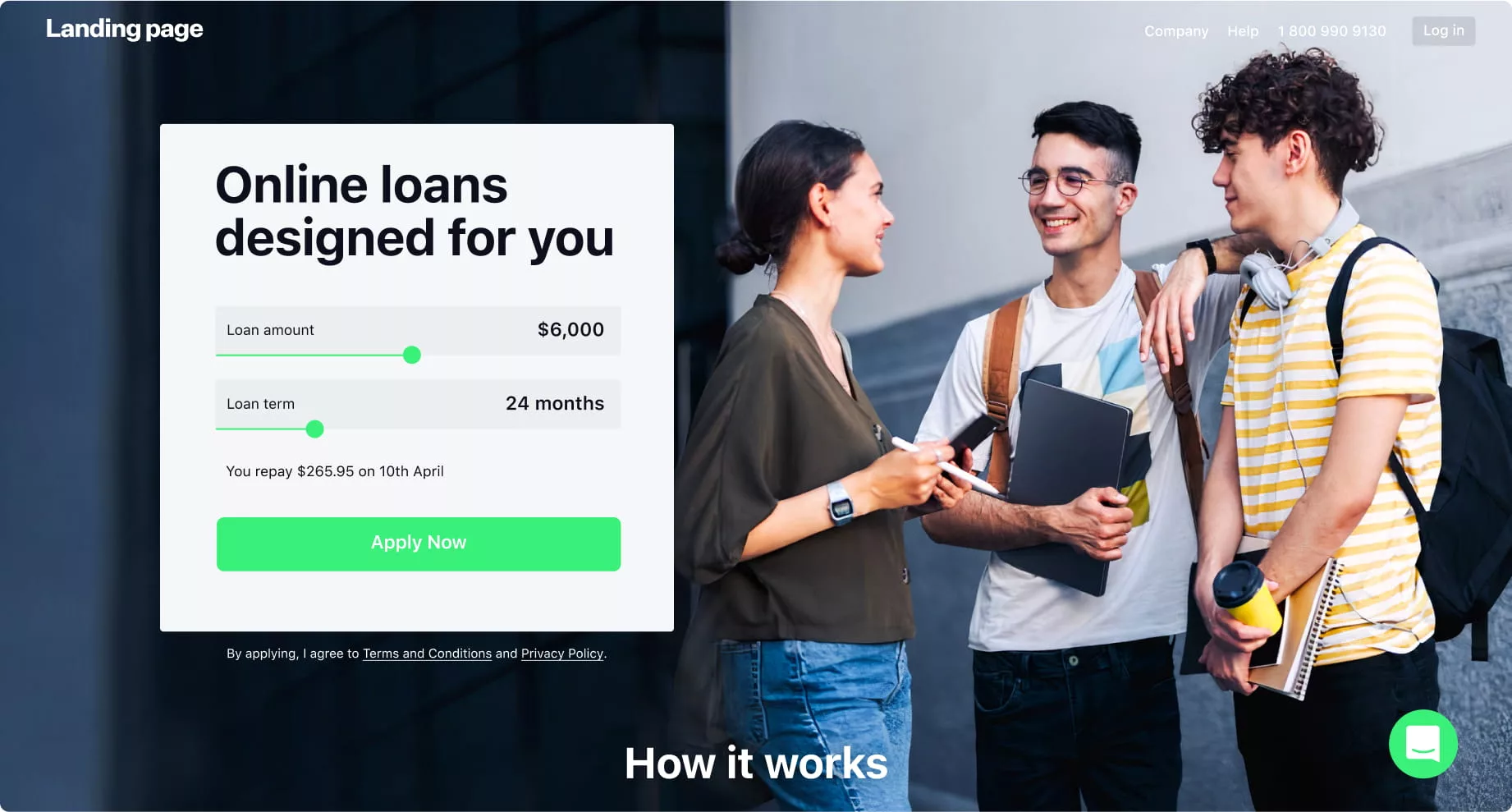

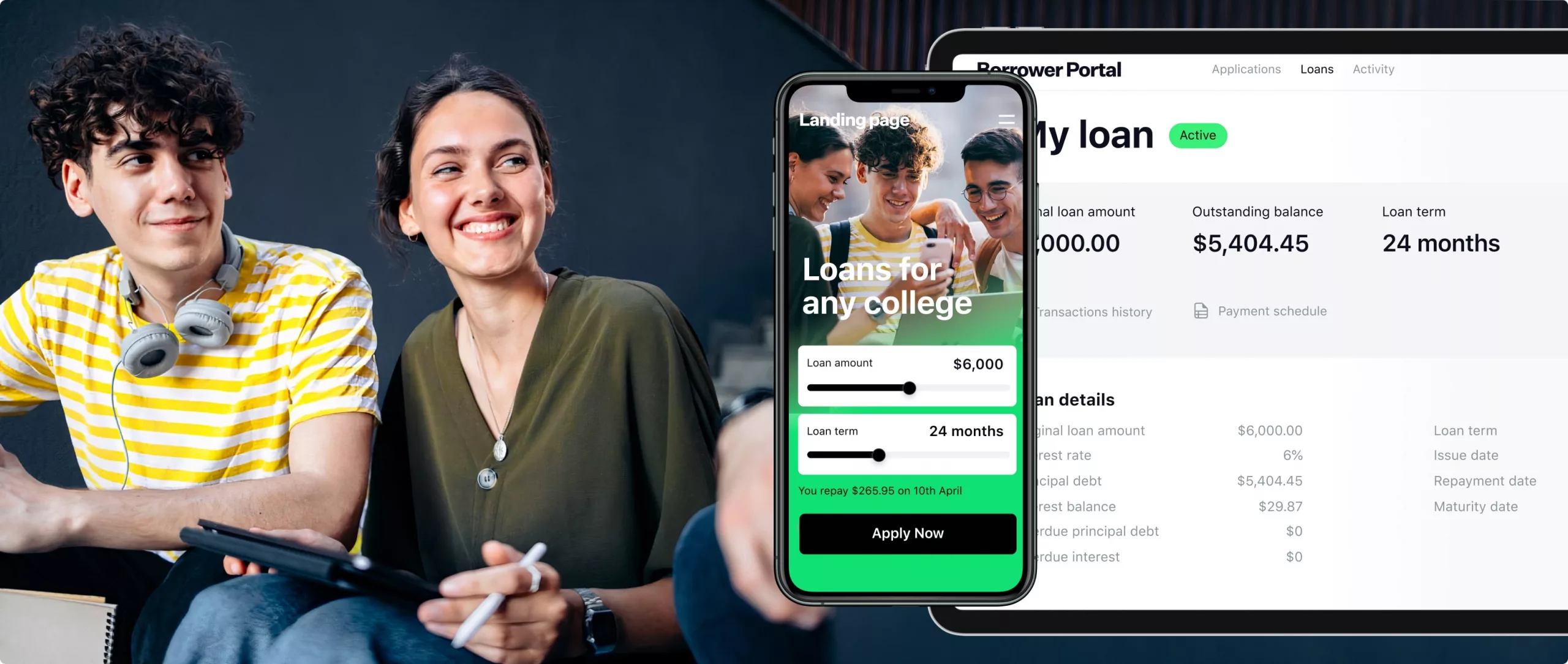

Landing Page

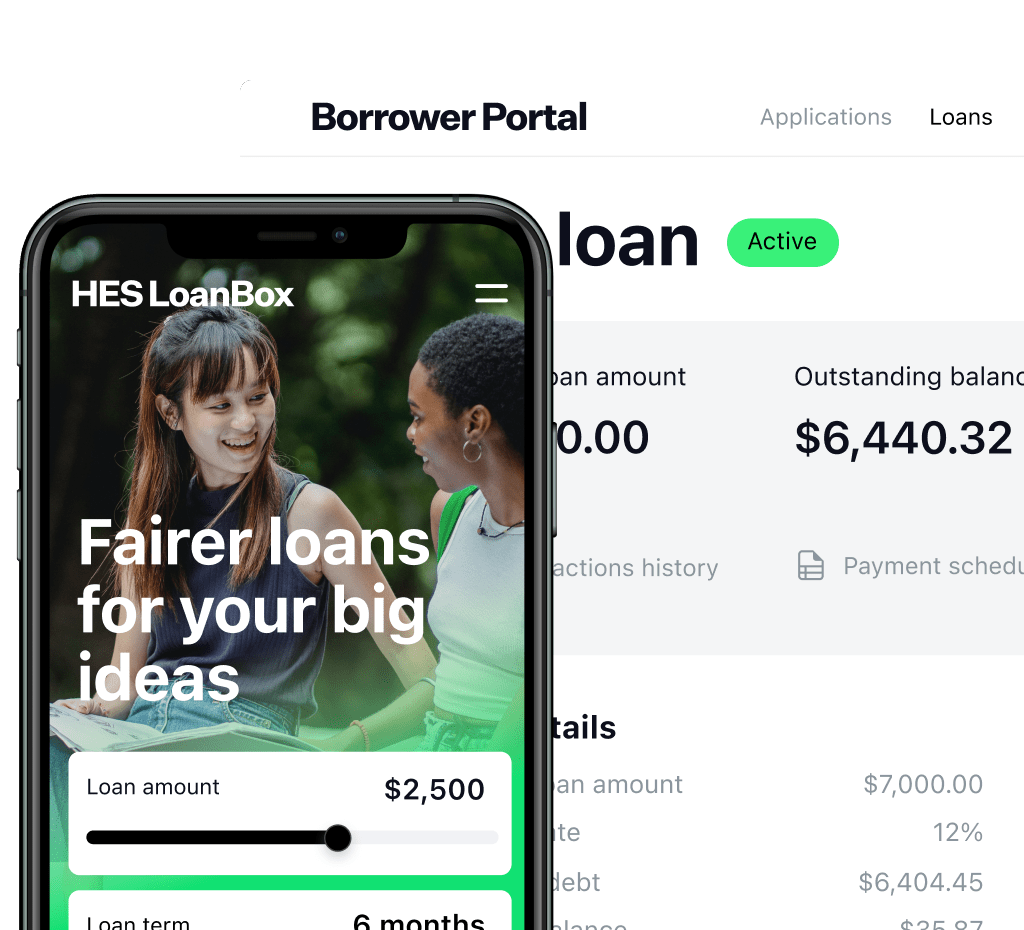

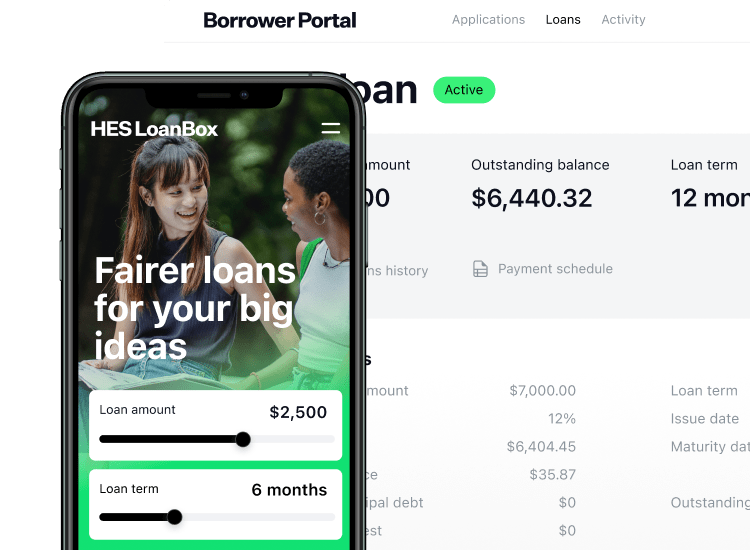

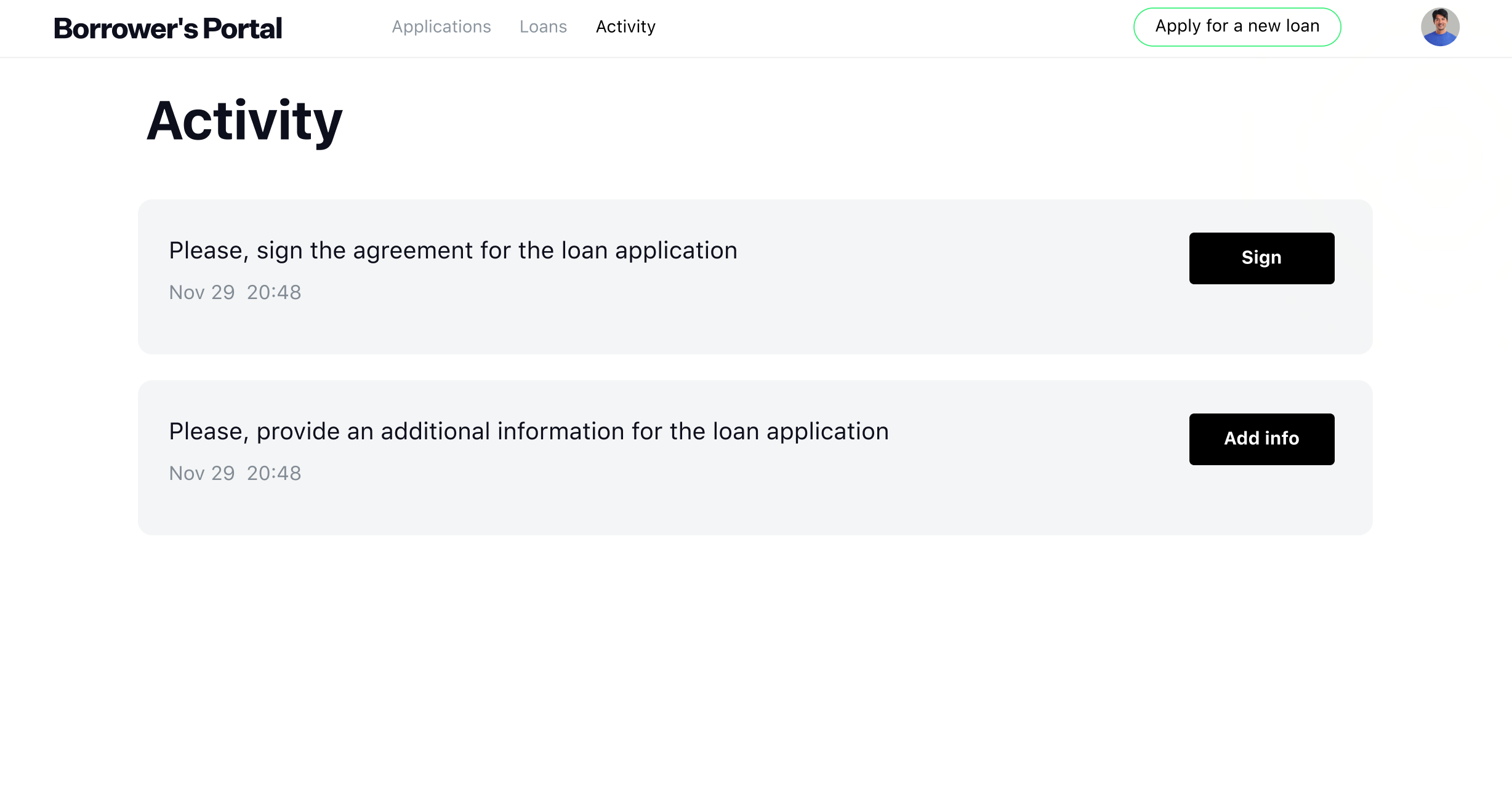

Borrower Portal

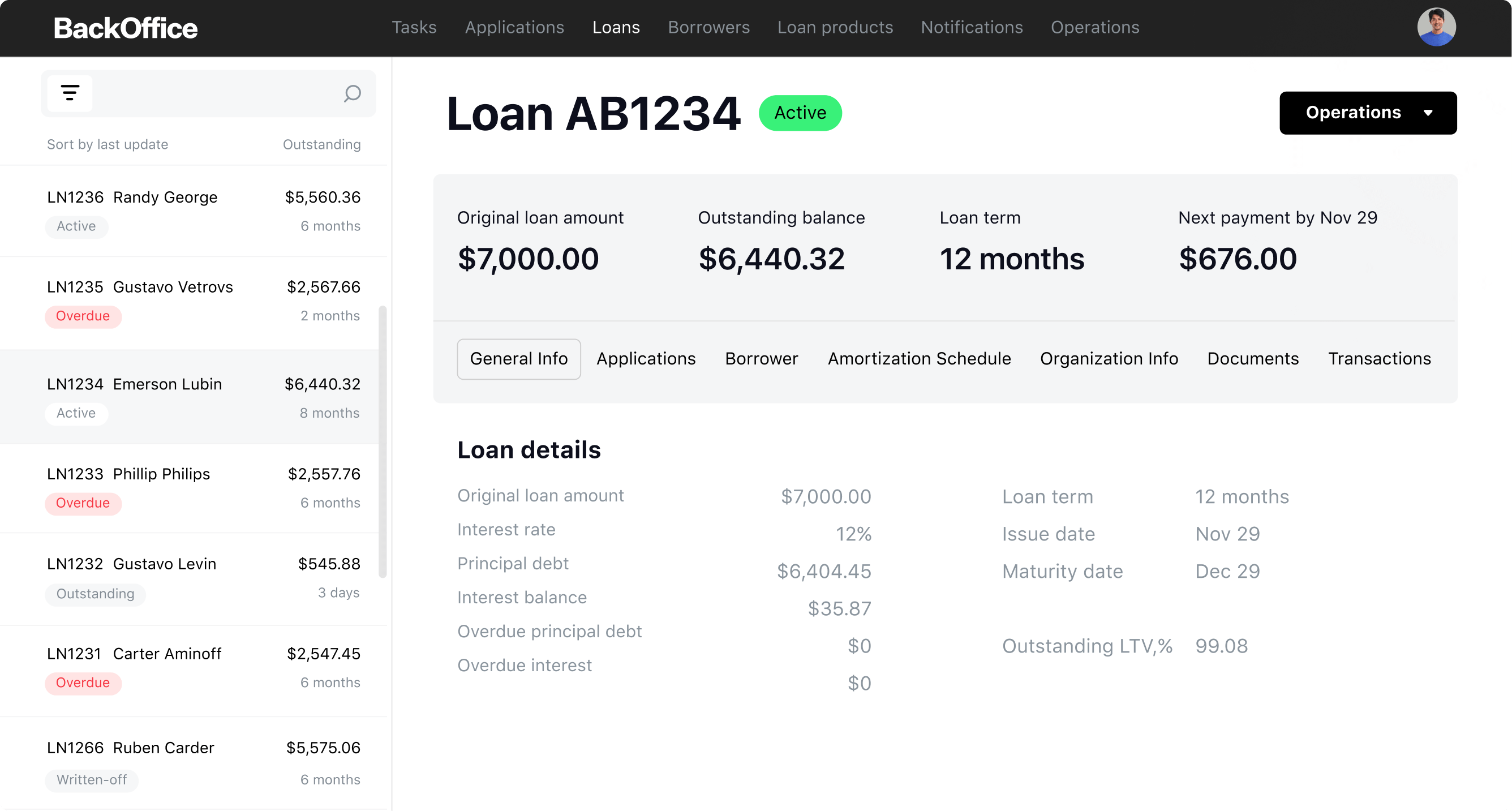

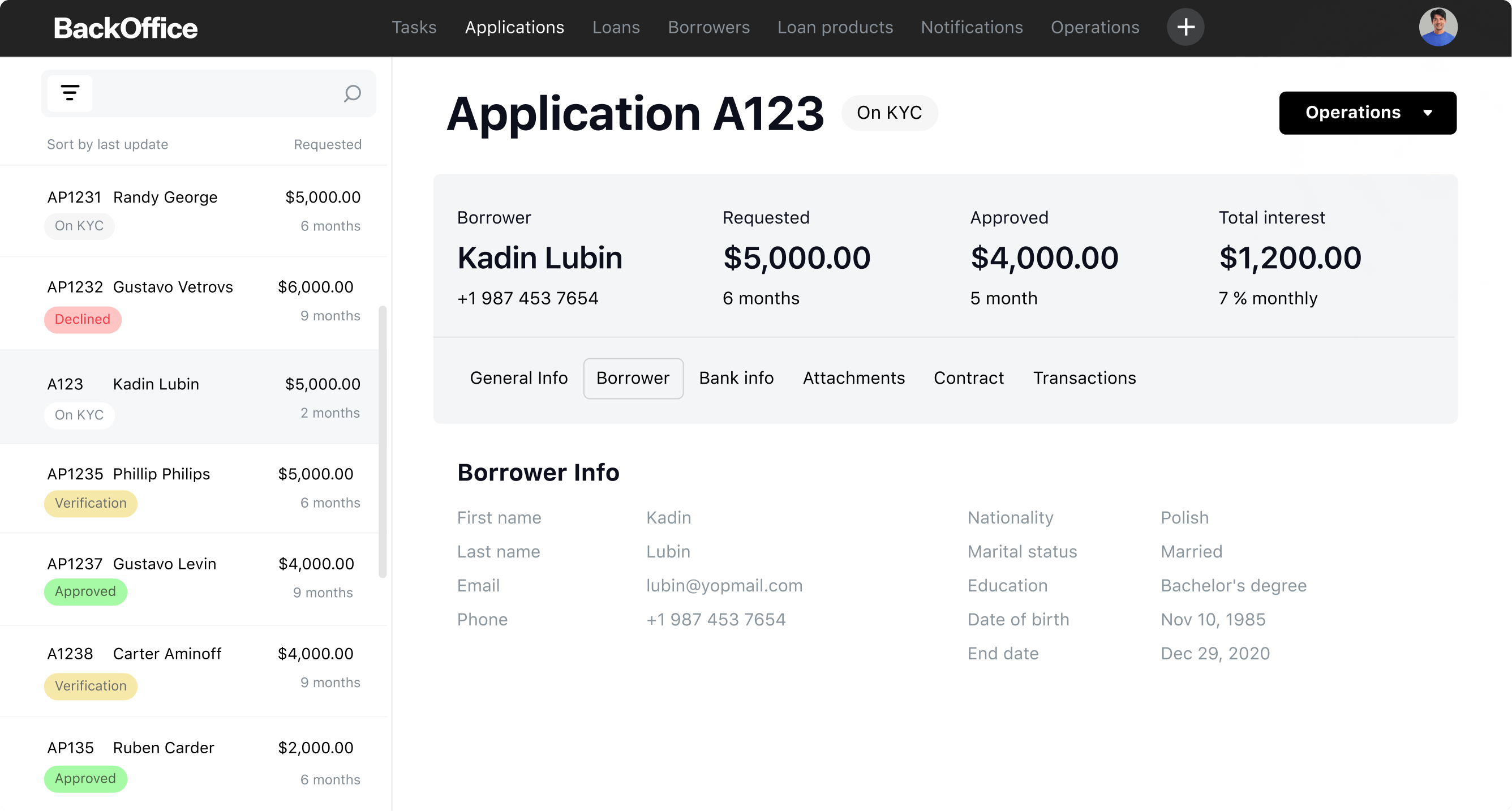

Back Office

Payment processing automatization

In-depth dashboards and reports

Flexible integrations

Lifetime user support

User-friendly whitelabel design

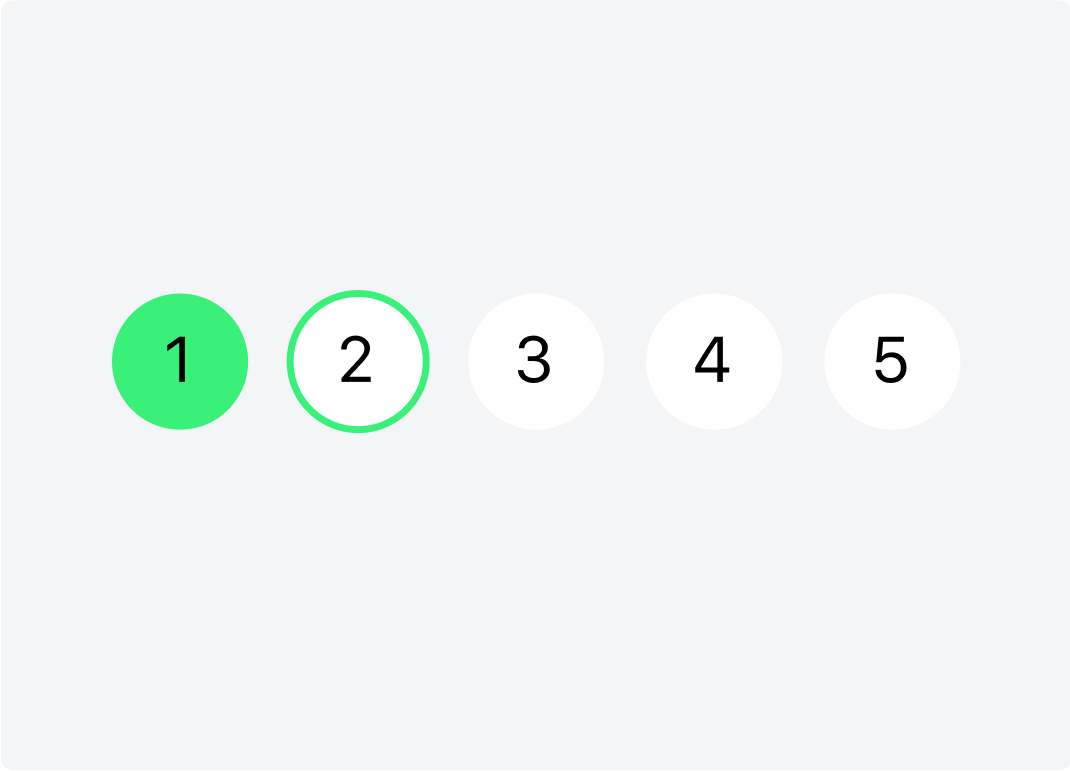

Multi-channel application process

With HES ready-made student loan platform, borrowers have the flexibility

to seamlessly switch between devices while filling out their loan applications.

to seamlessly switch between devices while filling out their loan applications.

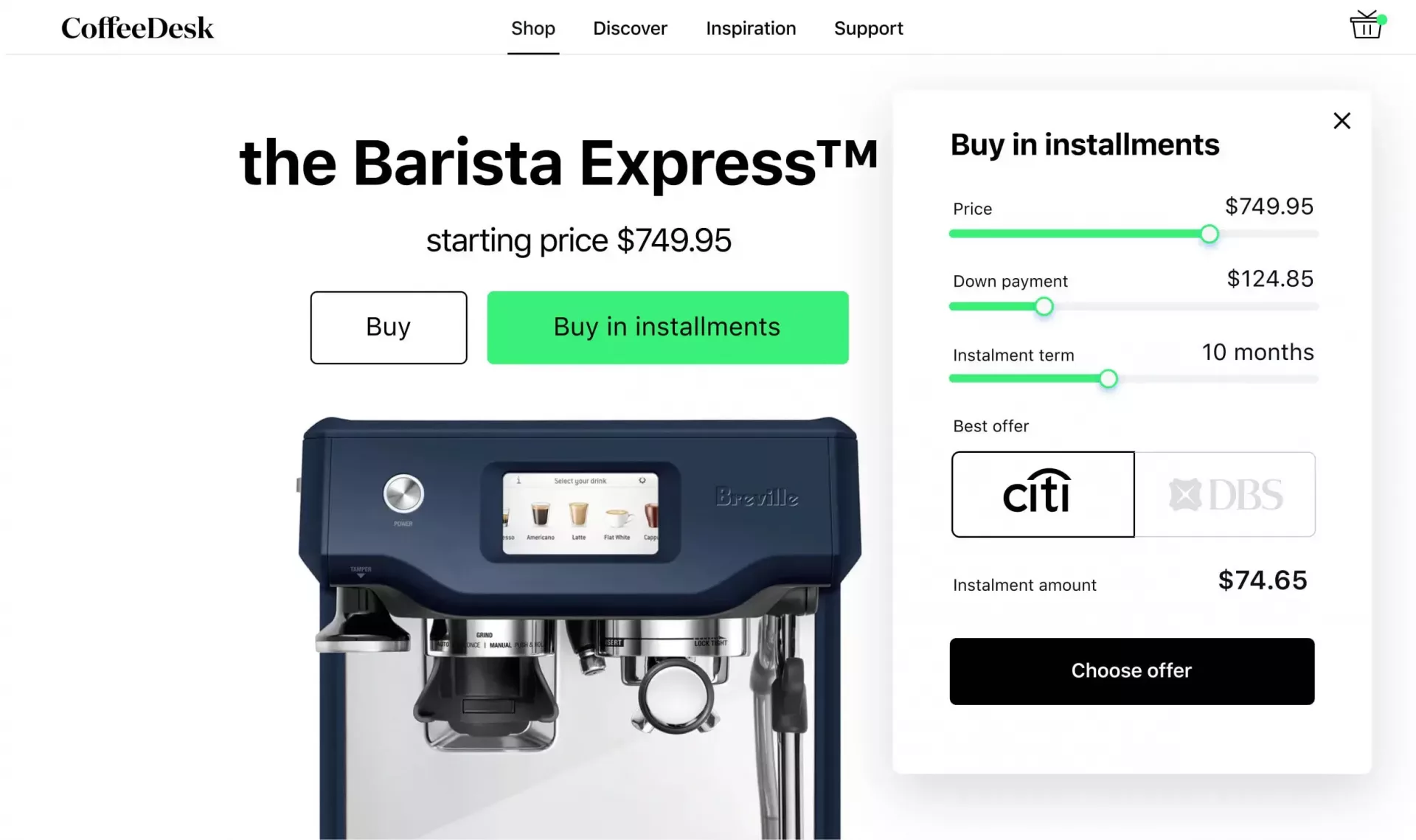

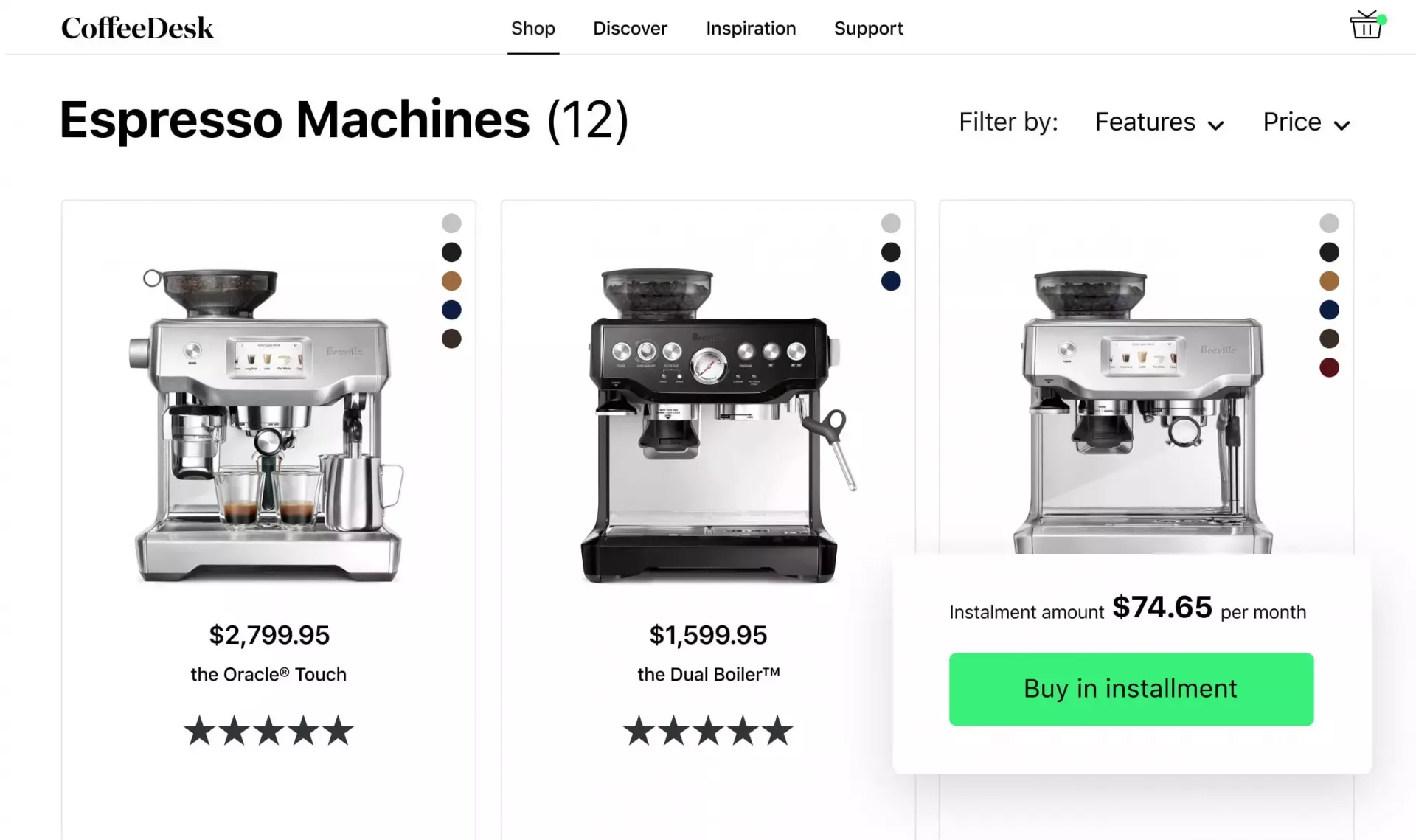

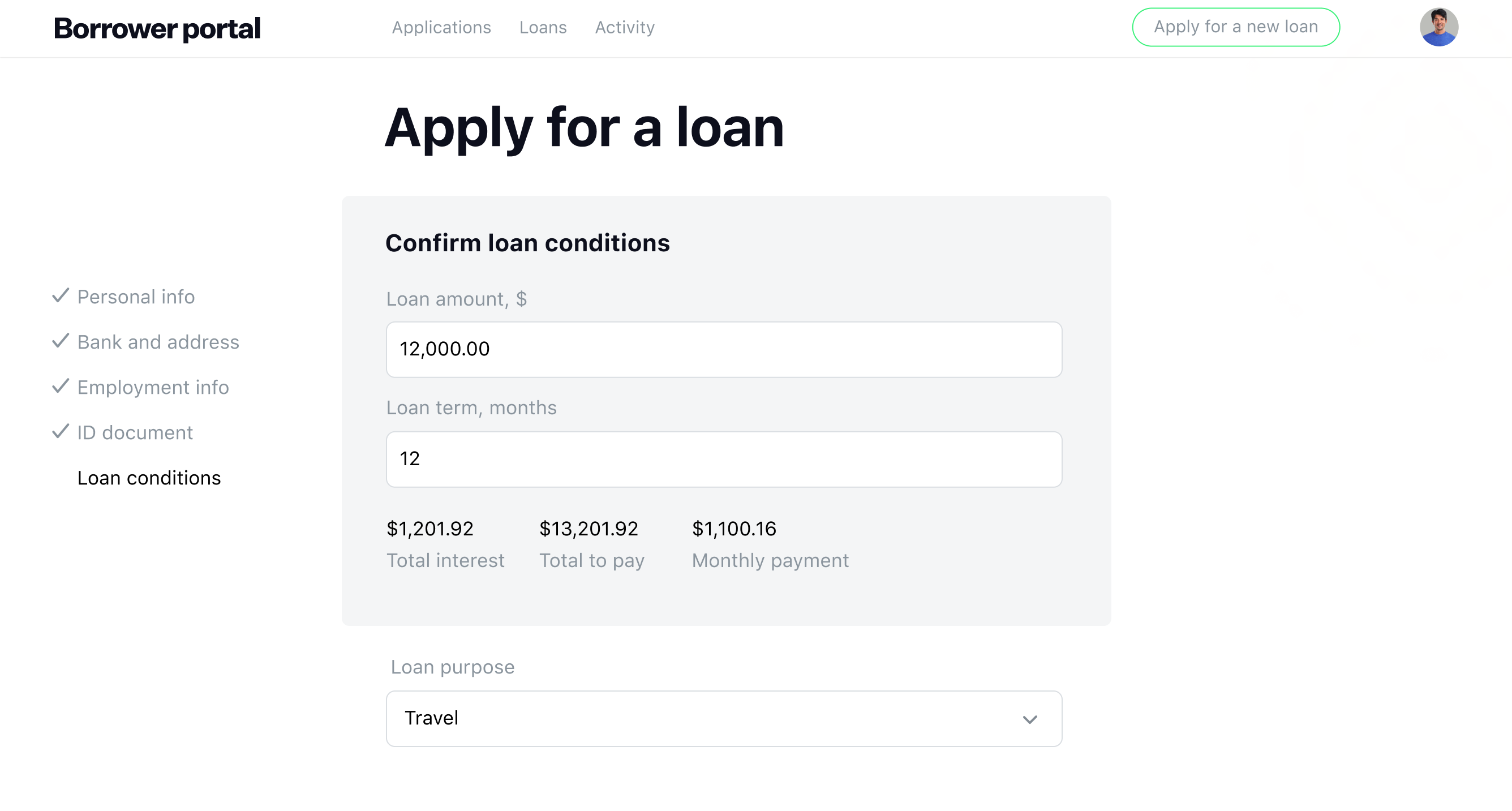

Front-end loan calculator

HES student lending software features a calculator that allows borrowers

to monitor repayments and opt for the best-suited option based on variables like loan amount

and payment frequency.

to monitor repayments and opt for the best-suited option based on variables like loan amount

and payment frequency.

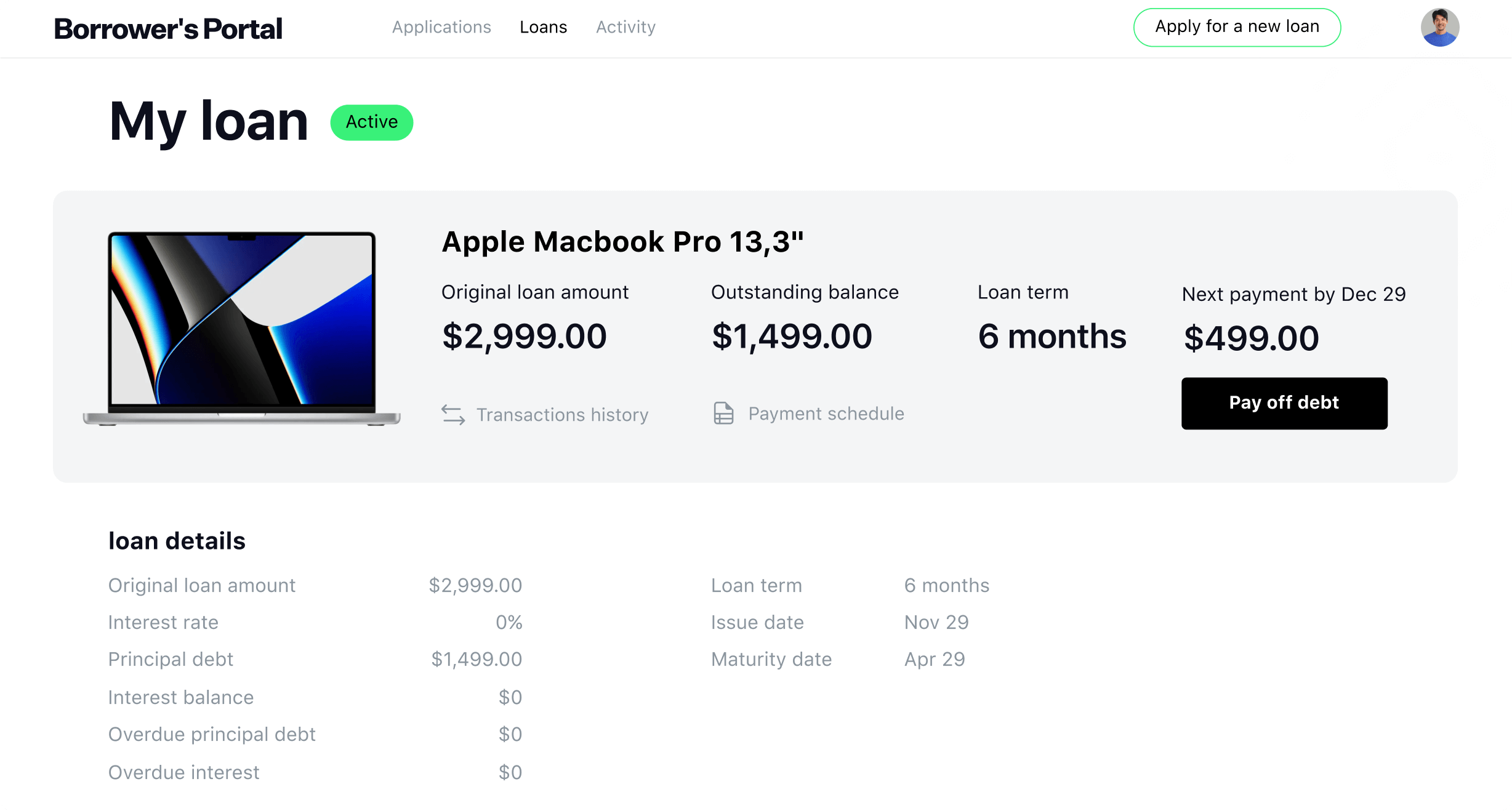

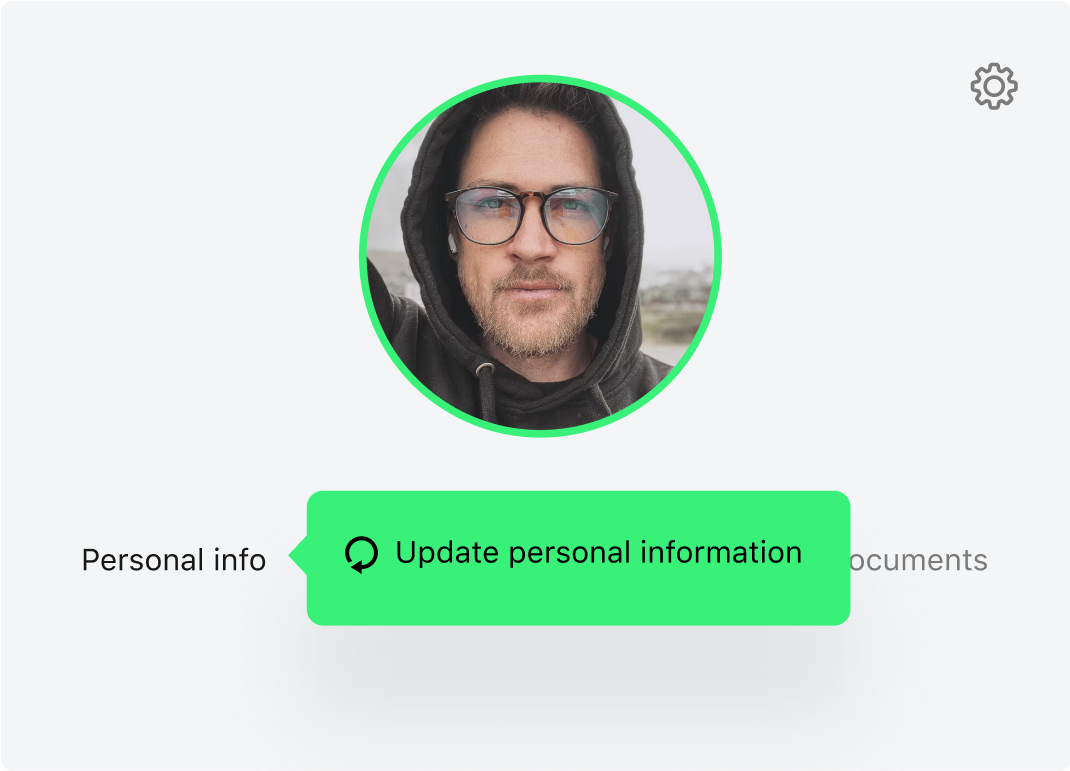

Easy-to-use borrower profile

Our student loan platform empowers borrowers to securely store and update

their personal information for future loan applications.

their personal information for future loan applications.

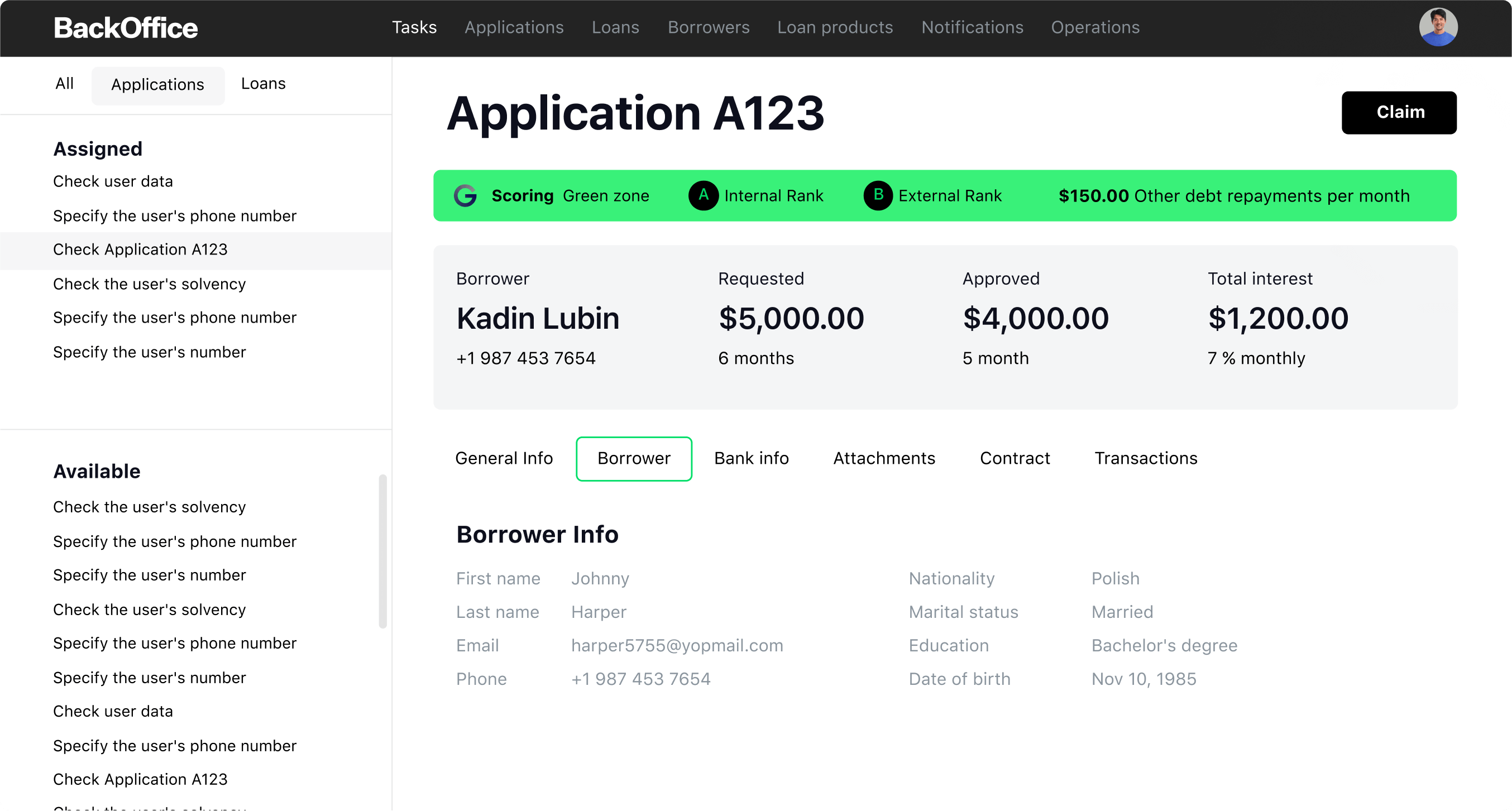

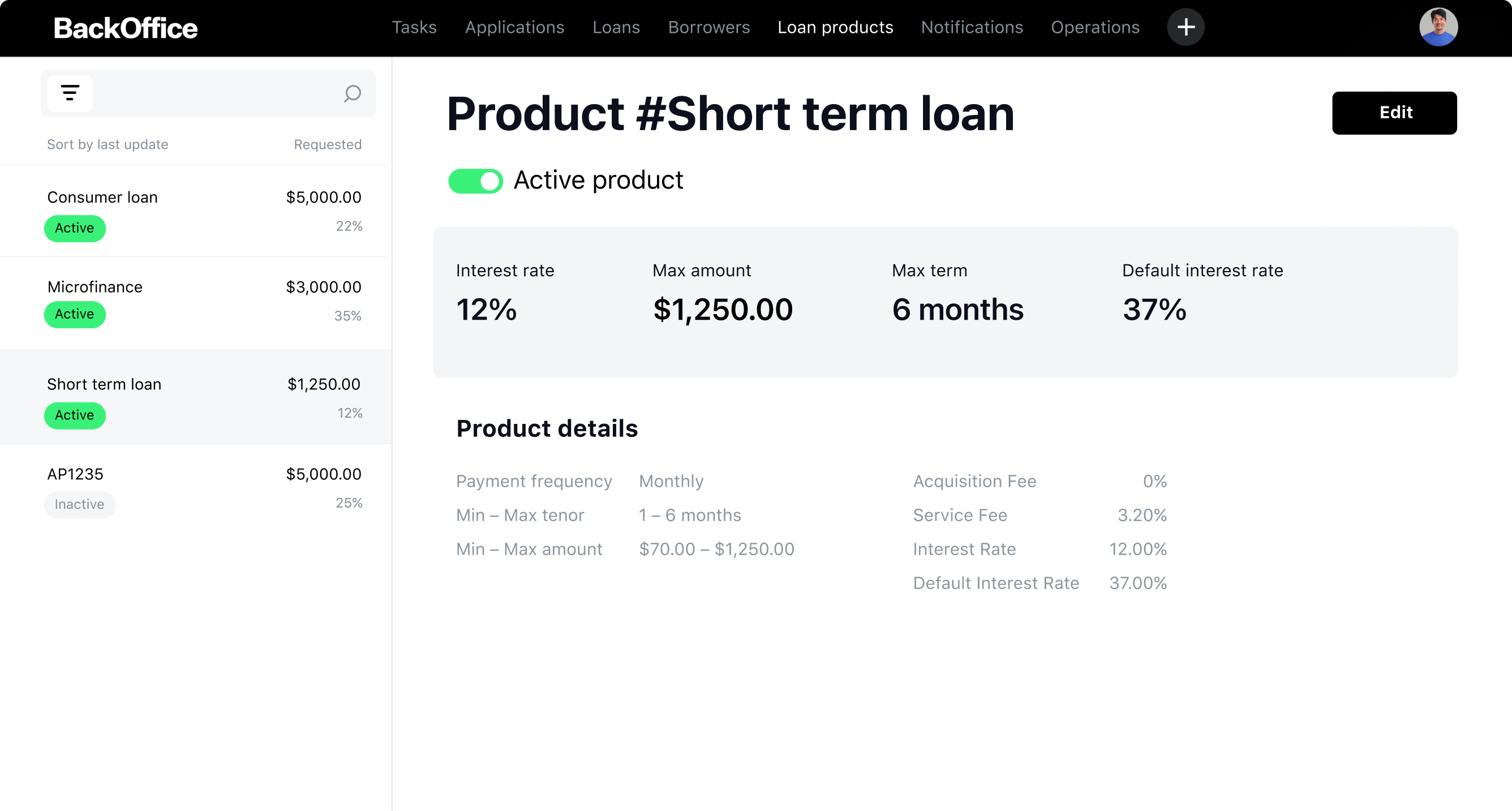

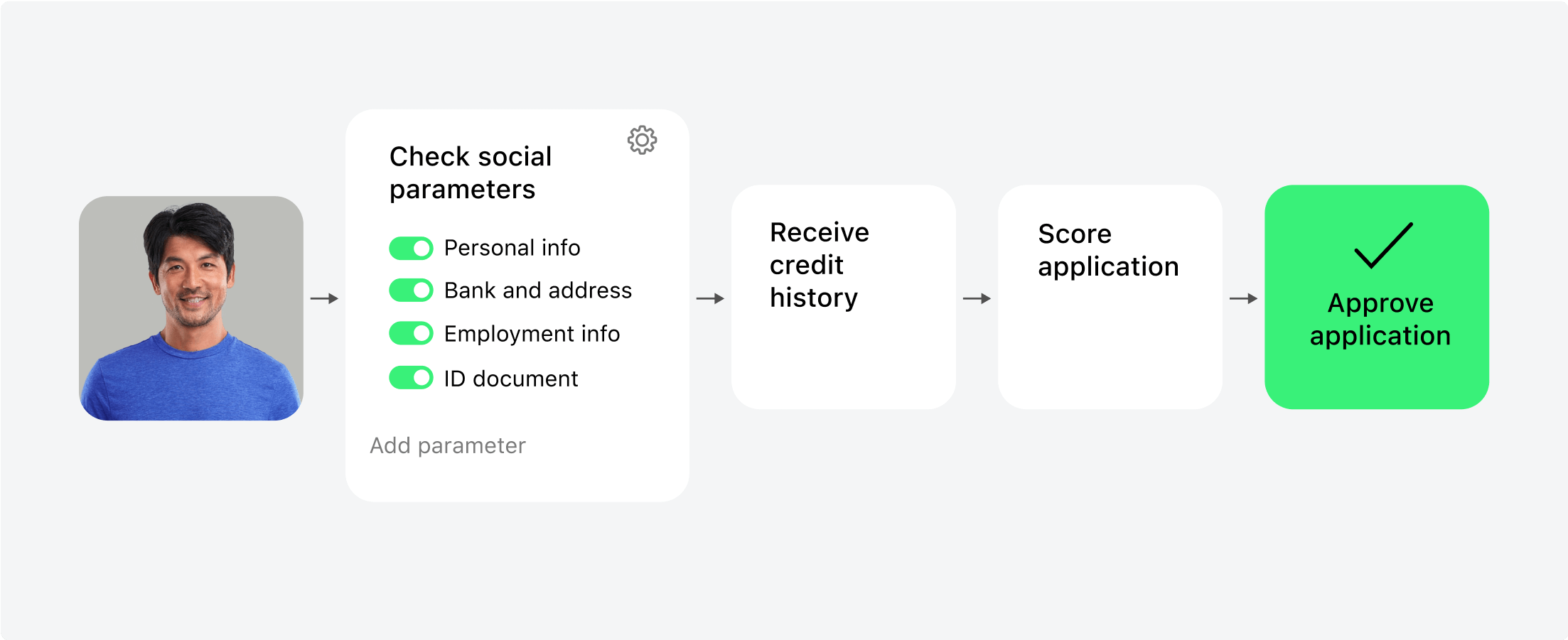

Feature-rich back office

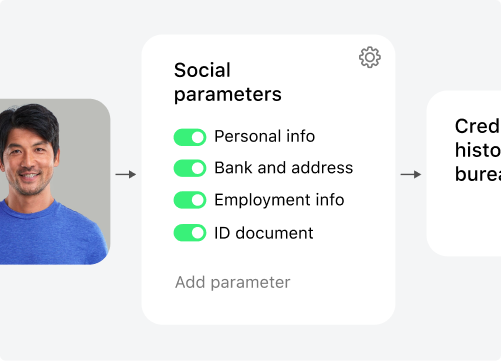

Automated decision-making

Simplify your lending operations with our innovative student loan management

software equipped with AI-fueled decision-making capabilities featuring stop factor detection,

loan product matching, and more.

software equipped with AI-fueled decision-making capabilities featuring stop factor detection,

loan product matching, and more.

and much more

Lifetime customer support

Security updates

Document templates

Automatiс transactions

Customization opportunities

Flexible integrations with high-end solutions

See our product in action with a quick demo

Turnkey software

for student lending

Ready-made education loan software

HES’ student lending solution is highly adaptable to meet the unique demands

of your business. By utilizing student loan origination software, you can automate

repetitive tasks, resulting in significant time savings and decreased operational

expenses.

Only 3 month to launch

The HES student loan management software can be up and running in just three months,

giving your business a quick start. Our robust solution offers a rapid return on

investment and increased business efficiency.

No additional charges per user

HES provides fully managed student loan software solutions with no extra charges

based on the number of users or customers. Our pricing model is flexible and depends

on the specific features you require.

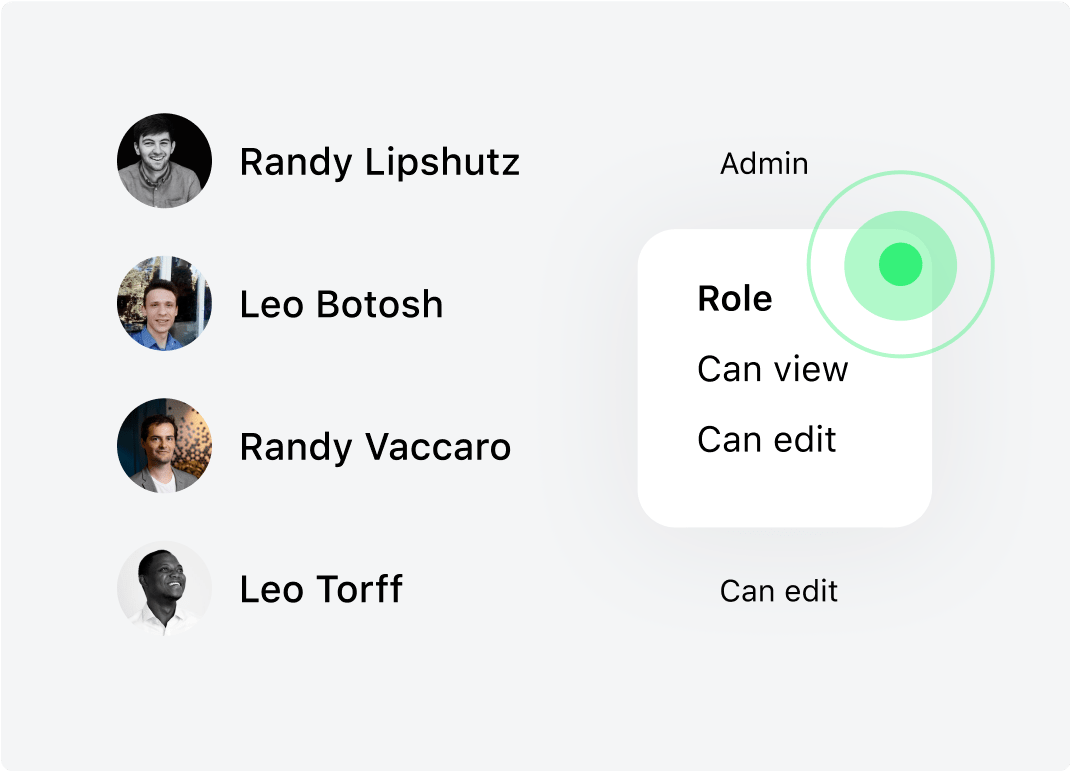

Easy white-label interface

Our user-friendly interface is designed to be easily learned and does not require any

technical skills. Additionally, you have the freedom to modify the branding of your

landing website, borrower portal, and back-office system.

technical skills. Additionally, you have the freedom to modify the branding of your

landing website, borrower portal, and back-office system.