SME loan management software

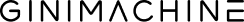

An end-to-end loan management software solution for SME lenders to issue and manage credit products efficiently. Automates tasks like onboarding borrowers, collecting documents, assessing credit, and approving applications. It also checks each borrower's financial health by reviewing key financial indicators.

Learn more

Commercial loan management software

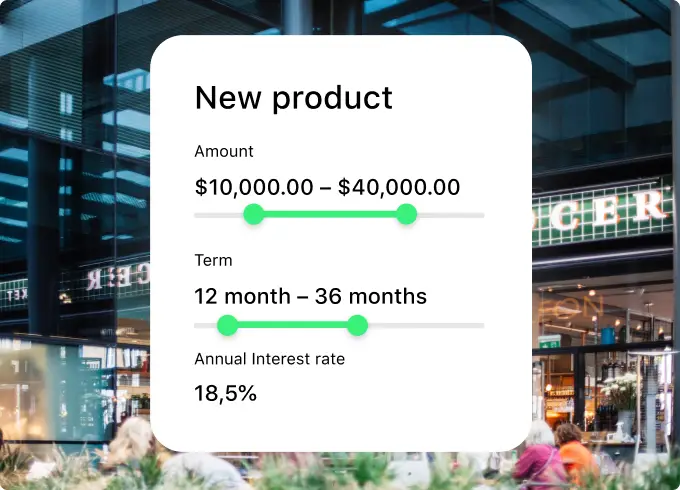

This loan management software automates every step of the lending process, from applications and underwriting to disbursement and monitoring. Supports complex commercial credit facilities, credit lines, and large transactions involving several parties. Data-driven credit and risk assessment tools give lenders insights into each borrower's financial health and help identify risks at an early stage.

Learn more

Working capital loan management software

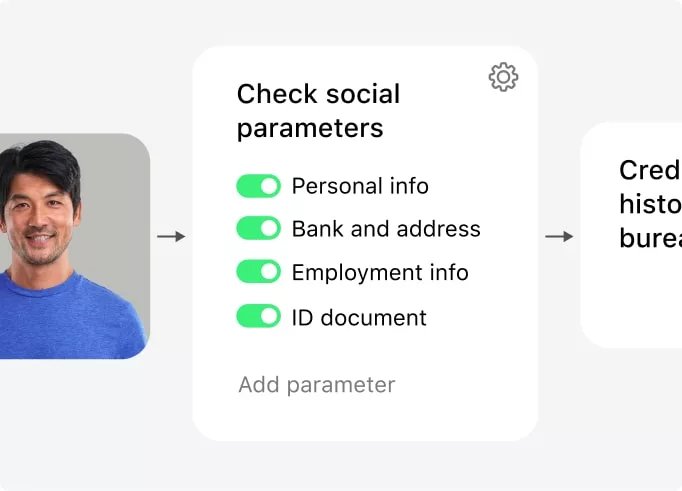

A specialized loan management platform for managing short-term lending and liquidity. This loan management software automates credit limits, interest rates, and payment terms, while supporting multiple financing models like revolving credit lines, deferred payments, and receivables financing. Built-in risk assessment and borrower scoring help lenders quickly evaluate creditworthiness, even across large portfolios and high transaction volumes.

Learn more

Bank loan management software

An integrated loan management platform for managing all bank lending activities, from origination to servicing and repayment. This loan management software supports personal and corporate credit products with automated credit checks, customizable scorecards, real-time portfolio data, and smooth integration with core banking, credit bureaus, AML/KYC, and payment systems. Built to meet regulatory requirements and available with flexible cloud or on-premise deployment options.

Learn more

Merchant cash advance software

Manages revenue-based financing by automating advances, repayment tracking, and risk assessment. This lending software supports flexible repayment structures linked to merchant sales and high-volume, short-term funding models for alternative finance providers.

Learn more

Leasing management software

Covers the full leasing lifecycle, from contract setup to billing and asset tracking. Automates payments, renewals, and residual value management for both operating and finance leases, making it a powerful lending software solution for asset-based finance companies.

Learn more

Trade finance software

Supports multifaceted global trade transactions, including letters of credit and guarantees. This lending software streamlines document handling, risk management, and compliance across multiple counterparties involved in international transactions.

Learn more

Consumer loan management software

Built to help banks, credit unions, and other institutions better handle personal financing. This loan management software automates application processing, credit checks, and decision-making, and empowers lenders to manage the entire credit lifecycle, right from origination to final payoff in one place.

Learn more

Auto finance software

Optimizes all stages of the vehicle financing process, including origination, offer generation, servicing, and repayment tracking. As specialized lending software for automotive finance providers, it integrates credit scoring and decision-support tools to approve more applications faster while maintaining strong portfolio control.

Learn more

BNPL software

Brings flexible financing right into the online shopping journey and lets customers split purchases into smaller, often interest-free installments. This lending software takes care of credit checks, decision logic, repayment tracking, and reconciliation in real time, enabling a fast and transparent experience on both sides.

Learn more

P2P lending software

Provides a centralized hub where lenders can manage funding listings, bids, disbursements, and repayments within one transparent interface. Can help track account balances, freeze bid amounts, and transfer funds once financing is fully completed.

Learn more

Microfinance software

Built for institutions that serve individuals and microbusinesses that are either underserved or have limited access to traditional banking services. This lending software centralizes all financing activities, including borrower onboarding, portfolio tracking, repayment, and reporting, and grants organizations a unified view of portfolio health and client performance.

Learn more

Islamic finance

Supports all major Sharia-compliant structures, including Murabaha, Ijarah, Tawarruq, Mudarabah, Wakala, Musharakah, and Istisna'a. It enables rule-based, Sharia-aligned financing workflows and operates as a compliant lending software environment, integrating with credit bureaus for deeper financial insights and connecting with regional systems to ensure full alignment with local regulations and market requirements.

Learn more