Loan management software

in Canada

Expand your business with an AI-driven, secure, fully digital, and completely automated solution.

Trusted by lenders across the world

Digital lending platform for banks and alternative lenders

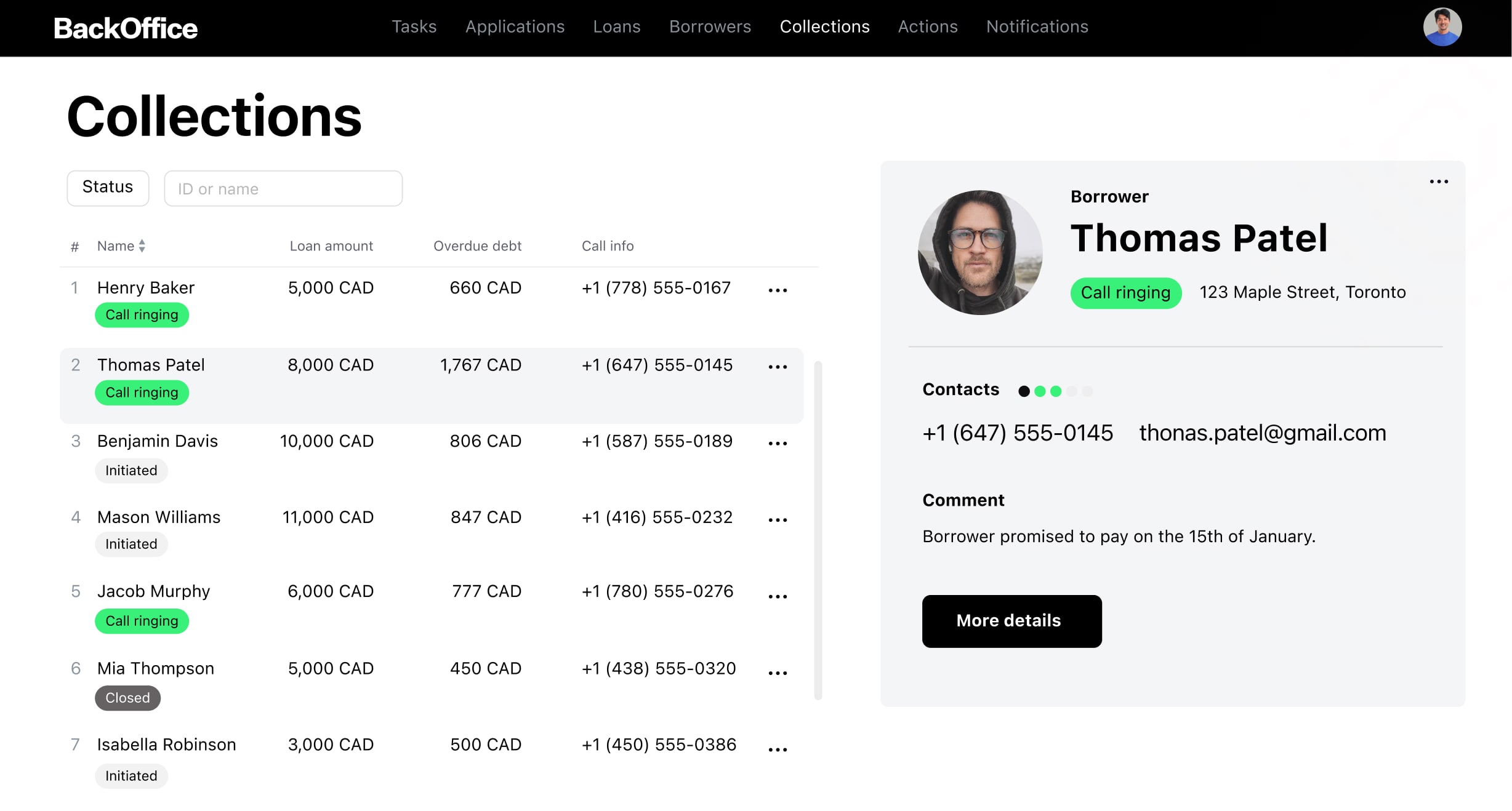

HES LoanBox is an advanced, AI-driven, cloud-based platform designed to streamline every phase of loan management, from origination to collection. Tailored for Canadian banks, alternative lenders, and financial institutions, it enhances efficiency, boosts security, and automates processes, leading to reduced non-performing loans and increased profitability.

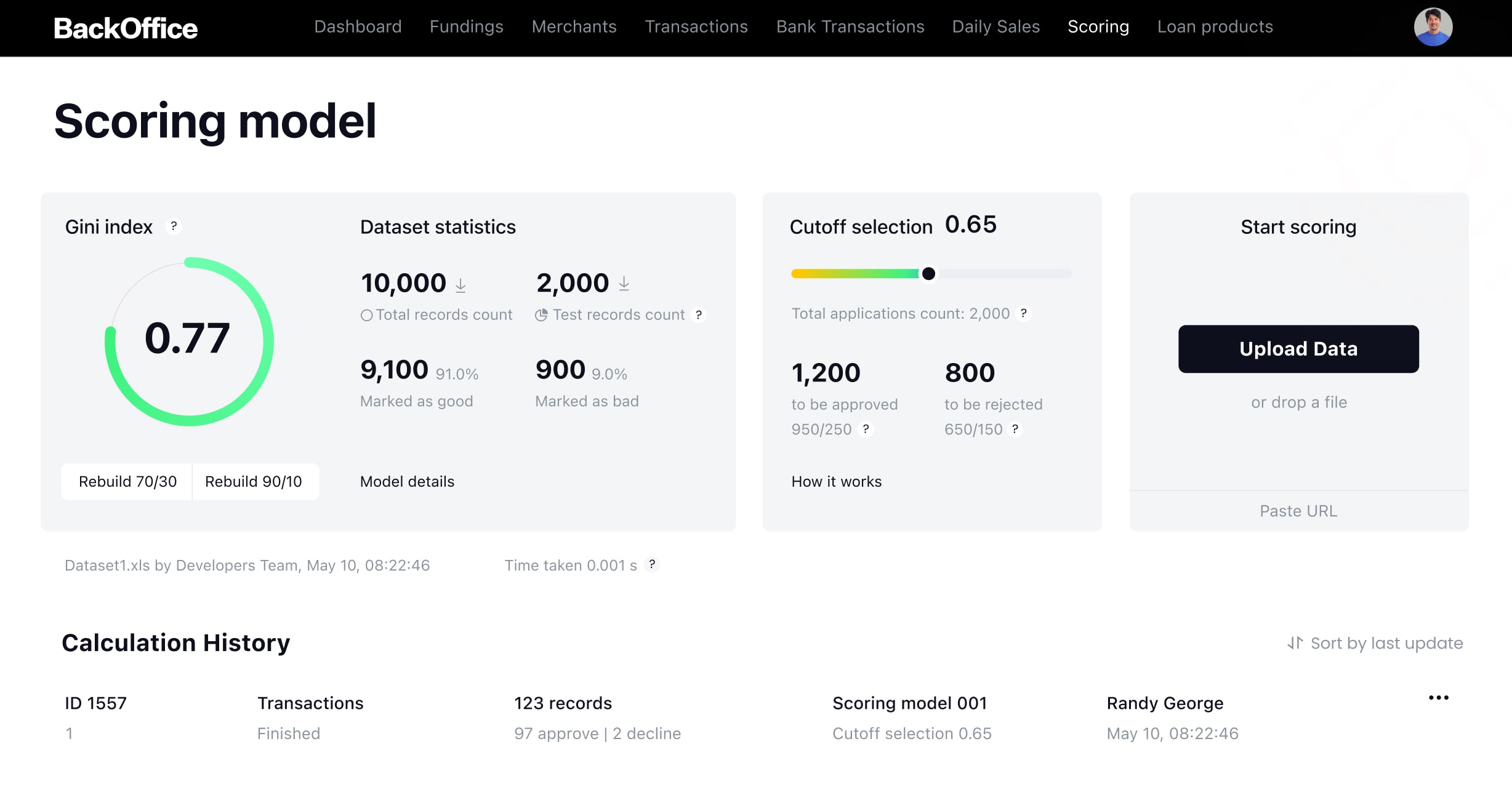

GiniMachine is a no-code AI tool that uses machine learning algorithms to assess borrowers’ data and offer lenders insights into their behaviour. Seamlessly integrated with HES LoanBox, it takes the guesswork out of decision-making, enabling informed, data-driven choices.

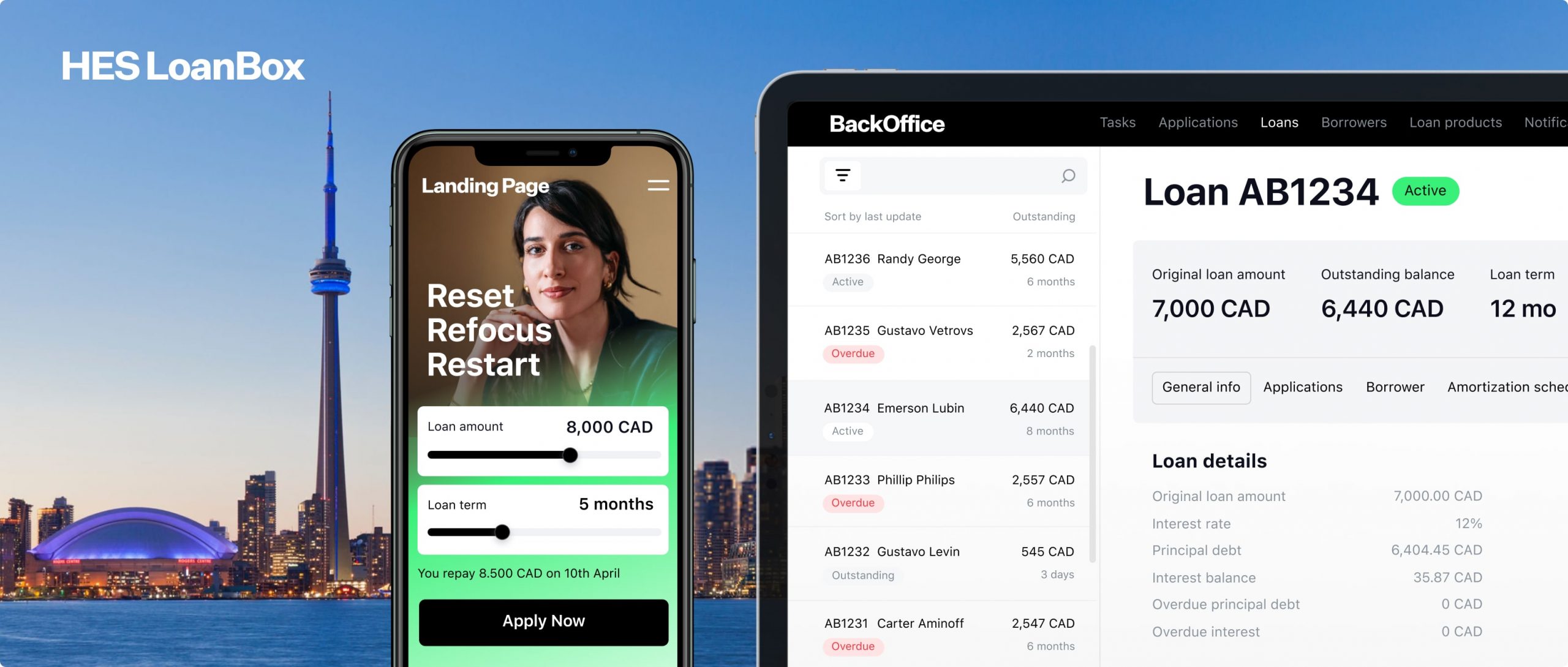

HES LoanBox overview

All-in-one loan

management system

The ultimate loan management software, equipped with a comprehensive set of features and seamless integrations to support all your lending operations.

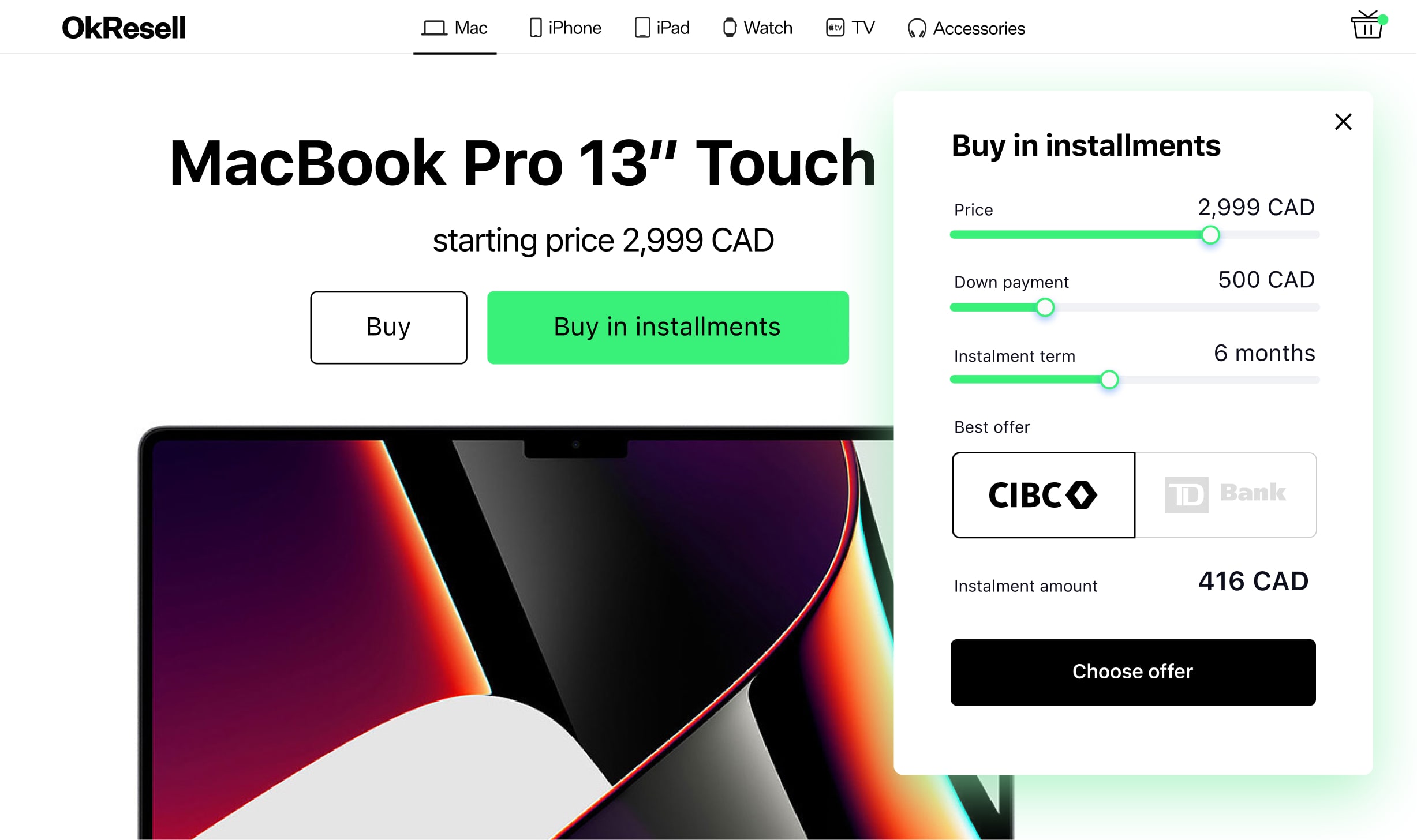

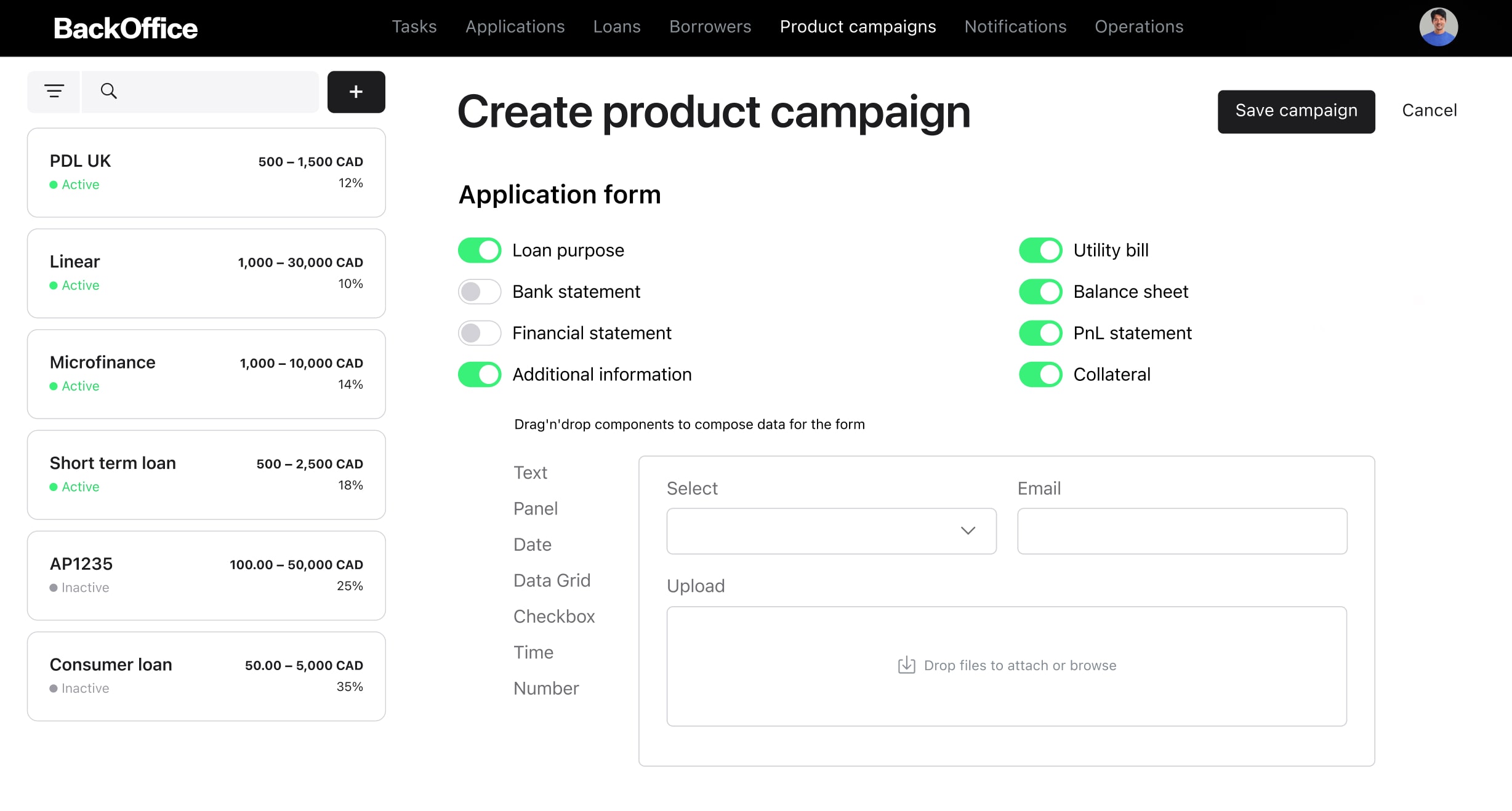

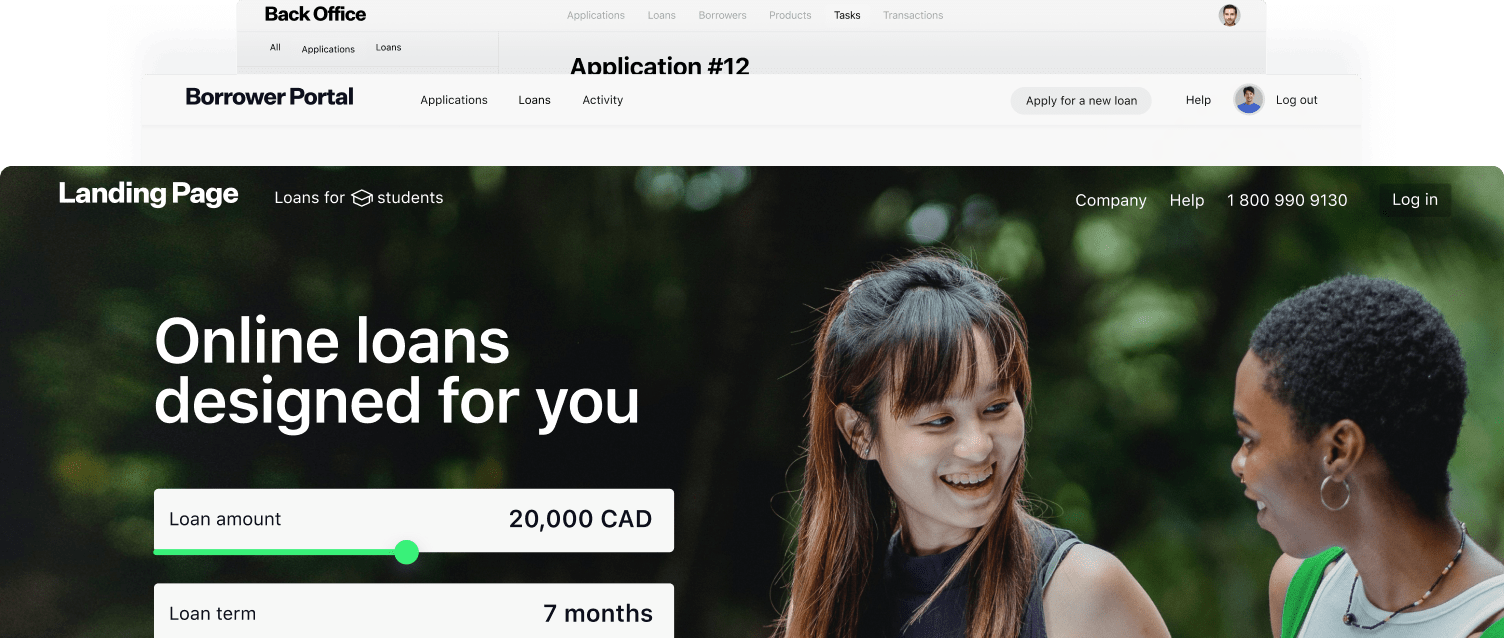

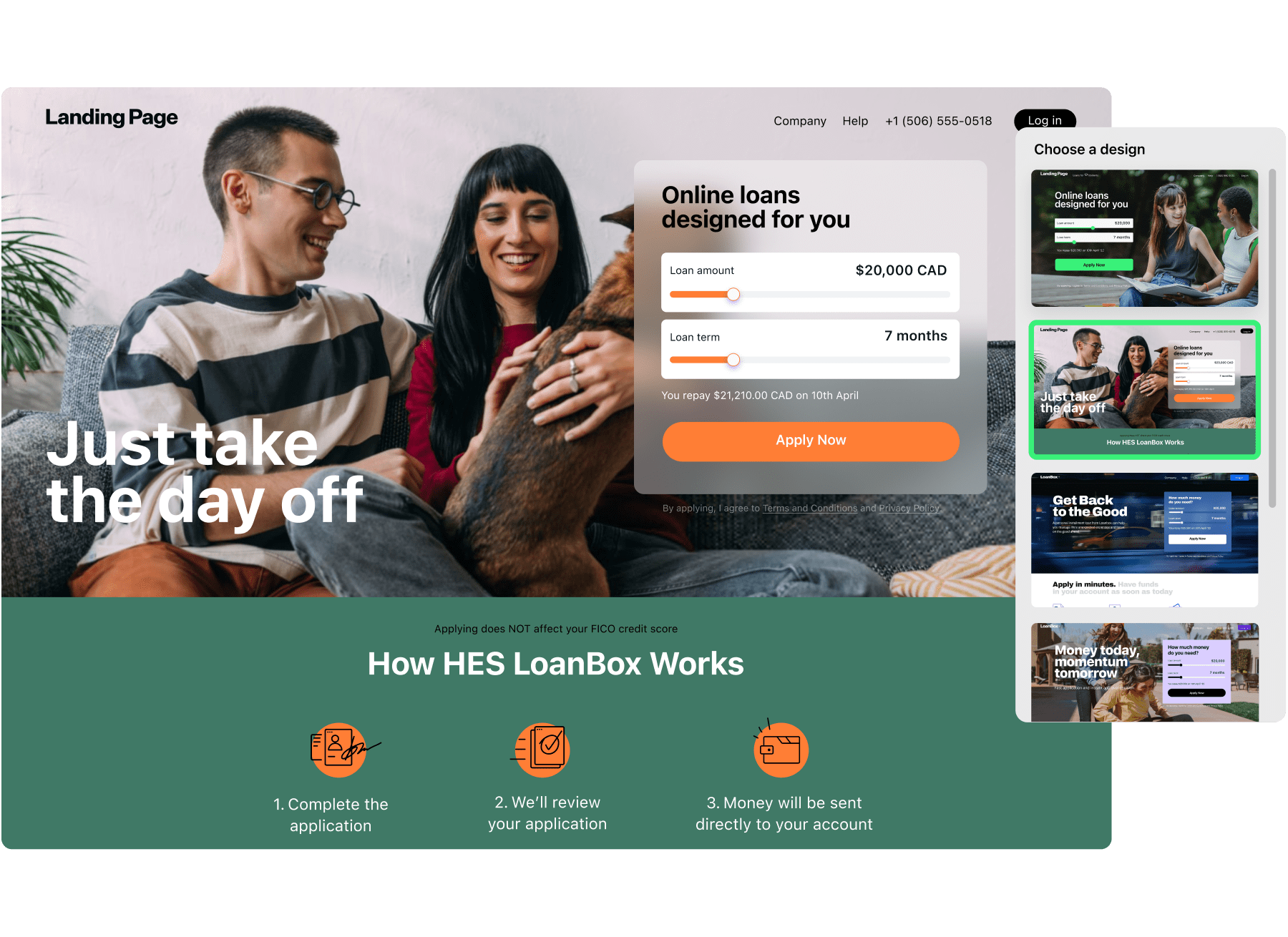

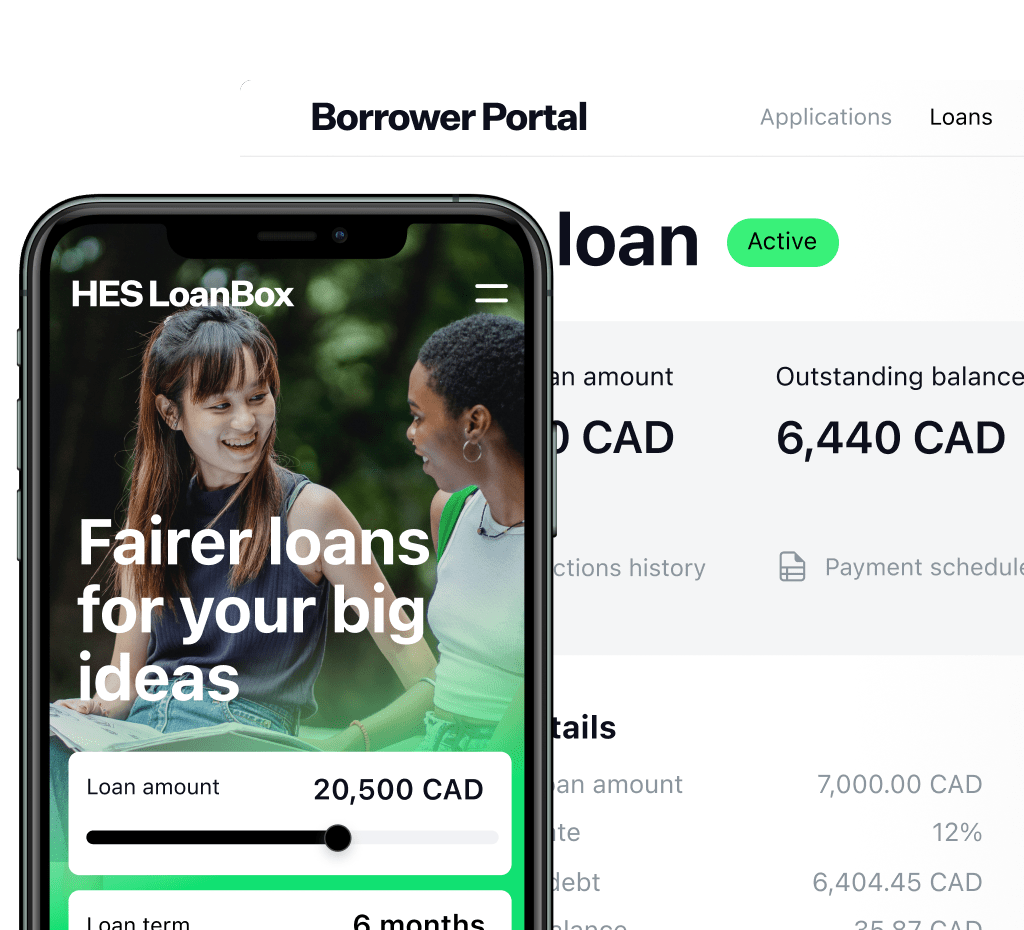

Custom loan website design

Design your loan website with customisable features to create a user-friendly experience that boosts engagement and increases application rates.

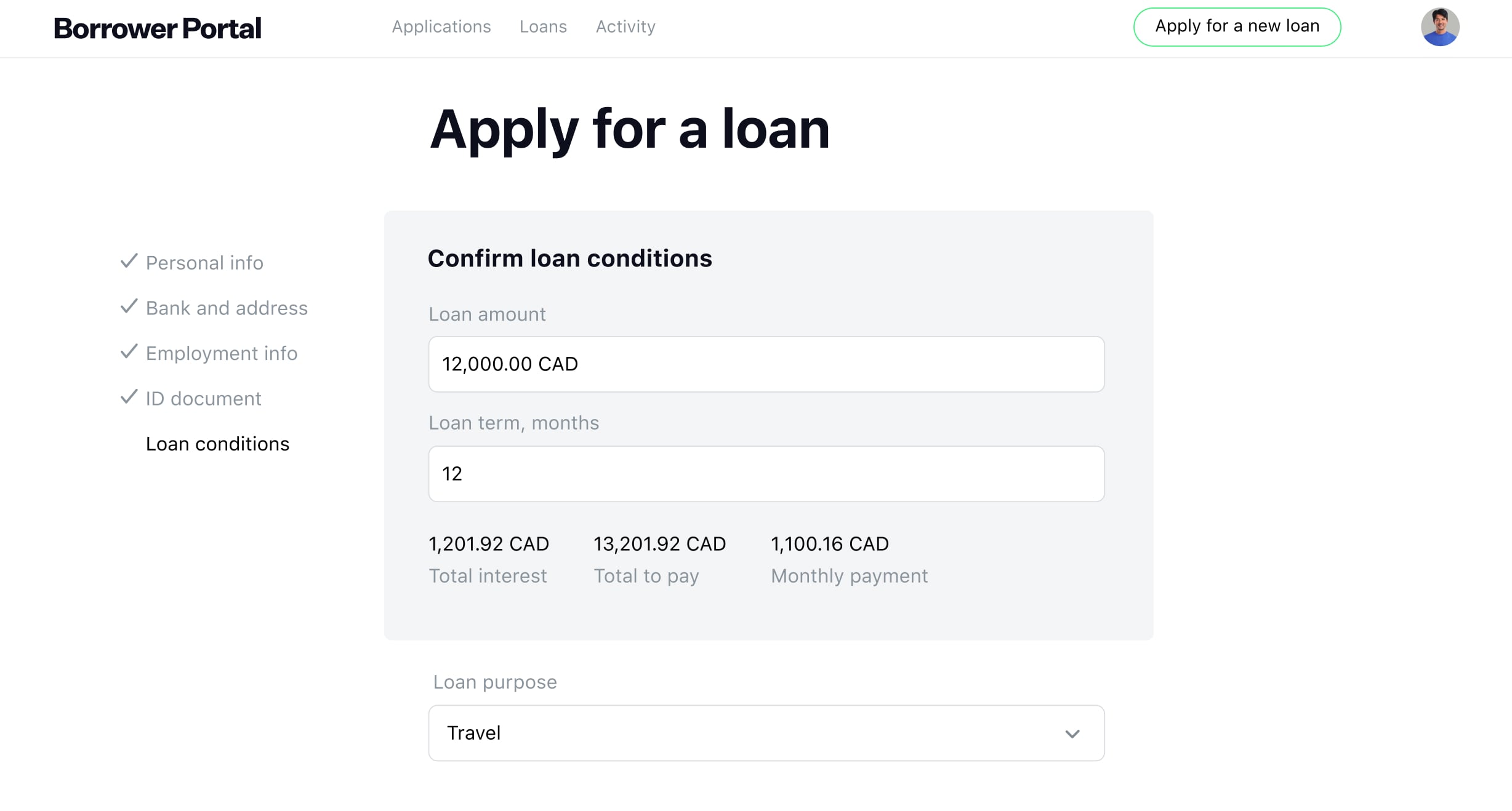

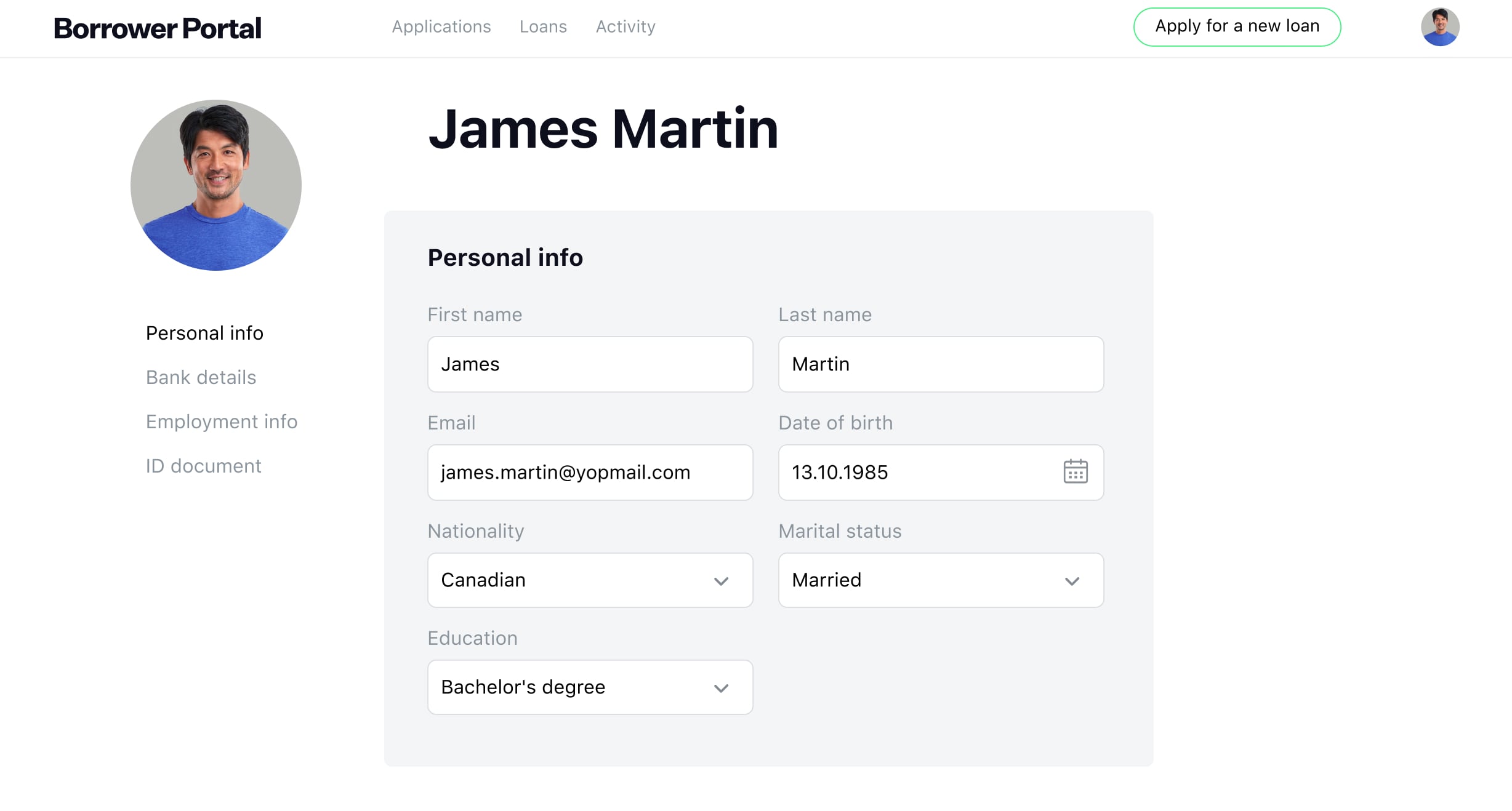

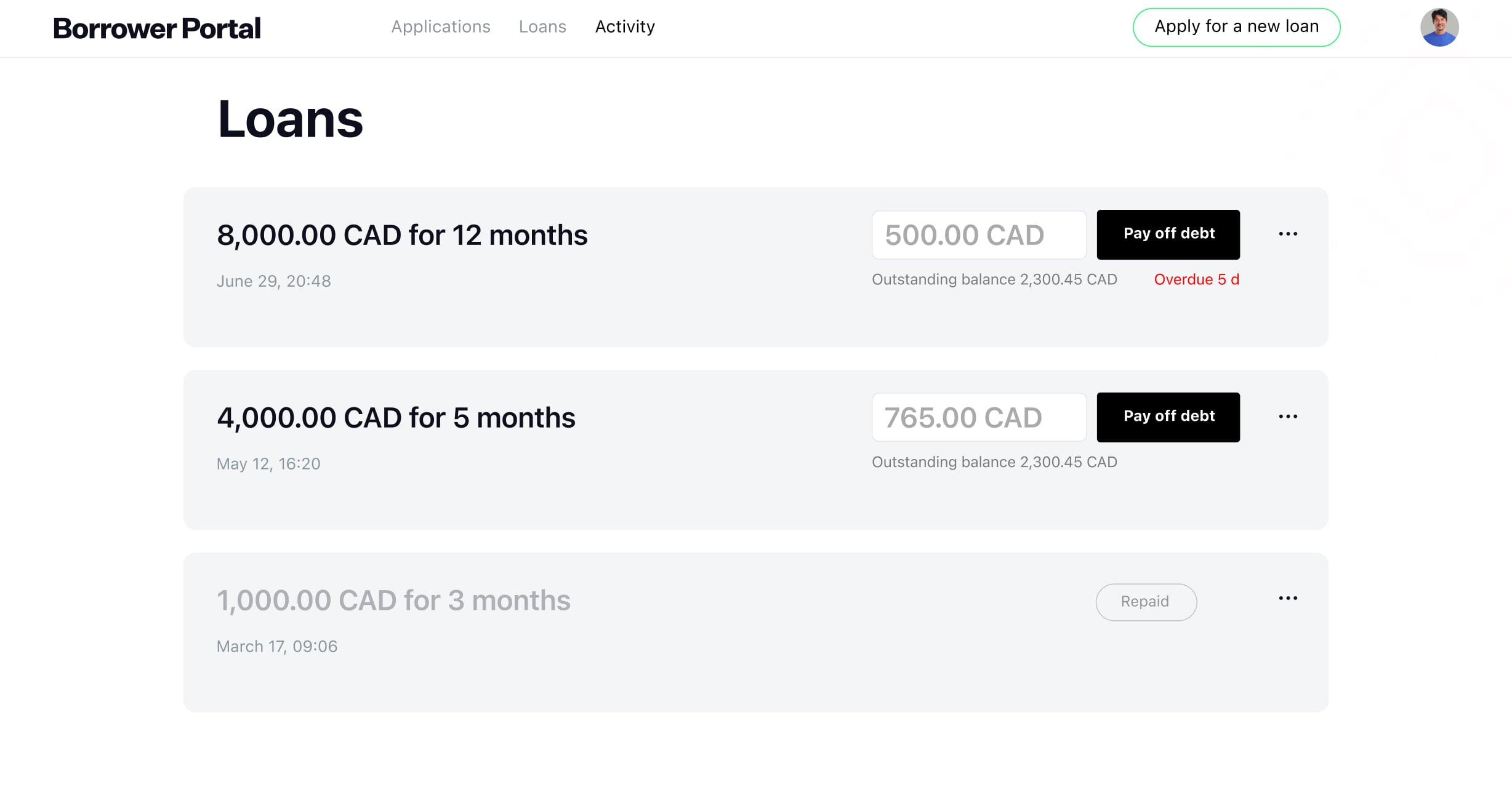

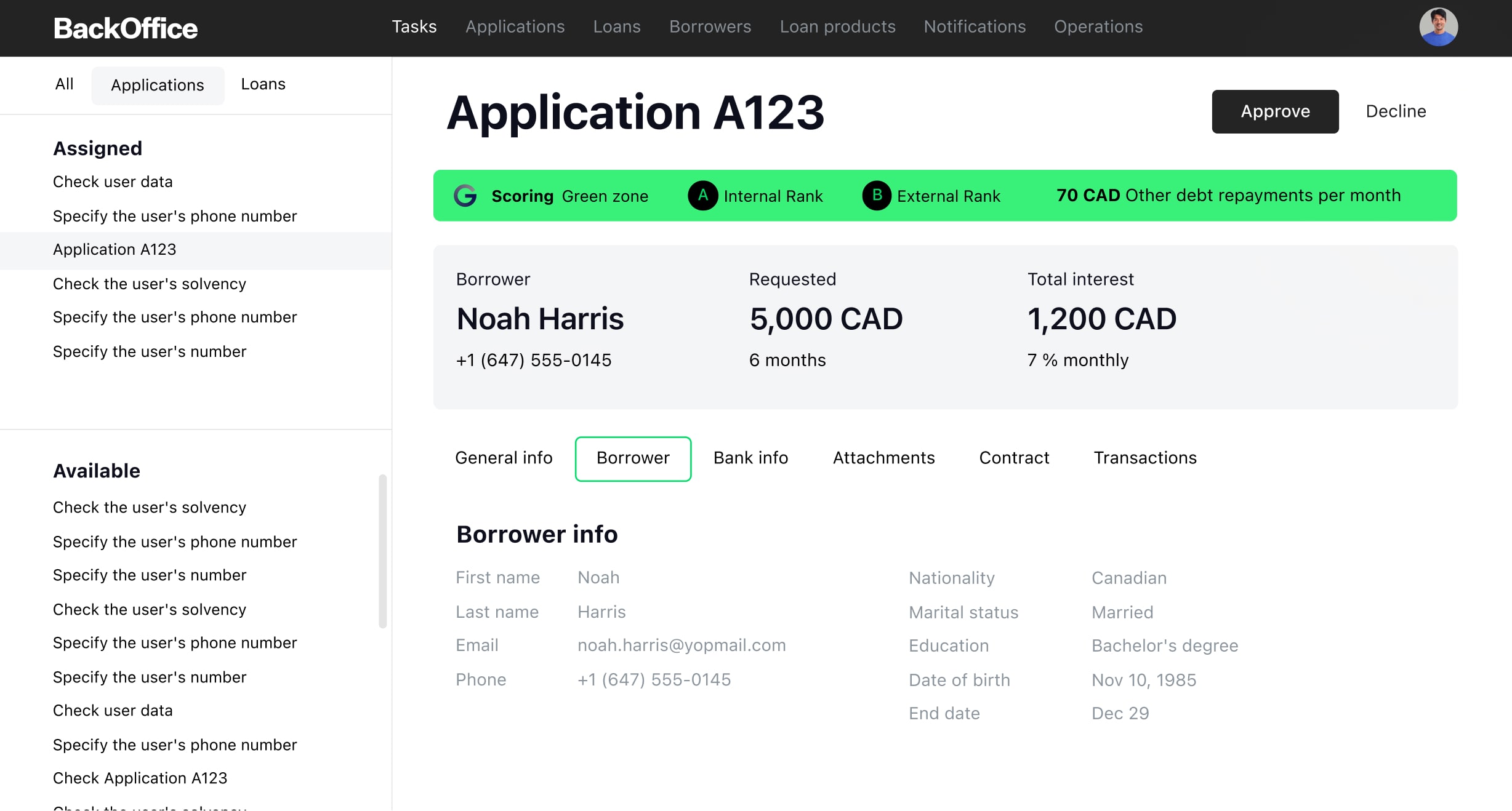

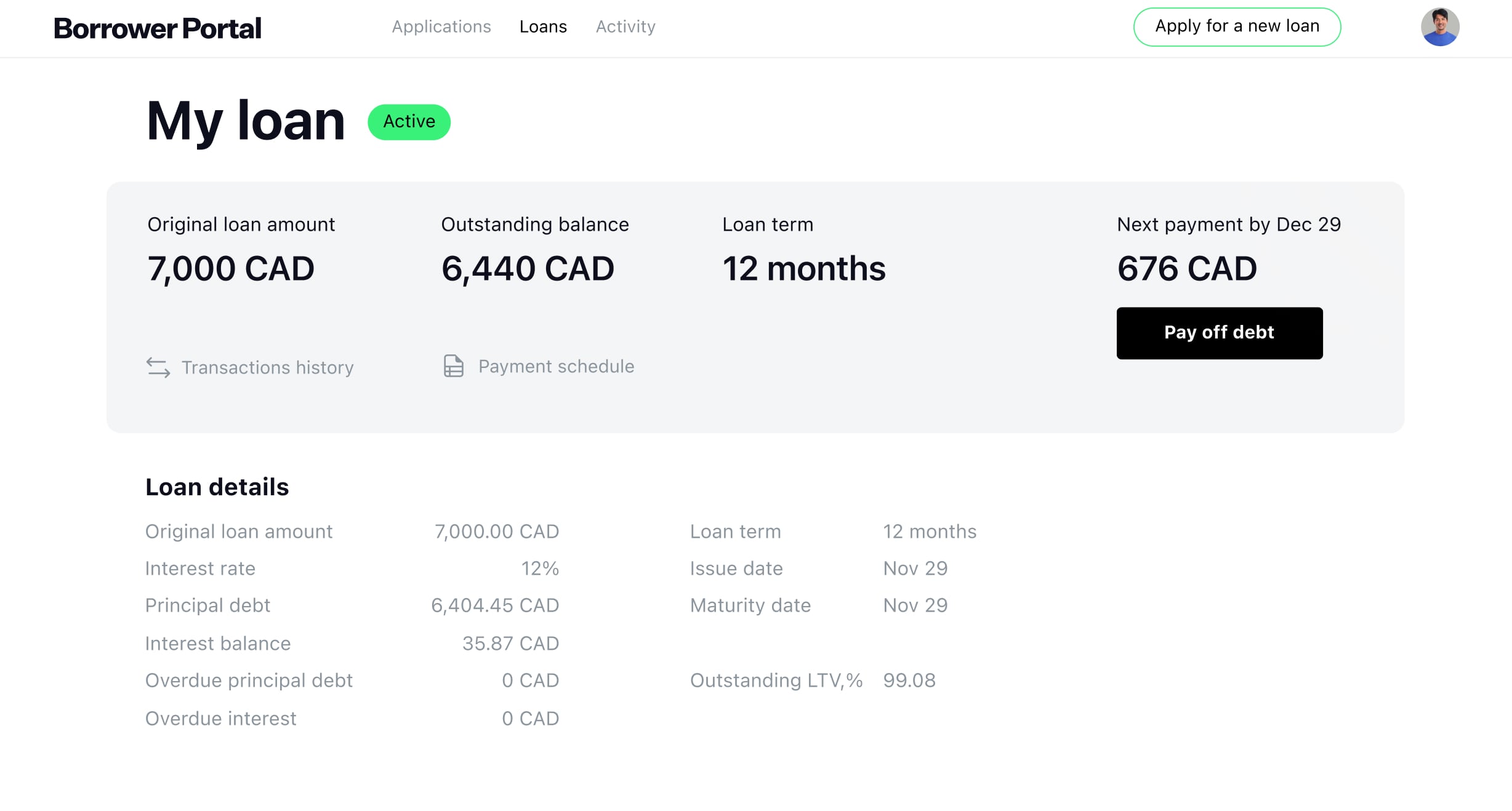

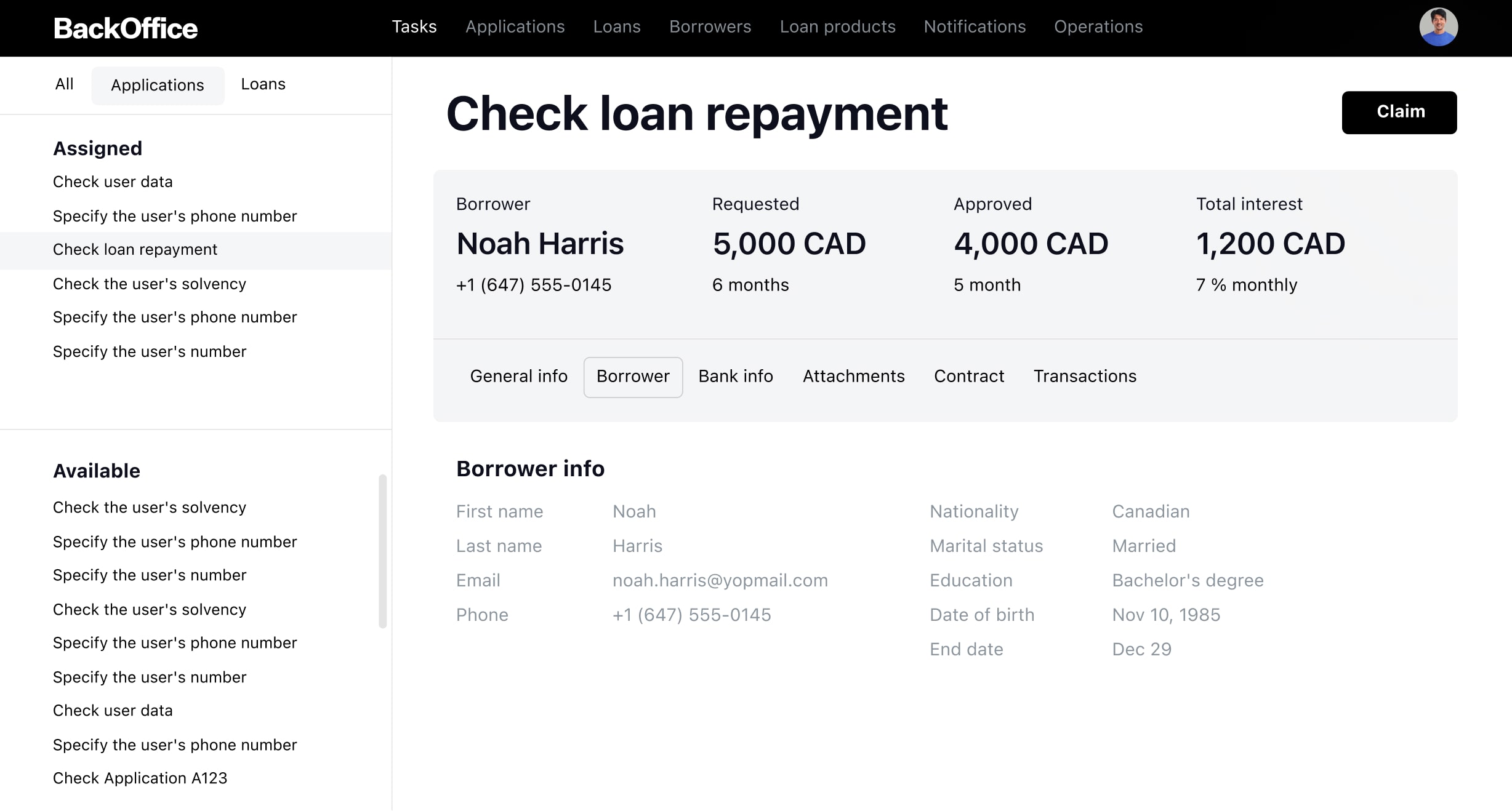

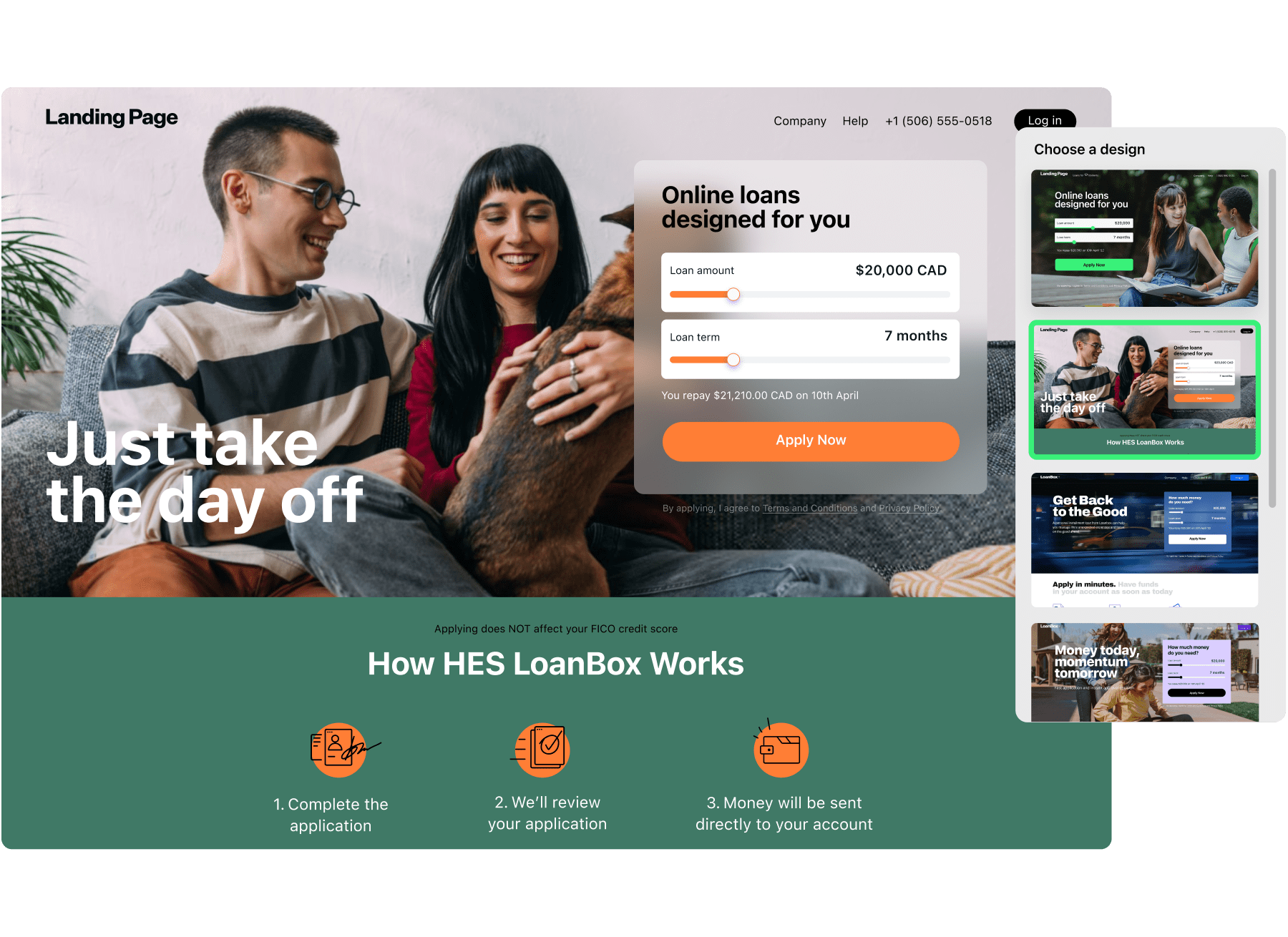

Personalised loan management portal

Empower borrowers with a custom space to oversee their entire loan process, from application to verification.

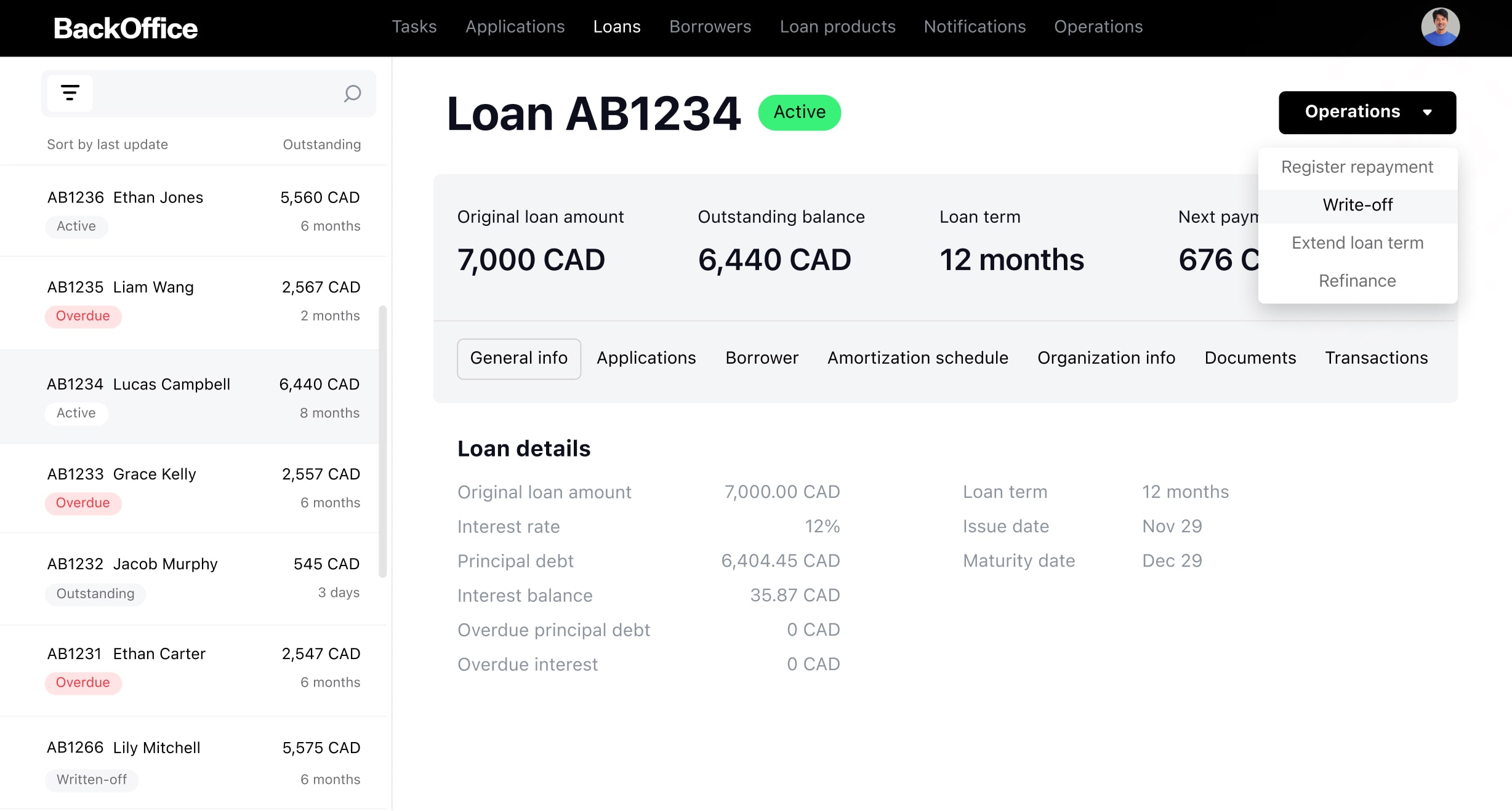

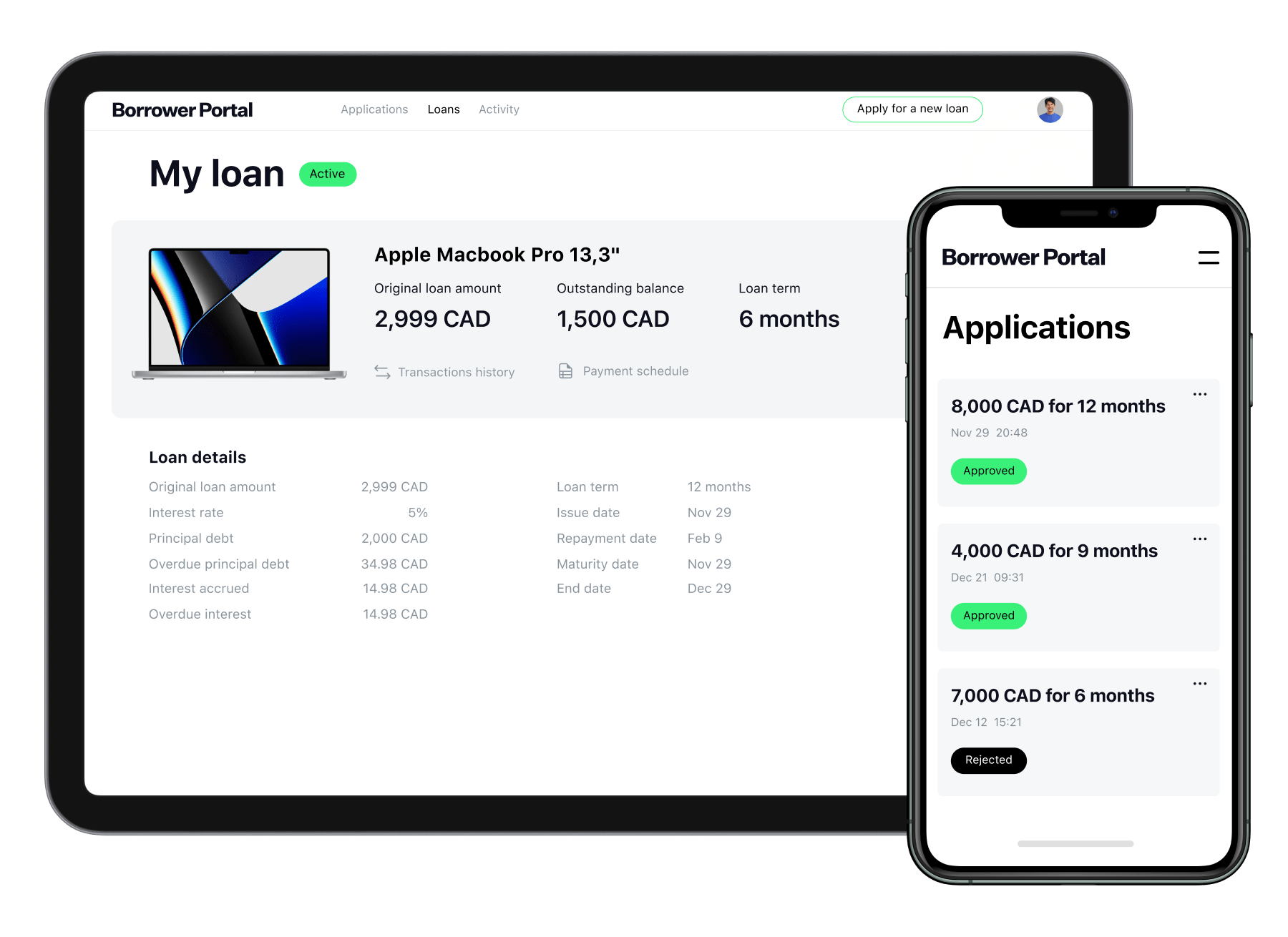

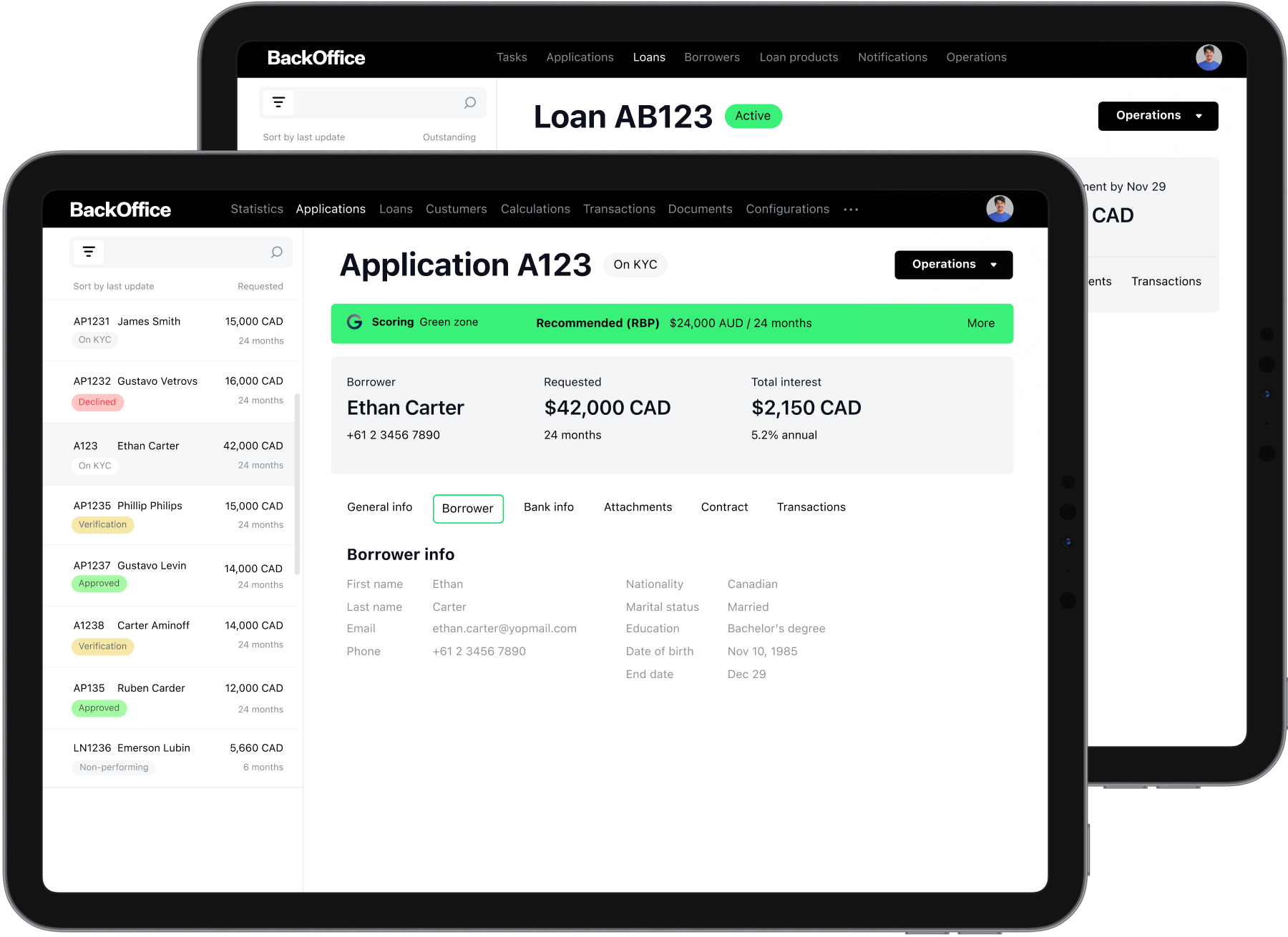

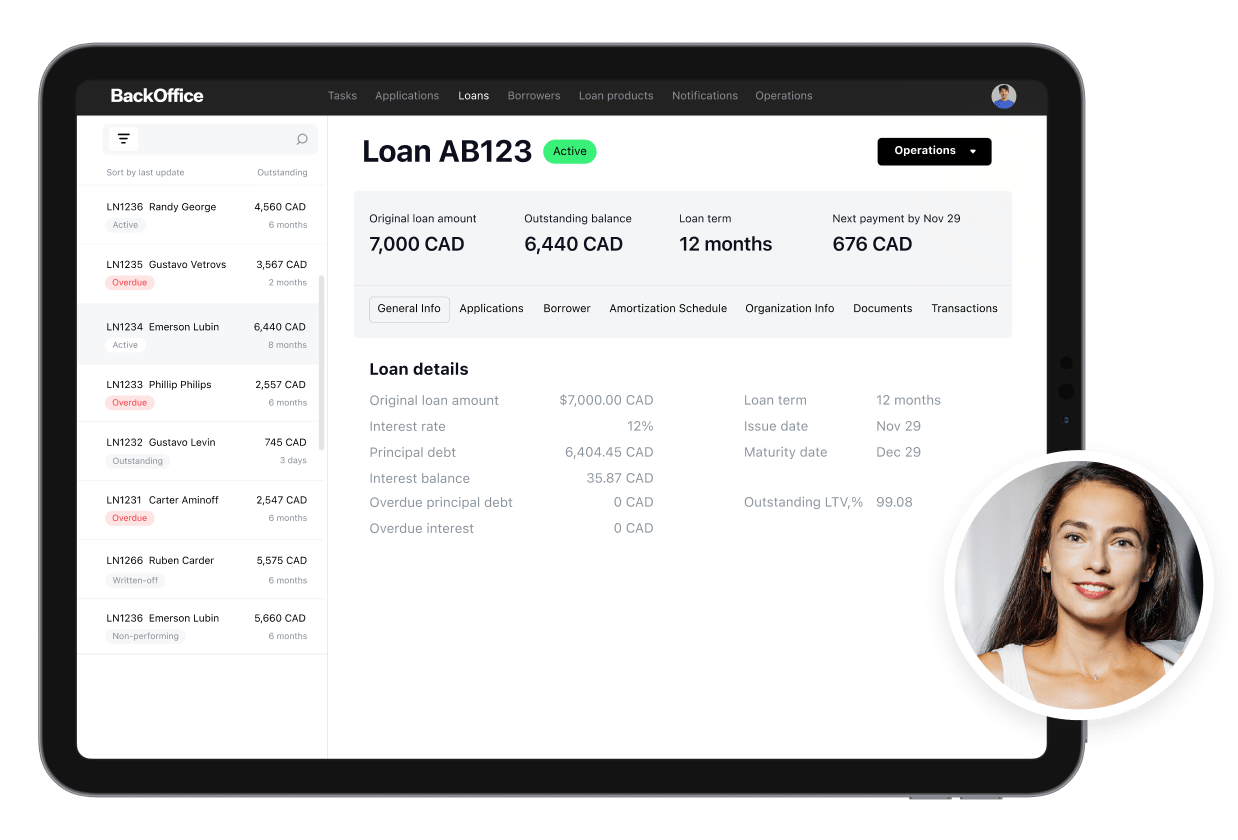

Unified lending

operations hub

operations hub

Boost your efficiency with our API-rich Back Office, offering comprehensive loan products, real-time data, amortisation schedules, automated calculations, and all the tools needed to grow your business.

AI-powered credit scoring

GiniMachine utilises advanced AI to analyse complex data patterns, enhancing the accuracy of credit decisions, reducing NPLs, and delivering more reliable credit assessments.

Advanced tech stack

Use HES LoanBox’s cutting-edge, open-source tech stack for scalable, secure, and high-performance loan management.

Experience

HES LoanBox firsthand

Seamless

integrations

Canadian lending

market expertise

With a deep understanding of local regulations and industry practices, we provide tailored solutions that meet the specific needs of Canadian financial institutions.

Why choose HES LoanBox

Kickstart online lending

Smooth integration

Reliable customer support

Future-proof architecture

Why HES FinTech

software?

Post-lauch support

Our team ensures your lending processes are efficient and compliant through ongoing support, system updates, and continuous optimisation.

Global credibility

Trusted by over 130 businesses worldwide, HES FinTech’s loan management solutions stand out for their innovation, security, and compliance.

Local clients and partners

Our expertise in the Canadian lending market allows us to create solutions tailored to regional requirements and compliance needs.

Success stories

Lending software

solution in Canada

Instant loan decision-making

Absolute compliance

Complete loan management software

Go live in just 3 months

FAQ

What features does HES LoanBox offer for Canadian lenders?

How long does it take to implement HES LoanBox?

Is HES LoanBox suitable for both small and large lending institutions?

What are the benefits of using AI in HES LoanBox?