Try

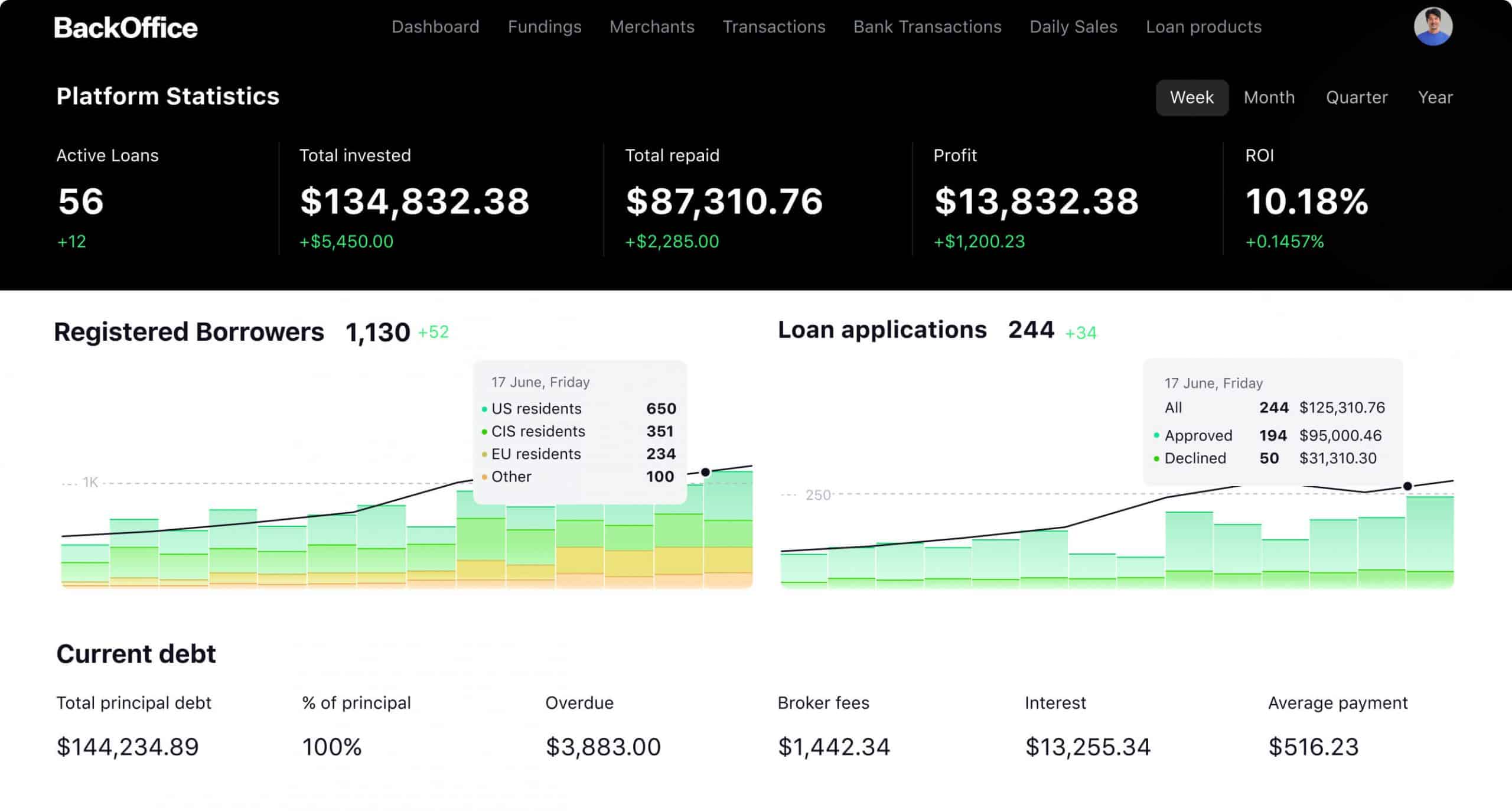

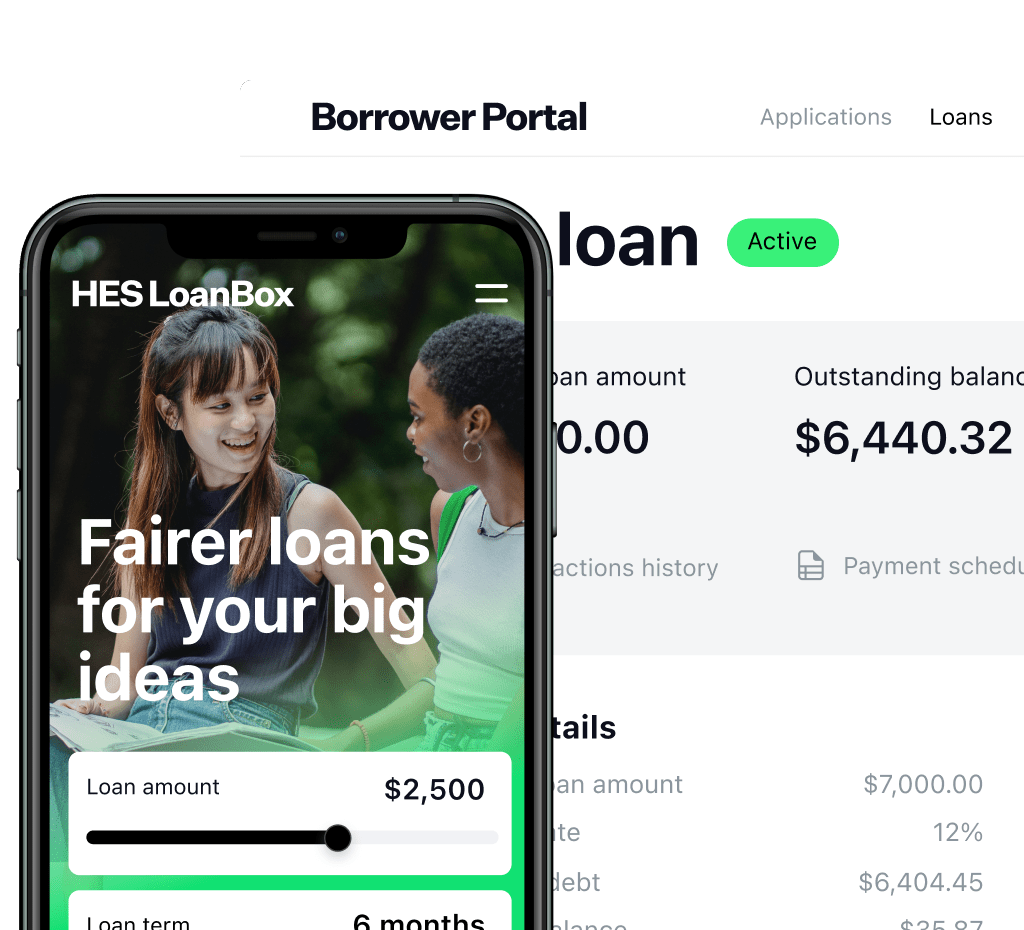

HES FinTech loan servicing system that exceeds

your functionality

expectations and provides a fast ROI

Ready-to-launch 3 months

Flexible level of automation

Paperless and secure

One-roof lending software

Easy integrations

for loan servicing platform

BI / Reporting tools

Choose any standalone tool for generating reports. Whether it is Tableau, Zoho Analytics,

QlikView, we are ready to incorporate it into our system.

QlikView, we are ready to incorporate it into our system.

Accounting systems

HES system can be integrated with any accounting system. We can perform integration and

fetch information for internal purposes, like scoring and SME assessment.

fetch information for internal purposes, like scoring and SME assessment.

Collateral registry / PBX systems

Link collateral information from private sources for your securitized credits. Use online

PBX for auto dialing, voice messages, record calls with your clients.

PBX for auto dialing, voice messages, record calls with your clients.

Your business environment

You might need just a separate part of the loan management system — we can deliver a

particular module and integrate it within your business environment.

particular module and integrate it within your business environment.

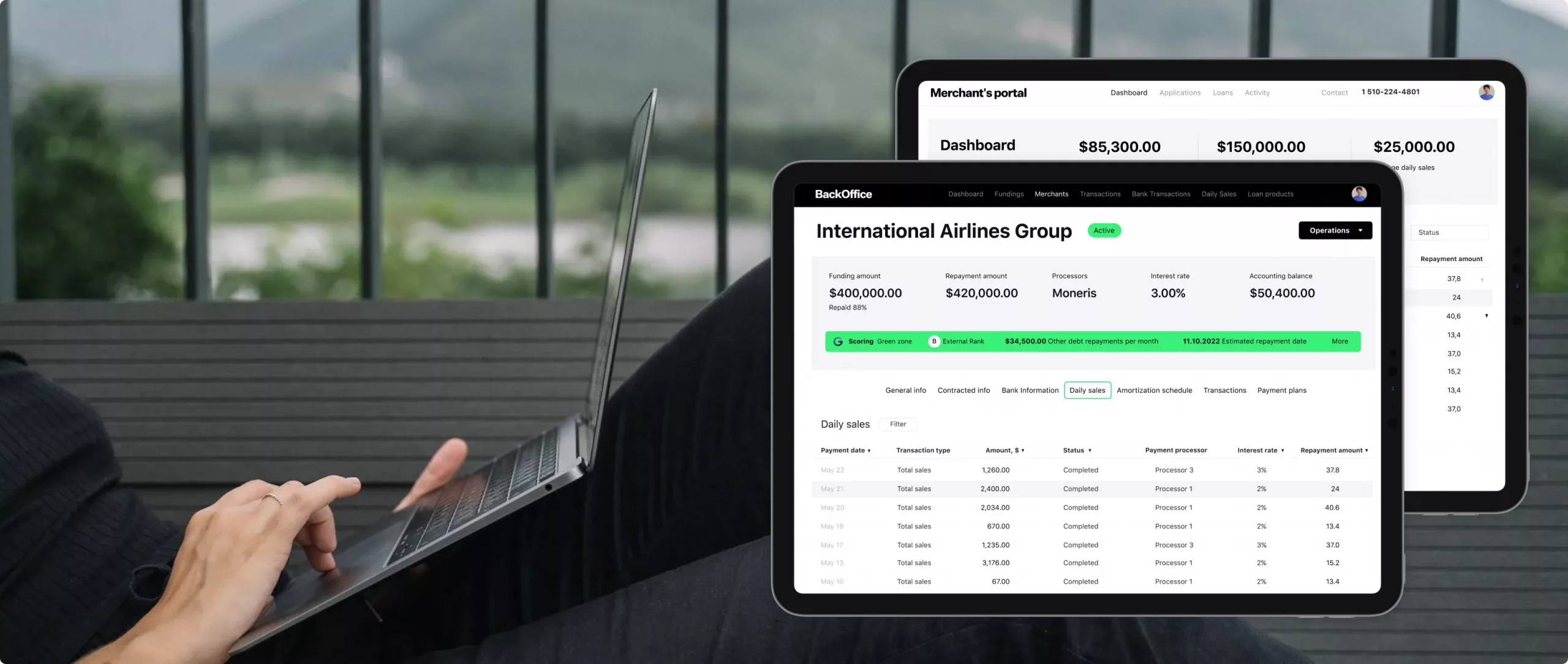

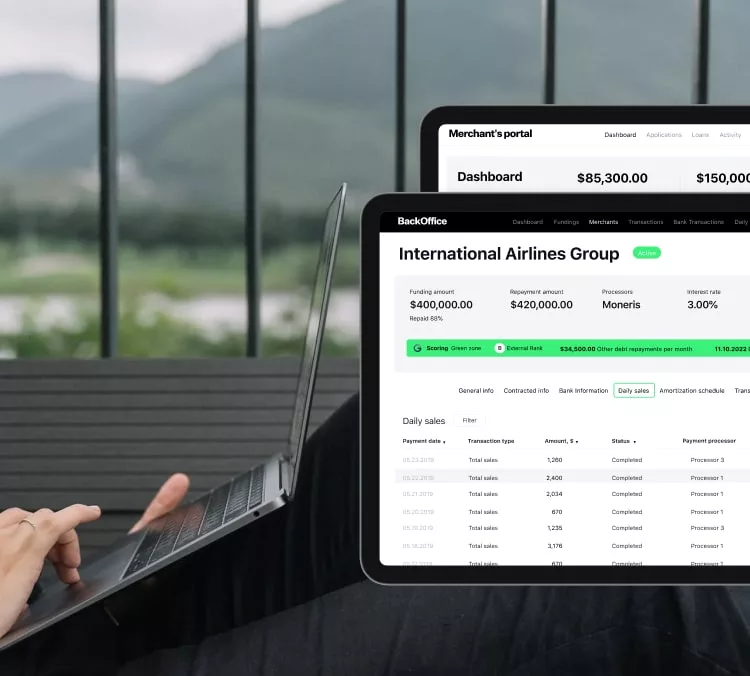

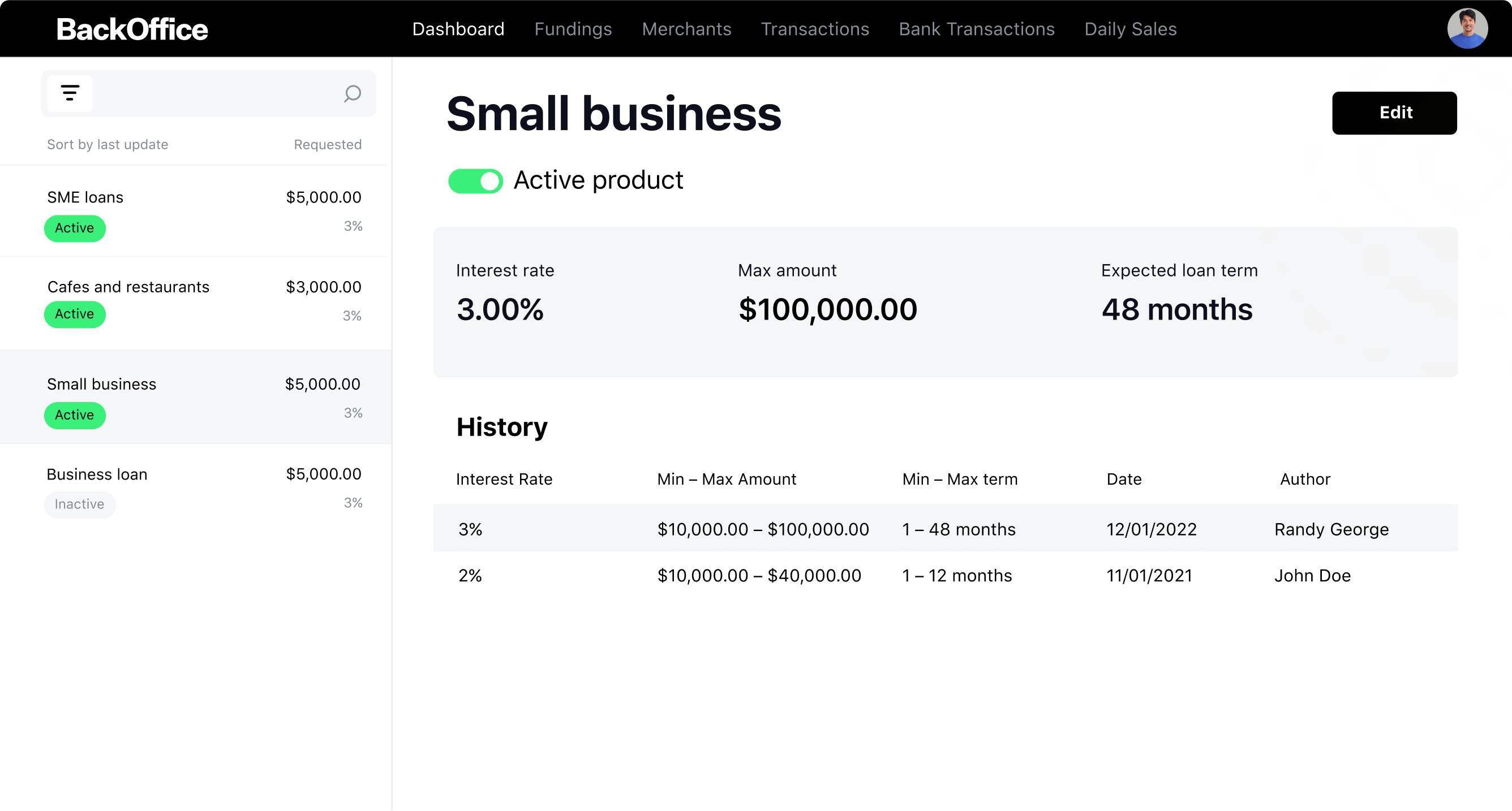

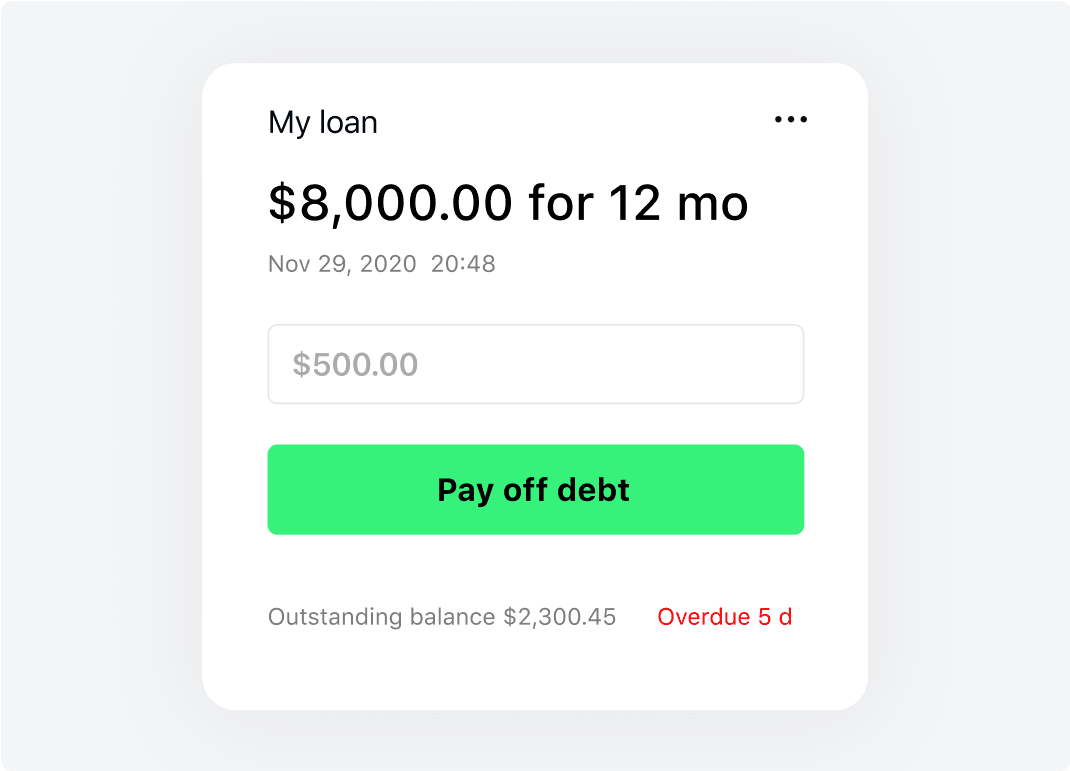

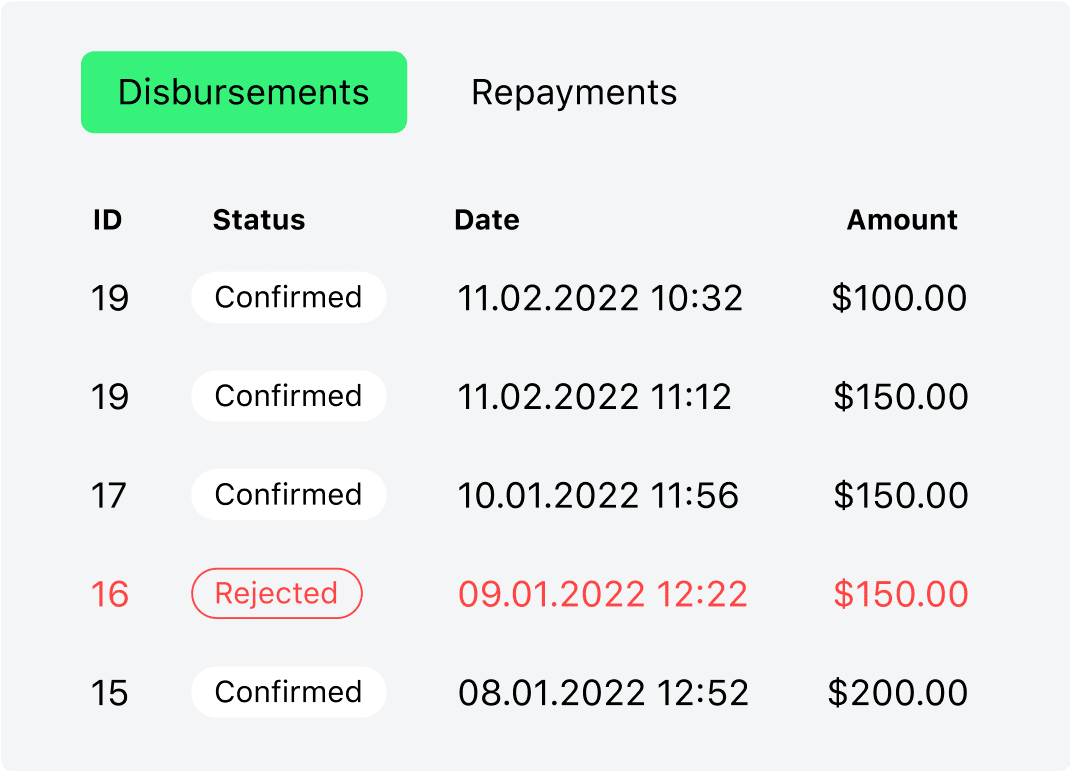

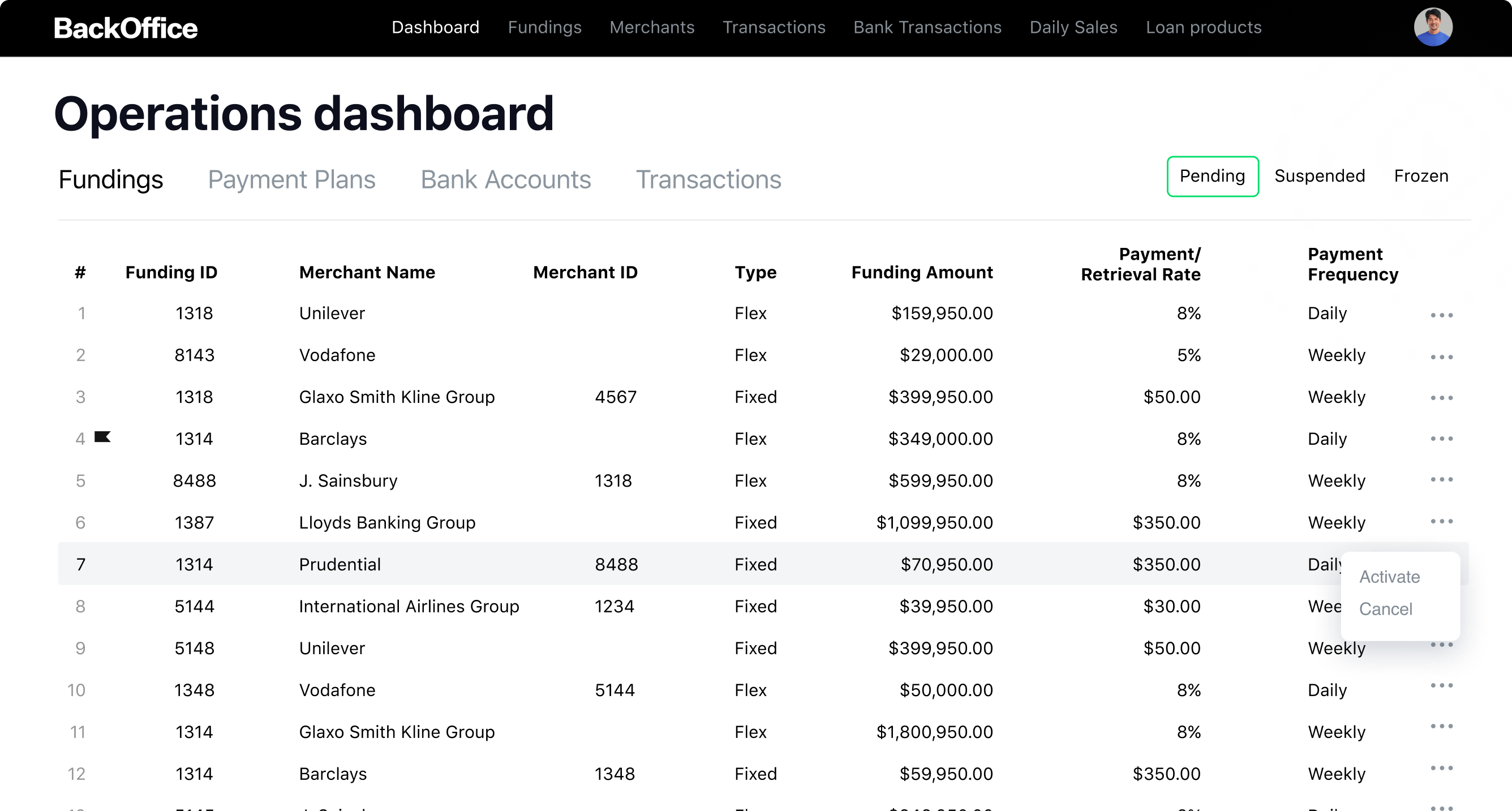

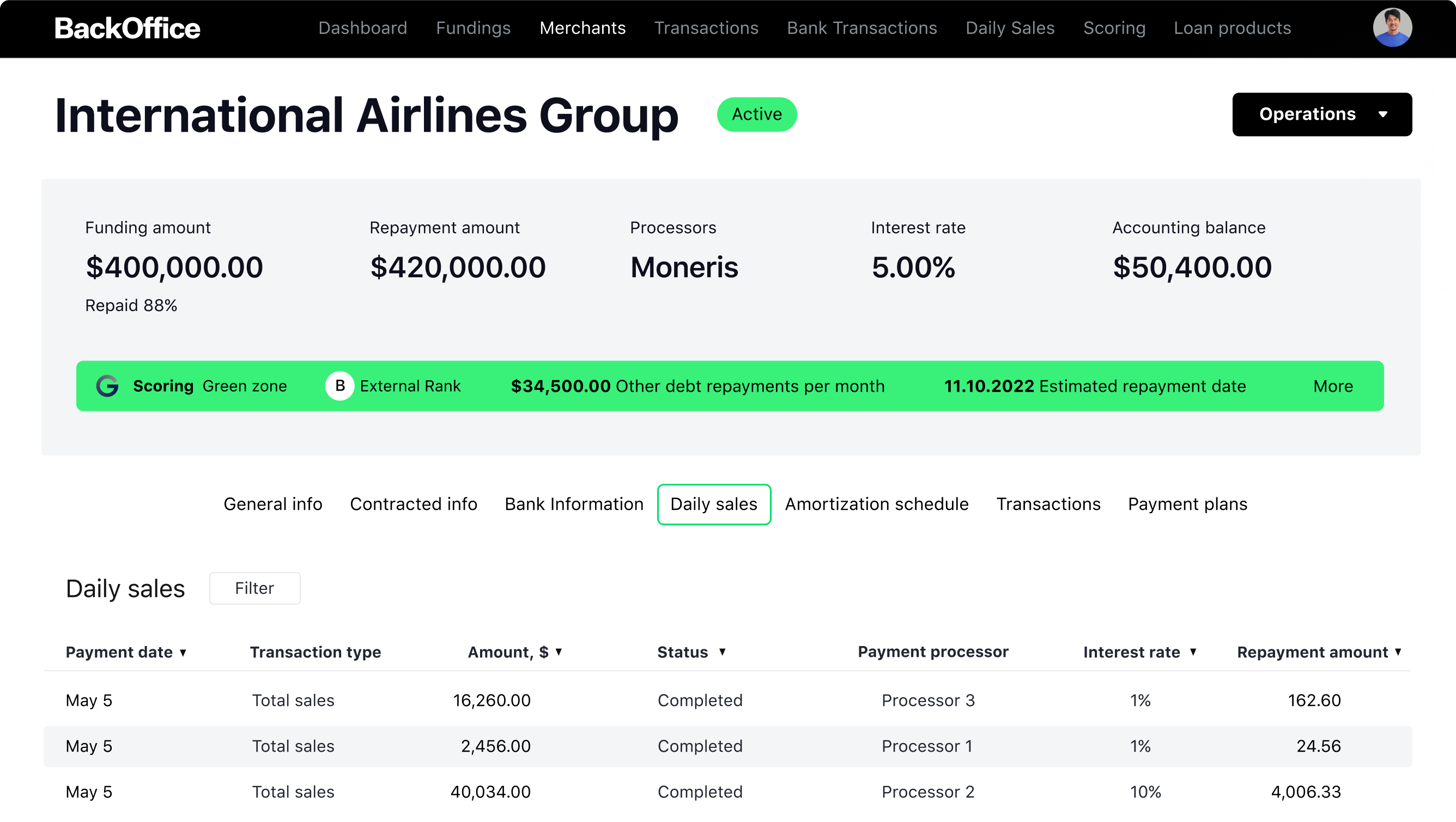

Basic operations

Loan servicing automation enables all of the loan attributes and parameters, transactions, and dynamic

amortization schedules with initial interest, fees, and commissions at your fingertips.

amortization schedules with initial interest, fees, and commissions at your fingertips.

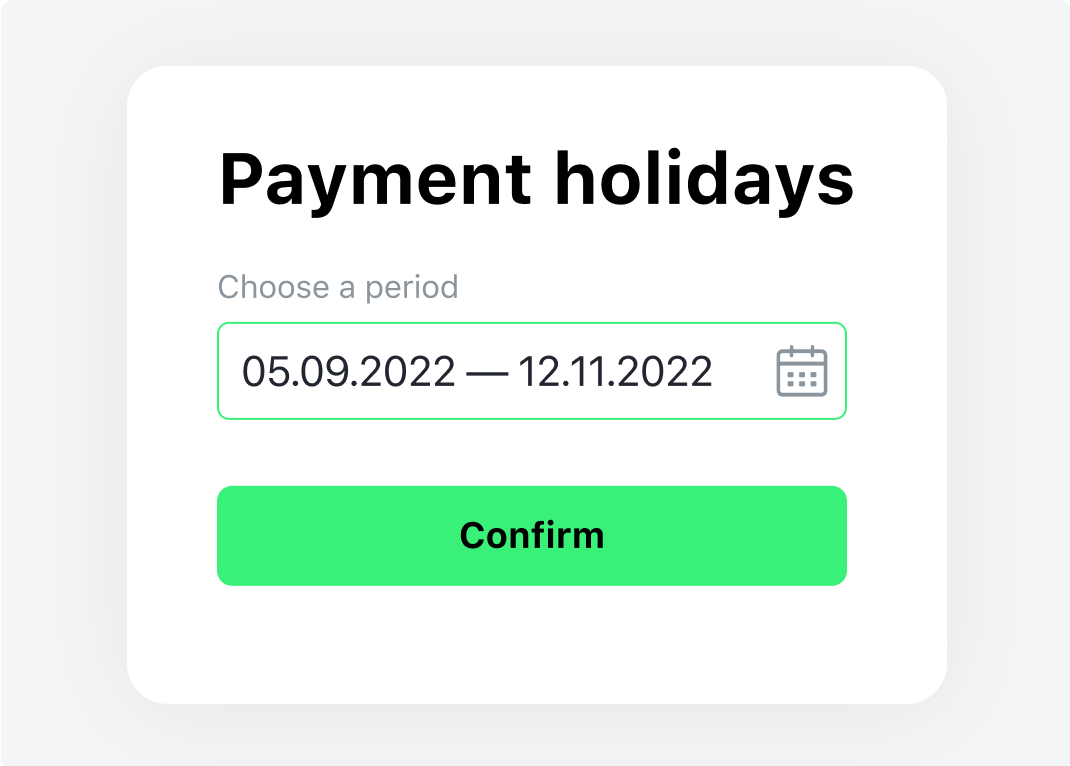

Payment holidays

Flexibility is your competitive advantage powered by HES: the loan

processing system easily allows you to pause penalties accrual and introduce payment

holidays.

processing system easily allows you to pause penalties accrual and introduce payment

holidays.

Customer success

Direct loan servicing systems

for your business

Scalable platform

Customize your lending servicing platform at ease.

Benefit from 100+ pre-built integrations and unlimited possibility to scale your system

Benefit from 100+ pre-built integrations and unlimited possibility to scale your system

Advanced tech stack

HES LoanBox is a cloud-based, AI-powered loan management software built with open-source tools, ensuring high scalability, robust performance, and enhanced security

Lifetime user support

From the initial software launch to its discontinuation, count on our exceptional customer support services.

During the launch phase, we may provide thorough training to your credit management team, ensuring they are

well-equipped to handle all aspects of the software

During the launch phase, we may provide thorough training to your credit management team, ensuring they are

well-equipped to handle all aspects of the software

No additional charges per customer

HES provides fully managed lending servicing with no limits

on the number of users. Pricing models are based on the features you choose

on the number of users. Pricing models are based on the features you choose

FAQ

How does your software handle loan payments and collections?

Can your software handle loan modifications and refinancing?

Does your software integrate with third-party systems like accounting or credit bureaus?

Is your loan servicing software scalable to accommodate growing loan portfolios?