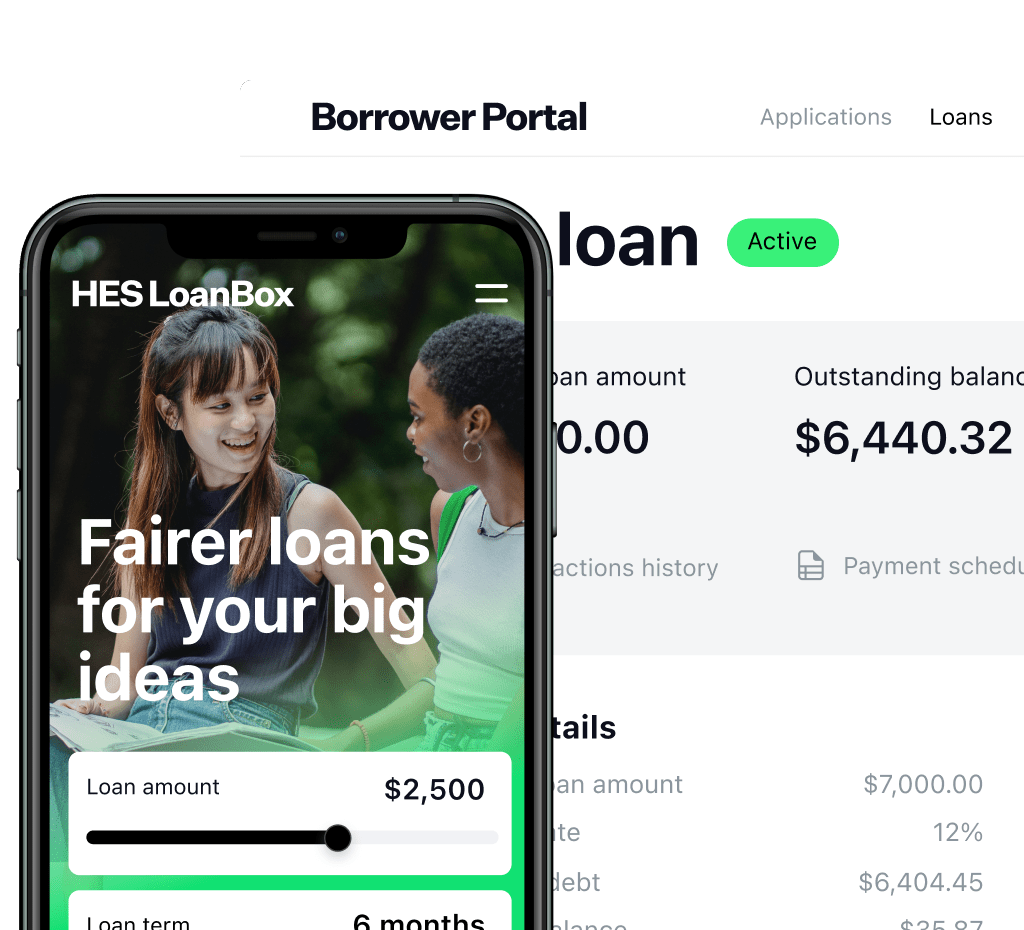

Superior bank loan software

Automate and agile your lending process with a bank loan origination

software designed by HES.

Adjustable platform with 20+ prebuilt modules.

AI scoring. Advanced customization and BPM optimization.

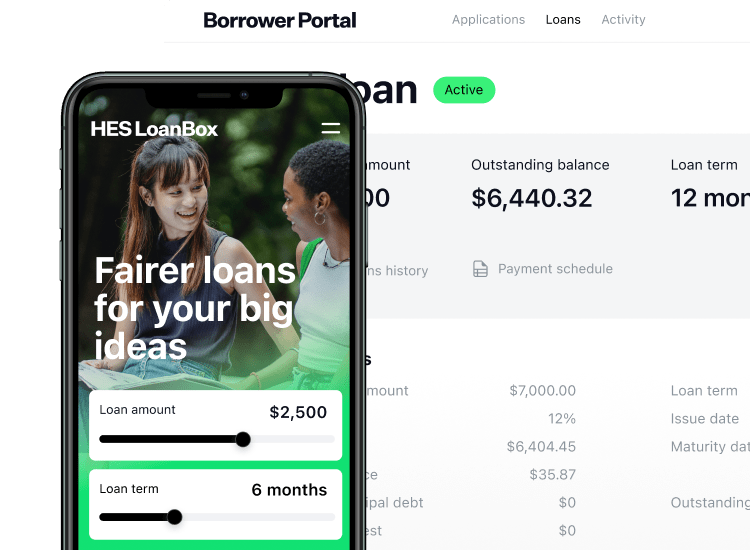

React to the market changes and build competitive advantages

by building loan

products and product groups. HES designs bank loan origination

software as

automated and optimized as possible with

no overhead in staff or manual actions.

by building loan

products and product groups. HES designs bank loan origination

software as

automated and optimized as possible with

no overhead in staff or manual actions.

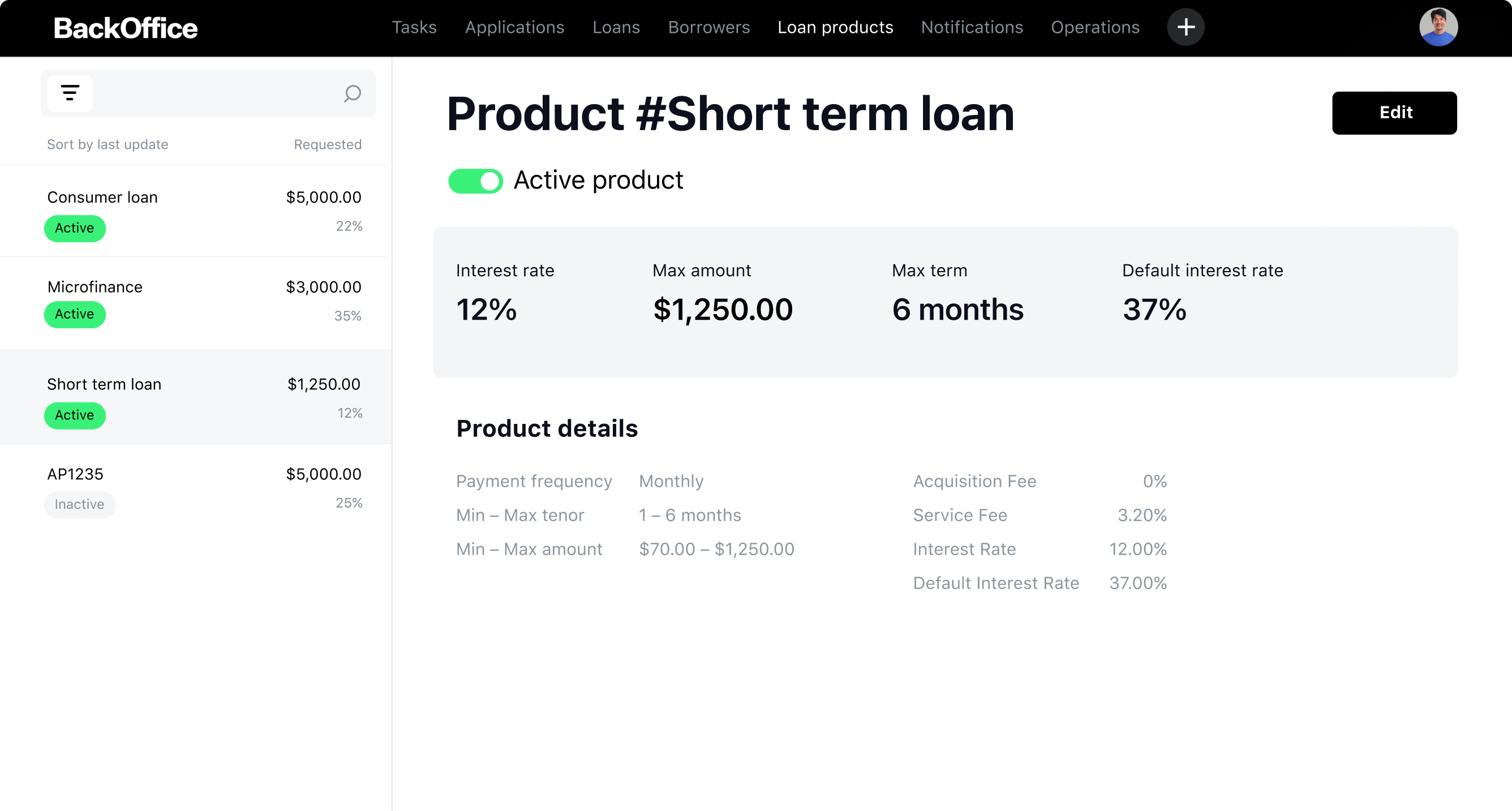

Configure your

bank loan platform

Feature-rich lending

software for banks

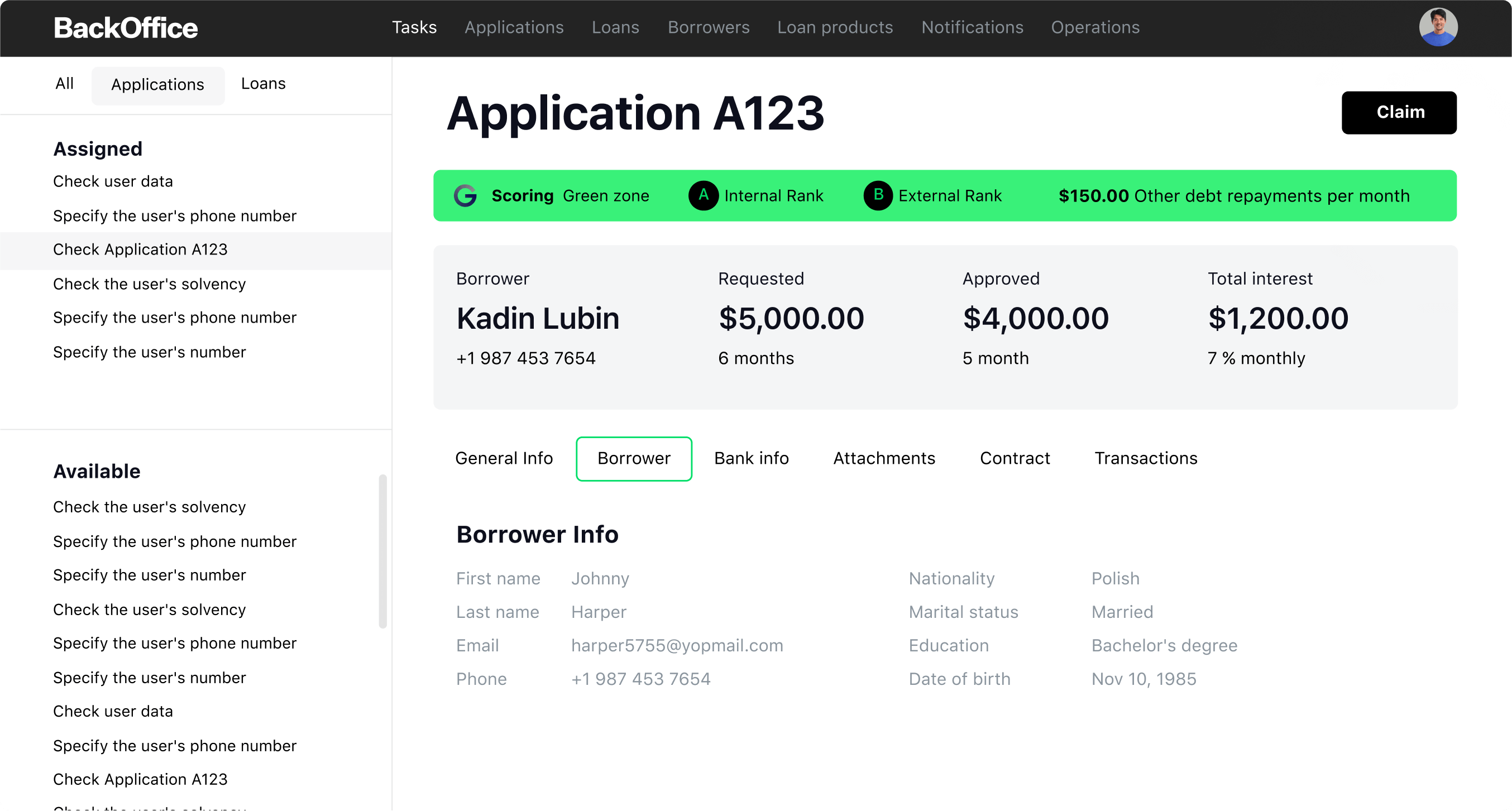

Task management

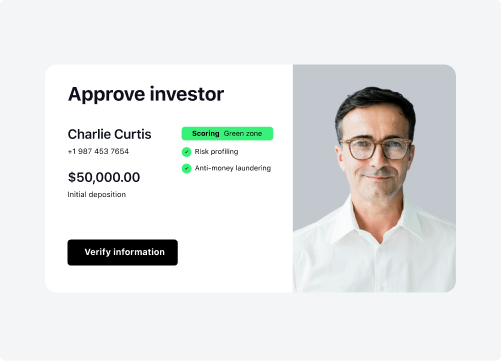

Granular user roles and models allow effective and secure taks management in

every region or branch. The bank loan platform is seamlessly API integrated with existing core banking

software along with external services, like credit bureaus, AML/KYC, payment systems, BI and

accounting systems, e-signature, and more.

every region or branch. The bank loan platform is seamlessly API integrated with existing core banking

software along with external services, like credit bureaus, AML/KYC, payment systems, BI and

accounting systems, e-signature, and more.

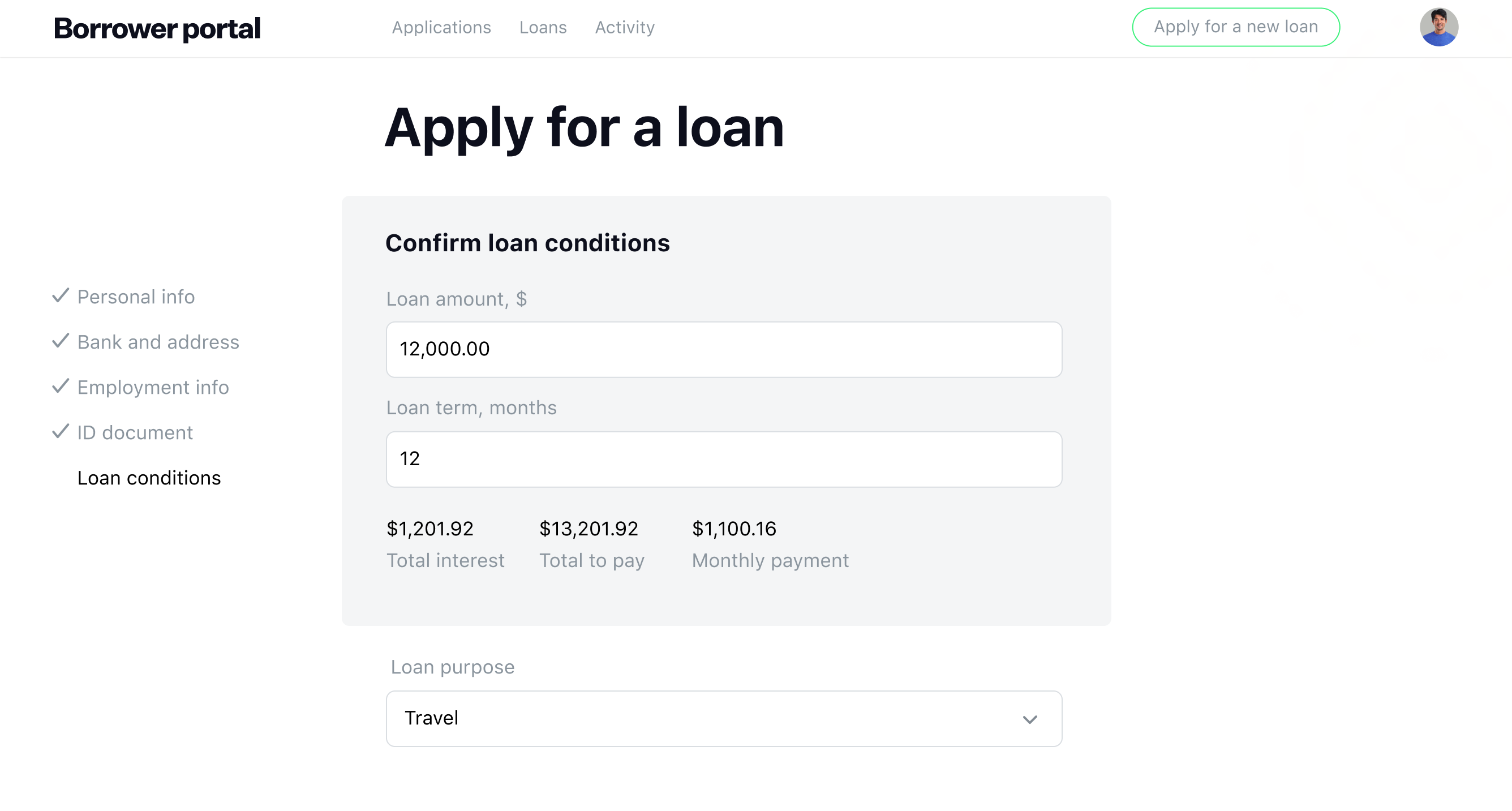

Bank lending system also includes

Bank loan origination

Bank lending management

Document templates

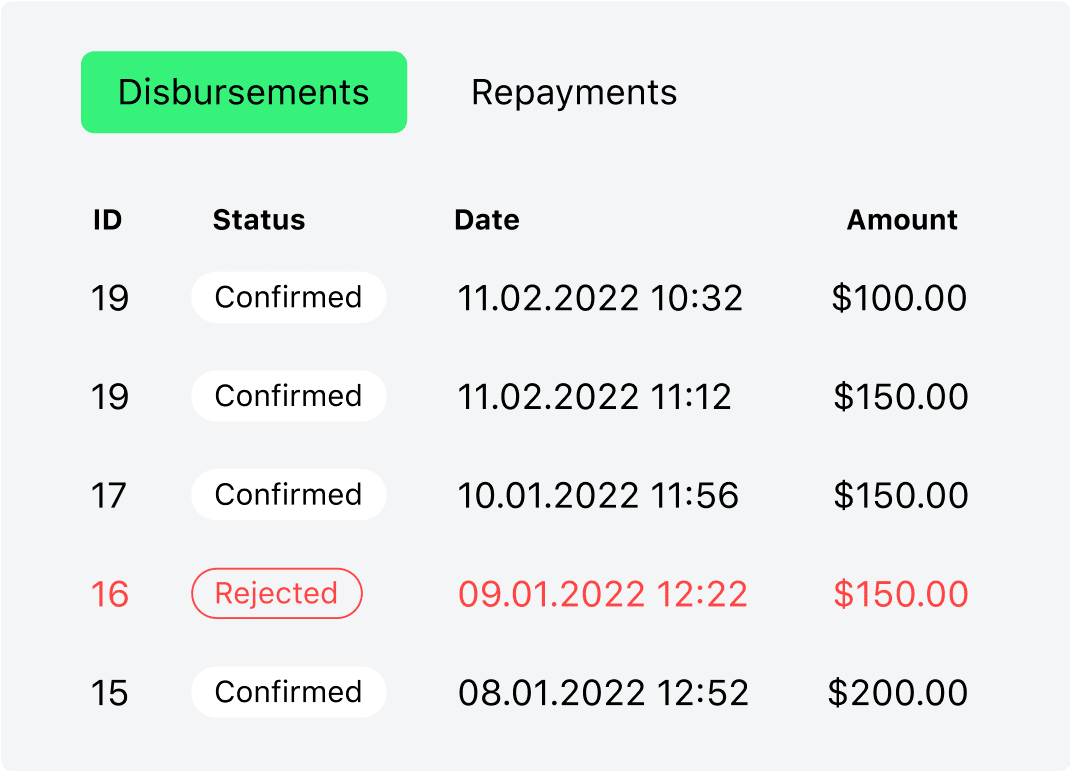

Automation of disbursements and payments

Transactions and reporting

Easy integrations

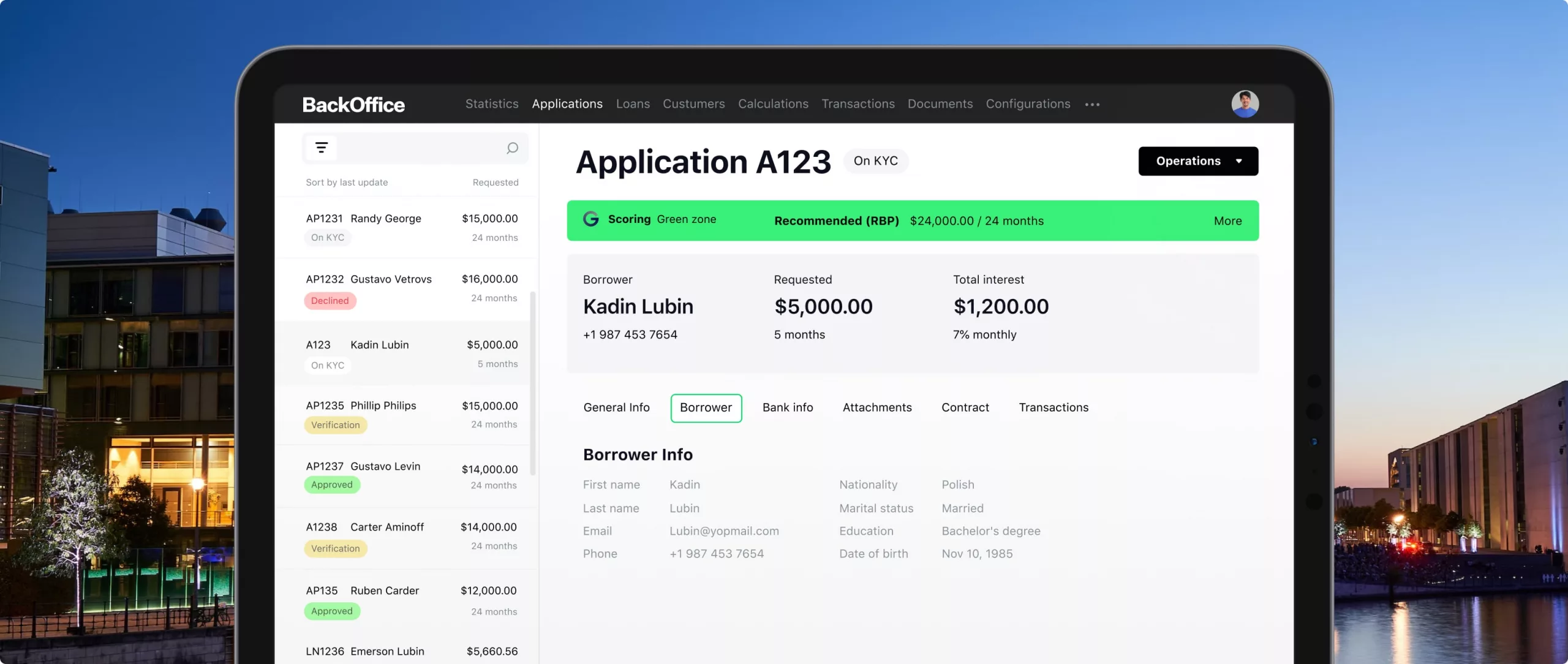

Bank loan software

for efficient management

End-to-end bank lending software

3-4 months time-to-market

Lifelong user support

No additional charges per customer