HES Core

The driving force behind every custom loan solution designed by HES Fintech

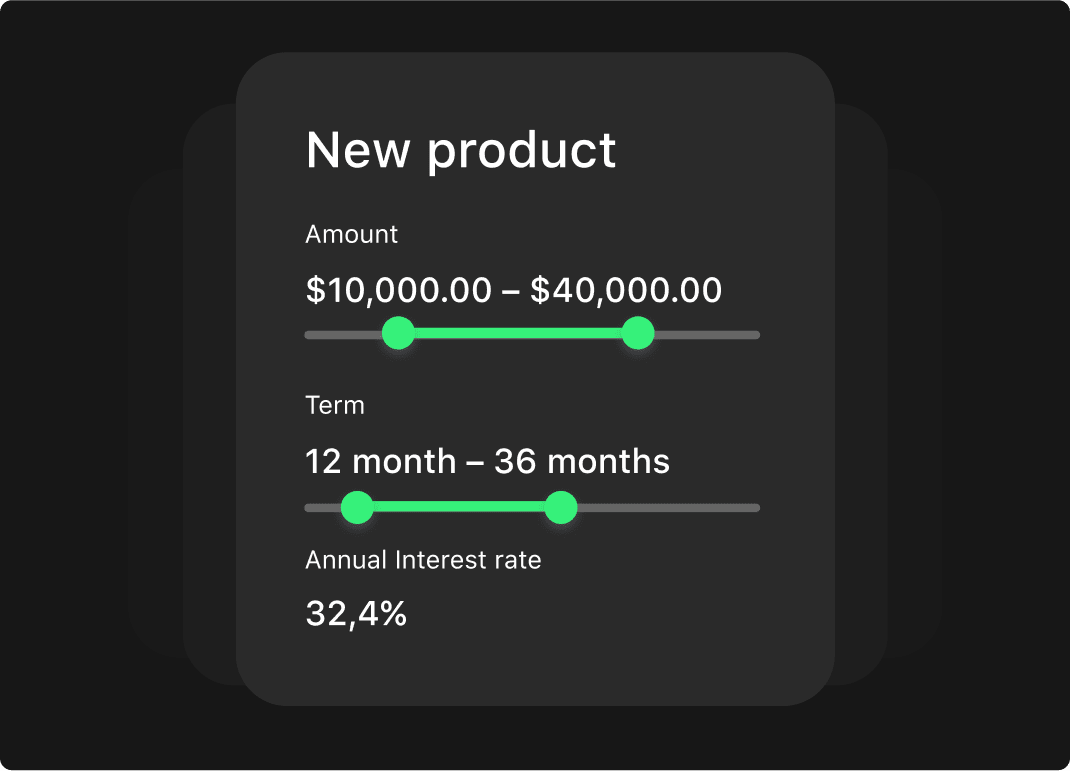

HES Core custom lending solution is a set of prebuilt components that can be adapted to your

business needs. Launch

a new line of business or transform your current lending system in just 3-4 months.

HES Core is fully configurable, meaning we build your modular lending software around it, not

from

scratch. Break monolithic architecture into microservices & leverage the benefits of the

latest tech stack.

HES Core modules

Under the hood

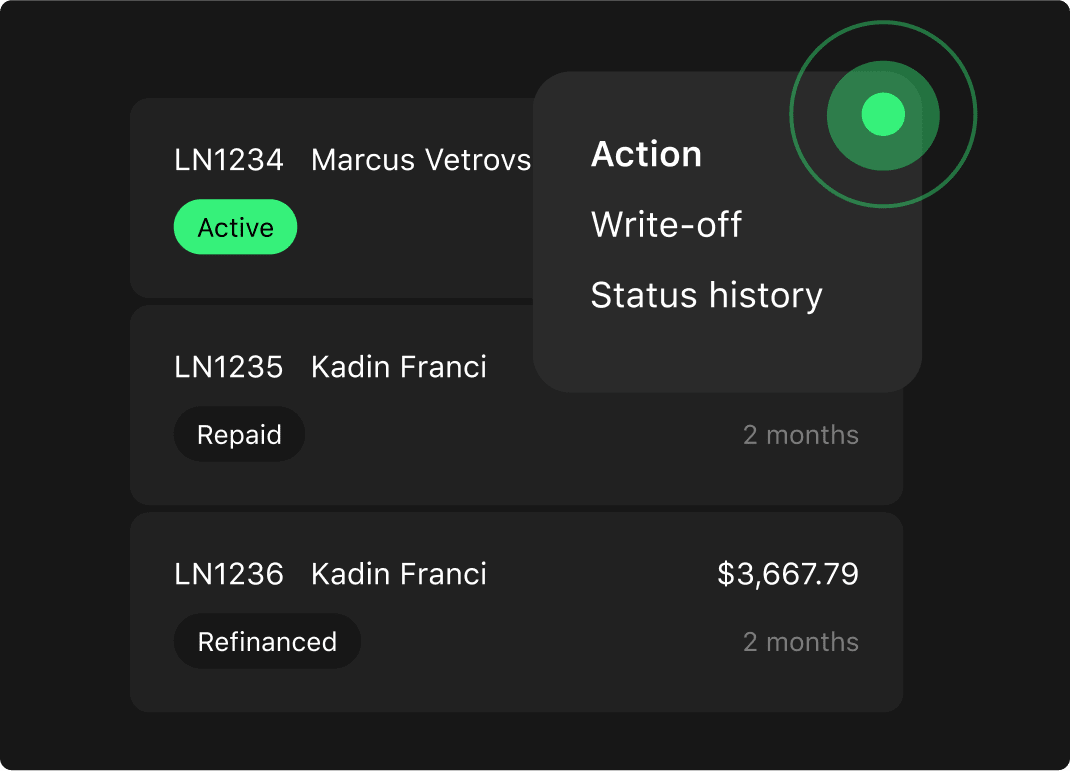

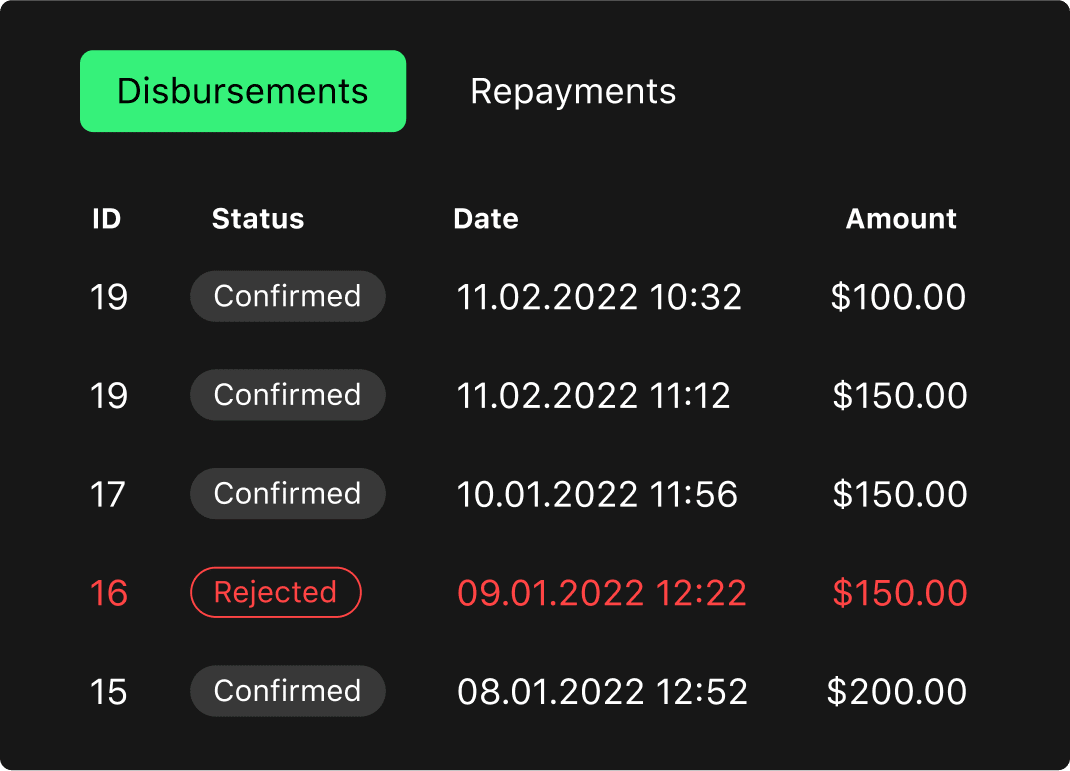

The custom loan solution with 20+ scalable modules for full-cycle

loan management,

from loan origination to collection

loan management,

from loan origination to collection

Customer onboarding

Automate and streamline the entire process with modular lending system.

Onboarding in a matter of

minutes. Enhanced digital user experience.

Onboarding in a matter of

minutes. Enhanced digital user experience.

BPMN in custom lending solutions

Reduce time-consuming processes, which cause delays to the total

procedures.

Model business processes with the BPMN module.

procedures.

Model business processes with the BPMN module.

and much more

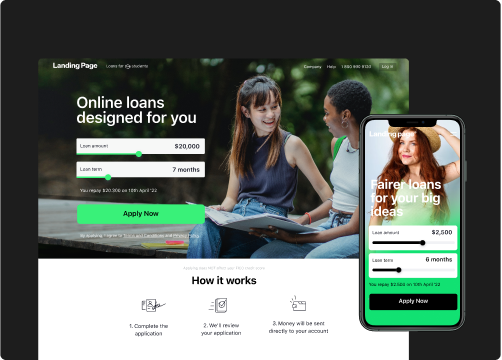

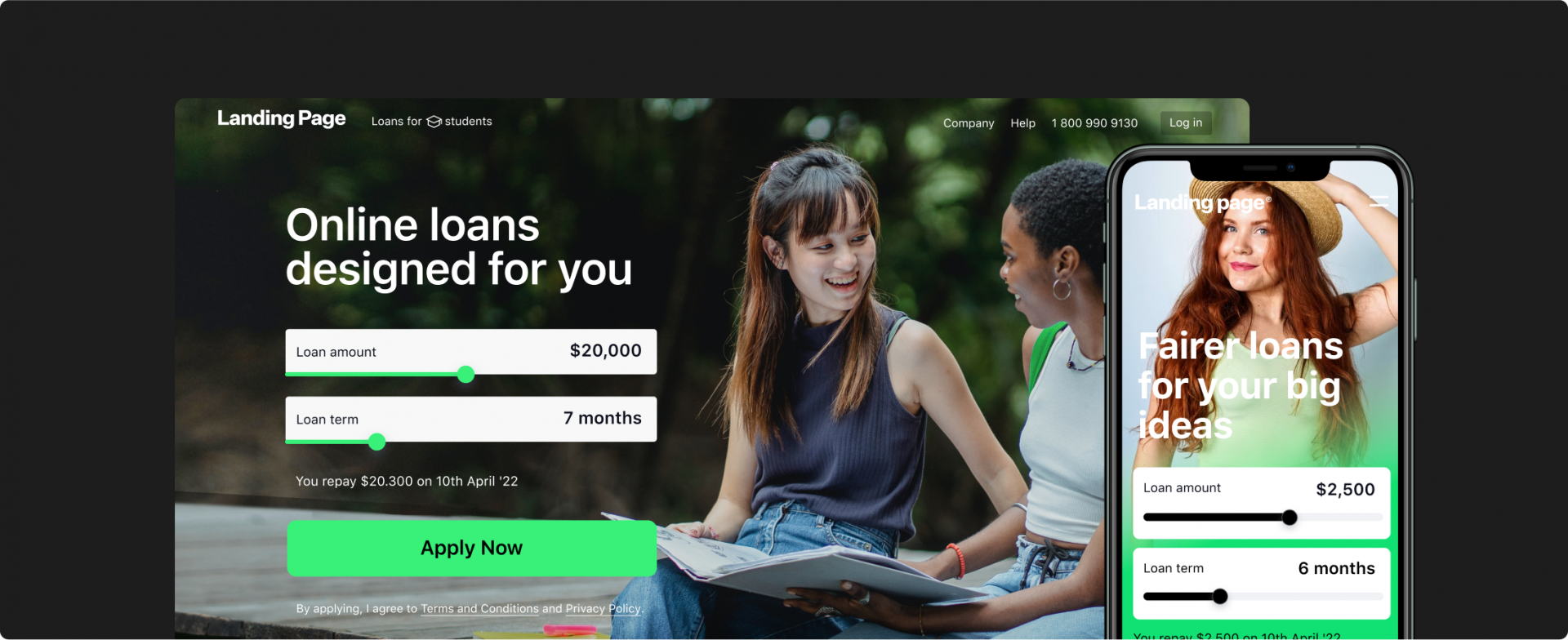

Multi-Channel loan application

Collect loan applications from multiple channels both online and offline,

including web, mobile, call centres and more.

including web, mobile, call centres and more.

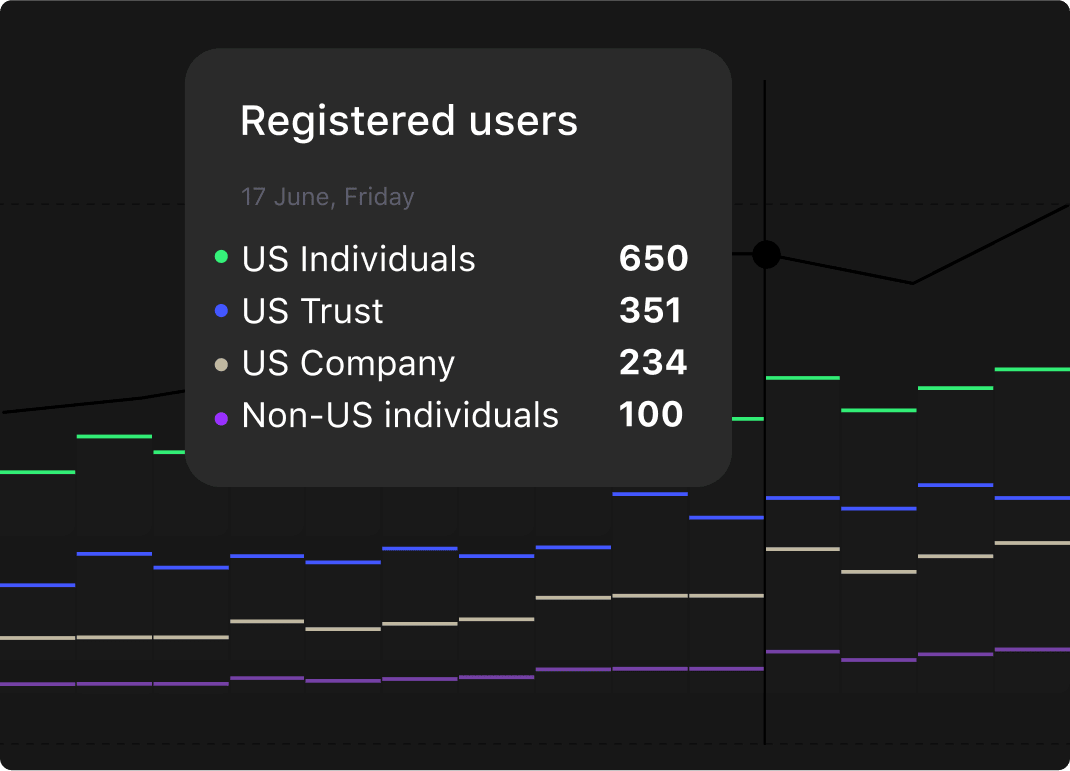

Online marketing

Attract and retain borrowers, build brand awareness campaigns, track the

results of your lead generation campaigns, including CPC/CPA and partnership networks.

results of your lead generation campaigns, including CPC/CPA and partnership networks.

Document management

Manage loan agreements, offers, contracts, notes and other system

documents.

documents.

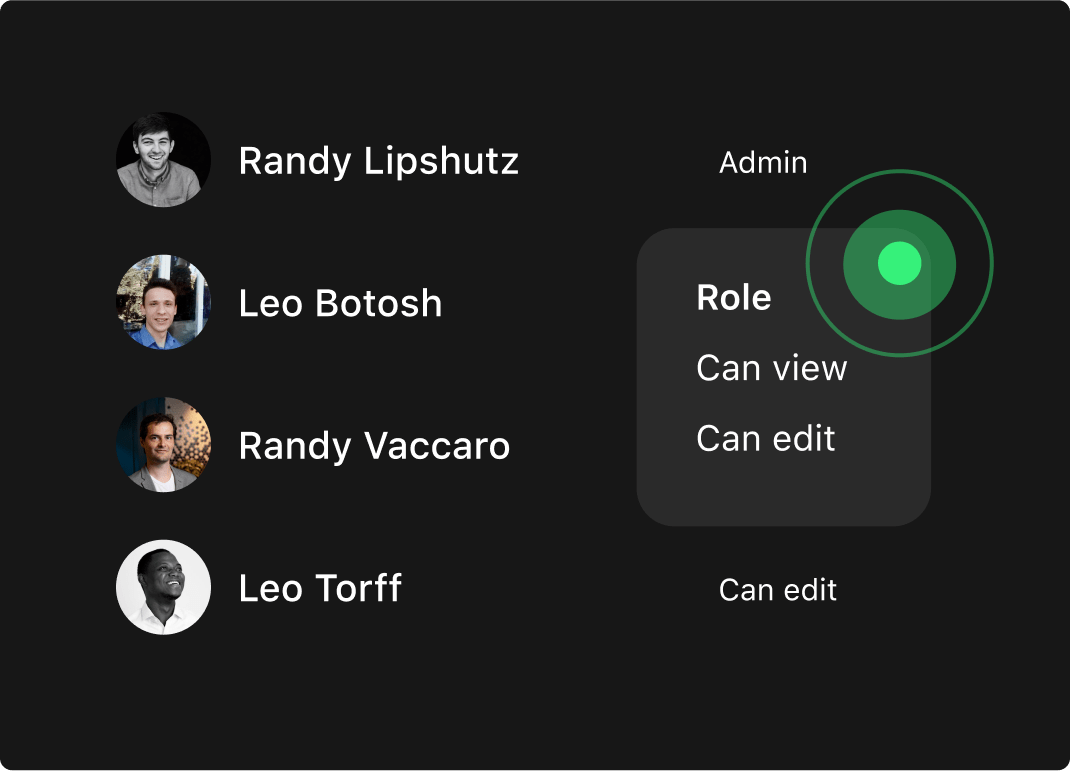

Security settings

and preferences

and preferences

Manage user permissions using role-based access control features. Define

password policies. Build rules to allow or block access by device ID.

password policies. Build rules to allow or block access by device ID.

Data validation

Check and validate all the data entered by a customer on the fly (address,

contact details, passport expiration dates, etc.).

contact details, passport expiration dates, etc.).

Marketplace features

The borrower-lender matching engine delivers advanced capabilities for

automatic loan matchmaking.

automatic loan matchmaking.

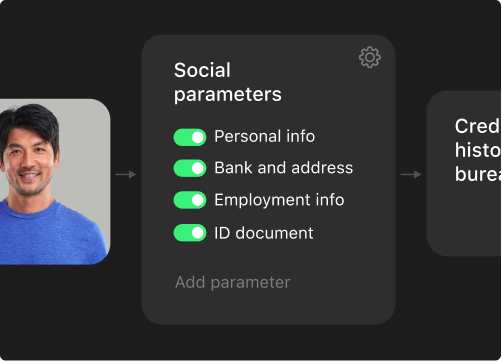

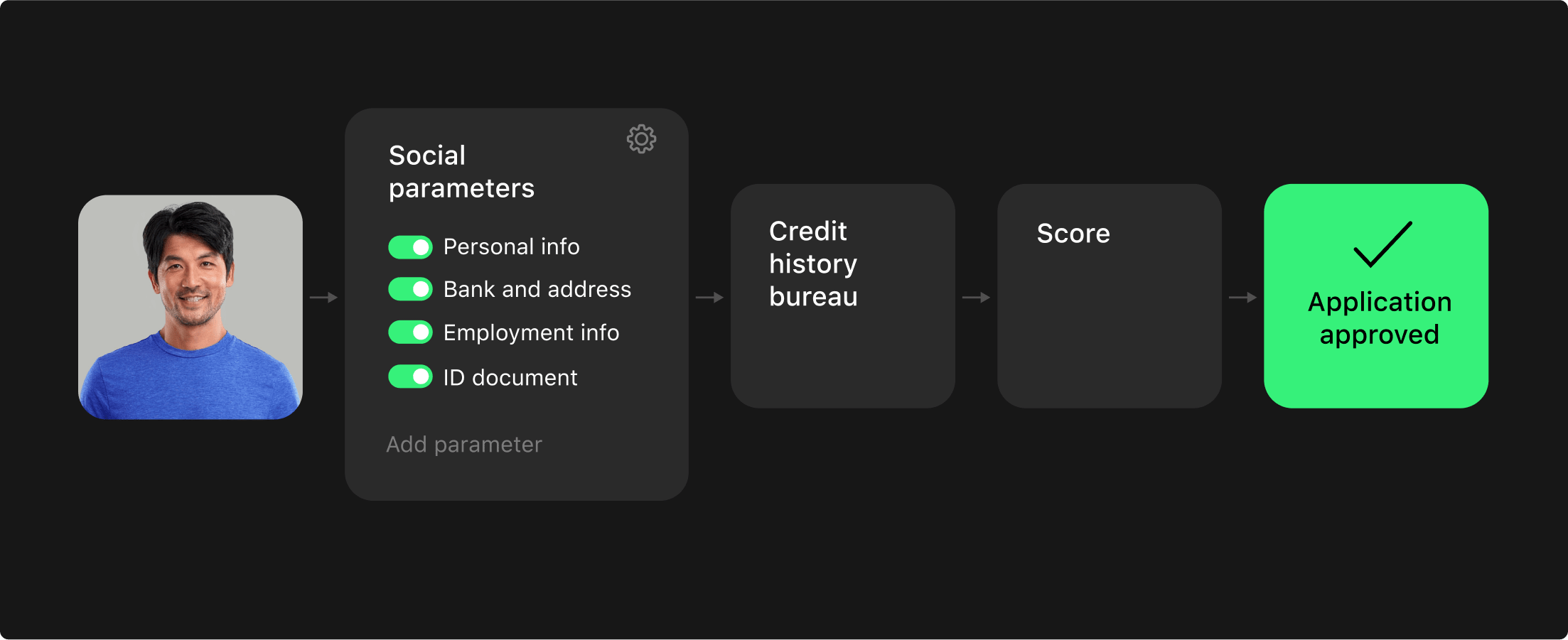

100+ APIs for the custom loan solution

HES Core gives you the ability to integrate with any third party

service

provider in the

fast-changing lending environment. Custom loan solution can be easily

integrated

with any

financial service provider:

service

provider in the

fast-changing lending environment. Custom loan solution can be easily

integrated

with any

financial service provider:

Issue first loans in 3 months