Consumer lending software

Get your retail lending system ready

in 3 months

HES LoanBox solution includes

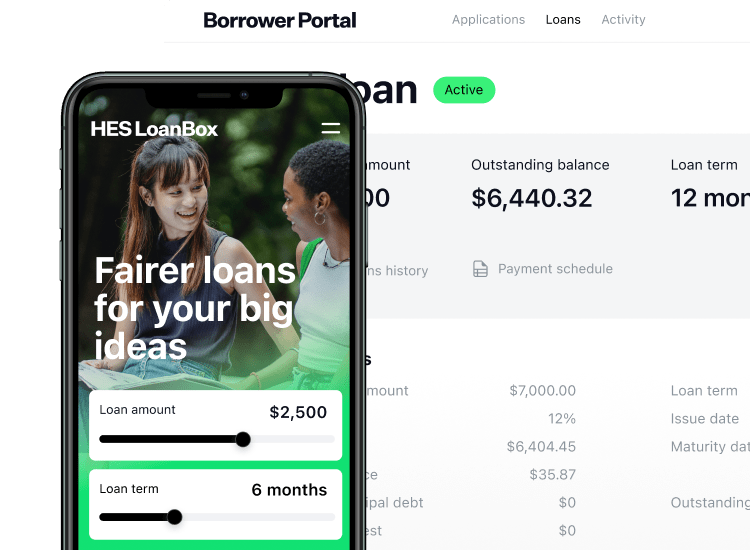

Landing Page

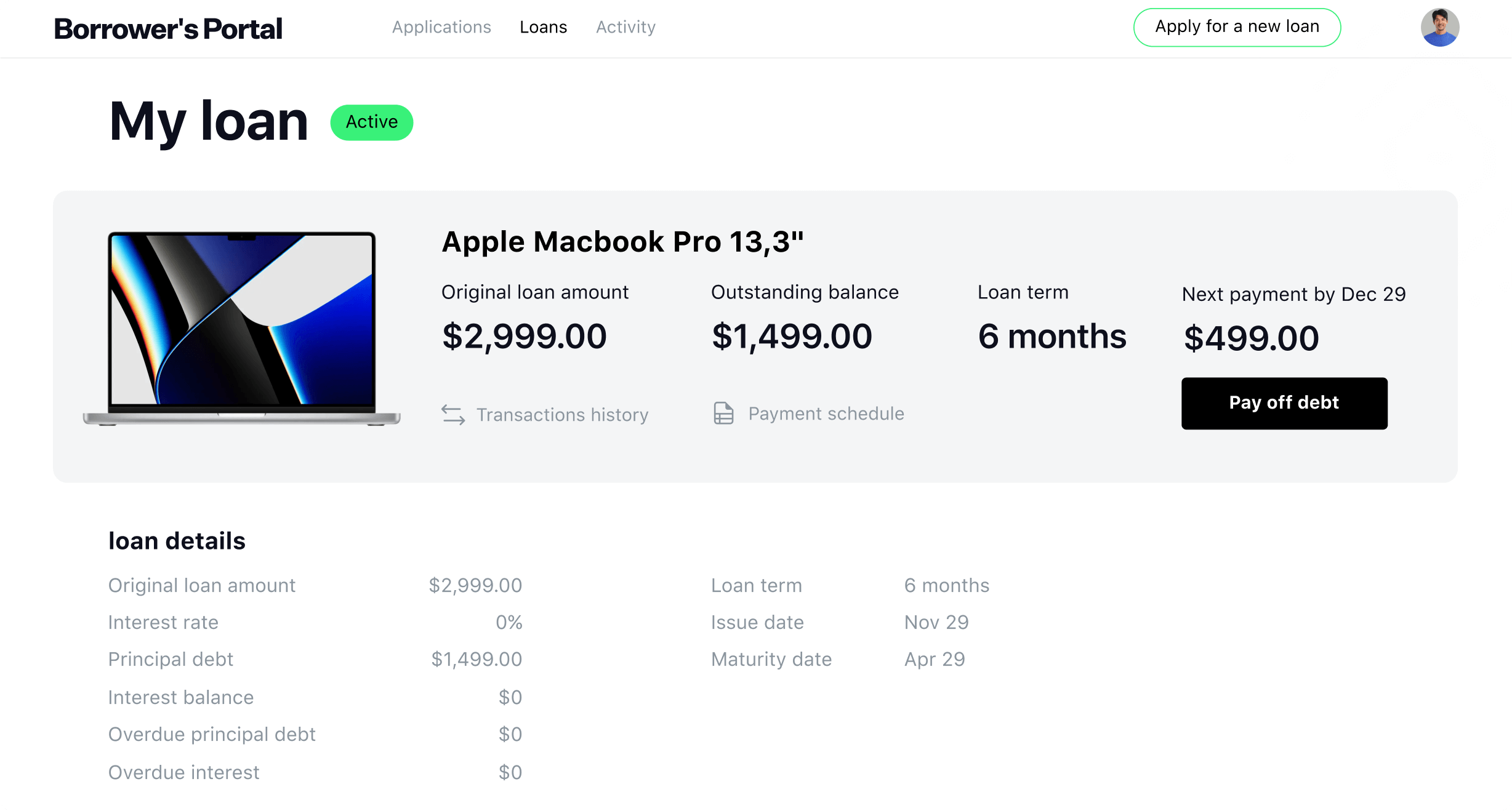

Borrower Portal

Back Office

Ready-made consumer lending platform

User-friendly, white-label design

Multichannel loan application process

Dedicated customer support

Flexible integration options

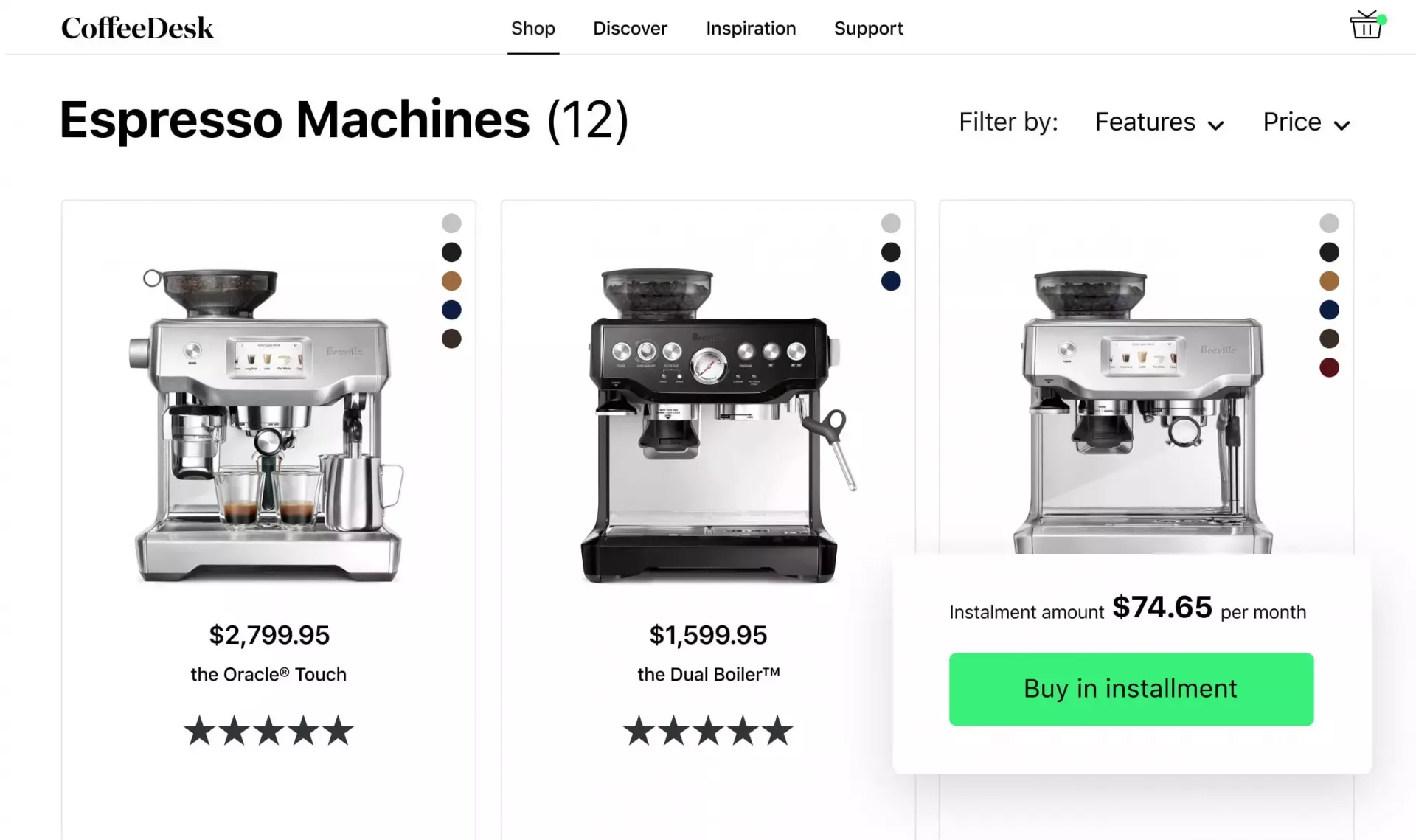

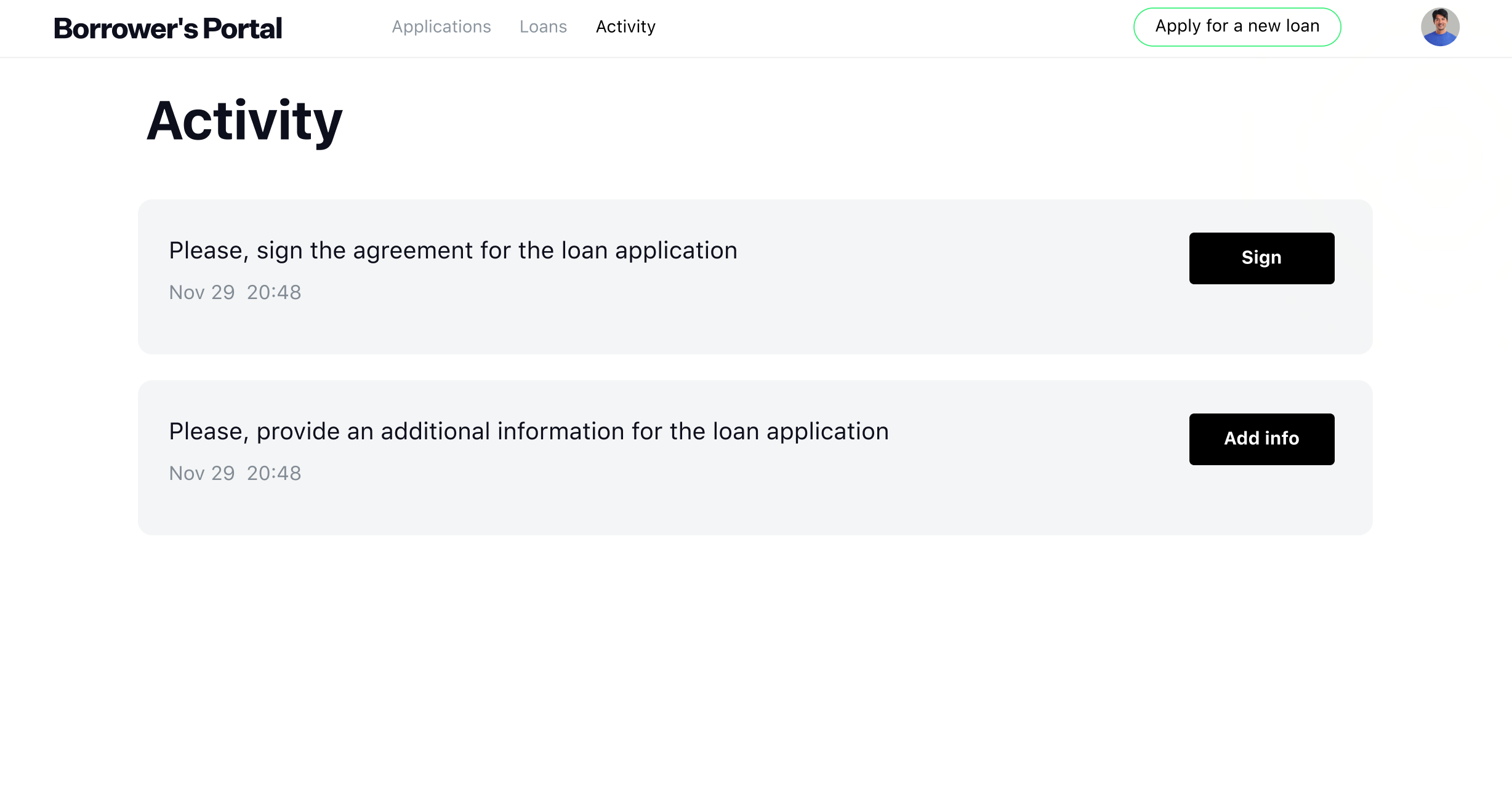

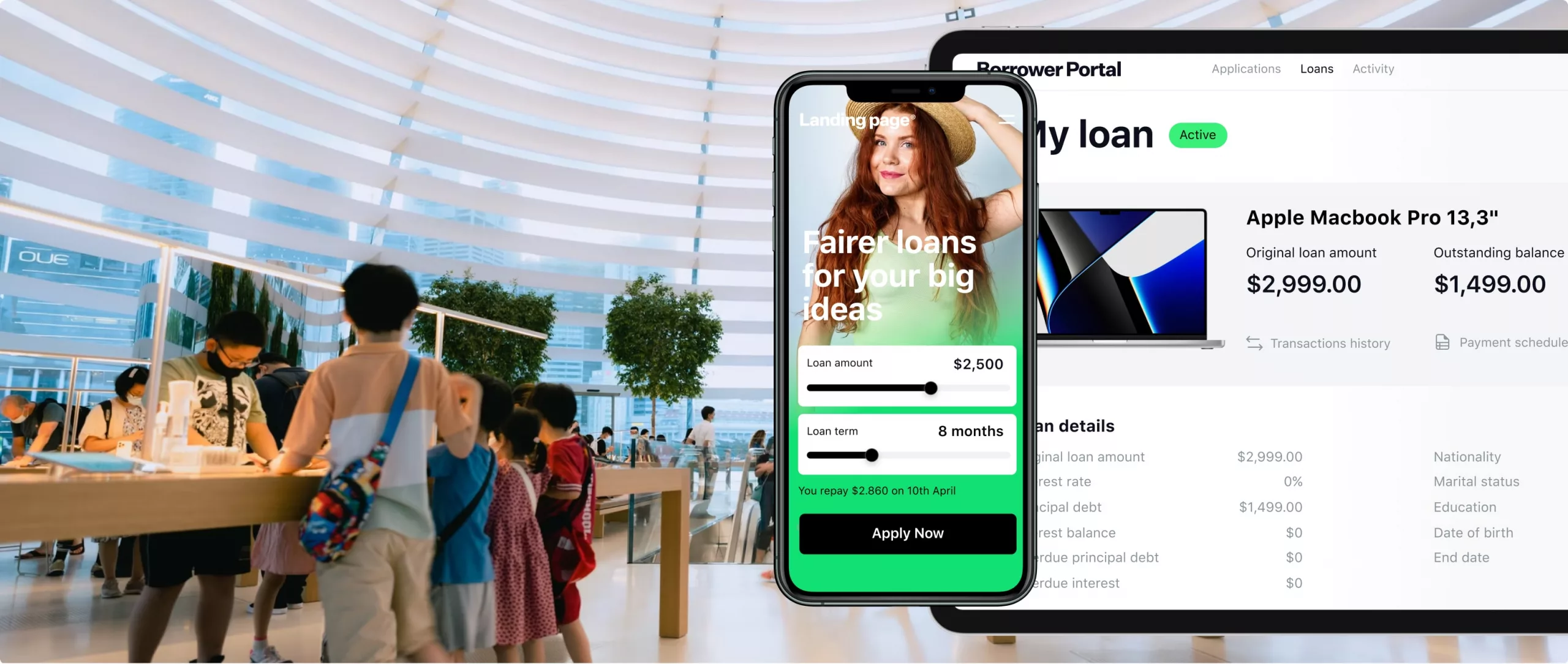

Cross-channel application process

Allow your customers the flexibility to apply for a loan through any

channel, using any device — from PC to smartphone — and even switch

devices mid-process. The retail lending solution by HES FinTech

enables seamless and paperless onboarding.

channel, using any device — from PC to smartphone — and even switch

devices mid-process. The retail lending solution by HES FinTech

enables seamless and paperless onboarding.

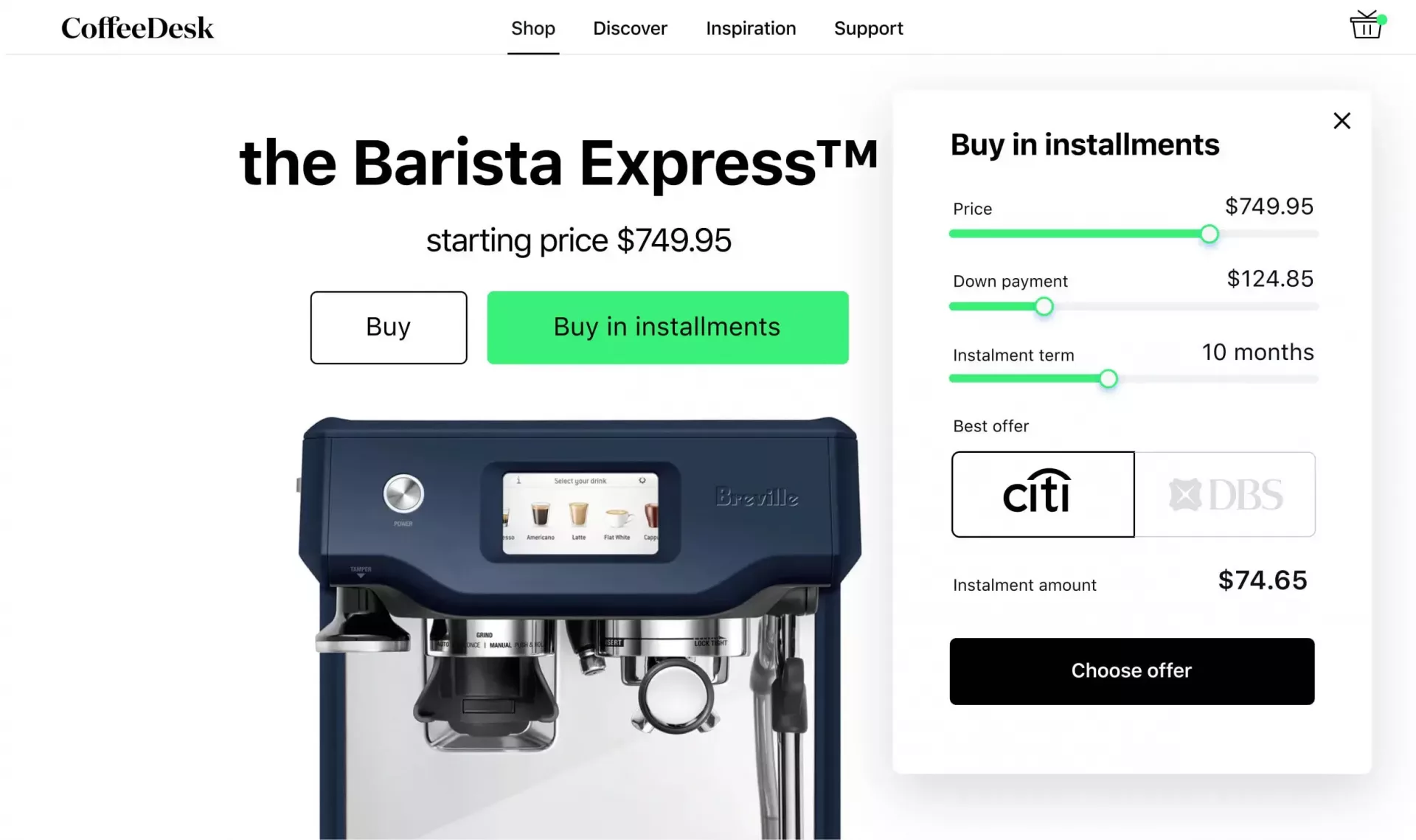

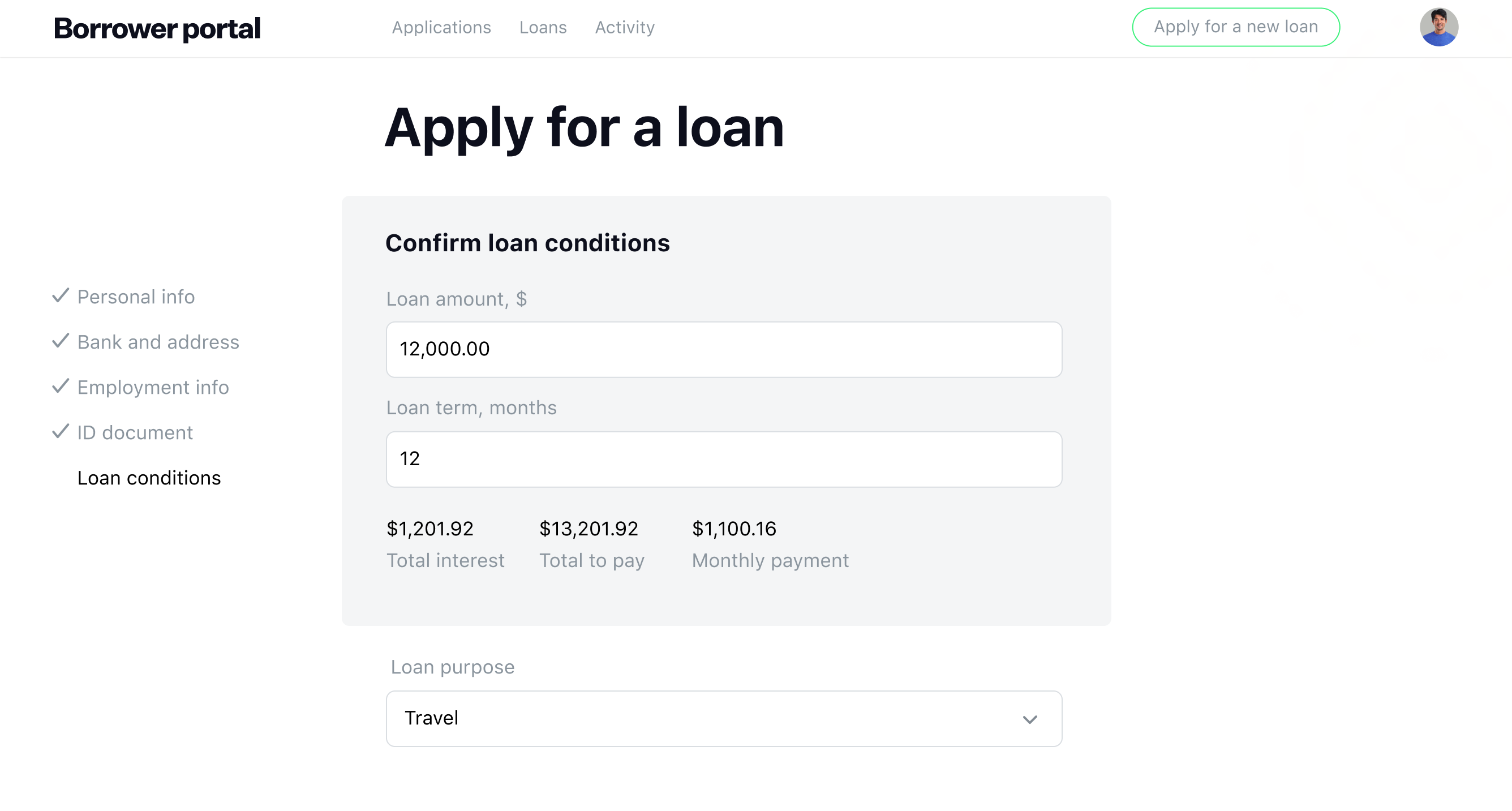

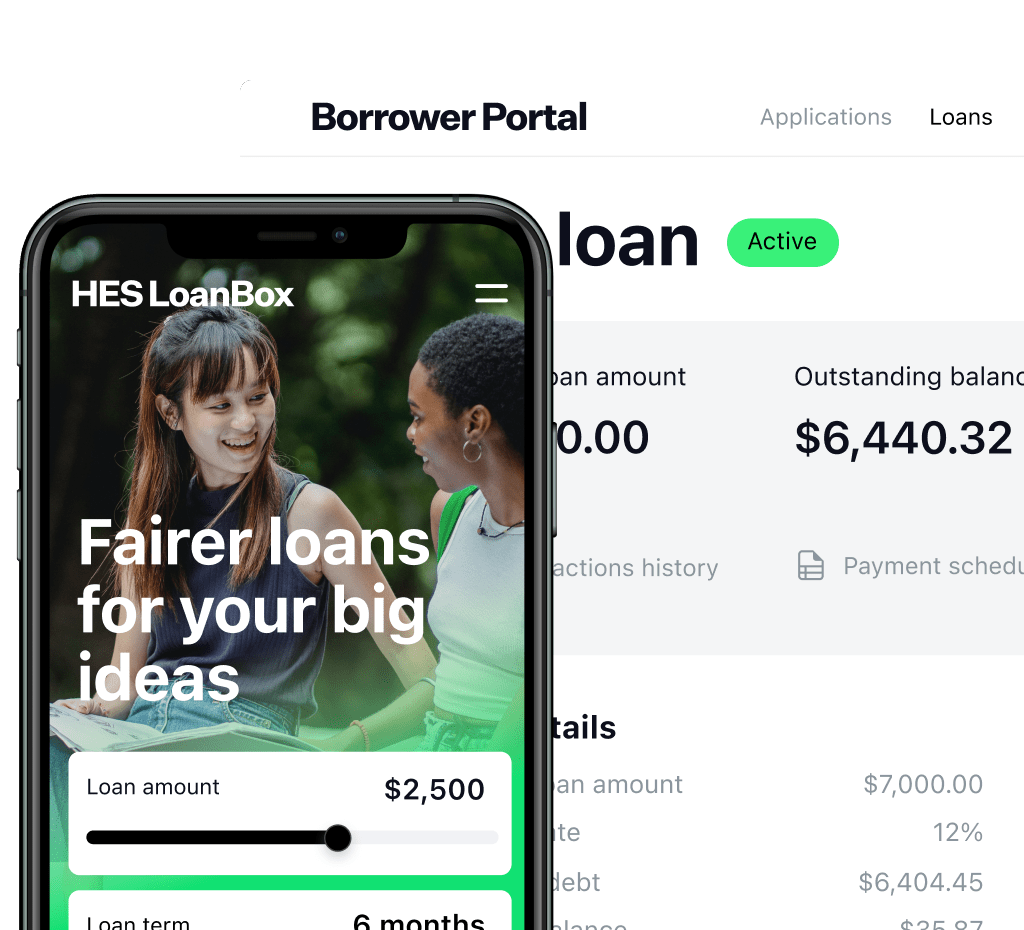

Loan calculator

HES LoanBox includes a front-end loan calculator that helps

borrowers choose the most suitable loan products by illustrating

how regular repayments adjust based on terms like loan amount and

payment frequency.

borrowers choose the most suitable loan products by illustrating

how regular repayments adjust based on terms like loan amount and

payment frequency.

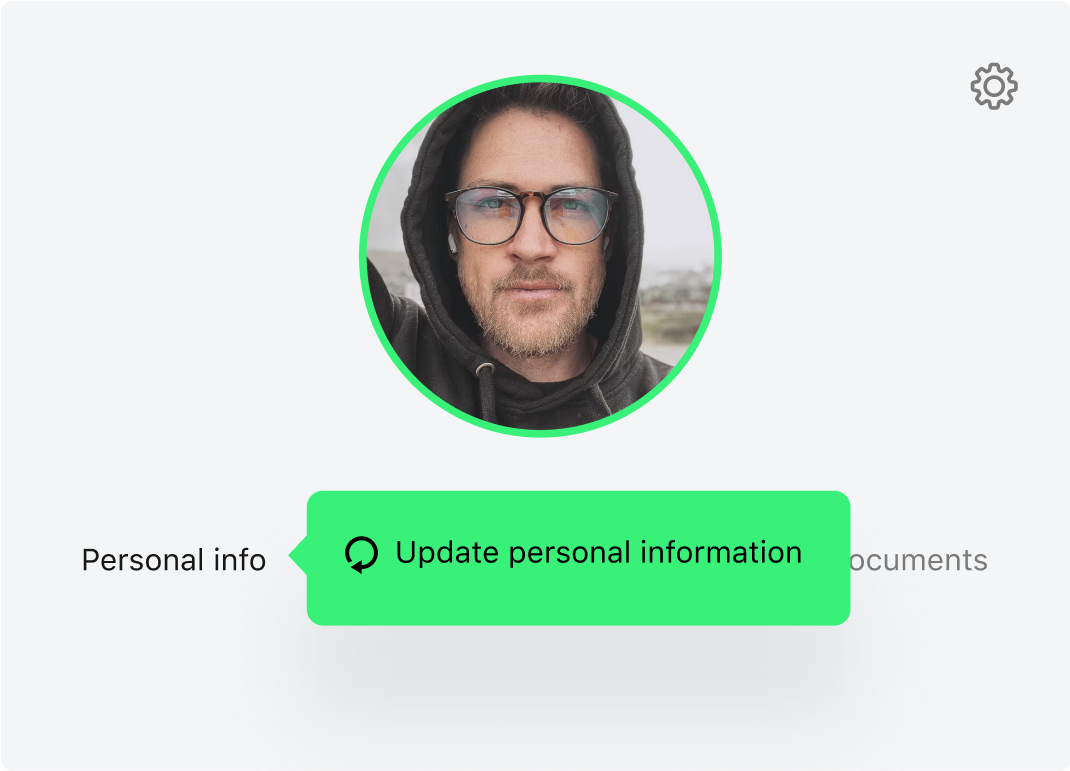

Borrower Profile

Let your borrowers save and update their personal information and

use it for new loan applications. Stored sensitive data is

protected by

KeyCloak

technologies.

use it for new loan applications. Stored sensitive data is

protected by

KeyCloak

technologies.

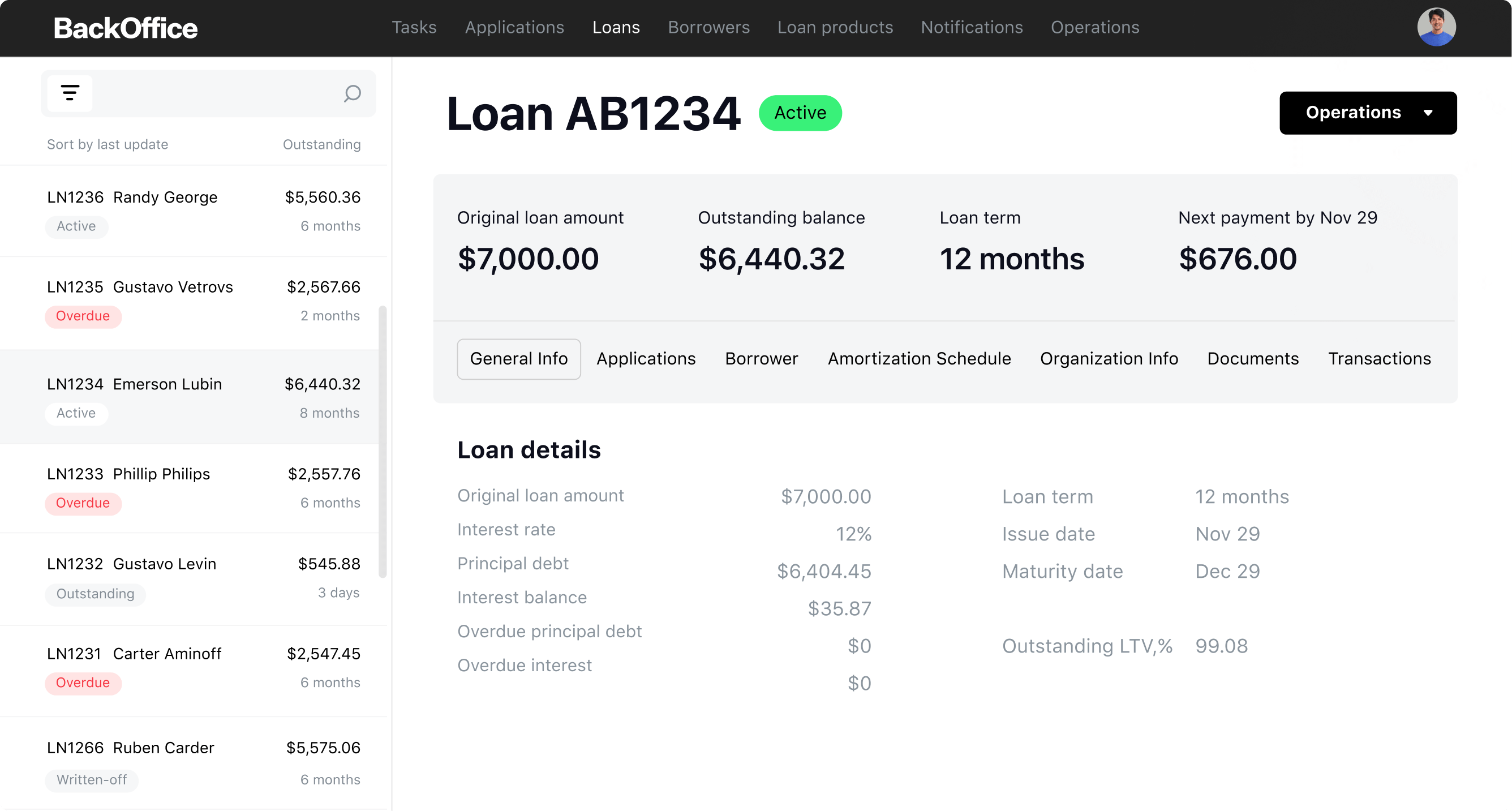

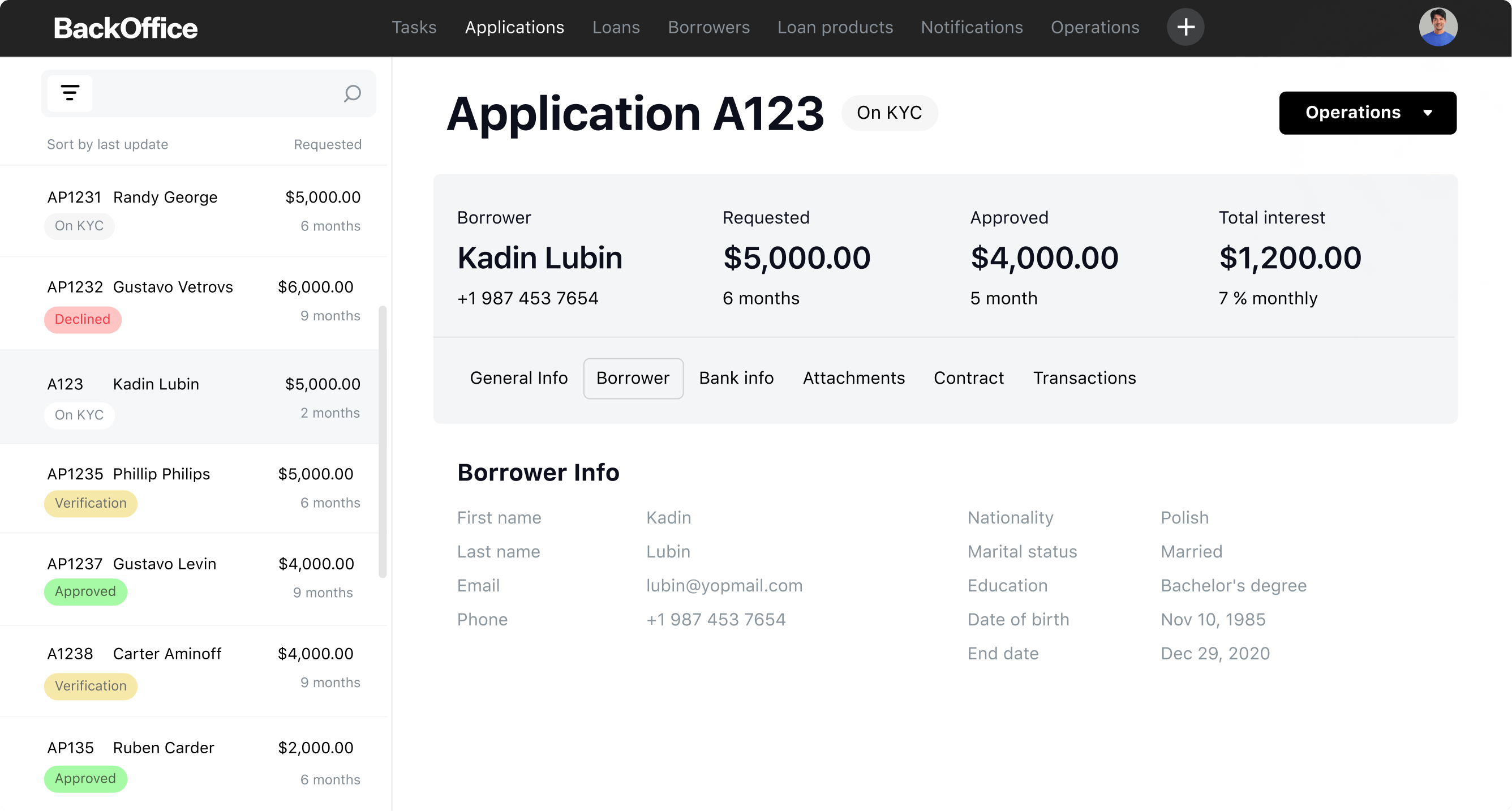

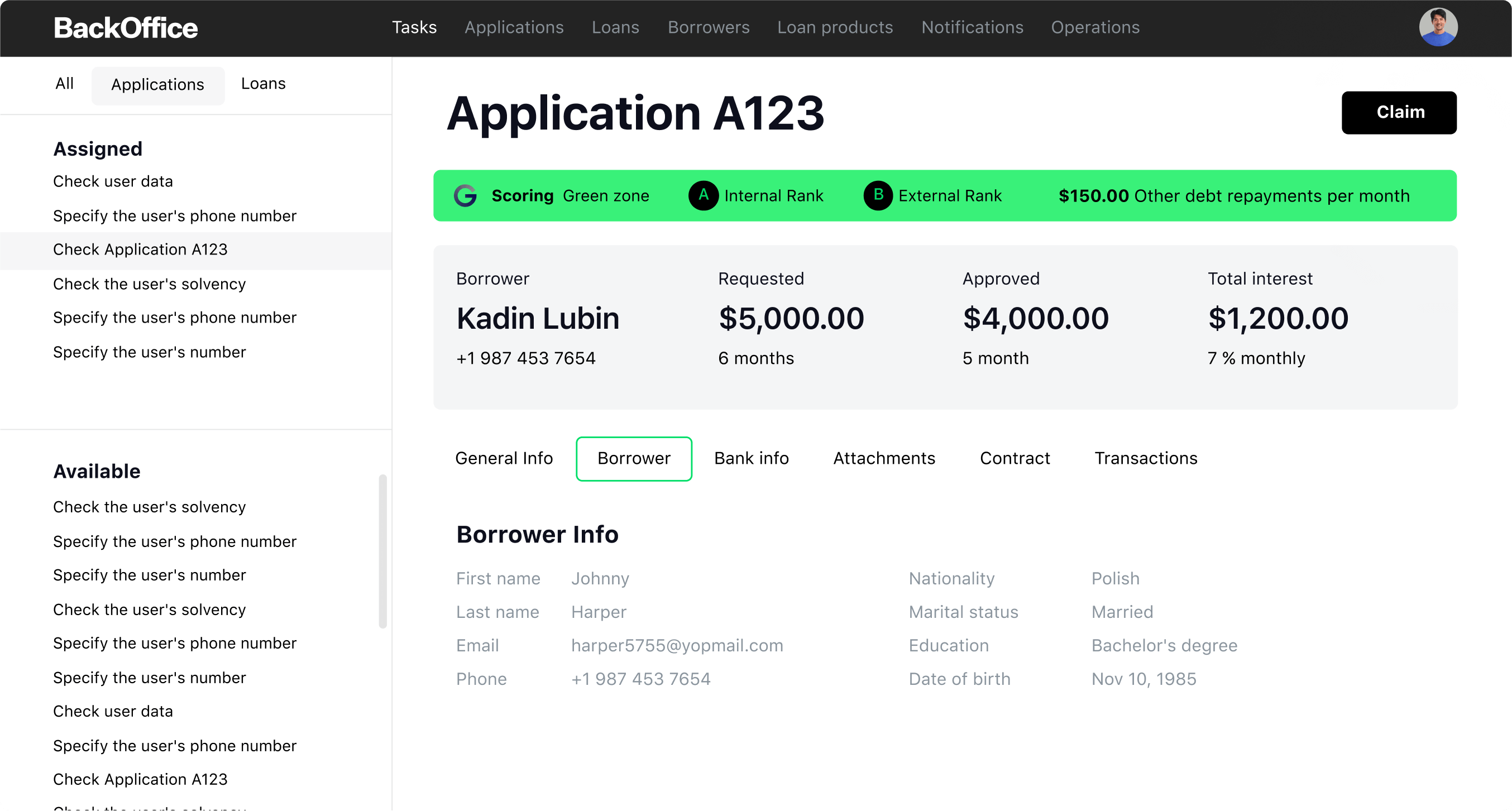

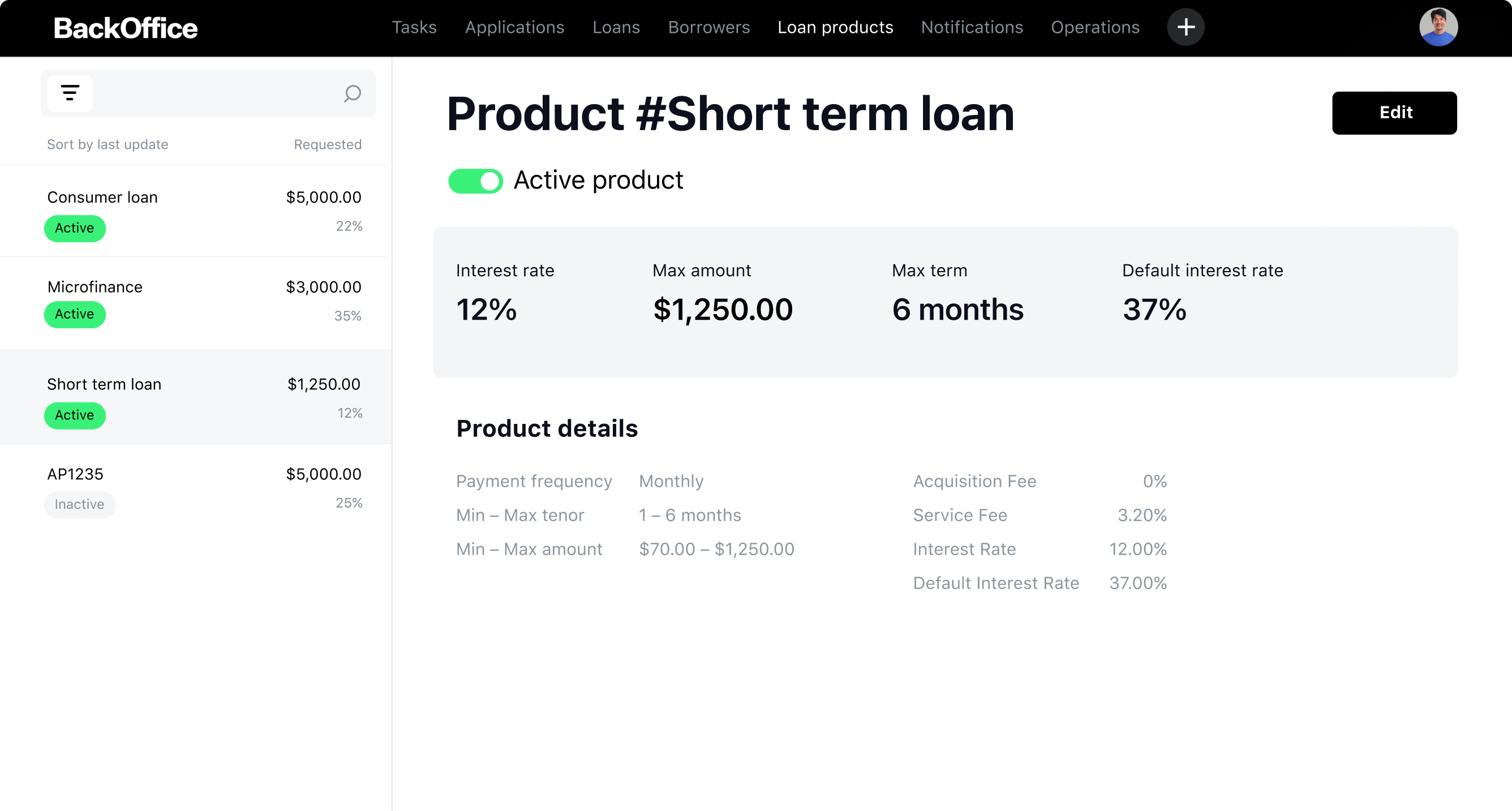

Feature-rich Back Office for managers

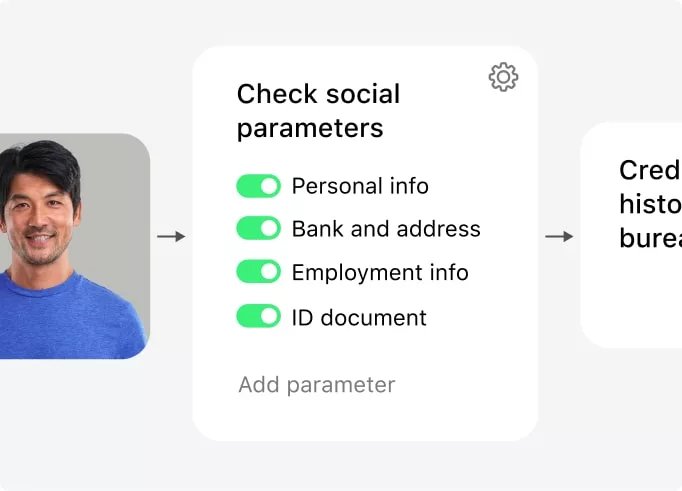

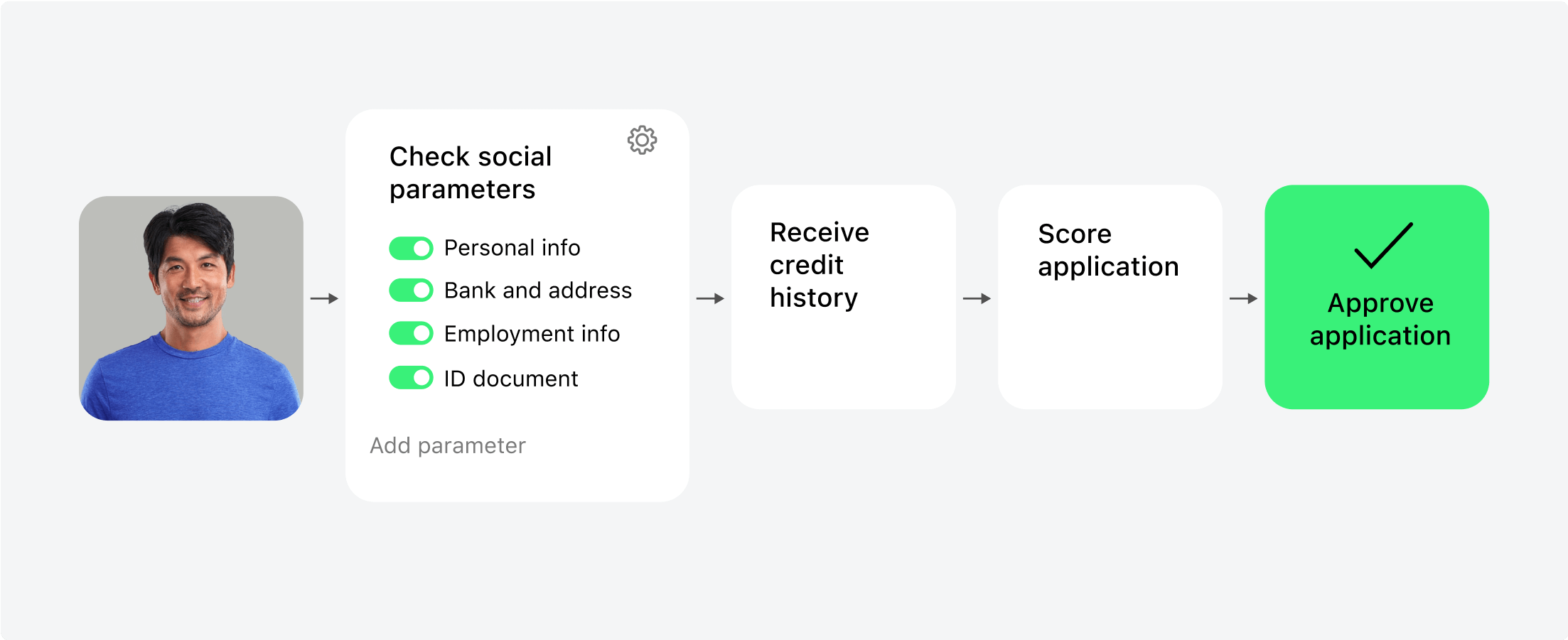

Automated decision-making

HES LoanBox retail lending software empowers you to configure semi-

and fully-automated decision-making processes. The platform can

score loan applications, detect stop factors, find matching lending

products, and approve or decline requests automatically.

and fully-automated decision-making processes. The platform can

score loan applications, detect stop factors, find matching lending

products, and approve or decline requests automatically.

and much more

Consumer loan origination control

Loan management

Document templates

Automation of disbursements and payments

Transactions and reporting

Benefit from cutting-edge integrations

Empower your lending business with

HES LoanBox

HES LoanBox

Off-the-shelf solution

for consumer

lending

Ready-made consumer lending software

The intelligent consumer lending solution is fully

customizable to meet your business needs. Automate mundane

tasks with consumer loan origination software to save time

and reduce operational costs.

2 weeks time-to-market

HES consumer finance software is ready for a kickstart in

just 2 weeks. Robust consumer loan management software

provides a quick payback of the project along with an

increase in business efficiency.

AI-powered consumer loan software

Adhere high service standards with the AI/ML-based

consumer installment loan software. Implement powerful

application scoring models to improve your credit

portfolio. Make data-driven decisions instantly with the

consumer loan system.

No additional charges per customer

HES provides fully managed consumer credit software

solutions with no limits on the number of users. Flexible

pricing depends on the features you choose.

FAQ

Can I customize the software to meet my specific business needs?

Is HES FinTech’s consumer lending platform easy to use?

What types of loans can be managed with the consumer loan system?

Does lending software integrate with other systems and software?