Tavan Bogd Group success story

Digitizing lending operations for

Mongolia’s largest conglomerate

Mongolia’s largest conglomerate

We joined forces to transform Tavan Bogd Finance’s lending infrastructure with an automated and

scalable loan management system.

scalable loan management system.

Challenge

Key obstacles in scaling financial

services for a growing market

Tavan Bogd Finance, a subsidiary of Tavan Bogd Group, sought to implement a scalable fintech

platform to cater to the evolving financial needs of its customers. The company aimed to

streamline its loan origination and management processes to offer faster and more flexible

financial services, including consumer and commercial lending. The platform also needed to

integrate a loyalty point system, an e-wallet feature, and various lending products to enhance

customer engagement and operational efficiency.

platform to cater to the evolving financial needs of its customers. The company aimed to

streamline its loan origination and management processes to offer faster and more flexible

financial services, including consumer and commercial lending. The platform also needed to

integrate a loyalty point system, an e-wallet feature, and various lending products to enhance

customer engagement and operational efficiency.

The main challenges included the need for automation of loan decisions, improving service speed

and quality, expanding their target customer base, and reducing operational costs. Additionally,

Tavan Bogd Finance required a seamless transition from their existing non-bank loan software,

with minimal disruption and complete data migration.

and quality, expanding their target customer base, and reducing operational costs. Additionally,

Tavan Bogd Finance required a seamless transition from their existing non-bank loan software,

with minimal disruption and complete data migration.

Approach

Customer verification flow

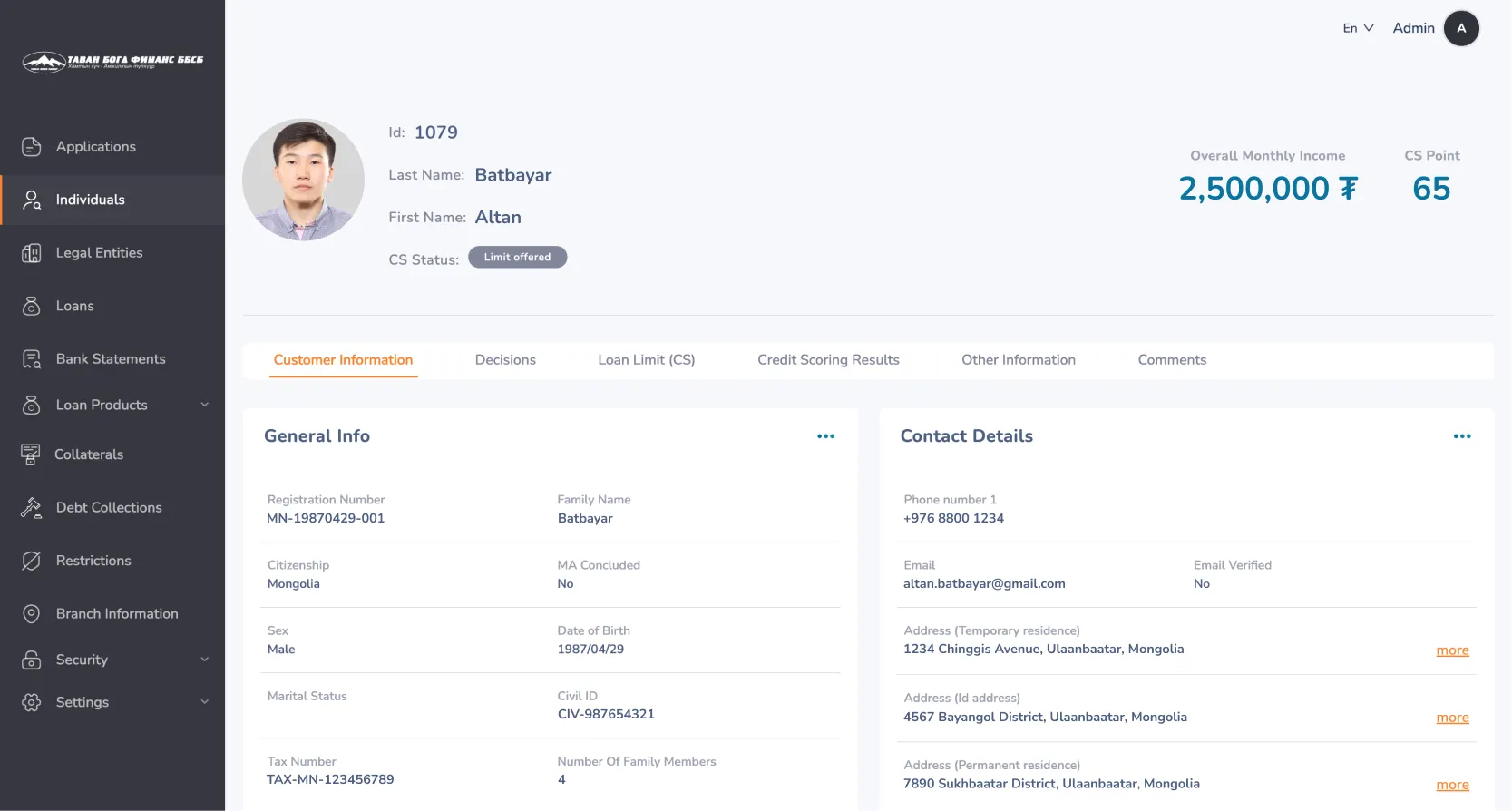

Our solution for Tavan Bogd Finance includes a customer verification flow that evaluates

individual borrowers before initiating the loan application process. To ensure connectivity with

Tavan Bogd Finance’s app, we provided the necessary endpoints and back-office infrastructure to

seamlessly connect our HES LoanBox system to their mobile application and middleware. The

middleware, acting as an intermediary between our solution and over 20 Mongolian service

integrations, was responsible for direct connectivity with those services.

individual borrowers before initiating the loan application process. To ensure connectivity with

Tavan Bogd Finance’s app, we provided the necessary endpoints and back-office infrastructure to

seamlessly connect our HES LoanBox system to their mobile application and middleware. The

middleware, acting as an intermediary between our solution and over 20 Mongolian service

integrations, was responsible for direct connectivity with those services.

The developed loan application process is highly efficient and automated. Customers share their

personal information through the mobile app, initiating a verification process. This process

includes multiple automated checks, such as income verification and credit history review,

ensuring a swift and accurate evaluation without manual intervention.

personal information through the mobile app, initiating a verification process. This process

includes multiple automated checks, such as income verification and credit history review,

ensuring a swift and accurate evaluation without manual intervention.

Within two minutes, the system automatically calculates and provides loan limits based on the

applicant’s personal information. The decision-making process is fully automated, ensuring no

manual intervention from back-office users is required. Once calculated, these limits are valid

for 24 hours, after which they expire and must be recalculated. If the customer is approved,

they are presented with eligible loan products tailored to their financial profile. Should the

customer fail any criteria (such as age or blacklist status), they receive an immediate push

notification.

applicant’s personal information. The decision-making process is fully automated, ensuring no

manual intervention from back-office users is required. Once calculated, these limits are valid

for 24 hours, after which they expire and must be recalculated. If the customer is approved,

they are presented with eligible loan products tailored to their financial profile. Should the

customer fail any criteria (such as age or blacklist status), they receive an immediate push

notification.

For Tavan Bogd Finance employees, the entire verification process, including ranges, values, and

scores, is accessible within the borrower’s profile, providing complete transparency and control

over loan decisions.

scores, is accessible within the borrower’s profile, providing complete transparency and control

over loan decisions.

Approach

Loan origination and management

process

In developing the Loan Management System (LMS) for Tavan Bogd Finance, we addressed the diverse

needs of Installment Loans (LeaseOn), BNPL (Buy Now, Pay Later), Pledged Loans and Trusted

Pledged Loans. Each loan type required unique handling, which we streamlined through a tailored

approach.

needs of Installment Loans (LeaseOn), BNPL (Buy Now, Pay Later), Pledged Loans and Trusted

Pledged Loans. Each loan type required unique handling, which we streamlined through a tailored

approach.

For Installment Loans (LeaseOn), borrowers started with a detailed loan application. After the

system calculated the loan terms, the borrower could add co-borrowers (references) for

additional support. Contract signing was made convenient, offering two methods: OTP confirmation

or a signature uploaded via image. This ensured a fast and seamless experience for both the

borrower and the institution.

system calculated the loan terms, the borrower could add co-borrowers (references) for

additional support. Contract signing was made convenient, offering two methods: OTP confirmation

or a signature uploaded via image. This ensured a fast and seamless experience for both the

borrower and the institution.

With BNPL loans, the system integrated directly with the merchant portal, automatically pulling

invoice data to verify the loan amount and status. This seamless connection reduced the need for

manual input, speeding up the process and increasing accuracy.

invoice data to verify the loan amount and status. This seamless connection reduced the need for

manual input, speeding up the process and increasing accuracy.

Pledged Loans, being more complex, required multiple layers of manual intervention. A processing

fee was introduced upfront, and the loans underwent a series of thorough review stages to ensure

compliance and mitigate risk. These stages included reviews by CIAT, LAAT, the Credit Committee,

the Relationship Manager, the Branch Manager, and the Accountant. This comprehensive, multi-step

review process allowed for careful handling of more sensitive loan products, ensuring that every

aspect of the loan was scrutinized before approval.

fee was introduced upfront, and the loans underwent a series of thorough review stages to ensure

compliance and mitigate risk. These stages included reviews by CIAT, LAAT, the Credit Committee,

the Relationship Manager, the Branch Manager, and the Accountant. This comprehensive, multi-step

review process allowed for careful handling of more sensitive loan products, ensuring that every

aspect of the loan was scrutinized before approval.

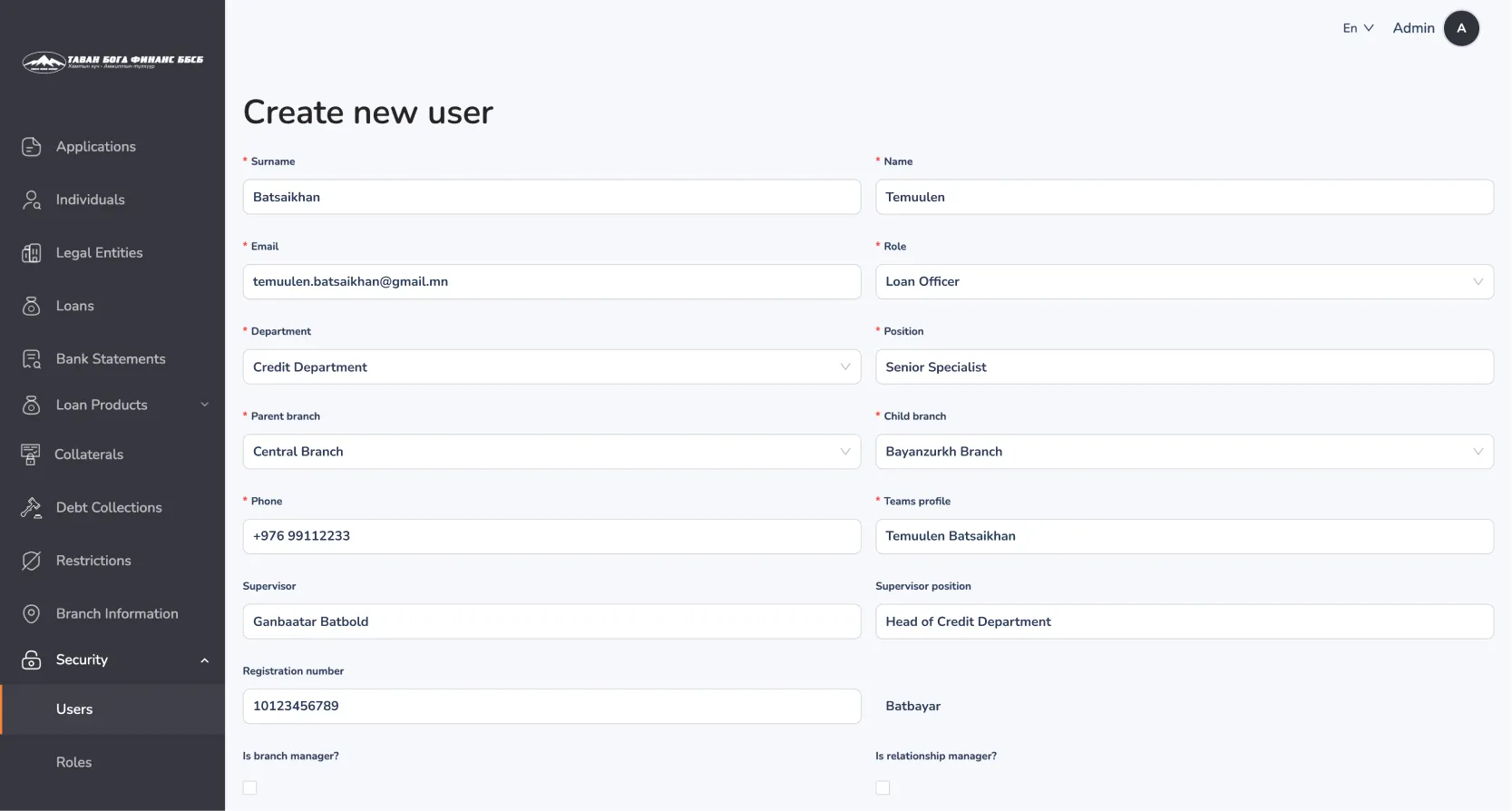

To ensure secure and efficient operations, we implemented clear user permissions. These

role-based permissions controlled access to sensitive information, preventing unauthorized

actions and ensuring that only qualified personnel could handle key loan management tasks.

role-based permissions controlled access to sensitive information, preventing unauthorized

actions and ensuring that only qualified personnel could handle key loan management tasks.

Additionally, we introduced branch management functionality, which allowed the company to

organize different departments of users based on their region, with each region assigned to a

specific branch. Loan applications were automatically assigned to branches according to regional

and other parameters, which streamlined operations. The system also provided the ability to

filter loans and applications by branch, a crucial feature for a large company like Tavan Bogd

Finance. This segregation of duties, combined with branch-specific management, enhanced both

security and operational efficiency.

organize different departments of users based on their region, with each region assigned to a

specific branch. Loan applications were automatically assigned to branches according to regional

and other parameters, which streamlined operations. The system also provided the ability to

filter loans and applications by branch, a crucial feature for a large company like Tavan Bogd

Finance. This segregation of duties, combined with branch-specific management, enhanced both

security and operational efficiency.

The system automated the calculation of repayment schedules based on the loan type and the

borrower’s preferences. Both annuity and differentiated repayment options were supported:

borrower’s preferences. Both annuity and differentiated repayment options were supported:

- Annuity repayment allowed for equal payments throughout the loan term, simplifying

financial planning for borrowers. - Differentiated repayment involved higher initial payments, with decreasing amounts over

time, providing borrowers with the flexibility to reduce their loan balance faster.

Additionally, the system allowed for various payment frequencies—monthly, biweekly, quarterly,

or end-of-term. A special calculation logic was developed to accommodate quarterly payments,

accounting for the varying number of months in each quarter, which was a critical requirement

from Tavan Bogd Finance.

or end-of-term. A special calculation logic was developed to accommodate quarterly payments,

accounting for the varying number of months in each quarter, which was a critical requirement

from Tavan Bogd Finance.

To support effective risk management, we introduced features like the provision rate and

on-balance/off-balance parameters, which were regularly reviewed by accountants. This enabled a

better understanding of potential risks, as loans in delinquency would trigger a provision rate

that increased with the number of overdue days. The system automatically adjusted the loan’s

status based on the length of the delinquency period.

on-balance/off-balance parameters, which were regularly reviewed by accountants. This enabled a

better understanding of potential risks, as loans in delinquency would trigger a provision rate

that increased with the number of overdue days. The system automatically adjusted the loan’s

status based on the length of the delinquency period.

We also implemented 11 different restructuring options, allowing Tavan Bogd Finance to offer

flexible repayment solutions to their large-scale clients. These restructuring features provided

an additional level of support for high-value customers, ensuring their needs could be met

without disrupting the overall loan management process.

flexible repayment solutions to their large-scale clients. These restructuring features provided

an additional level of support for high-value customers, ensuring their needs could be met

without disrupting the overall loan management process.

For BNPL loans, while they typically have 0% interest, we accounted for the risk of delayed

payments. If a BNPL loan was overdue by more than 93 days, it was reclassified and managed as an

installment loan, with appropriate late fees and interest calculations applied, ensuring

effective risk mitigation.

payments. If a BNPL loan was overdue by more than 93 days, it was reclassified and managed as an

installment loan, with appropriate late fees and interest calculations applied, ensuring

effective risk mitigation.

The LMS also supported the ability to handle past-date repayments and payment cancellations,

automatically recalculating affected repayment schedules and amounts. This flexibility ensured

that the company could manage its loan portfolio with precision, even when adjustments were

needed after the fact.

automatically recalculating affected repayment schedules and amounts. This flexibility ensured

that the company could manage its loan portfolio with precision, even when adjustments were

needed after the fact.

Additionally, we developed a system to manage transactions from multiple channels, including

bank statements. This system automatically sorts and allocates these transactions while

simultaneously detecting and eliminating duplicates. Such a mechanism added a layer of

reliability, making transaction management smoother and more efficient for Tavan Bogd Finance.

bank statements. This system automatically sorts and allocates these transactions while

simultaneously detecting and eliminating duplicates. Such a mechanism added a layer of

reliability, making transaction management smoother and more efficient for Tavan Bogd Finance.

$63M+

Loan portfolio

268,000+

Customers served

2 min

Loan limits calculation

Result

Creation of advanced systems for

streamlined loan management

Our collaboration with Tavan Bogd Finance, a subsidiary of Mongolia’s largest and most

diversified conglomerate, Tavan Bogd Group, led to the successful creation and implementation of

entirely new systems: a Loan Origination System (LOS) and a Loan Management System (LMS). These

systems were built from scratch, presenting a significant challenge but ultimately transforming

the way the company handled loan processing and management.

diversified conglomerate, Tavan Bogd Group, led to the successful creation and implementation of

entirely new systems: a Loan Origination System (LOS) and a Loan Management System (LMS). These

systems were built from scratch, presenting a significant challenge but ultimately transforming

the way the company handled loan processing and management.

A key aspect of this project was the simultaneous development of both the mobile application

(handled by Tavan Bogd Finance’s team) and the back-office system. Beyond delivering our

solution, we actively consulted with their development team, sharing best practices, offering

guidance, and ensuring alignment between both teams. This collaborative approach helped keep

both projects on track and demonstrated our ability to successfully manage the coordination of

multiple teams, a capability Tavan Bogd Finance had specifically inquired about during the early

stages of the project. This experience further highlights our strength not only in development

but also in facilitating effective teamwork across various stakeholders.

(handled by Tavan Bogd Finance’s team) and the back-office system. Beyond delivering our

solution, we actively consulted with their development team, sharing best practices, offering

guidance, and ensuring alignment between both teams. This collaborative approach helped keep

both projects on track and demonstrated our ability to successfully manage the coordination of

multiple teams, a capability Tavan Bogd Finance had specifically inquired about during the early

stages of the project. This experience further highlights our strength not only in development

but also in facilitating effective teamwork across various stakeholders.

management, enhancing operational efficiency and risk mitigation.