Success story from Philippines

A fast-growing microfinance company sets up a new business unit

A large microlending provider in the APAC region required reboosting of their

legacy software for process optimization, faster time-to-decision, and winning a

larger market share due to a top-notch technological solution for end-customers.

legacy software for process optimization, faster time-to-decision, and winning a

larger market share due to a top-notch technological solution for end-customers.

Challenge

Lending platform as a competitor advantage

Due to the growing demand for short-terms loans, the customer was looking for an opportunity to

set up a new business unit in the Philippines. There was a need to back up the operational lending

business with a new platform, which could provide higher performance and decrease the amount of

manual operations.

set up a new business unit in the Philippines. There was a need to back up the operational lending

business with a new platform, which could provide higher performance and decrease the amount of

manual operations.

Approach

Development with end-user convenience in mind

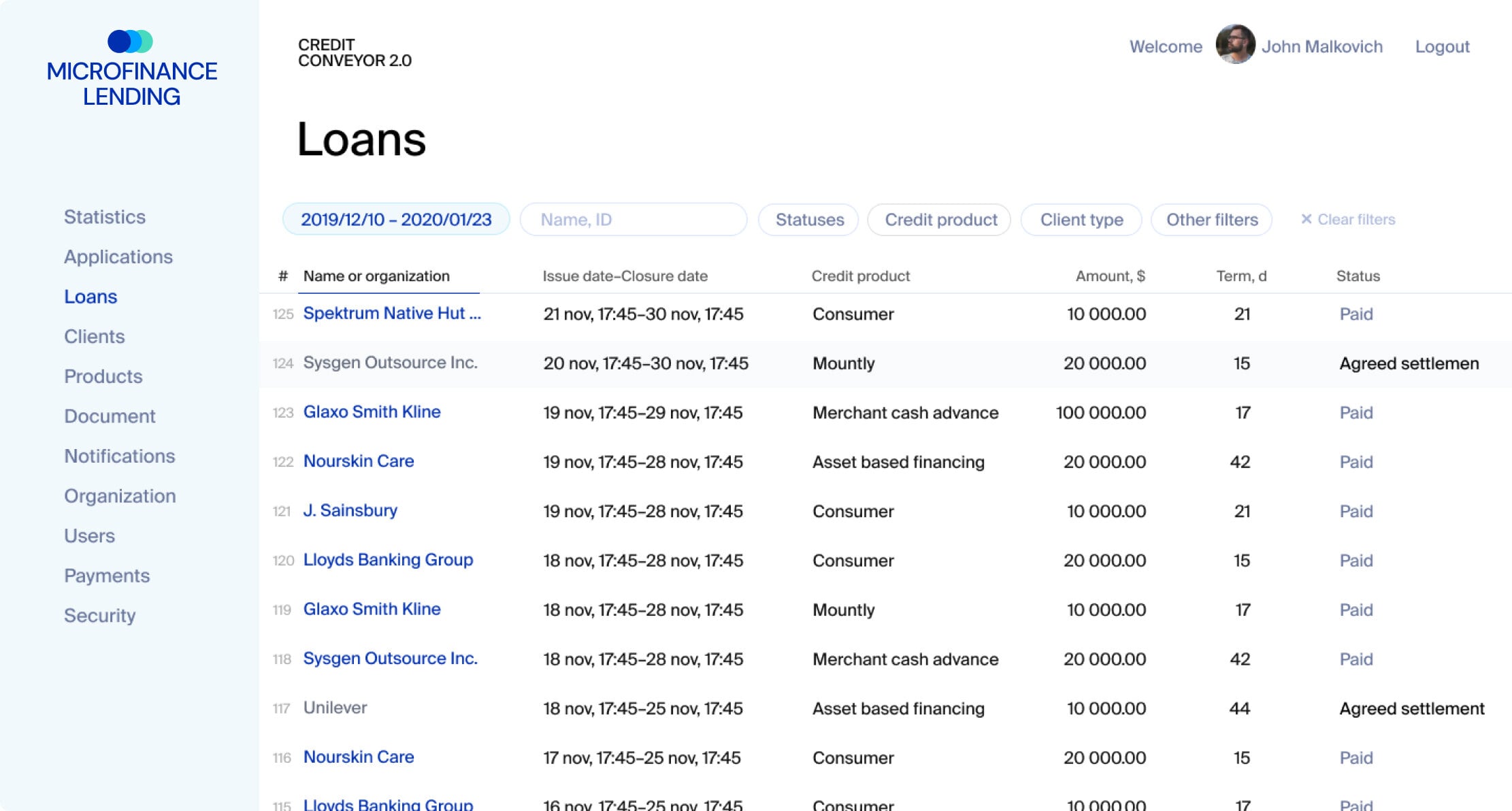

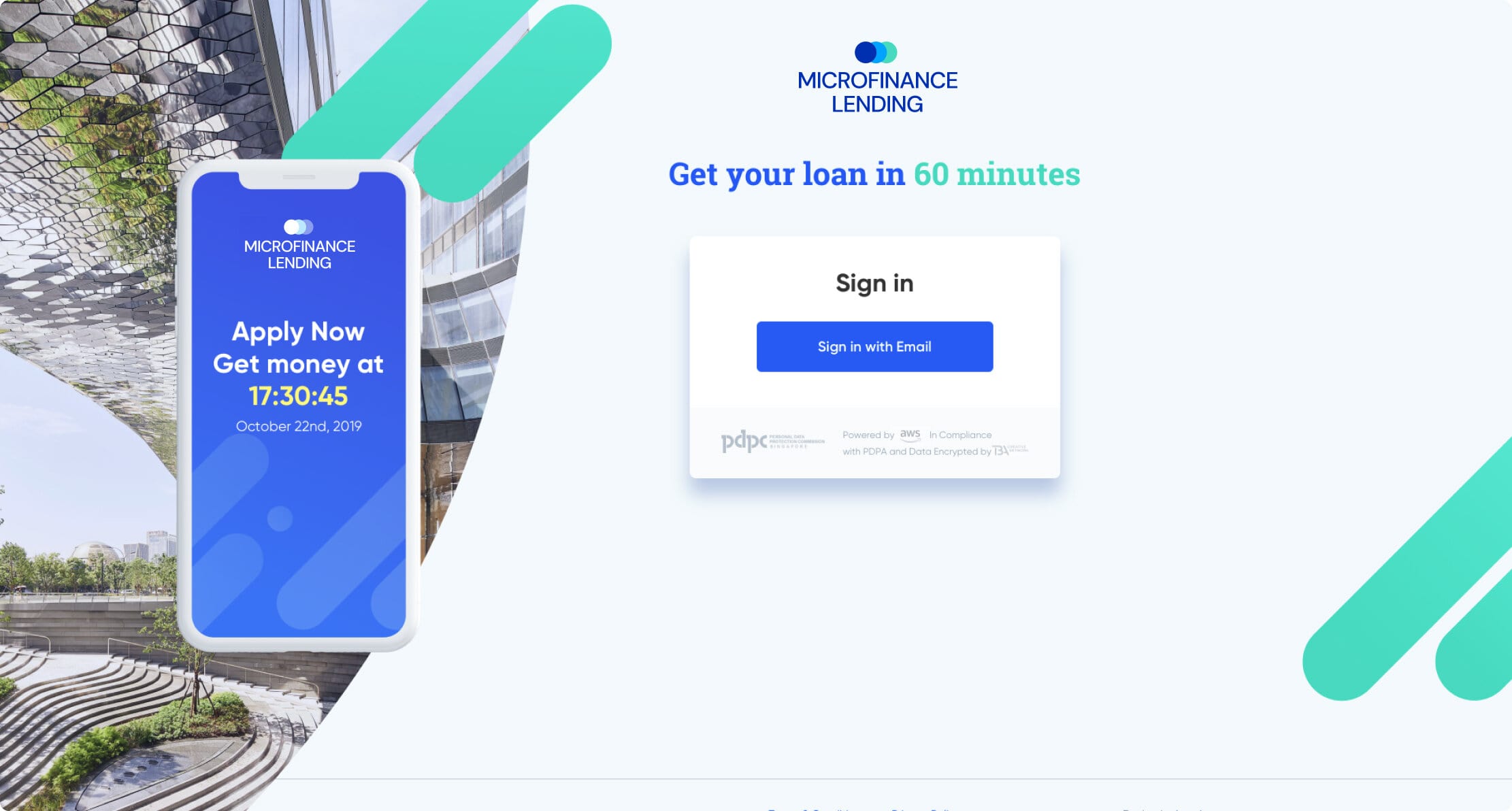

The proposed solution from HES FinTech includes an end-to-end system

that automates the workflow from loan origination to servicing. HES LoanBox allows borrowers to apply for a loan online.

that automates the workflow from loan origination to servicing. HES LoanBox allows borrowers to apply for a loan online.

2,5 months

Time-to-market

60 minutes

for a loan decision

35%

revenue growth

for the first 12 months

Result

Full automation of verification

and underwriting for faster loans

Following the deployment of HES LoanBox, we successfully automated manual processes within client verification and underwriting workflows. Decision-making time was reduced to less than 60 minutes, and integration with the payment provider enabled instant money transfers.

their industry expertise with microlending

automation in various markets. We enjoyed the demo, the

estimates and the mutual work of our

teams. The solution was deployed as expected.