Lending is becoming ever more flexible, and finance, in general, is democratized. TransUnion reports that in the second quarter of 2022, the total balance of personal loans reached $192 billion, reflecting a 31% increase from the same period in 2021.

In-house financing empowers both businesses and their customers to increase their spending power and does so at a singular point of service. From in-house customer financing for cars, insurance, and more, the industry is developing at a rapid pace never seen before. The only questions that remain are what in-house finance means how to start in-house financing, follow the trends, and what in-house financing software is good enough to improve your bottom line tomorrow.

What Is In-House Financing and Why Offer It?

In-house financing is financing provided by a retailer to facilitate the purchasing process for customers, i.e. providing a loan to complete a transaction.

This financing type goes back a while, almost to the beginning of money itself. However, in recent history, two historical events have marked its rise. The first was the financial crisis of 2008 when businesses had to stop and rethink their current strategies to remain viable. The second is more recent.

Why Digital Lending is More Powerful than EverAs we navigate the post-pandemic landscape in 2023, businesses continue to adapt and innovate to meet evolving customer needs. The lessons learned from the onset of COVID-19 in 2020 have accelerated the adoption of more efficient and customer-friendly services. In this context, in-house financing—or in-house customer financing—stands out as a key strategy for enhancing customer experience and streamlining transactions.

In-house financing, also known as in-house customer financing, offers:

- Point-of-Service efficiency. Instead of going elsewhere to seek out financing or using a credit card that may have high-interest rates, customers can seamlessly apply for credit in-store. This lowers the risk of a broken sales funnel, meaning a purchase is more likely. In addition, this speeds up the process for the customer, allowing them to get the service or product they need even faster.

- More sales overall. By having more control over how they pay for a product or service, clients feel empowered to make a purchase safely in the knowledge that they can afford it. Not only does this increase the sale amount, but it also means they are more likely to purchase more.

- Higher levels of trust. Retaining clients is a crucial part of any business strategy, and one way to do that is by building trust. Flexible finance options, supported by in-house financing software, show that a business understands its customers’ needs and is willing to empower them with purchase power.

- Simplicity. No one wants an overcomplicated purchase process. Instead, clients seek clarity—transparent financing, straightforward process, and excellent customer service. By implementing reliable in-house financing software, businesses can streamline their operations and offer a seamless financing experience to their customers.

How to Offer In-House Financing: A Practical Guide

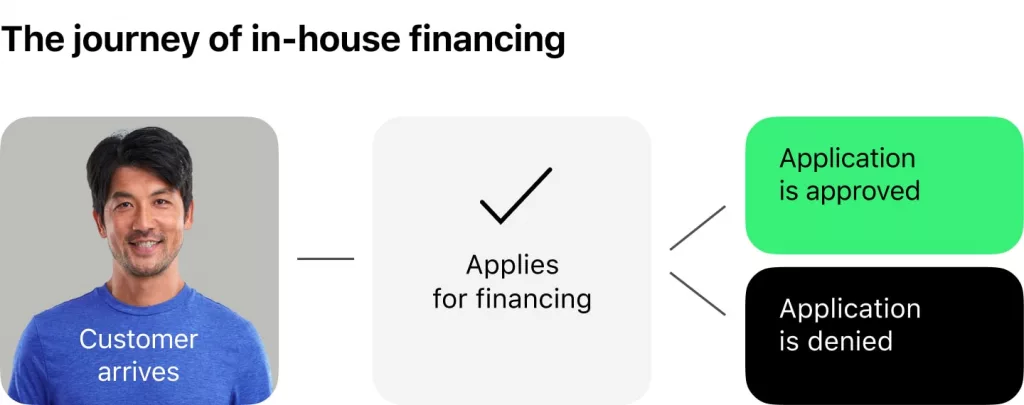

Now that you know the benefits of in-house customer financing, let’s look at how it works in action. What happens when a client comes to your business to purchase a product or service with POS finance, supported by in-house financing software?

1. Customer seeks out your business

At this stage, they will be assessing whether the product or service you offer is right for them. If they decide on a product/service, they may now determine how financially viable it is for them to own it.

2. Applies for financing

If your client is unable or doesn’t want to make the purchase outright. Offering alternative financing can help them make the decision to purchase now or later. At this stage, they can apply for flexible in-house financing that works for your specific product or service.

3. Customer’s application is approved (or denied)

Once the application is in, you can run it through your internal systems to check the creditworthiness of the client and the terms you can offer them. Using the smart point-of-sale lending software, your business is empowered to know whether or not this is a profitable decision. For the client, the waiting time is minimal, and they will often be able to walk out of the shop with a clear yes or no answer, or at the most within a couple of days.

Top 5 Businesses Set to Benefit from In-House Customer Financing in the Next 5 Years

In-house financing is an increasing trend in almost all industries. However, in these top 5, it’s fast becoming the new norm. For businesses wondering how to do in-house financing, these sectors offer compelling examples. Without further ado, here they are:

No.1: Car dealerships

Lending Platforms in Automobile Finance Industry: Auto Lending Trends 2022 A vehicle is a sizable purchase, no matter the budget, and it’s a serious investment. For many, the only way to own a vehicle is with credit. That’s why, for automobile dealerships, it makes sense to onboard in-house financing for customers and allow them to get the service they need all in one place. Adding POS finance also gives dealerships the power to create finance conditions—repayment rates, conditions, etc.—that suits their particular industry, not generalized credit.

No.2: Medical and dental services

When it comes to healthcare, time is of the essence, and getting treatment at the right time sets your clients up for success. However, for many, medical treatment isn’t free, and sometimes the costs are unaffordable for the client to pay in one lump sum. Learning how to do in-house financing with healthcare finance software allows clients to get the treatment they need when they need it and achieve better outcomes in the long term.

No.3: Retail products

From a new fridge to technology to something else entirely, when it comes to retail products, your clients may not always be able to afford them right away. Instead of creating a dilemma or forcing a potential customer to wait, offering financing for customers through in-house finance can be particularly effective for those who need to make multiple purchases or are seeking a luxury item.

No.4: Jewelry

Back in the day, they used to say that an engagement ring should cost 3x the salary of the person giving it. At today’s rates, statistics show that couples are spending on average between $3,756 and $7,829 on their engagement ring. Offering smart in-house financing allows for people to spread payments for a large or valuable purchase out over time and get a piece of jewelry they’re truly happy with.

No.5: Education

Innovative Student Loan Software Solutions: Where to Start In the last 50 years, education has become more accessible than ever, and that trend is continuing today. Unfortunately, education is not always free. Universities and private courses often charge fees for the services they provide. Knowing how to do in-house financing empowers educational facilities to offer their clients more at a rate that suits them. This allows clients to access education without experiencing financial stress from exorbitant fees that need to be paid right away.

Get a digital strategy for your in-house finance business

Want to get a personalized strategy for your in-house finance business? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your lending company. Your answers are totally confidential.

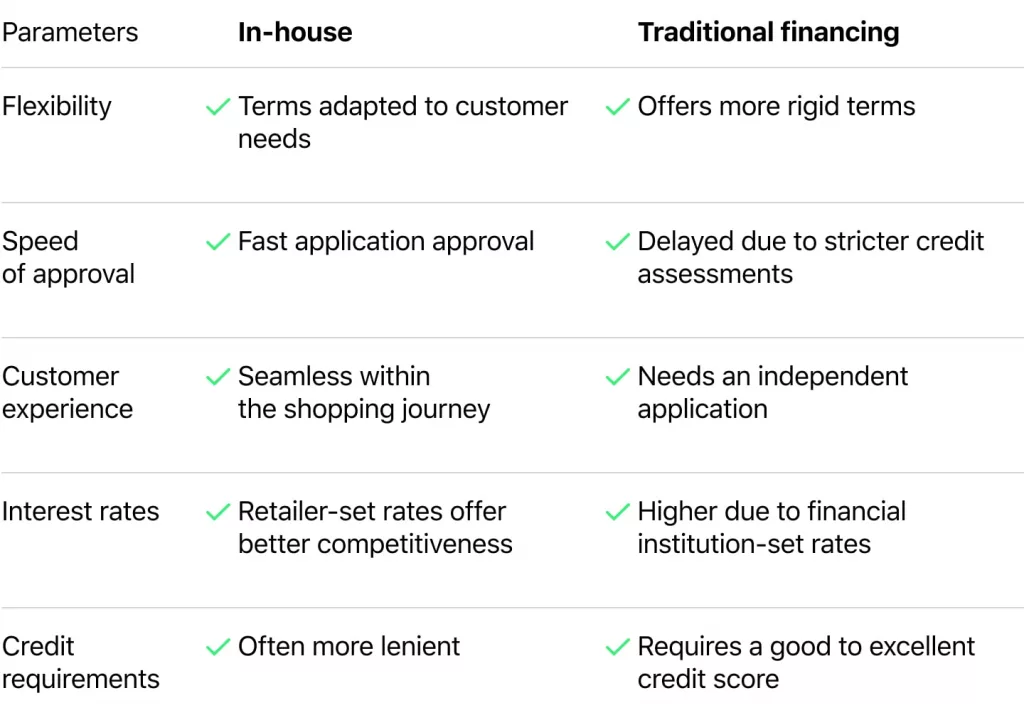

Comparison with Traditional Financing Options

While in-house financing offers a plethora of advantages, it’s essential to understand how it stacks up against traditional financing options. Here’s a quick comparison:

Flexibility

- In-house financing: Offers more flexible terms tailored to the customer’s needs.

- Traditional financing: Often has rigid terms that may not suit every customer.

Speed of approval

- In-house financing: Quick approval process, often instant or within a day.

- Traditional financing: May take longer due to more stringent credit checks and approval processes.

Customer experience

- In-house financing: Streamlined and integrated into the shopping experience, making it more convenient.

- Traditional financing: Usually requires a separate application process, which can be cumbersome.

Interest rates

- In-house financing: Rates can be more competitive as they are set by the retailer.

- Traditional financing: Rates are usually set by financial institutions and may be higher.

Credit requirements

- In-house financing: Often more lenient, allowing customers with less-than-perfect credit to finance purchases.

- Traditional financing: Generally requires a good to excellent credit score.

In summary, the choice between traditional financing and in-house financing hinges on various factors, including customer needs, business objectives, and operational efficiency. While traditional methods remain a viable option for some, the agility and customer focus offered by in-house financing make it an increasingly attractive alternative for modern businesses. As the landscape of consumer finance continues to evolve, in-house financing stands as a compelling strategy for those aiming to simplify the purchase process and foster long-term customer relationships.

You could start lending in 3 months

How to Start Offering Financing to Your Customers with Ready-Made Lending Software

Starting in-house financing, every retailer faces whether to engage with a third-party lender or equip a lending platform to lend without any third parties. The choice and the decision-making factors may vary from retailer to retailer, however, 3rd party lenders provide the following benefits:

- Retailers are out of risk.

- Retailers don’t need to expand their teams and train people to handle new processes.

- Retailers are uninvolved in lending processes after the payment is made.

Meet HES LoanBox: Ready-to-Use Lending Platform When it’s possible to use an option to shove the majority of lending tasks on a lender, it’s hard to compete and offer to try in-house financing software. However, with complete process automation delivered by HES LoanBox retailers don’t need to put much effort into lending in-house. Here are the key benefits of the platform:

- Time to market is 3 months

- Enhanced automation for both employees and borrowers

- Smart scoring module

- Available loan product engine

- 3 components in a single product: onboarding, back office, and borrower portal + dozens of available integrations

If you have already decided not to engage with a third-party lender in favor of the ready-made lending solution HES LoanBox, here’s more about it.

Digital onboarding

The digital onboarding component allows you to select custom brand colors and a logo to design your landing page. LoanBox offers intuitive navigation, an FAQ section, a real-time loan calculator, and more. The page is designed to effectively navigate borrowers through your website to involve them in communication and finally apply for a loan.

Main benefits:

- Marketing-effective landing page

- Data verification (KYC)

- Fully digital process

- Security and data protection

Borrower portal

Borrower portal is made to provide borrowers with insightful loan details and extensive control over loan applications, active loans, and activity history. The component is 100% flexible and can be adjusted to any business model. The platform comes with robust security features and personal data protection to help you improve customer satisfaction and build a loyal customer base.

Main benefits:

- Intuitive application flow

- Smart calculator

- Complete app management

Back office

Back office is the heart of the lending platform that provides a lender/retailer with a detailed overview of the process, including loan application, active loans, underwriting, amounts, and lending decisions. The platform is empowered with a decision-making engine that can be adjusted to fit your business processes while scoring and underwriting can be performed either with or without manual application screening. What is more, the system is enriched with role management and duties segregation, calculation, product engines, statistics, reporting, etc.

Main benefits:

- End-to-end loan origination and management

- Easy to adapt to any business environment

- Automatic notifications and updates

- Higher customer involvement and loyalty

HES FinTech and VoPay Partnership: Lending Powered with Leading-Edge Payment Processing In addition, HES LoanBox can be integrated with a variety of tried-party apps and solutions, such as KYC, SMS/Email, credit bureaus, payment providers, and many more. Here you can find a full list of HES LoanBox integrations.

Setting Your Business Up for Success: A Step-by-Step Guide on How to Set Up In-House Financing

Step 1: Assess your needs

Before diving into any new technology, make sure you understand what your business needs are and how in-house financing can meet those needs.

Step 2: Research providers

Look for companies that specialize in in-house financing software. Check their reviews, case studies, and customer testimonials to ensure they are reputable.

Step 3: Request a demo

Don’t hesitate to ask for a demo or trial period to test the software. This will give you hands-on experience and help you make an informed decision.

Step 4: Make the decision

After thorough research and testing, decide whether the software aligns with your business objectives and make the final decision to integrate it into your operations.

Step 5: Train your team

Once you’ve chosen a provider, ensure that your team is well-trained to use the software effectively. This will help in the smooth implementation of the new system.