When the coronavirus pandemic hit back at the start of 2020, no one could have predicted the impact it would have on the world. Alongside accelerating the vaccines’ development and disease control, the IT sector started adapting to lockdowns boosting digital lending growth.

What digital banking ecosystem has to offer after the crisis? Follow the article to discover the importance of digital lending technology for crisis recovery. We shed the light on digital lending solutions of the near future and show how digital lending revolutionizes the loan market.

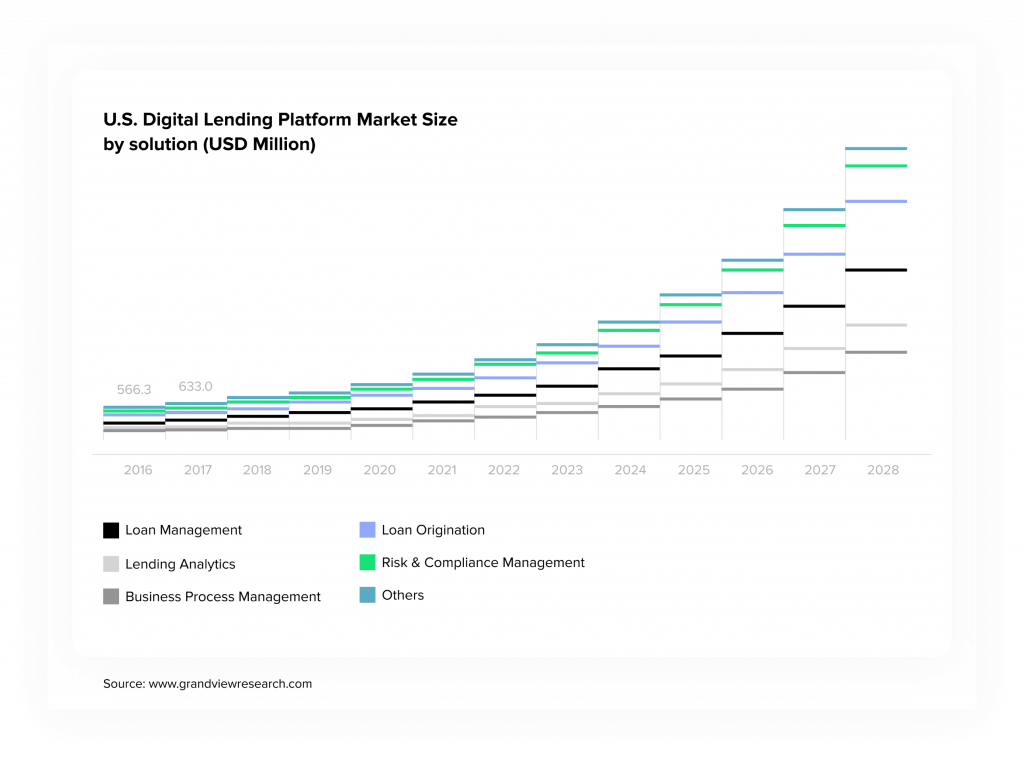

Digital Lending Growth Metrics

The digital banking ecosystem has changed over the years due to the adoption of digitalization. While traditional lending still dominates the market, the benefits of digital opportunities are paving the way for the adoption of online technologies and solutions across businesses.

According to the Research and Market report, the digital lending market was valued at $ 311.06 billion in 2020. It’s expected to reach $ 587.27 billion by 2026 at a CARG of 11.9%.

The major factor driving the market growth is the changing consumer behavior and expectations. Different generation groups have their own lending behavior. While Boomers still opt for traditional banking, Millennials and Gen Z, becoming the dominating generations, chose mobile banking and digital lending first.

Customers from diversified backgrounds may require loans for lots of purposes from personal and POS loans to SME finance and home loans and more. And the adoption of technological advancements like AI and machine learning, Cloud computing benefit the fintech and banks allowing to process huge amount of data about customers. These data are compared to obtain results about needed services or solutions that drive the development of long-lasting customer relations.

One of the leading startups in AI decision-making – GiniMachine – uses AI and ML to predict customer behavior and helps users decide whether to approve loan applications or not. Based on your historical data, the platform builds custom scoring models (the number is unlimited) and provides its scoring predictions per application. As a result, a client uses alternative data for prediction reaching thin-file borrowers and reducing time-to-decide to minutes.

Key Lending Market Trends

- Almost two-thirds of people who have applied for loans in the past two years now do so either partially or fully online, representing a significant increase from 2018. Specialists claim that the digital lending growth is boosted by the increasing usage of tablets and smartphones.

- Millennials have no credit history and a few years of working experience, so their loans are either not approved by traditional lenders or come at high rate interests.

- Time-to-decision in brick and mortar averages between three and five weeks, while alternative digital lenders need up to seven days and may issue digital loans on the application day.

These “traditional” challenges are driving the demand for overall digitalization. While the widespread use of smartphones makes digital power lending applications affordable for almost every user.

Read also

How Digital Lending Revolutionizes the Loan Market

Digital lending is an element of technological innovation. It’s a service designed for business growth and development. Below we’ll look at how access to such services is more important for financials than ever before.

Accessibility

Digital lending solutions made loans accessible for almost everyone since business is no longer just done locally. Deals are being made from thousands of miles away. A recent report by PwC suggests that in the coming years globalization will grow into ‘snowballization.’

While traditional supply-chain businesses may struggle to adapt to the new reality, the services industry is only set to grow. Instead of heading to a local bank for a business loan, would-be founders can access funding from across the globe, while investors have more choice in funding a growing business of their choice.

For instance, peer-to-peer lending provides a simple way to fund scholarships, real estate, and startup investments. It became a revolution in how financing is done and grew into a profitable business. Early estimates show P2P lending could be worth over $ 44 billion by 2024.

Downfall of brick and mortar

Digital banking services are growing, while brick and mortar branches are decreasing. Moving from traditional institutions to digital structures can’t occur overnight. For retail lending customers, the closure of physical banking branches means they are often left uncertain and distrust of where to go for personal financing. But this only confirms the demand for secure, trustworthy, and legitimate lending systems that are customer-friendly and accessible on the lender’s side.

For businesses, digital lending challenges present opportunities to access lending from further afield and seek financiers with more experience in their field. They are more likely to find investors suited to their ventures. In addition, the lenders can adapt their portfolios without any limits presented by traditional investment structures.

On the whole, what we see here is an expansion of the digital power lending industry — from traditional brick and mortar bank lenders with digital services to modern P2P lenders entering the scene.

Increasing globalization

Over the last few decades, the word globalization has developed both positive and negative connotations. On the negative side, we have seen multinational companies becoming global giants. Yet, on the positive side, we have also seen smaller firms and service providers gaining access to the broader market, boosting their potential.

But what does this all mean for lenders? Aside from the already-established opportunity to invest in a wider variety of businesses, increased globalization presents some challenges for lenders regardless of their geographical location. No country or its regulations work portfolios the same. When entering new markets, it pays to be aware of every little detail. This affects everything from making risk assessments to complying with legislation and making sure your business has the right paperwork.

Digital lending technologies employment gives companies the ability to tackle these challenges efficiently, no matter what lending area they’re in — from PayDay digital loans to P2P lending and microfinancing.

Risk assessment

No one can take away the risks associated with lending, but they can be minimized. Considering the rapidly-changing market businesses need new methods to adequately assess lending risks. With current market instability, being able to make reasonably accurate predictions based on existing data could be the difference between a smart loan and lost funding. Adding digital lending technology lets companies incorporate more considerable amounts of data, take a more complex view of any lending case, and make intelligent lending decisions that extend beyond the pandemic.

Security

Knowing how and when to invest your money to get a decent return is any professional investor’s challenge. While statistics may show a potential ‘smart’ investment from a risky one, various security processes need to occur behind any loan agreement – Know your Customer (KYC) and Anti-Money Laundering (AML).

In traditional structures, these are typically done in-house, completed by a specialist who is face-to-face with a client. In doing so, they can gather all information about customers and compare it with their data. But what about digital lending?

Digital lending software integrates security processes into the loan software so that essential security checks can be done swiftly and efficiently. This helps both to protect your business from fraudsters but also ensures security for your clients.

Read also

Wrapping it Up

The world is changing, perhaps even faster than we anticipated. Following the same processes as we used to is not enough anymore. Businesses, banks, and other financial institutions need to upgrade to stay current and keep ahead of the curve. Adding technology, new digital lending companies adapt their existing services and take them into a new era before it’s too late.

Want to try digital lending technology? Get in touch with HES FinTech.