We’re living in the digital world, but the pace of technology adoption is slower than the development of technology itself. It’s quite natural that a significant number of financial institutions still use traditional techniques in their business processes and the domain of KYC ” and AML ” is no exception. However, AML/KYC compliance is designed to help prevent identity theft, financial fraud, money laundering, and other financial crimes.

The Ultimate Marketing Ideas for Loan Companies to Generate Leads In this in-depth guide we’re going to discover the main challenge of AML and KYC adaptation, the problem with traditional KYC underwriting, and solutions provided by fintech companies to improve AML lending.

KYC and AML in Lending

Before plunging into more specific details, let’s observe KYC/AML meaning.

KYC

KYC is the principle of activity applied to banks, lenders, investment and mutual funds that oblige these institutions to identify a borrower before conducting a financial transaction. Under KYC, borrowers must provide credentials to prove their identity and their address. ID cards, face and/or biometric verification, utility bills, etc. are examples of acceptable documents.

Such a policy helps to better understand clients, monitor financial transactions, reduce customer risks, and consequently prevent bribery and corruption.

AML

AML is a set of measures that ensures that companies are able to detect and prevent money laundering, and, accordingly, protect themselves and the financial systems in which they operate.

What’s the difference between KYC and AML?

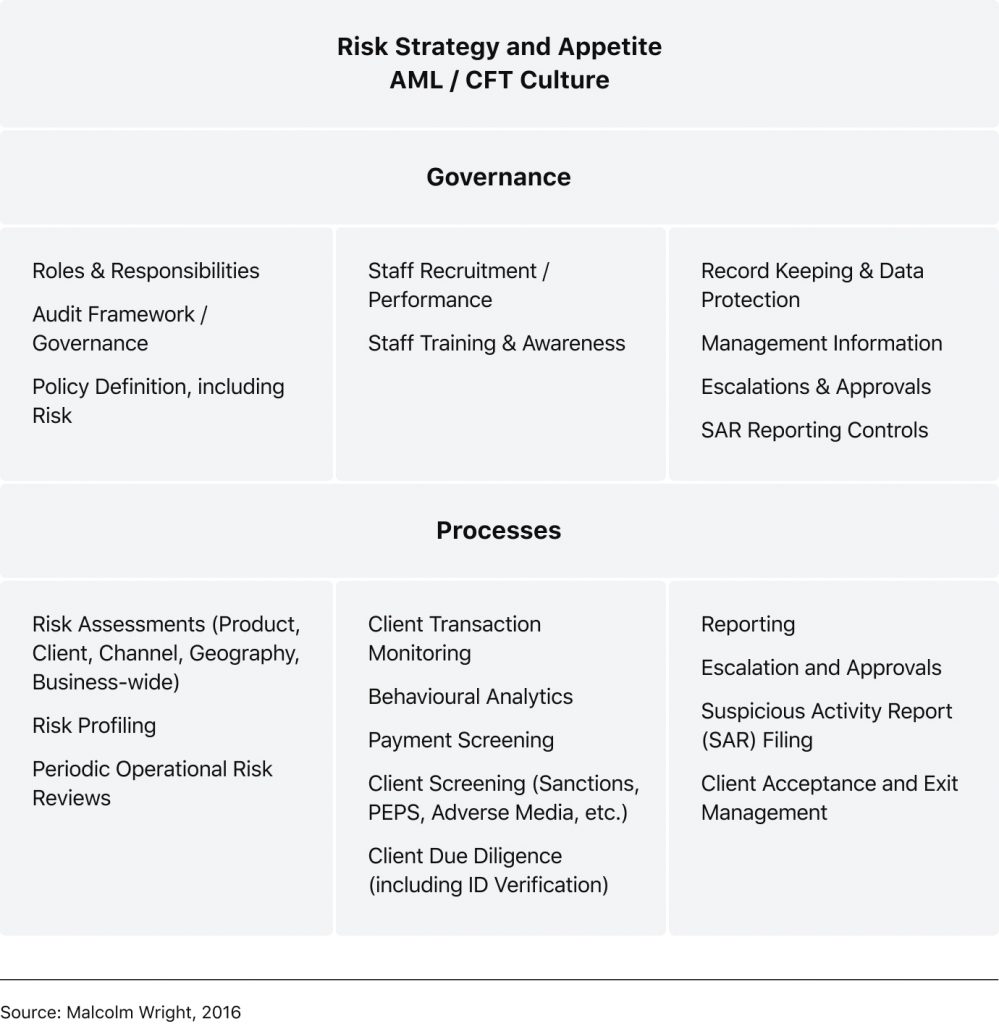

To put it briefly, KYC is a part of the AML. If you want an analogy, AML is a river while KYC is its inflow. It’s fair to define KYC as a set of procedures and tools within the framework of the general AML / CFT policy.

The Problem with Traditional KYC Processes

The idea of KYC appeared in official documents in the United States several years ago. The FinCEN Treasury Department for Financial Crimes introduced the formal requirements of KYC, although private companies employed this abbreviation earlier. AML is a concept with a longer history. It was coined back in 1989 following the creation of the Group for the Development of Financial Measures against Money Laundering (the FATF) in Paris.

According to Fenergo, violations in AML and KYC compliance totaled $5.4 billion of fines in 2021, a decrease of 49% from 2020. Financial institutions consider the following business actions as triggers for initiating checks based on AML principles:

- running a business on the basis of cash payments

- making investments in securities via 3rd parties, especially those affiliated with the company

- transferring funds abroad

- the use of different accounts in several banks

What You Need to Know About BI for Your Customer Service Strategy Today KYC and AML rules are obligatory and lenders have no choice but to comply with them. However, 2022 Thomson Reuters AML Insights Survey revealed that nearly half of the respondents (46%) reported facing considerable challenges in adhering to the US Anti-Money Laundering Act. This forces financial institutions and alternative lenders to balance between two extremes – the necessity to follow AML rules and customers prioritizing the speed of services over security.

There’s no doubt that preventing terrorism, money laundering, and fraud is significant for lenders and banks. There’s no precise information on the total volume of laundered funds in the world. Globally, an estimated amount of 2-5% of the total global GDP, which is equivalent to $800 billion to $2 trillion in current US dollars, is believed to be laundered in a single year. Naturally, money laundering has a significant negative effect on the distribution of domestic and international monetary resources and undermines macroeconomic stability.

This way, AML/KYC compliance should be one of the most important strategic directions for each and every financial organization. But with the lack of fraud prevention mechanisms, financial institutions have to collect user data, analyze them and only then make a decision whether to serve the customers or not. Especially when the AML rules are rather strict. In 2020, for instance, FSA ”” fined SEB $107.3 million following the review of their efforts to comply with anti-money laundering. While the US Department of Justice still remains the most punitive regulator globally, Europe, Asia Pacific, and even Middle Eastern regulators don’t lag so far behind.

Thus, anyone who thinks about entering the digital lending market should understand KYC and AML and how modern lending automation platforms can offer to help businesses stay compliant.

How Automation Accelerates AML and KYC Compliance in Lending

The Value of QA Testing in Fintech Industry Even if the volume of fines may come as a shock, KYC and AML aren’t something to be afraid of. The solution to proper compliance lies in a SaaS finance software that automates all stages of loan origination and makes sure that any fraudulent behavior is detected at an early stage. Again, the KYC procedure (client verification) is just a part of the business process held by loan origination software along with credit underwriting, scoring, and risk assessment.

Digital Loan Origination Process: Integrity and Automation Slowly, but steadily, the use of automation for KYC/AML compliance is gaining popularity in both banking and lending. The report by Deloitte claims that 35% of participants already use automation while another 34% are actively experimenting with the technology. The most important benefit is associated with an increase in the speed of the analysis process. This approach effectively responds to the latest trends in improving methods of KYC/AML compliance. Companies report a reduction of “false alarms” in their systems and an increase in the ability to generate preventive notifications that previously remained unnoticed. In all, enhanced analytical capabilities help to identify incoming threats and improve the whole level of security within an organization.

Here’s how HES FinTech can assist its clients in terms of KYC compliance:

- The automation of the KYC business process. Authority-matrix-based operations. Configurable workflows for different clients. Maker-checker decision-making process. Keeping registries of disallowed individuals/companies (blacklists).

- Consult the client. If a client has little experience in the domain of compliance, our specialists can outline the best approaches in setting up the basics of the KYC process. Depending on a country, we can help to address particular legislation constraints.

- Perform integrations with 3rd parties such as Ondato and Jumio. Data is a vital part of the KYC/AML procedure. HES FinTech helps businesses to do integrations with 3rd parties (AML lists, terrorist lists, PEP checks, Ministry of Interior data cross-checks, banks and credit bureau data cross-checks).

- Suggest partners. Companies such as Experian or Equifax provide data for KYC and operate globally. Since many of them are our partners, we can suggest the best provider to work with for each particular client’s case.

- HES FinTech regards data protection as an integral part of the KYC process. We follow generally accepted standards for data protection and assist in meeting a variety of local legislative requirements (like storing data in the country of operation).

- The tools for loan portfolio performance tracking. These statistics and key metrics serve to gradually improve/adjust compliance processes with the time going.

Final Thoughts

KYC and AML compliance is not as hard as it may seem. All you need as a lender is to use a top-notch credit platform that enables automation and KYC/AML software integration. Here at HES, we offer a variety of options for our customers from the ready-made platform LoanBox with KYC integration opportunities to configurable lending solutions designed based on the client’s needs.

Are you interested in taking AML/KYC compliance to the next level? Contact us to discuss how we can make it happen.