Application Programming Interfaces (APIs) have become critical in connecting disparate systems and enabling digital transformation within various financial institutions. Central to maximizing the effectiveness of these APIs is API lifecycle management—a strategic process that guides APIs from creation to retirement, aligning them with business and technical needs. This article explores the essential stages of API lifecycle management and introduces digiRunner by TPIsoftware, a platform designed to streamline this process within the banking and lending sectors.

What API Lifecycle Management Is: Definition and Key Stages

APIs serve as the glue that integrates disparate systems, applications, and third-party services. Then, API lifecycle management is the systematic process of guiding them from conception through to retirement. It encompasses the planning, design, implementation, deployment, operation, and eventual sunsetting of APIs, ensuring they align with both business goals and technical requirements. The goal? Enabling financial institutions to optimize their APIs’ performance, security, and utility throughout their operational lifespan, and address challenges that arise from integrating complex systems.

This process is broken down into several stages, each with its own set of activities that contribute to the API’s overall success and longevity. Let’s learn more about them.

Design Stage Activities

The design stage is the foundational phase where the conceptual groundwork for the API is laid out. It begins with identifying the necessary process and business requirements, followed by the creation of a logical data model. This model is then translated into logical services and API groupings. To test the feasibility and functionality of the design, API resources, operations/methods, and request/response payloads/codes are modeled, simulating how the API would function in a real-world scenario. An essential part of this stage is gathering feedback through mock-ups and interactive consoles, allowing developers to refine the API design based on real user feedback. The validation of these designs through continuous feedback loops ensures the API’s usability and functionality are optimized for end-user needs.

This phase highlights the criticality of repeatability and adherence to best practice patterns at both the structural and method levels of the API. It facilitates the discovery and sharing of repeatable patterns, enhancing the API’s design and integration capabilities.

Implementation Stage Activities

In the implementation stage, the API transitions from concept to reality. This stage involves the development and testing of the API, guided by the specifications established during the design phase. Architectural patterns play a significant role here, supporting essential functions such as orchestration, transformation, routing, data mapping, and system connectivity. Rigorous testing ensures that the API operates as expected, with multiple rounds of adjustments and the use of test automation tools integrating seamlessly into continuous delivery and deployment processes.

This stage underscores a systematic approach to building and testing, focusing on creating an API that is not only robust and secure but also prepared for deployment and integration into backend systems and other APIs.

Management Stage Activities

Once deployed, the API enters the management stage, where its performance, security, and reliability are continually monitored and maintained. This involves applying security policies to shield the API from potential threats and vulnerabilities, deploying the API into the production environment, and monitoring its traffic to quickly identify and address any operational issues. Troubleshooting and managing the API’s lifecycle, including version control and the decommissioning of outdated APIs, are also critical activities in this phase.

Through these stages, API lifecycle management ensures that APIs remain effective, secure, and aligned with the evolving needs of the organization, playing a pivotal role in the digital ecosystems of the lending and banking industries.

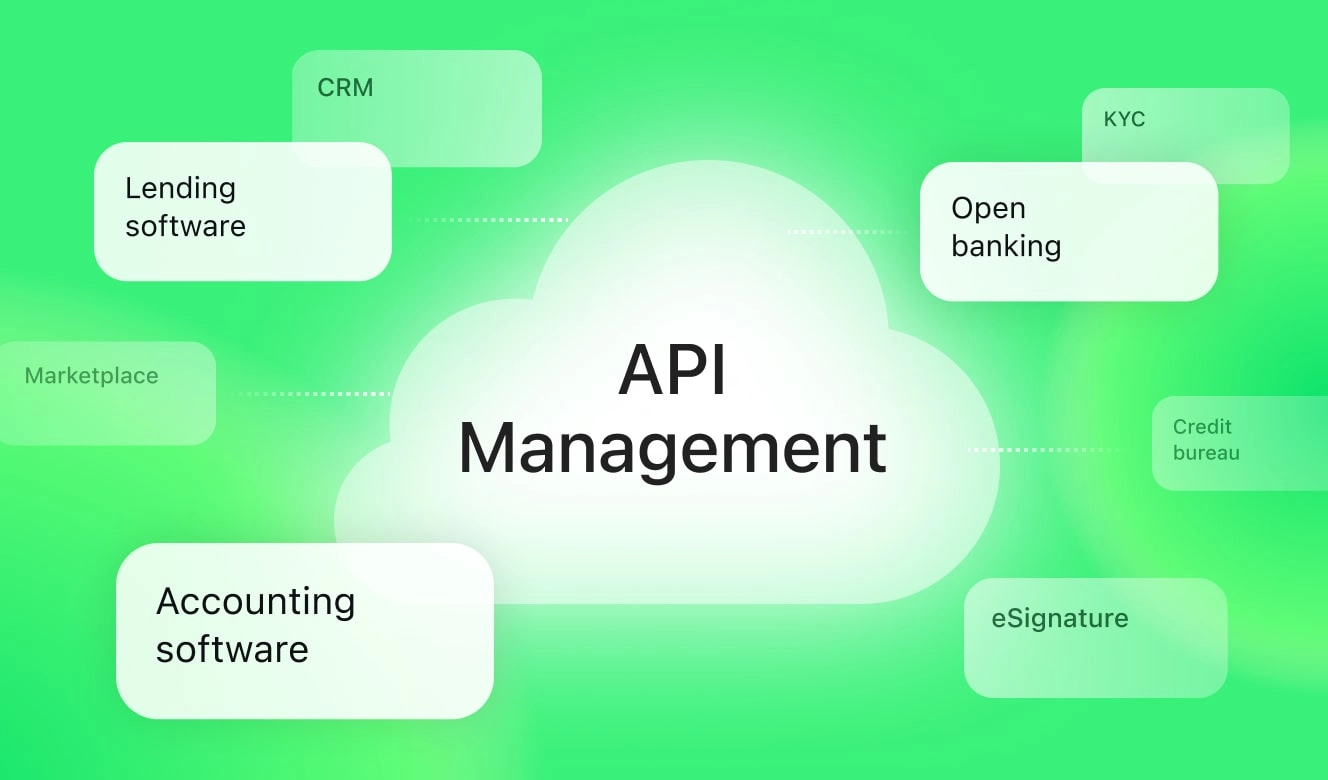

What API Lifecycle Management Is Used for in Lending?

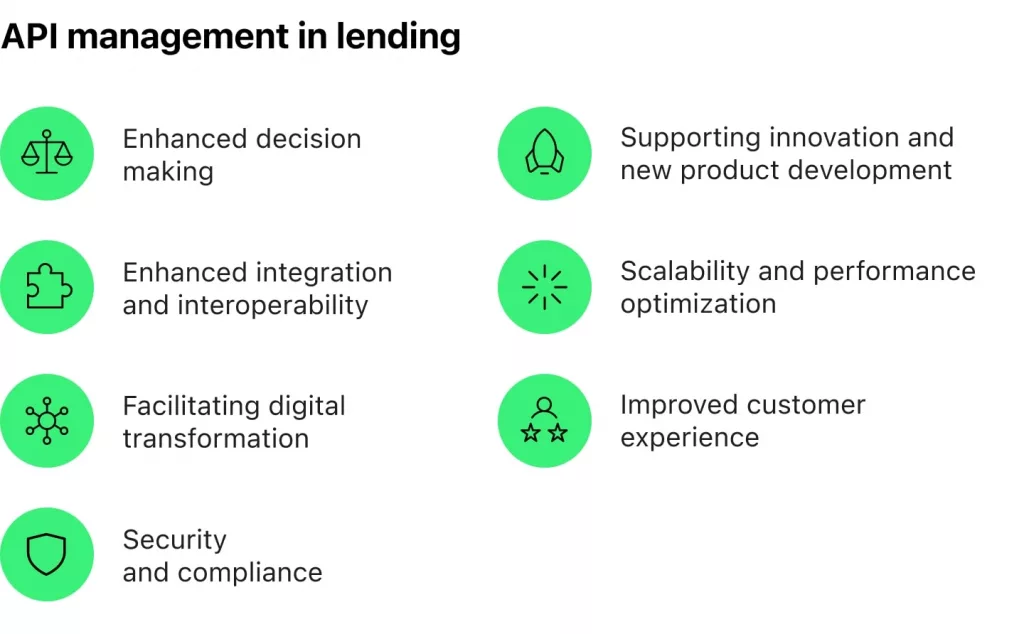

API lifecycle management in the lending and banking sector is a critical practice used to enhance financial services, drive digital transformation, and meet the evolving needs of consumers and businesses. Below, we’ll examine 7 key applications and benefits of API lifecycle management in lending and banking in more detail.

1. Facilitating Digital Transformation

API lifecycle management is foundational to the digital transformation efforts of banks and lending institutions. By managing APIs effectively, these institutions can rapidly introduce new digital services, such as online banking, mobile lending apps, and automated investment platforms. This enables them to stay competitive, meet regulatory requirements, and exceed customer expectations in a digital-first world.

2. Enhancing Integration and Interoperability

API lifecycle management ensures that these integrations are seamless, secure, and efficient, facilitating interoperability among banking systems, fintech solutions, payment gateways, and other financial services. This interoperability is crucial for offering a unified and cohesive customer experience across all digital touchpoints.

3. Improving Customer Experience

When managed through a meticulous lifecycle approach, APIs enable banks and lenders to offer personalized and convenient services to their customers. Businesses can gain insights into customer behavior, preferences, and needs, allowing them to tailor their products and enhancing customer satisfaction and loyalty.

4. Ensuring Security and Compliance

The lending and banking sector is subject to stringent regulatory requirements aimed at protecting consumer data and ensuring financial stability. API lifecycle management includes robust security practices, such as authentication, authorization, encryption, and regular security audits. These practices help prevent data breaches, fraud, and other cyber threats, ensuring that financial institutions comply with regulations like GDPR, PSD2, and CCPA.

5. Enabling Scalability and Performance Optimization

As financial institutions grow and the demand for their digital services increases, the ability to scale APIs without compromising performance becomes essential. API lifecycle management allows for efficient traffic management, load balancing, and resource allocation, ensuring that APIs can handle high volumes of requests while maintaining optimal performance. This scalability is crucial for supporting peak usage periods and expanding services to new markets.

6. Supporting Innovation and New Product Development

API lifecycle management fosters an environment of innovation within financial institutions by streamlining the process of developing, testing, and deploying new APIs. This agility enables banks and lenders to quickly experiment with new ideas, integrate emerging technologies (such as blockchain and artificial intelligence), and launch innovative financial products and services that meet the changing needs of the market.

7. Enhancing Analytical Insights and Decision Making

Through comprehensive monitoring and analytics, API lifecycle management provides valuable insights into API usage, performance, and user behavior. These insights enable financial institutions to make data-driven decisions, optimize their services, and identify new opportunities for growth and improvement.

However, with the increasing reliance on APIs comes the complex challenge of managing them effectively—a task underscored by the broader financial sector’s recognition of APIs’ pivotal role. A global survey highlighted by McKinsey found that 81% of respondents are viewing API management as a critical priority for both business and IT functions. This growing acknowledgment underlines the necessity of robust API management in ensuring secure, efficient, and scalable digital services.

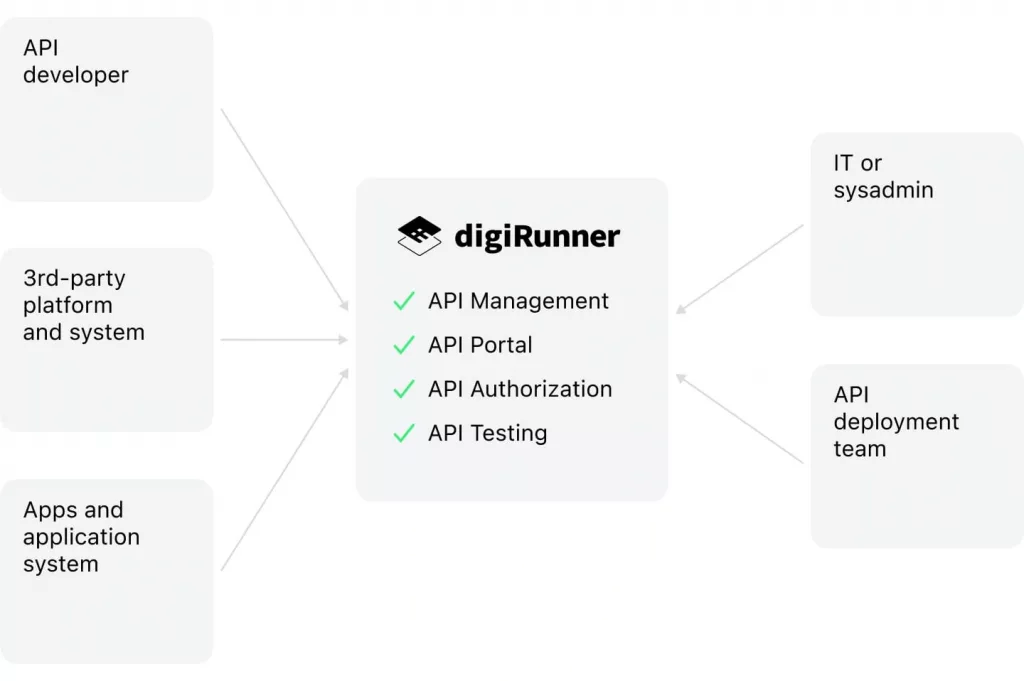

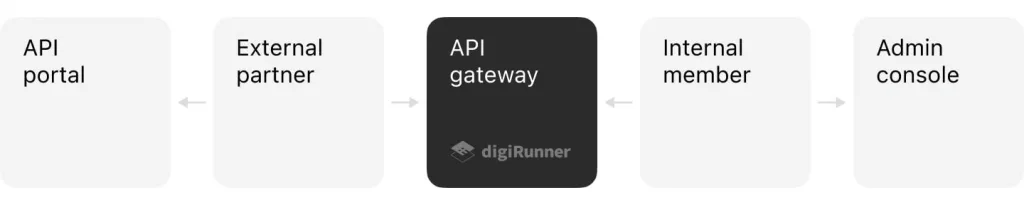

Enter digiRunner by TPIsoftware, a cutting-edge solution designed to meet and exceed these needs.

In the forthcoming section, we will delve deeper into how digiRunner leverages its innovative capabilities to provide a seamless, secure, and user-friendly platform for API lifecycle management.

How digiRunner Revolutionizes API Lifecycle Management in Lending

digiRunner, developed by TPIsoftware, is a comprehensive API management platform designed to tackle the multifaceted challenges of API lifecycle management within the banking and lending sectors. It stands as a robust solution that streamlines the creation, deployment, and management of APIs, ensuring they are secure, efficient, and scalable. One of digiRunner’s key strengths lies in its adaptability across various platforms, including Windows and Linux, and its flexible deployment options that cater to on-premises, cloud, and hybrid environments. This versatility allows it to seamlessly integrate into the diverse IT infrastructures of financial institutions, making it a versatile tool for businesses aiming to enhance their digital service offerings.

digiRunner offers a range of VIP benefits that directly address the critical needs of API management:

- User priority settings: Enables high-priority clients to execute APIs with shorter wait times, ensuring that critical requests are handled efficiently.

- Anomaly alerts: Provides automatic email alerts for API anomalies, with integration options for LINE and other communication services, facilitating real-time monitoring and rapid response to potential issues.

- Log record management: Offers complete logs with a statistics and analysis dashboard, enabling detailed monitoring and analysis of API usage and performance.

- Black/whitelisting control: Enhances security with two-level protection, including router software layering and platform IP checks, to safeguard against unauthorized access.

A standout feature of digiRunner is its low-code development environment, which simplifies API format changes and composition through intuitive drag-and-drop gestures. This allows teams to rapidly prototype, develop, and deploy APIs without deep coding expertise, significantly reducing development time and enabling faster response to market demands.

digiRunner Features and Their Benefits

digiRunner includes specific features that translate into tangible benefits for the lending and banking industries:

- Routers and traffic control: Ensure high availability and manage transactions per second (TPS), enhancing the reliability and performance of digital services.

- Mutual TLS authentication and WAF-level security: Provide a secured communication channel and protect against top security vulnerabilities, ensuring the integrity and confidentiality of sensitive financial data.

- OAuth 2.0 authentication and API key authorization: Offer flexible and secure access control mechanisms, facilitating safe and controlled access to APIs.

- Data integrity and security management: Features like duplicate transaction prevention and data encryption guarantee the security and accuracy of transactions, crucial for maintaining trust and compliance in financial operations.

These features address the immediate challenges of API management and also empower lending businesses and banks to enhance their security, improve customer experience, and achieve operational efficiency. Allow the success stories of Taipei City Government and Taishin Bank to speak for themselves.

Wrapping Up

In light of the undeniable advantages that digiRunner offers, we invite you to take the next step in your organization’s digital transformation journey. Whether you’re seeking to streamline operations, enhance security, or accelerate innovation, digiRunner provides the tools and capabilities necessary to achieve these goals. Visit TPIsoftware’s website to learn more about digiRunner and discover how it can revolutionize API lifecycle management for your business. Embrace the future of financial services with digiRunner, and let the success stories of industry leaders inspire your path to digital excellence.