With a decent loan management system, a company can improve the quality, performance, turnaround time, and customer experience for the clients. Beyond these immediate benefits, a well-chosen loan management system also acts as a shield, safeguarding your company from NPLs and seamlessly streamlining the entire loan processing cycle.

In short, the right lending management software empowers alternative lenders with agility, cost-effectiveness, data-driven decision-making, and a competitive edge in the dynamic financial landscape.

So, without further ado, let us embark on a journey of discovery as we explore the ten crucial questions that will guide you towards making an informed choice for your financial institution’s success.

1. How Does the System Integrate with Existing Banking Infrastructure?

One of the critical pillars of an effective Loan Management System (LMS) is its seamless integration with your existing banking infrastructure. The software has to integrate with existing banking solutions like CRM, ERP, etc. Moreover, it needs to support third-party integrations to further improve the functionality of the whole loan processing cycle. It will save a lot of time and help the other teams to get proper data.

However, the integration does not stop there. A truly robust LMS should also possess the capability to support third-party integrations, further enhancing the functionality of the entire loan processing cycle. This not only saves valuable time but also ensures that other teams within your organization have access to the precise and timely data they require for informed decision-making.

HES LoanBox comes with several inbuilt integrations and supports customer ones too. The flexible integration options allow you to get the best out of HES LoanBox and offer a seamless experience to the customer for the complete loan processing cycle and efficient lending experience.

2. What Levels of Customization Are Available in the Loan Management System?

When evaluating a Loan Management System (LMS), it’s essential to understand the levels of customization it offers. LMS platforms provide a spectrum of customization options, enabling financial institutions to tailor the system precisely to their unique requirements. These customization capabilities are the bedrock upon which you can build a solution that aligns perfectly with your business objectives. For example, loan products can be customized, with adjustable parameters like interest rates and repayment terms.

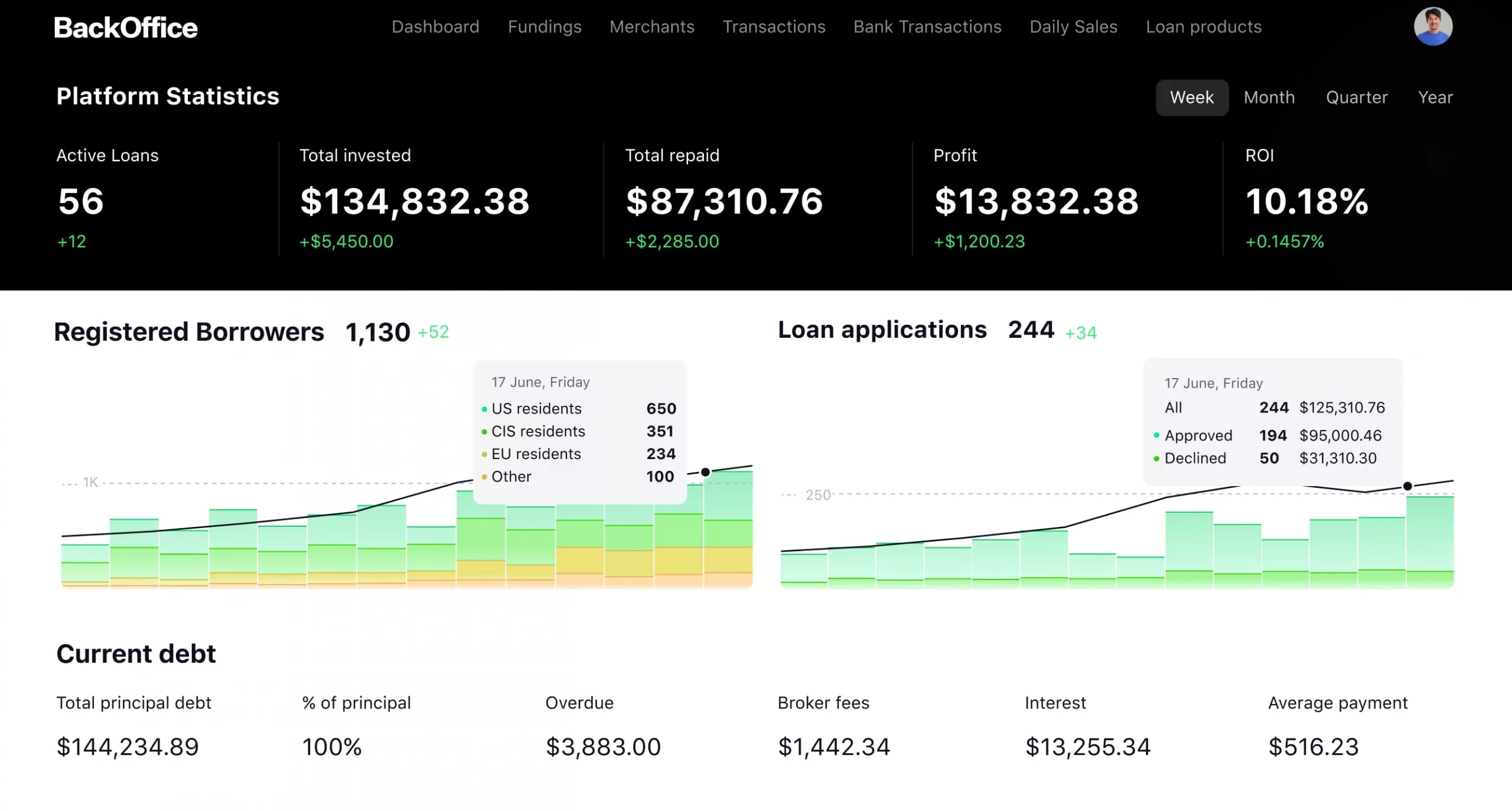

With HES LoanBox, you have the freedom to grant multi-tier rights or revoke permissions to the users through a simple interface to protect the whole system. You get an intuitive dashboard to oversee and manage everything without any hassle. Moreover, the automated decision-making feature can approve or decline loan applications after setting predefined criteria. This will increase the overall productivity and reduce the probability of human errors.

3. Does the System Provide Comprehensive Regulatory Compliance Features?

Ensuring regulatory compliance is a non-negotiable requirement for financial institutions operating in diverse regions. A robust LMS should offer features that support compliance with regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), Fair Lending, and other industry-specific guidelines.

HES LoanBox leverages the power of Ondato and Jumio to take care of KYC. The whole verification process is complete in less than 1 minute which further elevates the security while expediting the whole loan origination and completion process. Moreover, the end-to-end digital process offers robust verification of the borrower by accessing the loan history and other essential data. Besides this, the AI-driven scoring system is capable of reducing the overall NLPs for your business by 40%.

Learn More About KYC in Lending

4. How Does the System Ensure Data Security and Privacy Compliance?

When evaluating a Loan Management System (LMS), ensuring data security and privacy compliance is paramount. As you consider your options, it’s essential to delve into the mechanisms employed to ensure robust data security and compliance with privacy regulations.

First and foremost, inquire about the utilization of encryption protocols for both data transmission and storage within the LMS. The use of robust encryption technologies guarantees that sensitive information remains shielded from unauthorized access at every stage of the loan processing cycle.

Another critical aspect is the implementation of granular access controls coupled with multi-factor authentication. These measures ensure that only authorized personnel gain access to specific data and functionalities within the system. This multi-layered approach enhances the overall security posture of your institution, reducing the risk of data breaches.

Moreover, the presence of comprehensive audit trails is instrumental in maintaining user activity transparency. These logs provide an unambiguous record of every action taken within the LMS, facilitating both accountability and compliance reporting.

When it comes to data security and privacy compliance, HES LoanBox provides a comprehensive and proactive solution that empowers financial institutions to protect their valuable data assets while complying with the stringent privacy regulations that govern the financial industry.

It empowers you with complete control over user rights and permissions, allowing you to create a secure and tightly managed system environment. The intuitive dashboard simplifies the management of these permissions, enhancing transparency throughout the system.

Furthermore, HES LoanBox integrates an Open Banking API, which enables the system to access user data with their explicit consent. This consent-driven approach not only adheres to privacy regulations but also bolsters the verification process, ensuring data accuracy and trustworthiness.

5. What Scalability Options Does the System Offer to Accommodate Business Growth?

The scalability of an LMS is the linchpin of operational efficiency, ensuring that it can effortlessly accommodate surges in loan volume, an expanding user base, and escalating data requirements without sacrificing performance.

The importance of scalability lies in its capacity to support your business’s expansion and adapt to fluctuations in your loan portfolios. A truly scalable LMS is not just a tool for the present but a strategic asset that prepares your institution for the future.

Therefore, as you evaluate your LMS options, consider whether the system can seamlessly handle increased loan volumes, more users, and the growing influx of data. A system that can grow without constraints ensures that your institution remains agile and responsive to market dynamics.

Ultimately, a scalable LMS is your partner in success, evolving alongside your institution as it charts a course toward growth and prosperity.

6. What Analytical and Reporting Capabilities Are Included in the System?

Analytical and reporting features are your window into the heart of your lending operations, offering invaluable insights that guide strategic decision-making. When selecting an LMS, it’s essential to assess the depth and breadth of its analytical and reporting offerings.

These capabilities empower you to pinpoint areas of weakness within your lending plan and strategy, allowing you to focus your efforts where they are most needed. Furthermore, robust analytical tools enable you to deploy precise strategies that mitigate risks, reducing the potential for severe losses within your institution.

In this regard, HES LoanBox shines as an exemplary solution. It equips you with data-driven insights and reports that empower you to fine-tune your lending strategy for optimal performance. With automated dashboards and advanced data analytics, you gain an enhanced reporting experience that elevates your overall decision-making capability.

7. Is There Dedicated Customer Support and Training for the Loan Management System?

Customer support and training play key roles in any LMS. With the evolving technology, new features are added to the solution that can require additional skill and training. So, you should look into both aspects before opting for any LMS.

With HES LoanBox, you are not merely choosing a software solution; you are entering into a partnership that prioritizes your success. The company offers a commitment of lifetime customer support, a testament to their dedication to your ongoing success. This means that, for the entire lifespan of your usage, their support team is readily available to address any queries or issues related to their product.

HES LoanBox’s mission is clear: to empower clients to fully utilize the solution and achieve their business objectives. Regardless of the nature of your query, you can confidently reach out to their support team for prompt and expert assistance. They are not just troubleshooters; they are guides who offer valuable insights and guidance to ensure that you harness the software’s full potential.

8. How User-Friendly and Intuitive Is the System’s Interface?

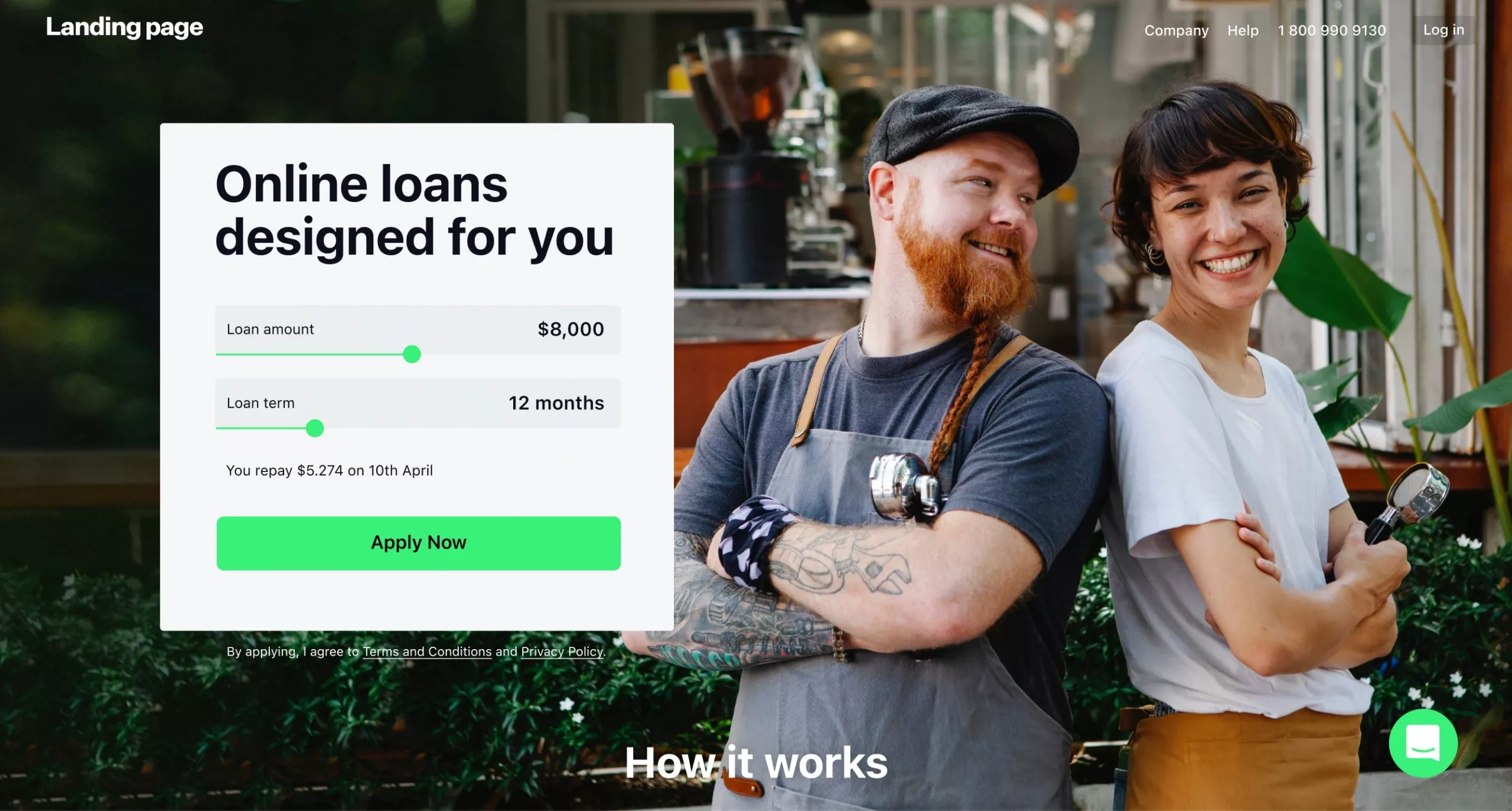

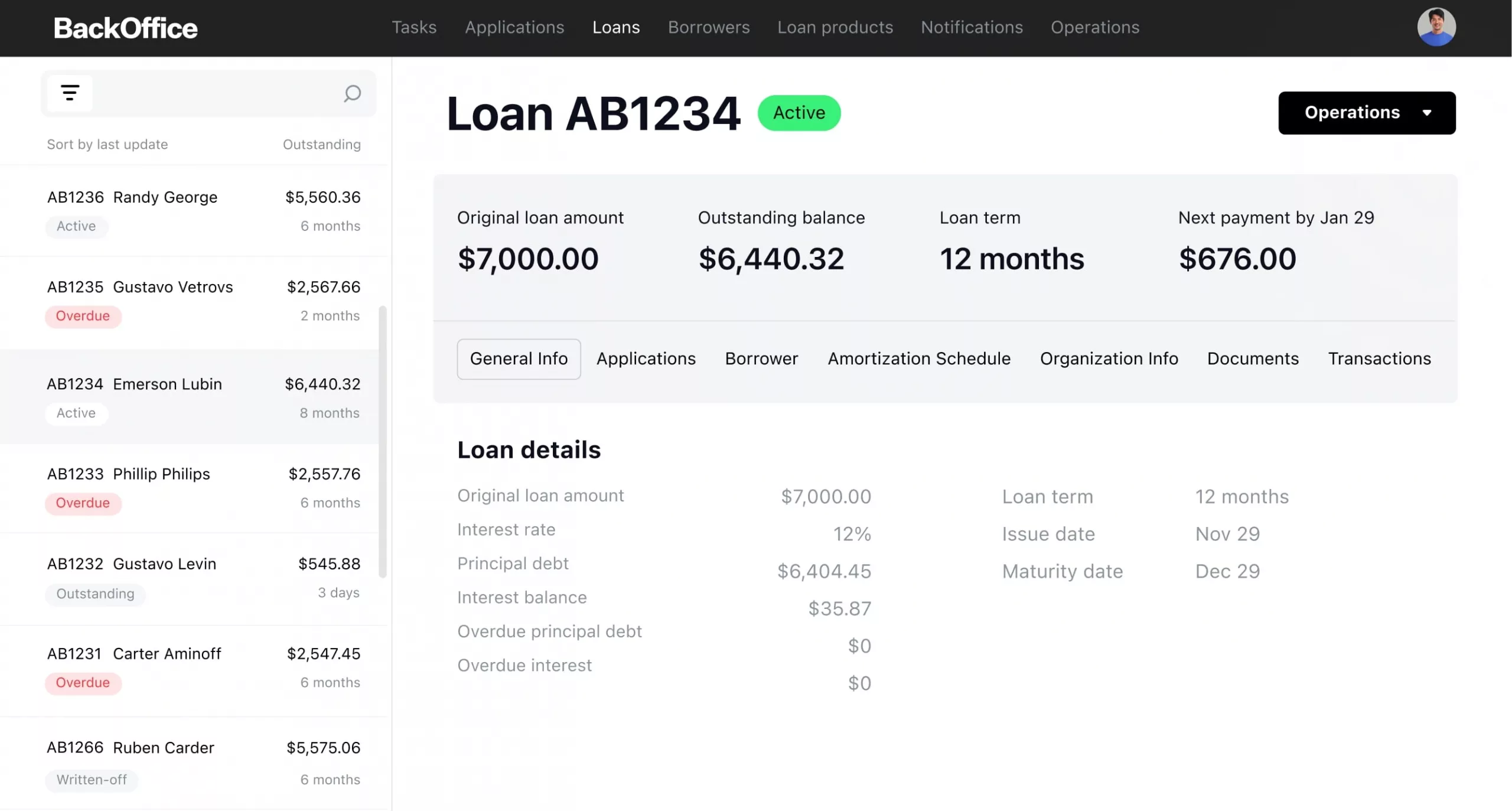

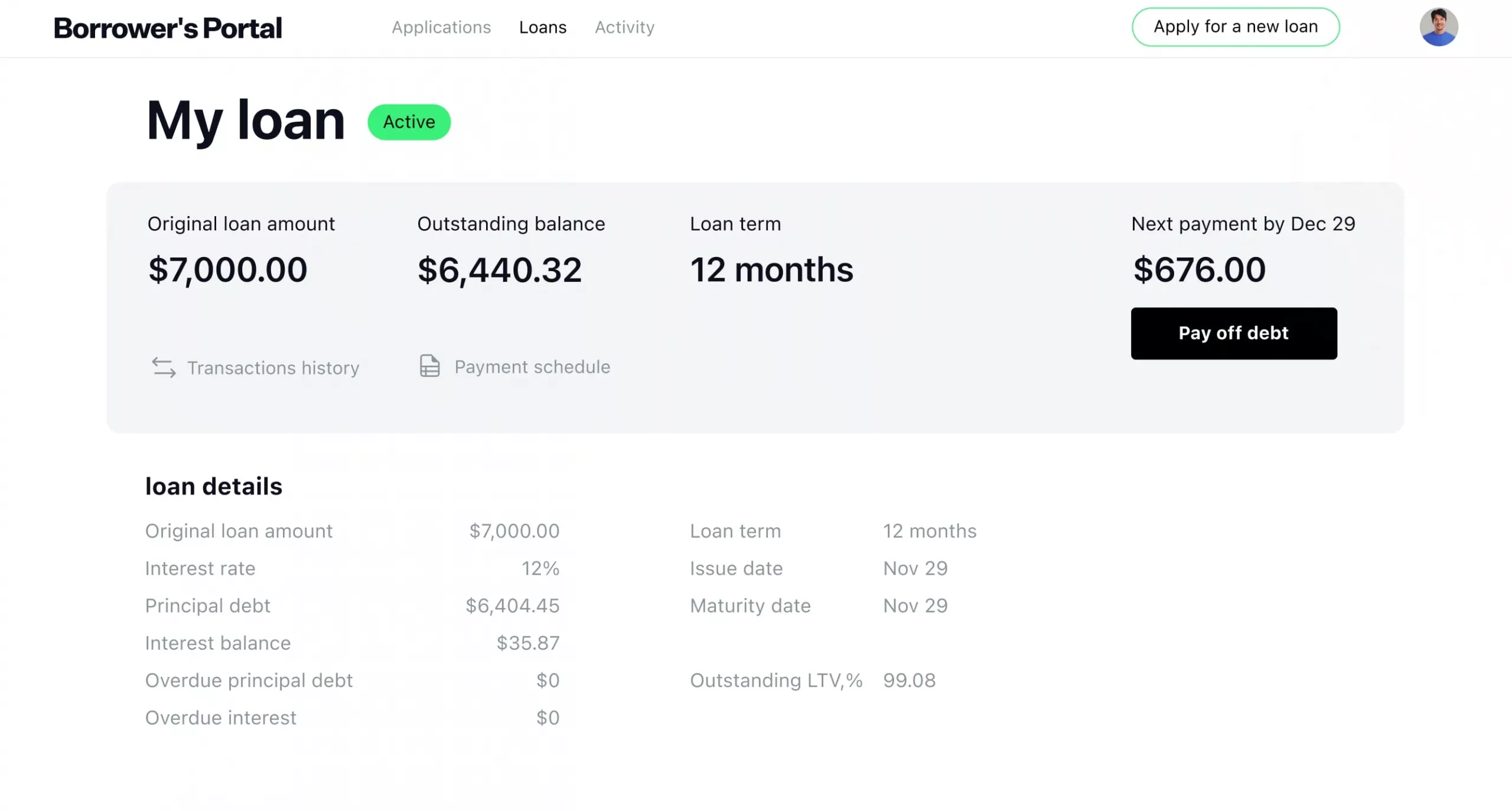

An LMS should come with a simple, clean, and interactive interface for both customers and employees. Customers should be able to navigate through the interface to find everything without any hassle. Moreover, employees should be able to use the features of the software without going through any complex process. In short, the system should be easy to set up and use.

HES LoanBox distinguishes itself as a beacon of user-friendliness. It is designed to be accessible to users of all skill levels, irrespective of their technical proficiency. Unlike some software that requires coding expertise, HES LoanBox eliminates such barriers. Its non-coding architecture ensures that no special technical skills are needed, enabling users to harness its full potential with ease.

HES LoanBox

/

HES LoanBox’s thoughtful design includes different modules tailored for both customers and employees, enhancing their ability to navigate and use the system’s features effortlessly. Should any issue or question arise, the dedicated customer support team is readily available to provide guidance and assistance in implementing and effectively utilizing the system.

9. What Is the Total Cost of Ownership for the System, Including Maintenance and Upgrades?

The total cost of ownership of the system with its maintenance and upgrades is another important factor to deem before picking any option. Maintenance and upgrades are essential for the smooth and seamless functioning of the system with the evolving technology. So, you should check about any additional costs and charges for upgrades and maintenance.

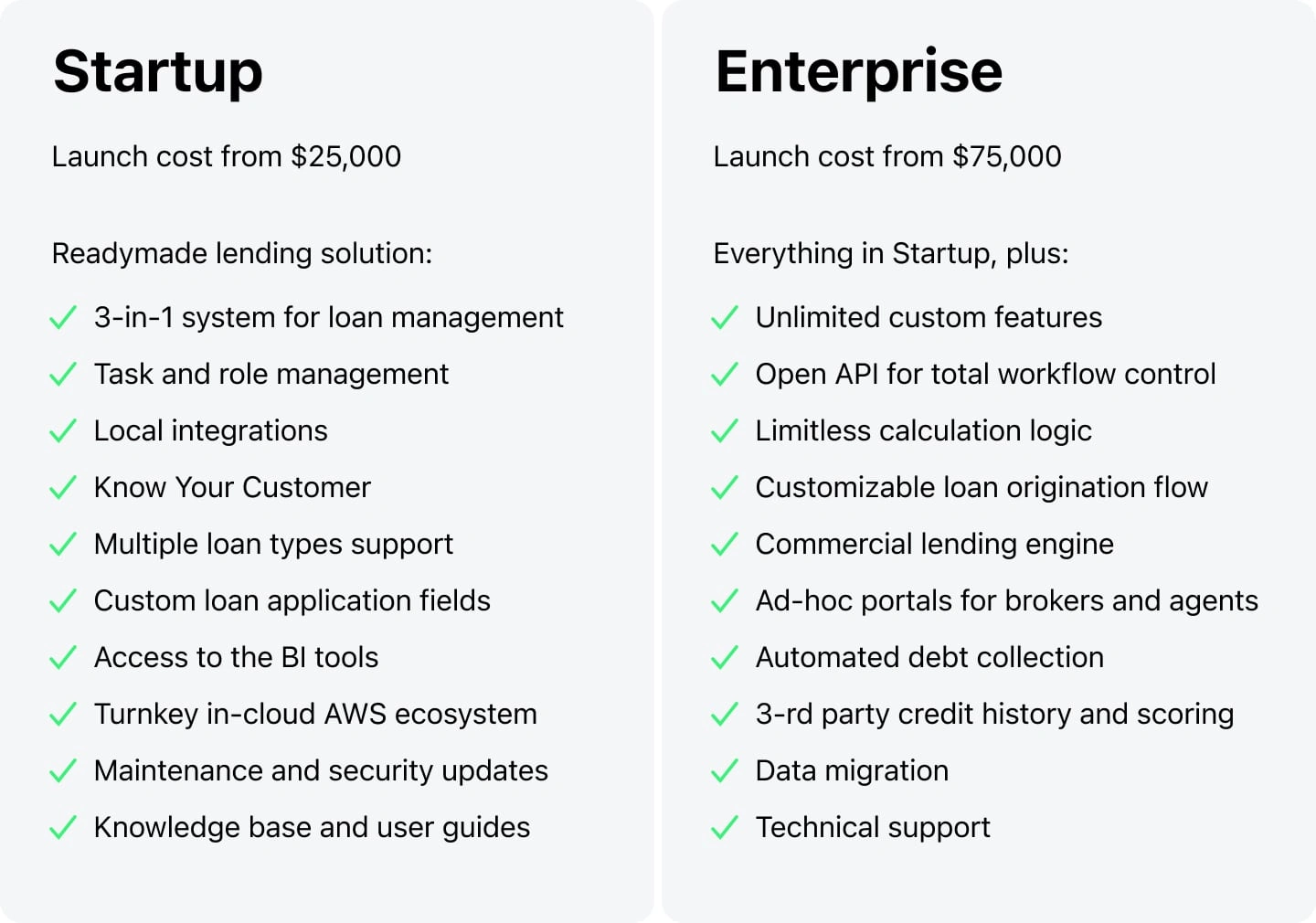

The cost structure of HES LoanBox is adaptable to meet your specific needs. It offers two distinct pricing plans, each designed to cater to different requirements and budgets. However, it’s essential to note that the total cost can vary based on several factors, including the inclusion of additional features, custom integrations, and specific payment timeframes (monthly, quarterly, or yearly).

10. How Prepared Is the System for Future Technological Integrations (e.g., AI, Blockchain)?

Future technology adoption is a critical aspect when selecting a Loan Management System (LMS). A forward-looking LMS should demonstrate compatibility with emerging technologies such as artificial intelligence, machine learning, and blockchain. Compatibility with open APIs and a modular architecture enhances the LMS’s capacity to incorporate future advancements seamlessly. Choosing a system that embraces emerging technologies positions financial institutions to stay competitive in the dynamic market.

HES LoanBox is developing with the latest Java LTS stack that ensures long-term support for SaaS lending technology. Moreover, the in-house team commits to offering innovative features by leveraging cutting-edge technologies, and the whole system is backed with ISO 27001 certification.

Final Verdict

After getting answers to all these important questions, you can pick a LMS for your business. HES LoanBox offers a reliable, scalable, and flexible system to manage loans with proper future-proofing. You can contact us for proper pricing and more details on its superior features.