The ongoing digital transformation of banking and lending puts the industry at theft and fraud risks. With the growing possibility of potential cyber attacks on banks, organizations have to increase their financial cyber security activity. In the era of digital crediting having an effective lending cyber security program and safe online platform is more important than never ever before.

Understanding the importance of cyber security banking, we want to deliver a guide to digital lending without security risks. The goal of the article is to explain why it’s rational to empower banking information security instead of defeating bank cyber attacks. We’ll make clear how to safe lender, cyber loans and predict cyber attacks on banks.

Over the past years, digital lenders, credit unions, and banks have experienced an 8% increase in fraud. According to the fraud statistics for 2020, the average number of monthly fraud attempts in the digital mortgage only is 1,8100, with over 900 successful ones. Business owners report losing around 6% of their revenue due to fraud every year.

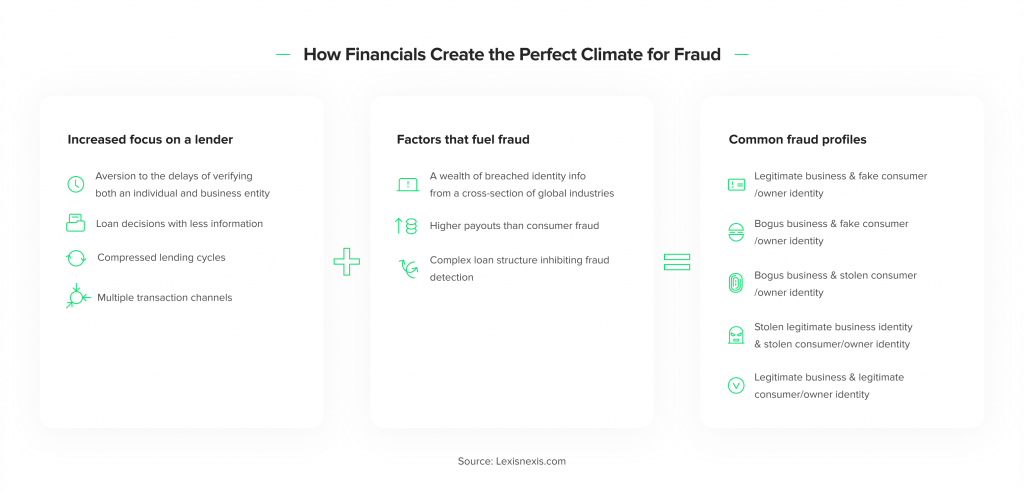

What Are the Main Fraud-Promoting Factors?

Quite often the main reason why hackers stole money is banks themselves. The mistake they make is common to any business or activity — every time we want to improve one feature, we might forget about others. While in the decade of digitalization all lenders strive to streamline processes and drive excellent customer experience, we might forget about security terms and create breaches in the system.

There is a need for banks to secure their digital lending platforms to guarantee borrowers the protection of their data. Financial information is the number one target of hackers and thieves. If customers feel unsafe, for example, they aren’t sure that their passwords, credit cards, e-wallets, payment history, or bank statements are safe and might be exposed to third parties, they will turn away from your lending services to competitors who prioritize banking cyber security.

Online lenders need to deliver secure cyber loans to outperform competitors and stay afloat. However, there’re two more reasons to update your lending cyber security strategy.

Cheaper to prevent fraud than address the impact

Even if you don’t experience cyber attacks, you need to take steps towards protecting the business and borrowers.

Having lost customer data, you put your users at risk. With information about their financial activities, bank and credit card data, historical operations, etc. customers might lose their savings and find their personal data free to access on the internet. In some situations, customers might need compensation from a lender, if they feel vulnerable. It can end in a lengthy trial with a large number of plaintiffs. Moreover, you’ll have to pay for a full system and software update or change.

According to IBM Security, the average data breach costs institutions $3.86 million and varies based on the size of the institution. Considering other cyber attacks, malware costs a lender an average of about $900,000 to resolve the consequences and update the system.

Cheaper to maintain brand image than recover

Apart from financial losses, fraud and data breach cases create a poor brand image among customers and might lead to a large outflow of loyal borrowers. In the eyes of customers, a data breach is proof of low security in a company and its inability to guarantee risk-free services. So they’ll seek a safe lender able to protect their personal data.

According to statistics, 61% of respondents say they’re unlikely to turn to a company that suffered a data breach. Following the CNBC news, 38% of companies say they have lost business due to hacking concerns and lack of banking security concerns.

All these can be avoided if lenders maintain a high level of preparedness for cybercrime. Being able to handle any possible bank cyber attack allows not to interrupt business activities and protect customers.

Read also

How Banks Secure their Data and Cyber Loans

Conquering data theft and fraud starts with dedicated technology tools and resources to proactively identify and closely track any fraud activities. A complex fraud strategy with a 360-degree view around every business activity and lending operation is a key to reach a high level of financial cyber security. Let’s consider several steps you can follow to enjoy cyber secure lending.

Employee training

Uninformed and unqualified personnel is one of the main sources providing access to private borrowers’ information. Human errors might create data breaches via email or an unsecured internet connection. To avoid such issues, we recommend providing lectures to your employees about banking security terms and training them regularly.

The staff should be aware of how to detect possible cyber attacks on banks and solve them. This can be handled during training by modeling possible hacker attacks.

Entity ID verification

For digital lenders, ID verification not only reduces fraud but also allows speeding up the decision-making process. Let’s address the issue in detail. The online lending workflow, generally, starts with gathering information about a lead, his or her credit score, and history, appearance in blacklists of lenders and banks, etc. Placing ID verification in the first place of your workflow reduces the time you spend collecting information on a user whose application will be rejected after verification.

Using an identification platform means that applicants will have to provide identity document detail. The modern solutions provide a variety of verification approaches, for example, facial match when a tool captures face biometrics and matches it with a passport, ID, or driver’s license. A provided document can be checked for forgery by scanning for visible irregularities and the correct position of elements of a document.

Entity ID verification is a must for every lender since it allows to find fraud applications fast and don’t waste time on non-performing borrowers, so your best applicants will get funds faster.

Moreover, we recommend providing your customer with information on what data a lender can request and which not. That is a guarantee of bank information security.

Consumer and business fraud analytics

Checking every application isn’t enough to rest assured. Modern fraud analytics allows you to have a 360-degree over your platform, check every customer, and detect breaches if they appear.

Pay attention to software that can spot suspicious behavior in real-time and predict fraudulent activities. Use the system that can instantly verify proxies, VPN, device identity to uncover malware and bots.

Choose a robust data restore solution to protect your personal information on customers and guarantee that it won’t reach the public domain.

Besides, choosing tools to integrate with your lending platform, such as payment gateway, carefully consider the security terms of a provider you want to purchase a solution. Every element of your financial business should be under protection.

Dedicated IT team

A skilled IT department guarantees that all your security terms and conditions work correctly. They will monitor the platform’s performance, reduce potential loopholes for cyber attacks, and defend them if needed. Also, it’s a guarantee that if the system requires immediate attention, your IT team will handle everything and does its best to keep things under control. However, a safe lender works collaboratively with the outsourced company that is responsible for their lending software development.

The security of your lending planform depends on the development team you pick. Dedicated specialists from HES FinTech have a reasonable advantage over other companies. HES specializes in lending software having a deep understanding of the domain and comprehension of how every internal and external lending process should work. We’re majoring in P2P, POS, leasing, mortgage, factoring, and any other lending-related solutions.

HES FinTech’s expertise and secure-only solutions prove the recently received ISO 27001 certification, a specification for an information security management system. It’s a framework of policies and procedures that includes all legal, physical, and technical controls involved in an organization’s information risk management processes.

With up to 10 years of experience in the field, the HES team can be a reliable partner on the way by following high standards of lending cyber security.

Read also

Wrapping it Up

It’s clear that online lenders are the main target for cyber hackers. Hopefully, now you have a simple guide to digital lending and safe and secure online loans. However, there’re far more ways to protect your customers, company, and employees. If you feel the lack of cyber loan security, HES FinTech is ready to make all your needs real fast and effectively.

Want to lend securely? Get in touch with HES to rest assured with lending cyber security.