Investors see P2P lending as an opportunity to diversify their investment portfolio. While borrowers pick it up for fair credit being allowed and a quick funding process. Since it’s mainstream, what can you do to start a peer to peer lending business?

Searching for information on successful P2P crowdlending guides, the majority of users stumble upon obvious tips, like gather a dedicated team, fill out a business registration form, develop a platform, etc. But there’re no ideas on how to develop a peer to peer crowdfunding platform and what tools to add for streamlined user acquisition. Being good at lending and software development, we decided to share our vision of a functional white label peer to peer lending software platform. You’ll find the average development cost on the market and get some tips on choosing a reliable software development team.

The peer to peer lending market is currently valued at $67.93 billion and is expected to grow at a CARG of 29.7% by 2027. To put that in context, the average funding per loan has risen by about 50% in the last year. It means that crowdlenders are about to take a large piece of a banking and lending pie.

Looking for unique software for P2P lending?

What is Peer to Peer Lending?

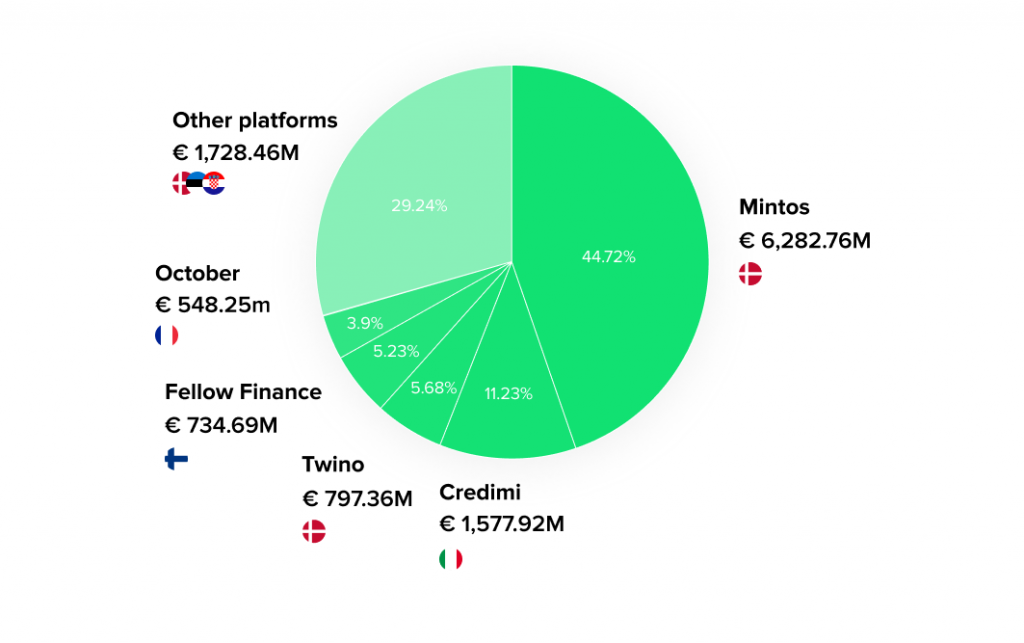

P2P lending allows individuals to obtain loans directly from investors. It’s an alternative to traditional bank and credit union lending services. Peer to peer platforms make money on fees they charge both borrowers and investors. The most popular websites include Mintos, Credimi, Twino, and others.

There’re several niches where you can start a peer to peer lending business and then enter other markets. P2P lending covers educational, real estate, auto, business loans as well as debt consolidation.

Education

Education and scientific invoicing is a relatively new market for P2P lenders. Statistically, about 85% of students take educational loans. While the average public university student borrows $30,030 to attain a bachelor’s degree only.

Following educational purposes, users can collect money to get a degree to funding scientific programs and research. Despite a high and growing demand for educational P2P lending, there’re not so many businesses providing this kind of service. The top companies include Prosper, Kiva, CollegeFinance, etc.

For instance, CollegeFinance - a US-based education crowdfunding website - offers different products to cover the needs of various categories of students:

- Private student loans with a range of APRs from 1.12% to 14.50%.

- Refinance student loans with a range of APRs from 1.98% to 8.49%.

- Shop student credit cards with a range of APRs from 15.25%.

- Scholarships with cash prizes starting at $2.000.

Auto financing

Auto finance is also a relatively young niche in P2P crowdlending. Following the latest surveys, the value of the auto finance market is about $37.610 billion, 80% of which are secured personal loans.

Car P2P loans are the fastest and the easiest method to purchase a vehicle with no joining fees, lower rates, and customer-oriented service. For instance, Zopa offers auto loans for up to 5 years with a 3.9% APR.

Real estate

Real estate is the most demanded niche in the P2P market. Real estate P2P lending is the perfect choice for property borrowers to collect extra capital. Besides, such lending remains less risky compared with traditional investing, when you need to invest in real projects. It means that when projects are stuck, investors are the first ones to get payoffs. So, P2P lending is more attractive on the market.

The main players in the niche are EstateGuru, EvoEstate, and Crowdestate. For example, the last company offers rental and development credits with up to 16% ROI and a minimal sum of investment of about €100,00.

B2B

Business to business investment is the main market of P2P lenders. There’re hundreds of websites targeted at hotels, restaurants, cryptocurrency, transportations, fintech, and tech startups.

For instance, LendingCrowd offers to borrow up to £250,000 with rates from 5.6% for up to 60 months. In addition, there’re no early repayment fees and no need to pay for the first 12 months.

Debt consolidation

Debt consolidation is the process of combining several loans into one with more parameters. Users get debts with a fixed return rate and improved credit score when paying in time.

As an example, Prosper is one of the P2P lenders who started offering such a service. It consolidates loans from $2.000 to $40.000 with APRs 7.95% - 35.99%.

What Peer to Peer Crowdfunding Platform Needs

Once you’ve chosen a target niche, it’s time to consider how to develop a P2P lending banking software. It doesn’t matter whether you want to start a small startup-related agency or develop a giant corporation for all P2P needs, there’s a set of tools and features your digital platform can’t do without.

HES developers are experienced in peer to peer lending and claim that every P2P platform needs several fundamentals. Here's our view on how to build a P2P lending platform:

- Safety and security module to protect users from fraud and data theft. This’s a guarantee that your users won’t lose their investments, personal data, and loyalty to your brand.

- Payments and money transfer is fundamental of the lending platform. Note that not all payment solutions are suitable for lenders since you need a solution to accept both customer-to-business and business-to-customer transactions.

- Document management module allows you to streamline processes of electronic transactions by eliminating paper documentation and reporting.

- Admin dashboard and CRM to provide a 360-degree view over the platform’s performance, common management tasks, server information, user statistics, etc.

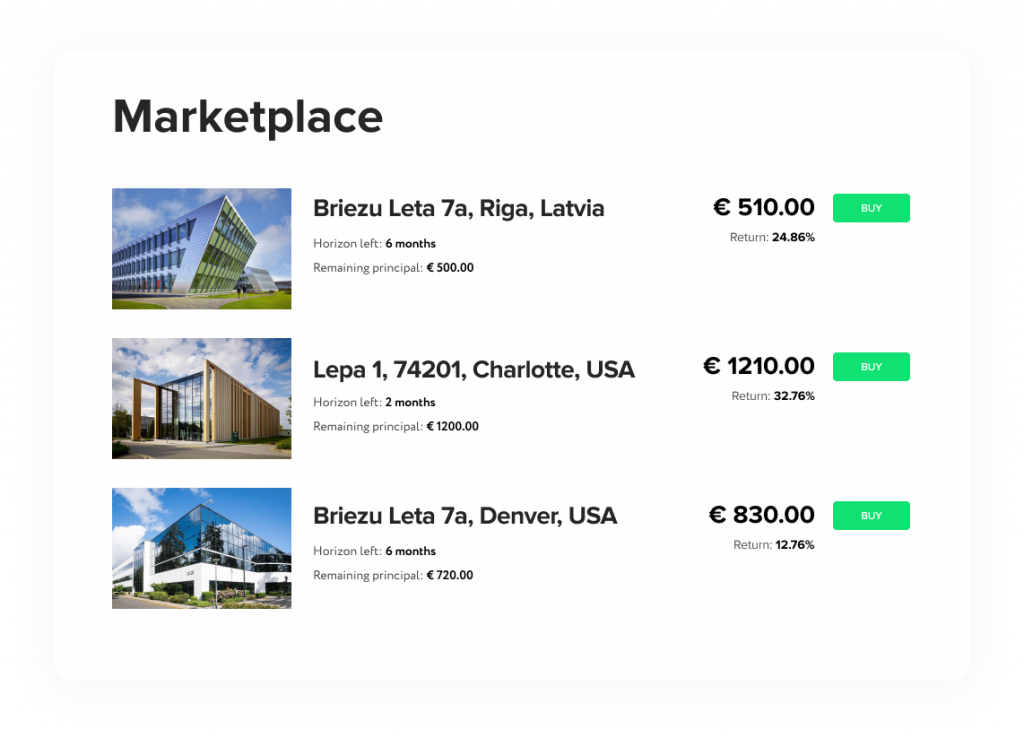

- Marketplace feature for automatic loan matchmaking between a borrower and investor. Without this module, you’ll be unable to provide P2P services.

Read also

Apart from all these, a P2P money lending platform might need some extra benefits to drive exceptional customer experience and stand out in a crowd. Let’s discover them in detail.

Online loan calculator

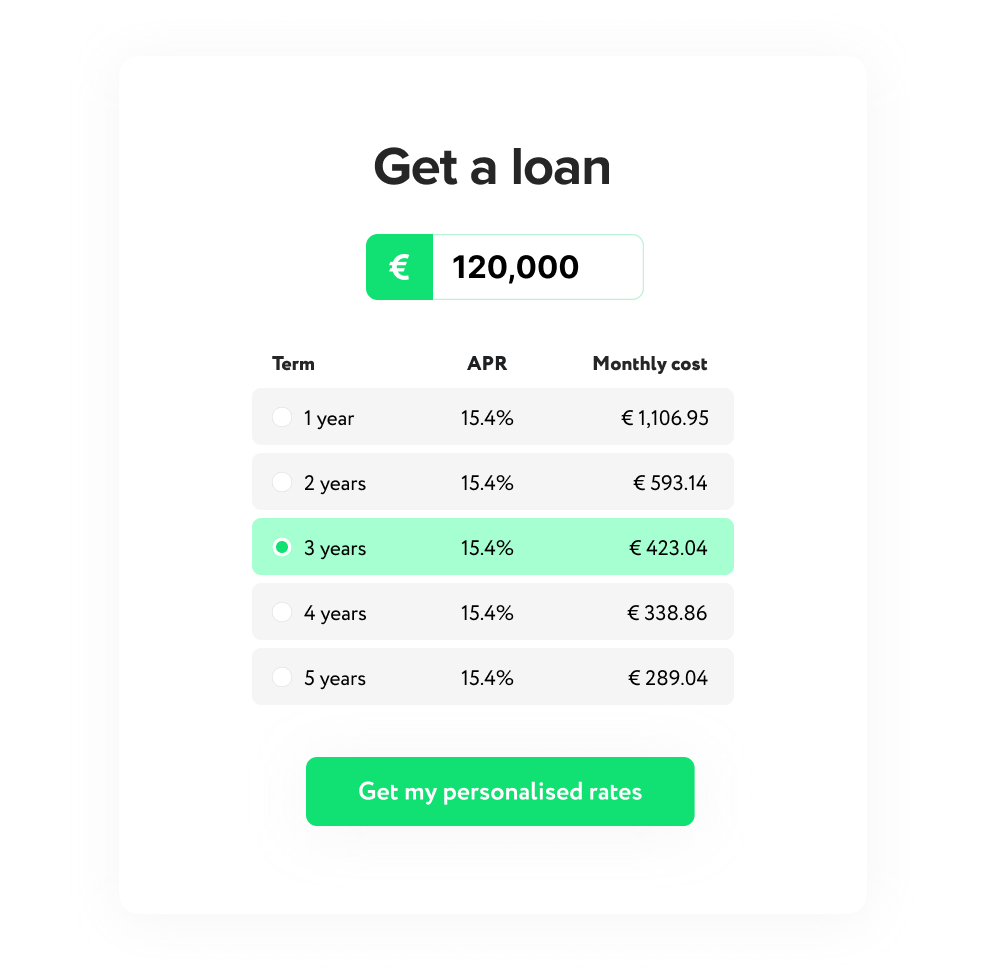

A loan calculator is an excellent tool for explaining to new website visitors what they can reach working with you. Your customers will enter the preferable sum of money, and the calculator will show the annual percentage rate, the given loan period, and the amount of monthly payments. The number of displayed information may vary, depending on customer needs.

We recommend placing the tool on the main page of your website to generate leads more effectively. You can also create a separate page with a user guide through the calculator.

Credit score checker

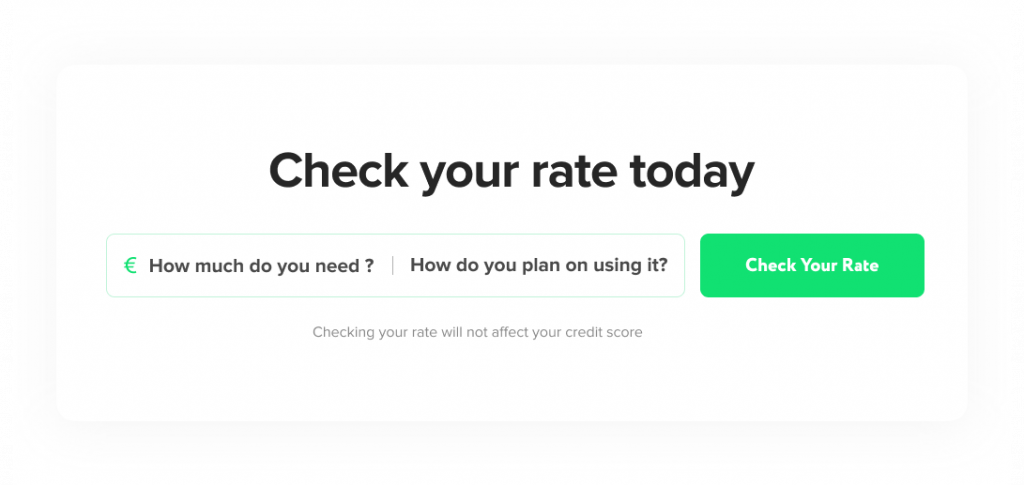

Credit score check opportunity can be an excellent addition to the previously described online calculator. Instead of placing a simple contact form on the website, you can update it to something more functional.

Unlike traditional contact forms, we suggest adding more questions as an opportunity to fasten the communication and lending in general. For example, add the following lines:

- Ask a user about a desired amount of money.

- Let a user choose a lending plan, such as B2B, education, etc.

- Clarify a user’s full name.

- Specify a user’s location.

- Add a button “Check Your Rate”.

Pushing on the “Check Your Rate” button, a platform will send the filled-out information to the service provider and initiate credit score checking. This streamlines the process by eliminating lots of email communications.

Automated investing

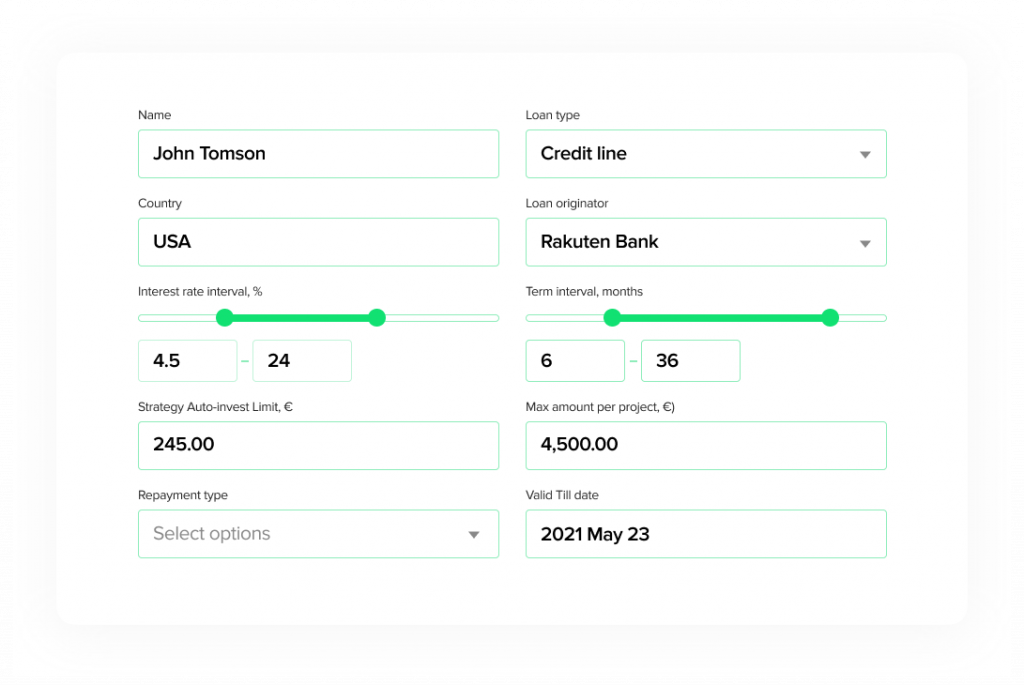

An automated investment function allows users to diversify their portfolios in the short term. By using the auto-invest function, P2P investors can automatically invest money in available loans based on the criteria they chose.

Allow your users to set up the following loan parameters in their accounts:

- Annual interest

- Max investment per loan

- Loan term in months

- Loan amount available for investment

- Stop invest with the balance below X

- Countries where loans are from

- Interest to be reinvested or not

- Invest in extended loans or not

- Terms to delay loans

Secondary markets

Secondary markers in P2P lending allow users to buy and sell already refunded loans when the repayment period has begun. So, lenders can use the function to exit loans earlier. Investors use the function to increase returns by reselling and start lending instantly instead of waiting for new loans to be available for funding.

As an alternative, you can offer an option to sell the loan back to the P2P platform at a discount - usually up to 5%. However, most new platforms do not provide this function since they might feel unstable on the market. We recommend considering this feature not first and foremost.

What’s the Cost for White Label P2P Lending Platform

The peer to peer lending software cost directly depends on the development type you choose. The platform can be created from scratch by hiring an outsourcing team or you can buy an OOTB platform. However, it’s better to consider white label or ready-to-use solutions that need customization. Here’s why:

- Custom-made software will cost much more than white-label, as well as require more people to create it. Besides, it’ll take a least two years till going to market.

- OOTB solutions are not always suitable for unique crest products. While label allows users to get custom software integrated into their lending scenario.

White label or configurable software is faster, safer, and less risky. You can get a platform in a very short time - up to three months - with a unique filling. If you want to update or customize it, you can easily add the feature by contacting the development team.

Psss... Wanna start lending within 90 days?

Considering peer to peer lending software cost, there’s no one and only figure among developers. The average price for a P2P lending platform starts from around $50.000 and reaches $100.000 for solutions with fundamental functionality, such as payment processing software, automated KYC/AML verification, management module, automated notifications, reporting, etc. However, the price might be far higher, everything depends on the functionality. Comparing the cost with the development from scratch, the price for a fully custom P2P platform might reach $1 million or even more.

If you don’t know how to start a P2P lending company or are looking for a unique development approach, the HES FinTech team is glad to walk your lending path together. Understanding the lending business from the inside, we can advise on tools and solutions that will work for your P2P business perfectly. Our aim is to develop a high-quality solution that will fit your business model. Simplify and automate your P2P lending, as well as let you reach every goal set up by you.

Wrapping Up

There’re lots of ideas on how to set up a P2P lending company. There’s plenty of solutions on the web offering variable business and lending visions. Your task is to find a team either able to implement your view or guide you through the development to success. Hopefully, we presented some insights on creating an eye-catching P2P crowdlending platform that you can take into account. If you’re ready to discuss some thoughts about your monkey lending platform, the HES team is here to help.

Want a white label P2P lending platform? Contact us to know more.