Fintuity success story

A machine learning-powered financial advisory platform for a UK-based company

Check out how Fintuity managed to launch an updated fintech platform catering for financial advisory

and wealth management. With HES FinTech, it took just 5 months.

HES FinTech is one of those vendors that offers comprehensive front-to-back solutions with

full integration. We feel confident that our new ML platform will allow us to offer

clients the best-in-class investment advice services.

Edward Downpatrick

Strategy Director at Fintuity

Challenge

New domain: financial advisory platform development

Fintuity was looking for an experienced long-term technological partner

to create a flexible

hybrid advisory platform that leverages machine learning and human expertise. HES engineers were

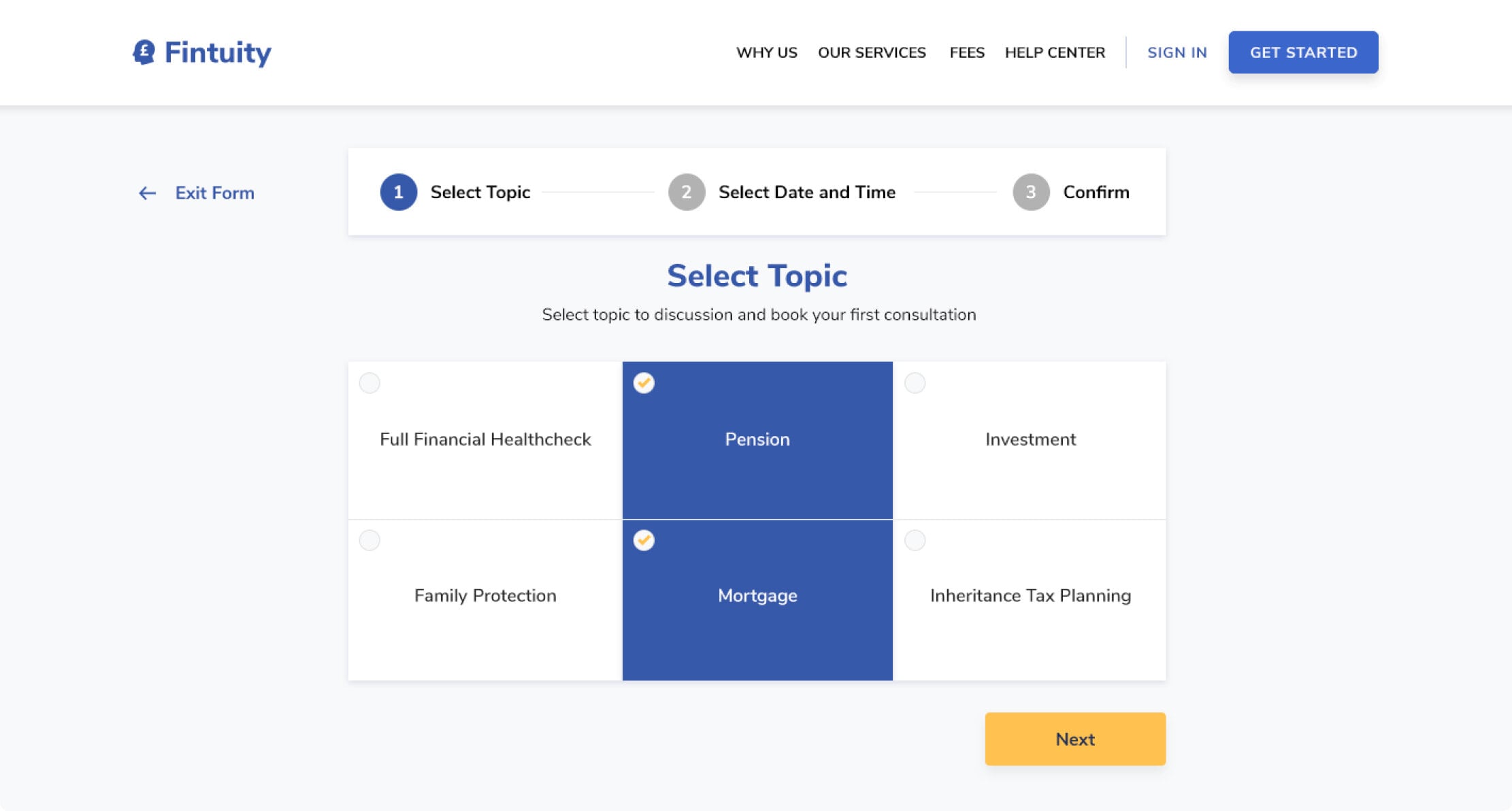

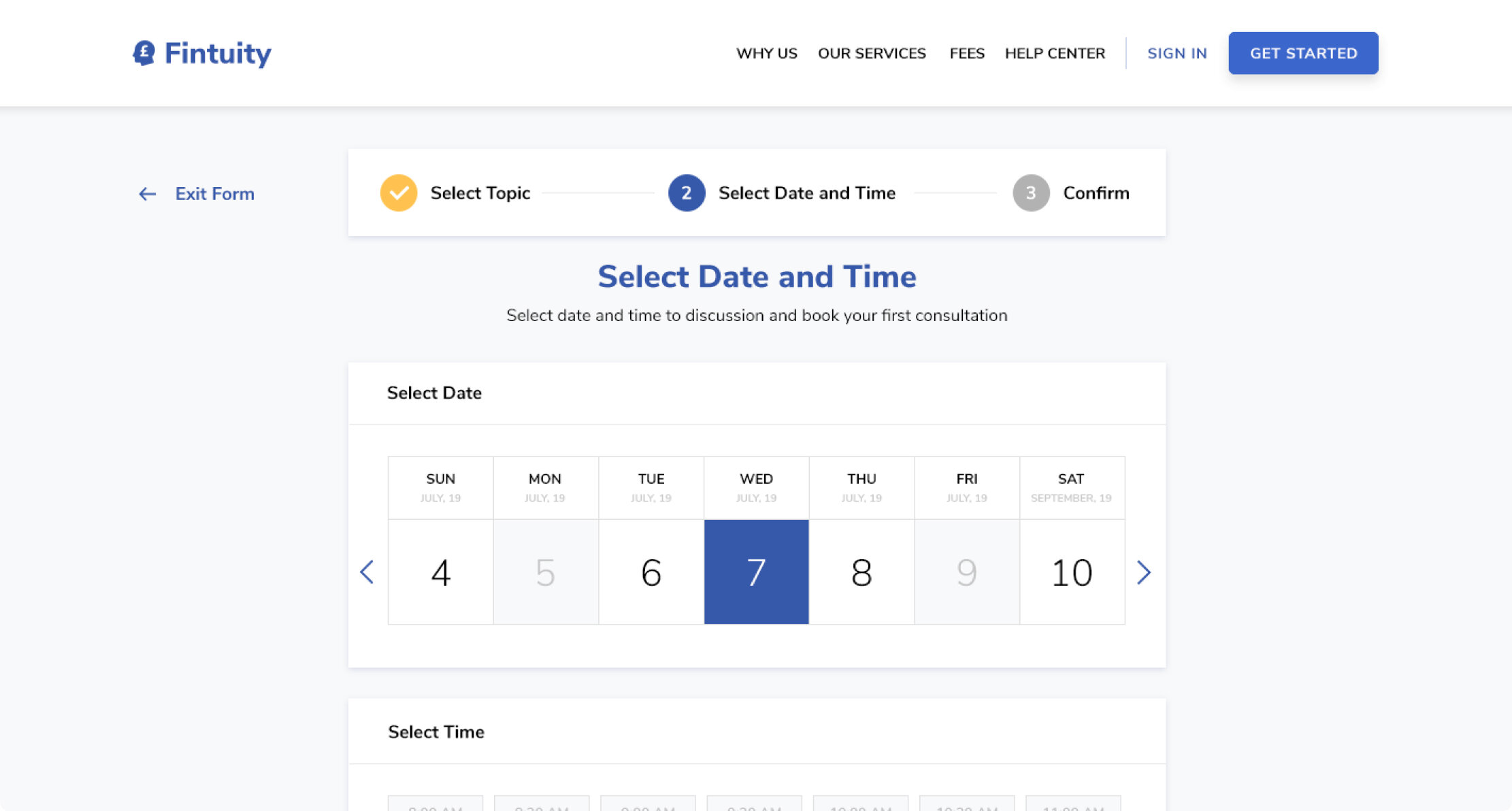

tasked with implementing an end-to-end system: from web design and a client portal to the core

logic and back-office architecture.

Approach

Using HES LoanBox for automation

The delivered solution is a machine learning-based platform that analyzes data in

real time and automatically creates investment plans. The platform is built on the basis of HES LoanBox: some of the modules were re-used, some of them were built from scratch.

4 months

Time-to-market

70-75%

Automated processes

10 months

Return on investment

Result

Customized and optimized ML-based advisory platform ready for market challenges

The solution is based on modular architecture and comprises the following elements:

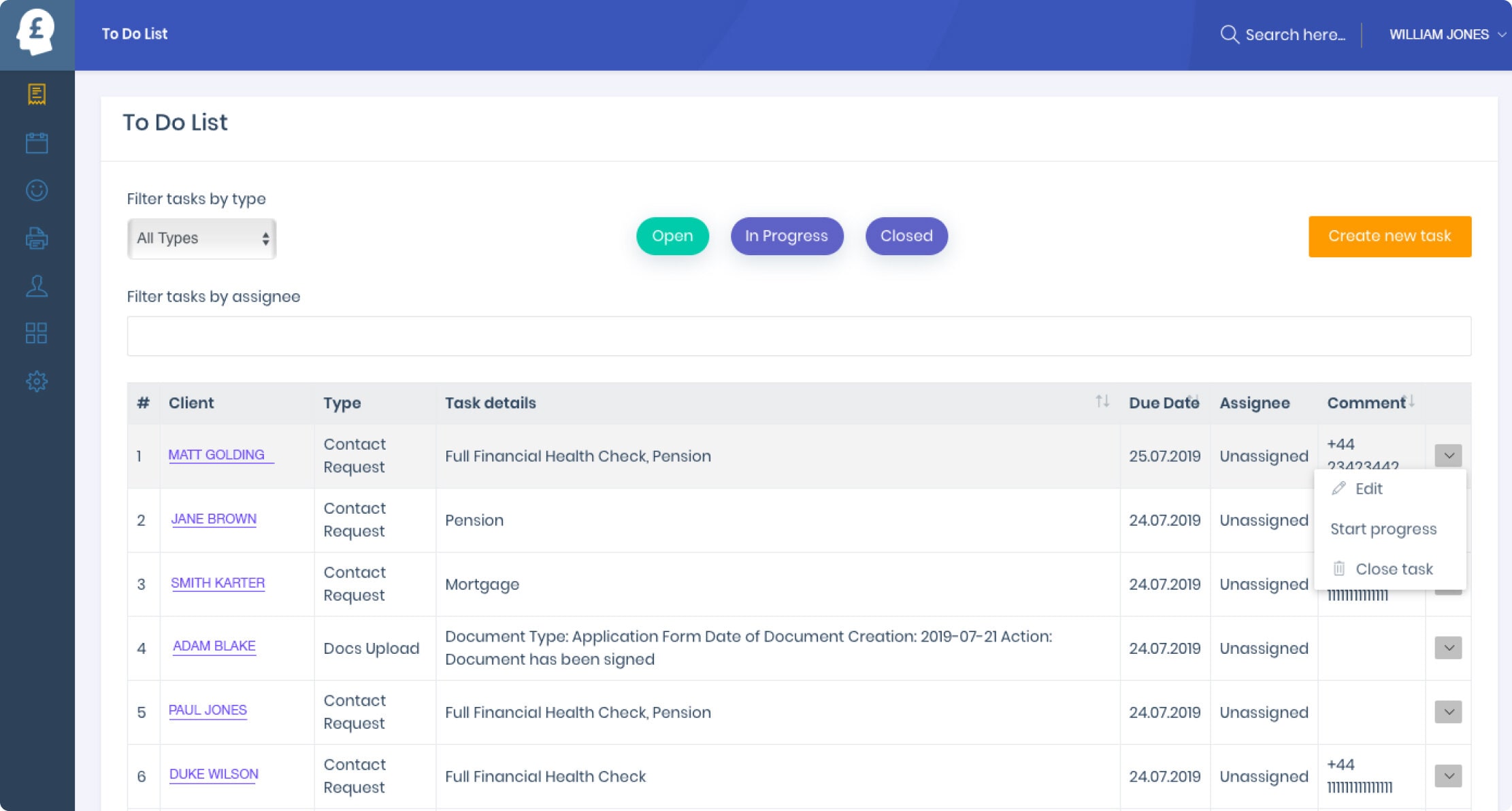

- Roles and permissions for managing system users (IFAs, system administrators, assistants, support specialists)

- Advanced system configuration including security and calculator base settings, KYC profiles

- Template-based document generation

- In detail information about clients and service providers (IFAs)

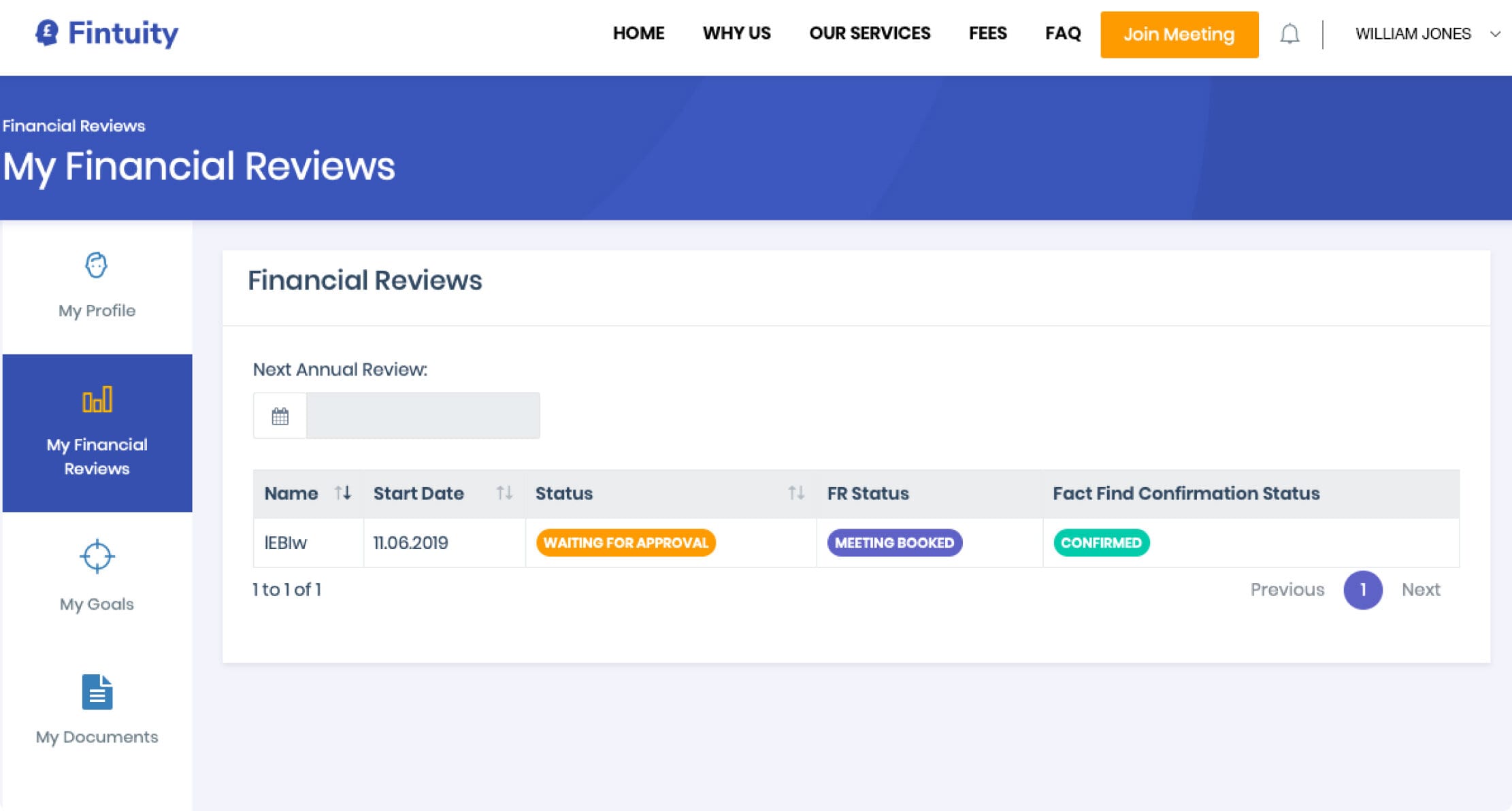

- Investment plan generation according to the goals of a client

Based on machine learning algorithms, the solution allows each client to take on an appropriate

level of risk and ensures that they will not pay excessive fees.