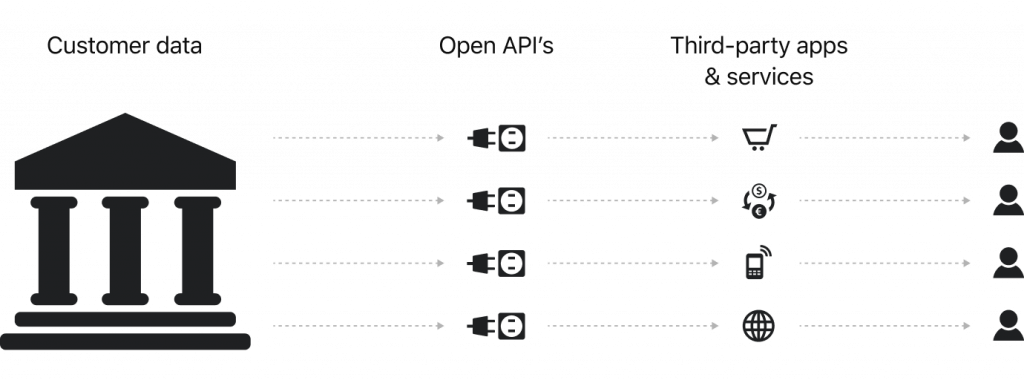

Open Banking is a technology that helps to securely provide financial data to third parties via API. Customers agree to make their financial data available to multiple financial service providers, while banks and financial institutions offer additional tailored services. Open Banking becomes possible due to banks building APIs that follow PSD2 standards and third-party providers asking customers for their consent to connect.

To put it simply, Open Banking enables financial market players expand their range of services and product offerings. Customers remain in control of their data use and can disconnect at any time.

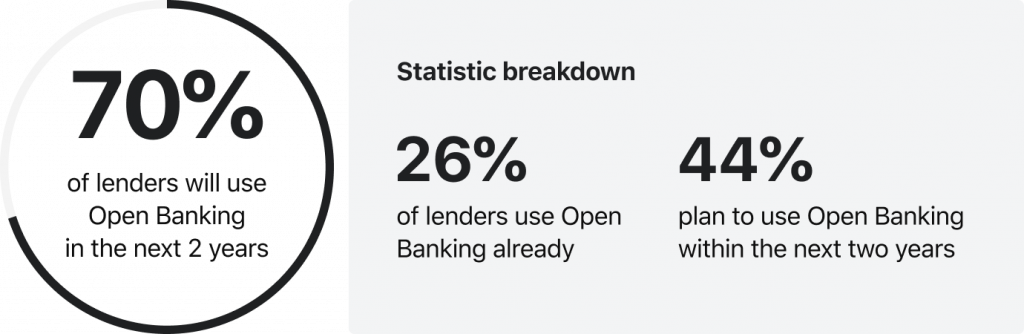

According to market research in 2021, 26% of lenders are using open banking technology, but a recent report by Credit Kudos says the adoption will dramatically increase in 2022-2023 and backs up this suggestion with facts. 44% of lenders who previously had no experience with open banking say they are planning to implement it in the future.

It means that 70% of lenders will use Open Banking in the next 2 years.

Perhaps, the growing enthusiasm for Open Banking can be explained by the pandemic, which changed the operational mode from offline to fully online and then to hybrid and increased the value of extra user data.

Also, around 4 out of 6 lenders changed the approval criteria during the period of huge uncertainly, which increased their missed revenue. However, technology adoption helped to control risks, but this technology (like AI-based credit scoring) led to increased need for new data sources.

The same research says that almost half of the lenders interviewed assume that Open Banking technology can help their financial institution cut time and cost on credit decisioning.

Read also

What about Open Banking Regulations?

The European regulations regarding Open Banking appeared in 2018, and that was a turning point to facilitating the access for financial data.

According to the Open Banking Impact Report 2020, the APIs growth in 2019-2020 reached striking 450%. The situation is the following: in theory, Open Banking has been free since 2019 (ever earlier in the UK). In fact, access to the same APIs doesn’t seem to be free for the end consumer.

Free Open Banking

According to PSD2 banks provide free access to their API. Free Open Banking means more fintech services, more developers and businesses will be able to improve the life quality of endcustomers and to compete with large banks.

However, not every bank supports free open banking. The reasons are additional costs that arise from the development of compliant APIs. Some specialists suggest that creating a paywall around the data available with API would create some kind of incentive and speed up Open Banking adoption. The position is explainable, but it would lead to the growing number of mediators and increased total costs that definitely won’t democratize the market.

What’s Next for Lenders?

Credit management is one of the financial services available to SMEs, along with consulting and accounting. The use of open banking in loan management will help to better control the entire credit process and ensure the business will receive the payment. SME owners are much more likely to open up their data when they understand that it will give the opportunity to create a transparent lending ecosystem.

According to research, the total value of Open Banking payments is expected to exceed £210 million in the UK in 2021. In addition, Juniper Research says that over a half (53%) of the world’s population could be using digital banking by 2026, which is likely to make financial data sharing the new normal. Open Banking has the potential to boots agile financial products and customized services, and increase customer reach for lenders.

It is not only about the evolution of the lending industry, but of the entire financial industry as well.

Rolands Mesters, CEO and Co-founder of Nordigen, a European freemium open banking data platform in Europe, is assured that Open Banking is going to be fun, when it goes mainstream.

“Open Banking has what crypto does not have - the full support from the regulations and corporations, <...> the safety rails needed to mainstream adoption”.

Mesters is assured that Open Banking has a great potential to be used in ways no one could have imagined. For example, integrating finances to the places people use the most: like virtual assistants, or other apps.

Read also

The Bottom Line

Open Banking tech can help lenders overcome the limitations and drawbacks of traditional credit data and pave the way for a more effective financial behavioral data use. Lenders can expect more rounded assessments, increased approval rates and reduced default loans. Let’s see how and when the industry is going to embrace these changes in full.