Business loans are a vital part of a healthy economy. Entrepreneurs, startups, and established companies alike seek financing for a variety of reasons — expansion, growth, debt consolation, new equipment, etc. — supporting the wider economic system and delivering products and services to the market.

In 2023, the commercial loan market in the US was estimated at $2.77 trillion. However, just because demand is growing, doesn’t mean market need isn’t changing. For financial providers, keeping ahead of the commercial lending trends allows you to deliver a client-first service and get the best results long term.

Latest Statistics Driving the Business Lending Trends This Year

Before we dive into the latest commercial and small business lending trends in technology and more this year, let’s get to grips with some of the statistics that are informing these changes:

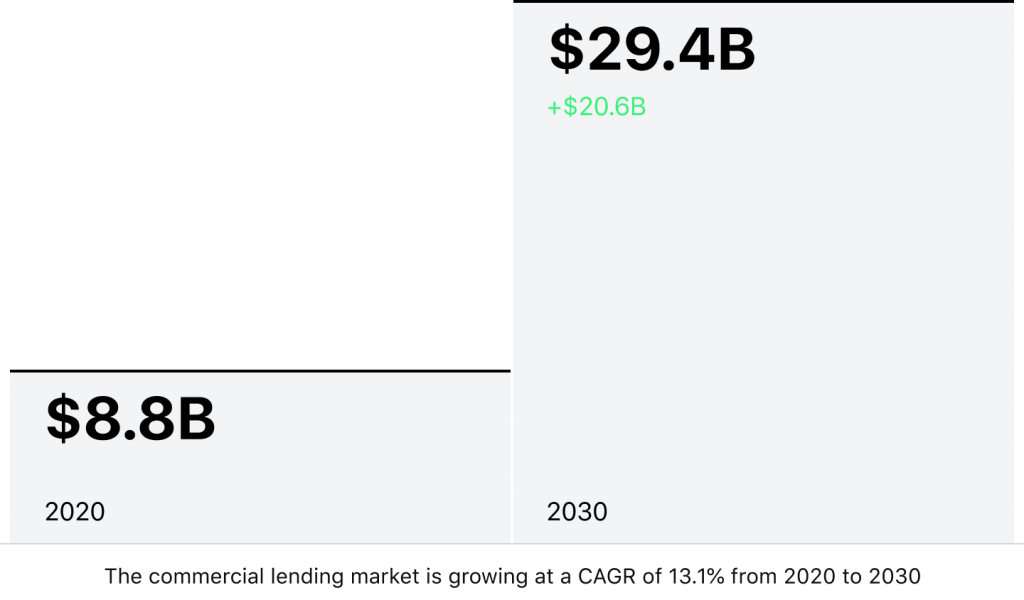

- $9,012 billion — the value of the commercial lending market in 2021

- $29,379.83 billion – the value of the commercial lending market by 2030

- Market growth at an estimated CAGR of 13.1% within the next ten years

- Small businesses often seek out loans to improve their growth — 43% in 2019, 37% in 2020

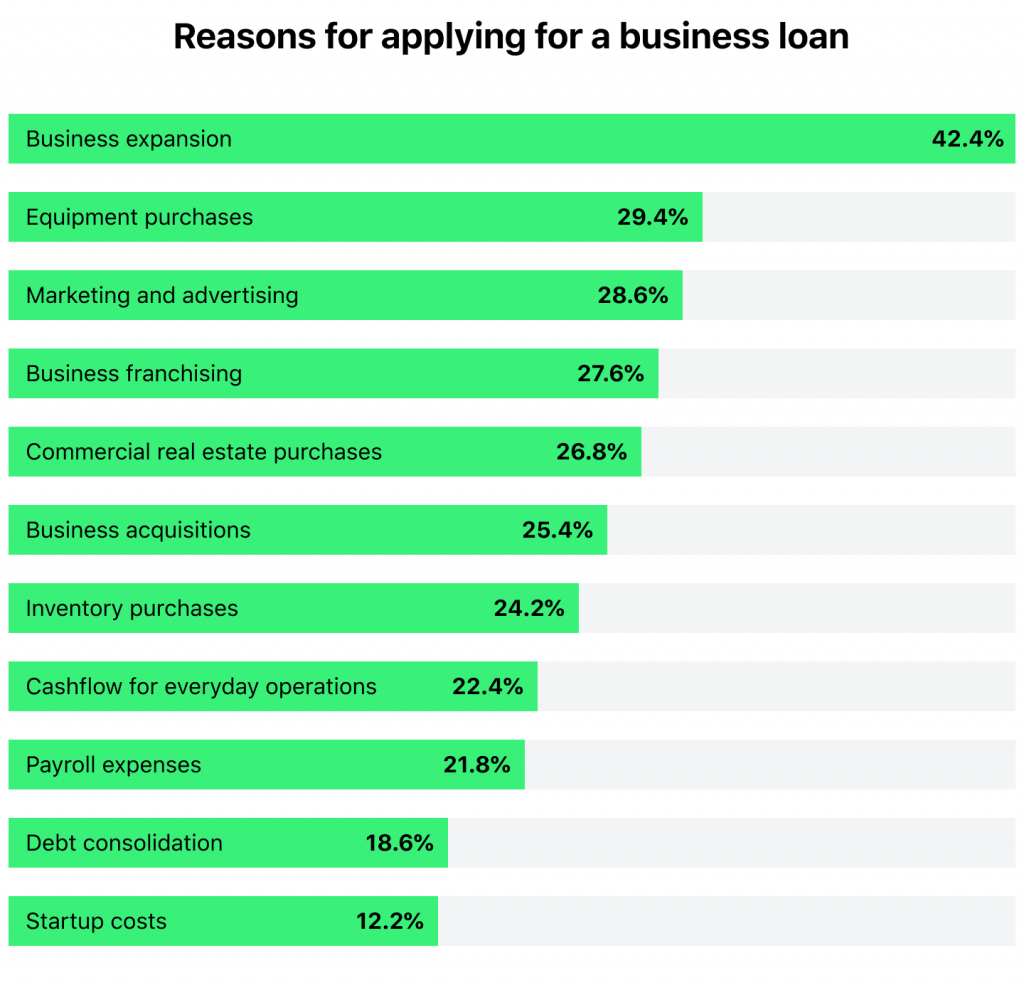

- Top reasons to apply for a business loan include business expansion (42.4%), equipment purchase (29.4%), and marketing and advertising (28.6%).

What’s Driving the Commercial Lending Trends in 2024 and Beyond?

5 Small Business Lending Mistakes and How to Fix ThemEver since the beginning of the pandemic, the loan market has been shifting in somewhat unexpected ways. Although, as a whole, interest in small business credit is rising and averages at approximately $663,000 per business on average (FED), there has been some ups-and-downs in the amount of credit applied for through traditional firms.

Conversely, interest in alternative forms of lending seems to be rising. Modern banking technology and P2P (Peer to Peer) lending platforms are on the rise, with P2P being valued at an estimated $82,300 million in 2021 with a CAGR 29.1% giving a $804,200 million by 2030 estimate.

Of course, it’s not just numbers driving the trends, geopolitical movements, sociological changes, and technology advancements are intensely impacting how commercial lending is moving.

- Geopolitical changes — as people move more frequently, the need for globalized services is growing, this also applies to business loans. In addition, greater regulatory requirements and more adoptions are required to account for a more challenging KYC/AML landscape.

- Sociological changes — business owners, irrelevant of business size, are now seeking smarter ways to fund their businesses. Gone are the days of traditional bank loans and in its place are smart lending systems and peer to peer platforms. In addition, many companies are also seeking more ethical services that may not suit the current market.

- Changes to small business operations—with small businesses accounting for 99.9% of all businesses in the US, they make up a market majority—and that majority needs credit. The challenge is that 59% of these small businesses are experiencing financial difficulty, rated poor to fair by the FED’s small business credit survey. Among some of the factors, this means that the credit systems they are using are no longer working for them.

- Technological advancements — in the last few years, we’ve observed a massive boost in the use of AI and machine learning technologies in the banking sector. These are currently driving and will continue to do so, updates in the market and the solutions created.

These are not the only factors that are impacting market trends but stand as some of the most prominent examples. Depending on your region, you may experience micro and macro influences or variations of these factors.

Top 7 Commercial Lending Trends to Watch Out For

So much is changing in the world of finance and lending, following these top 7 credit trends in commercial lending will help you keep your business on track.

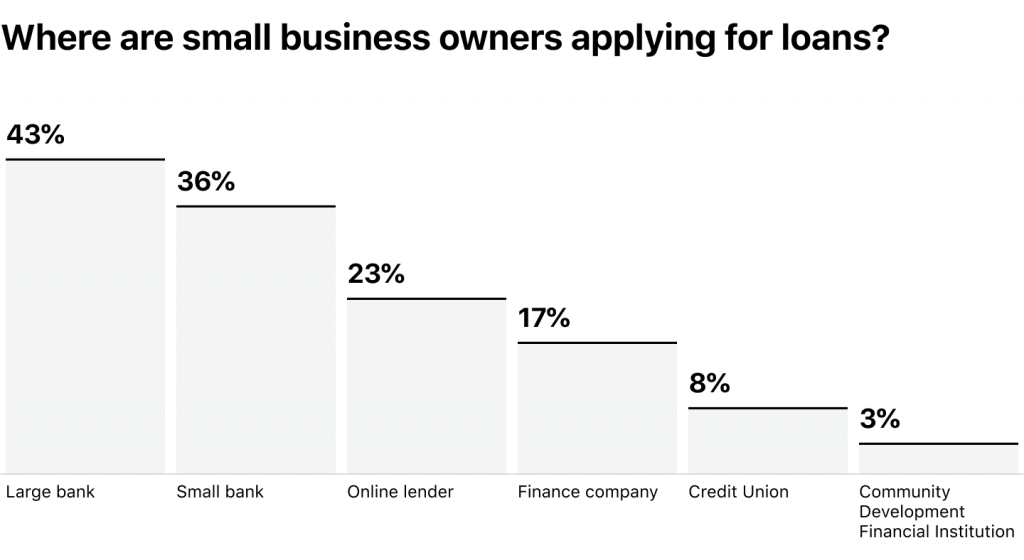

Diversified options for lenders and borrowers

How SME Lenders Can Tackle ‘Invisible Borrowers’ with Alternative Data In the past, the loan process was simple—go to the bank (most likely local) and make an application. Those days are gone. Not only is there a reduction of local branches, but services have moved online. However, digital loan processes are only step one. In addition, new forms of lending and business support have arrived, including P2P lending, DAOs, and other alternative lending platforms.

AI innovations

Undoubtedly, AI has impacted almost every industry in 2022/23 to some degree or another. Although such advancements may still be in their early stages of refinement, they are still revolutionizing the industry and will do so for years in the future. When it comes to credit trends in commercial lending, AI-usage is no exception and is being onboarded at a rapid pace by fintechs and traditional structures alike.

Do you believe AI will transform SME lending?

Personalization

This is not the first year that hyper-personalized services have reached the top of our list. As we move further into 2024, we can see that financial providers are striving to deliver services that match the needs of their clients. This trend extends beyond just personalized in-app content; it includes offering customized loans and interest rates, among other services. The availability of new tools such as Big Data and AI analytics is facilitating this shift, allowing lenders to more accurately understand and respond to individual client requirements.

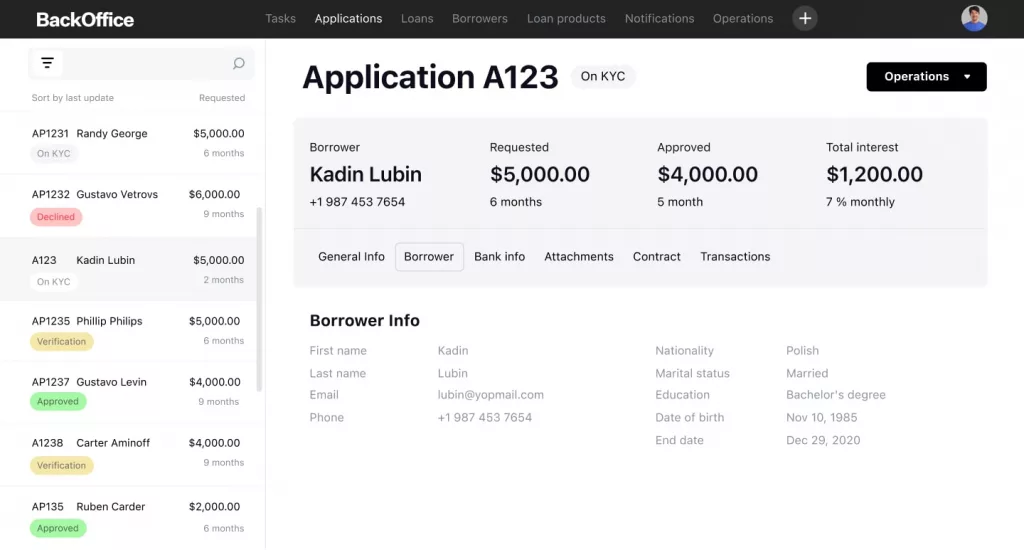

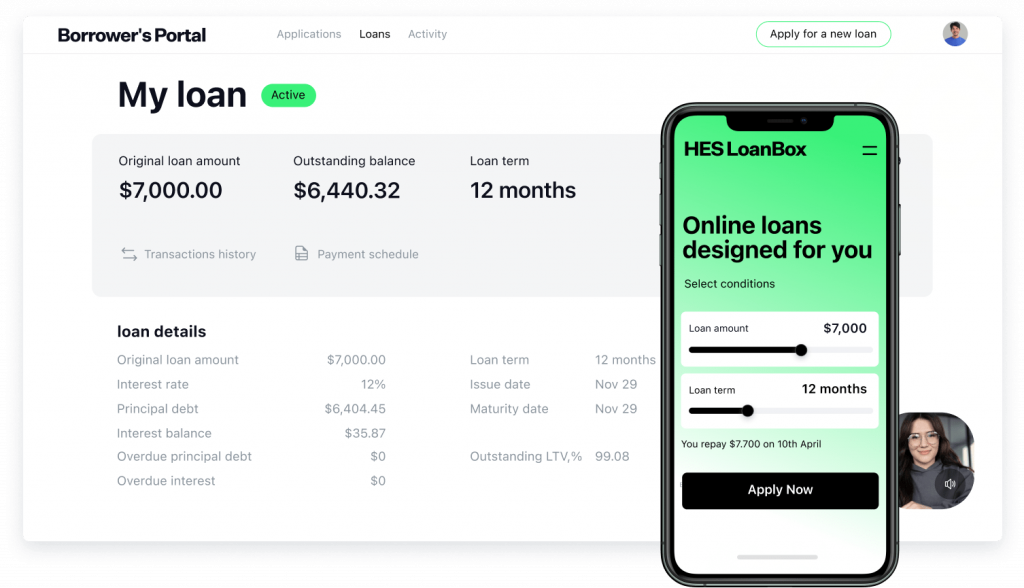

In this context, HES LoanBox can play a crucial role in enabling alternative lenders to offer highly personalized services. HES LoanBox is a comprehensive lending software that leverages the power of AI and machine learning to provide sophisticated, tailored solutions for lenders. Here’s how it can support the trend of personalization in the following ways:

- Data-driven decision making: HES LoanBox utilizes Big Data analytics to gather and process vast amounts of information. This allows lenders to make more informed decisions based on a borrower’s creditworthiness, financial history, and other relevant factors. By analyzing this data, lenders can offer loans and terms that are more aligned with each borrower’s specific situation.

- Customized loan products: The platform supports the creation of customized loan products. Lenders can design loan offerings that cater to the unique needs of different customer segments, whether they are small businesses, startups, or individuals with specific financial requirements.

- AI-driven risk assessment: AI algorithms in HES LoanBox help in assessing the risk associated with each loan application more accurately. This technology enables lenders to identify potential risks and make more precise lending decisions, which is particularly valuable for alternative lenders who often deal with non-traditional borrowers.

- Real-time analytics: The platform provides real-time analytics and reporting, giving lenders immediate insights into their loan portfolios. This feature helps in continuously refining and personalizing lending strategies based on up-to-date data.

- Automated processes: The automation capabilities of HES LoanBox streamline various lending processes, from loan origination to underwriting and servicing. This efficiency not only speeds up the lending process but also allows lenders to offer a more personalized experience by reducing the time spent on manual tasks.

- Integration capabilities: HES LoanBox can integrate with various third-party services and data sources, enhancing its ability to offer personalized services. For example, integration with credit bureaus and financial databases can provide deeper insights into a borrower’s financial health.

Embedded experiences

How to Choose Affordable SME Lending Software Popular in the retail lending world, embedded experiences are making their way into the business world as well. Companies will soon start to find embedded, smart lending experiences across the apps and programs they use, including financial management software. This will help them to better manage their businesses and calculate results in real time.

Cybersecurity

Alongside the drive for technology and advancement, cybersecurity will play a major part in the commercial lending trends of the coming year. For companies developing commercial lending software, it’s vital to assess that adequate security measures have been taken and these are efficiently related to users to ensure their and their businesses’ ultimate security at the end point. As cyber criminals continue to use more devious means to infiltrate or defraud businesses, companies should take extra care in this area..

Regulatory advancements

With the advent of cryptocurrencies and advancements of digital banking, regulatory measures are a hot discussion at the moment. As the regulators battle out the next generation of laws for finance, companies operating in the arena need to ensure they are aware of upcoming and already implemented changes. To do so, many are employing smart technology that keeps watch on changes and helps developers update platforms based on the latest regulatory updates.

Evolving business requirements

With the advancement of technology, business requirements are evolving. Clients are increasingly seeking innovative methods to manage their credit, such as through intelligent dashboards or more flexible payment options. Consequently, companies are exploring new approaches to streamline the entire credit process. Effective use of technology is pivotal in this regard. Advanced modules capable of analyzing credit risk, calculating repayment terms, identifying problematic loans, and enabling proactive intervention are essential. The key challenge for companies lies in effectively integrating these technologies to enhance their services, ensuring seamless compatibility with existing legacy software and tools.

With HES LoanBox, borrowers are offered a seamless and flexible application process. One of the key features of our platform is its ability to save the progress of a loan application, even when a borrower switches devices. This means a client can start their application on one device, such as a computer, and then switch to another device, like a smartphone or tablet, without losing any of the information they have already entered. This level of convenience and user-friendly design ensures a smoother, more efficient loan application experience for borrowers.

Wrapping Up Credit Trends in Commercial Lending

As financial organizations adjust their plans for 2024, it can be all too easy to take an adaptation to survive. Instead, we recommend taking a moment and following the mood of the market — a back-to-basics approach.

HES LoanBox Business Solution for Commercial Lending Currently, clients are interested in a seamless, efficient platform that lets them get things done efficiently — not just bells and whistles. By engaging the right, smart technology, such as AI software, machine learning tools and software, you can reinvigorate your current solutions or develop a new one from scratch to delight both clients and their customers alike.

Need help getting started? Reach out to HES FinTech and we’ll walk you through all you need to stop jumping on the bandwagon and start being an industry leader.