With small businesses inclining towards loans from banks and other institutions for that extra capital, they tend to make several mistakes that can backfire in the worst way. Mind you, even a rookie mistake for quick loan approval can turn out to be a big blunder, especially with consistent increase in interest rates over the last two years.

This blogpost points out all the common mistakes in small business lending and their viable solutions to save yourself from the bear trap of hefty or hidden loan interest amounts later. So, let’s get started!

Mistake 1: Inadequate Risk Assessment

Inadequate risk assessment is one of the top mistakes that can impact the complete performance of the entire portfolio for a small business. It comes with far-reaching consequences that can affect the overall performance. The mistake can lead to exposure to unnecessary risks as the investors may not be aware of various risks associated with the investments. It results in setting financial expectations and goals that are unrealistic. Furthermore, this mistake can result in poor diversification of the portfolio which leads to higher systematic risk.

How to Choose Affordable SME Lending SoftwareOne of the top solutions to fix this mistake is by implementing an AI-powered credit scoring system for your small business lending approach. HES LoanBox is a smart lending software that comes with a Back office module that offers an AI-powered credit scoring feature. It automates all the underwritings with smart pre-approvals. Also, it scores all the requests automatically and identifies irresponsible borrowers by analyzing their past data patterns.

Mistake 2: Overlooking UX

The second common error is neglecting the UX from the perspective of lending business managers. Often, complex or unintuitive software can hinder a manager’s ability to effectively oversee and manage loan applications and borrower interactions. This can lead to inefficiencies and potential loss of business.

To remedy this, it’s crucial for lending software to offer features that streamline management tasks and improve overall operational efficiency. For instance, a portal that rapidly addresses managerial concerns and supports mobile access can significantly enhance productivity. Clear communication and transparency, facilitated by a well-designed UX, are essential.

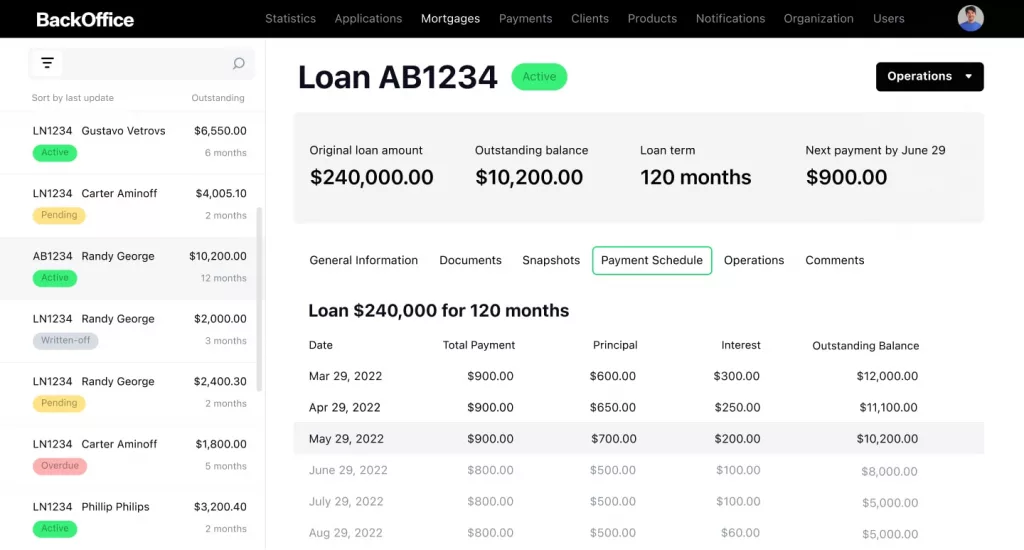

So, it is best to shift to alternative business lending software like HES LoanBox which comes with an intuitive portal and dedicated modules that can be used by borrowers and small business lending owners and managers. The no-code software is pretty easy to learn as employees need no technical training to work with it. The Back Office module of the software comes with an intuitive task management dashboard that allows the owner to manage and oversee everything. One can check all the tasks, applications, active loans, and potential borrowers under a single roof.

Mistake 3: Limited Product Flexibility

Commercial Lending Trends 2024One of the common business loan mistakes is offering limited product flexibility, which can lead to several negative consequences. You have to understand that all small businesses are unique and the one-size-fits-all approach will not work in the online lending arena. The limited flexibility can hurt you as you will not be able to offer the correct loan option to the correct small business. Moreover, with the rising competition, limited product options will leave you behind as borrowers always opt for options with high flexibility. The most important thing is that the market comes with a capricious nature that cannot be handled with limited product flexibility.

The best way to fix this mistake is to regularly assess the financial landscape and collect proper customer feedback. Once you get the customer feedback, analyze it and take the necessary steps to remove the negative points. Also, it is essential to adapt to the new changes in the market and evolve with it. You have to stay agile and adjust your product offering on a regular basis. With flexible product options, you can easily cater to the diverse needs of small businesses.

Mistake 4: Inefficient Loan Processing

Inefficient loan processing is another mistake that can adversely affect small business lending if not fixed promptly. The manual loan processing can lead to several human errors which can affect the overall turnaround time. Small businesses often require quick access to funds, and delays in processing can be detrimental to their operations. Moreover, manual processes can add stress to your budget as it is a labor-intensive task. In addition to all this, manual processing of loans can lead to inconsistent decision making which is not a good sign in small business lending. Besides all this, manual processes cannot struggle in scaling while the applications of load increase which can delay everything.

One of the best ways to tackle this issue is by leveraging the power of technology and shifting to a reliable solution. HES LoanBox can manage the whole lifecycle of a loan from origination to debt collection. It offers proper modules to manage everything and comes with several automated features that scrutinize the borrowers and pre-approve the loan application. Moreover, it offers informative reports and analytics that you can use to improve your lending strategy and enhance your overall loan management.

Mistake 5: No Data-Driven Decision Making

HES LoanBox Business Solution for Commercial LendingThe lack of business intelligence in decision-making can become a critical mistake in small business lending. The lenders are not able to make wise decisions without proper insights and robust data analytics. They have to rely on subjective judgments to make decisions which increases the risk exposure due to inconsistent evaluations.

Business intelligence tools enable the assessment of creditworthiness, risk mitigation, and strategic planning which improve the overall decision-making approach and enhance portfolio management.

HES LoanBox comes with automatic reporting that offers deep insights that you can use to adjust your strategy. You can make informed business decisions and stay alert with all the power of data in your hands.

Final Verdict

These are some of the most common mistakes that occur in the domain of small business lending. HES LoanBox serves as a LaaS platform that offers digital loan origination, flexible loan servicing options, and automated underwriting. The platform can be easily customized to clients’ customer requirements and offers simple management for all tasks from a single dashboard. You can check all the features and pricing of HES LoanBox or contact us directly to secure your free demo.