Nowadays, when applying for credit, borrowers are searching for comfort, transparency, and a smooth process of getting money. Loan servicing software has become a must-have for lenders in today’s digital and highly regulated world. It automates a lot—from calculating interest to processing payments and tracking overdue accounts.

Beyond automation, these tools solve major pain points like scattered data, manual errors, and slow workflows. By streamlining routine tasks and supporting compliance through audit logs, workflow controls, and reporting, they cut costs and build borrower trust. Innovative platforms also keep your team organized, accurate, and ready to respond quickly, while making sure you meet regulatory requirements and scale as your business grows.

By exploring the eight options in this article, you will be better prepared to choose a solution that works today and positions your company for future success.

What Are the Key Elements of a Loan Servicing System?

When searching for loan management solution, we advise you to focus on automation, compliance, security, ease of use, scalability, and cloud support. These make a big difference—helping you stay secure and compliant, speed up loan processing, and simplify financial management with built-in accounting functions.

Key elements to prioritize:

- Automated billing and computation

All payment-related tasks should be handled automatically. This includes generating repayment schedules for different loan types (such as annuity or differentiated), calculating interest, penalties, and fees, and supporting partial or early repayments without manual intervention. - Omnichannel integration

Borrowers expect flexibility. A strong system connects with online banking, mobile apps, and external tools through APIs. It must additionally incorporate payment gateways and e-wallets, enabling quick and seamless transactions. - Credit risk and delinquency monitoring

Managing exposure is essential. High-tech platforms automatically send reminders and notifications to clients, classify overdue accounts, calculate reserves, and seamlessly integrate with credit bureaus to ensure accurate credit assessments. - Information analysis and reporting

Sound decisions rely on clear visibility. Dashboards should deliver live portfolio tracking, generate compliance reports (from IFRS and Basel III to AML and risk analytics), and leverage predictive analytics to anticipate defaults and reveal emerging trends. - Data protection and regulatory alignment

Safeguarding confidential information is a must. Leading solutions employ encryption, adhere to frameworks like GDPR and ISO 27001, and monitor user actions to maintain transparency and security. - Flexibility and growth readiness

The platform should scale effortlessly. This includes support for both horizontal scaling, by adding more servers or nodes to handle increased workloads, and vertical scaling, by upgrading existing hardware to boost performance. Choose solutions that allow new products to be introduced without altering the core system and that offer adaptable workflows and configurable business rules to match your unique operations.

Top Loan Servicing System Comparison

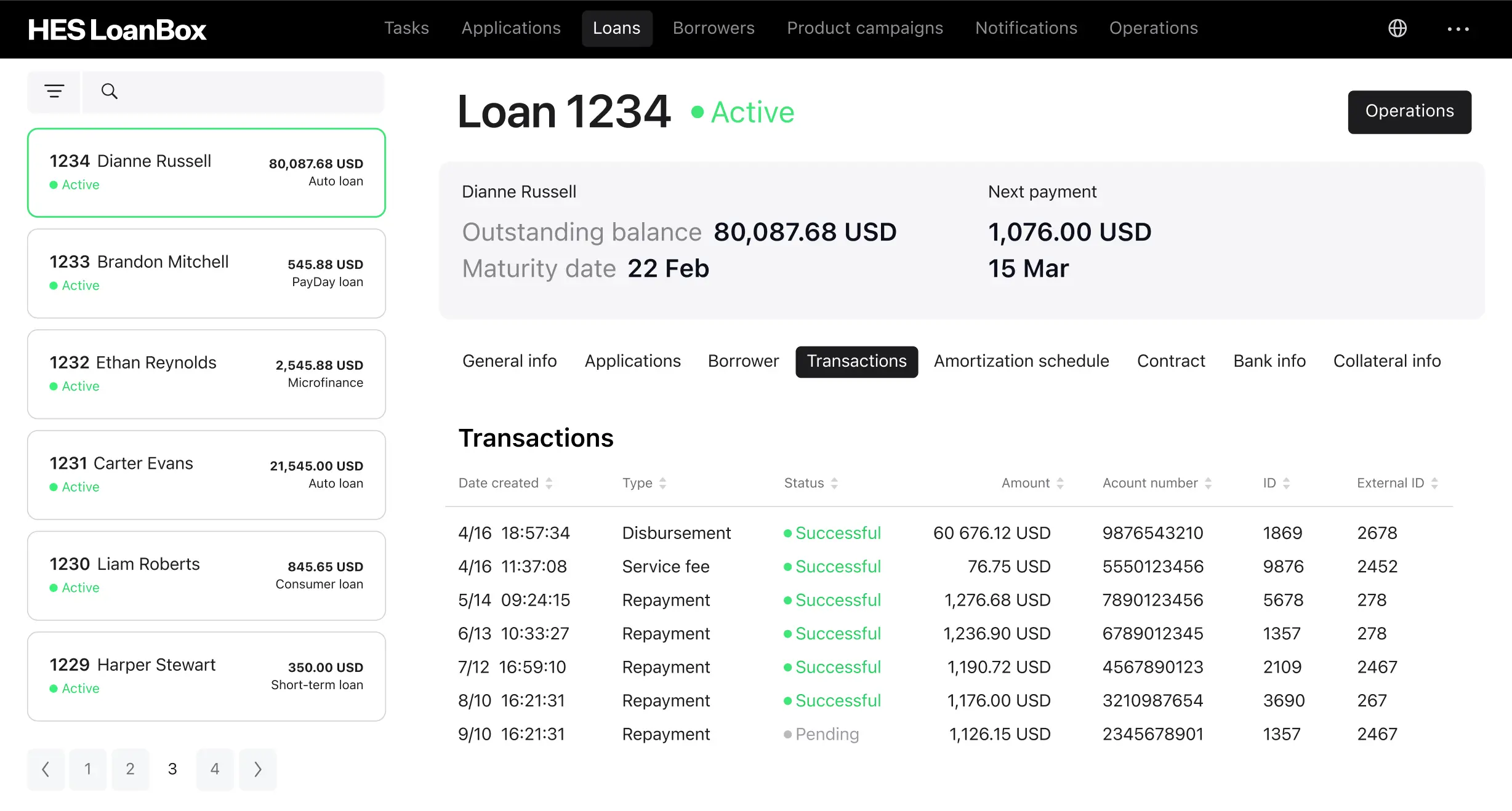

1. HES LoanBox

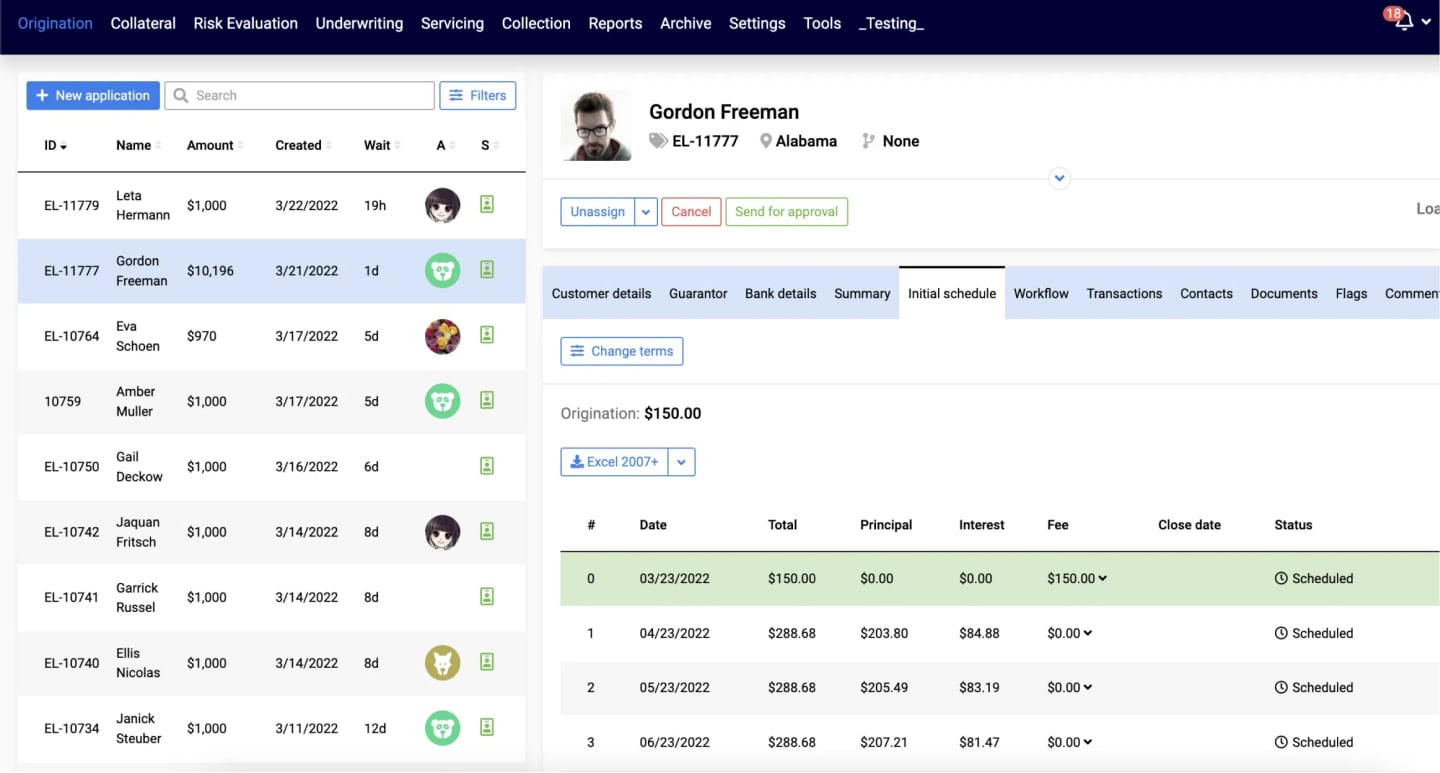

The core product, HES LoanBox loan servicing software, represents the next generation of intelligent lending technology. It gives lenders a competitive advantage by combining modular architecture, full-cycle automation, AI capabilities, a high level of customization, and the possibility of full ownership of the solution that general-purpose lending platforms cannot match.

Ideal for

- Fintech companies (digital lending platforms, neobanks launching credit products)

- Alternative lenders, banks

- Embedded lending providers (BNPL, retail, healthcare, B2B financing)

- Auto/vehicle finance companies

- Leasing firms

- Microfinance institutions

Core capabilities

- Digital loan origination with automated KYC/AML

- Configurable underwriting and rule-based decisioning

- Integration with credit bureaus, Open Banking, and fraud-prevention services

- Flexible loan product engine for any loan type (consumer, SME, BNPL, leasing, auto)

- Automated disbursement and repayment workflows

- Dynamic schedule management: interest, fees, accruals, restructures

- Real-time loan and asset tracking across the entire portfolio

- Automated collections

- Borrower communications: SMS, email, reminders, PTP tracking

- Analytics dashboards with performance, risk, and regulatory reporting

- Financial reporting (SPV, trusts, fund structures)

- Secure document management with e-signature and full audit log

- Multi-language support

- Open API for embedded lending and external system integrations

Key strengths

- End-to-end digital onboarding with automated workflows, omnichannel borrower access, and seamless KYC/AML checks.

- High configurability and modularity. Use LoanBox as a full end-to-end lending platform or integrate only the required microservices based on your workflow, regulatory environment, or lending model (consumer, SME, BNPL, auto, leasing).

- Optional developer license option that eliminate vendor lock-in and provide full control for internal development teams.

- Built-in compliance automation ensuring adherence to security standards, audit requirements, and financial regulations.

- Optional AI-powered decisioning via the GiniMachine engine for application scoring, risk modeling, fraud detection, and optimized collection strategies.

- Advanced document automation with configurable templates, e-signatures, and borrower-facing flexibility for agreements and communication workflows.

- Rich analytics ecosystem featuring customizable dashboards offering real-time insights into loan performance, portfolio quality, and operational KPIs.

- Fast deployment and scalability, with a typical launch in 3 months and a modular architecture that supports growth, new product launches, and regional expansion.

Key limitations

- Integration and workflow configuration may require technical expertise, especially in complex IT ecosystems.

- Higher upfront implementation costs compared to lightweight SaaS tools may be challenging for smaller lenders.

- Deep customization capabilities can extend deployment timelines and require structured project planning.

- Advanced analytics and AI-driven modules may require additional staff training to achieve full value.

Price model: HES LoanBox operates on a fixed annual subscription with no additional fees for user seats, application volumes, transactions, or data usage. The only extra costs apply solely to optional customization and implementation work requested by the client.

Demo access: rovided upon request.

Rating (G2, Capterra and Software Advice)

HES LoanBox holds a 4.8 out of 5 on Capterra, with high marks for ease of use, customer service, and feature set. G2 lists HES LoanBox at 4.5 out of 5. This indicates a solid reputation among its user base, particularly for flexibility and compliance features, while still being a specialized solution in the lending software market.

Summary

HES FinTech stands out for lenders who need highly configurable origination processes and advanced workflow automation. Its modular architecture and low-code tools allow institutions to design tailored lending journeys, automate complex back-office tasks, and adapt quickly to new products or markets—all without sacrificing speed or compliance. HES is the perfect choice if you’re creating a truly unique solution and need a technology partner who collaborates with you—not just a software vendor.

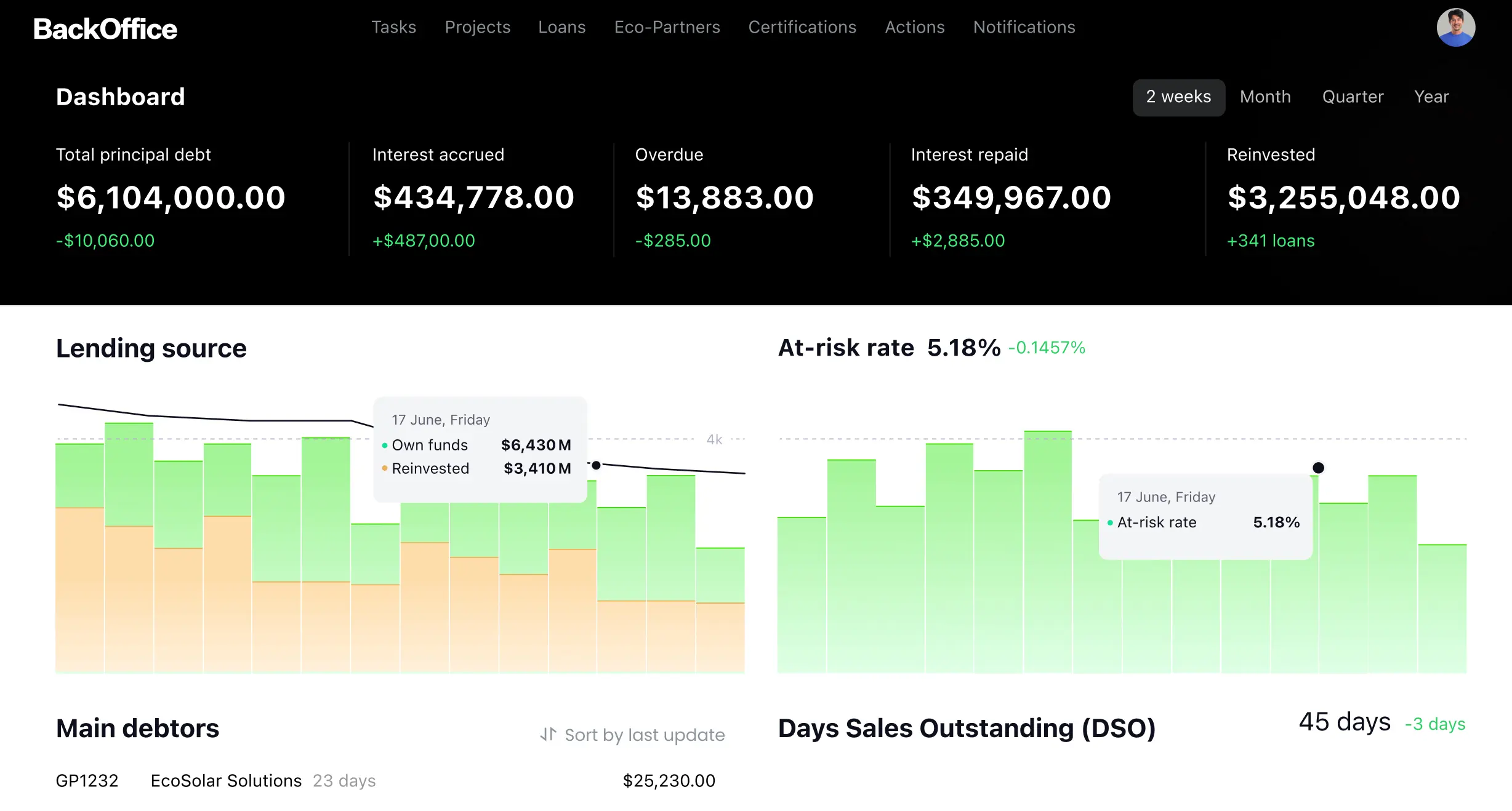

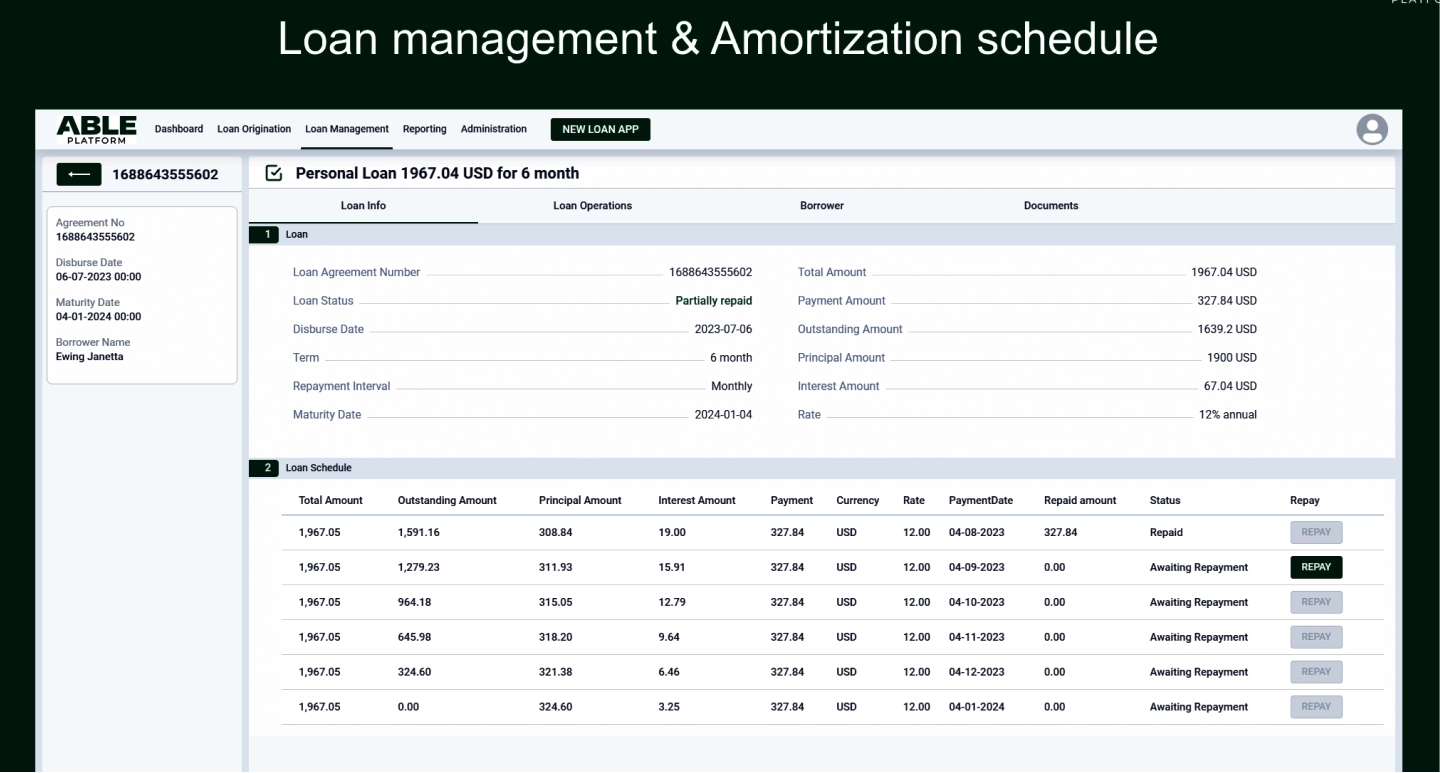

2. ABLE Platform

ABLE Platform company was founded in London in 2014. Now it has over 250 specialists across multiple regions. Its mission is to simplify lending operations, lower costs, and let lenders roll out new loan products quickly—without needing massive IT projects. Its flagship product, ABLE Platform, is a low-code lending system of loan origination and servicing in banks.

Ideal for

- Big, global players (companies, banks, etc.) with huge capital and complex systems running large-scale lending portfolios (Tier 1)

- Mid-sized, regional players or regional banks upgrading legacy systems (Tier 2)

- Alternative lenders, such as microfinance groups or credit unions

- Fintech firms that need integration-ready, flexible technology

Core capabilities

- Loan origination and underwriting automation

- Customer onboarding and KYC

- Payment scheduling and collection

- Risk management with AI/ML models

- Document management and e-signature

- API-based third-party integrations

- Available in SaaS (cloud) and on-premises versions

Key strengths

- Highly customizable workflows and lending models

- Fast time-to-market (minimum 2–4 months)

- Strong compliance and fraud protection tools

- Omni-channel borrower experience

- Proven scalability for Tier 1 and Tier 2 banks

Key limitations

- On-prem installations can be costly upfront

- Some customizations still need technical help

- The interface can feel complex for small institutions

- Requires staff training during setup

- Fewer third-party plug-ins than major global vendors

- Custom reporting for niche metrics can take extra effort

- Better suited to mid- and large-scale lenders

Price model: Custom pricing based on scope and modules. No free version.

Demo access: Provided on request via the official website.

Price scheme

Cloud (SaaS): from $500 per month.

On-premises: from $60,000+, excluding customization.

Demo access

ABLE provides a public trial and offers prospective clients the option to request a live guided demo via its official website.

Rating (G2, Capterra and Software Advice)

While ABLE receives a 5.0 score on Capterra, the number of reviews is currently limited. G2 does not appear to have a dedicated listing for ABLE yet. This suggests the platform may be newer to these review ecosystems or more niche in its market.

Summary

ABLE Platform gives lenders a scalable, flexible foundation to modernize loan operations. It’s fast to deploy, packed with automation, and ideal for institutions that want digital efficiency without heavy development work.

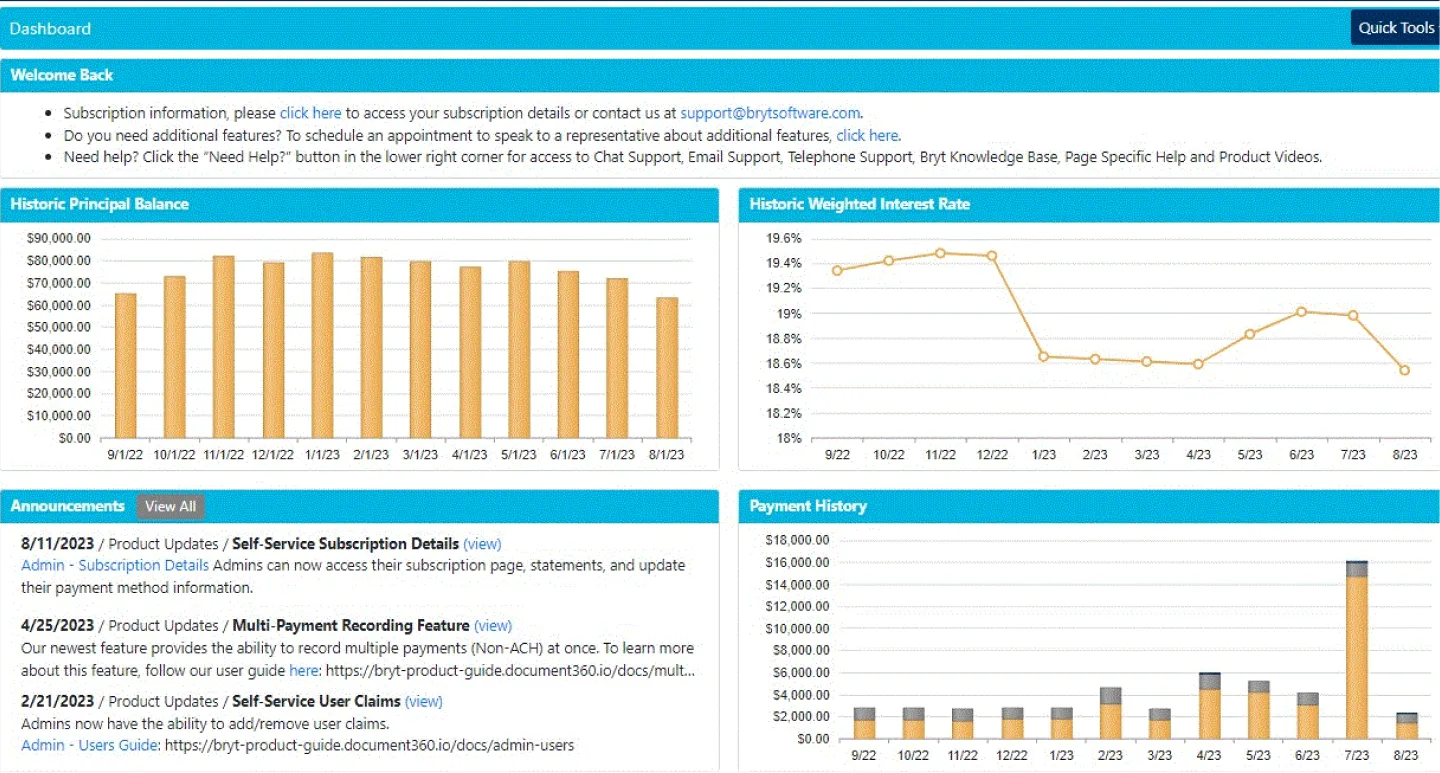

3. Bryt Software

Bryt Software LLC was founded in 2016 and is headquartered in California, USA. The company was created to provide a loan-servicing platform that is both flexible and easy to use. The idea is to deliver modern loan management tools without the complexity and cost of legacy systems. Bryt Software offers a streamlined alternative to bulky legacy systems while supporting varied loan portfolios.

Ideal for

- Smaller banks, credit unions, CDFIs, and private lenders

- Real estate and property-based lenders managing loans and investor relationships

- Fintechs and specialty lenders

Core features

- Single interface for servicing, monitoring, and client engagement

- Flexible setup for tailored loan products and schedules

- Dedicated portals for borrowers and lenders for independent management of accounts

- Automated servicing workflows

- Reporting tools with real-time metrics and data export

- Cloud-hosted on Microsoft Azure

Key strengths

- Fast onboarding and intuitive interface

- Flexible loan servicing and custom configurations

- Scalable cloud infrastructure

- Integrated ecosystem with API connectivity

- Transparent pricing and white-label portals

Key limitations

- Less suited for very complex, enterprise-scale portfolios requiring deep custom workflows

- Integration with legacy or highly unique systems may need external effort

- Advanced modules (e.g., escrow/impound, asset tracking) may require add-ons or upgrades

- Pricing tiers can lead to incremental costs as usage expands

- Fewer large-bank references compared to major enterprise platforms

Rating (G2, Capterra and Software Advice)

Bryt Software holds a strong reputation on Capterra, with an overall score of 4.8 out of 5, praised for ease of use and exceptional customer support. On G2, Bryt currently has no published reviews, suggesting the product is either new to that review ecosystem or primarily focused on other channels for user feedback.

Price model

The business plan is designed to accommodate approximately 5–20 active loans. Features provided include customized documentation, personalized user fields, loan monitoring, and accelerated setup.

The professional plan supports unlimited or more than 20 active loans. Capabilities such as collateral and asset management, custom documents, user field customization, and impound/escrow handling are included.

The enterprise plan allows unlimited loans and multiple user access. Advanced tools for asset and insurance tracking, along with comprehensive modules, are provided.

Demo access

The platform offers a 30-day free trial. Guided demonstrations and trial access are available.

Summary

For lenders seeking a service-friendly, cost-effective platform with modern features and low operational overhead, Bryt Software is a match. It delivers solid automation and configurability without enterprise-scale complexity. If your lending business handles highly complex loan products, massive portfolio volumes, or deep integration requirements, you may need to assess whether Bryt’s feature set aligns fully with those demands.

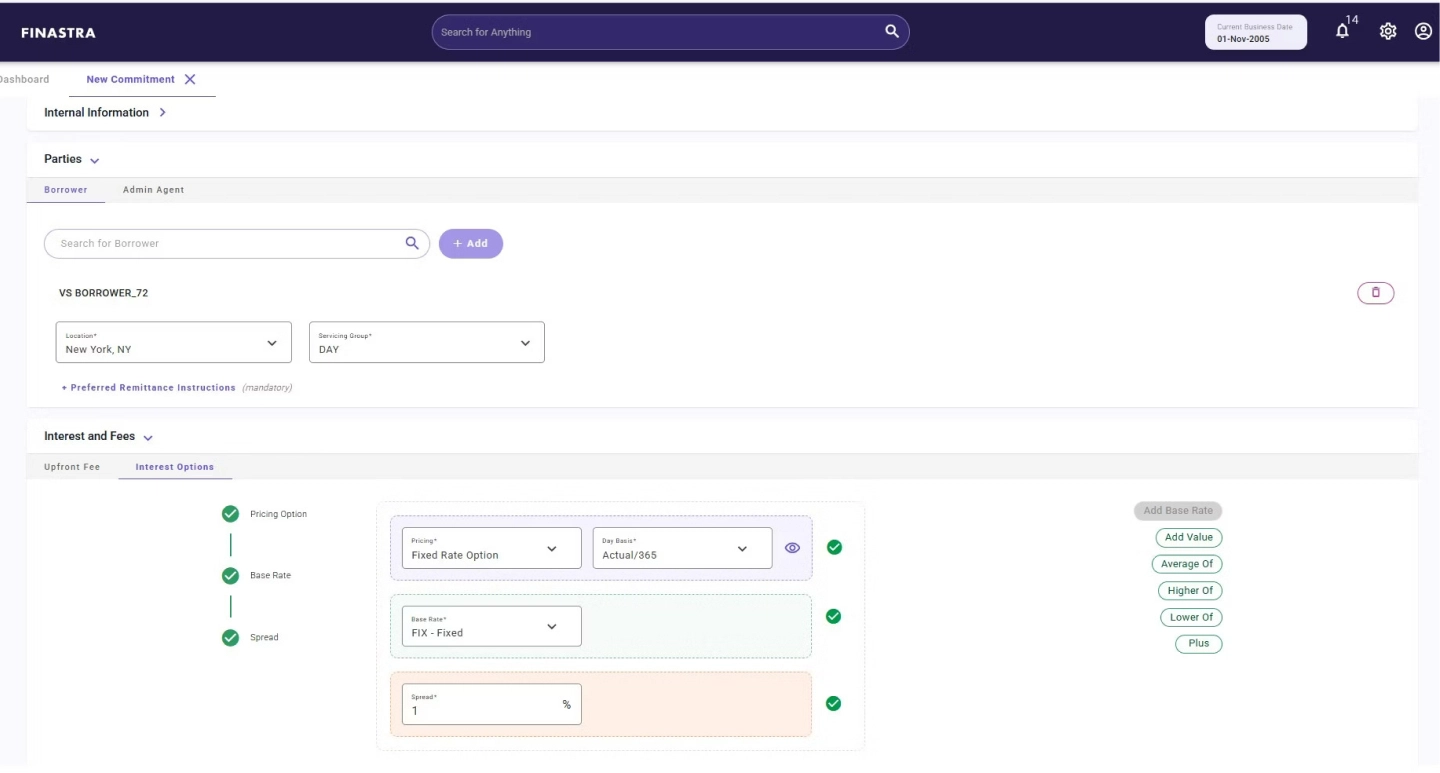

4. Finastra

Finastra is a UK-based financial technology firm formed in 2017 with headquarters in London. It operates globally, focusing on digital transformation and open banking. Its flagship product, Finastra offers Loan IQ, a platform focused on servicing, booking, and lifecycle management of commercial and syndicated loan portfolios. For upstream origination or application workflows, it integrates with other systems or modules (such as Loan IQ Build or third-party origination tools).

Ideal for

- Tier 1 global banks

- Regional and Tier 2 banks

- Fintech firms integrating with large banking systems

- Alternative lenders and microfinance organizations

Core features

- Facilitation of corporate, syndicated, SME, and bilateral lending

- Sophisticated risk control and credit exposure tracking

- Multi-currency, multi-entity, and global deployment capability

Key strengths

- Enterprise-grade scalability for large institutions and complex credit portfolios

- Proven reliability through global bank deployments

- Coverage of commercial, syndicated, and structured lending products

- Automation of origination, servicing, and syndication workflows

- Advanced risk, exposure, and collateral management

- API architecture and integrations with core banking and external systems

Key limitations

- Less flexibility for highly bespoke or non-standard workflows compared with more open platforms

- Not every operation in the system is exposed via API. Developers may still have to rely on manual steps, file imports, or database procedures

- Onboarding and deployment tend to be lengthy and resource-intensive

- No public, standard pricing is published—budget estimation is more difficult

- Requires significant internal IT and operational support for full utilization

- Licensing modules may vary by functionality and geography, adding complexity

Price model: Not publicly available. Finastra provides tailored quotes based on the size of the institution, the scope of deployment, the modules required, and the complexity of integrations.

Demo access: Freely accessible self-service trials are not offered. Prospective buyers must engage via Finastra’s enterprise sales team.

Rating (G2, Capterra and Software Advice)

Finastra’s Loan IQ holds a moderate reputation on G2, with an overall score of 3.1 out of 5, reflecting mixed feedback on usability and complexity. On Capterra, the product currently has no published reviews, which may indicate limited engagement on that platform or a focus on other feedback channels.

Summary

Finastra’s Loan IQ is a comprehensive solution designed for large financial institutions that deal with complex loan products and high volumes. It offers strong automation, risk management, and integration capabilities—but with that comes cost, complexity, and longer implementation timelines. It’s best suited for enterprise-scale environments rather than smaller or quickly moving lenders.

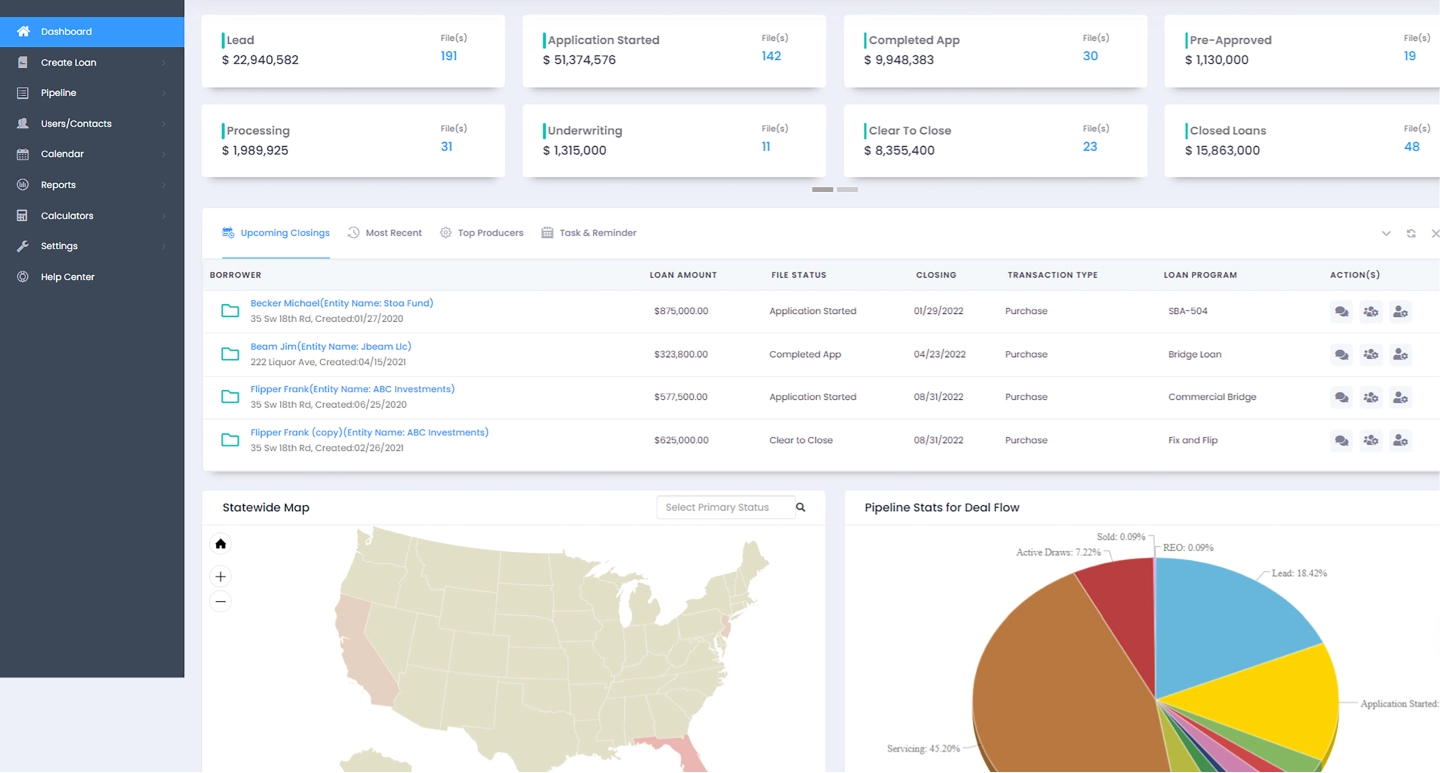

5. LendingWise

LendingWise is a US-based lending software provider focused on the real estate and commercial finance sector. The platform was built to centralize lead intake, underwriting, loan management, and servicing in a single system. Its mix of CRM tools, configurable workflows, and borrower portals makes it especially attractive to lenders that handle non-standard or document-heavy loan products.

Ideal for

- Private lenders and hard-money lenders

- Commercial and real estate finance firms

- Mortgage brokers and loan originators

- Small and mid-sized lending companies with custom workflows

Core features

- Built-in CRM for managing pipelines, tasks, and communication

- Customizable workflows for origination, processing, and servicing

- Borrower and broker portals for document uploads, status updates, and payments

- E-signature support for faster agreement execution

- Automated document handling and compliance tracking

- Solutions for payment recovery and ongoing portfolio oversight

Key strengths

- Flexible workflows for diverse lending models, including real estate deals

- Borrower and broker portals for streamlined communication

- Fast onboarding and short learning curve

- Integration library with Zapier and third-party systems

- Unified platform for origination and servicing

- Support for multi-role teams across the lending lifecycle

Key limitations

- Primarily optimized for real estate and commercial finance—less universal than some loan origination systems platforms

- Customization can require setup time to get the most value

- The interface and visual design are functional but not as modern as newer fintech UI styles

- Limited appeal for large enterprises or highly regulated banking environments

- Reporting is solid, but some advanced analytics require external BI tools

Price model: LendingWise offers tier-based subscription pricing, depending on features, users, and modules. Rates are not listed publicly, and quotes are provided after consultation.

Demo access: A guided demo and trial access are available upon request through the vendor’s website.

Rating (G2, Capterra, and Software Advice)

LendingWise enjoys a strong reputation on Capterra and Software Advice, with an average score of 4.6 out of 5. Users frequently highlight its flexibility, responsive customer support, and customizable workflows as key strengths. On G2, the platform currently has limited visibility.

Summary

LendingWise is a strong fit for private lenders, brokers, and commercial real estate finance teams that want a flexible pipeline-to-servicing platform with built-in CRM tools. It offers solid workflow automation and borrower portals at a reasonable complexity level. It is less suited for large enterprise banks but highly effective for specialized lending operations.

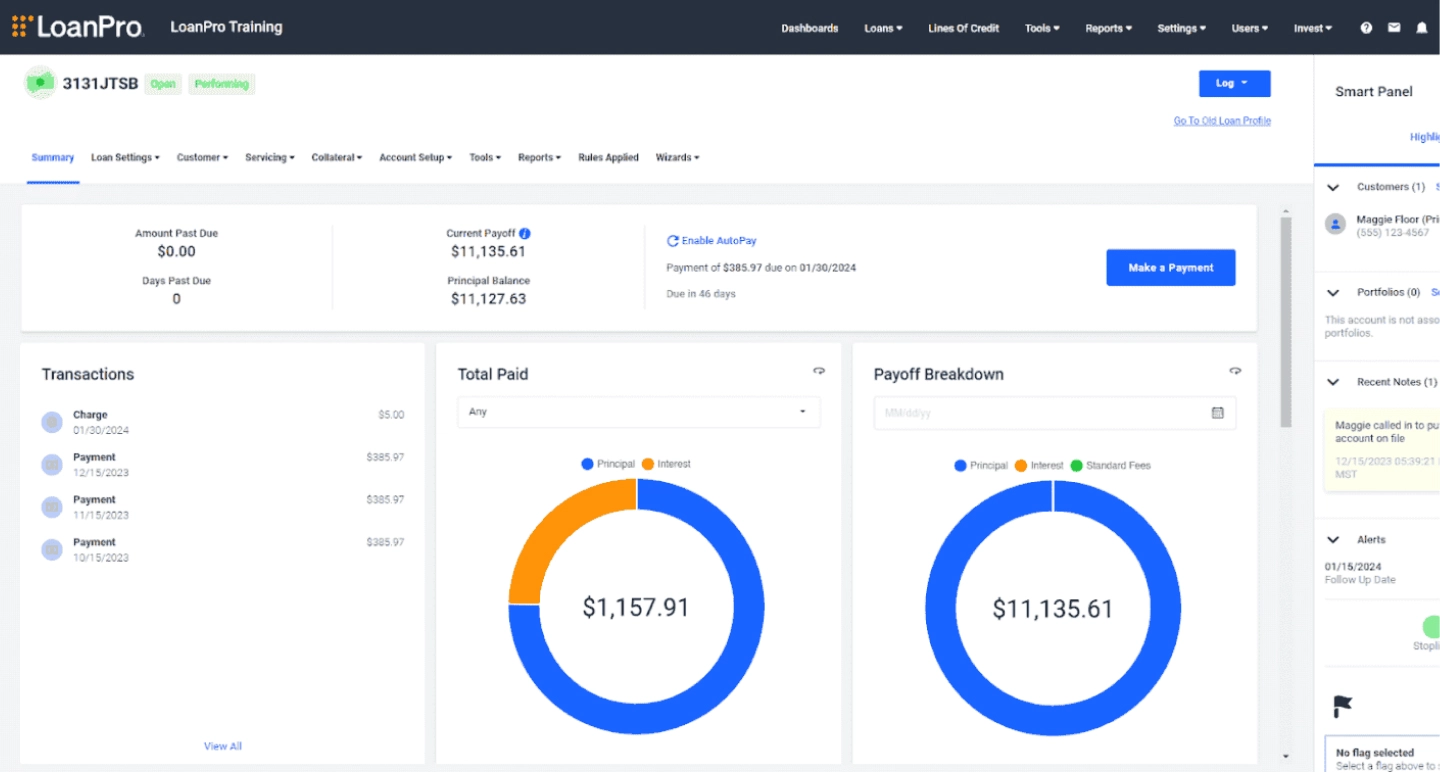

6. LoanPro

Founded in the USA, LoanPro is built for lenders that want control, flexibility, and strong automation without having to custom-code every workflow from scratch. It’s especially popular with fintechs and modern lending teams thanks to its API-first approach, secure infrastructure, and clear audit trails.

Ideal for

- Consumer lenders and fintech startups

- Banks managing multiple loan products

- Auto finance, point-of-sale, and lease management firms

- Micro-lenders and community-based financial organizations

Core features

- Suitable for every loan category: personal, business, vehicle, and credit lines

- Flexible loan management with auto-scheduled payments

- APIs for connecting to CRM tools, finance platforms, and payment systems

- Compliance automation aligned with US and international law regulations

- Instant reports with interactive data dashboards

- Customizable tools for collections and client alerts

- Cloud-native system built for growth and dependable performance

Key strengths

- Support for multiple lending models and multi-brand environments

- Security protocols and audit trails for regulatory compliance and portfolio transparency

- API connectivity with CRMs, ERPs, and payment processors

- White-label borrower portals and operator-focused interfaces for brand consistency

- Automated payments, recurring billing, instant disbursements, and borrower self-service tools

- Advanced analytics and portfolio visibility for actionable insights

Key limitations

- Customization complexity—requires technical knowledge for setup

- Some API endpoints are limited to higher-tier plans

- Pricing transparency is limited; costs vary by feature usage

- Focused mainly on North American regulations, global users may need extra configuration

- No offline mode—internet connection required for all functions

- Initial learning curve for non-technical staff

Price model: LoanPro’s pricing depends on loan volume and features used. Packages are quote-based after consultation, typically including setup, transaction, and monthly access fees.

Demo access: It is possible to schedule a guided demo (via LoanPro’s sales team). No public “free trial” is generally advertised.

Rating (G2, Capterra, and Software Advice)

LoanPro holds a strong reputation on Capterra, with an average rating of 4.8 out of 5, reflecting high user satisfaction. Customers frequently praise its robust compliance features, flexible lending configurations, and reliable API integrations. On Software Advice, the platform maintains similarly positive feedback, emphasizing ease of automation and scalability. However, LoanPro currently has limited visibility on G2.

Summary

LoanPro is a strong choice for lenders who value flexibility, compliance, and integrations—and who don’t mind some technical setup to get everything right. It’s well-suited for fintechs, auto lenders, and consumer finance providers that prioritize integration and compliance, though it may require more technical management compared to simpler platforms.

7. Nortridge

Nortridge Software is a company based in the USA offering the Nortridge Loan System—a platform for loan servicing and portfolio management built for lenders who need high flexibility. It supports a wide range of loan types and provides tools to automate servicing, manage investors, and tailor workflows in detail.

Ideal for

- Mid-sized and large lenders with complex servicing needs

- Credit unions, banks, and private lenders handle diverse loan portfolios

- Specialty lenders offering non-standard or niche loan products

- Loan servicers managing multiple investors or participation structures

Core features

- Complete loan servicing from setup and payment processing to final closure

- Supports multiple loan types: personal, business, auto, specialty, and credit lines

- Tools for managing investors and tracking cash flow accurately

- Customizable dashboards with in-depth reports and easy data export

- Pre-built APIs for integration with external platforms

- Deployment choices: cloud or on-premise

Key strengths

- Customizable platform and adaptive servicing workflows

- Advanced reporting and portfolio analytics

- Support for multi-investor structures and complex product mixes

- Reliable servicing automation and reduced manual effort

- Established market presence and continuous product development

- Integrated collections management and configurable recovery workflows

Key limitations

- Steeper learning curve due to the depth of configuration options

- Implementation may require experienced internal resources or vendor support

- The interface and navigation are powerful but not always intuitive for new users

- Customization efforts can extend rollout timelines

- Best suited to larger or more complex lenders—not an ideal fit for small, simple portfolios

- Limited out-of-the-box borrower self-service tools—requires additional setup for portals

Price model: A standard, off-the-shelf price list is not published. The cost is based on a number of factors, including the size of the lender, the number and types of loan products, configuration/modification needs, and any integration or ongoing support required.

Demo Access: Nortridge offers demo access upon request through its sales team. There is no instant, self-service trial, but prospective clients can schedule a guided demonstration and, in many cases, receive access to a test environment.

Rating (G2, Capterra and Software Advice)

On Capterra, the platform holds an overall rating of 4.3 out of 5, based on approximately 80 user reviews. Feedback often highlights its flexibility and strong reporting capabilities.

On G2, visibility is limited, with only a single public review showing a score of 3.5 out of 5, suggesting room for improvement in user engagement.

On Software Advice, ratings are consistent with Capterra, emphasizing robust servicing features and customization options, though some users note a steeper learning curve.

Summary

Nortridge Loan System is well-suited for institutions that manage complex portfolios and need deep control over how their servicing platform operates. Its flexibility and investor-management capabilities make it a strong choice for enterprise-grade servicing environments. However, the system requires more configuration effort than simpler, out-of-the-box solutions, making it most appropriate for lenders with the scale and resources to fully leverage its customization power

8. Turnkey Lender

Turnkey Lender began in Austin, Texas, in 2014 and has rapidly expanded to serve over 200 clients in 50+ countries. The company’s goal is to simplify lending automation, particularly for financial providers that lack large IT departments. It is widely used by community lenders, fintech startups, and non-banking financial institutions.

Ideal for

- Community lenders

- Credit unions

- Fintech startups, non-banking financial institutions

- Alternative lenders

- Microfinance providers

- Payday loan companies and specialized lenders in sectors like healthcare and auto financing

- BNPL (Buy Now, Pay Later)

Core Capabilities

- ML-powered system for credit scoring and lending decisions

- All-in-one solution for loan setup, management, and collections

- E-commerce and online payment integration

- SMS/email notifications for customer communication

- Sales and marketing automation tools

- Payroll and expense management for small lenders

- API access for external system integration

Key strengths

- Unified solution for loan initiation, tracking, recovery, and customer communication

- Swift deployment using pre-designed templates for quicker go-live

- ML-assisted decisioning for consistent scoring and accelerated approvals

- Cloud-based accessibility for distributed teams and remote operations

- Configurable workflows supporting multiple loan types and business models

- Built-in borrower communication tools (SMS, email, notifications)

Key limitations

- High pricing for smaller lenders; cost can be a barrier for low-volume portfolios

- Interface complexity for first-time users, requiring initial training

- Limited depth of customization compared to open-framework platforms

- Reporting and dashboards may need extra setup for specific KPIs or compliance

- Performance can slow under heavy load, as noted in some user feedback

- Integration with legacy systems may require additional effort

Price model: Fixed rates are not published. Costs depend on deployment, user counts, and selected modules and are shared after a consultation.

Demo access: Provided upon request. A self-service or instant “sandbox” trial is not publicly available.

What reviewers highlight (G2, Capterra and Software Advice)

On G2, the platform holds a rating of 4.7 out of 5, based on 18 user reviews. Feedback often highlights its ML-driven decisioning and fast deployment capabilities.

On Capterra, the solution scores 4.6 out of 5 across 36 reviews, with users praising its unified lending workflow and strong compliance features. On Software Advice, ratings align closely with Capterra, emphasizing ease of automation and multi-language support, though some reviewers note a learning curve for first-time users.

Summary

Turnkey Lender suits organizations that want a ready-to-use platform with broad automation and a short deployment timeline. For highly specialized processes, buyers should clarify customization options, reporting capabilities, and potential extra costs in advance.

Lending Platforms Comparison Table

| Platform | Positioning | Key strengths | Highest rating | Users |

|---|---|---|---|---|

| HES LoanBox | Modern lending platform for end-to-end automation and fast deployment. | Flexible workflows, rich automation, strong integrations, and advanced analytics. | 4.8 (G2 / SA) | Medium and large lenders are digitizing origination, servicing, and collections with high customization needs. |

| ABLE Platform | Enterprise-grade system for complex digital lending ecosystems. | Scalable architecture, strong process automation, and wide loan type support. | 4.7 (Capterra) | Banks and large financial organizations with multi-product operations. |

| Bryt Software | Simple and budget-friendly servicing system for smaller teams. | Easy onboarding, responsive support, clear interface. | 4.8 (Capterra/ SA) | Small lenders and property finance teams seeking straightforward servicing without complexity. |

| LendingWise | Flexible CRM-centric lending platform, especially for real estate. | Custom workflows, built-in CRM, borrower and broker portals. | 4.6 (Capterra / SA) | Brokers and private lenders managing commercial or real estate deals. |

| Turnkey Lender | All-in-one automated lending solution with AI-driven decisioning. | Unified origination–servicing– collections, fast launch, AI scoring. | 4.7 (G2) | Fintechs and non-bank lenders that want rapid automation without building IT teams. |

| Nortridge Loan System | Deeply configurable servicing platform for enterprise portfolios. | Broad loan support, customizable modules, strong reporting. | 4.3 (SA) | Large lenders that require complex servicing and investor management. |

| LoanPro | API-first servicing engine for modern lending products. | Strong API layer, advanced rules engine, scalable architecture. | 4.6 (G2) | Digital lenders and enterprises building custom lending products. |

| Finastra Fusion Loan IQ | Global enterprise system for corporate and syndicated lending. | Enterprise workflow depth, global compliance, scalability. | 4.2 (Gartner / Industry sources) | Large banks managing corporate, commercial, and syndicated credit. |

- HES LoanBox stands out for its modular architecture and advanced automation, ideal for lenders needing high customization and compliance support

- ABLE Platform offers low-code flexibility and rapid deployment for large-scale institutions and regional banks

- Bryt Software provides a simple, cost-effective option for smaller lenders, praised for ease of use and transparent pricing

- Finastra Loan IQ is built for global banks managing complex syndicated and commercial loans, offering deep risk management and enterprise-grade scalability

- LendingWise focuses on real estate and commercial finance, combining CRM tools with borrower portals for streamlined workflows

- LoanPro delivers an API-first approach for modern lenders, enabling strong integrations and compliance automation

- Nortridge Loan System suits lenders with complex portfolios and investor management needs, offering extensive configurability

- Turnkey Lender provides fast deployment and ML-driven decisioning for fintechs and SMB lenders seeking end-to-end automation

How to Find Loan Servicing Software That Meets Your Needs?

Whether you’re a small local lender looking for simplicity or a large bank managing complex portfolios, the key is finding a system that fits your needs. Here are the factors worth focusing on when evaluating lending systems.

1. Business model

- Loan types. Make sure the system supports the loans you offer—personal, business, mortgage, student, or niche products.

- Company size. Be aware that some platforms are built for startups, others for enterprise-level lenders.

- Scalability. Pick a solution that can handle higher volumes and new products without slowing you down.

2. Automation and flexibility

- Automation. Look for features like automatic payment processing, late fee calculations, and borrower alerts. These save time and cut errors.

- Customization. Make sure you can tailor workflows, communication templates, and reporting to match how your team operates—not the other way around.

3. Remember about compliance and security

- Legal compliance aid. Be certain that software assists you in corresponding to local and global lending regulations through audit logs, workflow controls, and reporting.

- Data safeguarding. Keep in mind that reliable encryption, controlled access, and ongoing security updates are essential for safety.

4. Consolidation with other tools

- CRM & accounting. Remember that integration with your existing systems is key.

- Analytics. You can keep an eye on performance with built-in dashboards or BI tools.

- API. Be aware that with open APIs, linking your tools becomes significantly faster and less complex, though some development work is still required.

5. Fast and easy setup

- Deployment speed. Analyze how quickly you can go live; cloud-based platforms often launch faster.

- Trainings. Be aware that good vendors provide onboarding, training, and support so your team gets up to speed quickly.

6. User experience

- For staff. Keep in mind the interface should be intuitive and reduce the learning curve.

- For borrowers. Consider that a clear borrower portal or app enhances clients' loyalty and satisfaction.

7. Supplier help and reliability

- Consumer support. Search for reactive, knowledgeable service—preferably 24/7.

- Performance history. Check out reviews, success stories, and what customers are saying.

- SLAs. Make sure you know the promises for uptime, quick responses, and fixing issues

Conclusion

The reviewed loan servicing software demonstrates that the right solution can automate complex workflows, reduce operational costs, and improve borrower satisfaction while ensuring regulatory alignment.

There is no universal solution. Ultimately, success depends on matching the platform to your business model, loan types, and growth plans. A system that combines automation, compliance, and flexibility will give lenders a strong advantage over time.