Alternative lending is rapidly evolving, and so must the tools alternative lenders use on a daily basis, to grow the customer base and provide exceptional service to existing customers. From credit assessment to customer communication, the right set of tools can make all the difference. Here, we explore essential tools that every alternative lender should know about. Let’s get started.

FICO

How Fintech is Transforming the Lending IndustryFICO is synonymous with credit scoring. For alternative lenders, it’s an invaluable tool for assessing credit risk. FICO scores provide a quick, standardized measure of a borrower’s creditworthiness, helping lenders make informed decisions. Beyond scoring, FICO offers analytics and decision-making solutions that can be integrated into the lending process for enhanced risk assessment.

Experian

Experian is a global leader in consumer and business credit reporting. Its detailed credit reports are crucial for lenders to understand a borrower’s financial behavior and credit history. Experian’s advanced analytics and comprehensive data sets also assist in fraud prevention and risk management, making it a top choice for alternative lenders.

Equifax

Equifax offers detailed credit reports and scores, similar to Experian, but with its own unique data insights. Its robust portfolio includes fraud prevention tools, identity verification services, and risk management solutions. Equifax’s extensive data helps lenders make more accurate and fair credit decisions.

PandaDoc

PandaDoc streamlines the document management process, a critical component in lending. It allows for the creation, distribution, and e-signature of loan documents, making the process faster and more efficient. With PandaDoc, lenders can enhance borrower experience and reduce paperwork significantly.

Their knowledge hub is quite remarkable. They not only explain how to use the product and streamline the signing process within your organization but also invite industry leaders to share their insights on business-related topics.

HES LoanBox

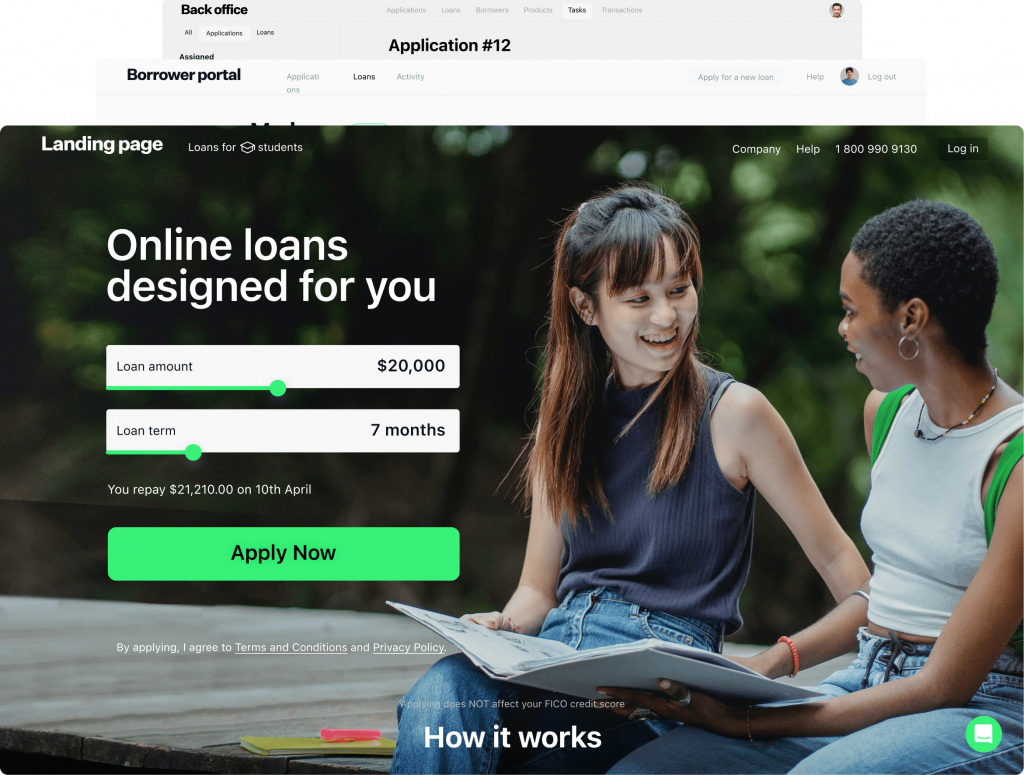

HES LoanBox is a versatile SaaS lending platform, ideal for modernizing lending processes. Our tool offers an all-in-one solution for digital loan origination, loan servicing, and automated underwriting.

At its core, it features a white-label platform, offering a high degree of customization to reflect a lender’s brand identity.

Security and user verification are paramount in the HES LoanBox environment. The platform employs an advanced KYC plugin along with biometric authentication, creating a secure and streamlined borrower verification process. This commitment to security extends to the online loan origination process, where borrowers benefit from a dedicated portal. This portal simplifies loan applications and document management, making the process efficient and user-friendly.

HES LoanBox uses AI for credit scoring. This automated underwriting system provides real-time credit scoring, enhancing the accuracy and speed of loan decision-making. The platform’s comprehensive loan management system further bolsters its efficiency. It enables lenders to efficiently manage borrower profiles, contracts, and workflows, all within a streamlined interface.

HES LoanBox Grand UpdateUnderstanding the diverse needs of the financial sector, HES LoanBox offers over 20 customizable modules and a wide range of loan software integrations. These modules are not only flexible but also scalable, ensuring that they can adapt and grow according to the evolving needs of different financing types. Rapid deployment is another key feature of the platform. Its quick implementation process and user-friendly interface require no specialized coding skills, making it accessible for a wide range of users.

QuickSight

As a part of Amazon Web Services (AWS), QuickSight offers a fast, cloud-powered business intelligence service that allows users to build visualizations, perform ad-hoc analysis, and quickly get business insights from their data.

Powered by AWS’s super-fast, parallel, in-memory calculation engine – SPICE – QuickSight delivers rapid responses to queries, allowing users to explore and visualize large datasets without any significant delay. This speed is crucial for businesses needing real-time analytics.

Plaid

Plaid is a financial services company that provides APIs for banking data. It allows lenders to securely access borrower’s financial data with consent, streamlining the underwriting process. Plaid’s technology makes assessing a borrower’s financial health quicker and more accurate.

Plaid’s APIs act as a bridge, connecting financial institutions’ databases with third-party financial applications and services. This integration allows for real-time data retrieval, including account balances, transactions, and investment portfolios, with the account holder’s consent.

Vo-Pay

How to Start a Lending BusinessVo-Pay specializes in payment processing solutions. It offers seamless and secure methods for money transfers, which is vital for lenders disbursing loans and collecting repayments. Vo-Pay’s technology ensures efficient and reliable financial transactions.

The tool supports a diverse range of transaction types, including electronic fund transfers (EFT), direct deposits, and international money transfers. This makes it an ideal solution for lenders who operate both domestically and internationally, offering them a broad spectrum of transactional capabilities.

SquarePay

SquarePay, known for its payment processing capabilities, is also beneficial for lenders. It offers an easy-to-use platform for managing transactions, whether it’s disbursing loans or processing repayments. SquarePay’s robust system can simplify financial operations for lenders.

Twilio

Twilio is a cloud communications platform that enables lenders to engage with customers through various channels like SMS, email, and voice. Personalized communication enhances borrower experience and Twilio’s scalable solutions make it easier to maintain customer relationships.

SendGrid

SendGrid, now part of Twilio, focuses on email marketing and communication. It provides tools for creating and managing email campaigns, essential for customer engagement and retention strategies in lending. SendGrid’s analytics also help in understanding and improving email performance.

Communication Tools

Effective communication tools are indispensable for businesses to thrive. Mailchimp, Slack, and Zoom stand out as three pivotal platforms, each serving unique communication needs while complementing each other in a business’s technology ecosystem.

Mailchimp is a marketing automation platform and email marketing service that has evolved into a comprehensive solution for small to medium-sized businesses. It specializes in creating, sending, and analyzing email campaigns, making it a go-to tool for targeted marketing communications. With its user-friendly interface, businesses can design compelling newsletters, automate their email marketing strategies, and track the effectiveness of their campaigns through detailed analytics. Mailchimp’s strength lies in its ability to facilitate personalized communication with customers at scale, making it an essential tool for customer engagement and retention.

Slack, on the other hand, revolutionizes internal business communication. It’s a messaging app designed for teams and workplaces that streamlines the way colleagues interact with each other. Slack offers organized channels for different projects or departments, direct messaging, and the ability to share files and media. Its integration capabilities with other tools and software make it an efficient hub for team collaboration.

Zoom has become synonymous with video conferencing, especially in the context of the increase in remote work and virtual meetings. It offers reliable, high-quality video and audio conferencing, along with features like screen sharing, virtual backgrounds, and breakout rooms. Zoom caters not only to business meetings but also to webinars, online training, and even virtual social events. Its ease of use and robust performance, even with low bandwidth, make it a preferred choice for businesses needing a reliable tool for face-to-face communication regardless of geographical barriers.

Conclusion

The right combination of these tools can significantly enhance the efficiency, accuracy, and customer experience in alternative lending operations. It’s worth noting at this point that HES LoanBox serves as a one-stop-shop for the needs of alternative lenders, offering integrations of the aforementioned tools under one unified platform.

Interested in seeing how it works? Contact us today and secure your personalized demo.