The best debt collection software can upend the way businesses manage overdue accounts and help finance teams recover payments faster, automate routine follow-ups, and keep every customer interaction organized in one place.

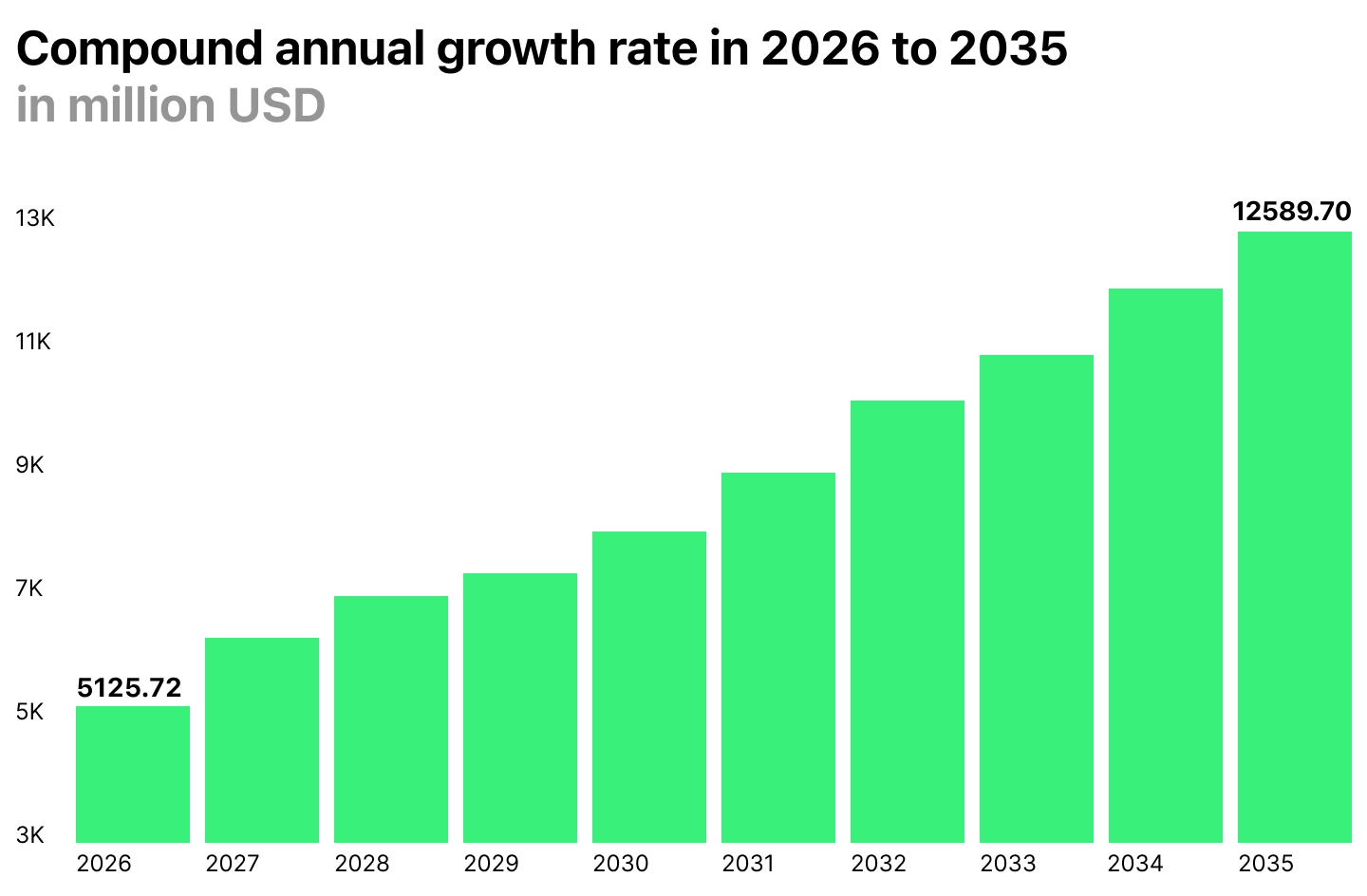

With advantages like these, it’s no surprise that automated debt collection software is picking up serious momentum, with the global market projected to surpass $11,393 million by 2034.

In this article, we’ve rounded up the 11 best digital solutions for optimizing collections processes and outlined their core features and capabilities. For greater convenience and easier comparison, we’ve grouped them into two categories, namely established platforms and promising startups.

Key Takeaways

- There isn’t one debt collection software that fits every business. The choice depends on many factors: your portfolio’s complexity, regulatory needs, where you operate, and whether you handle early-stage accounts, late-stage recovery, or the whole process.

- Integration strategy matters as much as features. Many solutions deliver more value when connected to existing ERPs, CRMs, dialers, payment gateways, or data providers.

- Successful adoption depends on operational readiness. Even the most advanced platform may underperform without defined strategies, clean data, and teams prepared to work with automation and analytics.

What Is Debt Collection Software?

Debt collection software is a specialized platform that helps automate, organize, and optimize different stages of the debt collection cycle, including early reminders and final recovery efforts.

With core capabilities like automated outreach, real-time account tracking, compliance management, and integrated payment tools, these systems make it easier for finance teams to stay on top of overdue accounts and boost their overall workflow efficiency.

Importantly, thanks to such platforms, companies stand to gain the following business benefits:

- Reduced operational friction

- Faster payment recovery

- More consistent and targeted customer communication

- Improved accuracy and fewer manual errors

- Better oversight and visibility across portfolios

- Lower administrative workload

It’s also worth pointing out that many of today’s best collections automation fintech platforms are tapping into the capabilities of AI and machine learning to predict who’s likely to pay, when to reach out, and how to customize each message for better results.

EY also points out that AI indeed is set to meaningfully influence how lending and collections teams operate, make decision-making more data-driven, and help businesses substantially improve results when the technology is applied responsibly.

Best Debt Collection Software to Watch in 2026

If you’ve been trying to figure out what is the best debt collection software, it helps to review the top solutions available right now. Let’s take a closer look at the top digital solutions for optimizing the collections process in 2026. We’ll cover:

- Top established systems

- New innovative solutions (startups)

The solutions below support different stages of the collections cycle, from early AR and behavioral engagement to regulated, enterprise-grade recovery.

Top Rating Among Debt Collection Software Startups

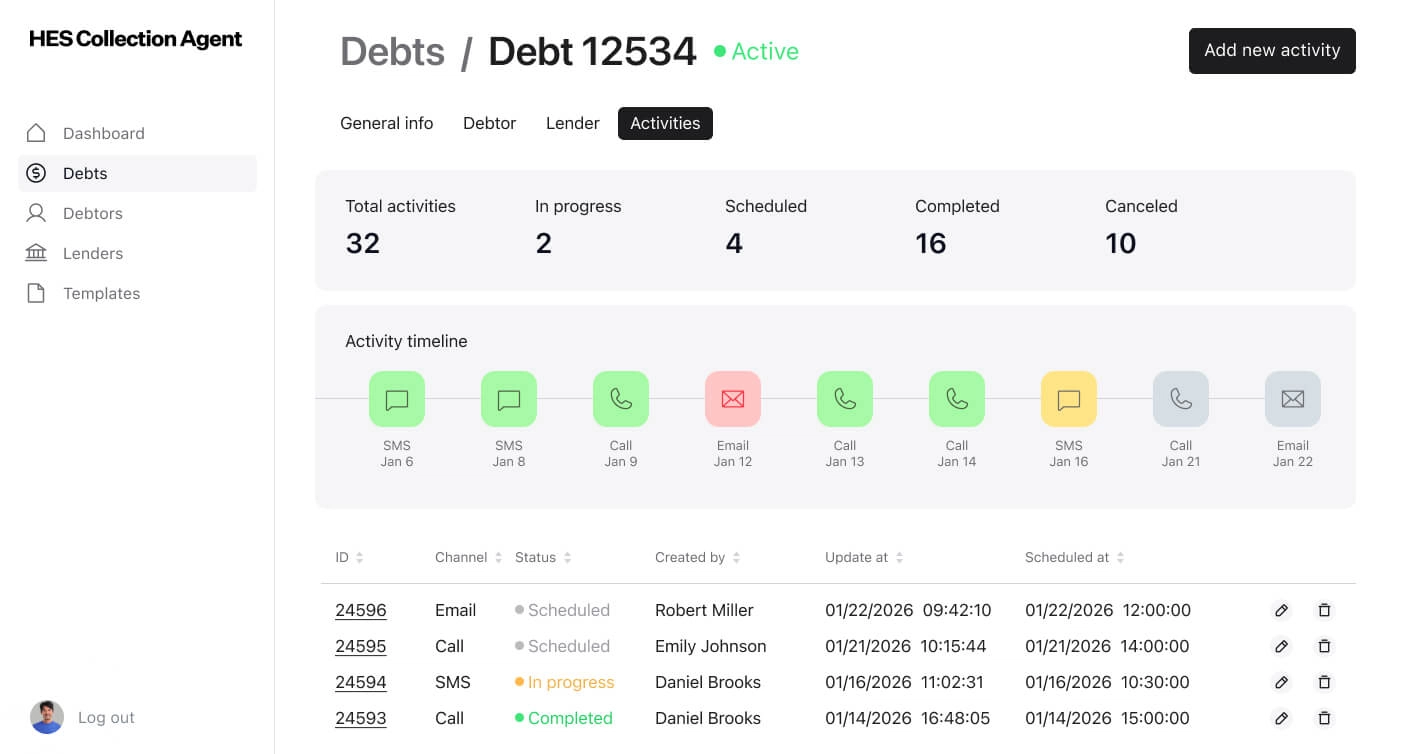

1. HES Collection Agent: AI-Powered Debt Recovery

HES Collection Agent is an AI-powered platform that transforms debt collection from a cost center into a strategic asset for lenders through intelligent, risk-based prioritization and automated multichannel outreach for delinquent accounts.

The platform brings the entire collection lifecycle into one place — from early-stage delinquency to legal and agency management — giving recovery teams clear oversight and control over workflows, interactions, and payment plans.

Its AI engine analyzes historical, transactional, and behavioral borrower data to calculate propensity-to-pay scores. Where permitted by policy and regulations, it enriches existing data with behavioral and digital insights to build a 360-degree debtor profile, segment accounts, and separate “Can’t Pay” (hardship) from “Won’t Pay” (strategic defaulters) — so collection resources focus where they deliver the highest return, while keeping treatment fair and consistent.

The “Next Best Action” engine orchestrates the optimal channel, timing, and contact frequency (email, SMS, push, voice), dynamically switching channel or tone as behavior changes, and supports messengers, social media, AI calls, and legal notices.

For lenders operating in regulated environments, the system prioritizes control and compliance: it uses pre-approved templates with A/B testing (tone, timing, wording) and validates actions against configurable regulatory rules (GDPR, FDCPA, local laws), supported by full encryption in transit and at rest.

API-first architecture and no-code workflows enable fast integration via API or bulk import and quick strategy updates with minimal technical overhead.

Business outcomes include 25% improvement in recoveries, 50% higher response rate, and a 90% reduction in operational costs and processing time through automation of segmentation, outreach, follow-ups, and promise-to-pay tracking.

Key features

- End-to-end collection lifecycle management (early delinquency → legal & agency)

- Single borrower view (centralized interactions, payment plans, history) to eliminate data silos

- Data enrichment (where permitted) for a 360-degree debtor profile

- Automation at scale: task assignment, reminders, and follow-ups

- Compliance guardrails: rule-based validation for every action + regional frameworks for timing/tone/channel/frequency

- Enterprise-grade security: encryption in transit & at rest + ISO/IEC 27001 security framework

- API-first integrations + bulk data import (no “rip-and-replace”)

- No-code configurable workflows (change strategies, rules, roles in minutes)

- DPD-based automatic classification + portfolio KPIs + account-level insights

- Feedback loop for continuous model improvement (using success/fail outcomes)

Free trial: Available (on request)

Price: Custom pricing; special early-client offers available

Link to the product: here

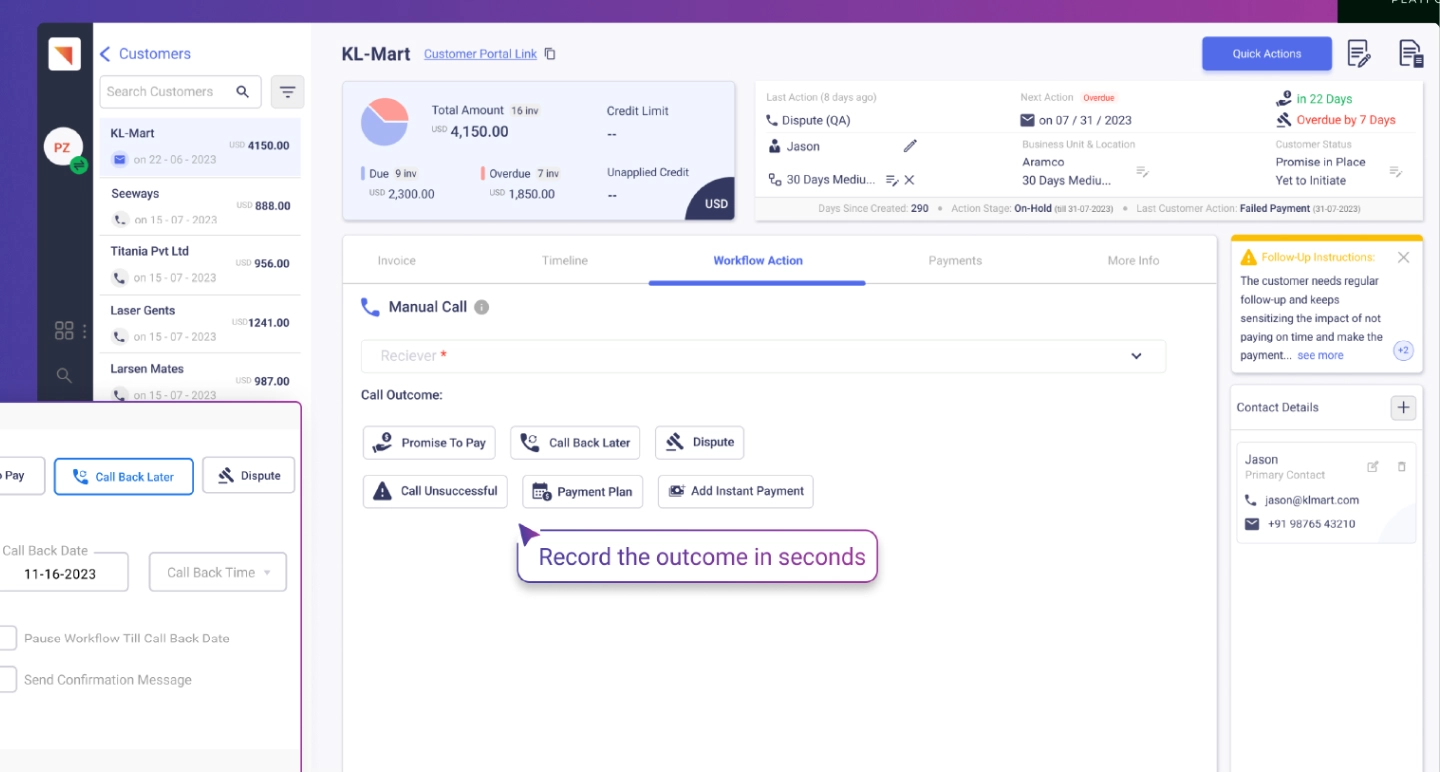

2. Kolleno

Kolleno centralizes AR and collections management in one interface, eliminating the need to switch between ERPs, spreadsheets, and email threads. Its AI-powered workflows automate reminders, follow-ups, and escalations based on invoice age, customer risk, and payment history, while automated reconciliation matches incoming payments to the right invoices to cut down on manual bookkeeping.

When customers pay, Kolleno provides a branded payment portal and a transaction matching module that ensures payments are applied accurately. Plus, to help teams accelerate recovery, its AI Copilot also suggests the optimal tone, channel, and message content for each outreach.

Kolleno includes live dashboards that track key AR indicators such as invoice aging, overdue balances, DSO, and overall collections performance.

In addition, built-in dispute and deduction workflows, along with task assignment and activity tracking, make it easier for finance, sales, and customer success teams to collaborate and maintain visibility into who’s handling each step of the process.

Key Features

- Real-time analytics and reporting on cash flow and collections

- Risk monitoring and credit checks

- Dispute and deduction tracking with full activity logs

- Multi-channel communications and team task management

Challenges

Focus on SMB and mid-market: Larger enterprises with complicated legal or post-charge-off collections may need additional systems or ensure the software meets their complex needs like multi-entity ERP integration.

Geographic compliance obstacles: Regulatory coverage may vary depending on region, requiring due diligence for multi-country operations.

3. Maxyfi

Maxyfi can support the collections lifecycle across different industries and use cases, including in-house collections teams, collection agencies, debt buyers, law firms, and post-judgment collections.

The platform connects with payment gateways, SMS providers, auto-dialers, cloud telephony systems, voice applications, and skip-tracing tools, and allows data, communications, and actions to flow through one connected system. Chiefly, in order to engage with customers at the right time, place, and channel, Maxyfi offers features like automated two-way email, SMS, and call interactions, as well as offers a self-resolve feature that lets customers resolve their debts on their own.

With more than 30 dashboards and visualizations, Maxify provides insight into workflow performance, recovery progress, and agent productivity. Moreover, it allows the reporting functionality to be configured at the customer, invoice, or operational level.

The platform supports adherence to Regulation F and other industry standards through controlled workflows, compliant communication handling, disposition tracking, and audit-ready reporting. As well as this, communication limits, confirmations, reminders, and interaction histories are automatically captured, which helps teams better comply with regulatory expectations.

Key Features

- Regulation F-aligned compliance workflows with disposition tracking and audit-ready records

- Customer-, invoice-, and portfolio-level reporting structures

- Omnichannel engagement and secure self-service resolution portals

- Intelligent settlement and disposition automation

Challenges

Configuration overhead: Setting up the wide range of integrations and dashboards can be time-intensive.

User experience consistency: With many modules and options, maintaining a streamlined agent experience requires thoughtful configuration.

Training requirements: Teams may need organized training to fully utilize reporting and automation capabilities.

4. Symend

Symend is mostly focused on outreach rather than being an end-to-end collection system. Aimed to encourage self-resolution (or self-cure), the solution uses AI and behavioral insights to guide customers toward payment options like autopay and structured payment plans through personalized and data-driven engagement. Data can be ingested from virtually any source, unified into a consistent foundation for analytics, engagement, and reporting, and then scored to support segmentation based on likelihood to repay, respond, or relapse.

The platform runs on Microsoft Azure and incorporates enterprise-grade cybersecurity controls, including advanced endpoint protection, intrusion detection systems, and compliance with industry standards, including SOC 2, GDPR, ISO, and CCPA.

Symend is able to integrate with businesses’ existing collections systems and standard workflows, ingesting data from CRMs, risk models, dialer files, and core banking platforms via APIs and pre-built connectors. In addition, it allows communication execution to be fully orchestrated right within the solution or delivered through a client’s existing email, text, IVR, and letter infrastructure.

Key Features

- Behavioral science-driven customer segmentation models

- AI-optimized engagement journeys with continuous learning

- Unified data ingestion for analytics and reporting consistency

- Psychological archetype assignment for tone and timing guidance

Challenges

Not a traditional collections tool: Symend is cutting-edge yet still evolving. It focuses on early to mid-stage delinquency (digital nudges and personalized outreach) to cure accounts before they charge off, working as an engagement layer rather than a full collections platform. May need a backup tool for tracking accounts or a legal collections process.

5. Aktos

Aktos is an AI-powered debt collection platform that reduces operational friction by bringing integrations, communications, and reporting into one single workspace. The solution allows teams to sync and manage external audiences directly within the collections platform, while its tailored automation capabilities help deal with much of the manual back-office and administrative workload.

The Aktos platform is built around native integrations with commonly used APIs, including payment processors, email services, dialers, and client data transfer systems. From within the platform, users are able to generate, export, and send client invoices with minimal effort as well as produce compliant credit reports across major credit bureaus. Compliance is further supported through configurable communication limits, while role-based access controls empower businesses to define user permissions that comply with both internal workflows and client requirements.

Another aspect worth highlighting is that Aktos centralizes digital communications. Teams can handle SMS, email, and dialer interactions within the platform and set up custom sequences that automatically trigger outreach based on business rules. The integrated reports and dashboards provide visibility into all activity, performance, and account status and help teams keep abreast of their operations and progress.

Key Features

- Native API integrations with payments, dialers, and email systems

- Compliance controls, including configurable user roles and communication limits

- Credit bureau reporting across major agencies

- Centralized multichannel digital communications

Challenges

Growing ecosystem: As a relatively newer platform, some integrations or expanded capabilities may still be evolving.

Best suited for uniform processes and small-to-mid businesses: Altos’ workflow is oriented toward operations in agencies and SMEs, while highly bespoke, complex, or jurisdiction-specific edge cases may need extra customization.

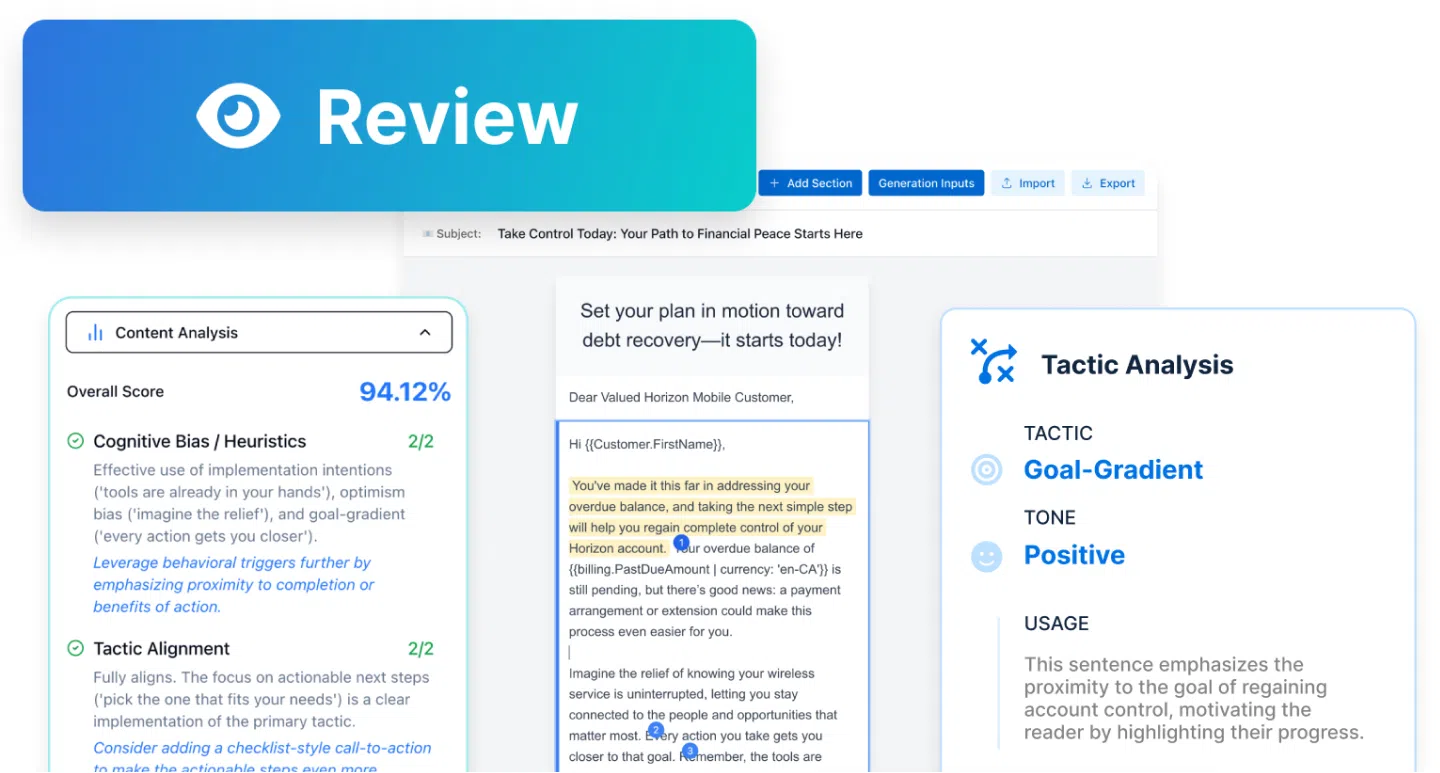

6. Murphy AI

Murphy offers an AI-powered debt collection platform that supports financial institutions, banks, fintechs, debt collection agencies, and NPL (non-performing loan) funds with end-to-end automated collections. The solution assists teams with managing the collection lifecycle, from first contact through resolution and legal follow-up.

In Murphy, collection strategies, decision paths, and conversation flows are all defined by the client upfront and then applied across every eligible account. Importantly, there’s no case selection and no capacity constraints to manage, while every interaction is automatically tracked and stored to provide teams with an end-to-end audit trail across the portfolio.

The platform uses AI-driven agents to communicate with debtors across channels such as SMS, email, phone calls, and WhatsApp, with support for more than 15 languages to reach customers in their preferred language. Besides, each and every conversation adapts to payment history, past interactions, and the customer’s financial situation, while staying true to the client’s tone and communication standards.

As far as security and compliance are concerned, Murphy operates on infrastructure that meets ISO 27001, SOC 2, and GDPR standards and executes continuous quality checks to make sure that every interaction stays compliant, ethical, and transparent.

Key Features

- End-to-end AI-driven collections execution

- Client-configured decision paths and interaction strategies

- Human-like multichannel outreach (SMS, email, calls, WhatsApp, etc.)

- Full auditability with tracked, logged, and stored interactions

Challenges

Narrow focus: Servicing just the communications aspect with AI technology, Murphy does not cover the entire collection lifecycle. For this reason, a company adopting the software should plan additional dev work for its integration into a complex portfolio management system.

Top Rating Among Established Debt Collection Software Providers

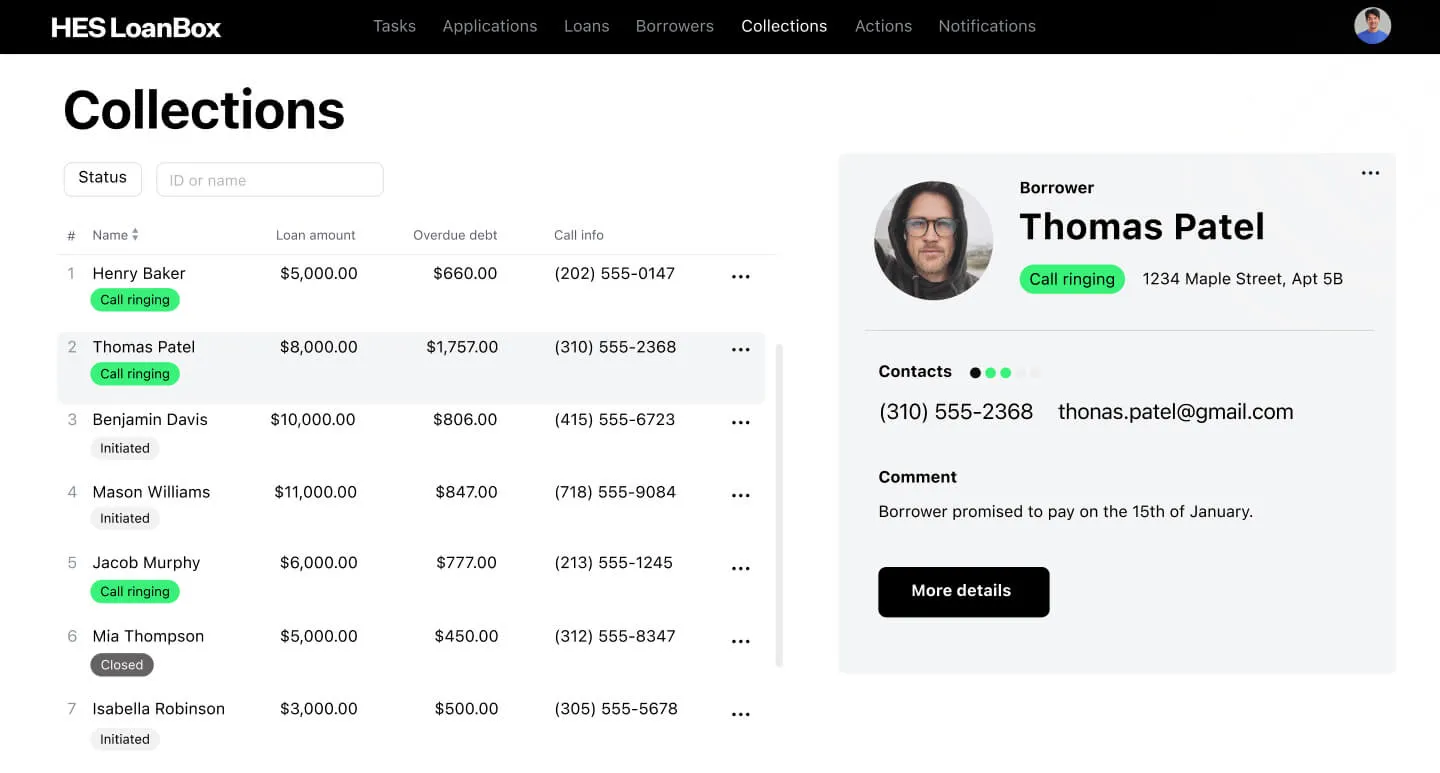

7. HES LoanBox

HES FinTech provides a modular and highly configurable platform (HES LoanBox) built for any lending or collection business, including small startups and large enterprises. It boasts a user-friendly interface and seamlessly integrates with ERP, CRM, accounting, and other third-party tools that are essential for lending and debt collection operations. In addition, HES offers a developer license option that eliminates vendor lock-in and gives internal development teams full control over customization and further product evolution.

The debt collection software from HES FinTech supports flexible deployment models: it can be installed on-premise for organizations with strict data-management or regulatory requirements, or deployed in the cloud with multiple configuration options.

The platform can handle an end-to-end debt collection cycle, or be implemented only in selected business areas such as collection, loan management, servicing, or origination, depending on specific workflow, regulatory requirements, or lending model. In other words, you get a fully-functional core when you need it as well as the flexibility to pick and choose modules that match your individual operations and strategy.

HES LoanBox offers a built-in AI-driven collection scoring module available via integration with a decision engine. It helps build an effective debt collection strategy with portfolio segmentation, further account prioritization, and the selection of effective communication channels such as email and SMS notifications across different segments or deal types. Optionally, the AI models can also be enriched with alternative data (collected in a GDPR-compliant way, as they rely on data footprints rather than direct personal data), including behavioral patterns, transaction histories, device data, or open-banking insights, which increases model accuracy and improves scoring outcomes.

HES LoanBox solution supports all features needed for compliance automation, security standards, and audit requirements: detailed transaction logs, encryption of sensitive financial information, activity monitoring, and appropriate permissioning. It also helps ensure compliance with applicable regulations at the collections stage, including GDPR, local data protection laws, and debt-collection rules.

Key Features

- AI/ML-powered collection scoring

- Highly configurable and customizable workflows and modules

- Custom dashboards and comprehensive analytics

- Multi-channel communication support (email/SMS/voice/etc.)

- Secure data handling and compliance automation

- Flexible deployment (end-to-end or selective module use)

Challenges

Implementation effort: Due to its high configurability and modular architecture, initial setup typically requires strong involvement from internal IT teams or implementation partners. This can extend time-to-value compared to more prescriptive, out-of-the-box tools.

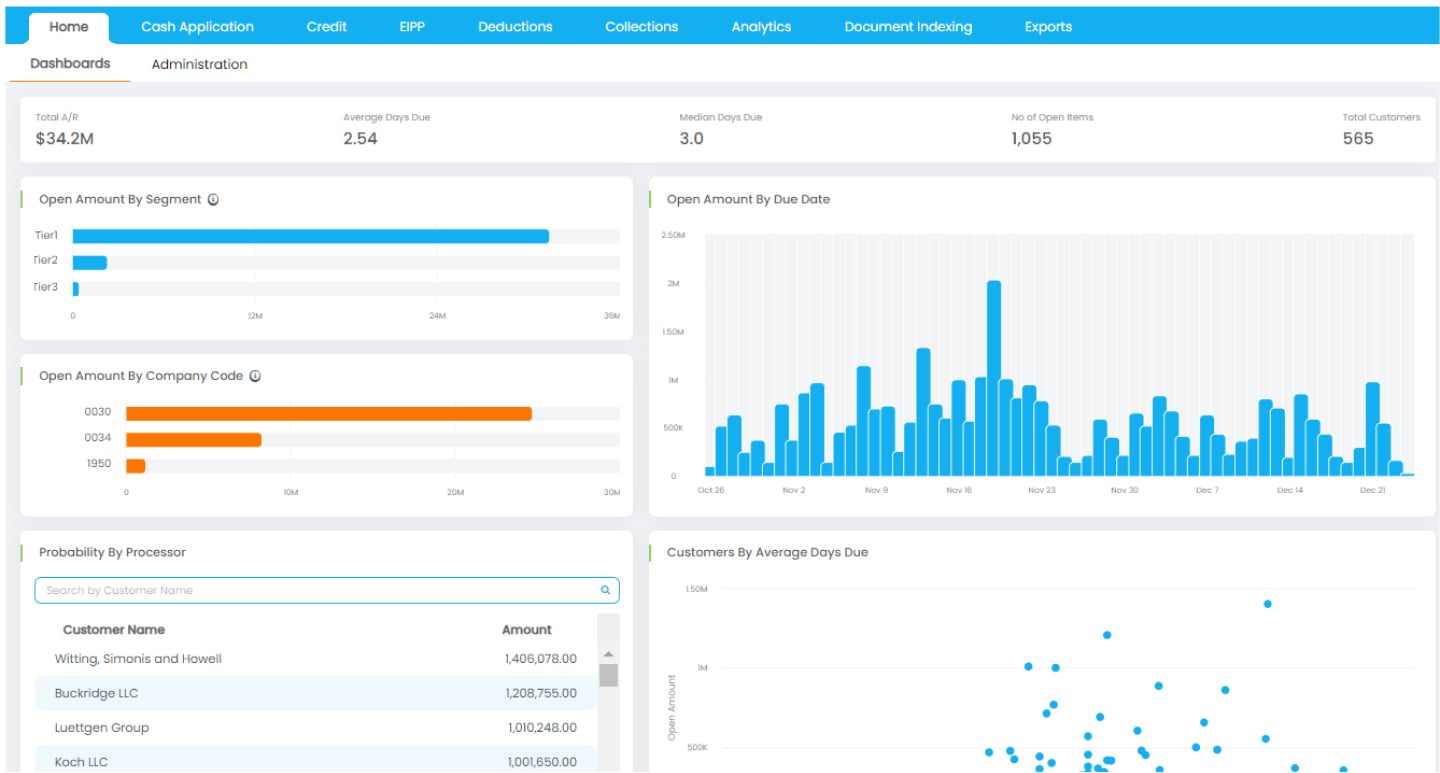

8. HighRadius

HighRadius offers a debt collection automation platform that relies heavily on its Agentic AI engine which analyzes each customer’s payment history, credit risk, and behavior across 20+ variables to prioritize which accounts need attention first.

The solution provides support for invoice upload and payment tracking across 600+ AP and customer portals through RPA bots, meaning that invoices and payment statuses from various portals get automatically synced into one central system to keep data clean and up-to-date without manual copying.

HighRadius also automates outreach. It can generate personalized dunning emails, schedule reminders, embed secure payment links, and send messages at optimal times based on prior customer response patterns.

To keep performance visible, HighRadius provides real-time dashboards and analytics. With them, financial teams gain the ability to see overdue aging, collector productivity, cash flow trends, past-due coverage, and more.

Key Features

- Automated invoice uploads across 600+ AP and customer portals

- Centralized communication with call logging and email tracking

- Automated reminders, dunning letters, and payment links

- Real-time payment tracking and dispute management

Challenges

Configuration complexity: While automation is a strength, some users report that tailoring certain workflows and rules requires dedicated setup time, clarity around internal processes, and vendor intervention. For this reason, new potential buyers should focus on how the system can be configured to fit their processes.

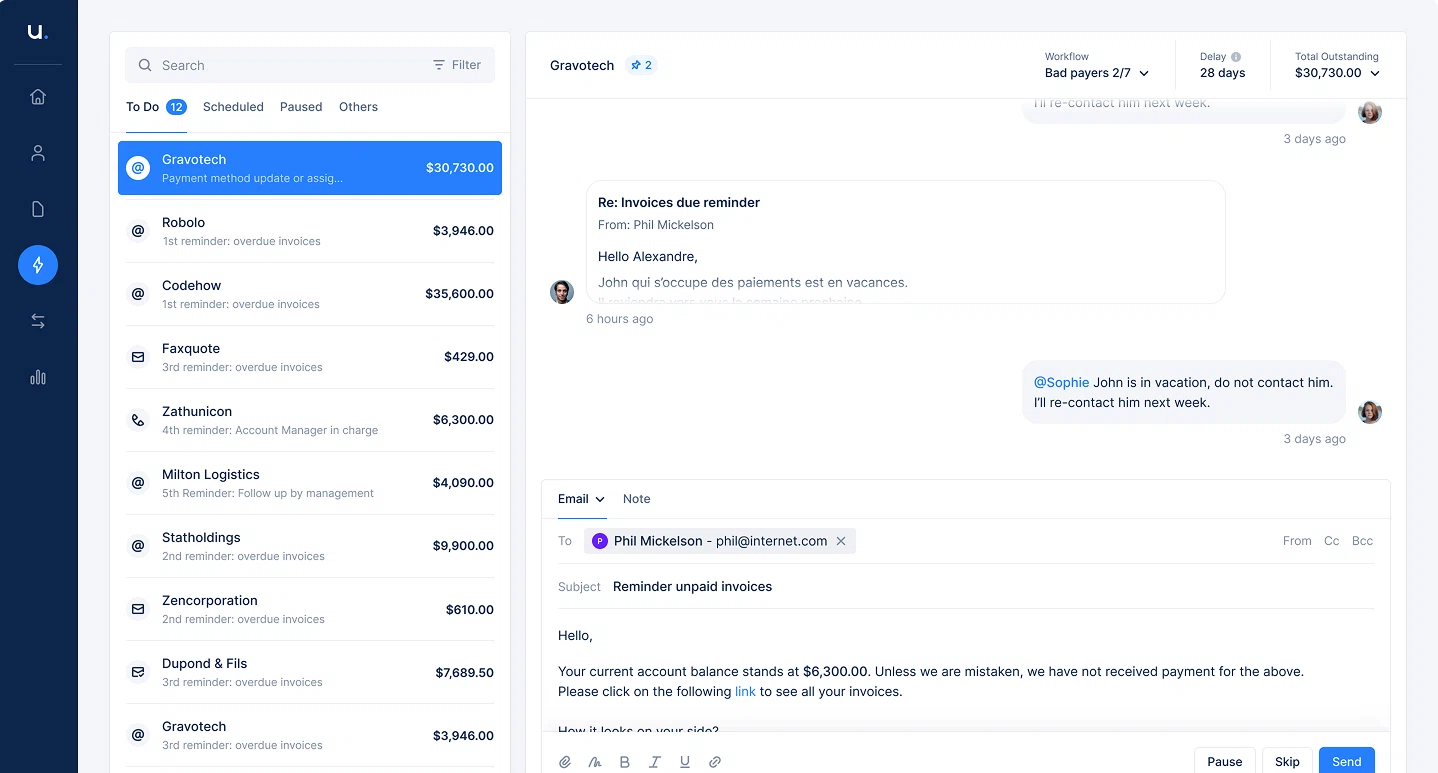

9. Upflow

Upflow offers software that helps finance teams implement systematic and proactive collection processes. The solution centralizes collections and accounts receivable activities, improving collaboration across finance, sales, and other relevant departments. Its AI-powered assistants handle repetitive tasks like updating contact details and applying cash to invoices, identify why payments are delayed, and recommend targeted strategies.

The platform integrates with existing ERPs or CRMs and supports accounting software like QuickBooks, Xero, and NetSuite, with options for custom API setups, if needed. It also automates personalized payment reminders and allows businesses to send customizable emails to their customers. Clients, for their part, are able to access a personalized payment portal with multiple payment options that include credit or debit cards, wire transfer, ACH payment, or direct debit.

In addition, Upflow provides comprehensive dashboards that allow teams to monitor DSO, aging balances, and overdue invoices, dive deep into AR performance, and take informed actions. The collected metrics support financial reporting and forecasting and deliver an accurate and actionable view of cash flow and collections efficiency.

Key Features

- Automated, personalized payment reminders to reduce manual efforts

- Real-time A/R dashboards with actionable indicators

- One-click integration with billing tools and major accounting systems

- Systematic collection workflows designed to improve DSO

- Collaboration tools for finance and business teams

Challenges

Primarily AR-focused: Upflow is designed mainly for accounts receivable and early-stage collections, which may limit its applicability for legal recovery, litigation, or complex debt-buying scenarios.

Limited compliance tooling for regulated collections: Compared to dedicated collections platforms, Upflow compliance automation has been primarily designed around common EU/US practices and may not have out-of-the-box support for all local Italian requirements.

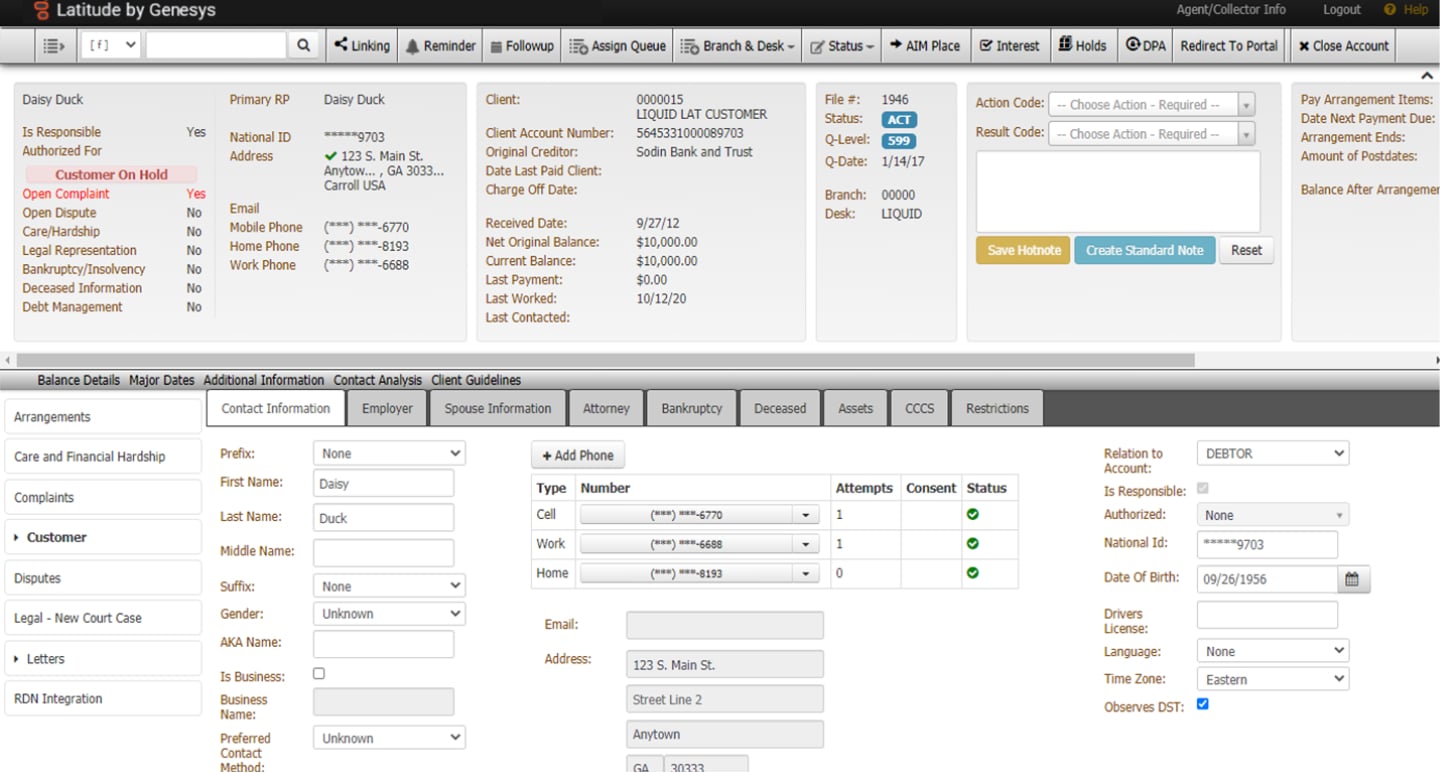

10. Latitude

The Latitude debt collection platform by Genesys assists with operations such as collections, recovery, and litigation. The solution supports first-party creditors, debt buyers, and collections agencies, as well as empowers teams to manage pre- and post-charge-off accounts, apply business rules through automated workflows, and assess performance across channels such as email, SMS, IVR, and live interactions.

Latitude enables clearly defined account treatment strategies and enforces them through automated monitoring, updates, and follow-ups, thanks to which organizations are able to comply with local, federal, and international regulations.

In addition to this, the solution features reporting and visualization tools, configurable dashboards, and bi-directional data exchange capabilities that help businesses monitor their account inventory by tracking key performance metrics and making informed decisions.

Furthermore, Latitude’s pre-built integrations with service providers for mail generation, payment processing, skip tracing, and data enrichment extend the platform’s value and allow for greater operational efficiency.

Key Features

- Browser-based agent desktop with full collections and recovery tools

- Agency Interface Manager for oversight of internal and external partners

- Configurable dashboards and KPI portals for real-time operational metrics

- ETL data exchange and bi-directional system integrations

Challenges

Complexity for smaller teams: Latitude’s breadth, covering collections, recovery, and litigation, can be overwhelming for organizations with simpler operational models. The same is true for longer onboarding cycles due to extensive rule configuration and integrations.

UI learning curve: Some users mention that agents may need time to adapt to the depth of features available in the browser-based desktop. Therefore, prospective buyers should compare user experience against newer systems if those are high priority.

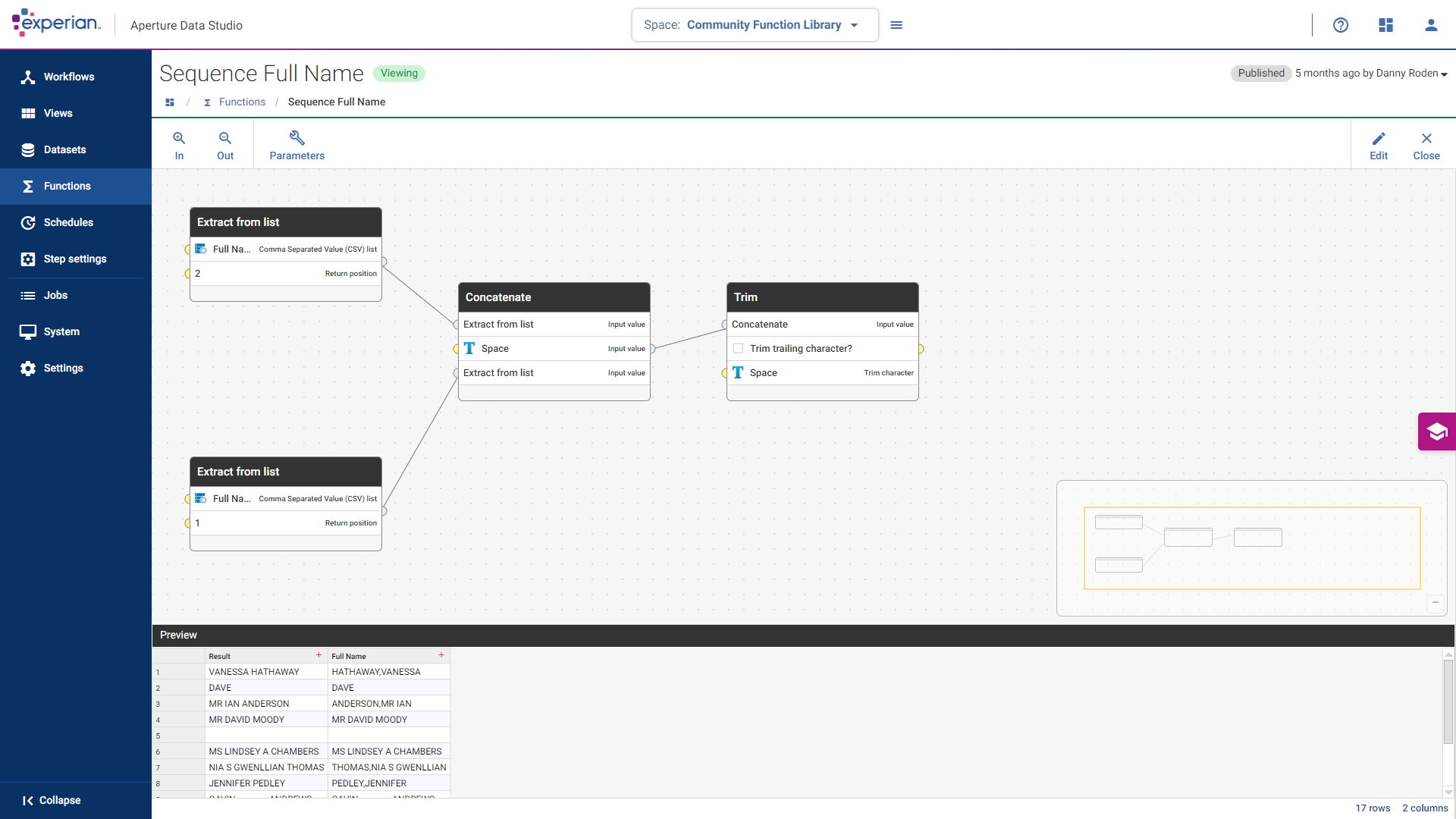

11. Experian

Experian’s collection management system brings debtor discovery, account prioritization, and debt recovery into one platform, and helps teams conveniently manage all collection processes from a single web portal. It also offers a range of products and packages, from one-off skip tracing to full collection management setups, with flat-rate subscriptions available and unlimited users per account.

The platform gives access to accurate and up-to-date consumer information that is refreshed daily, with more than 1.3 billion updates made per month. This includes both credit and non-credit data, covering hundreds of millions of consumers, and helps teams reach the right person faster by validating their names, addresses, phone numbers, and identity details.

Importantly, Experian allows teams to stay compliant by flagging protected or high-risk accounts before outreach happens. It helps identify bankruptcy status, deceased records, military status, cell phone type, and litigious consumers so as to reduce wasted outreach and support adherence to consumer protection rules.

Experian supports smarter portfolio management through collection-specific scores, attributes, and account alerts. With these capabilities, teams can segment accounts and focus efforts where repayment is more likely. Plus, the daily monitoring feature delivers updated contact details and notifications when meaningful account changes occur.

Key Features

- Extensive and continuously updated consumer and business contact data

- Compliance support with automatic identification of high-risk/protected accounts

- A unified collections portal that eliminates the need for multiple systems

- Scalable subscription options with no per-user licensing fees

Challenges

Enterprise-grade complexity. As Experian’s collections software is designed for big banks, lenders, and utilities, it can be complex to implement and maintain for small or mid-sized organizations.

Positioned as a highly configurable, analytics-driven solution, in practice, it may entail the need for resources, mainly for upfront configuration and later harnessing the insights.

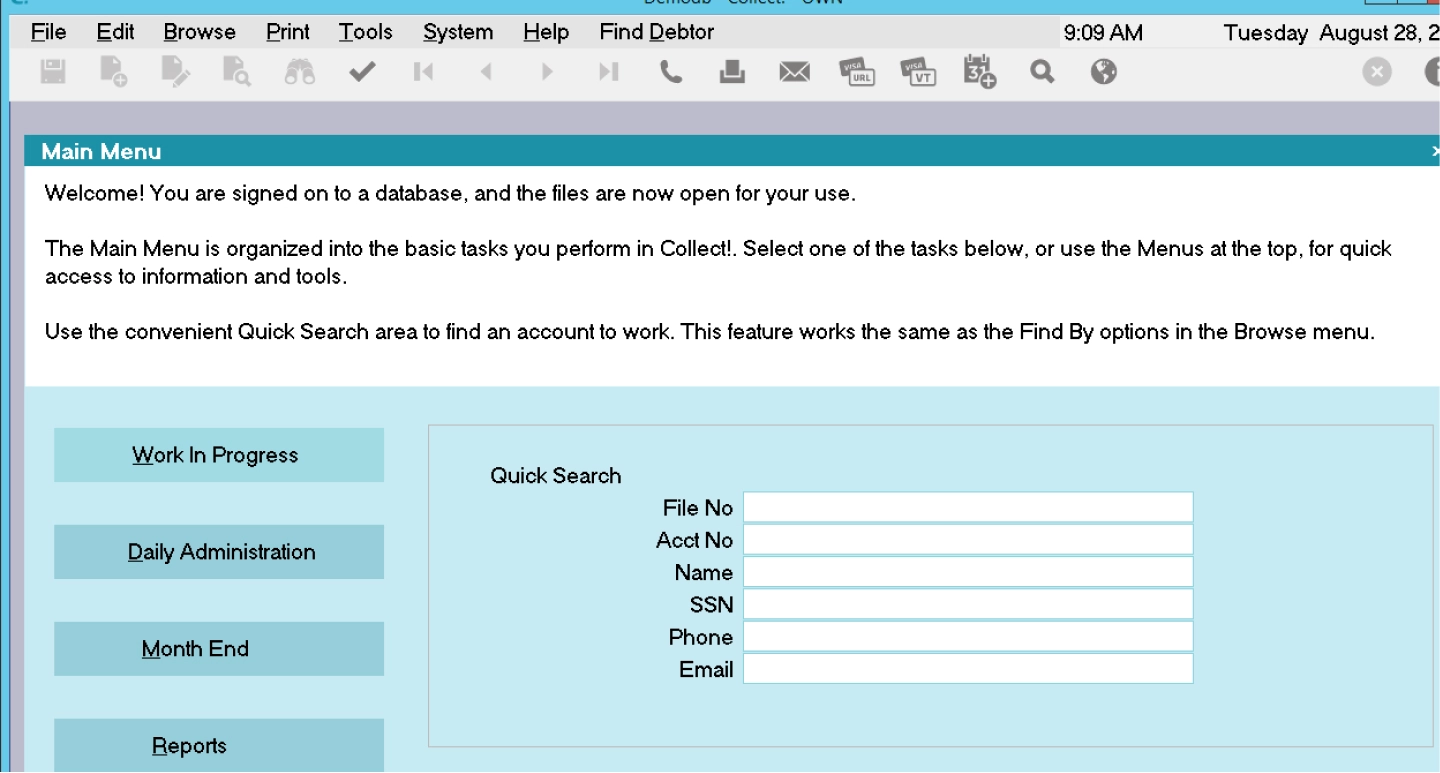

12. Collect!

The Collect! debt management solution caters to the needs of businesses of all sizes, including small agencies and large enterprises with complex operational needs. Used by first-party creditors for pre-collection activities as well as by third-party collection agencies and debt buyers as a system of record, it delivers a modular and configurable environment that can be adapted to different business models and workflows.

Collect! centralizes operations as well as manages and stores account records, financials, contact and letter schedules, attached documents, personnel data, and a complete and auditable history of events. It also supports infinite client layering, along with portfolio-, client-, and department-level reporting.

The solution comes with APIs and a wide range of partner integrations to automate data exchanges with external service providers. It enables owners and managers to define global controls and workflows, while empowering collectors to work from configurable Work Queues that serve as the central hub for daily activity.

As far as compliance is concerned, Collect! Version 13 introduced enhanced global controls, workflow audits, and stock Model Validation Notices that comply with CFPB Regulation F. The system also includes rule sets, opt-in and opt-out tracking, dedicated compliance fields, and workflow analysis tools. Besides, Collect! supports encrypted data transfer, granular access controls, multi-factor authentication options, automatic logging and backups, and multiple security levels, along with SOC 2 Type II alignment and formal business continuity planning.

Key Features

- Centralized account management with full financial and activity history

- Configurable workflows, global controls, and collector Work Queues

- Advanced reporting with multi-client and portfolio-level visibility

- Opt-in and opt-out compliance tracking and Reg F model notices

Challenges

Traditional UI approach: Compared to newer debt collection platforms, the interface may feel less modern or visually polished, though functional, particularly for teams accustomed to highly visual dashboards.

Learning curve for advanced features: Collect! is highly customizable, but that power comes with complexity. While basic use is straightforward, doing more complex things requires experienced administrators and learning the system’s scripting or logic to implement configuration of rules and workflows correctly.

How to Choose the Best Debt Collection Software for Your Business

We perfectly understand that with so many best collection software on the market, it can feel a bit overwhelming and challenging to figure out which one is right for your business.

Yet, to make the decision easier and choose the best debt recovery software for your needs, it helps to focus on a few key aspects. Also, you should consider which stages of the collections process you need to cover and which tools are best suited for each stage, from pre-delinquency and delinquency, through mid- and late-delinquency, to post-charge-off.

Now, let’s take a look at the factors our experts recommend keeping in mind when narrowing down your options.

1. Check flexibility and customization. Highly flexible and customizable debt collection systems let you tailor workflows, triggers, and communication rules to your needs, which gives more independence from the vendor after implementation and reduces the need for future modifications. You also pay only for the features you actually need, rather than for pre-packaged functionality.

2. Check integration capabilities. The top debt collection software should sync with your ERP, CRM, accounting, and other platforms and tools to eliminate manual data entry, reduce errors, and get a single source of truth for every customer account.

3. Prioritize compliance support. As you know, debt recovery and collection are heavily regulated, so the platform should help you stay in line with rules like the FDCPA (US), PIPEDA (Canada), ASIC/CCCFA (Australia), FCA/CONC (UK), or GDPR (EU). Besides, check if it has features such as automated communication logs, audit trails, consent tracking, and built-in dispute management so as to protect your business from compliance breaches as well as ensure transparent, fair, and well-documented treatment of customers.

4. Evaluate ease of use and ergonomics. The easier the software is to operate, the fewer errors occur and the faster teams adopt it. Thus, make sure that a debt collection system features an intuitive interface, as this will speed up onboarding for collectors and managers and reduce the learning curve across the team.

5. Review vendor support and deployment options. Select a provider that delivers responsive and knowledgeable support and a transparent product roadmap. This way, the platform will be able to scale with your business’s growing needs and requirements and adapt to new workflows. Also, consider the available deployment options: cloud, hosted and maintained by the vendor for easy access and updates, or on-premise, installed locally for greater control over data and infrastructure.

6. Consider actionable analytics and forecasting. Check if the solution comes with customizable dashboards that allow for deep drill-downs into individual collector performance and portfolio health. Ideally, the tool should also offer predictive modeling to help you forecast recovery rates and pivot your strategy based on live data.

Conclusion

The best collections software allows businesses to enjoy benefits such as faster payment recovery, reduced manual work, improved cash flow visibility, better customer communication, and enhanced compliance with industry regulations.

To choose the most suitable one, it’s important to assess your business needs, consider customization and integrations, prioritize compliance and usability, and evaluate analytics and reporting capabilities, and take into account the stage of the collections process you are at and the specific tasks you need to accomplish at that stage.