Rising customer debt, tighter compliance regulations, and an increasing demand for digital experiences are pushing financial providers to rethink the way they operate. Debt collection technology is a fundamental feature of the loan process and modernization is no longer an option with manual and outdated processes risking debt recovery rates, disrupting business cash flow and exposing organizations to increased risk.

The High Cost of Manual Debt Collection

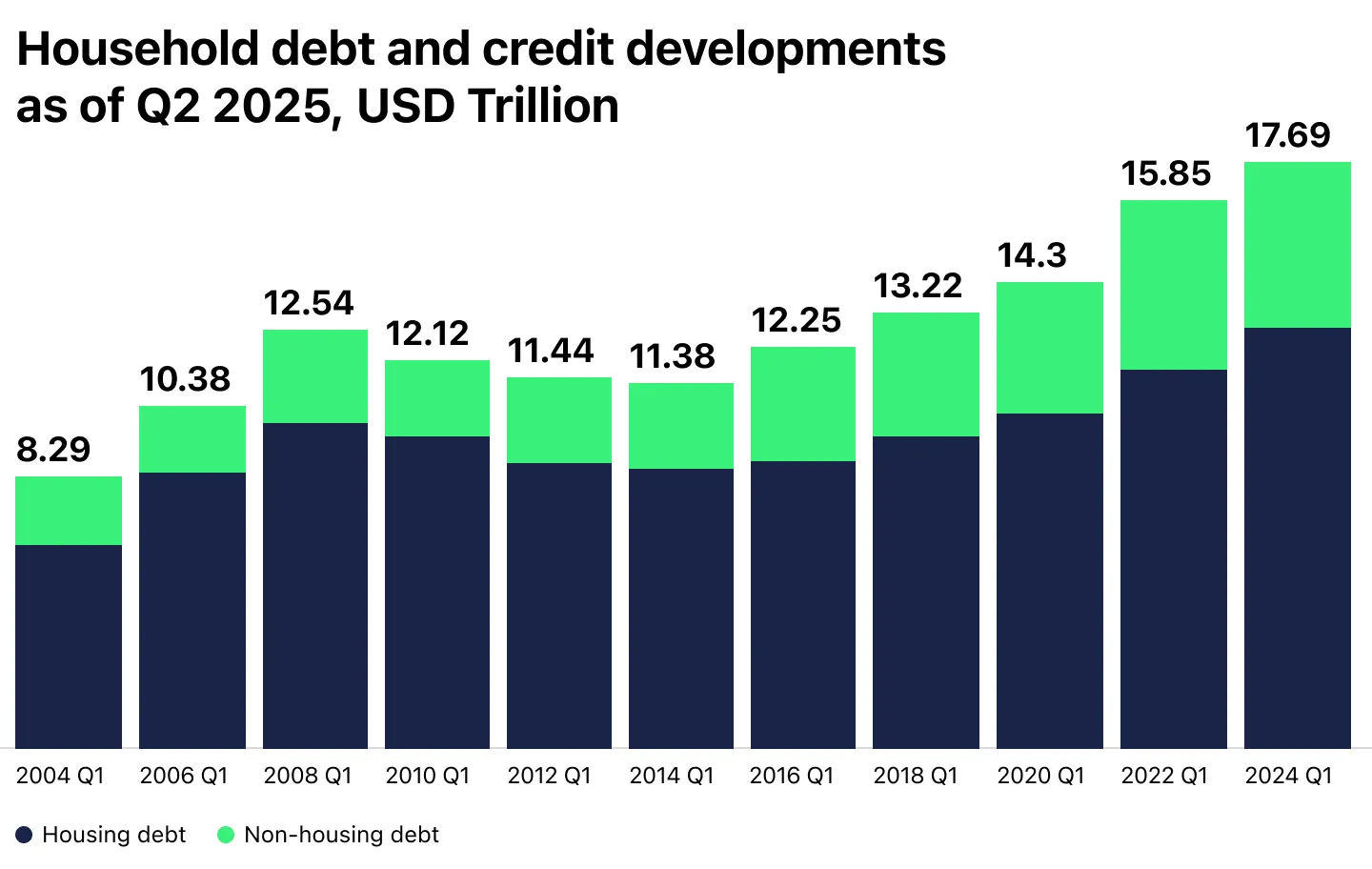

In Q1 of 2025, total household debt in the US reached $18.20 trillion, an increase from Q4 2024’s figures of $167 billion. The rise, driven by higher mortgage and student loan balances, as well as a surge in student loan delinquencies totalling more than 4.3% places increased pressure on lenders to implement robust loan debt collection practices and digital updates. A similar situation is observed across Europe and most of the world.

Source: New York Fed

The collections industry is facing mounting long-simmering pressure from the economy. Due to this, manual debt collection risks have exposed businesses to a number of once-manageable challenges. With the collections industry facing mounting pressure as long-simmering challenges from the economic climate, manual debt collection risks have exposed businesses to a number of once-manageable challenges. Labor and overhead costs — manual debt collection requires countless hours of tracking, making phone calls, and crafting reminders. These are not only costly to the business, but impact operational efficiency leading to less time to take on tasks that matter. Inefficiency and lost opportunities — manual debt collection eats up valuable working hours and drains team resources. In contrast, 50% of our survey respondents report that with automated debt collection technology, they save time and energy that can be redirected from administrative tasks to profit-generating work. Slower recovery and impacted cash flow — delays in collections and slower reaction times lead to mounting uncollectible debt. Inefficient processes extend the average days sales outstanding (DSO), which puts pressure on operational capital and increases the need for short-term financing for cash flow, leading to increased debt. Ultimately, this leads to more bad debt. Human errors — mistakes in data handling, incorrect customer details, and lost documentation can slow processes and increase operational costs. Automating processes that can be automated reduces this risk and keeps your business safe. Compliance risk — whether triggered by human error or other factors, compliance and other data breaches can lead to costly regulatory fines, lengthy litigation, and lasting reputational harm. Automation ensures processes are followed consistently, deadlines are met, and documentation is audit-ready, reducing exposure to compliance failures. Missed write-offs and revenue — manual debt collection can result in a significant portion of debt going uncollected. This leads to significant revenue loss, particularly for medium and large-scale businesses. Automated systems can improve operational efficiency and help businesses recover lost debt by automating multichannel communications, tracking, and follow-up.How Automated Debt Collection Technology Is Transforming the Industry

Knowing the pitfalls of manual processes, it might seem that immediate automation is the only step forward. Yet, although modernization is essential, so too is taking the right approach for your business. Implementing effective business analytics to understand your needs can help avoid unwanted costs associated with updating software; alternatively, working with a reliable debt collection software provider could help you work through the challenges more efficiently, saving you in the long run. Let’s take a look at some of the tools changing the collections industry today, that businesses are using to upgrade their toolkit.Predictive Analytics and AI Tools

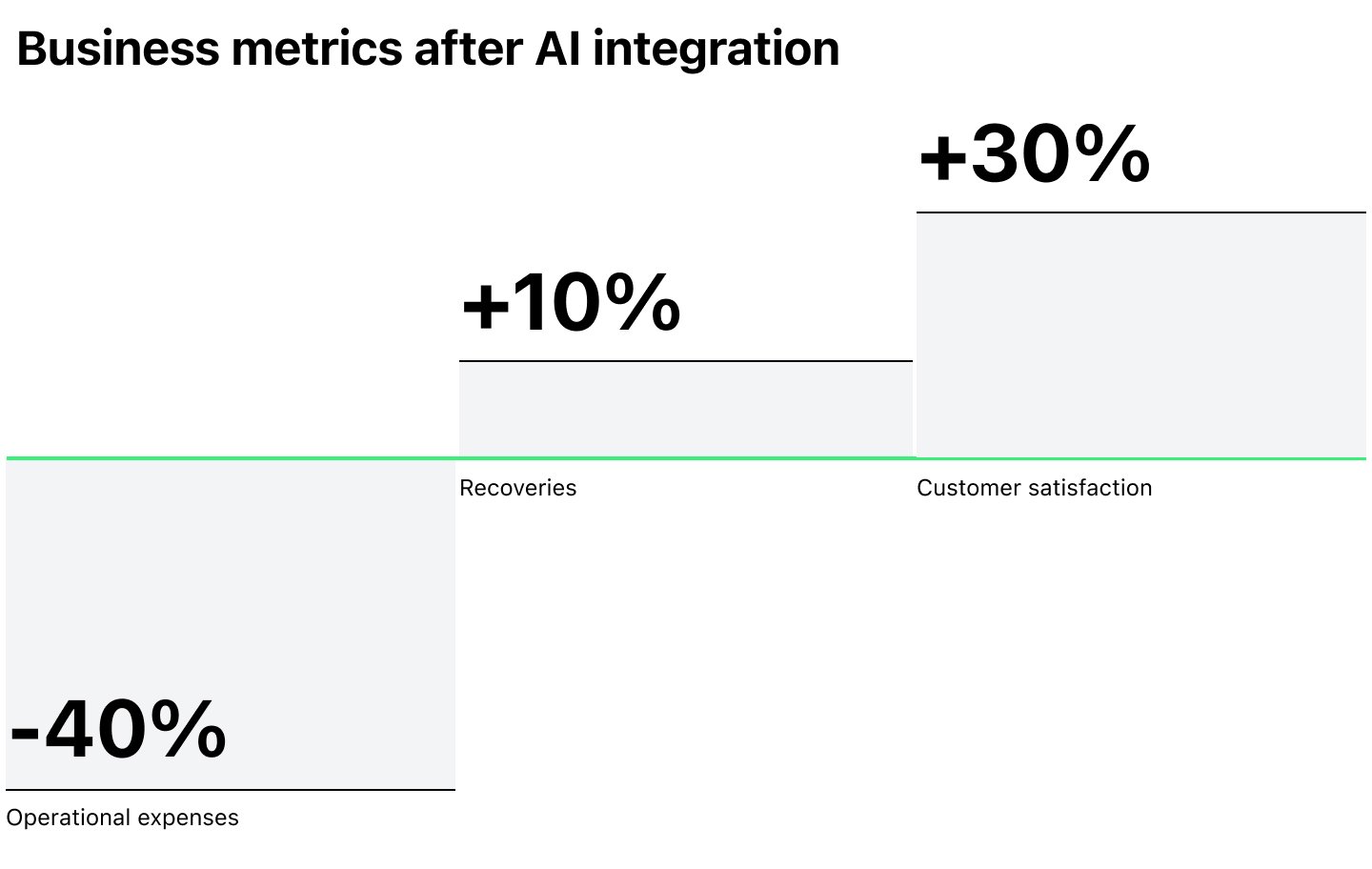

Tools such as predictive analytics and AI are a key feature in many software development initiatives. Within the debt collections sphere, they find their use in transforming the way companies manage debt recovery. By identifying high-risk accounts early and forecasting repayment probability, these tools allow businesses to take a proactive approach to debt recovery, improving early outreach and long-term repayment. For example, such tools can flag clients and accounts that show patterns of missed payments, automatically prioritize them for early outreach, and recommend tailored repayment schedules based on income, spending behavior, and other factors. Research by McKinsey shows that businesses that integrate AI generative tools into the customer communication journey could see not only a 40% reduction in operational expenses but a 10% increase in recoveries. These results are coupled with a 30% increase in customer satisfaction, indicating that it’s not just the businesses that are happy, it’s their clients too.

Source: McKinsey

Additionally, AI adapts quite successfully for chatbots, which help streamline client communications and boost satisfaction. It can also rapidly analyze debtor profiles and personalize repayment options based on the latest data.Automated Debt Collection Technology

Modern debt collection technology transforms the recovery process by automating tasks, including payment reminders, follow-ups, generating payment plan proposals, and account monitoring for disputes or changes. Not only do these consumer lending systems allow businesses to keep track of the credits issued, but they also empower clients to easily manage their accounts through self-service portals and offer more flexibility in repayment, boosting the likelihood of settlement. Automation also frees up staff to focus on higher-value activities like complex communications, relationship building, and business development, which improves business sustainability long-term. Additionally, automation reduces the risk of human error and subsequent large losses. Within built-in workflows, efficient communication, and real-time account tracking, lenders can ensure that fewer accounts fall through the cracks.Digital Payments and Multichannel Communications

Keeping connected to your clients is essential in improving debt collection outcomes, and the responsibility lies with businesses to set up reliable, non-invasive systems to do so. By integrating seamless, user-friendly payment options directly into reminders (without the need to contact support) companies make it easier for clients to repay their debt or change payment options. This measure boosts both convenience and repayment rates. Having a multichannel communication strategy is essential. It allows companies to utilize the communication channels approved by the client while staying compliant with GDPR and other data protection laws. Automating this technology helps businesses strike the right balance between compliance and convenience.Compliance Automation

The ever-shifting field of compliance is a challenge for organizations seeking to modernize effectively. Minor changes can have implications down the line. Staying compliant isn’t only about legal repercussions; it’s an essential part of reputation management, ensuring trust, and operational integrity. By embedding advanced compliance tools to automate the process, businesses can auto-flag high-risk interactions, such as suspicious payment patterns, verify consent before sending notifications, maintain detailed audit trails, and follow through on compliance processes with efficiency. This streamlines responsibilities and frees up the team for more in-depth tasks. Additionally, automated documentation creates a seamless experience for the user. Uploads are automated, and documentation becomes logged and traceable with clients able to submit and verify ID and income instantly. With built-in compliance, companies can confidently modernize and scale their operations without compromising on trust.Enhanced Analytics and Reporting

When any business starts to expand, its business analysis becomes more complex and the data it generates keeps growing. Managing debt collection and its analysis at scale requires intelligent systems that allow you to process and analyze data in a meaningful way. Upgrading to enhanced analytical and reporting tools provides businesses with real-time performance metrics — from repayment rates to communication effectiveness, customer trends, payment insights, and everything in between. This aids in decision-making, future planning, and early intervention. Data-driven decisions, backed by advanced analytical tools, help businesses fine-tune their strategies and refine their work. For example, managers can allocate resources more effectively to target underperforming loans, test reminders across communication channels, and identify issues earlier. It provides a clearer picture of general and individual loan performance, allowing the team to act faster, allocate resources more accurately, and optimize for long-term growth. This also helps alert both client and business early if things are going wrong to boost recovery outcomes.How HES FinTech Can Help Improve Your Debt Сollection Process

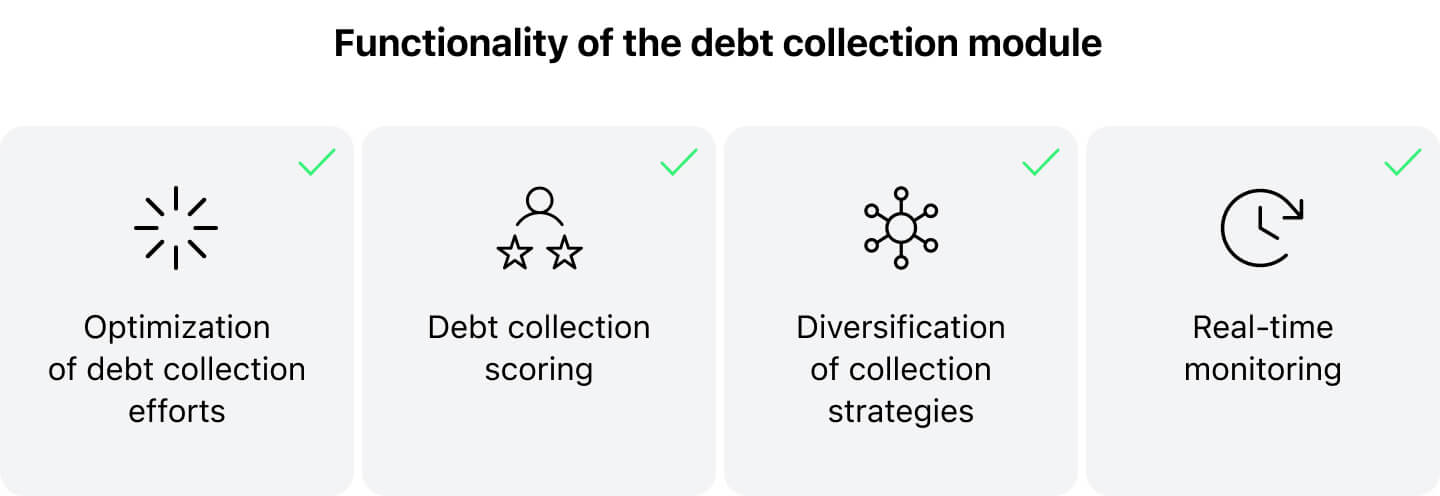

The functionalities described above are all available in HES LoanBox, and can be further enhanced by integrating the AI-powered GiniMachine engine into the lender’s loan management system. While it is widely applied for scoring by loan origination, the functionality of GiniMachine extends far beyond credit approval. Integrated as a debt collection module, it automates and optimizes the entire recovery process, making it faster, more precise, and efficient. The solution offers a comprehensive set of tools for debt collection automation, including:- Scoring models that identify patterns influencing collection outcomes

- Comprehensive evaluation reports that analyze model performance

- Real-time monitoring dashboards for instant insights into collection performance, highlighting cases that require urgent decisions (like reaching out to the client, transferring the debt to a collection agency, or write-offs)

- Portfolio segmentation that groups debtors based on financial status and willingness to pay, thus predicting recovery amounts for individuals or entire portfolios.

- Strategy assignment that applies different collection approaches across portfolios or deals.

- Optimization tools that help prioritize efforts and choose the most effective communication channels.

- debt handling becomes a structured, data-driven workflow

- processing time taken for records reduces from weeks to minutes

- lender сan swiftly identify debtor categories and optimize collection strategies

- debt recovery rates are improved