Loan management software

in United Kingdom

Transform your lending operations from weeks to hours with AI-powered software fully tailored to your business goals

Trusted by lenders worldwide

Digital lending ecosystem for banks and alternative lenders

Complete lending ecosystem in one platform.

HES LoanBox loan management software replaces legacy systems with FCA-compliant intelligent automation, delivering faster decisions powered by AI, lower risks, and higher profitability for UK banks and alternative lenders.

HES LoanBox loan management software replaces legacy systems with FCA-compliant intelligent automation, delivering faster decisions powered by AI, lower risks, and higher profitability for UK banks and alternative lenders.

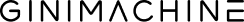

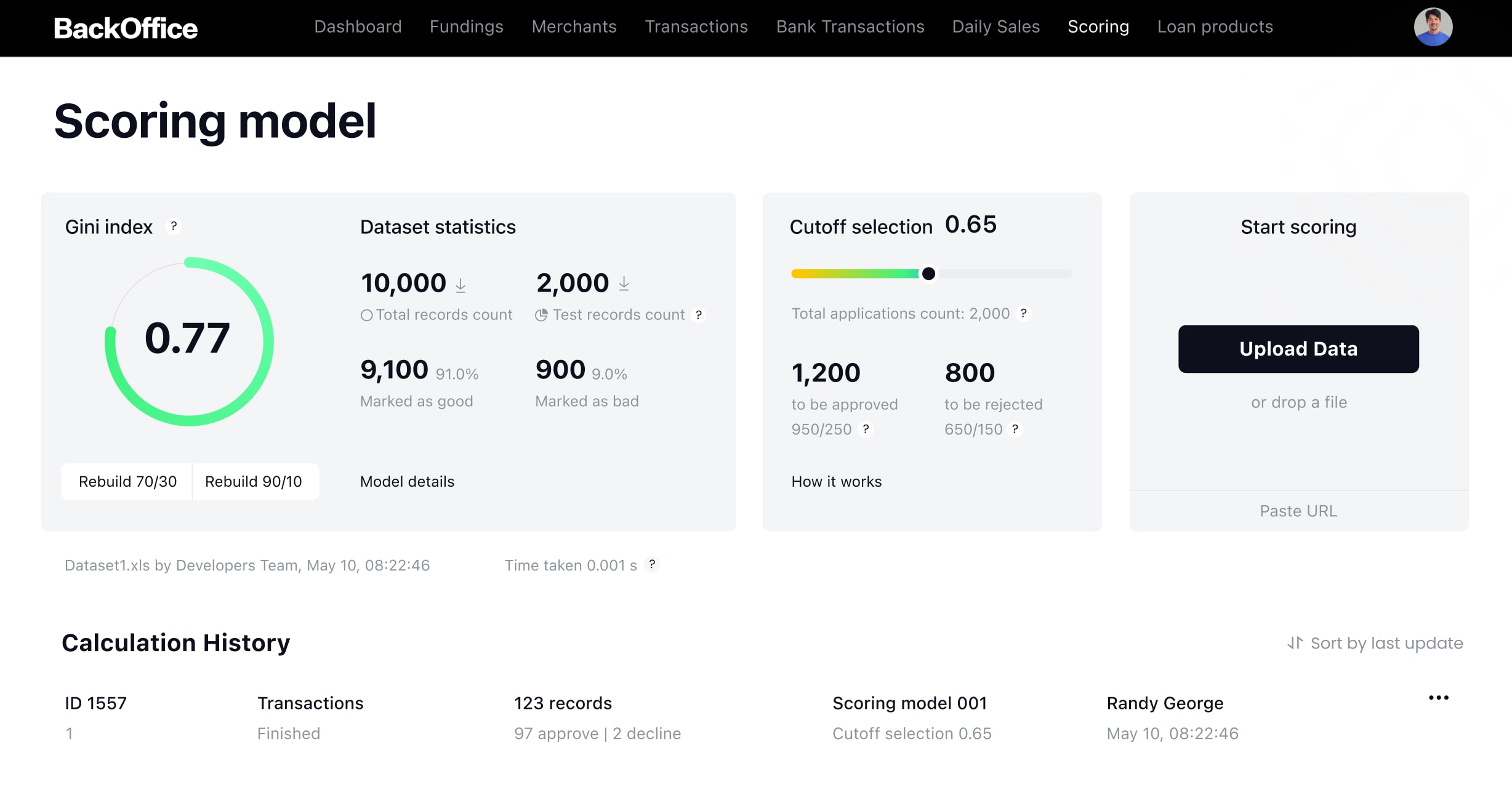

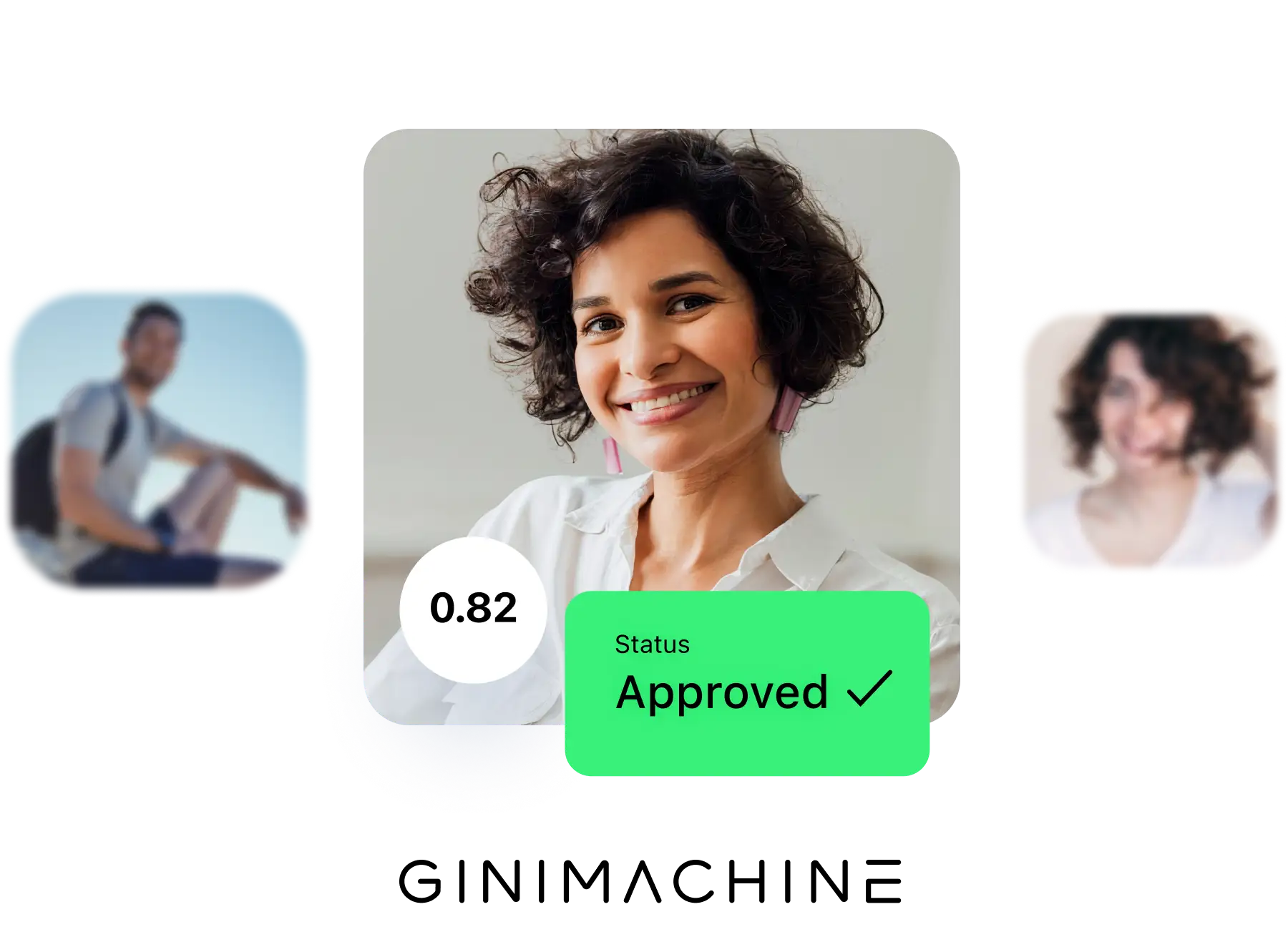

GiniMachine is a no-code AI tool that utilizes machine learning algorithms to analyse borrowers' data and provide you with insights into their behavior. Integrated within HES LoanBox, it helps lenders make informed, data-driven decisions.

60-sec decisions | Custom models | 300+ data points | Open banking | Alternative data

60-sec decisions | Custom models | 300+ data points | Open banking | Alternative data

HES LoanBox overview

Complete loan

management system

The only loan management software you'll ever need, offering a suite of features and integrations for all your lending operations.

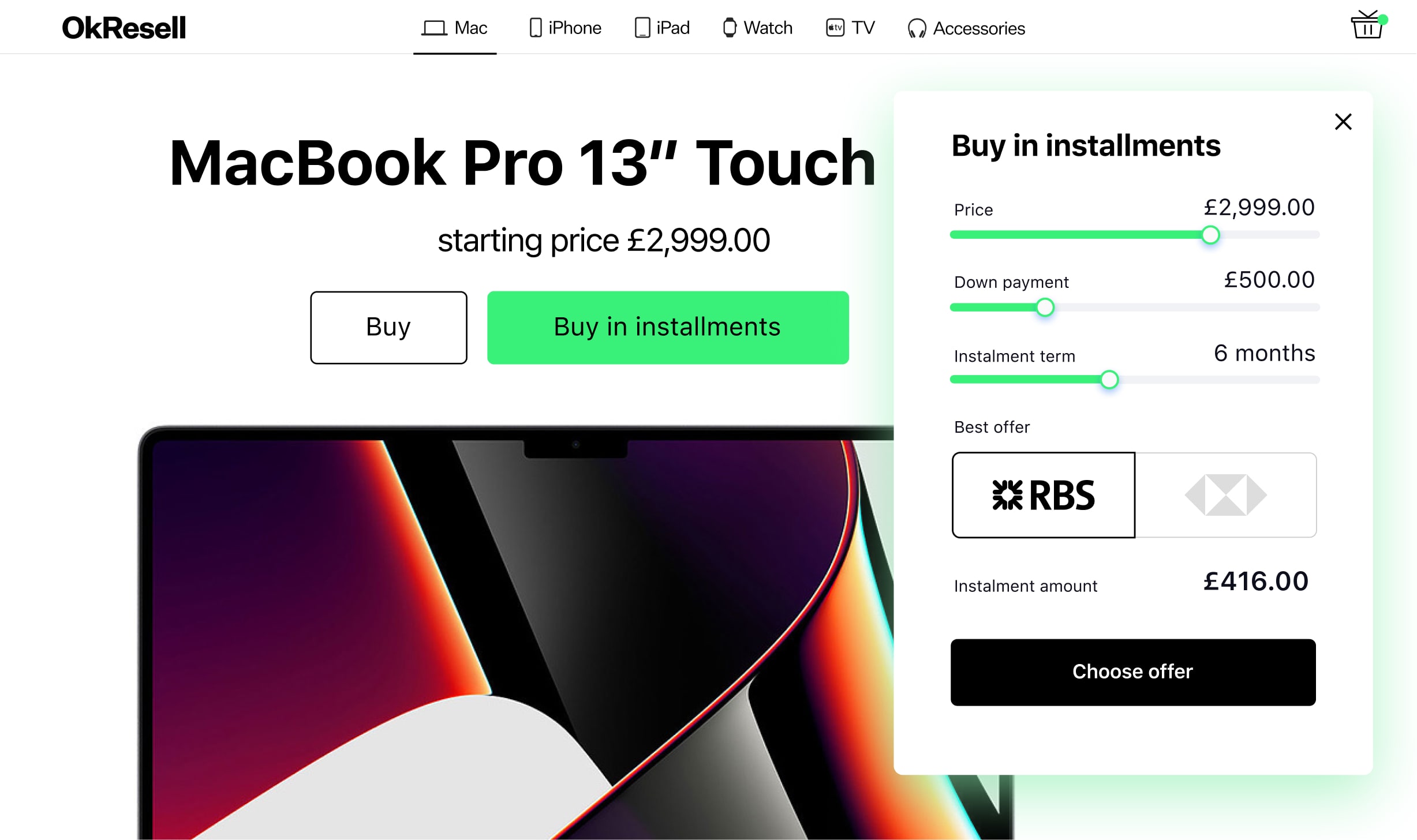

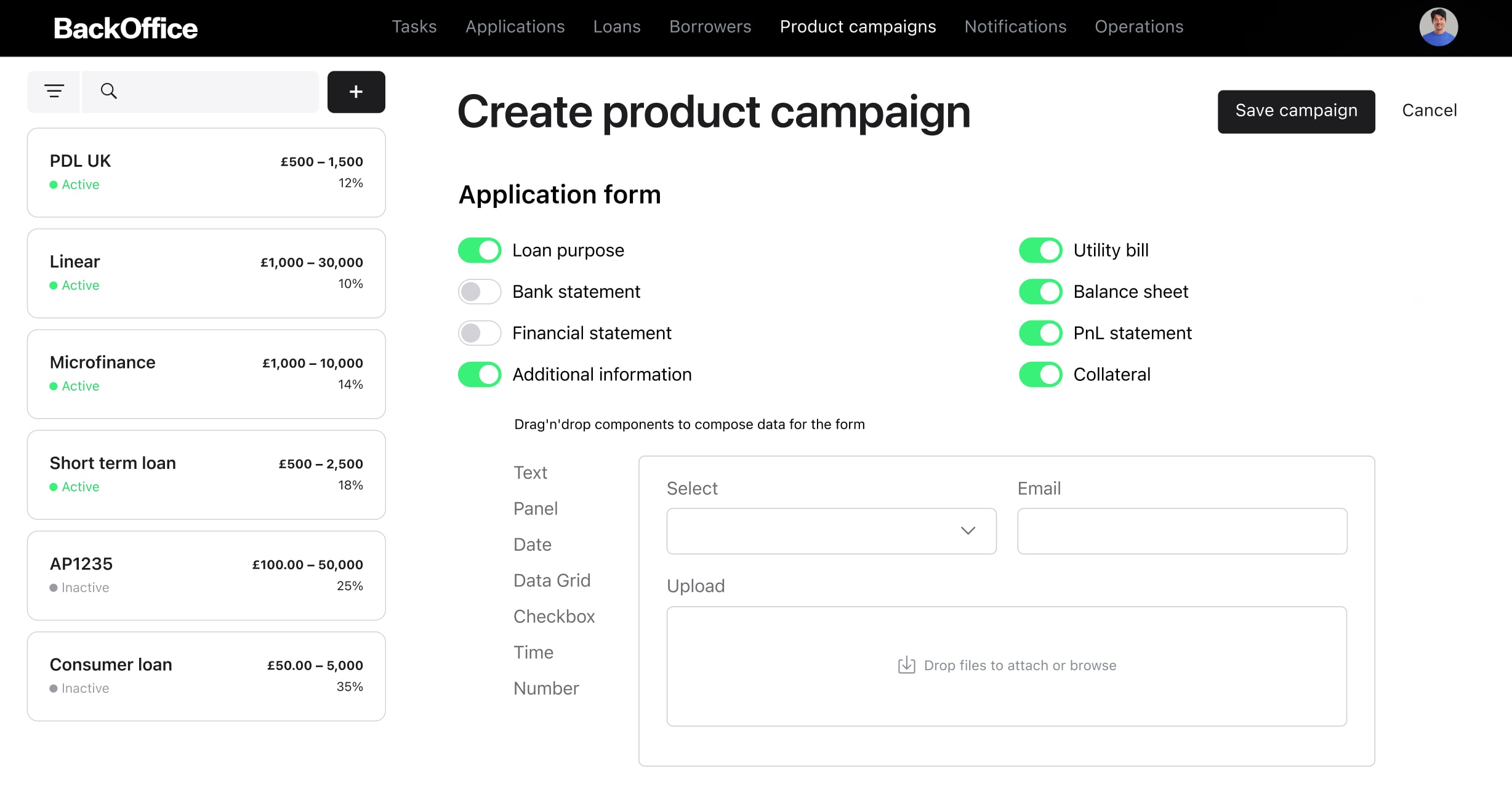

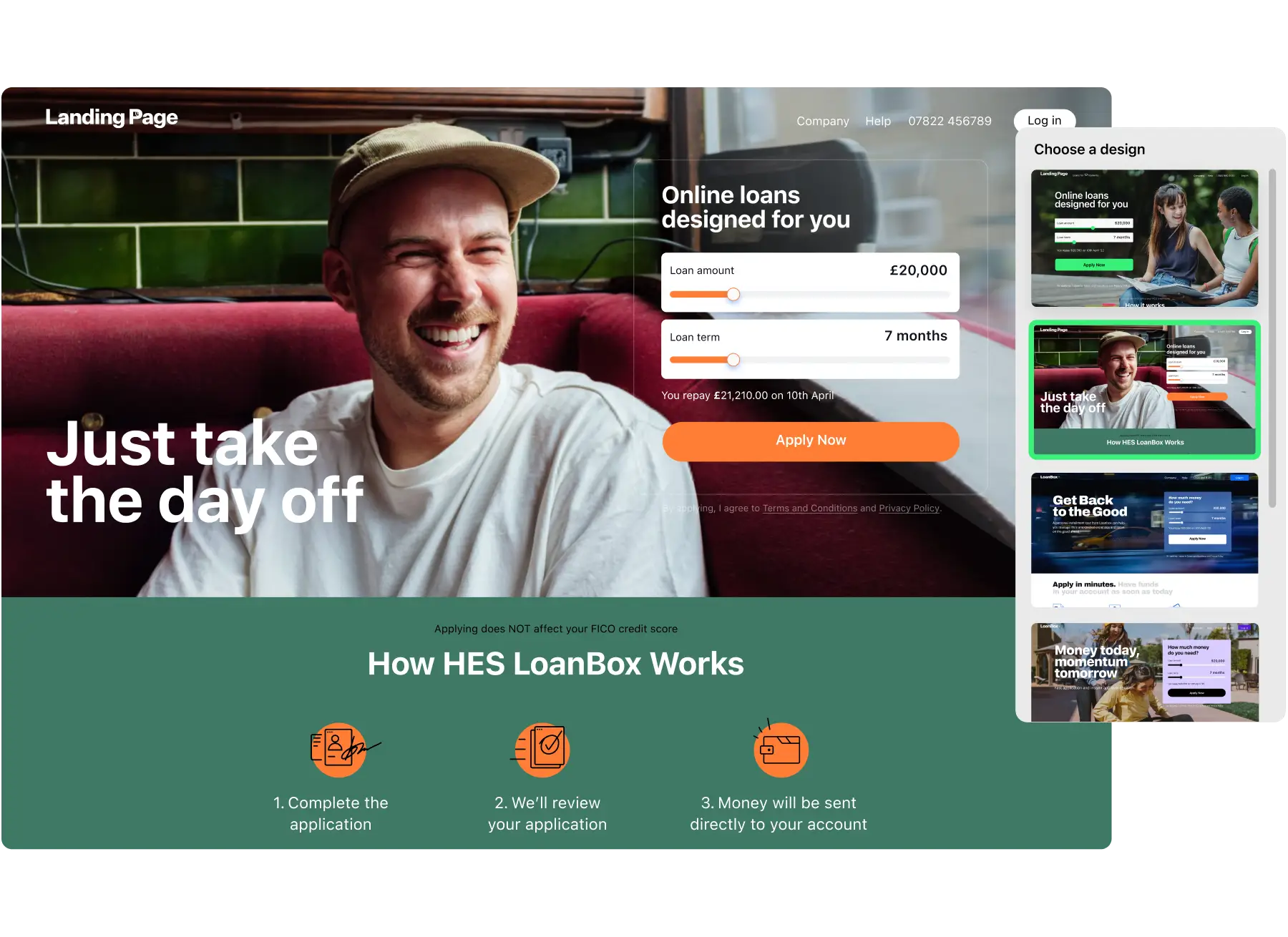

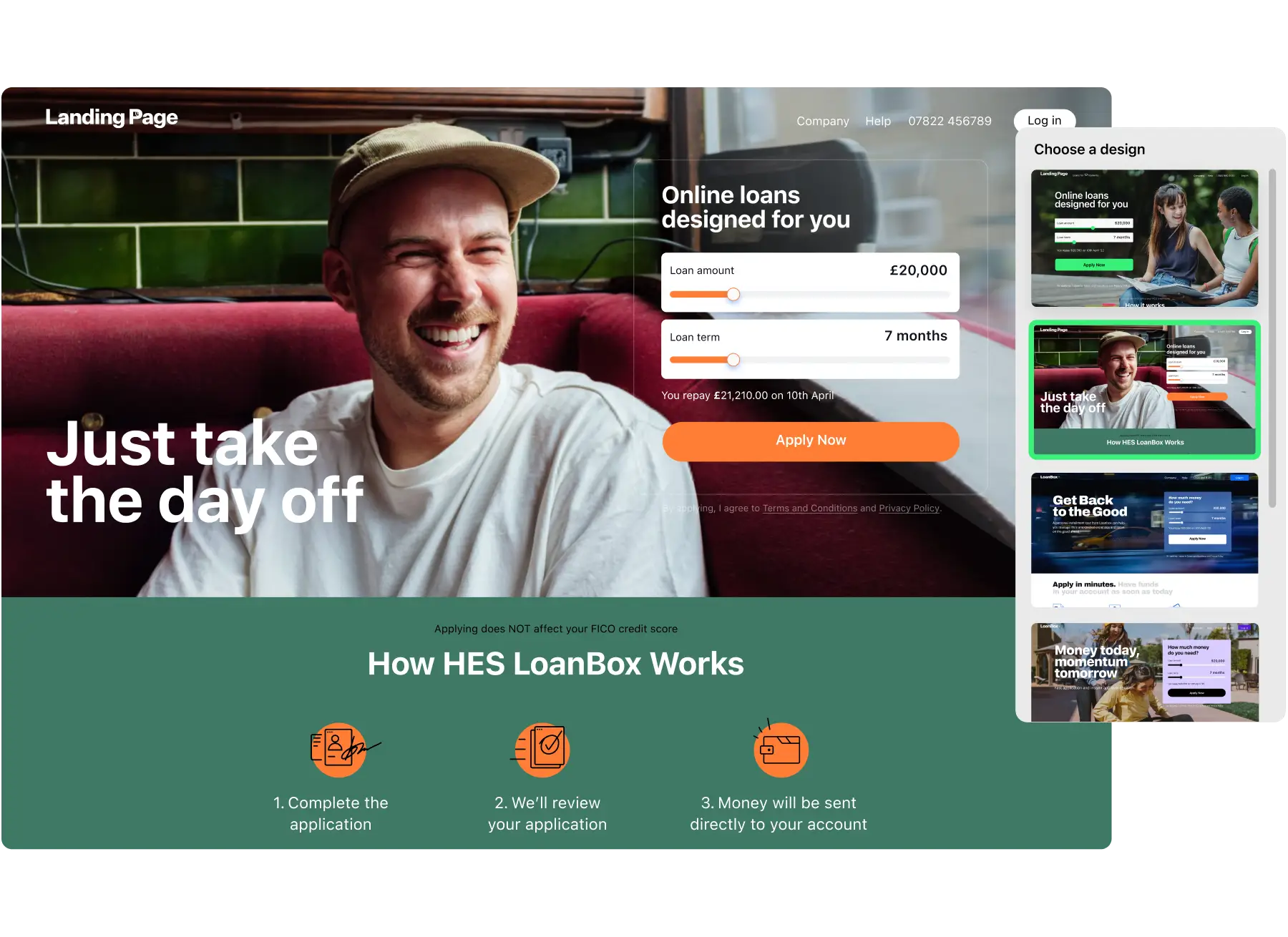

Launch your branded lending platform in weeks, not months

HES LoanBox white-label loan management solution meets FCA requirements while delivering conversion rates 20-30% higher than industry average.

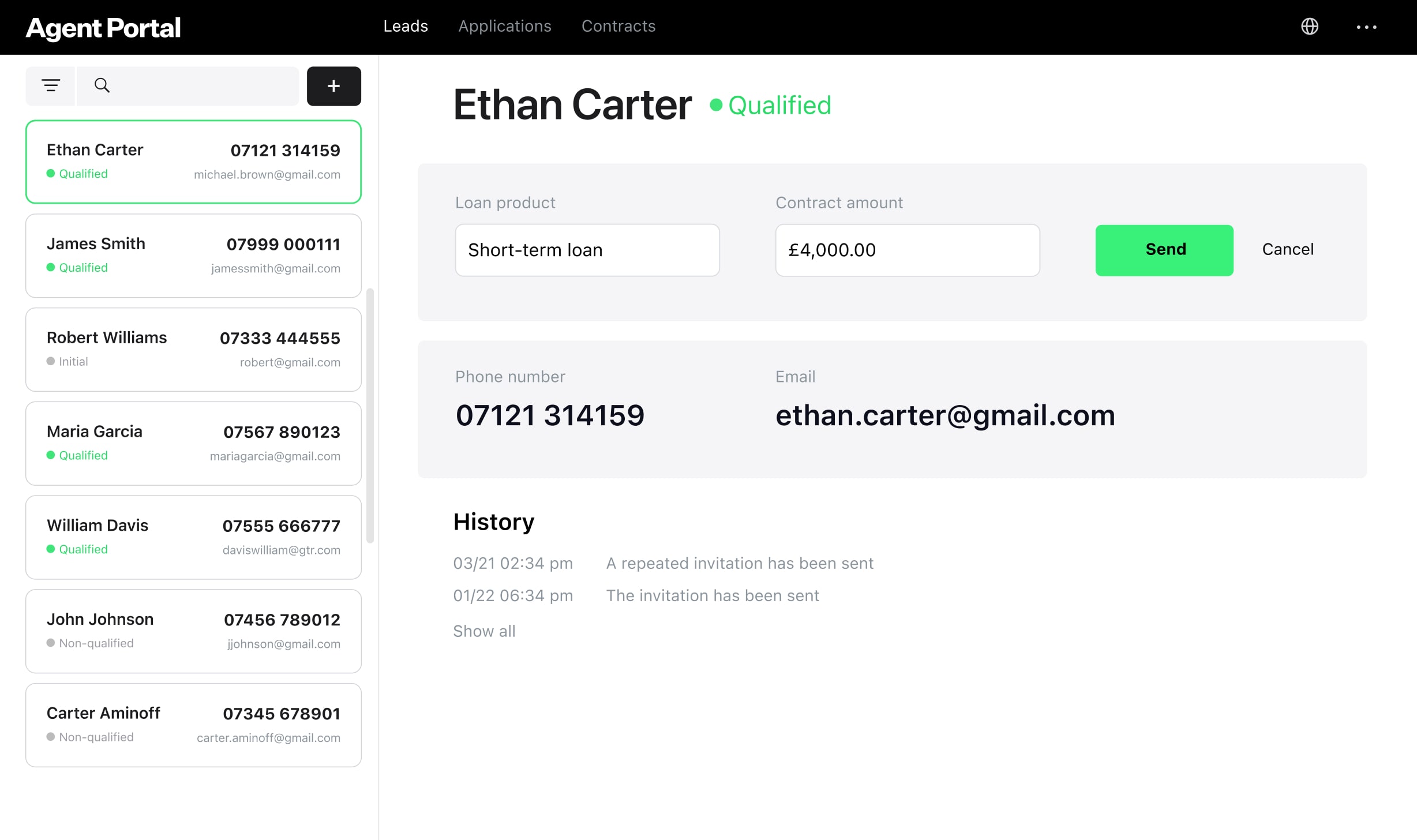

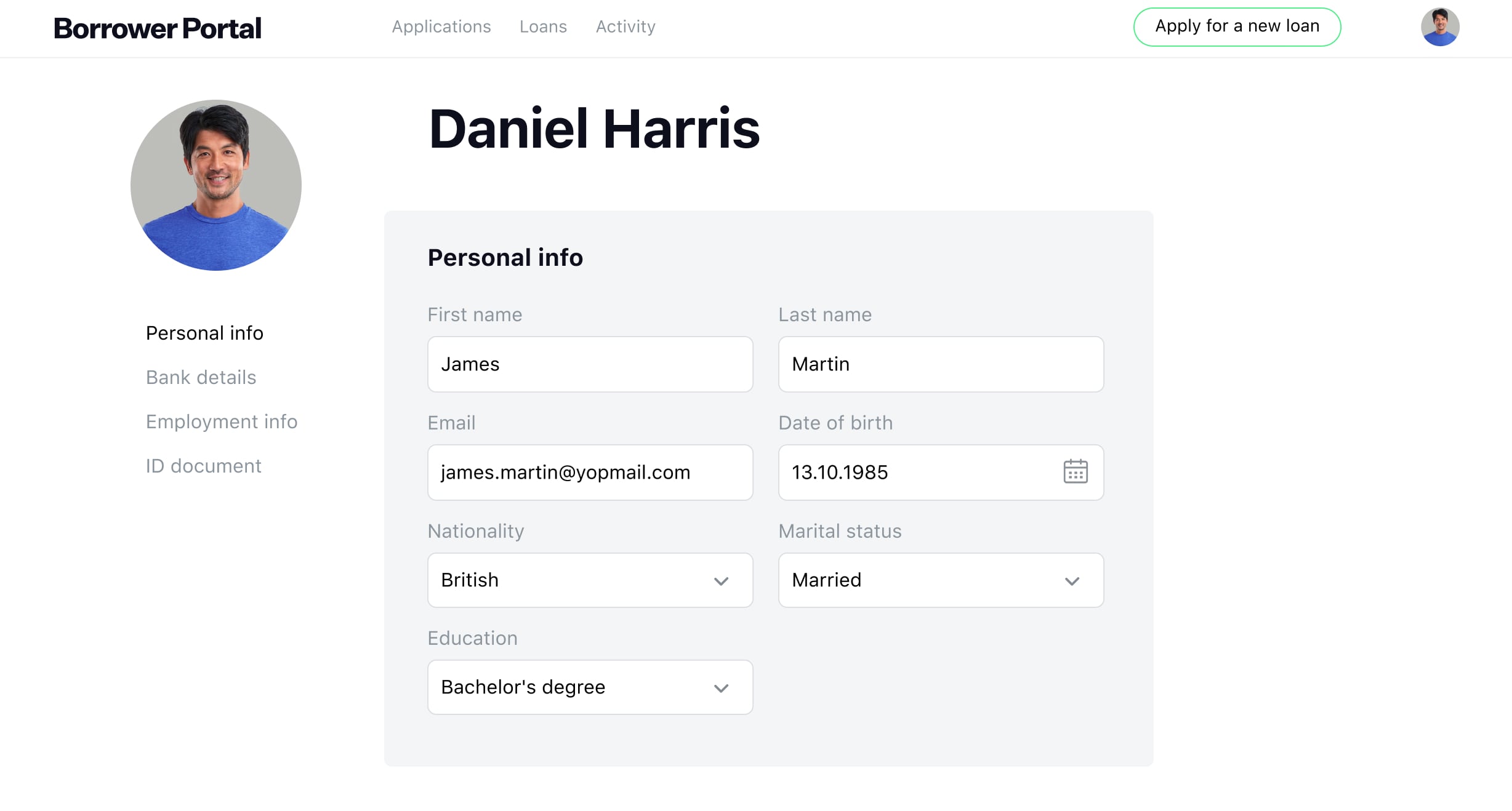

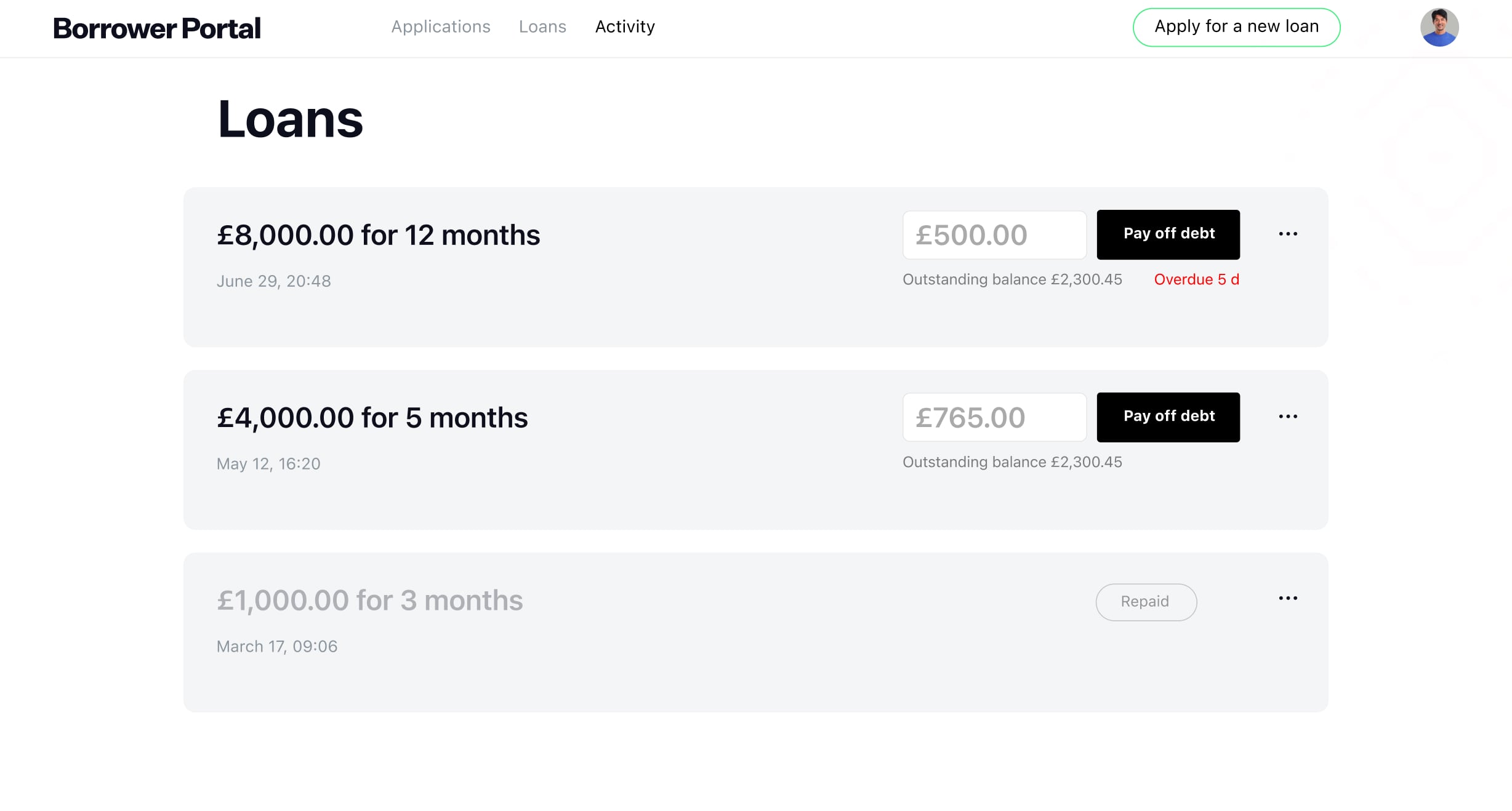

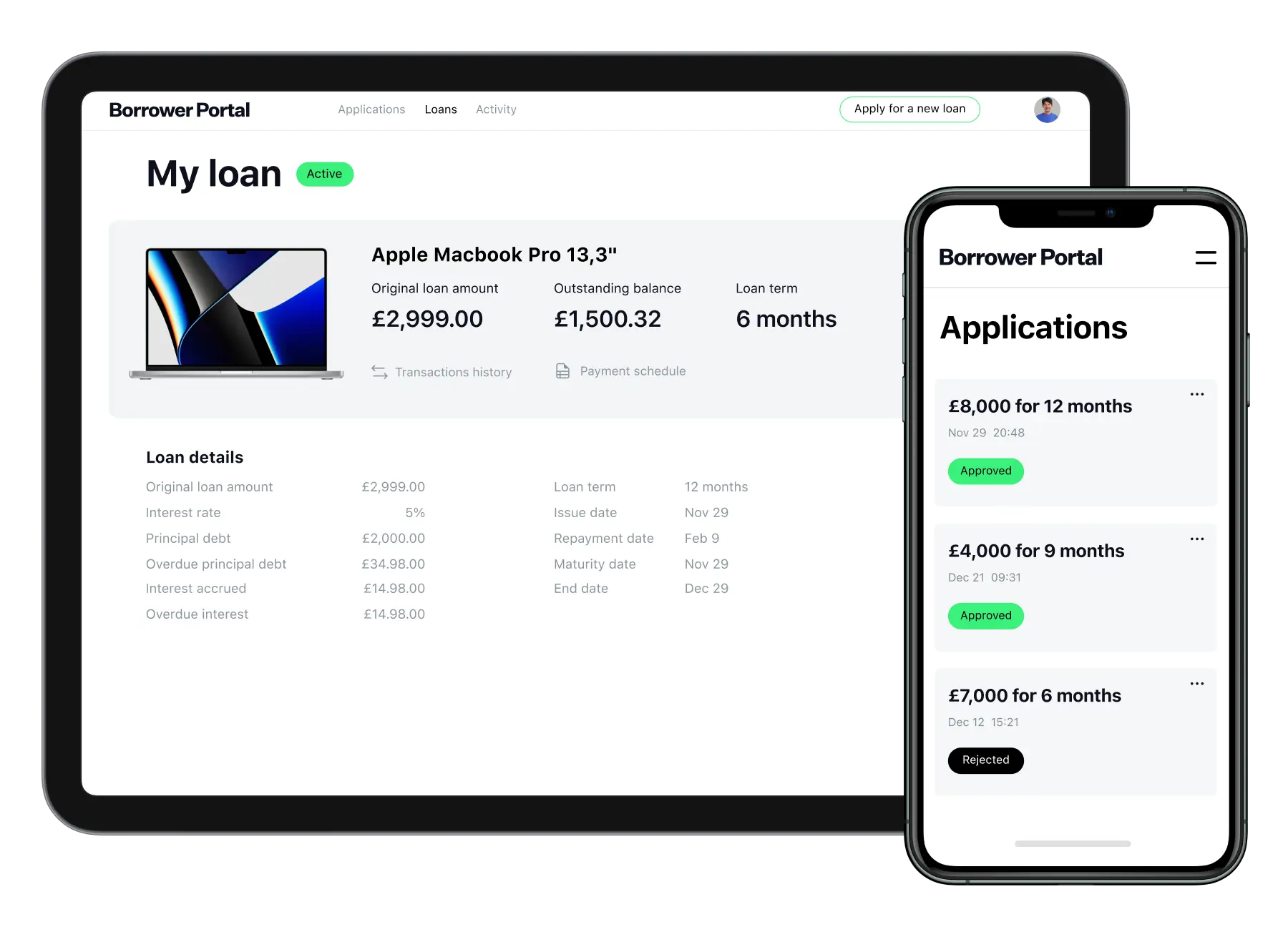

Transform customer loan experience with end-to-end digital lending

From Open Banking integration to automated KYC verification, reduce application time from days to minutes while ensuring full regulatory compliance.

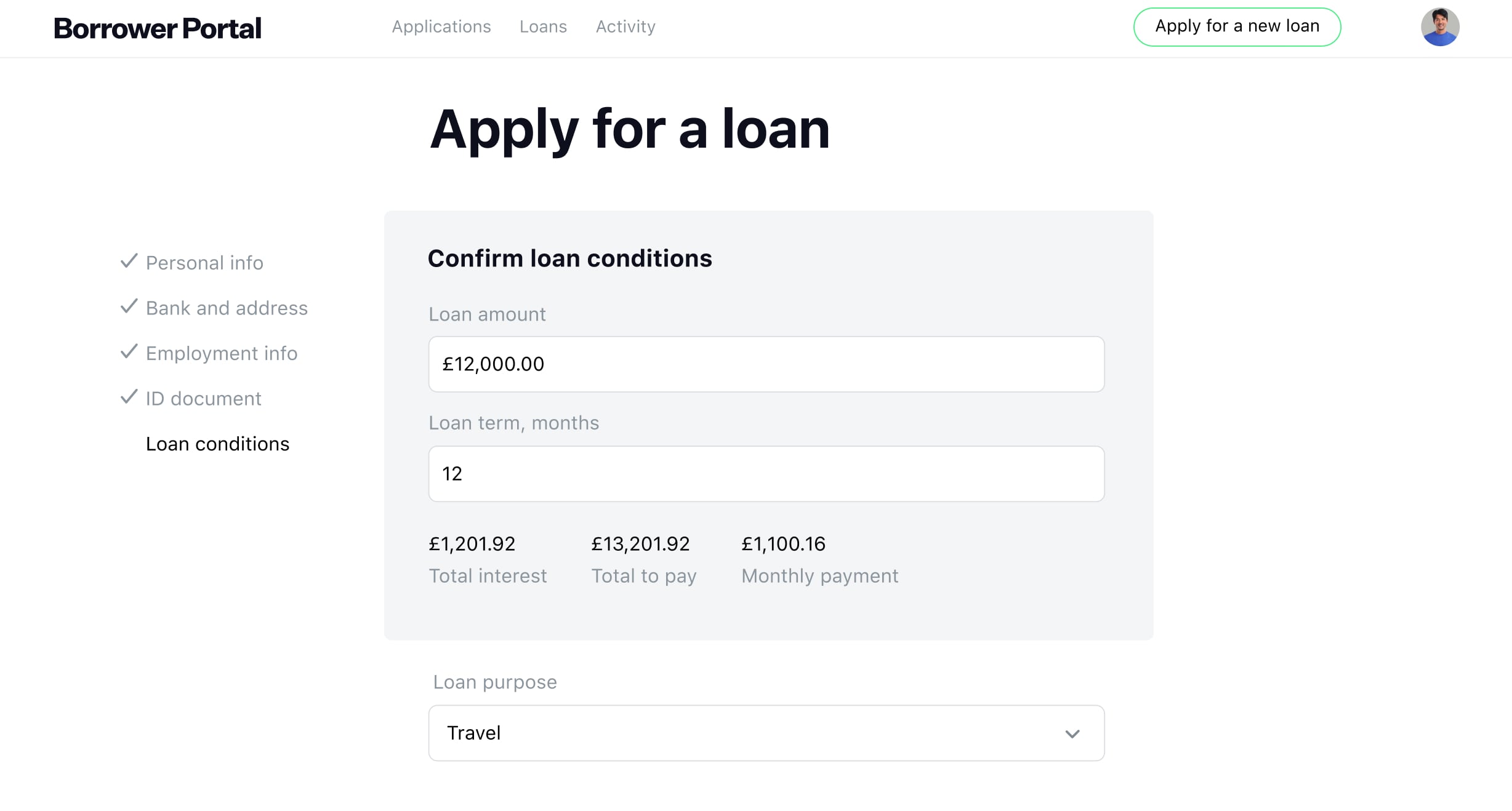

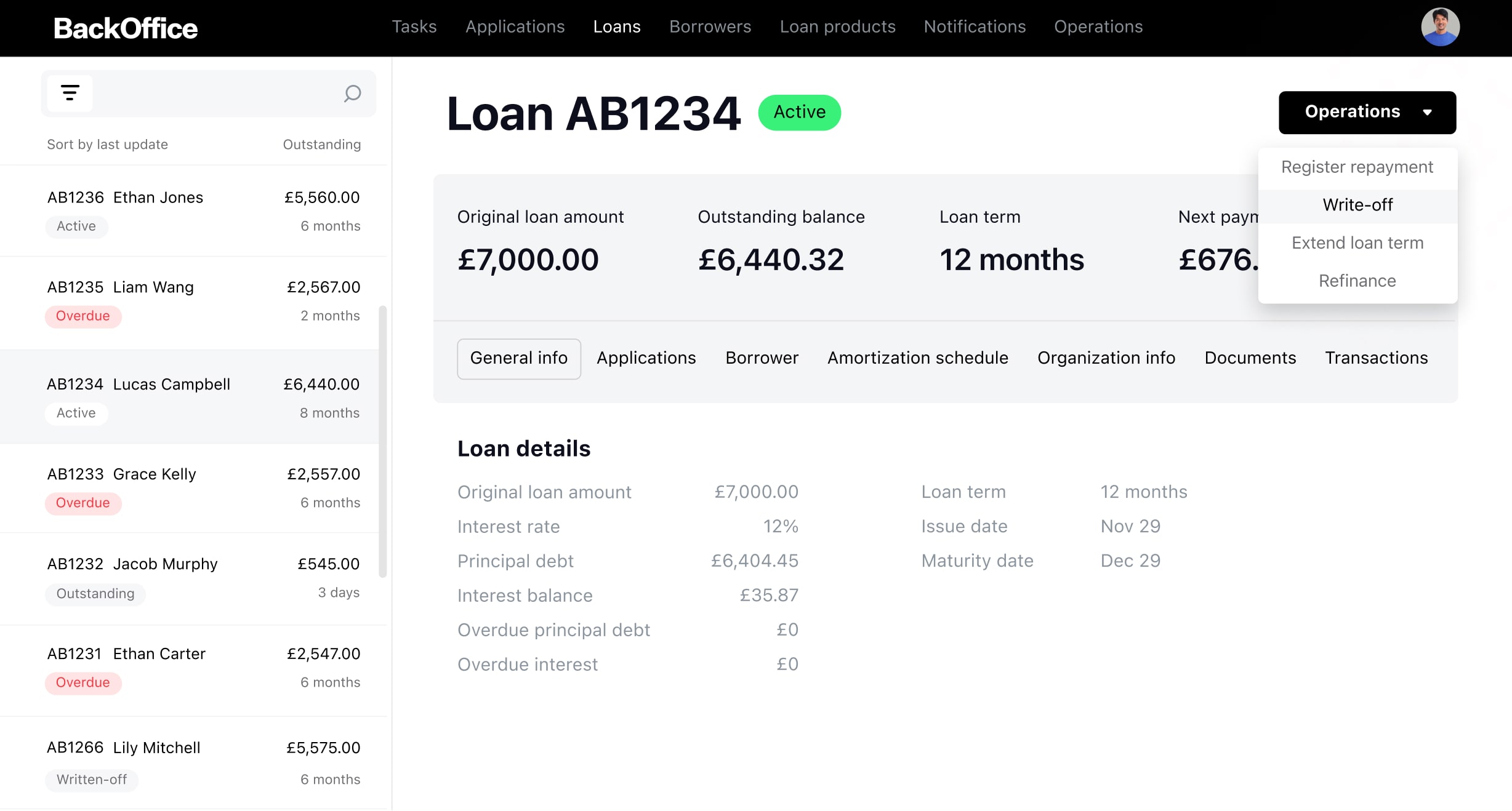

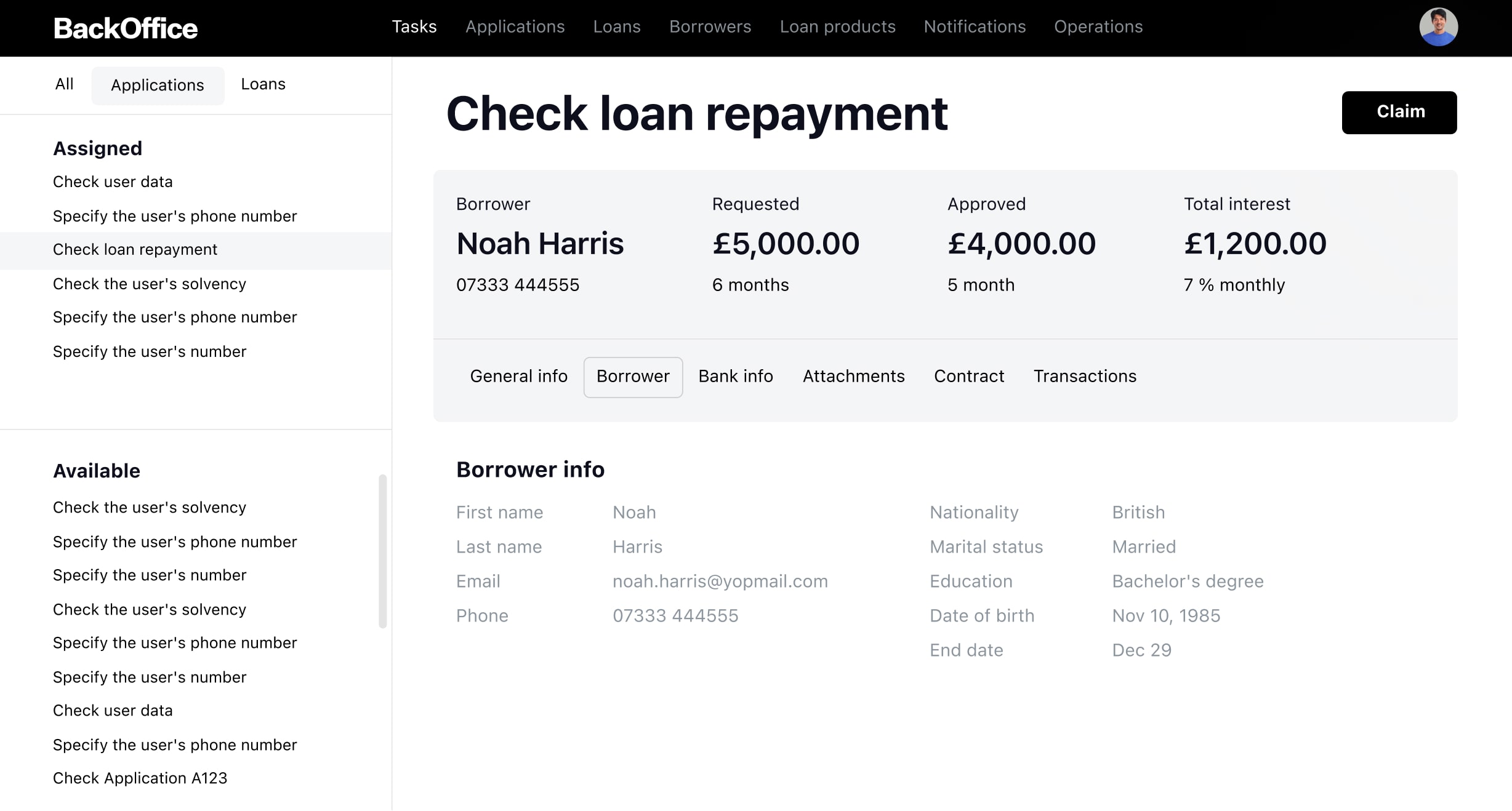

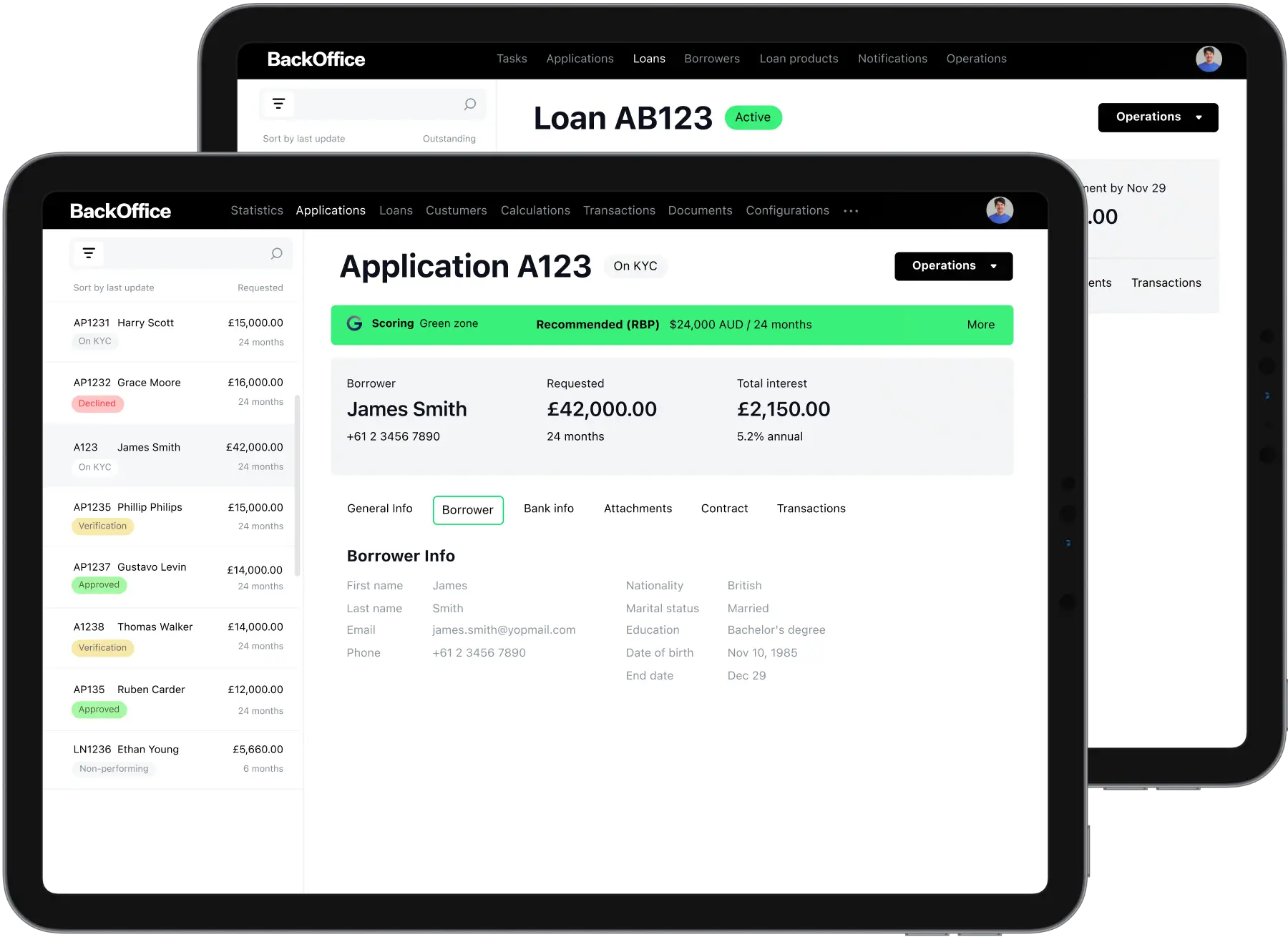

Complete operational control in one platform

Manage £100M+ loan portfolios with real-time risk monitoring, automated compliance reporting, and seamless integration with UK payment systems.

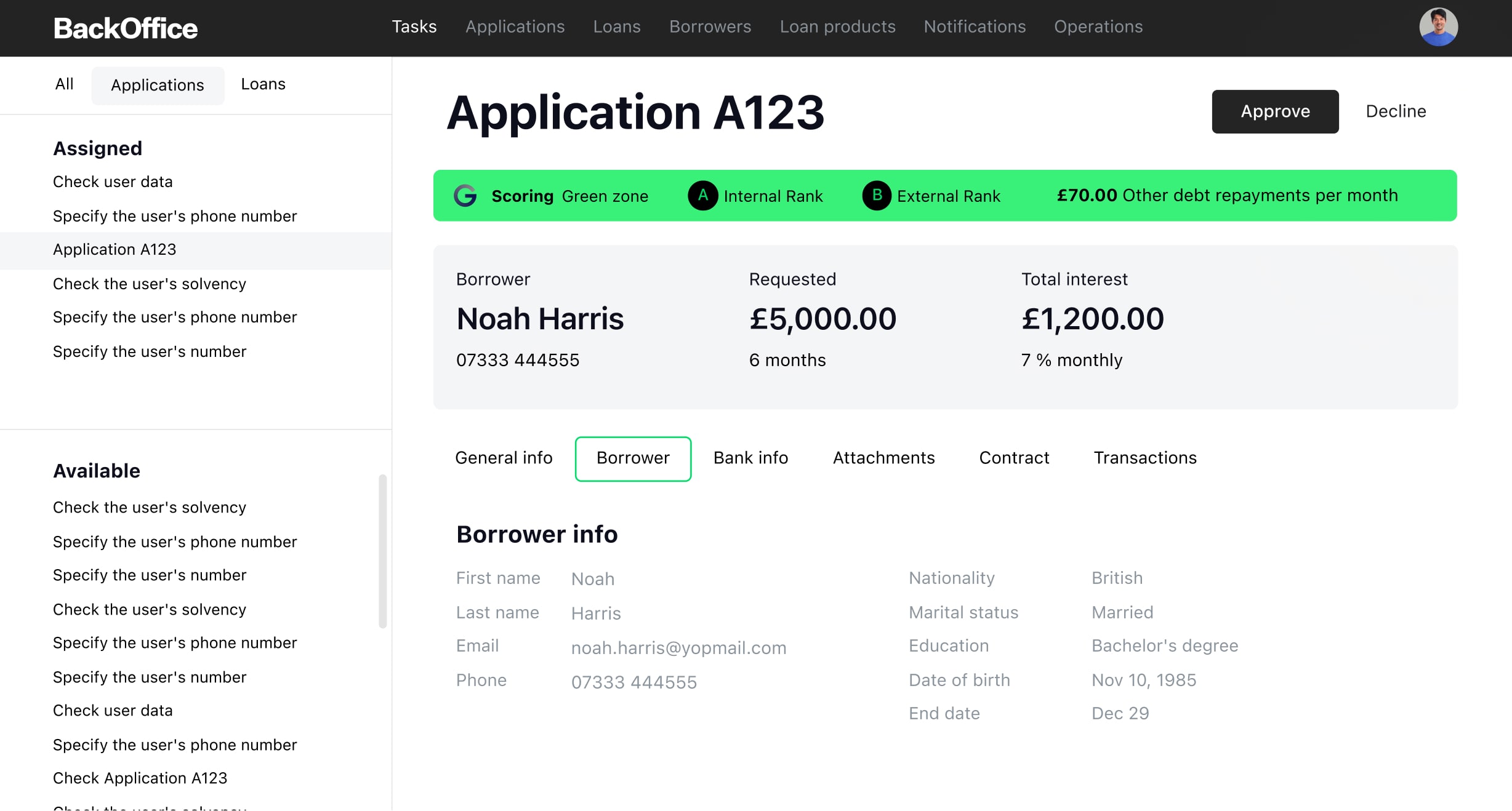

Get AI-powered credit decisions in under 60 seconds

Make instant, accurate lending decisions using Open Banking data and 300+ risk factors. GiniMachine reduces NPLs while approving more creditworthy customers.

Seamless

integrations

Your partner

in UK lending

We deliver a powerful, ready-to-use lending platform, enhanced through our expertise in customization and scalability. Tailored to support any type of lending, our solution guarantees efficiency, flexibility, and full regulatory compliance.

Why choose HES LoanBox

Lending software in 4 months

Enterprise-grade security

Seamless integrations

24/7 customer support

Why HES FinTech

software?

Post-launch support

Our team provides ongoing assistance, system updates, and continuous optimisation to keep your lending processes efficient and compliant.

Global trust

HES FinTech's loan management solutions are trusted by over 130 businesses worldwide, thanks to our commitment to innovation, security, and compliance.

Local clients and partners

We prioritize building strong connections with local industry players. This approach allows us to provide effective and compliant solutions that drive business success.