Loan management system

in Philippines

Grow your business with an end-to-end online lending system compliant with regulatory standards.

Empowering lenders worldwide

Digital lending software for banks and alternative lenders

HES LoanBox is a cloud-based loan management system designed to streamline and automate the entire lending process for banks, alternative lenders, and other financial institutions. It covers the complete lending workflow, from origination to collection. Our loan management software can be integrated with existing systems or serve as the foundation for new business processes.

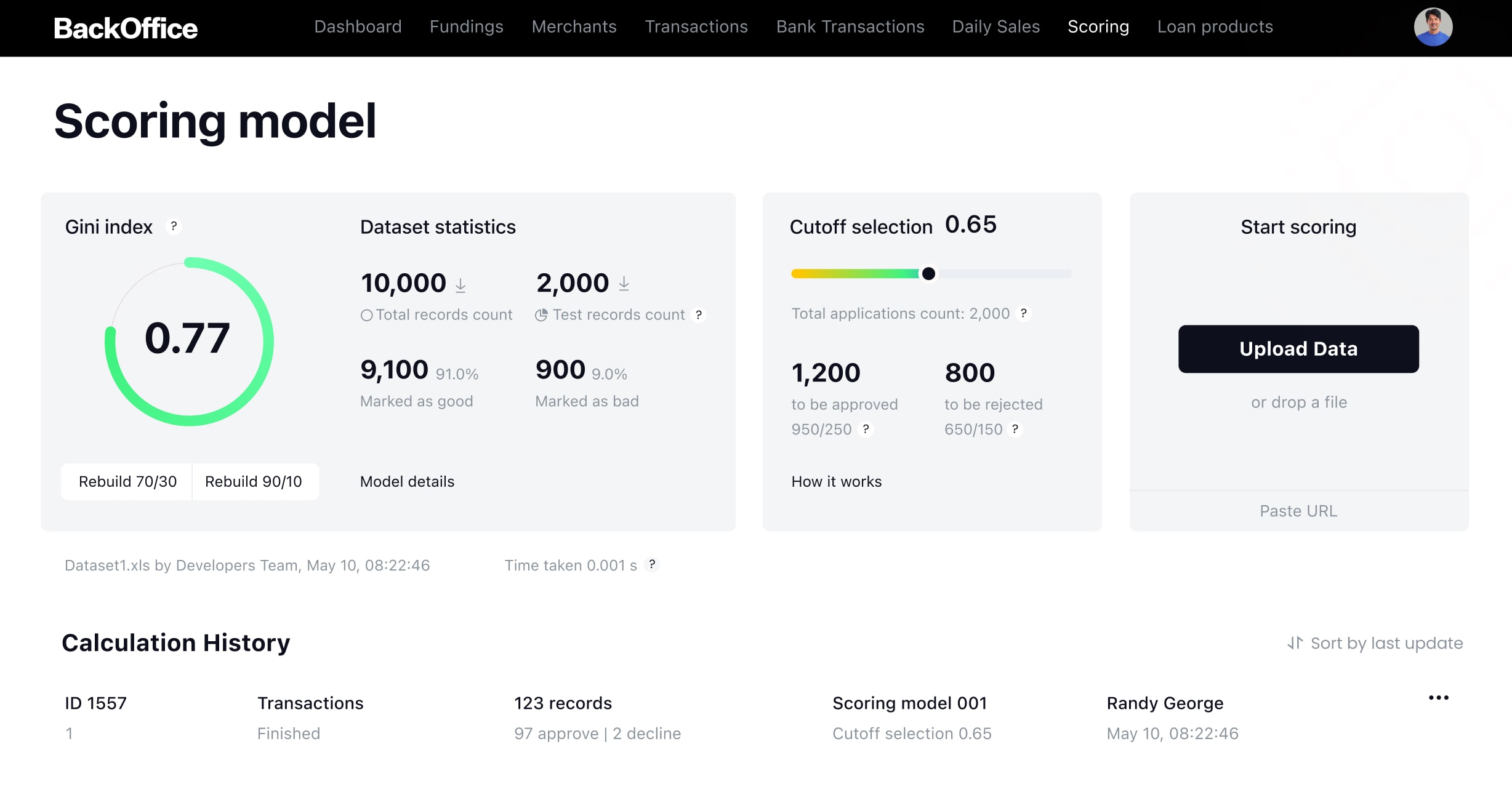

GiniMachine is a no-code AI solution that harnesses machine learning to analyze borrower data and provide lenders with insights into their behavior. Seamlessly integrated into HES LoanBox, it removes uncertainty from decision-making and supports data-driven decisions.

Discover HES LoanBox

Take your business

to the next level

Streamline processes from application to repayment, reduce manual tasks, and enhance customer satisfaction.

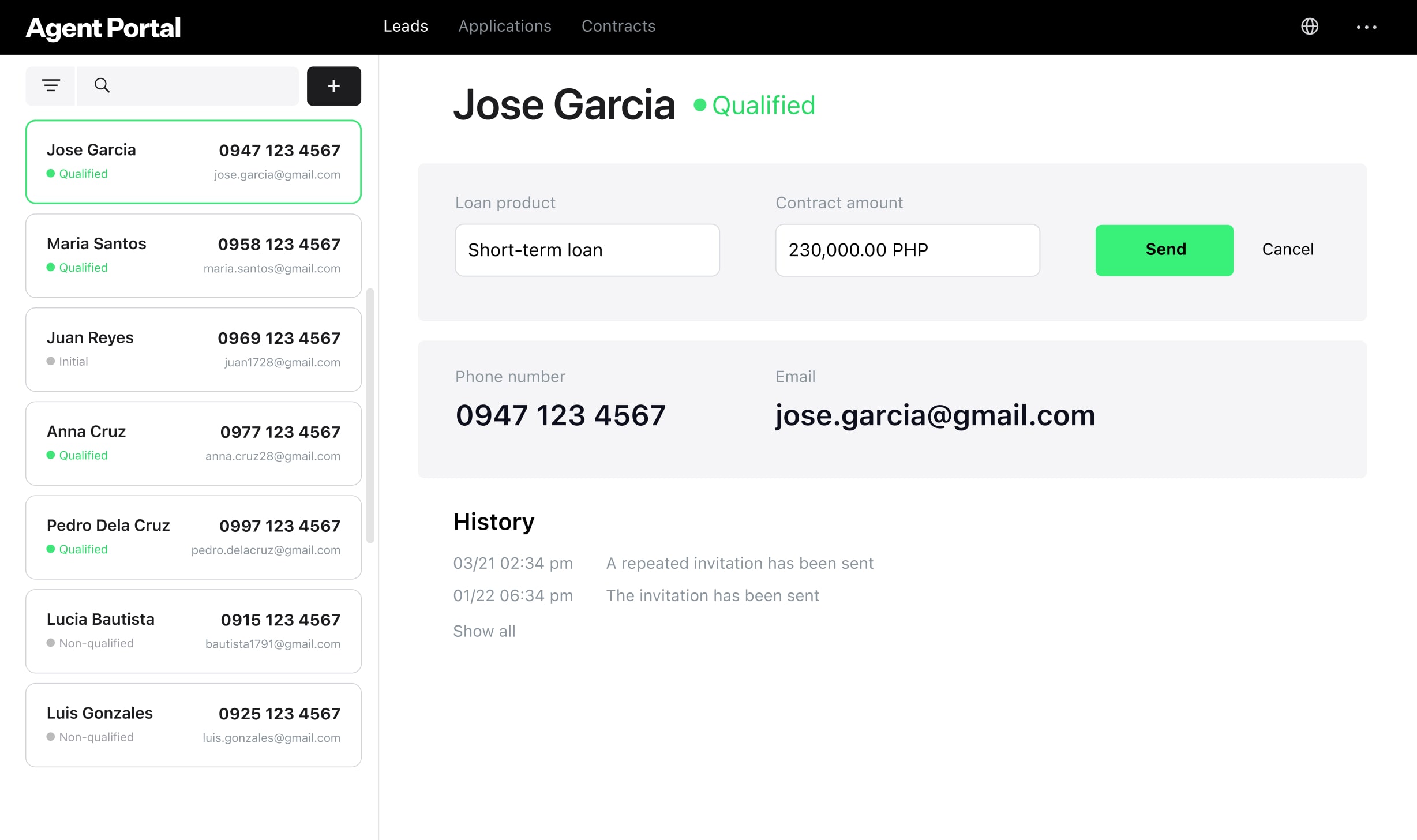

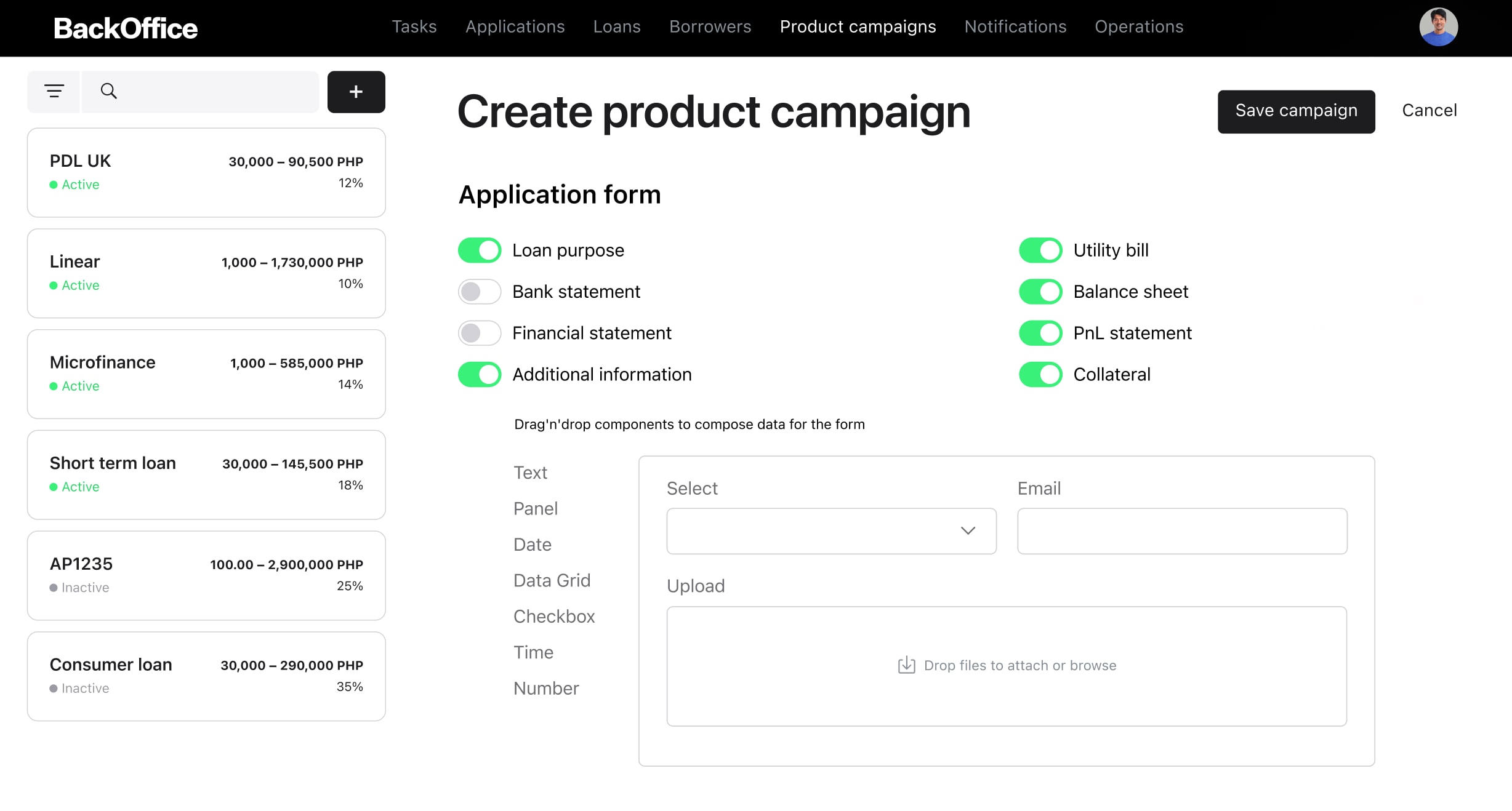

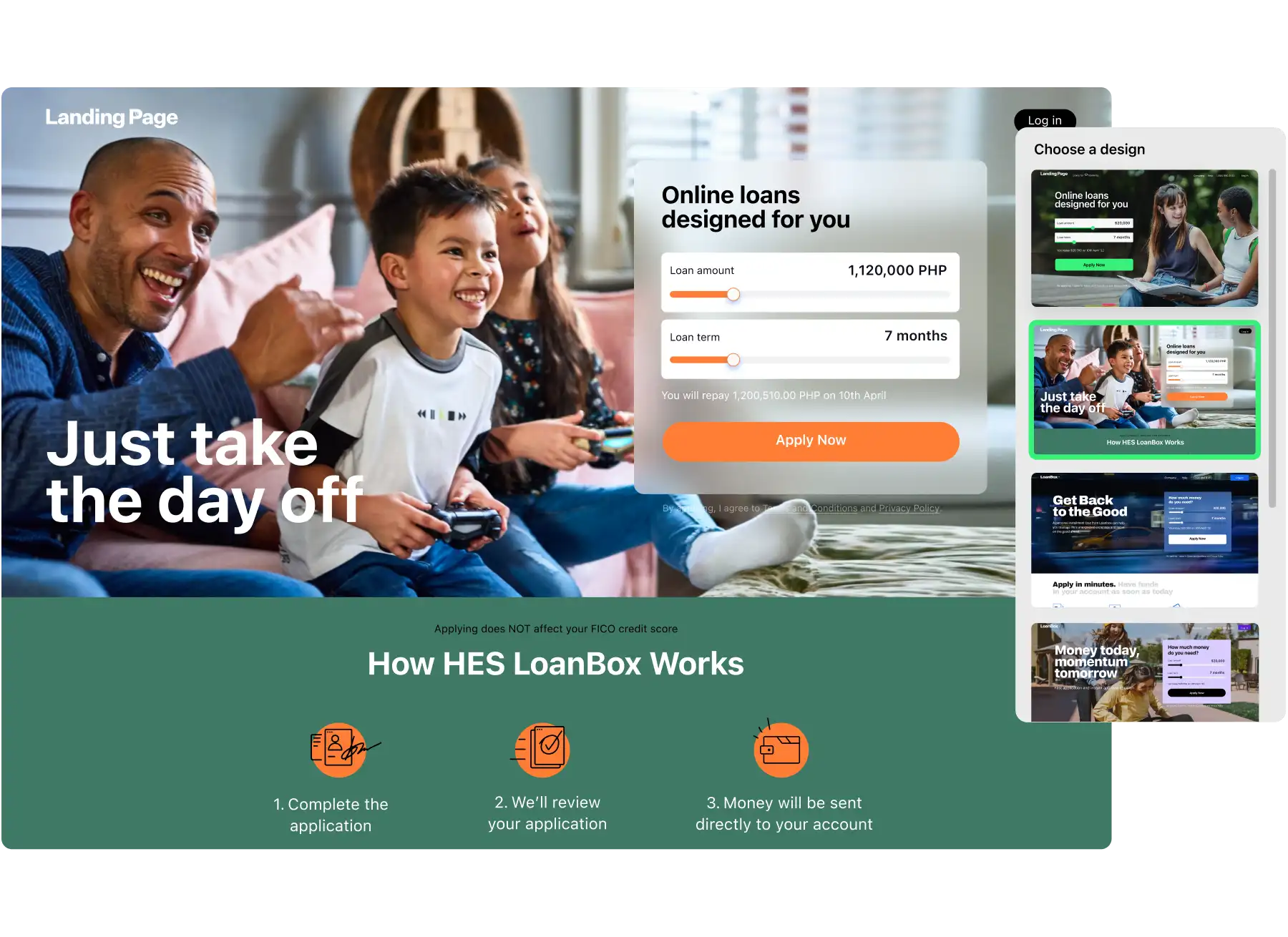

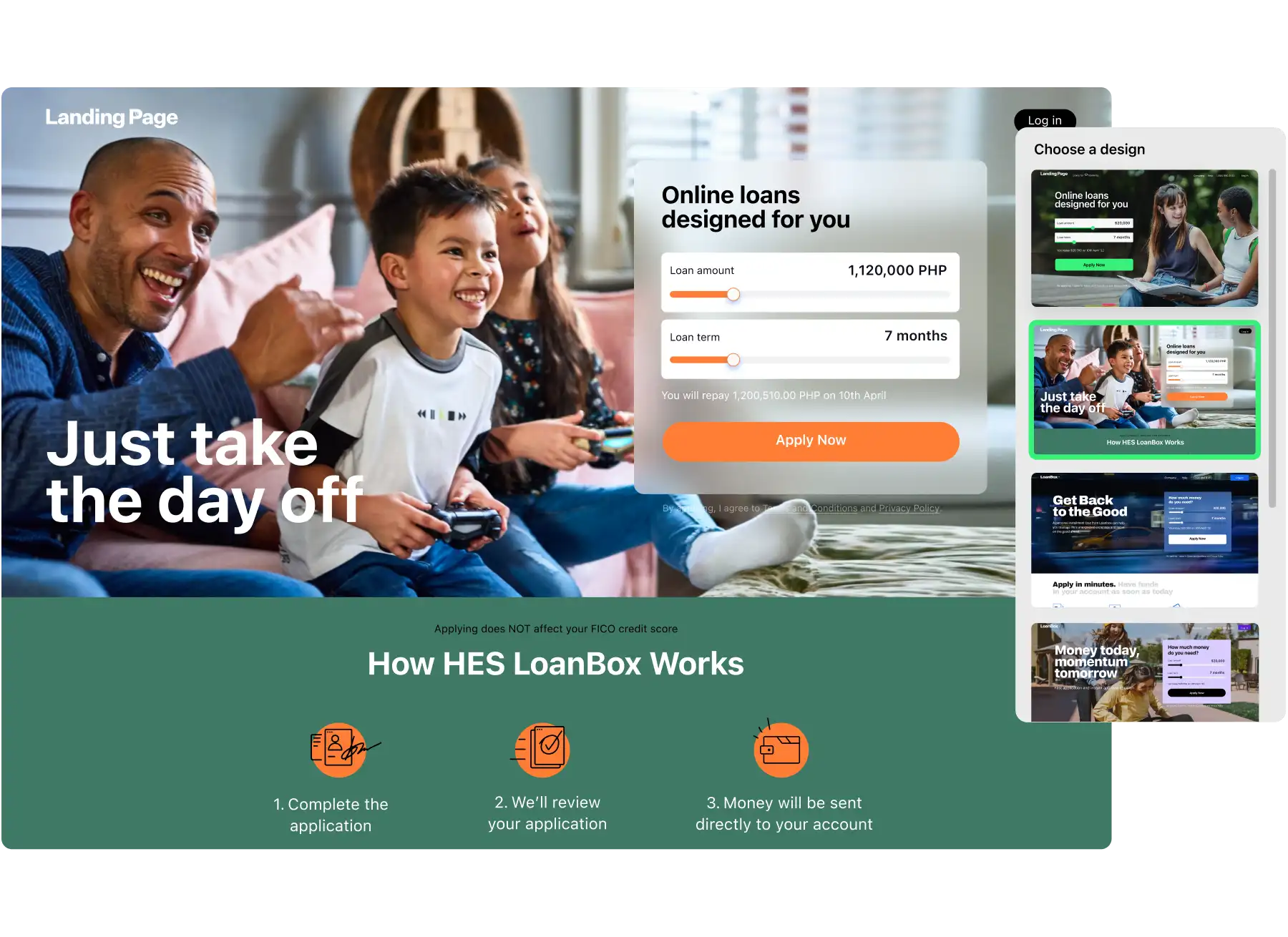

Customizable loan website

Create a unique and user-friendly loan website tailored to your needs. Our white-label solution offers a seamless online experience, enhances user engagement, and increases loan applications.

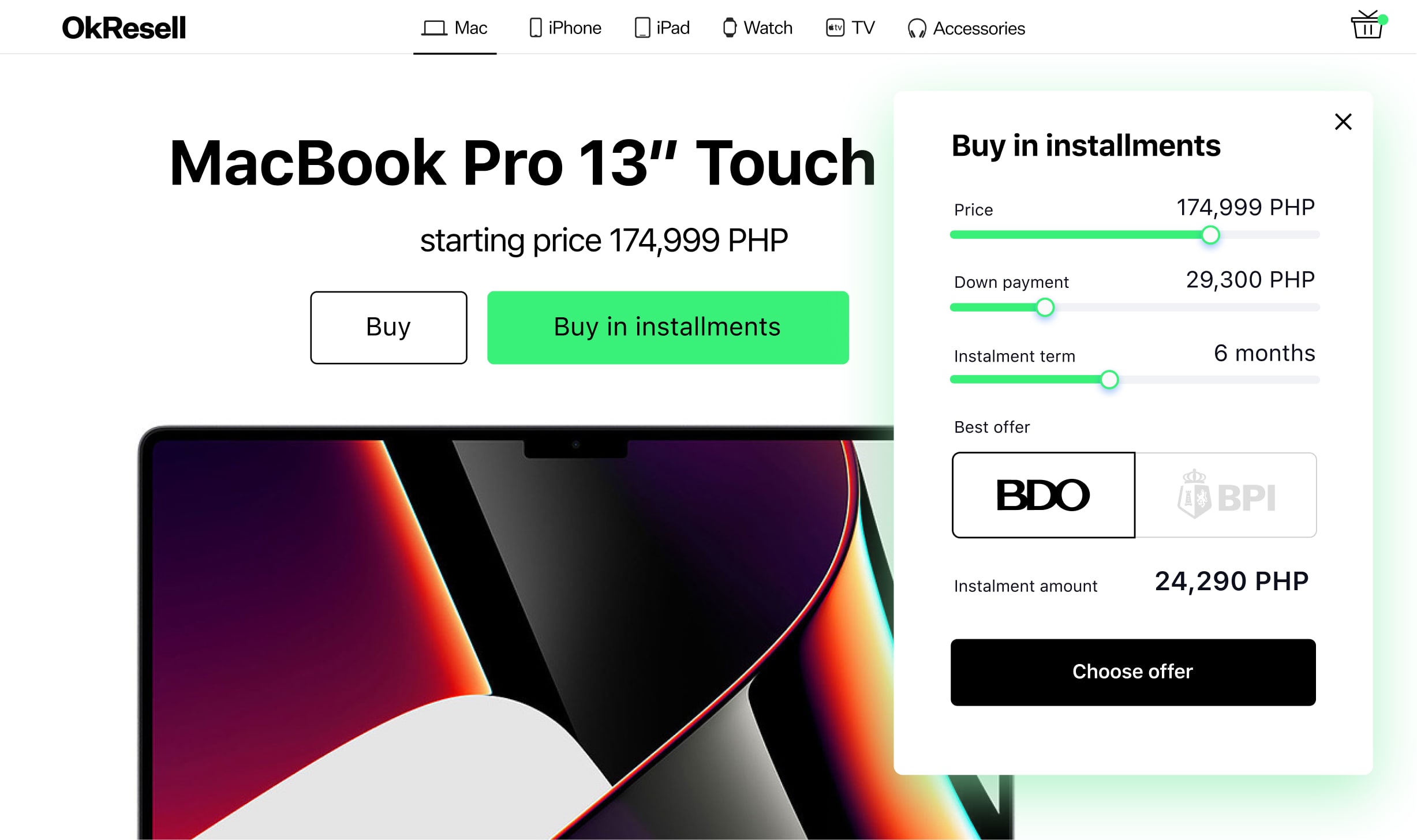

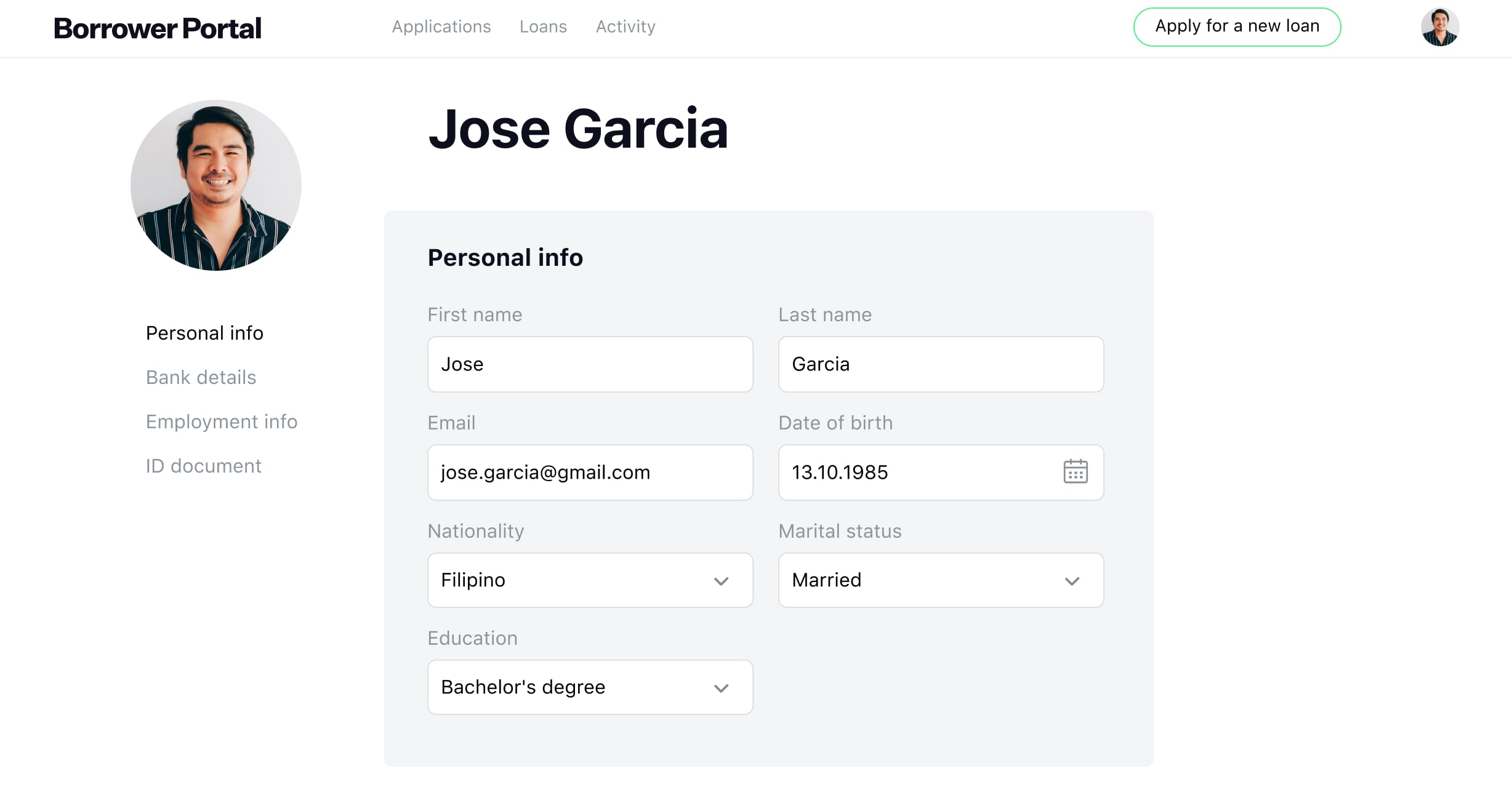

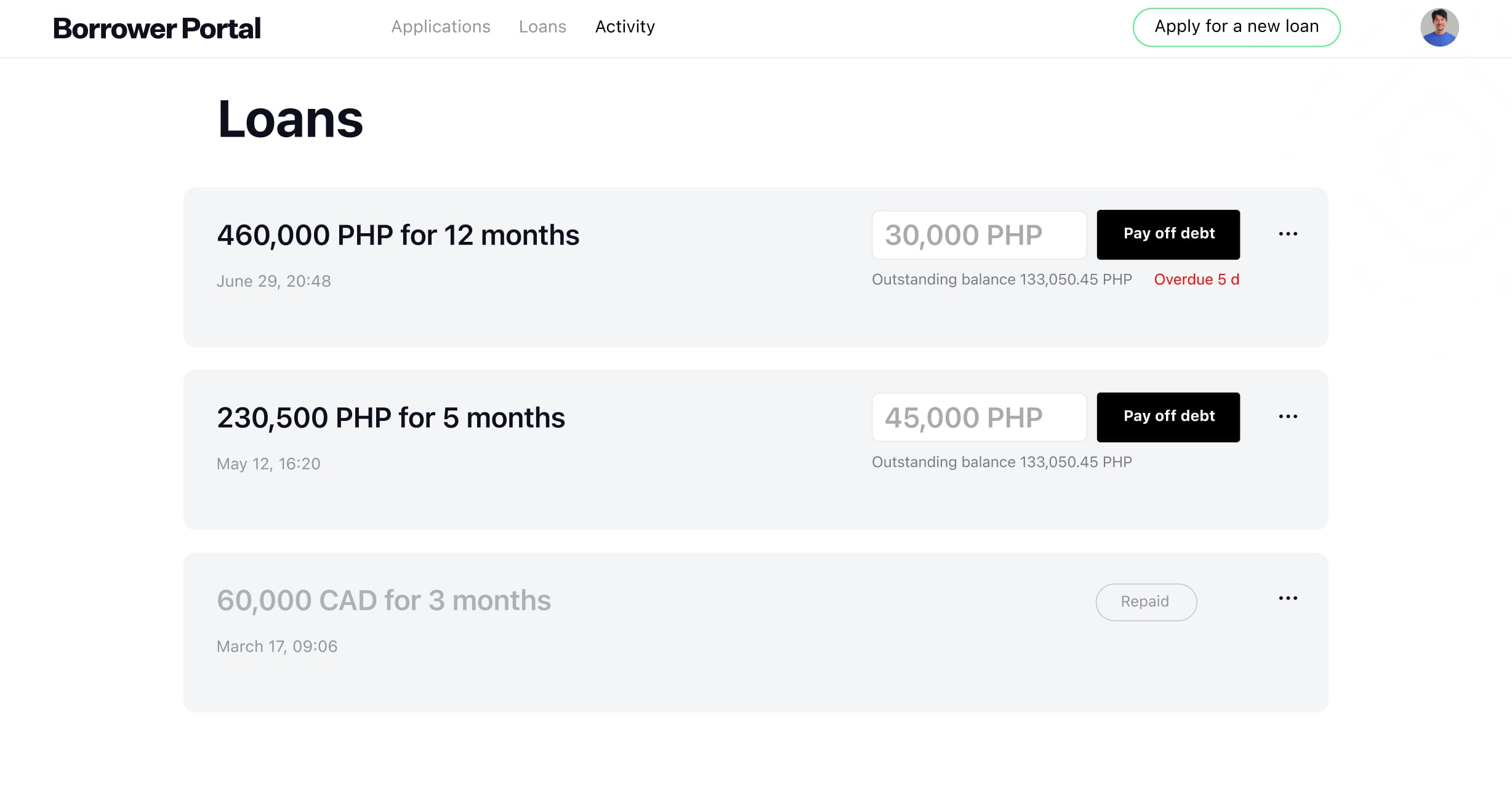

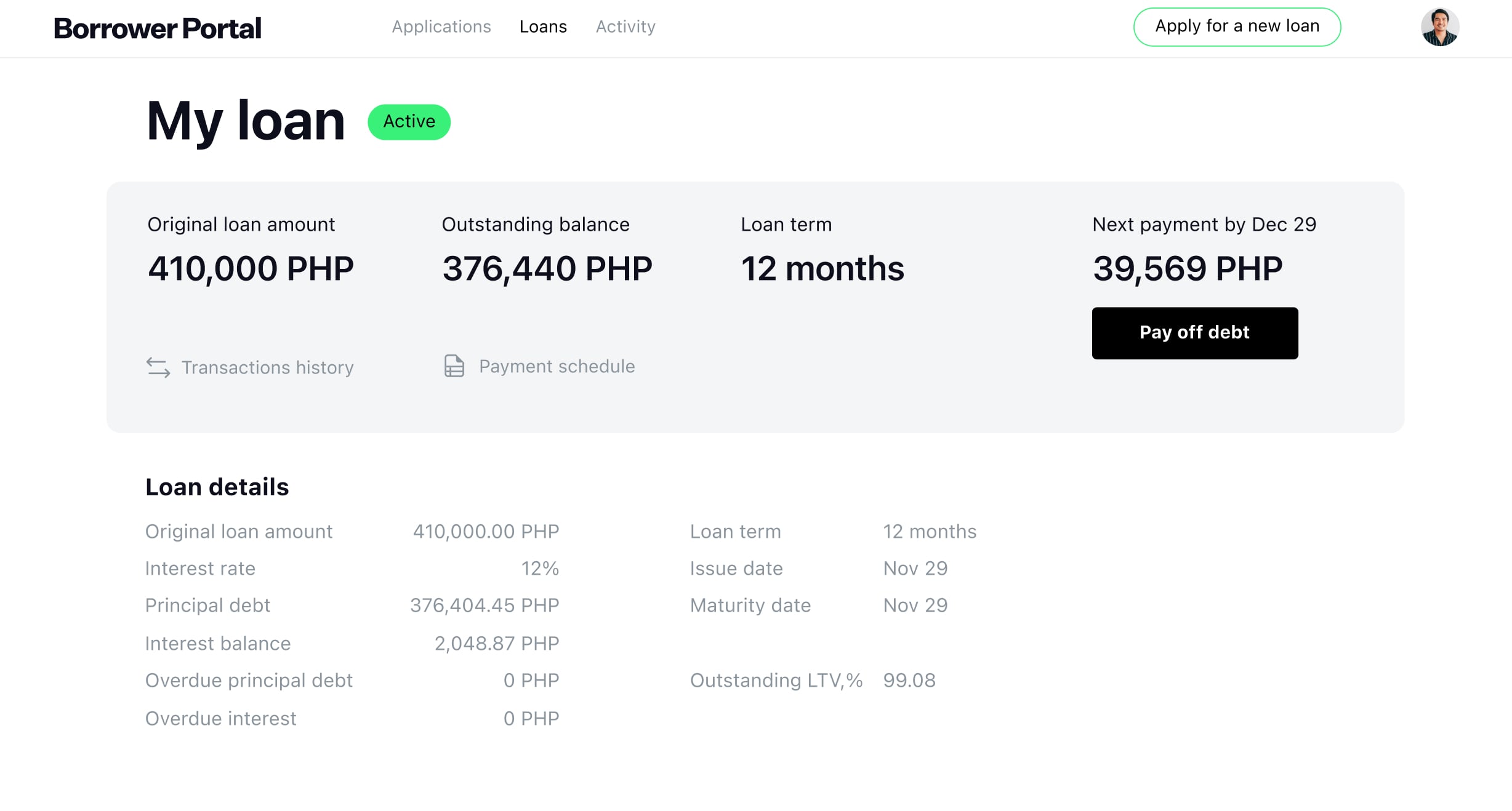

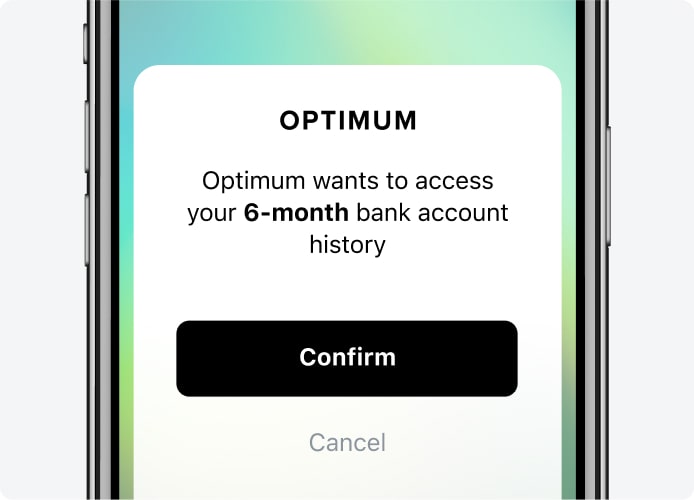

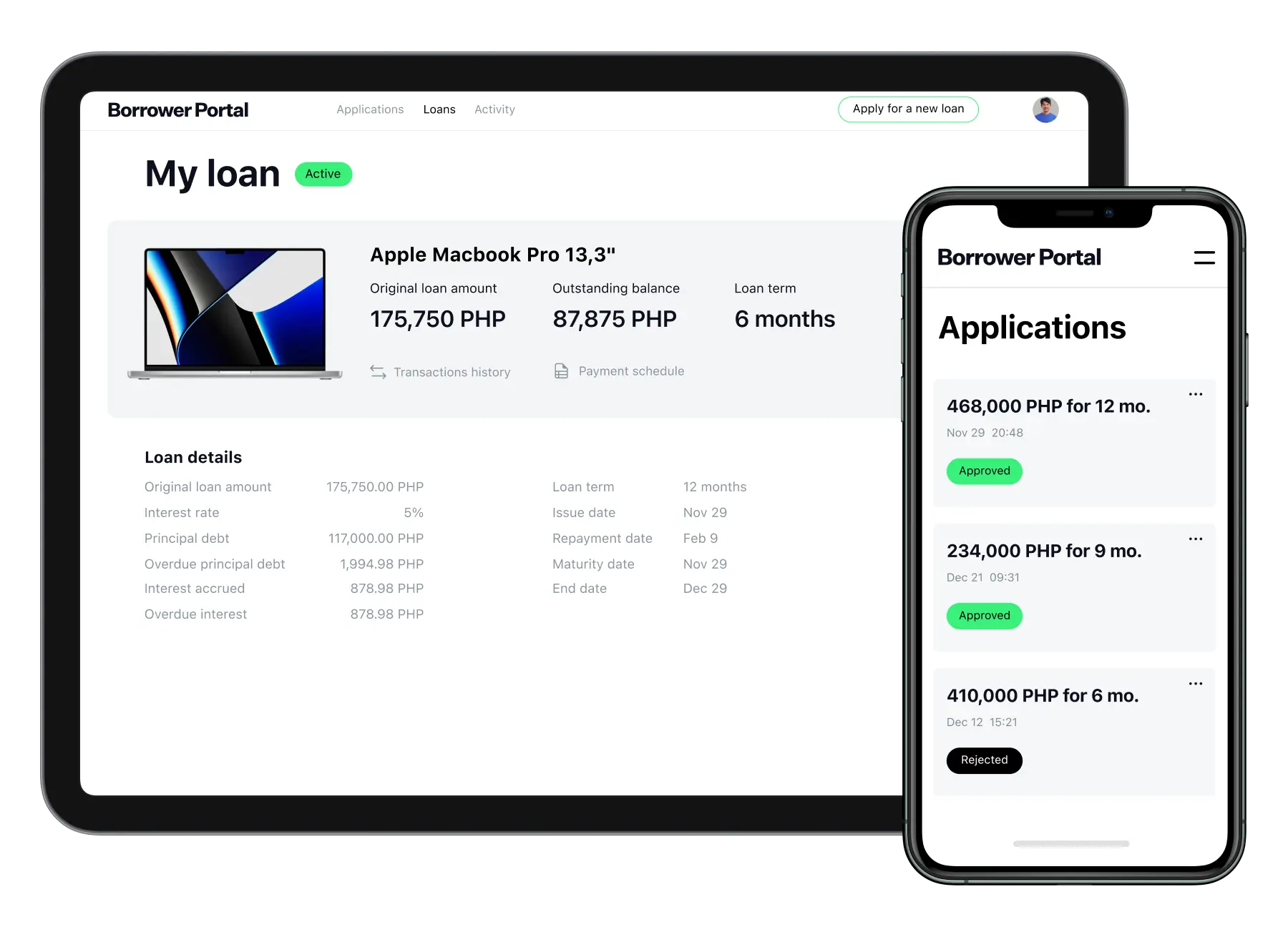

Personalized Borrower Portal

Give your borrowers a dedicated space to manage their loan journey. From easy applications to quick digital KYC verification, streamline every step for a hassle-free experience.

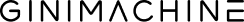

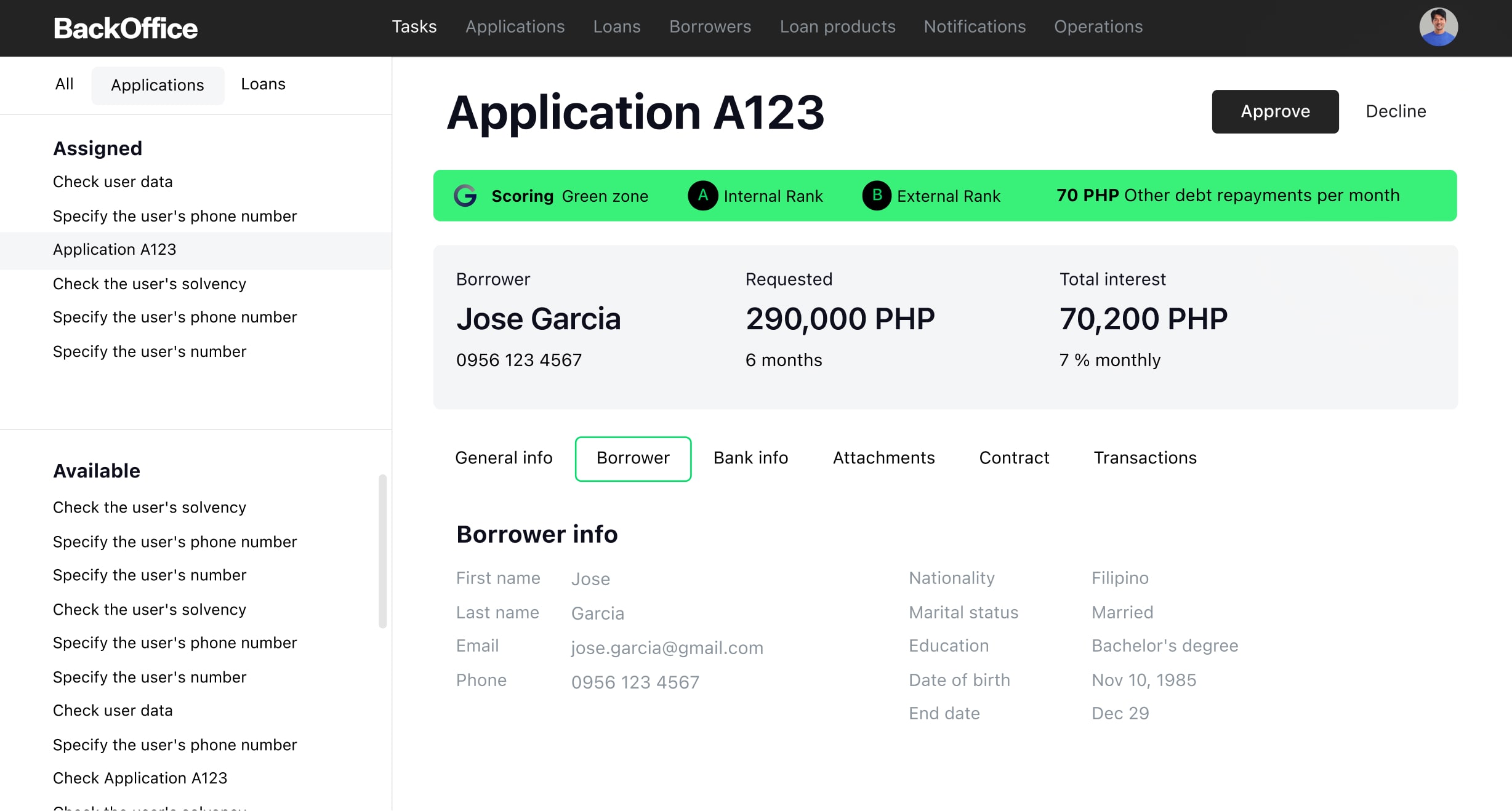

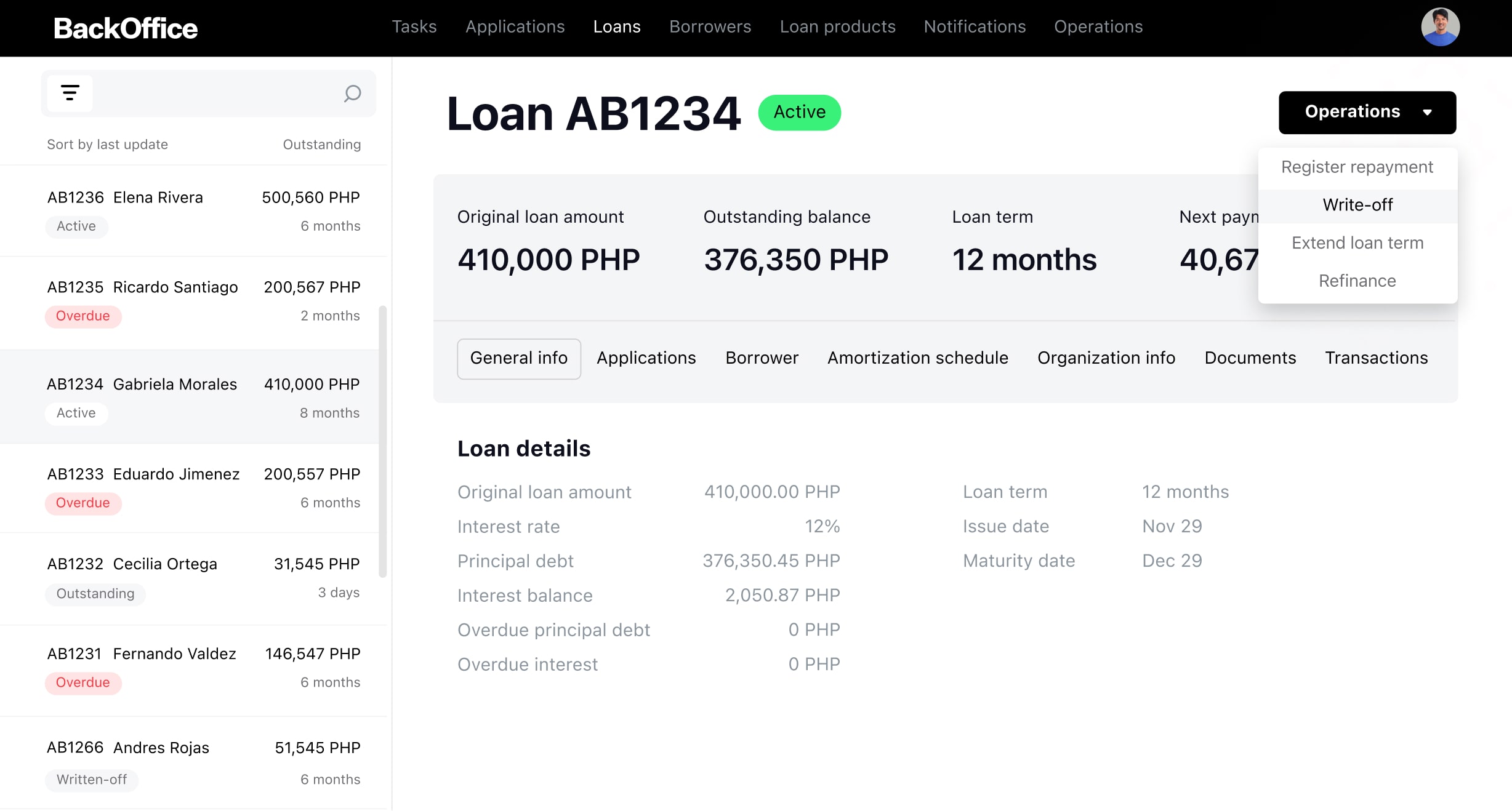

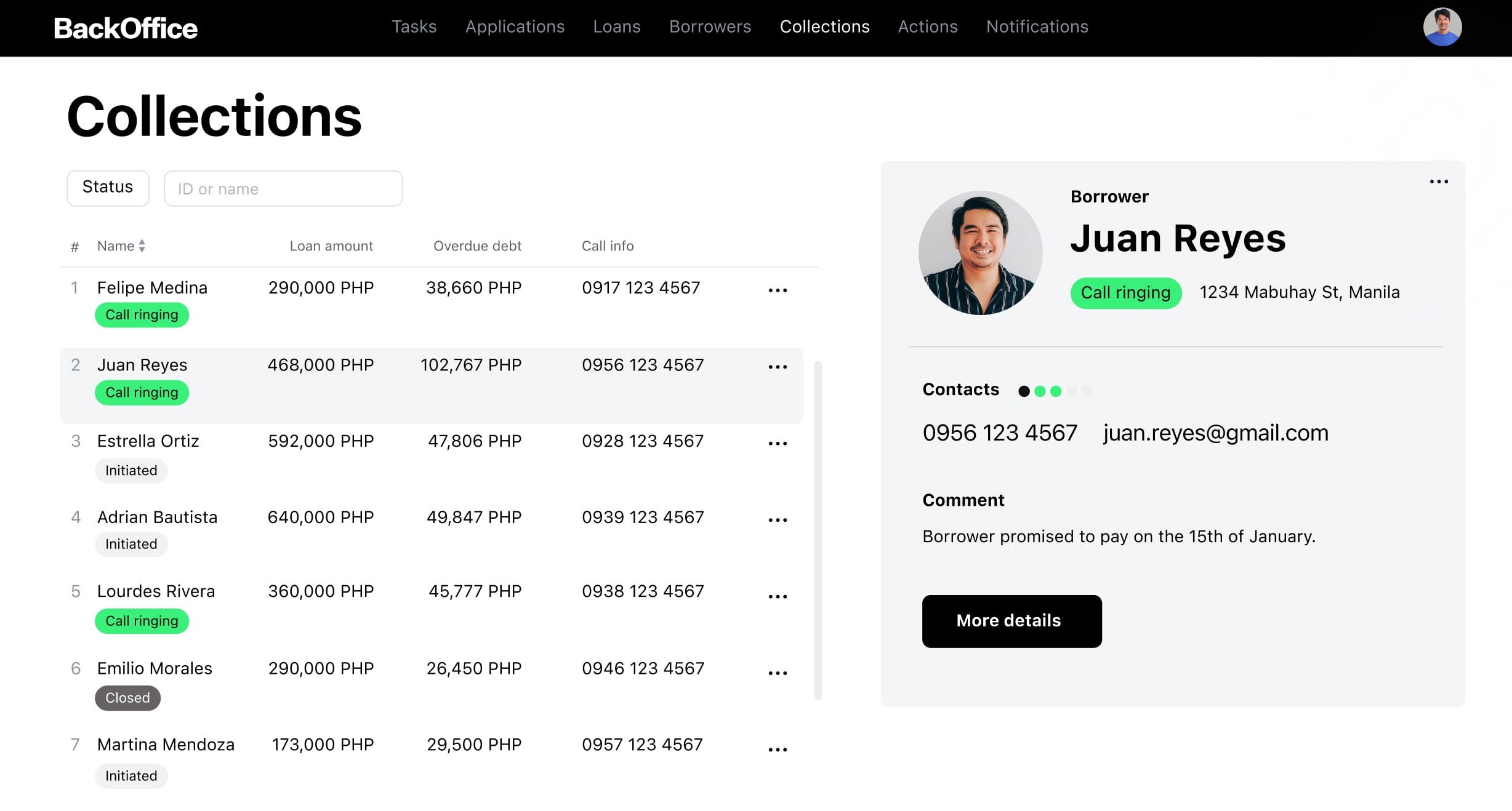

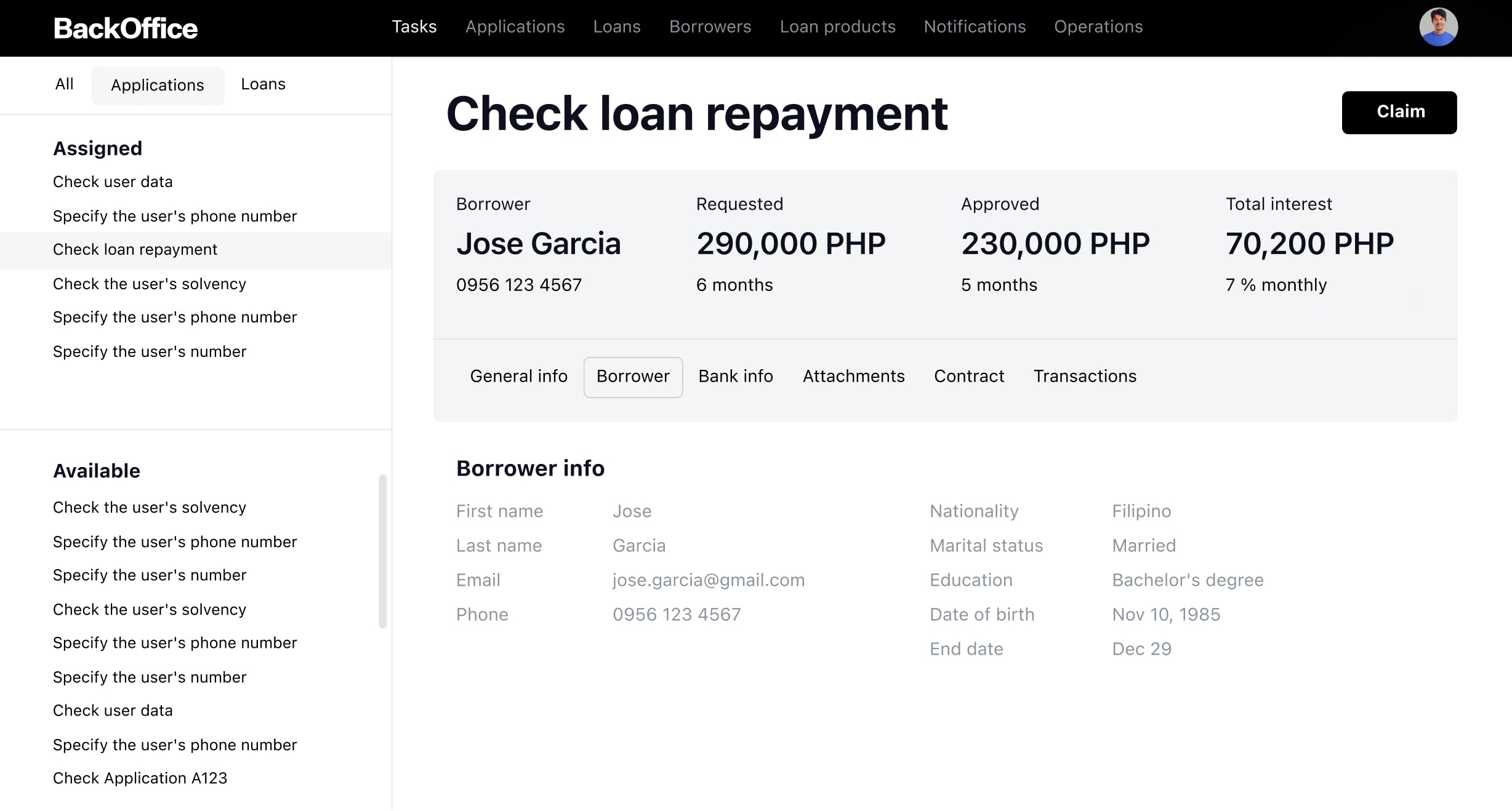

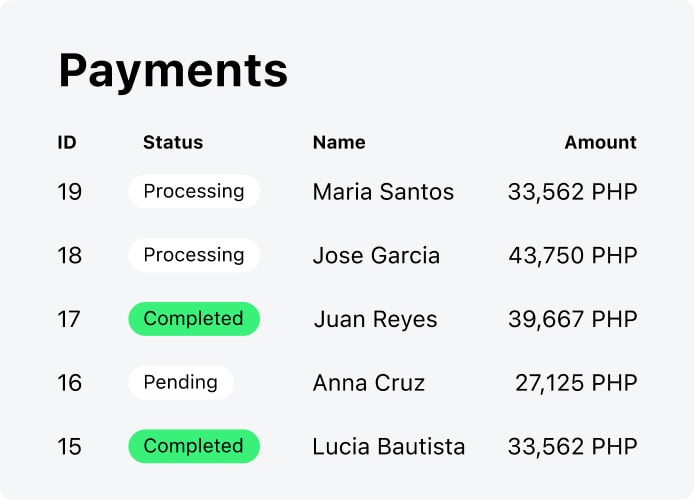

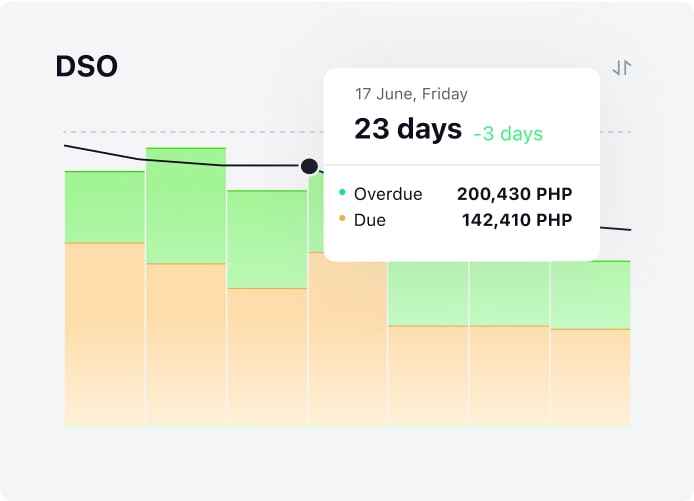

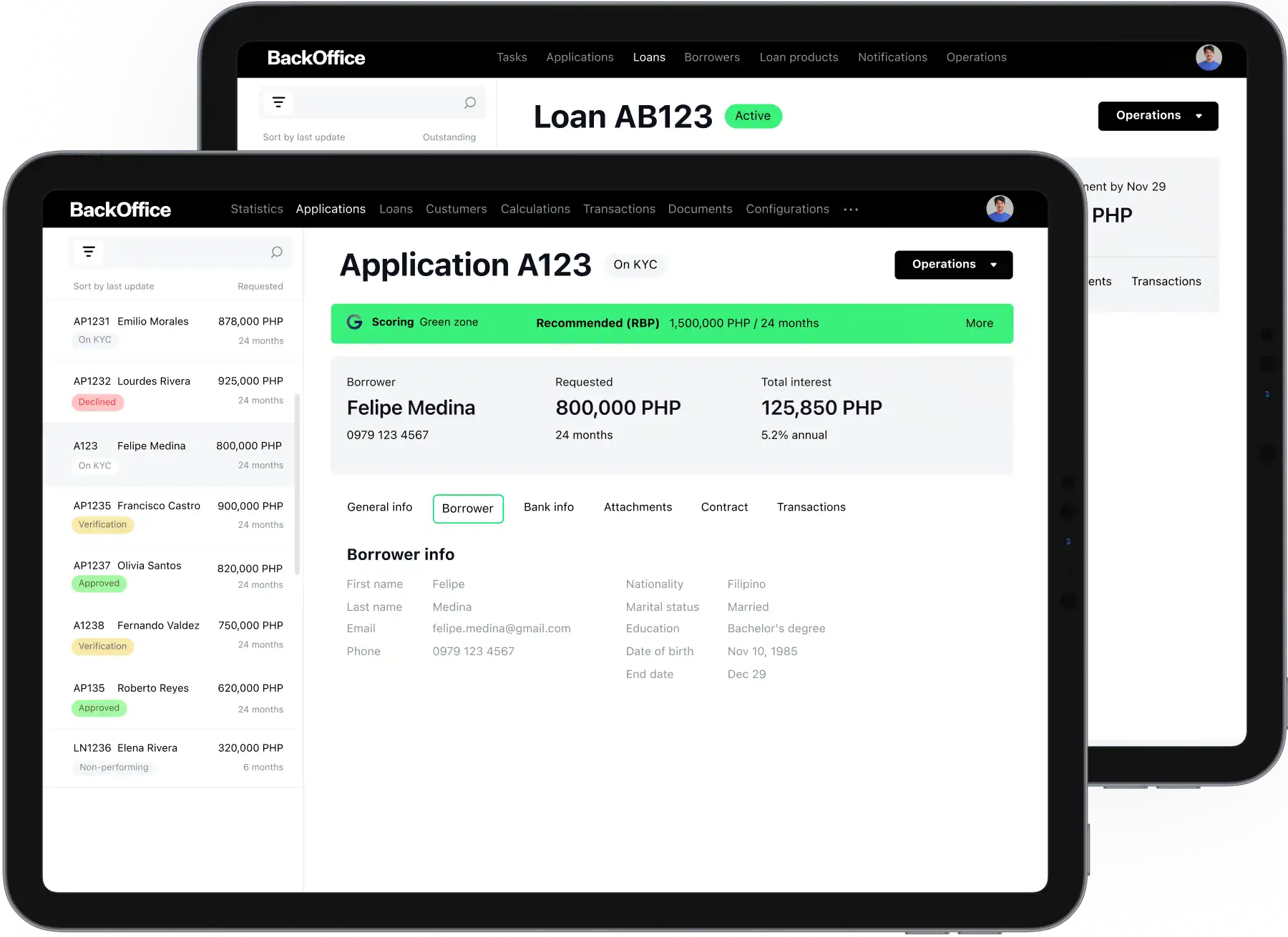

Unified lending operations

Simplify your lending process with our feature-rich Back Office. Access loan products, real-time data, amortization schedules, and automated calculations, all designed to expand your business.

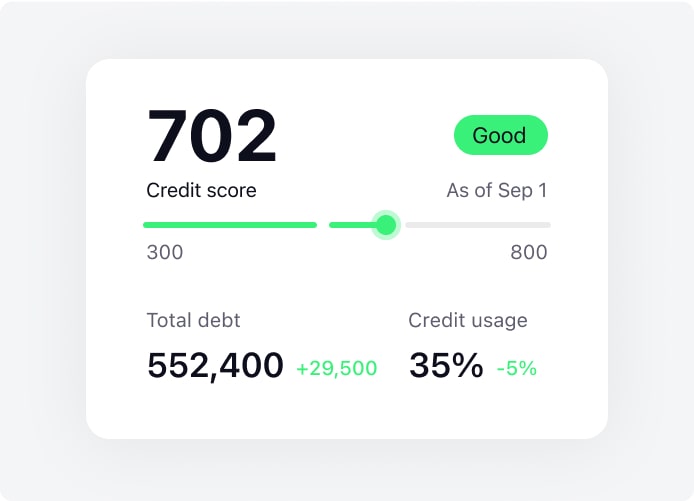

AI-driven credit scoring

Reduce the risk of NPLs and ensure reliable credit assessments with GiniMachine, a no-code AI-powered decision management platform.

Latest tech infrastructure

HES LoanBox's performance, scalability, and security are ensured by the latest tech stack and open-source technologies.

Seamless

integrations

Expertise in Filipino

lending practices

Our expertise in local lending practices, regulations, and customer behaviors allows us to tailor HES LoanBox to meet the specific needs of businesses in the Philippines.

Why choose HES LoanBox

Kickstart online lending

Seamless integrations

Customer support

Future-proof architecture

Why HES FinTech

software?

Post-lauch support

We are always ready to assist you, ensuring smooth operations and continuous adaptation so your business can get the most out of our software.

Global trust

Since 2012, we've earned the trust of over 100 companies in more than 30 countries worldwide. Many of them have stayed with us for years.

Committed to your growth

We're a self-funded company and grow only when our clients grow. That's why we always deliver best-in-class solutions as quickly as possible.

Lending

software

solution

in Philippines

Scalable digital lending tool

Complete process automation

AI-driven credit scoring

First deployment in 3 months

Learn moreFAQ

How long does it take to implement HES LoanBox?

Can HES LoanBox be customized to fit our specific business needs?

What is the primary benefit of using HES LoanBox for our lending operations?

Is HES LoanBox suitable for both small and large lending institutions?