Under the hood

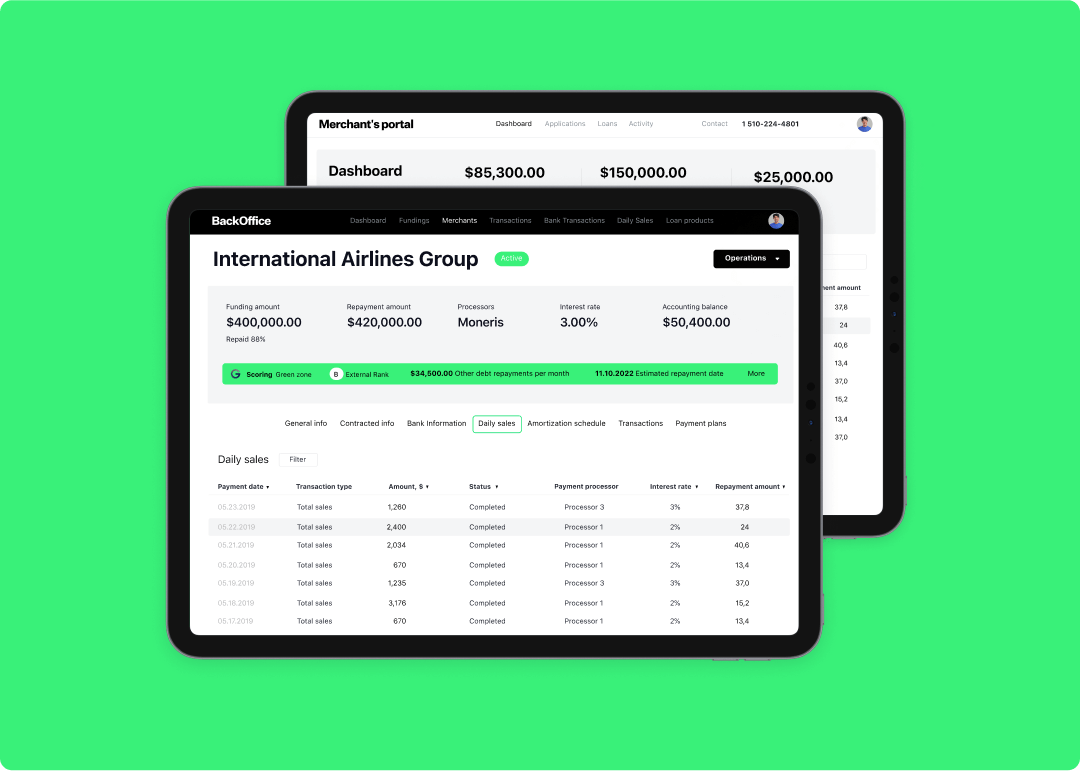

Credit scoring and KYC

Automate KYC/AML and ID checks. Have your in-house decision-making

process, utilize AI capabilities, or integrate with the 3rd party providers.

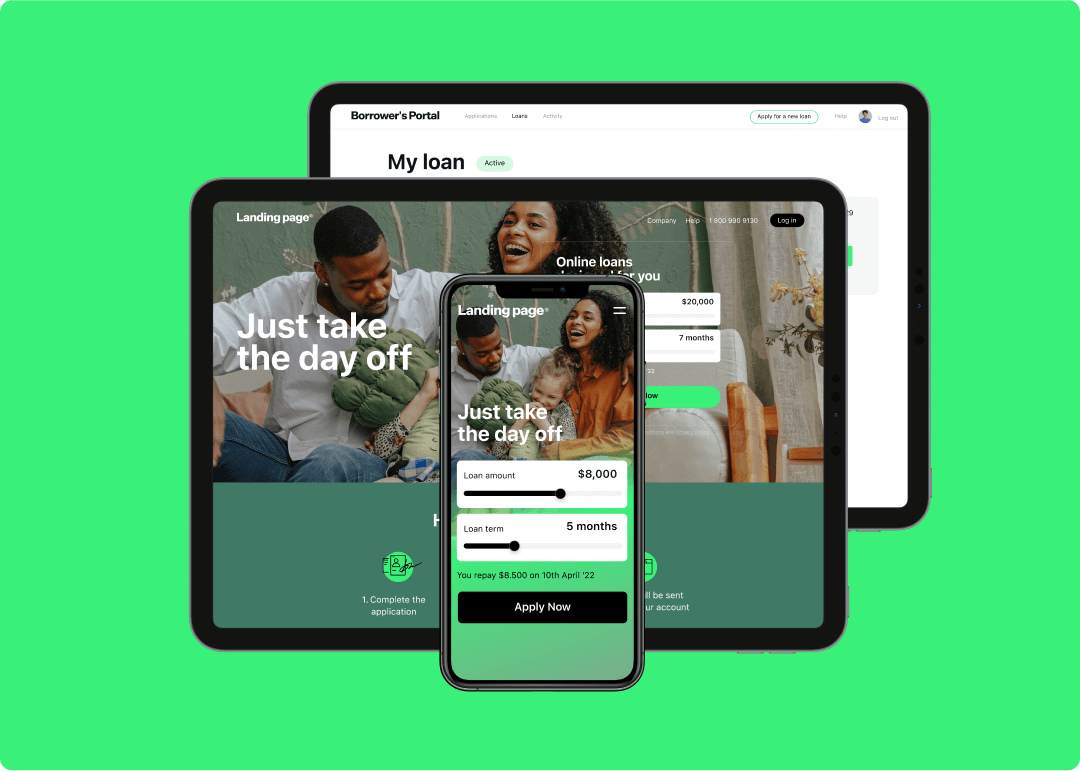

Origination module

Automate customer onboarding and account opening across multiple

channels. Run a feature-rich customer portal and personal area.

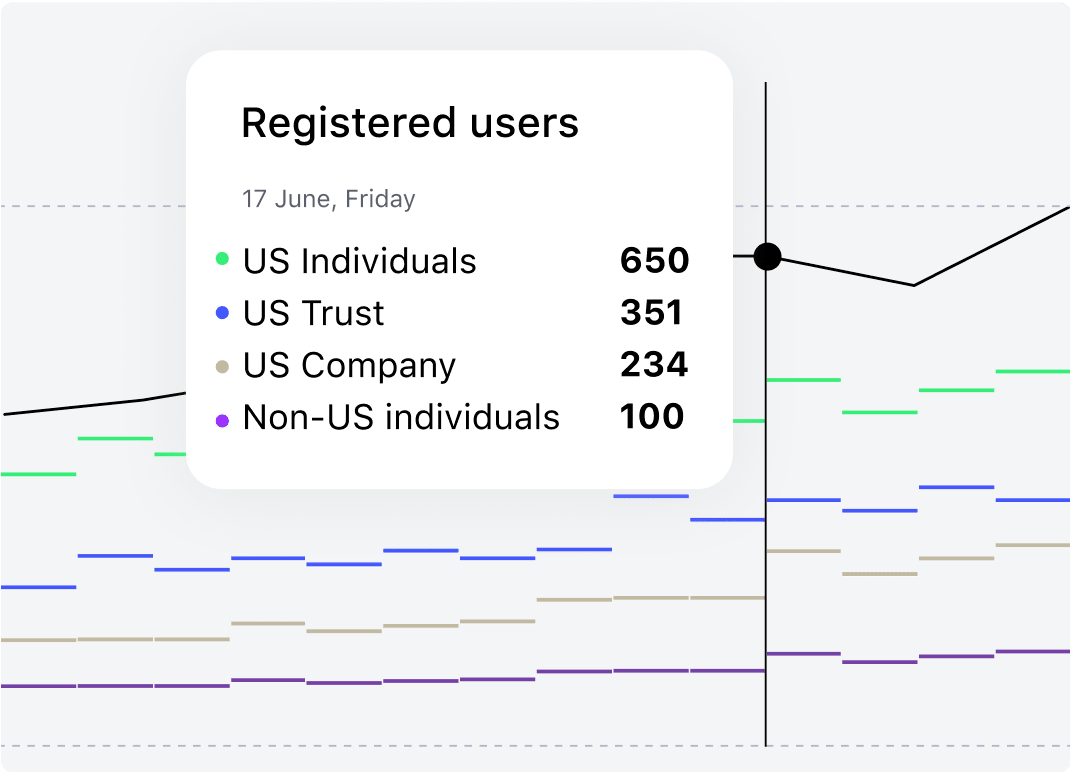

Statistics and reporting

Take advantage of the data visualization tools. Customize performance

and service dashboards. Configure new reports or modify existing ones.

Product engine

Launch numerous unique product types and comply with the legislation

changes. Configuration of the product, including repayment period, rates, penalties.

and much more

Debt collection

Set and deploy a collection strategy.

Automatically manage overdue loans (check status, notify, etc). Generate notifications and letters.

Document management

Security settings

Easy integrations

Get your lending

product estimate

in 3 minutes

STEP:

/

We deliver complete lending software for banks, financials, and alternative lenders. HES Fintech has been

transforming business demands into helpful features in Malaysia since 2012. Utilizing the

expertise, we power lending transformation at scale.

For loan management in Malaysia

we suggest

Scalable end-to-end lending solution

3-4 months time-to-market

A few seconds for a loan decision

No additional charges per customer

Learn more