Debt collection software

for

tailored strategies

Achieve the highest recovery rates with our AI-powered debt collection software and unique strategic

approach to each case.

Achieve tangible results with HES Collection Agent

Get automated debt collection

software for smooth workflows

In day-to-day struggles, financial teams are trying to balance efficiency, compliance, and

customer care. There's a smart way to solve these challenges.

Challenge

Solution

ML models personalizes tone, timing, and channel, making each interaction feel

relevant, respectful, and human.

Challenge

Solution

Advanced neuro models select the best recovery strategy based on borrowers’ past

behavior and proven outcomes.

Challenge

Solution

With smart software, you will get more transparency in workflows and thus

identify the most effective patterns.

Challenge

Solution

Automate repetitive workflows and outreach — so your team can focus on high-impact

cases.

Challenge

Solution

We ensure full compliance with local regulations and uses

communication that protects your reputation.

Challenge

Solution

No infrastructure rebuild required — our software unifies your channels and

workflows into one intelligent ecosystem.

Why choose HES FinTech

as debt collection software

Our team has spent years developing lending software. With this background, we understand

the complexity of debt collection, one of the most demanding phases of the lending cycle.

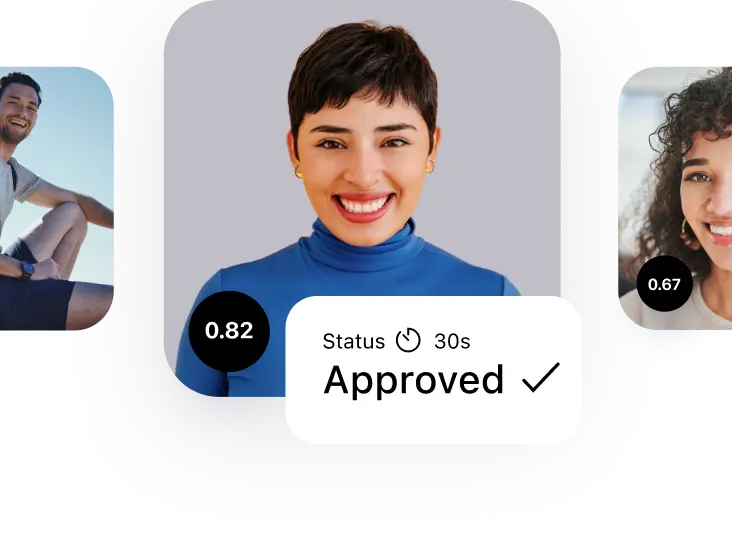

Our ML models are built and trained on genuine lender datasets rather than synthetic or

static exports. They reflect financial behavior using transactions, communication records,

and repayment histories.

For organizations with an existing client base or management system, our software integrates

seamlessly through API or bulk data import, automating the entire data acquisition process.

Our debt collection software helps understand your debtors. It enriches the database with

alternative data sources, from digital footprints and social insights to behavioral

indicators that reveal repayment potential.

You get empowered with a transparent, data-enriched view of your portfolio’s health and

possible risks. As a result, segmentation gives you more accurate, fair, and consistent

decisioning and higher recovery rates.

Compliance

and data protection

Work in a fully secure and compliant environment. In every scenario, the system strictly

adheres to all contractual obligations and regional regulations that impact debt

collection. Alignment with local laws, agreements, and privacy requirements is

automatically ensured.

Test live scenarios and see AI-powered debt collection software in action.

Book a demo

Need more than debt management

and collection software?

Build a fully automated ecosystem powered by AI- and ML-technologies, effective at all stages of the

lending journey

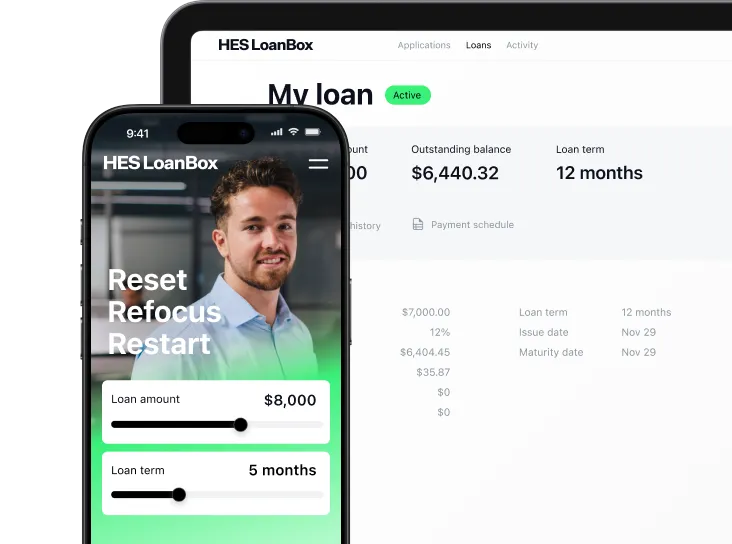

HES LoanBox

End-to-end loan automation tool, with the flexibility to be tailored for lender’s needs and

deployed as modular microservices.

GiniMachine

No-code AI solution for building models for credit scoring, fraud detection, risk assessment,

and debt collection.

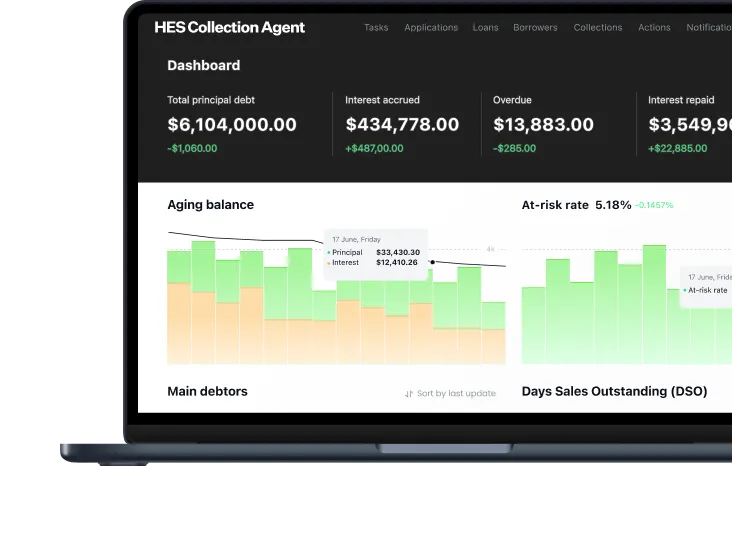

HES Collection Agent

AI-powered communication and strategy tool, adapting to business needs, client behavior, and

local compliance.

Strengthen every key

metric in debt recovery

Get higher connect rates, stronger returns, and faster repayments from day one.