CashU success story

A platform for a large microfinance company offering instant payday loans

CashU (Smart Finance) aimed to develop an end-to-end lending platform

with an online customer acquisition channel for their payday loan services.

The priorities included fast time-to-market, structured and convenient UI/UX, and a

high level of automation.

HES FinTech allowed us to automate the entire lending

process as efficiently as possible: from tracking

leads and submitting applications, to working with

overdue debts. Also, thanks to the technological

solutions of the HES team, we were able to

significantly improve the customer experience and

create a stable competitive advantage.

Aliya Akchurina

CEO at Smart Finance

Challenge

End-to-end lending platform development

Smart Finance was searching for a new reliable financial software vendor who is able to provide end-to-end

development of an online lending platform. The company decided to change its technical partner due

to a prolonged time-to-market and lack of opportunity to work with the source code.

Along with the fast product launch, the key task for HES FinTech was to build an outstanding user

experience, fast and seamless client onboarding, automated scoring and approval, granting a loan for

approved customers in a few hours. The project started at the very beginning of the pandemic, which

was an additional challenge for everyone.

Approach

PayDay loan automation by credit scoring algorithms

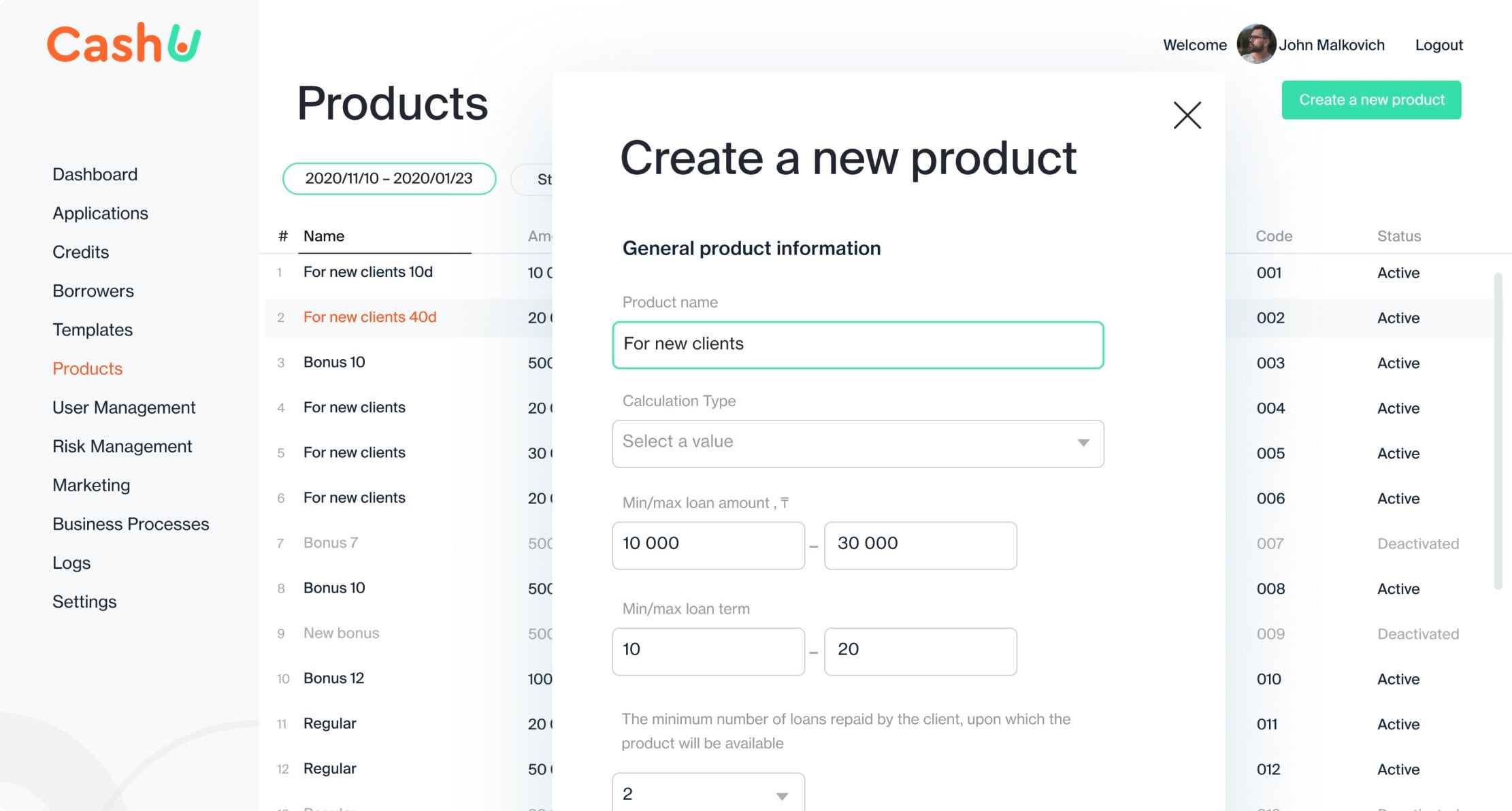

The business analysts collected a set of requirements and planned out a platform which

automates most operations in payday

loan origination by leveraging credit scoring algorithms. It

helped in creating fast and seamless client onboarding, automated scoring and approval,

issuing a loan in a few hours.

Smart Finance was planning to grant loans solely online without brick-and-mortar offices. Our

team implemented HES LoanBox, a comprehensive solution that covers all processes from loan

origination to collection.

4 months

Time-to-market

24/7

Customer acquisition online

170%

more in applications

Result

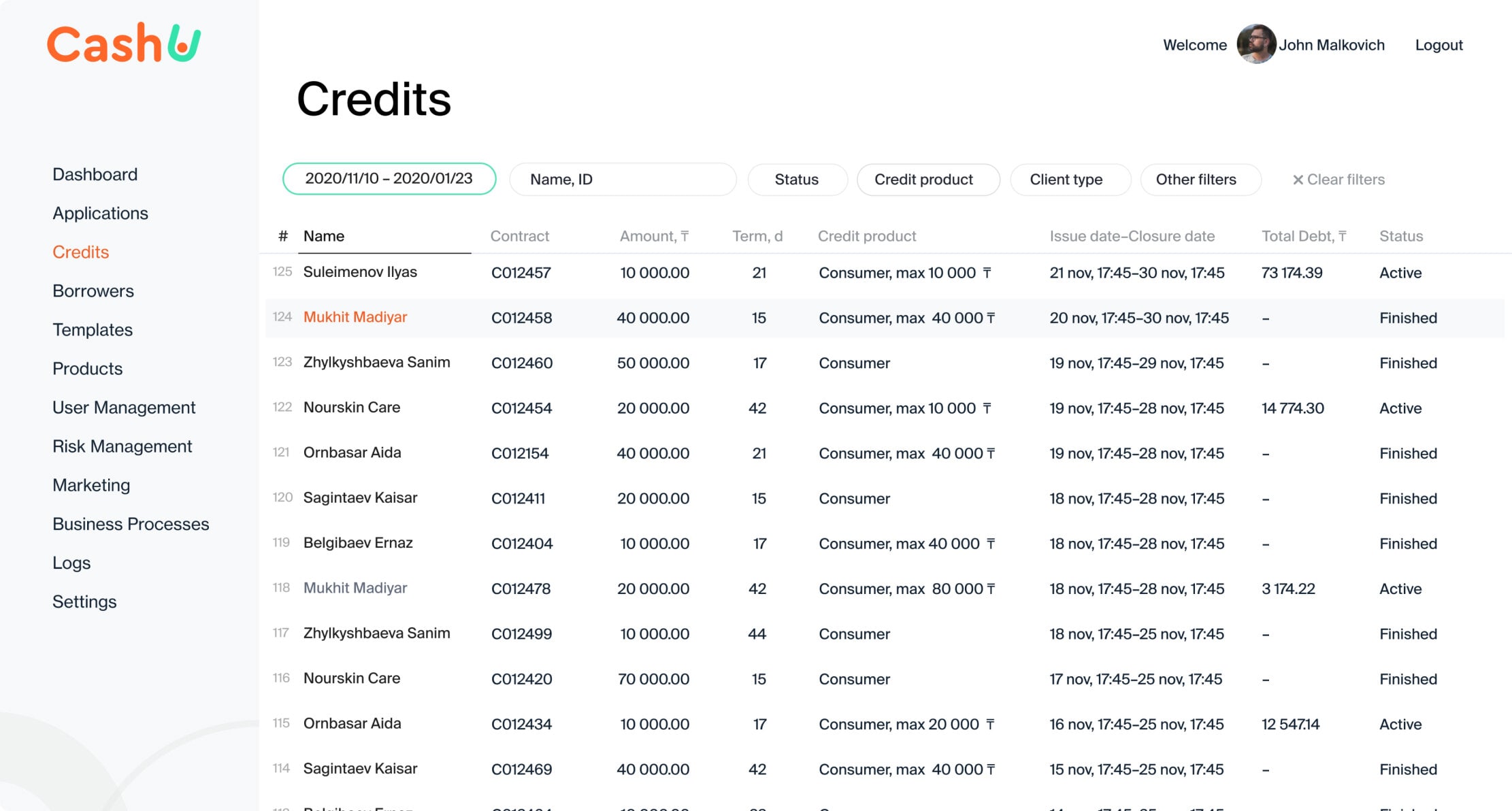

Real-time loan processing and end-to-end coverage of business workflows

The delivered solution is an online PDL platform that analyzes data in real-time and

automatically grants loans to approved borrowers in less than a minute. The system picks up

verified applications once every few minutes and prepares the payment. Due to integrations

with providers, approved customers receive money within several hours.

It was a successful solution to launch the MVP in a couple of weeks. Afterward, the

functionality was gradually expanded and improved with the relevant use cases in mind.

The active development stage took 4 months in total. The implementation of the Camunda Workflow and Decision Automation Platform allowed the customer to improve risk management workflow by testing the hypotheses in real-time. It helps significantly cut expenses and optimize business process.

COVID-19 added challenges and limitations to the project work, but added value to the result. The project team managed to meet the deadlines and successfully deliver a solution that allows end-customers to stay home and get loans at any time.

We keep going: the Smart Finance team is full of ideas about new financial products and building a more personalized customer experience. While the HES FinTech team is moving on to the new page of a successful collaboration with Smart Finance.