Future of Finance: What Fintech Evolvers Can Teach Us With over 300 million crypto users in the world today — and growing — it’s no surprise that the sphere is expanding at a rapid pace. Decentralized finance innovations, such as crypto lending, are on the rise as well, with one lending provider, CoinLoan, boasting a 2,000% growth in issuing crypto loans last year.

Crypto lending offers an alternative to traditional bank-backed loans, and cryptocurrency loans could be the next step not only in legitimizing the crypto industry but in delivering a more equitable financial boost to the economy and a wider variety of options to borrowers. Although regulators believe that this process and concept needs a little work before it becomes an everyday reality for retail borrowers.

So, let’s get to the grip of it and learn what is crypto lending and how does it work?

What is crypto lending?

Alternative Finance vs Banking: Industries Non-Traditional Lenders Turn Mainstream In Cryptocurrency loans or lending works just like regular loans, except that the asset backing the loan isn’t a fiat currency; it’s a crypto one. Just like in a fiat currency loan, crypto lending requires repayments, which are usually returned with interest on a regular basis — weekly, monthly, etc. Given that the global blockchain market is valued at $10.02 billion and growing — with an expected CAGR of 68.4% — cryptocurrency lending could prove an effective financing tool soon.

How does crypto lending work?

Currently, there are two known types of crypto-lending platforms in existence today:

- Decentralized crypto lenders

- Centralized crypto lenders

These handle cryptocurrency loans and transactions.

Like fiat lenders, crypto lenders often work with high-interest rates — 20% is not uncommon, although some lenders offer 0% APR — and require some sort of proof or collateral for loans, much in the same way a regular loan or digital lending software solution would work.

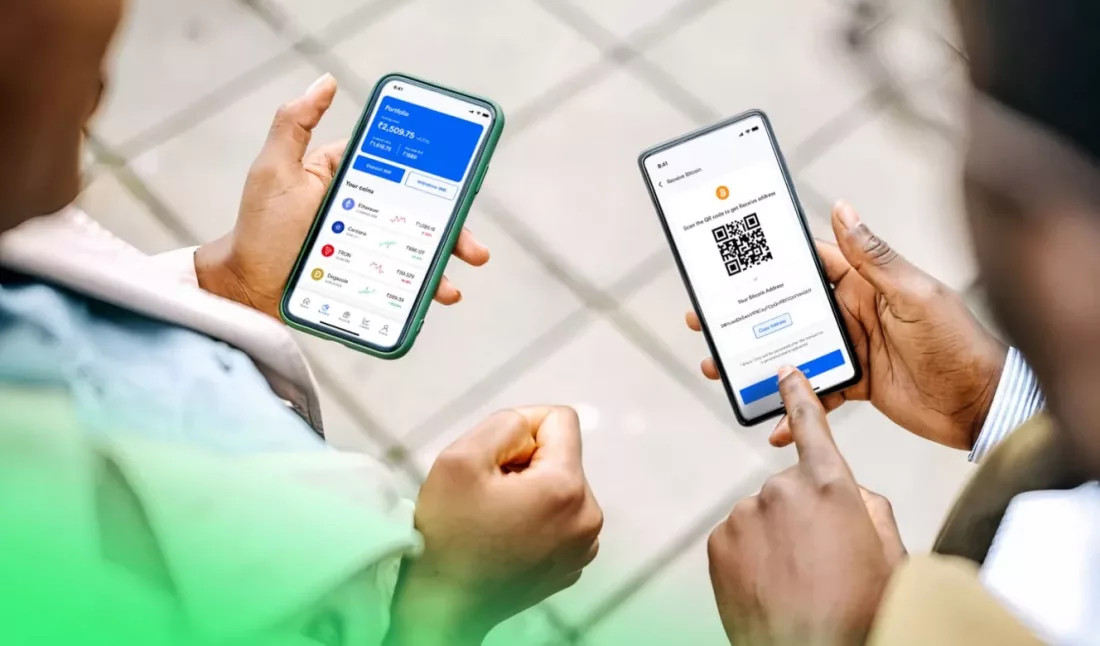

Usually, crypto lending is carried out via a Decentralised finance app (Defi DApp) or, alternatively, via a cryptocurrency exchange. These services, often acting as intermediaries (platforms), allow crypto holders to lend out their holdings to borrowers, although some services are independent lenders in and of themselves.

Digital Lending in Banks 2.0: Unobvious Opportunities and Stumbling Blocks Those borrowing can get loans via the platform, while lenders get returns from interest on the assets they lent out. Transactions are handled via the blockchain making the process secure and transparent for all participants.

Normally, crypto lending requires the following elements:

- Crypto lending platform — DApp or cryptocurrency exchange

- Crypto wallet

- Smart contracts

- Blockchain

For those interested in how to get a crypto loan, normally, the best way is to find a reputable platform offering the service. It’s important to note that depending on where you are in the world, this service may be challenging to find or unavailable. For example, due to the current development of cryptocurrency regulations in the US, many US-based crypto services aren’t offering lending services at this moment.

Psss… Wanna start lending within 90 days?

What are the pros and cons of crypto lending?

Bank-Fintech Partnerships: Models, Details, and Success Factors No matter whether you’re seeking a loan through an innovative platform or via traditional finance lending software, it’s important to know the ins and outs of what you’re actually getting into. So, let’s take a look at cryptocurrency lending and its pros and cons.

Pros of cryptocurrency loans and borrowing crypto

- With fewer formal checks currently needed — although this could change with new SEC regulations — crypto borrowers have a little more flexibility when it comes to avoiding credit checks and scores that might be prohibitive in the traditional lending environment. Additionally, when and where the collateral is needed, there is flexibility for both borrowers and lenders, creating a more equitable environment.

- Rates on crypto lending can be quite profitable for lenders, allowing them to make money lending crypto using the assets they were otherwise holding — similar to traditional lending. These rates are often more than similar practices, such as staking, which carry lower interest rates and are, therefore, not as profitable.

- For those seeking crypto loans, the pay-back amounts may be lower than traditional lenders, and there is room for flexibility, meaning there is a market opportunity.

Cons of cryptocurrency loans and borrowing crypto

- It almost goes without saying that cryptocurrency is a highly volatile asset, and, as such, lending in crypto could potentially be risky for both lender and borrower alike. Large-scale lending cases, such as the Three Arrows Capital (3AC), which filed for bankruptcy, are extreme examples but highlight the risks inherent to this type of asset.

- At the same time, there is the issue of insurance. As regulation is still very much a work in progress, both crypto lenders and borrowers may find themselves exposed to additional risk should things go south in the deal. While traditional loans are covered under law, crypto loans may not be, so your capital may truly be at risk.

- High LTV (loan-to-value) rates may put off some borrowers. As crypto is a risky asset, some providers have decided to hedge this risk with high LTV deposits prior to lending, which not only risks the borrowers’ capital should something go wrong but may act as a barrier to borrowing in the first place.

The perfect crypto loan strategy?

How to Start a Lending Business, according to Boris Batine Is there an ideal way how to get a crypto loan or to enter the world of cryptocurrency lending as a lender? In short, no. Cryptocurrency lending is a rapidly evolving industry, and unsurprisingly, there are some speed bumps along the way. As the industry develops, it’s likely more regulations will appear for cryptocurrency lending and other transactions that will make the process clearer and more secure for all involved.

For those thinking of starting their journey in cryptocurrency lending, we have this to say. Before getting involved in crypto lending or borrowing, it’s important that you fully grasp the market’s volatility and understand the inherent risks in trading with this type of novel asset.

Wanna start a lending business?Hop on a live demo tour with our team.