Since the 2010s financial technology and services lived through a turbulent revolution. Today fintechs are launched daily taking away their piece of cake from incumbent banks in such areas as lending, payments, personal finance management, and investment banking. The competitive landscape is still forming itself, and the regulatory framework is one of the key challenges for startups trying to get to market.

Some fintechs are looking for partnerships with reputable and insured depository institutions, like banks or credit unions, as an opportunity to build mutually beneficial cooperation, expand the geographical presence, and mitigate the compliance burden. For fintechs, partnering with banks or BaaS solutions is a promising near-term direction of development and growth.

Banks, in turn, are also considering fintech to bring technology closer and the possibility of providing new products. Throughout 2021, there has been a gradual yet consistent trend of banks acquiring fintech companies. In fact, out of the 484 total fintech merger and acquisition deals that occurred during the year, banks were the acquirers in eight of them, which is consistent with their activity in previous years. According to the 2020 Conference of State Bank Supervisors Survey of Community Banks, over 63% of participants emphasized the significance of incorporating new or emerging technologies to fulfill customer requirements.

Benefits and Tradeoffs for Fintechs

The Ultimate Marketing Ideas for Loan Companies to Generate Leads The advantage of partnering with a bank is an exemption from regulatory and licensing requirements, such as money transmission, state usury, etc. The financial services providers can focus on technologies, customer experience, marketing, and advertising. The disadvantage is that fintechs need to comply with various banks’ risk management practices, as well as with applicable legal and regulatory requirements, which may be quite tough.

Bank-Fintech Collaboration: Details

Roadmap

It is necessary to start with a roadmap including legal, regulatory, and transactional steps with a focus on lending, payments, or different area that would be a basis for financial service offerings in a partnership model.

Compliance management

How Automation Improves Compliance in Lending A comprehensive compliance program with clearly written documents, listed functions, processes, tools, and controls can minimize misunderstandings and issues. The exact document type depends on the partnership, but most often it includes:

- General compliance management policy

- Product-specific policies (for lending, payments, deposits)

- Customer documents including receipts

- Marketing and advertising activities

- Recordkeeping, audit, and AML policies

- Employee training policies and standards.

Negotiating and executing the partnership agreement

This step is crucial, the document is created to set expectations and govern the regulations in customer relationship management and financial protection, state-by-state licensing, software issues, data processing, as well as generated revenue, and expenses. Keep in mind that in some states the bank partnership model requires the involvement of licensed loan brokers and servicers, lead generators, and debt buyers.

Get a digital transformation roadmap for your bank

Want to get a ready-made strategy for the digital transformation of your bank institution? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your finance company. It’s free, and your answers are totally confidential.

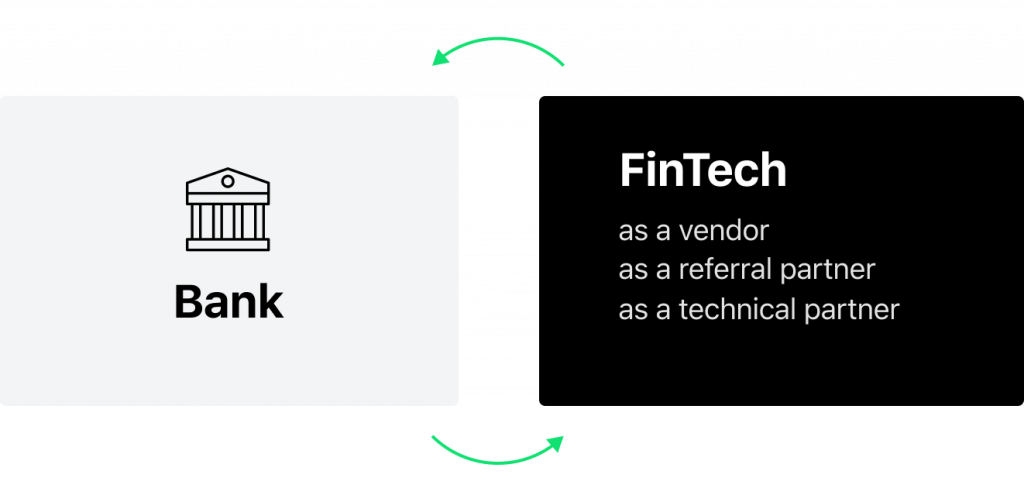

Partnership Models

Aside from the general considerations we listed above, each bank-fintech partnership type has its unique goals and requirements that are tailored for the types of services offered as a result of such partnerships. We analyzed multiple models of partnerships and realized they all can be added to one of the following three groups:

- Fintech as a vendor – is a common group of partnership types where booths banks and fintechs bear approximately the same level of responsibility and control over the customer experience and services offered.

- Fintech as a referral partner – such partnerships are based on bank’s commissions for referring customers to fintechs. Banks win customer loyalty for filling gaps and being a one-stop-shop, while fintechs get an additional audience.

- Fintech as a technical partner – in this case, a bank purchases the white-label solution with further customization, and the fintech remains ‘invisible’ when creating a seamless experience for customers. However, it generates enough income for fintechs to consider this option attractive. It is worth mentioning, that this model can perform vice versa, i.e. bank purchases account or loan assets originated inside a fintech platform.

According to Nelson Mullins Law Firm, the groups of possible bank-fintech partnership models can also include the possible types:

- Versatile referral models

- Fintech investment or acquisition (bank invests in fintech with a similar mission and then buys key technology for its own use or for resale)

- Private label solution/SaaS

- Bank to bank partnerships

- Partial outsourcing (fintech has a limited role in processes, such as underwriting or data collection, and allows banks to purchase the technology)

- Bank model partnership (bank serves as the lender or as an account issuer and has full integration with fintech frontend and backend).

Bank-Fintech Partnership in Lending

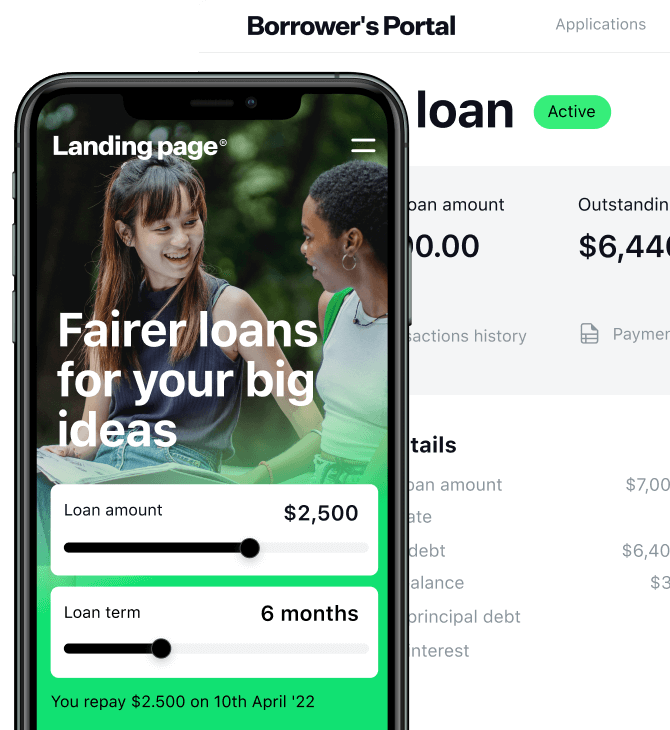

In these model, fintechs typically act as service providers to banks. They develop lending automation platforms used by borrowers to apply for financing online. Such platforms are supporting and streamlining the existing underwriting process in banks and may enable electronic document management including the delivery of disclosures and credit agreements.

For such partnerships, the loans are provided by banks, while fintechs contract to purchase and take assignments of originated loans. Another option is purchasing an interest in loan payments.

A significant barrier in such a partnership is compliance. Fintech needs to have a CMS that includes policies and procedures for compliance with regional laws.

Bank partner lending models in the United States, for example, have faced substantial legal challenges based on the theory of a “true lender”.

How Loan Automation Maximizes the Efficiency of Lending Process In addition to the compliance issues that may arise, it is important to keep in mind additional issues like marketing of the loan program, digital onboarding details, KYC, current and special loan servicing systems, security, fraud prevention, and customer service.

Other issues to be discussed and signed are:

- Data ownership, storage, and distribution

- Purchase of loans and receivables, transactions between parties

- Termination or transferring the loan program to another bank

- Audit rights

- Exclusivity terms

Will Bank-Fintech Partnerships thrive?

How to Increase the Chance for Success when Going into a Bank-Fintech Partnership?

Experts figure out three major points:

- Establishing a governing body with executives from both sides for fast and effective decision-making on critical issues.

- Practice daily, weekly and monthly review of partnership touchpoints with the evaluation of objectives achieved and progress made.

- Develop a set of practices for approvals and compliance reviews.

What Hybrid Banking and Hybrid Customers Mean for Your Business in 2020ies Perhaps the most successful organization type is hybrid. The organizational structure needs to include a centralized team able to evaluate technical integration requirements, vet and negotiate with potential partners. Also, the personnel needs to be involved and motivated to communicate their ideas and findings to decision-makers responsible for business results.

Looking for unique software for lending?

Conclusion

While there are outstanding opportunities for fintechs to partner with banks in payment, lending, and other services, there are significant business challenges and regulatory restrictions. A common recommendation both for startups and for experienced fintech providers is to reach the balance when managing innovation, effective business operation, compliance issues, and customer service at the same time. All that is feasible, and the benefits from bank-fintech cooperation can outweigh the challenges.